THIRD QUARTER SUMMARY:

- Net sales: $724.7 million, increase of 4.6% y/y

- Gross profit: $135.4 million, increase of 2.7% y/y

- Gross margin: 18.7%, decrease of 30 basis points y/y

- Net income: $27.1 million, increase of 5.7% y/y

- Diluted EPS: $1.02, compared to $0.97 y/y

Connection (PC Connection, Inc.; NASDAQ: CNXN), a leading

information technology solutions provider to business, government,

healthcare and education markets, today announced results for the

third quarter ended September 30, 2024. The Company also announced

that its Board of Directors declared a quarterly dividend of $0.10

per share of the Company’s common stock. Payment will be made on

November 29, 2024, to shareholders of record on November 12,

2024.

“Connection achieved record net income and earnings per share of

$1.02 cents for the third quarter of 2024, in a challenging IT

environment. Our focus on working capital and operational

efficiencies enabled us to invest in AI readiness, technical sales

and customer engagements,” said Timothy McGrath, President and

Chief Executive Officer of Connection. He continued, “This will

position us well for the shifting dynamics of how customers deploy,

utilize, and consume technology.”

Third Quarter of 2024 Results:

Net sales for the quarter ended September 30, 2024 increased by

4.6%, year over year. Gross profit increased 2.7% while gross

margin decreased 30 basis points to 18.7%, compared to the prior

year quarter. Net income for the quarter ended September 30, 2024

increased by 5.7% to $27.1 million, or $1.02 per diluted share,

compared to net income of $25.6 million, or $0.97 per diluted

share, for the prior year quarter. Adjusted Diluted Earnings per

Share1 remained at $0.97 per share for both the quarter ended

September 30, 2024 and September 30, 2023.

Performance by Segment:

- Net sales for the Business Solutions segment decreased by 6.1%

to $252.6 million in the third quarter of 2024, compared to $269.0

million in the prior year quarter. Gross profit increased by 0.7%

to $63.1 million in the third quarter of 2024, compared to $62.7

million in the prior year quarter. Gross margin increased by 170

basis points to 25.0% for the third quarter of 2024.

- Net sales for the Public Sector Solutions segment increased by

18.7% to $175.1 million in the third quarter of 2024, compared to

$147.5 million in the prior year quarter. Sales to the federal

government increased by $25.6 million, while sales to state and

local governments and educational institutions increased by $2.0

million, compared to the prior year quarter. Gross profit increased

by 4.4% to $26.1 million in the third quarter of 2024, compared to

$25.0 million in the prior year quarter. Gross margin decreased by

200 basis points to 14.9% for the third quarter of 2024.

- Net sales for the Enterprise Solutions segment increased by

7.4% to $297.0 million in the third quarter of 2024, compared to

$276.6 million in the prior year quarter. Gross profit increased by

4.4% to $46.2 million in the third quarter of 2024, compared to

$44.2 million in the prior year quarter. Gross margin decreased by

40 basis points to 15.6% for the third quarter of 2024.

Sales by Product Mix:

- Notebook/mobility and desktop sales increased by 17% year over

year and accounted for 46% of net sales in the third quarter of

2024, compared to 42% of net sales in the third quarter of

2023.

- Software sales increased by 11% year over year and accounted

for 12% of net sales in the third quarter of 2024, compared to 11%

of net sales in the third quarter of 2023.

- Servers/storage sales decreased by 13% year over year and

accounted for 6% of net sales in the third quarter of 2024,

compared to 7% of net sales in the third quarter of 2023.

- Networking sales decreased by 32% year over year and accounted

for 8% of net sales in the third quarter of 2024, compared to 12%

of net sales in the third quarter of 2023.

- Accessories sales increased by 12% year over year and accounted

for 11% of net sales in the third quarter of 2024, compared to 10%

of net sales in the third quarter of 2023.

Selling, general and administrative (“SG&A”) expenses

increased in the third quarter of 2024 to $105.4 million from $99.8

million in the prior year quarter. SG&A as a percentage of net

sales increased to 14.5%, compared to 14.4% in the prior year

quarter. The increase in SG&A was driven by an increase in

investments in resources designed to strengthen our sales,

technical sales and services capabilities. In addition, we spent an

incremental $1.5 million dollars on targeted technical marketing

events for our customers.

