UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed

by the Registrant x

Filed

by a party other than the Registrant ¨

Check

the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

CONX

CORP.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): November 1, 2023 (October 30, 2023)

CONX Corp.

(Exact name of registrant as specified in

its charter)

|

Nevada |

001-39677 |

85-2728630 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS

Employer

Identification No.) |

5701 S. Santa Fe Dr.

Littleton,

CO 80120

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (303) 472-1542

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of

each class |

|

Trading

Symbol(s) |

|

Name of

each

exchange

on which registered |

| Units, each consisting of one share of Class A common stock and one-fourth of one redeemable warrant |

|

CONXU |

|

The Nasdaq Stock Market LLC |

| Class A common stock, par value $0.0001 per share |

|

CONX |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

CONXW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive

Agreement.

On

November 1, 2023, CONX Corp. (the “Company” or “CONX”) entered into a subscription agreement

(the “Subscription Agreement”) with Charles W. Ergen, the Company’s founder (the “Subscriber”).

Pursuant to the Subscription Agreement, the Subscriber agreed, subject to the closing of the Company’s initial business

combination, to purchase, and the Company agreed to issue and sell to the Subscriber, 17,391,300 shares of the Company’s

Series A Convertible Preferred Stock, par value $0.0001 per share (the “Preferred Stock”), at an aggregate purchase

price of approximately $200 million, or $11.50 per share (the “Transaction”). The closing of the Transaction is

contingent upon, and is expected to occur substantially concurrently with, the consummation of the Company’s initial business

combination.

In connection with the closing of the

Transaction, the Company will file a Certificate of Designation for the Preferred Stock in substantially the form attached as an

exhibit to the Subscription Agreement (the “Certificate of Designation”) with the Secretary of State of the State of

Nevada setting forth the terms, rights, obligations and preferences of the Preferred Stock. Pursuant to the Certificate of

Designation, on the tenth trading day following the date on which the volume-weighted average price for the Company’s common

stock over any twenty trading days within any preceding thirty consecutive trading day period is greater than or equal to $11.50,

each share of Preferred Stock will mandatorily be converted into shares of the Corporation’s Class A common stock on a one-for-one basis,

subject to certain customary adjustments for stock dividends, stock splits and similar corporate actions.

If

the Preferred Stock has not earlier been converted, the Company will redeem each Preferred Share after the date that is the fifth anniversary

of the closing of the Company’s initial business combination, on not less than 10 nor more than 20 days prior notice, in

cash at a price equal to $11.50 per share, subject to certain customary adjustments.

The Preferred Stock will entitle Subscriber to

receive dividends equal to and in the same form as dividends actually paid on shares of the Company’s common stock, in each case,

on an as-converted basis. The Preferred Stock will not have voting rights.

The foregoing descriptions of the Subscription

Agreement and the transactions contemplated thereby do not purport to be complete, and are qualified in their entirety

by reference to the full text of such instruments, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1,

and incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure

to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On October 30, 2023,

the Company received a notice from the staff of the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that the Company’s securities would be subject to suspension and delisting from The Nasdaq Capital Market at the opening

of business on November 8, 2023 due to the Company’s non-compliance with Nasdaq IM-5101-2, which requires that a special purpose

acquisition company must complete one or more business combinations within 36 months of the effectiveness of the registration statement for its initial public offering. The Company intends to request a hearing before an independent hearings panel, which request would result in a stay of

any suspension or delisting action pending the hearing.

Item 3.02. Unregistered Sales of Equity Securities

The information contained in Item 1.01 of this

Current Report on Form 8-K is incorporated by reference into this Item 3.02. The offering of the securities was not registered under

the Securities Act of 1933, as amended (the “Securities Act”), and made in reliance on

the Section 4(a)(2) exemption from registration under the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Forward Looking Statements

This Current Report on Form 8-K

includes forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not

historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ

from the forward-looking statements. These forward-looking statements and factors that may cause such differences include, without

limitation, uncertainties relating to our ability to complete our initial business combination, our ability to maintain our listing

on the Nasdaq, whether the Preferred Stock will be converted or redeemed for cash and the timing thereof, and other risks and

uncertainties indicated from time to time in filings with the Securities and Exchange Commission (“SEC”), including “Risk Factors” in the Extension Proxy

Statement (as defined below) and in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, filed

with the SEC on March 1, 2023, and our Quarterly Report on Form 10-Q filed with the SEC on August 9, 2023 and in

other reports we file with the SEC. CONX expressly disclaims any obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to reflect any change in CONX’s expectations with respect thereto

or any change in events, conditions or circumstances on which any statement is based.

Additional Information and Where to Find It

CONX

urges stockholders to read the definitive proxy statement filed with the SEC on October 12, 2023 (the “Extension Proxy Statement”),

as well as other documents filed by CONX with the SEC IN CONNECTION with THE EXTENSION, because these documents will

contain important information about CONX AND the Extension. Stockholders may obtain copies of these documents (when available),

without charge, at the SEC’s website at www.sec.gov or by directing a request to: CONX Corp., 5701 S. Santa Fe Dr., Littleton, CO

80120, Attn: Secretary.

Participants in Solicitation

CONX and its directors and executive officers may be deemed to be participants

in the solicitation of proxies of CONX stockholders. Investors and security holders may obtain more detailed information regarding the

names, affiliations and interests of CONX’s directors and officers in the Extension Proxy Statement, which may be obtained free

of charge from the sources indicated above.

Non-Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation

of a proxy, consent or authorization with respect to any securities and shall not constitute an offer to sell or a solicitation of an

offer to buy the securities of CONX, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CONX Corp. |

| |

|

|

| Date: November 1, 2023 |

By: |

/s/ Kyle Jason

Kiser |

| |

Name: |

Kyle Jason Kiser |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

SUBSCRIPTION AGREEMENT

November 1, 2023

Subject to the terms and conditions

hereof, the parties intend to enter into this agreement (the “Agreement”), pursuant to which Charles W. Ergen or an

affiliate (the “Subscriber”) will subscribe for the contingent right to receive shares of Series A Convertible

Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”) for $11.50 per share (the “Purchase

Price”), or an aggregate of approximately $200,000,000, of CONX Corp., a Nevada corporation (the “Seller”),

immediately prior to or concurrently with the closing of the Seller’s initial business combination (the “Business Combination”).

