Crinetics Pharmaceuticals Reports Third Quarter 2024 Financial Results and Provides Business Update

13 November 2024 - 8:05AM

Crinetics Pharmaceuticals, Inc. (Nasdaq: CRNX), a clinical stage

pharmaceutical company focused on the discovery, development and

commercialization of novel therapeutics for endocrine diseases and

endocrine-related tumors, today reported financial results for the

third quarter ended September 30, 2024.

“As we approach the end of 2024, it has been yet

another remarkable year for Crinetics as we continued to

consistently achieve key milestones to advance and expand our

pipeline and strengthen the company’s position,” said Scott

Struthers, Ph.D., Founder and Chief Executive Officer of Crinetics.

“The submission of our first NDA was a significant milestone in the

company’s history, and we remain on track for the expected launch

of our investigational drug paltusotine for acromegaly in 2025,

which will be a pivotal event for the company. The company’s core

commitment to internal innovation continues to bear fruit with four

new internally discovered drug candidates now in IND enabling

activities, including the first candidate from our novel nonpeptide

drug conjugate (NDC) targeted therapeutics platform emerging from

our laboratories. We are excited to share preclinical data for this

candidate intended for the treatment of SST2-expressing tumors at

the North American Neuroendocrine Tumor Society (NANETS) in Chicago

on November 21-23. Further, subsequent to quarter end, we

strengthened our already robust balance sheet by issuing additional

equity, allowing us to invest in these promising early-stage

programs, while continuing to fully support the anticipated launch

of paltusotine and later-stage clinical development efforts.”

Third Quarter 2024 and Recent

Highlights:

- Submitted New Drug

Application (NDA) for paltusotine for the treatment of

acromegaly. In September, Crinetics submitted an NDA to

the U.S. Food and Drug Administration (FDA) for its investigational

drug, paltusotine, the first once-daily, oral, selective

somatostatin receptor type 2 nonpeptide agonist, for the proposed

treatment of and long-term maintenance therapy for acromegaly.

Crinetics anticipates receiving notification from the FDA on the

status of the NDA submission in December 2024.

- Strengthened balance sheet

with $575 million public offering. In October, Crinetics

completed an upsized public offering of common stock for gross

proceeds of $575 million.

- Selected development

candidate in TSH antagonist program. Crinetics has

identified an oral thyroid stimulating hormone (TSH) receptor

antagonist for the potential treatment of Graves’ disease and

thyroid eye disease. First-in-human-enabling studies have commenced

and an Investigational New Drug (IND) filing is expected in

2025.

- Data from CRN09682, the

first drug candidate from novel Nonpeptide Drug Conjugate (NDC)

platform, to be presented at the North American

Neuroendocrine Tumor Society

(NANETS) Annual Meeting in November

2024. First-in-human-enabling activities are nearing completion and

IND filing is expected in early 2025.

- Total of four development

candidates currently in IND-enabling studies to support transition

to clinical development in 2025.

Key Upcoming Milestones:

- Additional data from the Phase 2

study of its investigational drug atumelnant* in CAH is anticipated

by early 2025.

- Crinetics expects to finalize a

Phase 3 protocol and initiate site startup activities for its

investigational drug paltusotine in carcinoid syndrome by the end

of 2024.

Third Quarter 2024 Financial

Results:

- Research and development expenses

were $61.9 million for the three months ended September 30, 2024,

compared to $43.8 million for the same period in 2023. The increase

was primarily attributable to higher personnel costs, outside

services costs, and manufacturing activities costs, all of which

were driven by the advancement of our clinical programs and the

expansion of our preclinical portfolio.

- General and administrative expenses

were $25.9 million for the three months September 30, 2024,

compared to $15.5 million for the same period in 2023. The increase

was primarily driven by higher personnel costs and outside services

costs.

- Net loss for the three months ended

September 30, 2024, was $76.8 million, compared to a net loss of

$57.5 million for the same period in 2023.

- There were no revenues during the

three months ended September 30, 2024, compared to revenues of $0.3

million for the same period in 2023. Third quarter 2023 revenues

were derived from the paltusotine licensing arrangement with our

Japanese partner, Sanwa Kagaku Kenkyusho (SKK).