Interest income in the third quarter of 2024 was $4.9 million,

compared to $2.7 million in the third quarter of 2023. Included in

other income is $1.7 million related to a legal settlement received

in the quarter.

Cash and cash equivalents and short-term investments were $429.1

million as of September 30, 2024, compared to $289.4 million as of

September 30, 2023. During the third quarter of 2024, the Company

repurchased 59,192 shares of stock at an aggregate purchase price

of $3.9 million.

Nine Months of 2024 Results:

Net sales for the nine months ended September 30, 2024 decreased

by 2.8%, compared to the nine months ended September 30, 2023.

Gross profit increased 2.1% while gross margin expanded 90 basis

points to 18.6%, compared to the nine months ended September 30,

2023. Net income for the nine months ended September 30, 2024

increased by 11.6% to $66.4 million, or $2.50 per diluted share,

compared to net income of $59.5 million, or $2.25 per diluted

share, for the nine months ended September 30, 2023. Adjusted

Diluted Earnings per Share1 increased to $2.47 per share for the

nine months ended September 30, 2024, compared to $2.33 per share

for the nine months ended September 30, 2023.

Earnings before interest, taxes, depreciation and amortization,

adjusted for stock-based compensation expense, restructuring and

other charges and non-routine legal settlements (“Adjusted

EBITDA”)1 increased 2% to $123.6 million for the twelve months

ended September 30, 2024, compared to $121.3 million for the twelve

months ended September 30, 2023.

_________________________

1 Adjusted EBITDA and Adjusted Diluted

Earnings per Share are non-GAAP measures. See pages 9 and 10 for

definitions and reconciliations of these measures.

Conference Call and Webcast

Connection will host a conference call and live web cast today,

October 30, 2024 at 4:30 p.m. EDT to discuss its third quarter

financial results. For participants who would like to participate

via telephone, please register here to receive the dial-in number

along with a unique PIN number that is required to access the call.

A web-cast of the conference call, which will be broadcast live via

the Internet, and a copy of this press release, can be accessed on

Connection’s website at ir.connection.com. For those unable to

participate in the live call, a replay of the webcast will be

available at ir.connection.com approximately 90 minutes after the

completion of the call and will be accessible on the site for

approximately one year.

Non-GAAP Financial Information

EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted

Diluted Earnings per Share are non-GAAP financial measures. These

measures are included to provide additional information with

respect to the Company’s operating performance and earnings.

Non-GAAP measures are not a substitute for GAAP measures and should

be considered together with the GAAP financial measures. Our

non-GAAP financial measures may not be comparable to similarly

titled measures of other companies. Definitions for each Non-GAAP

measure and a reconciliation to their most directly comparable GAAP

measures are available in the tables at the end of this

release.

About Connection

PC Connection, Inc. and its subsidiaries, dba Connection,

(www.connection.com; NASDAQ: CNXN) is a Fortune 1000 company

headquartered in Merrimack, NH. With offices throughout the United

States, Connection delivers custom-configured computer systems

overnight from its ISO 9001:2015 certified technical configuration

lab at its distribution center in Wilmington, OH. In addition, the

Company has over 2,500 technical certifications to ensure that it

can solve the most complex issues of its customers. Connection also

services international customers through its GlobalServe

subsidiary, a global IT procurement and service management company.

Investors and media can find more information about Connection at

http://ir.connection.com.

Connection–Business Solutions (800.800.5555) is a rapid-response

provider of IT products and services serving primarily the

small-and medium-sized business sector. It offers more than 460,000

brand-name products through its staff of technically trained sales

account managers, publications, and its website at

www.connection.com.