In connection therewith, the Subscriber and the Seller, in consideration of the premises, representations, warranties and the mutual covenants

contained in this Agreement, and for other good and valuable consideration, the receipt, sufficiency and adequacy of which are hereby

acknowledged, hereby agree as follows:

1.

Subscription. Subject to the terms and conditions of this Agreement, the Subscriber hereby subscribes for and agrees

to purchase from Seller such number of Preferred Shares as is set forth on the signature page of this Agreement at the Purchase Price

and on the terms provided for herein. The Subscriber further acknowledges and agrees that:

2.

Closing; Delivery of Preferred Shares.

a. Upon (i) satisfaction

of the conditions set forth in Section 3 below and (ii) not less than five (5) business days’ written notice

(which may be via email) from (or on behalf of) Seller to the Subscriber (the “Closing Notice”), which Closing Notice

shall contain Seller’s wire instructions, that Seller reasonably expects the closing of the Business Combination to occur on a date

that is not less than five (5) business days from the date of the Closing Notice, the Subscriber shall deliver to Seller, no later

than two (2) business days’ prior to the closing date specified in the Closing Notice (the “Closing Date”)

the Purchase Price for the Preferred Shares subscribed by wire transfer of United States dollars in immediately available funds to the

account specified by Seller in the Closing Notice against delivery, immediately prior to or concurrent with the consummation with the

Business Combination, to the Subscriber of the Preferred Shares, free and clear of any liens or other restrictions whatsoever (other than

those arising under state or federal securities laws), in book-entry form as set forth in Section 2(b) below (the “Closing”).

If, within three (3) business days following the Closing Date, the consummation of the Business Combination does not occur, Seller

shall promptly (but not later than two (2) business days thereafter) return the Purchase Price to the Subscriber and the Preferred

Shares shall not be issued. Notwithstanding such return, (i) a failure to close on the Closing Date shall not, by itself, be deemed

to be failure of any of the conditions to Closing set forth in Section 3 to be satisfied or waived on or prior to the Closing

Date and (ii) unless and until this Agreement is terminated in accordance with Section 8 hereof, the Subscriber shall

remain obligated (A) to redeliver funds following Seller’s delivery to the Subscriber of a new Closing Notice and (B) to

consummate the Closing upon satisfaction or waiver of the conditions set forth in Section 3. For purposes of this Agreement,

“business day” shall mean any day other than (x) a Saturday or Sunday or (y) a day on which the banking institutions

located in New York, New York are permitted or required by law, executive order or governmental decree to remain closed.

b. At the Closing, Seller

shall deliver (or cause the delivery of) the Preferred Shares in book-entry form with restrictive legends in the amount as set forth on

the signature page to the Subscriber as indicated on the signature page (or to the funds and accounts designated by Subscriber,

if so designated by Subscriber, or its nominee in accordance with its delivery instruction) or to a custodian designated by Subscriber,

as applicable, as indicated below.

3.

Closing Conditions.

a. The Closing is subject

to satisfaction or valid waiver by each party of the conditions that, on the Closing Date:

(i) no suspension of the

qualification of the Preferred Shares for offering or sale in any jurisdiction, or initiation or threatening of any proceedings for any

of such purposes, shall have occurred;

(ii) no applicable governmental

authority shall have enacted, issued, promulgated, enforced or entered any judgment, order, law, rule or regulation (whether temporary,

preliminary or permanent) that is then in effect and has the effect of making consummation of the Business Combination illegal or otherwise

restraining or prohibiting consummation of the Business Combination, and no governmental authority shall have instituted or threatened

in writing a proceeding seeking to impose any such restraint or prohibition; and

(iii) all conditions precedent

to the closing of the Business Combination, including all necessary approvals of Seller’s stockholders and regulatory approvals,

if any, shall have been satisfied or waived (other than those conditions that, by their nature, are to be satisfied at the closing of

the Business Combination) and the closing of the Business Combination shall be scheduled to occur concurrently with or immediately following

the Closing.

b. The obligations of Seller

to consummate the Closing shall be subject to the satisfaction or valid waiver by Seller of the additional conditions that, on the Closing

Date:

(i) all representations

and warranties of the Subscriber contained in this Agreement shall be true and correct in all material respects (other than representations

and warranties that are qualified as to materiality, which representations and warranties shall be true in all respects) at and as of

the Closing Date (except for representations and warranties made as of a specific date, which shall be true and correct in all material

respects (other than representations and warranties that are qualified as to materiality, which representations and warranties shall be

true in all respects) as of such date), and consummation of the Closing shall constitute a reaffirmation by the Subscriber of each of

the representations, warranties and agreements of each such party contained in this Agreement as of the Closing Date; and

(ii) the Subscriber shall

have performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by this Agreement

to be performed, satisfied or complied with by it at or prior to Closing, no later than the Closing Date.

c. The obligation of the Subscriber

to consummate the Closing shall be subject to the satisfaction or valid waiver by the Subscriber of the additional conditions that, on

the Closing Date:

(i) all representations

and warranties of Seller contained in this Agreement shall be true and correct in all material respects (other than representations and

warranties that are qualified as to materiality or Material Adverse Effect (as defined herein), which representations and warranties shall

be true in all respects) at and as of the Closing Date (except for representations and warranties made as of a specific date, which shall

be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Material

Adverse Effect, which representations and warranties shall be true in all respects) as of such date), and consummation of the Closing

shall constitute a reaffirmation by Seller of each of the representations, warranties and agreements of each such party contained in this

Agreement as of the Closing Date; and

(ii) Seller shall have

performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by this Agreement to

be performed, satisfied or complied with by it at or prior to the Closing.

4.