- Cash, cash equivalents, and

investment securities totaled $862.7 million as of September 30,

2024, compared to $558.6 million as of December 31, 2023. On

October 10, 2024, the Company completed an upsized underwritten

public offering of common stock for gross proceeds of $575 million,

strengthening its financial position with approximately $1.4

billion in cash, cash equivalents and investment securities. Based

on current projections, Crinetics expects that its cash, cash

equivalents and investment securities will be sufficient to fund

its current operating plan into 2029.

Conference Call and Webcast

DetailsManagement will hold a live conference call and

webcast today, Tuesday, November 12 at 4:30 p.m. ET. To

participate, please dial 1-800-579-2543 (domestic) or

1-785-424-1789 (international) and refer to Conference ID CRNXQ3.

To access the webcast, click here. Following the live event, a

replay of the call will be available on the Investors section of

the company’s website.

*Proposed international nonproprietary name

under review.

About Crinetics

PharmaceuticalsCrinetics Pharmaceuticals is a clinical

stage pharmaceutical company focused on the discovery, development,

and commercialization of novel therapeutics for endocrine diseases

and endocrine-related tumors. Crinetics’ lead development

candidate, paltusotine, is the first investigational once-daily,

oral, selectively-targeted somatostatin receptor type 2 (SST2)

nonpeptide agonist that has completed Phase 3 clinical development

for acromegaly and is in Phase 2 clinical development for carcinoid

syndrome associated with neuroendocrine tumors. Crinetics is also

developing atumelnant (CRN04894), an investigational,

first-in-class, oral ACTH antagonist, that is currently completing

Phase 2 clinical studies for the treatment of congenital adrenal

hyperplasia and Cushing’s disease. All of the company’s drug

candidates are orally delivered, small molecule new chemical

entities resulting from in-house drug discovery efforts, including

additional discovery programs addressing a variety of endocrine

conditions such as hyperparathyroidism, polycystic kidney disease,

Graves’ disease (including thyroid eye disease), diabetes, obesity

and GPCR-targeted oncology indications.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. All statements

other than statements of historical facts contained in this press

release are forward-looking statements, including statements

regarding the plans and timelines for the clinical development of

atumelnant and paltusotine, including the therapeutic potential and

clinical benefits or safety profile thereof; the plans and

timelines for FDA response and the commercial launch of paltusotine

if the NDA submission is approved; the expected timing of

initiation of a Phase 3 program of paltusotine for carcinoid

syndrome and FDA consultation; the expected timing of additional

data and topline results from studies of atumelnant in CAH and

Cushing’s syndrome; the expected timing of announcing preclinical

data for a candidate on the NDC platform; the potential and

expected timing for IND-enabling studies in four different

development candidates to transition to clinical development; the

expected timing of additional research pipeline updates; and the

expected timing through which our cash, cash equivalents, and

investment securities will fund our operating plans. In some cases,

you can identify forward-looking statements by terms such as “may,”

“will,” “should,” “expect,” “plan,” “anticipate,” “could,”

“intend,” “target,” “project,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential,” “upcoming” or “continue” or

the negative of these terms or other similar expressions. These

forward-looking statements speak only as of the date of this press

release and are subject to a number of known and unknown risks,

uncertainties and assumptions, including, without limitation,

initial or topline data that we report may change following

completion or a more comprehensive review of the data related to

the clinical studies and such data may not accurately reflect the

complete results of a clinical study, and the FDA and other

regulatory authorities may not agree with our interpretation of

such results; we may not be able to obtain, maintain and enforce

our patents and other intellectual property rights, and it may be

prohibitively difficult or costly to protect such rights;

geopolitical events may disrupt Crinetics’ business and that of the

third parties on which it depends, including delaying or otherwise

disrupting its clinical studies and preclinical studies,

manufacturing and supply chain, or impairing employee productivity;

unexpected adverse side effects or inadequate efficacy of the

Company’s product candidates that may limit their development,

regulatory approval and/or commercialization; the Company’s

dependence on third parties in connection with product

manufacturing, research and preclinical and clinical testing; the

success of Crinetics’ clinical studies and nonclinical studies;

regulatory developments in the United States and foreign countries;

clinical studies and preclinical studies may not proceed at the

time or in the manner expected, or at all; the timing and outcome

of research, development and regulatory review is uncertain, and

Crinetics’ drug candidates may not advance in development or be

approved for marketing; Crinetics may use its capital resources

sooner than expected; any future impacts to our business resulting

from geopolitical developments outside our control; and the other

risks and uncertainties described in the Company’s periodic filings

with the Securities and Exchange Commission (SEC). The events and

circumstances reflected in the company’s forward-looking statements

may not be achieved or occur and actual results could differ

materially from those projected in the forward-looking statements.