Connection–Enterprise Solutions (561.237.3300),

www.connection.com/enterprise, provides corporate technology buyers

with best-in-class IT solutions, in-depth IT supply-chain

expertise, and real-time access to over 460,000 products and 2,500

vendors through MarkITplace®, a proprietary next-generation,

cloud-based supply chain solution. The team’s engineers, software

licensing specialists, and subject matter experts help reduce the

cost and complexity of buying hardware, software, and services

throughout the entire IT lifecycle.

Connection–Public Sector Solutions (800.800.0019), is a

rapid-response provider of IT products and services to federal,

state, and local government agencies and educational institutions

through specialized account managers, publications, and online at

www.connection.com/publicsector.

Cautionary Note Regarding Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements generally relate to future

events or our future financial or operating performance and include

statements concerning, among other things, our future financial

results, business plans (including statements regarding new

products and services we may offer and future expenditures, costs

and investments), liabilities, impairment charges, competition and

the expected impact of current macroeconomic conditions on our

businesses and results of operations. You can generally identify

forward-looking statements by words such as “believe,” “expect,”

“intend,” “plan,” “estimate,” “anticipate,” “may,” “should,”

“will,” or similar statements or variations of such terms, although

not all forward-looking statements include such terms. These

statements reflect our current views and are based on assumptions

as of the date of this report. Such assumptions are based upon

internal estimates and other analysis of current market conditions

and trends, management’s expectations, plans and strategies,

economic conditions and other factors. These statements are subject

to known and unknown risks, uncertainties and other factors that

may cause our actual results, performance or achievements to be

materially different from expectations or results projected or

implied by forward-looking statements.

Such differences may result from actions taken by us, including

expense reduction or strategic initiatives (including reductions in

force, capital investments and new or expanded product offerings or

services), the execution of our business plans (including our

inventory management, cost structure and management and other

personnel decisions) or other business decisions, as well as from

developments beyond our control, including;

- substantial competition reducing our market share;

- significant price competition reducing our profit margins;

- the loss of any of our major vendors adversely affecting the

number of type of products we may offer;

- virtualization of information technology resources and

applications, including networks, servers, applications, and data

storage disrupting or altering our traditional distribution

models;

- service interruptions at fourth-partly shippers negatively

impacting our ability to deliver the products we offer to our

customers;

- increases in shipping costs reducing our margins and adversely

affecting our results of operations;

- loss of key persons or the inability to attract, train and

retain qualified personnel adversely affecting our ability to

operate our business;

- cyberattacks or the failure to safeguard personal information

and our IT systems resulting in liability and harm to our

reputation; and

- macroeconomic factors facing the global economy, including

disruptions in the capital markets, economic sanctions and economic

slowdowns or recessions, rising inflation and changing interest

rates reducing the level of investment our customers are willing to

make in IT products.

Additional factors include those described in this Annual Report

on Form 10-K for the year ended December 31, 2023, including under

the captions “Risk Factors,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” and “Business,”

in our subsequent quarterly reports on Form 10-Q, including under

the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations,” and in

the other subsequent filings we make with the Securities and

Exchange Commission from time to time.

A forward-looking statement is neither a prediction nor a

guarantee of future events or circumstances. You should not place

undue reliance on the forward-looking statements included in this

release. We assume no obligation to update any of these

forward-looking statements, or to update the reasons actual results

could differ materially from those anticipated, to reflect

circumstances or events that occur after the statements are made

except as required by law.

CONSOLIDATED SELECTED

FINANCIAL INFORMATION

At or for the Three Months

Ended September 30,

2024

2023

% Change

Operating Data:

Net sales (in thousands)

$

724,717

$

693,086

5

%

Diluted earnings per share

$

1.02

$

0.97

5

%

Gross margin

18.7

%

19.0

%

Operating margin

4.1

%

4.6

%

Inventory turns (1)

19

16

Days sales outstanding (2)

67

71

% of

% of

Product Mix:

Net Sales

Net Sales

Notebooks/Mobility

36

%

32

%

Software

12

11

Desktops

11

10

Accessories

11

10

Displays and Sound

10

10

Net/Com Products

8

12

Servers/Storage

6

7

Other Hardware/Services

6

8

Total Net Sales

100

%

100

%

Stock Performance Indicators:

Actual shares outstanding (in

thousands)

26,289

26,272

Closing price

$

75.43

$

53.38

Market capitalization (in thousands)

$

1,982,979

$

1,402,399

Trailing price/earnings ratio

22.2

18.0

LTM Net Income (in thousands)

$

90,152

$

78,316

LTM Adjusted EBITDA (3) (in thousands)

$

123,591

$

121,268

(1)

Represents the annualized cost of

goods sold for the period divided by the average inventory for the

prior four-month period.