Seller Representations and Warranties. Seller represents and warrants to the Subscriber that:

a. Seller is a Nevada corporation

duly organized, validly existing and in good standing under the laws of the State of Nevada. Seller has the corporate power and authority

to own, lease and operate its properties and conduct its business as presently conducted and to enter into, deliver and perform its obligations

under this Agreement.

b. Prior to the Closing Date,

the Preferred Shares will have been duly authorized and, when issued and delivered to the Subscriber against full payment therefor in

accordance with the terms of this Agreement, the Preferred Shares will be validly issued, fully paid and non-assessable and will not have

been issued in violation of or subject to any preemptive or similar rights created under Seller’s Amended and Restated Articles

of Incorporation or under the laws of the State of Nevada. Prior to the Closing Date, the shares of Common Stock to be issued upon the

conversion of the Preferred Shares (the “Conversion Shares”) will have been duly authorized and reserved and, when

issued and delivered to the Subscriber against full payment therefor in accordance with the terms of the Certificate of Designation to

be filed prior to the Closing by the Company with the Secretary of State of Nevada, substantially in the form of Exhibit A

attached hereto (the “Certificate of Designation”), the Conversion Shares will be validly issued, fully paid and non-assessable

and will not have been issued in violation of or subject to any preemptive or similar rights created under Seller’s Amended and

Restated Articles of Incorporation.

c. This Agreement has been

duly authorized, executed and delivered by Seller and is enforceable against Seller in accordance with its terms, except as may be limited

or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to

or affecting the rights of creditors generally, and (ii) principles of equity, whether considered at law or equity.

d. Assuming the accuracy of

the Subscriber’s representations and warranties set forth in Section 5, in connection with the offer, sale and delivery

of the Preferred Shares in the manner contemplated by this Agreement, it is not necessary to register the offer and sale of the Preferred

Shares by Seller to the Subscriber under the Securities Act of 1933, as amended (the “Securities Act”).

e. The Preferred Shares (i) were

not offered by any form of general solicitation or general advertising and (ii) assuming the accuracy of the subscriber representations

and warranties set forth in Section 5, are not being offered in a manner involving a public offering under, or in a distribution

in violation of, the Securities Act, or any state securities laws. Furthermore, neither Seller, nor any person acting on its behalf has,

directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security under circumstances that

would adversely affect reliance by Seller on Section 4(a)(2) of the Securities Act or would require registration of the issuance

of the Preferred Shares under the Securities Act.

f. The authorized

capital of Seller will consist of 500,000,000 shares of Class A common stock, $0.0001 par value, 50,000,000 shares of

Class B common stock, $0.0001 par value (collectively, “Common Stock”), and 20,000,000 shares of

undesignated preferred stock, $0.0001 par value, 17,391,300 of which will be designated as “Series A Convertible

Preferred Stock.” All shares of Common Stock and Series A Preferred Stock to be issued in connection with the Business

Combination and the transactions contemplated by this Agreement, as the case may be, prior to the Closing, will have been duly

authorized and validly issued, will be fully paid and nonassessable, and will not be issued in violation of (or subject to) any

preemptive rights (including any preemptive rights set forth in the organizational documents of Seller, rights of first refusal or

similar rights).

g. Seller is not required

to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other

federal, state, local or other governmental authority, self-regulatory organization or other person in connection with the execution,

delivery and performance by Seller of this Agreement (including, without limitation, the issuance of the Preferred Shares) the failure

of which to obtain would not be reasonably likely to have, individually or in the aggregate, a Material Adverse Effect.

5.

Subscriber Representations, Warranties and Covenants. The Subscriber represents and warrants to Seller that:

a. At the time the Subscriber

was offered the Preferred Shares, it was, and as of the date hereof, the Subscriber is (i) an institutional “accredited investor”

(within the meaning of Rule 501(a)(1), (2), (3) or (7) under the Securities Act) or an “accredited investor”

(within the meaning of Rule 501(a) under the Securities Act), (ii) acquiring the Preferred Shares only for his, her or

its own account or for an account over which it exercises sole discretion for another qualified institutional buyer or accredited investor,

(iii) other than this Agreement, not a party to a binding written agreement to sell, exchange or otherwise dispose of the Preferred

Shares and has no current plan or intention to sell, exchange or otherwise dispose of the Preferred Shares, and (iv) not acquiring

the Preferred Shares for the account of others, nor on behalf of any other account or person or with a view to, or for offer or sale in

connection with, any distribution thereof in violation of the Securities Act. The Subscriber is not an entity formed for the specific

purpose of acquiring the Preferred Shares.

b. The Subscriber understands

that the Preferred Shares are being offered in an offering not involving any public offering within the meaning of the Securities Act

and that neither the Preferred Shares delivered at the Closing nor the Conversion Shares will have been registered under the Securities

Act. The Subscriber understands that neither the Preferred Shares nor the Conversion Shares may be resold, transferred, pledged or otherwise

disposed of by the Subscriber absent an effective registration statement under the Securities Act except (i) to Seller or a subsidiary

thereof, (ii) pursuant to an applicable exemption from the registration requirements of the Securities Act, and in each of cases

(i) and (ii) in accordance with any applicable securities laws of the states and other jurisdictions of the United States, and

that any certificates representing the Preferred Shares delivered at the Closing or certificates representing the Conversion Shares delivered

upon conversion of the Preferred Shares shall contain a legend to such effect. The Subscriber acknowledges that neither the Preferred

Shares nor the Conversion Shares will be eligible for resale pursuant to Rule 144A promulgated under the Securities Act. The Subscriber

understands and agrees that the Preferred Shares and the Conversion Shares, until registered under an effective registration statement,

will be subject to transfer restrictions and, as a result of these transfer restrictions, the Subscriber may not be able to readily resell

the Preferred Shares or the Conversion Shares and may be required to bear the financial risk of an investment in the Preferred Shares

and the Conversion Shares for an indefinite period of time. The Subscriber understands that it has been advised to consult legal counsel

prior to entering into this Agreement or prior to making any offer, resale, pledge or transfer of any of the Preferred Shares or the Conversion

Shares.

c. The Subscriber understands

and agrees that the Subscriber is purchasing Preferred Shares directly from Seller. The Subscriber further acknowledges that there have

been no representations, warranties, covenants and agreements made to the Subscriber by Seller, or any of its officers, directors or representatives,

expressly (other than those representations, warranties, covenants and agreements included in this Agreement) or by implication.

d. The Subscriber acknowledges

and agrees that the Subscriber has received such information as the Subscriber deems necessary in order to make an investment decision

with respect to the Preferred Shares. The Subscriber represents and agrees that the Subscriber and the Subscriber’s professional

advisor(s), if any, have had the full opportunity to ask Seller’s management questions, receive such answers and obtain such information

as the Subscriber and such Subscriber’s professional advisor(s), if any, have deemed necessary to make an investment decision with

respect to the Preferred Shares.

e. The Subscriber became aware

of the transactions contemplated by this Agreement solely by means of direct contact between the Subscriber and Seller.