Additional information on risks facing Crinetics can be found under

the heading “Risk Factors” in Crinetics’ periodic filings with the

SEC, including its annual report on Form 10-K for the year ended

December 31, 2023 and its Quarterly reports on Form 10-Q for the

quarters ended March 31, 2024 June 30, 2024 and September 30, 2024.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

Except as required by applicable law, Crinetics does not plan to

publicly update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events,

changed circumstances or otherwise.

|

CRINETICS PHARMACEUTICALS, INC.CONDENSED

CONSOLIDATED FINANCIAL STATEMENT DATA(In thousands, except per

share data)(Unaudited) |

|

|

|

|

| |

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

| STATEMENTS OF

OPERATIONS DATA: |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

— |

|

|

$ |

346 |

|

|

$ |

1,039 |

|

|

$ |

4,013 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

61,905 |

|

|

|

43,839 |

|

|

|

173,590 |

|

|

|

122,947 |

|

| General and

administrative |

|

|

25,892 |

|

|

|

15,484 |

|

|

|

71,558 |

|

|

|

41,016 |

|

| Total operating expenses |

|

|

87,797 |

|

|

|

59,323 |

|

|

|

245,148 |

|

|

|

163,963 |

|

| Loss from operations |

|

|

(87,797 |

) |

|

|

(58,977 |

) |

|

|

(244,109 |

) |

|

|

(159,950 |

) |

| Total other income, net |

|

|

10,969 |

|

|

|

2,516 |

|

|

|

26,766 |

|

|

|

6,515 |

|

| Loss before equity method

investment |

|

|

(76,828 |

) |

|

|

(56,461 |

) |

|

|

(217,343 |

) |

|

|

(153,435 |

) |

| Loss on equity method

investment |

|

|

— |

|

|

|

(997 |

) |

|

|

(470 |

) |

|

|

(997 |

) |

| Net loss |

|

$ |

(76,828 |

) |

|

$ |

(57,458 |

) |

|

$ |

(217,813 |

) |

|

$ |

(154,432 |

) |

| Net loss per share - basic and

diluted |

|

$ |

(0.96 |

) |

|

$ |

(1.01 |

) |

|

$ |

(2.82 |

) |

|

$ |

(2.81 |

) |

| Weighted-average shares -

basic and diluted |

|

|

80,091 |

|

|

|

56,808 |

|

|

|

77,173 |

|

|

|

55,003 |

|

| BALANCE SHEET

DATA: |

|

September 30,2024 |

|

|

December 31,2023 |

|

| |

|

|

|

|

|

|

|

Cash, cash equivalents and investments |

|

$ |

862,668 |

|

|

$ |

558,555 |

|

| Working capital |

|

$ |

824,025 |

|

|

$ |

530,211 |

|

| Total assets |

|

$ |

937,374 |

|

|

$ |

635,353 |

|

| Total liabilities |

|

$ |

104,394 |

|

|

$ |

96,247 |

|

| Accumulated deficit |

|

$ |

(871,515 |

) |

|

$ |

(653,702 |

) |

| Total stockholders’

equity |

|

$ |

832,980 |

|

|

$ |

539,106 |

|

Investors:Gayathri DiwakarHead of Investor

Relationsgdiwakar@crinetics.com (858) 345-6340

Media: Natalie BadilloHead of Corporate

Communications nbadillo@crinetics.com (858) 345-6075

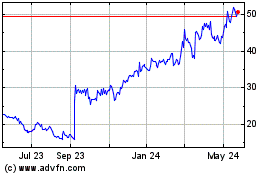

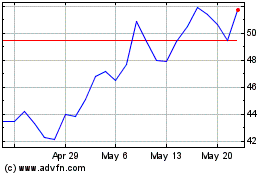

Crinetics Pharmaceuticals (NASDAQ:CRNX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Crinetics Pharmaceuticals (NASDAQ:CRNX)

Historical Stock Chart

From Nov 2023 to Nov 2024