(2)

Represents the trade receivable

at the end of the period divided by average daily net sales for the

same three-month period.

(3)

LTM Adjusted EBITDA is a non-GAAP

measure defined as EBITDA (earnings before interest, taxes,

depreciation and amortization) adjusted for stock-based

compensation, restructuring and other charges and non-routine legal

settlements for the last twelve months. See page 9 for a

reconciliation.

REVENUE AND MARGIN INFORMATION

For the Three Months Ended

September 30,

2024

2023

Net

Gross

Net

Gross

(amounts in thousands)

Sales

Margin

Sales

Margin

Enterprise Solutions

$

296,970

15.6

%

$

276,566

16.0

%

Business Solutions

252,631

25.0

269,021

23.3

Public Sector Solutions

175,116

14.9

147,499

16.9

Total

$

724,717

18.7

%

$

693,086

19.0

%

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

Three Months Ended September

30,

Nine Months Ended September

30,

(amounts in thousands, except per share

data)

2024

2023

2024

2023

Net sales

$

724,717

$

693,086

$

2,093,221

$

2,154,178

Cost of sales

589,311

561,198

1,703,201

1,772,217

Gross profit

135,406

131,888

390,020

381,961

Selling, general and administrative

expenses

105,365

99,822

315,181

304,064

Restructuring and other charges

—

44

415

2,687

Income from operations

30,041

32,022

74,424

75,210

Interest income, net

4,837

2,688

14,053

5,848

Other income

1,700

—

1,700

—

Income before taxes

36,578

34,710

90,177

81,058

Income tax provision

(9,519

)

(9,112

)

(23,803

)

(21,565

)

Net income

$

27,059

$

25,598

$

66,374

$

59,493

Earnings per common share:

Basic

$

1.03

$

0.97

$

2.52

$

2.26

Diluted

$

1.02

$

0.97

$

2.50

$

2.25

Shares used in the computation of earnings

per common share:

Basic

26,292

26,262

26,334

26,281

Diluted

26,501

26,434

26,518

26,406

CONDENSED CONSOLIDATED BALANCE

SHEETS

September 30,

December 31,

(amounts in thousands)

2024

2023

ASSETS

Current Assets:

Cash and cash equivalents

$

167,511

$

144,954

Short-term investments

261,603

152,232

Accounts receivable, net

585,076

606,834

Inventories, net

113,691

124,179

Income taxes receivable

7,088

4,348

Prepaid expenses and other current

assets

16,757

16,092

Total current assets

1,151,726

1,048,639

Property and equipment, net

53,255

56,658

Right-of-use assets, net

3,460

4,340

Goodwill

73,602

73,602

Intangibles assets, net

2,514

3,428

Other assets

1,188

1,714

Total Assets

$

1,285,745

$

1,188,381

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable

$

293,158

$

263,682

Accrued payroll

28,131

20,440

Accrued expenses and other liabilities

46,164

43,843

Total current liabilities

367,453

327,965

Deferred income taxes

18,383

15,844

Operating lease liability

2,030

3,181

Other liabilities

517

624

Total Liabilities

388,383

347,614

Stockholders’ Equity:

Common stock

293

293

Additional paid-in capital

136,326

130,878

Retained earnings

819,372

760,898

Accumulated other comprehensive income

477

81

Treasury stock at cost

(59,106

)

(51,383

)

Total Stockholders’ Equity

897,362

840,767

Total Liabilities and Stockholders’

Equity

$

1,285,745

$

1,188,381

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended September

30,

Nine Months Ended September

30,

(amounts in thousands)

2024

2023

2024

2023

Cash Flows provided by Operating

Activities:

Net income

$

27,059

$

25,598

$

66,374

$

59,493

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

3,279

3,289

9,818

9,456

Adjustments to credit losses reserve

420

567

830

1,814

Stock-based compensation expense

1,999

1,789

6,196

5,425

Deferred income taxes

811

—

2,434

—

Amortization of discount on short-term

investments

1,191

—

(4,402

)

—

Loss on disposal of fixed assets

13

88

49

563

Changes in assets and liabilities:

Accounts receivable

13,330

4,499

20,928

20,869

Inventories

22,922

17,491

10,488

66,439

Prepaid expenses, income tax receivable,

and other current assets

2,418

4,097

(3,405

)

(9,556

)

Other non-current assets

78

94

526

234

Accounts payable

(24,031

)

(12,936

)

29,141

31,648

Accrued expenses and other liabilities

3,455

5,644

9,643

(720

)

Net cash provided by operating

activities

52,944

50,220

148,620

185,665

Cash Flows used in Investing

Activities:

Purchases of short-term investments

(51,797

)

(48,699

)

(255,075

)

(48,699

)

Maturities of short-term investments

47,327

—

150,607

—

Purchases of property and equipment

(1,788

)

(2,495

)

(5,215

)

(7,355

)

Net cash used in investing activities

(6,258

)

(51,194

)

(109,683

)

(56,054

)

Cash Flows used in Financing

Activities:

Proceeds from short-term borrowings

14,644

2,982

25,204

70,877

Repayment of short-term borrowings

(14,644

)

(2,982

)

(25,204

)

(70,877

)

Purchase of common stock for treasury

shares

(4,119

)

—

(7,732

)

(5,392

)

Dividend payments

(2,629

)

(2,101

)

(7,900

)

(6,307

)

Issuance of stock under Employee Stock

Purchase Plan

—

—

537

537

Payment of payroll taxes on stock-based

compensation through shares withheld

(640

)

(399

)

(1,285

)

(870

)

Net cash used in financing activities

(7,388

)

(2,500

)

(16,380

)

(12,032

)

Increase in cash and cash equivalents

39,298

(3,474

)

22,557

117,579

Cash and cash equivalents, beginning of

period

128,213

243,983

144,954

122,930

Cash and cash equivalents, end of

period

$

167,511

$

240,509

$

167,511

$

240,509

Non-cash Investing and Financing

Activities:

Accrued purchases of property and

equipment

$

425

$

408

$

425

$

408

Accrued excise tax on treasury

purchases

$

45

$

54

$

45

$

54

Supplemental Cash Flow

Information:

Income taxes paid

$

6,587

$

6,841

$

24,533

$

34,251

Interest paid

$

3

$

1

$

5

$

19

EBITDA AND ADJUSTED EBITDA

A reconciliation from Net Income to EBITDA and Adjusted EBITDA

is detailed below. Adjusted EBITDA is defined as EBITDA (defined as

earnings before interest, taxes, depreciation and amortization)

adjusted for stock-based compensation, restructuring and other

charges and non-routine legal settlements. Both EBITDA and Adjusted

EBITDA are considered non-GAAP financial measures. Generally, a

non-GAAP financial measure is a numerical measure of a company’s

performance, financial position, or cash flows that either includes

or excludes amounts that are not normally included or excluded in

the most directly comparable measure calculated and presented in

accordance with GAAP. We believe that EBITDA and Adjusted EBITDA

provide helpful information with respect to our operating

performance including our ability to fund our future capital

expenditures and working capital requirements. Adjusted EBITDA also

provides helpful information as it is the primary measure used in

certain financial covenants contained in our credit agreement. When

analyzing our operating performance, investors should use EBITDA

and Adjusted EBITDA in addition to, and not as alternatives for Net

income or any other performance measure presented in accordance

with GAAP. Our non-GAAP financial measures may not be comparable to

other similar titled measures of other companies.