f. The Subscriber acknowledges

that it is aware that there are substantial risks incident to the purchase and ownership of the Preferred Shares. The Subscriber has such

knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment in the

Preferred Shares, and the Subscriber has sought such independent accounting, legal and tax advice as the Subscriber has considered necessary

to make an informed investment decision.

g. The Subscriber has adequately

analyzed and fully considered the risks of an investment in the Preferred Shares and determined that the Preferred Shares are a suitable

investment for the Subscriber and that the Subscriber is able at this time and in the foreseeable future to bear the economic risk of

a total loss of the Subscriber’s investment in Seller. The Subscriber acknowledges specifically that a possibility of total loss

exists.

h. In making its decision

to purchase the Preferred Shares, the Subscriber has relied solely upon independent investigation made by the Subscriber and the representations

and warranties set forth herein.

i. The Subscriber understands

and agrees that no federal or state agency has passed upon or endorsed the merits of the transactions contemplated by this Agreement or

made any findings or determination as to the fairness of this investment.

j. The execution, delivery

and performance by the Subscriber of this Agreement are within the powers of the Subscriber, have been duly authorized and will not constitute

or result in a breach or default under or conflict with any order, ruling or regulation of any court or other tribunal or of any governmental

commission or agency, or any agreement or other undertaking, to which the Subscriber is a party or by which the Subscriber is bound, and,

if the Subscriber is not an individual, will not violate any provisions of the Subscriber’s charter documents, including, without

limitation, its incorporation or formation documents, bylaws, indenture of trust or partnership or operating agreement, as may be applicable,

which would reasonably be expected to materially affect the legal authority of the Subscriber to comply in all material respects with

the terms of this Agreement. The signature on this Agreement is genuine, and the signatory, if the Subscriber is an individual, has legal

competence and capacity to execute the same or, if the Subscriber is not an individual the signatory has been duly authorized to execute

the same, and this Agreement constitutes a legal, valid and binding obligation of the Subscriber, enforceable against the Subscriber in

accordance with its terms, except as may be limited or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization,

moratorium or other laws relating to or affecting the rights of creditors generally, and (ii) principles of equity, whether considered

at law or equity.

k. No representations and

warranties made by the Subscriber herein shall modify, amend or affect the Subscriber’s right to rely on the truth, accuracy and

completeness of Seller’s representations and warranties contained herein.

l. The Subscriber is not (i) a

person or entity named on the List of Specially Designated Nationals and Blocked Persons administered by the U.S. Treasury Department’s

Office of Foreign Assets Control (“OFAC”) or in any Executive Order issued by the President of the United States and

administered by OFAC (“OFAC List”), or a person or entity prohibited by any OFAC sanctions program, (ii) a Designated

National as defined in the Cuban Assets Control Regulations, 31 C.F.R. Part 515, or (iii) a non-U.S. shell bank or providing

banking services indirectly to a non-U.S. shell bank (collectively, a “Prohibited Investor”). The Subscriber agrees

to provide law enforcement agencies, if requested thereby, such records as required by applicable law, provided that the Subscriber is

permitted to do so under applicable law. If the Subscriber is a financial institution subject to the Bank Secrecy Act (31 U.S.C. Section 5311

et seq.) (the “BSA”), as amended by the USA PATRIOT Act of 2001 (the “PATRIOT Act”), and its implementing

regulations (collectively, the “BSA/PATRIOT Act”), the Subscriber maintains policies and procedures reasonably designed

to comply with applicable obligations under the BSA/PATRIOT Act. To the extent required, it maintains policies and procedures reasonably

designed for the screening of its investors against the OFAC sanctions programs, including the OFAC List. To the extent required, it maintains

policies and procedures reasonably designed to ensure that the funds held by the Subscriber and used to purchase the Preferred Shares

were legally derived.

6.

Registration Rights.

a.

The Subscriber shall have the same registration rights with respect to the Conversion Shares as set forth in that certain Registration

Rights Agreement between the Seller and the parties thereto, dated as of October 29, 2020, as it may be amended from time to time.

7.

Termination. This Agreement shall terminate and be void and of no further force and effect, and all rights and obligations

of the parties hereunder shall terminate without any further liability on the part of any party in respect thereof, upon the earlier to

occur of (a) upon the mutual written agreement of each of the parties hereto to terminate this Agreement or (b) the liquidation

of Seller in accordance with its Amended and Restated Articles of Incorporation; provided that nothing herein will relieve any

party from liability for any willful breach hereof prior to the time of termination, and each party will be entitled to any remedies at

law or in equity to recover reasonable and documented out-of-pocket losses, liabilities or damages arising from such breach.

8.

Trust Account Waiver. Notwithstanding anything herein to the contrary, but subject to the following sentence of this Section 8,

the Subscriber hereby waives any and all right, title, interest or claim of any kind (“Claim”) in or to any distribution

of or from the trust account (the “Trust Account”) established in which the proceeds of the initial public offering

(the “IPO”) conducted by the Seller (including the deferred underwriters’ discounts and commissions) and the

proceeds of the sale of the warrants issued in a private placement that occurred immediately prior to the closing of the IPO were deposited,

and hereby agrees not to seek recourse, reimbursement, payment or satisfaction for any Claim against the Trust Account for any reason

whatsoever. Notwithstanding the foregoing, the Subscriber does not waive any Claims and does not waive its rights to seek recourse, reimbursement,

payment or satisfaction for any Claim against the Trust Account for distributions of remaining funds released to the Subscriber from the

Trust Account following redemptions or other distributions to the Seller’s public stockholders. Notwithstanding anything to the

contrary contained in this Agreement, the provisions of this Section 8 shall survive the Closing or any termination of this

Agreement and last indefinitely.

9.

Miscellaneous.

a. Neither this Agreement

nor any rights that may accrue to the Subscriber hereunder (other than the Preferred Shares acquired hereunder, if any) may be transferred

or assigned; provided that the Subscriber may assign its rights and obligations hereunder pursuant to a joinder to this Agreement in form

and substance reasonably satisfactory to Seller, to one or more funds or investment vehicles advised or managed by the Subscriber or its

affiliates, but such assignment shall not relieve the Subscriber from any of its obligations or liabilities hereunder. At the Closing,

the number of Preferred Shares delivered pursuant to this Agreement by Seller to the Subscriber and its permitted assignees shall equal,

in the aggregate, the number of Preferred Shares set forth on the Subscriber’s signature page hereto.

b. Seller may request from

the Subscriber such additional information as Seller may deem necessary to evaluate the eligibility of the Subscriber to acquire the Preferred

Shares, and the Subscriber shall provide such information as may reasonably be requested to Seller promptly upon such request, to the

extent readily available and to the extent consistent with its internal policies and procedures; provided, that Seller agrees to keep

such information confidential.

c. The Subscriber acknowledges

that Seller, and others will rely on the acknowledgments, understandings, agreements, representations and warranties contained in this

Agreement. Prior to the Closing, the Subscriber agrees to promptly notify Seller if any of the acknowledgments, understandings, agreements,

representations and warranties of the Subscriber set forth herein are no longer accurate.

d. The agreements, representations

and warranties made by each party hereto in this Agreement shall survive the Closing.

e. This Agreement may not

be modified, waived or terminated except by an instrument in writing, signed by the party against whom enforcement of such modification,

waiver, or termination is sought.

f. This Agreement constitutes

the entire agreement, and supersedes all other prior agreements, understandings, representations and warranties, both written and oral,

among the parties, with respect to the subject matter hereof. This Agreement shall not confer any rights or remedies upon any person other

than the parties hereto, and their respective successor and assigns.

g. This Agreement shall be

binding upon, and inure to the benefit of the parties hereto and their heirs, executors, administrators, successors, legal representatives,

and permitted assigns, and the agreements, representations, warranties, covenants and acknowledgments contained herein shall be deemed

to be made by, and be binding upon, such heirs, executors, administrators, successors, legal representatives and permitted assigns.

h. If any provision of this

Agreement shall be invalid, illegal or unenforceable, the validity, legality or enforceability of the remaining provisions of this Agreement

shall not in any way be affected or impaired thereby and shall continue in full force and effect.

i. This Agreement may be executed

in one or more counterparts (including by facsimile or electronic mail or in .pdf) and by different parties in separate counterparts,

with the same effect as if all parties hereto had signed the same document. All counterparts so executed and delivered shall be construed

together and shall constitute one and the same agreement.

j. The parties hereto agree

that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their

specific terms or were otherwise breached. It is accordingly agreed that the parties shall be entitled to an injunction or injunctions

to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement, this being in addition to

any other remedy to which such party is entitled at law, in equity, in contract, in tort or otherwise.

k. THIS SUBSCRIPTION AGREEMENT

SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK, WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS

OF LAWS THAT WOULD OTHERWISE REQUIRE THE APPLICATION OF THE LAW OF ANY OTHER JURISDICTION. EACH PARTY HERETO HEREBY WAIVES ANY RIGHT TO

A JURY TRIAL IN CONNECTION WITH ANY LITIGATION PURSUANT TO THIS SUBSCRIPTION AGREEMENT.

10.

Non-Reliance and Exculpation. The Subscriber acknowledges that it is not relying upon, and has not relied upon, any

statement, representation or warranty made by any person, firm or corporation, other than the statements, representations and warranties

contained in this Agreement, in making its investment or decision to invest in Seller. The Subscriber agrees that, without limiting Seller’s

obligations hereunder, no purchaser pursuant to the Agreement (including the respective controlling persons, members, officers, directors,

partners, agents, or employees of any purchaser) shall be liable to any other purchaser pursuant to the Agreement for any action heretofore

or hereafter taken or omitted to be taken by any of them in connection with the transactions contemplated hereby.

[SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be executed and delivered by their respective authorized signatories as of the date first indicated

above.

| |

CONX CORP. |

| |

|

| |

|

| |

By: |

/s/ Kyle Jason Kiser |

| |

|

Name: |

Kyle Jason Kiser |

| |

|

Title: |

Chief Executive Officer |

IN WITNESS WHEREOF, the Subscriber

has caused this Agreement to be duly executed as of the date first indicated above.

Name of Subscriber: Charles W. Ergen or affiliate

Signature

of Subscriber: /s/ Charles W. Ergen

Name of Authorized Signatory: Charles W. Ergen

Subscription Amount: US$199,999,950.00

Preferred Shares: 17,391,300 Shares of Series A Convertible

Preferred Stock

Exhibit A

Form of Certificate of Designation

(attached)

CERTIFICATE OF DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

SERIES A CONVERTIBLE PREFERRED STOCK

The undersigned, hereby certify that:

1. They are the [ ]

and [ ], respectively, of [ ]

(the “Corporation”).

2. The Corporation is authorized

to issue 20,000,000 shares of preferred stock, none of which have been issued.

3. The following resolutions

were duly adopted by the board of directors of the Corporation (the “Board of Directors”):

WHEREAS, the amended and restated

certificate of incorporation of the Corporation provides for a class of its authorized stock known as preferred stock, consisting of 20,000,000

shares, $0.0001 par value per share, issuable from time to time in one or more series;

WHEREAS, the Board of

Directors is authorized to fix the voting powers, designations, preferences, limitations, restrictions and relative or other rights,

if any, of any wholly unissued series of preferred stock and the number of shares constituting any series and the designation

thereof, of any of them; and

WHEREAS, it is the

desire of the Board of Directors, pursuant to its authority as aforesaid, to fix the voting powers, designations, preferences,

limitations, restrictions and relative or other rights relating to a series of the preferred stock, which shall consist of, except

as otherwise set forth in the Subscription Agreement, up to 17,391,300 shares of the preferred stock which the Corporation has the

authority to issue, as follows:

NOW, THEREFORE, BE IT

RESOLVED, that the Board of Directors does hereby provide for the issuance of a series of preferred stock for cash or exchange of

other securities, rights or property and does hereby fix the voting powers, designations, preferences, limitations, restrictions and

relative or other rights relating to such series of preferred stock as follows:

TERMS OF SERIES A CONVERTIBLE PREFERRED STOCK

Section 1.

Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Alternate

Consideration” shall have the meaning set forth in Section 7(c).

“Business

Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized

or required by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized

or required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee”

or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority

so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in The City of New York generally

are open for use by customers on such day.

“Closing”

means the closing of the purchase and sale of the Securities pursuant to Section 2 of the Subscription Agreement.

“Commission”

means the United States Securities and Exchange Commission.

“Common

Stock” means the Corporation’s common stock, par value $0.0001 per share, and stock of any other class of securities into

which such securities may hereafter be reclassified or changed.

“Common

Stock Equivalents” means any securities of the Corporation or the Subsidiaries which would entitle the holder thereof to acquire

at any time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that

is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Conversion

Date” shall have the meaning set forth in Section 6(a).