Three Months Ended September

30,

LTM Ended September 30,

(1)

(amounts in thousands)

2024

2023

% Change

2024

2023

% Change

Net income

$

27,059

$

25,598

6

%

$

90,152

$

78,316

15

%

Depreciation and amortization

3,279

3,289

(0

)

13,016

12,434

5

Income tax expense

9,519

9,112

4

32,081

27,414

17

Interest income

(4,888

)

(2,689

)

82

(18,230

)

(6,638

)

175

Interest expense

51

1

5,000

64

27

137

EBITDA

35,020

35,311

(1

)

117,083

111,553

5

Restructuring and other charges (2)

—

44

(100

)

415

2,687

(85

)

Legal settlement (3)

(1,700

)

—

100

(1,700

)

—

100

Stock-based compensation

1,999

1,789

12

7,793

7,028

11

Adjusted EBITDA

$

35,319

$

37,144

(5

)

%

$

123,591

$

121,268

2

%

(1)

LTM: Last twelve months

(2)

Restructuring and other charges

in 2024 and 2023 consisted of severance and other charges related

to internal restructuring activities.

(3)

The Company recorded $1.7 million

of income in other income as a result of a legal settlement

received.

ADJUSTED NET INCOME AND ADJUSTED DILUTED EARNINGS PER

SHARE

A reconciliation from Net Income to Adjusted Net Income is

detailed below. Adjusted Net Income is defined as Net Income plus

restructuring and other charges, net of tax plus or minus loss or

income from non-routine legal settlements. A reconciliation from

Diluted Earnings per Share to Adjusted Diluted Earnings per Share

is detailed below. Adjusted Diluted Earnings per Share is defined

diluted earnings per share adjusted for restructuring and other

charges, net of tax. Adjusted Net Income and Adjusted Diluted

Earnings Per Share are considered non-GAAP financial measures (see

note above in EBITDA and Adjusted EBITDA for a description of

non-GAAP financial measures). The Company believes that Adjusted

Net Income and Adjusted Diluted Earnings per Share provide helpful

information with respect to the Company's operating performance.

When analyzing our operating performance, investors should use

Adjusted Net Income and Adjusted Diluted Earnings per Share in

addition to, and not as alternatives for Net income and Diluted

Earnings per Share or any other performance measure presented in

accordance with GAAP. Our non-GAAP financial measures may not be

comparable to other similar titled measures of other companies.

Three Months Ended September

30,

Nine Months Ended September

30,

(amounts in thousands, except per share

data)

2024

2023

% Change

2024

2023

% Change

Net income

$

27,059

$

25,598

6

%

$

66,374

$

59,493

12

%

Restructuring and other charges (1)

—

44

(100

)

415

2,687

(85

)

Legal settlement (2)

(1,700

)

—

100

(1,700

)

—

100

Tax benefit

442

(12

)

(3,783

)

339

(715

)

(147

)

Adjusted Net Income

$

25,801

$

25,630

1

%

$

65,428

$

61,465

6

%

Diluted shares

26,501

26,434

26,518

26,406

Diluted Earnings per Share

$

1.02

$

0.97

5

%

$

2.50

$

2.25

11

%

Adjusted Diluted Earnings per

Share

$

0.97

$

0.97

0

%

$

2.47

$

2.33

6

%

(1)

Restructuring and other charges

in 2024 and 2023 consisted of severance and other charges related

to internal restructuring activities.

(2)

The Company recorded $1.7 million

of income in other income as a result of a legal settlement

received.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030632177/en/

Investor Relations: Thomas Baker, 603.683.2505 Senior

Vice President, CFO, and Treasurer tom@connection.com

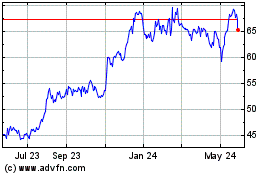

PC Connection (NASDAQ:CNXN)

Historical Stock Chart

From Dec 2024 to Jan 2025

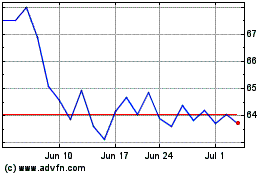

PC Connection (NASDAQ:CNXN)

Historical Stock Chart

From Jan 2024 to Jan 2025