“Conversion

Price” shall have the meaning set forth in Section 6(b).

“Conversion

Shares” means, collectively, the shares of Class A Common Stock issuable upon conversion of the shares of Preferred Stock

in accordance with the terms hereof.

“Fundamental

Transaction” shall have the meaning set forth in Section 7(c).

“Holder”

shall have the meaning given such term in Section 2.

“Liquidation”

shall have the meaning set forth in Section 5.

“Original

Issue Date” means the date of the first issuance of any shares of the Preferred Stock regardless of the number of transfers

of any particular shares of Preferred Stock and regardless of the number of certificates which may be issued to evidence such Preferred

Stock.

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company,

joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Preferred

Stock” shall have the meaning set forth in Section 2.

“Redemption

Date” shall have the meaning set forth in Section 8.

“Subscription

Agreement” means the Agreement, dated as of November 1, 2023, by and between the Corporation and the Holder, as amended,

modified or supplemented from time to time in accordance with its terms.

“Share

Delivery Date” shall have the meaning set forth in Section 6(c).

“Stated

Value” shall have the meaning set forth in Section 2, as the same may be increased pursuant to Section 3.

“Subsidiary”

means any subsidiary of the Corporation and shall, where applicable, also include any direct or indirect subsidiary of the Corporation

formed or acquired after the date of the Subscription Agreement.

“Successor

Entity” shall have the meaning set forth in Section 7(c).

“Trading

Day” means a day on which the principal Trading Market is open for business.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock

Exchange (or any successors to any of the foregoing).

“Transaction

Documents” means this Certificate of Designation, the Subscription Agreement, all exhibits thereto and hereto and any other

documents or agreements executed in connection with the transactions contemplated pursuant to the Subscription Agreement.

“Transfer

Agent” means the transfer agent of the Corporation.

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30

a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume

weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if

the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The

Pink Open Market (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per

share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined

by an independent appraiser selected in good faith by the Holders of a majority in interest of the Preferred Stock then outstanding and

reasonably acceptable to the Corporation, the fees and expenses of which shall be paid by the Corporation.

Section 2. Designation,

Amount and Par Value. The series of preferred stock shall be designated as its Series A Convertible Preferred Stock (the

“Preferred Stock”) and the number of shares so designated shall be up to 17,391,300 (which shall not be subject

to increase without the written consent of the holders of a majority in interest of the then outstanding Preferred Stock (each, a

“Holder” and collectively, the “Holders”)). Each share of Preferred Stock shall have a par

value of $0.0001 per share and a stated value equal to $11.50, subject to increase set forth in Section 3 below (the

“Stated Value”).

Section 3.

Dividends. Except for stock dividends or distributions for which adjustments are to be made pursuant to Section 7, Holders

shall be entitled to receive, and the Corporation shall pay, dividends on shares of Preferred Stock equal (on an as-if-converted-to-Common-Stock

basis) to and in the same form as dividends actually paid on shares of the Common Stock when, as and if such dividends are paid on shares

of the Common Stock. No other dividends shall be paid on shares of Preferred Stock.

Section 4.

Voting Rights. Preferred Stock shall not be entitled to vote with holders of outstanding shares of Common Stock with respect to

any matters presented to the holders of the Common Stock for their action or consideration (whether at a meeting of stockholders of the

Corporation, by written action of stockholders in lieu of a meeting, or otherwise).

Section 5.

Ranking; Liquidation. The Preferred Stock shall rank (i) senior to all of the Common Stock; (ii) senior to any class

or series of capital stock of the Corporation hereafter created specifically ranking by its terms junior to any Preferred Stock (“Junior

Securities”); (iii) on parity with any class or series of capital stock of the Corporation created specifically ranking

by its terms on parity with the Preferred Stock (“Parity Securities”); and (iv) junior to any class or series

of capital stock of the Corporation hereafter created specifically ranking by its terms senior to any Preferred Stock (“Senior

Securities”), in each case, as to dividends or distributions of assets upon liquidation, dissolution or winding up of the Corporation,

whether voluntarily or involuntarily. Subject to any superior liquidation rights of the holders of any Senior Securities of the Corporation

and the rights of the Corporation’s existing and future creditors, upon any liquidation, dissolution or winding-up of the Corporation,

whether voluntary or involuntary (a “Liquidation”), each Holder shall be entitled to be paid out of the assets of the

Corporation legally available for distribution to stockholders, prior and in preference to any distribution of any of the assets or surplus

funds of the Corporation to the holders of the Common Stock and Junior Securities and pari passu with any distribution to the holders

of Parity Securities, an amount equal to the Stated Value for each share of Preferred Stock held by such Holder and an amount equal to

any dividends declared but unpaid thereon, and thereafter the Holders shall be entitled to receive out of the assets, whether capital

or surplus, of the Corporation the same amount that a holder of Common Stock would receive if the Preferred Stock were fully converted

(disregarding for such purposes any conversion limitations hereunder) to Common Stock which amounts shall be paid pari passu with

all holders of Common Stock. The Corporation shall provide written notice of any such Liquidation, not less than 60 days prior to the

payment date stated therein, to each Holder.

Section 6.

Conversion.

a) Mandatory

Conversion. On the tenth (10) Trading Day following the date on which the VWAP over any twenty (20) Trading Days within any preceding

thirty (30) consecutive Trading Day period is greater than or equal to $11.50 (the “Conversion Date”), each share of

Preferred Stock shall be converted into that number of shares of the Corporation’s Class A Common Stock (“Class A

Common Stock”) (subject to the limitations set forth in Section 6(c)) determined by dividing the Stated Value of such share

of Preferred Stock by the Conversion Price. For conversions of shares of Preferred Stock to take effect, a Holder shall not be required

to surrender the certificate(s) representing the shares of Preferred Stock to the Corporation (if any) unless all of the shares of

Preferred Stock represented thereby are so converted, in which case such Holder shall deliver the certificate representing such shares

of Preferred Stock promptly following the Conversion Date. Preferred Shares converted into Class A Common Stock or redeemed in accordance

with the terms hereof shall be canceled and shall not be reissued.

b) Conversion

Price. The conversion price for each share of Preferred Stock shall be $11.50 (the “Conversion Price”).

c) Mechanics

of Conversion

i. Delivery of

Conversion Shares Upon Conversion. Not later than the earlier of (i) two (2) Trading Days and (ii) the number of Trading

Days comprising the Standard Settlement Period (as defined below) after the Conversion Date (the “Share Delivery Date”),

the Corporation shall deliver, or cause to be delivered, to the Holder (A) the number of Conversion Shares being acquired upon the

conversion of the Preferred Stock, and (B) a bank check in the amount of accrued and unpaid dividends, if any. The Corporation shall

deliver the Conversion Shares required to be delivered by the Corporation under this Section 6 electronically through the Depository

Trust Company or another established clearing corporation performing similar functions. As used herein, “Standard Settlement

Period” means the standard settlement period, expressed in a number of Trading Days, on the Corporation’s primary Trading

Market with respect to the Common Stock as in effect on the Conversion Date.

ii. Obligation

Absolute; Partial Liquidated Damages. The Corporation’s obligation to issue and deliver the Conversion Shares upon conversion

of Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder

to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any

action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such

Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law by such Holder or any other

person, and irrespective of any other circumstance which might otherwise limit such obligation of the Corporation to such Holder in connection

with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the

Corporation of any such action that the Corporation may have against such Holder.

iii. Fractional

Preferred Shares. No fractional shares or scrip representing fractional shares shall be issued upon the conversion of the Preferred

Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Corporation shall

at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the

Conversion Price or round up to the next whole share. Notwithstanding anything to the contrary contained herein, but consistent with the

provisions of this subsection with respect to fractional Conversion Shares, nothing shall prevent any Holder from converting fractional

shares of Preferred Stock.

iv. Transfer Taxes

and Expenses. The issuance of Conversion Shares on conversion of this Preferred Stock shall be made without charge to any Holder for

any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such Conversion Shares, provided that

the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery

of any such Conversion Shares upon conversion in a name other than that of the Holders of such shares of Preferred Stock and the Corporation

shall not be required to issue or deliver such Conversion Shares unless or until the Person or Persons requesting the issuance thereof

shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax

has been paid. The Corporation shall pay all Transfer Agent fees required for same-day processing of any conversion and all fees to the

Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery

of the Conversion Shares.

Section 7.

Certain Adjustments.

a) Stock Dividends

and Stock Splits. If the Corporation, at any time while this Preferred Stock is outstanding: (i) pays a stock dividend or otherwise

makes a distribution or distributions payable in shares of Common Stock on shares of Common Stock or any other Common Stock Equivalents

(which, for avoidance of doubt, shall not include any shares of Common Stock issued by the Corporation upon conversion of, or payment

of a dividend on, this Preferred Stock), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines

(including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues, in

the event of a reclassification of shares of the Common Stock, any shares of capital stock of the Corporation, then the Conversion Price

shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding any treasury shares

of the Corporation) outstanding immediately before such event, and of which the denominator shall be the number of shares of Common Stock

outstanding immediately after such event. Any adjustment made pursuant to this Section 7(a) shall become effective immediately

after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective

immediately after the effective date in the case of a subdivision, combination or re-classification.

b) Subsequent

Rights Offerings. In addition to any adjustments pursuant to Section 7(a) above, if at any time the Corporation grants,

issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record

holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire,

upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had

held the number of shares of Common Stock acquirable upon complete conversion of such Holder’s Preferred Stock (without regard to

any limitations on conversion hereof) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase

Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the

grant, issue or sale of such Purchase Rights.

c) Fundamental

Transaction. If, at any time while this Preferred Stock is outstanding, (i) the Corporation, directly or indirectly, in one or

more related transactions effects any merger or consolidation of the Corporation with or into another Person, (ii) the Corporation

(and all of its Subsidiaries, taken as a whole), directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance

or other disposition of all or substantially all of its assets in one or a series of related transactions, (iii) any, direct or indirect,

purchase offer, tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which holders of

Common Stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the

holders of 50% or more of the outstanding Common Stock, (iv) the Corporation, directly or indirectly, in one or more related transactions

effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which

the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (v) the Corporation, directly

or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including,

without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person

acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held by the other Person or

other Persons making or party to, or associated or affiliated with the other Persons making or party to, such stock or share purchase

agreement or other business combination) (each a “Fundamental Transaction”), then, upon any subsequent conversion of

this Preferred Stock, the Holder shall have the right to receive, for each Conversion Share that would have been issuable upon such conversion

immediately prior to the occurrence of such Fundamental Transaction (without regard to any limitation on the conversion of this Preferred

Stock), the number of shares of Common Stock of the successor or acquiring corporation or of the Corporation, if it is the surviving corporation,

and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction

by a holder of the number of shares of Common Stock for which this Preferred Stock is convertible immediately prior to such Fundamental

Transaction (without regard to any limitation in Section 6(c) on the conversion of this Preferred Stock). For purposes of any

such conversion, the determination of the Conversion Price shall be appropriately adjusted to apply to such Alternate Consideration based

on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Corporation

shall apportion the Conversion Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different

components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be

received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon

any conversion of this Preferred Stock following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions,

any successor to the Corporation or surviving entity in such Fundamental Transaction shall file a new Certificate of Designation with

the same terms and conditions and issue to the Holders new preferred stock consistent with the foregoing provisions and evidencing the

Holders’ right to convert such preferred stock into Alternate Consideration. The Corporation shall cause any successor entity in

a Fundamental Transaction in which the Corporation is not the survivor (the “Successor Entity”) to assume in writing

all of the obligations of the Corporation under this Certificate of Designation and the other Transaction Documents (as defined in the

Purchase Agreement) in accordance with the provisions of this Section 7(c) pursuant to written agreements in form and substance

reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental Transaction and

shall, at the option of the holder of this Preferred Stock, deliver to the Holder in exchange for this Preferred Stock a security of the

Successor Entity evidenced by a written instrument substantially similar in form and substance to this Preferred Stock which is convertible

for a corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares of Common

Stock acquirable and receivable upon conversion of this Preferred Stock (without regard to any limitations on the conversion of this Preferred

Stock) prior to such Fundamental Transaction, and with a conversion price which applies the conversion price hereunder to such shares

of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and

the value of such shares of capital stock, such number of shares of capital stock and such conversion price being for the purpose of protecting

the economic value of this Preferred Stock immediately prior to the consummation of such Fundamental Transaction), and which is reasonably

satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall

succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Certificate

of Designation and the other Transaction Documents referring to the “Corporation” shall refer instead to the Successor Entity),

and may exercise every right and power of the Corporation and shall assume all of the obligations of the Corporation under this Certificate

of Designation and the other Transaction Documents with the same effect as if such Successor Entity had been named as the Corporation

herein.

d) Calculations.

All calculations under this Section 7 shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. For

purposes of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be

the sum of the number of shares of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding.

e) Notice to

the Holders. Whenever the Conversion Price is adjusted pursuant to any provision of this Section 7, the Corporation shall promptly

deliver to each Holder by facsimile or email a notice setting forth the Conversion Price after such adjustment and setting forth a brief

statement of the facts requiring such adjustment.

g) Voluntary

Adjustment By Corporation. Subject to the rules and regulations of the Trading Market, the Corporation may at any time, subject

to the prior written consent of the Holders of the majority in interest of the Preferred Stock then outstanding, reduce the then current

Conversion Price to any amount and for any period of time deemed appropriate by the board of directors of the Corporation.

Section 8. Mandatory

Redemption.

a) Redemption

Event. Each Preferred Share shall be redeemed by the Corporation on or after the date that is the fifth (5) anniversary of

the closing of the Business Combination, on not less than 10 nor more than 20 days prior notice, in cash by wire transfer to a U.S.

dollar account maintained by the Holder with a bank in the United States designated in writing by the Holder at a price equal to the

Stated Value (the “Redemption Price”).

b) Notice of Redemption. Notice

of redemption shall be given by first-class mail, postage prepaid, to the Holder at the Holder’s address appearing in the Corporation’s

register (the date that such notice of redemption is given in connection with any redemption, the applicable “Redemption Notice

Date”). All notices of redemption shall state:

i. the date on which the Preferred Shares

will be redeemed (the “Redemption Date”);

ii. that on the Redemption Date the Redemption

Price will become due and payable in respect of the Preferred Shares;

iii. the place or places where any certificates

of the Preferred Shares are to be surrendered for payment of the Redemption Price.

Section 9.

Miscellaneous.

a) Notices.

Any and all notices or other communications or deliveries to be provided by the Holders hereunder including, without limitation, any Notice

of Conversion, shall be in writing and delivered personally, by e-mail attachment, or sent by a nationally recognized overnight courier

service, addressed to the Corporation, at the address set forth above Attention: [__], e-mail address [__], or such other e-mail address

or address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this Section 9.

Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered

personally, by facsimile or e-mail attachment, or sent by a nationally recognized overnight courier service addressed to each Holder at

the facsimile number, e-mail address or address of such Holder appearing on the books of the Corporation, or if no such facsimile number,

e-mail address or address appears on the books of the Corporation, at the principal place of business of such Holder, as set forth in

the Purchase Agreement. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest

of (i) the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number or e-mail attachment

at the e-mail address set forth in this Section prior to 5:30 p.m. (New York City time) on any date, (ii) the next Trading

Day after the time of transmission, if such notice or communication is delivered via facsimile at the facsimile number or e-mail attachment

at the e-mail address set forth in this Section on a day that is not a Trading Day or later than 5:30 p.m. (New York City time)

on any Trading Day, (iii) the second Trading Day following the date of mailing, if sent by U.S. nationally recognized overnight courier

service, or (iv) upon actual receipt by the party to whom such notice is required to be given.

b) Absolute Obligation.

Except as expressly provided herein, no provision of this Certificate of Designation shall alter or impair the obligation of the Corporation,

which is absolute and unconditional, to pay liquidated damages and accrued dividends, as applicable, on the shares of Preferred Stock

at the time, place, and rate, and in the coin or currency, herein prescribed.

c) Lost or Mutilated

Preferred Stock Certificate. If a Holder’s Preferred Stock certificate shall be mutilated, lost, stolen or destroyed, the Corporation

shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu of or in substitution

for a lost, stolen or destroyed certificate, a new certificate for the shares of Preferred Stock so mutilated, lost, stolen or destroyed,

but only upon receipt of evidence of such loss, theft or destruction of such certificate, and of the ownership hereof reasonably satisfactory

to the Corporation (which shall not include the posting of any bond).

d) Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation shall

be governed by and construed and enforced in accordance with the internal laws of the State of Nevada, without regard to the principles

of conflict of laws thereof. The Corporation and the Holder hereby irrevocably waive, to the fullest extent permitted by applicable law,

any and all right to trial by jury in any legal proceeding arising out of or relating to this Certificate of Designation or the transactions

contemplated hereby. If the Corporation or any Holder shall commence an action or proceeding to enforce any provisions of this Certificate

of Designation, then the prevailing party in such action or proceeding shall be reimbursed by the other party for its attorneys’

fees and other costs and expenses incurred in the investigation, preparation and prosecution of such action or proceeding.

e) Waiver.

Any waiver by the Corporation or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed

to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver

by any other Holders. The failure of the Corporation or a Holder to insist upon strict adherence to any term of this Certificate of Designation

on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist

upon strict adherence to that term or any other term of this Certificate of Designation on any other occasion. Any waiver by the Corporation

or a Holder must be in writing.

f) Severability.

If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation

shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to

all other Persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder violates the

applicable law governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum rate

of interest permitted under applicable law.

g) Next Business

Day. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made

on the next succeeding Business Day.

h) Headings.

The headings contained herein are for convenience only, do not constitute a part of this Certificate of Designation and shall not be deemed

to limit or affect any of the provisions hereof.

i) Status of

Converted or Redeemed Preferred Stock. Preferred Shares of Preferred Stock may only be issued pursuant to the Subscription Agreement.

If any shares of Preferred Stock shall be converted, redeemed or reacquired by the Corporation, such shares shall resume the status of

authorized but unissued shares of preferred stock and shall no longer be designated as Series A Convertible Preferred Stock.

*********************

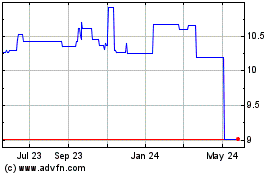

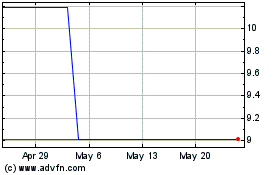

CONX (NASDAQ:CONXU)

Historical Stock Chart

From Nov 2024 to Dec 2024

CONX (NASDAQ:CONXU)

Historical Stock Chart

From Dec 2023 to Dec 2024