0001025835FALSE150 N. Meramec AvenueSt. LouisMissouri6310500010258352024-01-222024-01-220001025835us-gaap:CommonStockMember2024-01-222024-01-220001025835efsc:DepositarySharesMember2024-01-222024-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 22, 2024

ENTERPRISE FINANCIAL SERVICES CORP

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-15373 | 43-1706259 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

150 N. Meramec Avenue, St. Louis, Missouri (Address of principal executive offices) | 63105 (Zip Code) |

Registrant's telephone number, including area code

(314) 725-5500

| | |

| Not applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

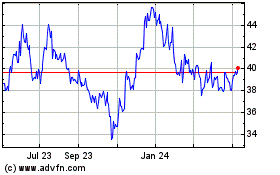

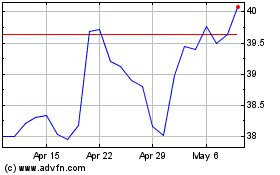

| Common Stock, par value $0.01 per share | | EFSC | | Nasdaq Global Select Market |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 5.00% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A | | EFSCP | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 22, 2024, Enterprise Financial Services Corp (the "Company" or "EFSC") issued a press release announcing financial information for the quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 and is incorporated herein by reference.

On January 23, 2024, at 10:00 a.m. Central time, the Company intends to hold a webcast to present information on its results of operations for the quarter ended December 31, 2023. The slide presentation which will accompany the webcast is furnished as Exhibit 99.2 and is incorporated herein by reference.

The press release, slide presentation and information contained therein and in this Item 2.02 shall not be deemed “filed” with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number Description

104 The cover page of this Current Report on Form 8-K, formatted in Inline XBRL.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | ENTERPRISE FINANCIAL SERVICES CORP |

| | | | |

| Date: | January 22, 2024 | | By: | /s/ Troy R. Dumlao |

| | | | Troy R. Dumlao |

| | | | Senior Vice President and Chief Accounting Officer |

| | | | |

EXHIBIT 99.1

ENTERPRISE FINANCIAL REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS

Fourth Quarter Results

•Net income of $44.5 million, $1.16 per diluted common share, or $1.21 per diluted common share when excluding $2.4 million FDIC special assessment1

•Net interest margin (“NIM”) of 4.23%, quarterly decrease of 10 basis points

•Net interest income of $140.7 million, quarterly decrease of $0.9 million

•Total loans of $10.9 billion, quarterly increase of $267.3 million, or 10% annualized

•Total deposits of $12.2 billion, quarterly increase of $266.5 million

•Return on Average Assets (“ROAA”) of 1.23%, or 1.28% adjusted for FDIC special assessment1

•Return on Average Tangible Common Equity (“ROATCE”)1 of 14.38%, or 14.98% adjusted for FDIC special assessment1

•Tangible common equity to tangible assets1 of 8.96%

•Tangible book value per share1 of $33.85, quarterly increase of 9%

2023 Results

•Net income of $194.1 million, $5.07 per diluted common share, or $5.12 per diluted common share when excluding $2.4 million FDIC special assessment1

•Net interest income of $562.6 million, increase of $88.7 million

•Total loans increased $1.1 billion, or 12%

•Total deposits increased $1.3 billion, or 12%

•ROAA of 1.41%, or 1.42% adjusted for FDIC special assessment1

•ROATCE1 of 16.25% or 16.40% adjusted for FDIC special assessment1

•Tangible book value per share1 increased $5.18, or 18%

St. Louis, Mo. January 22, 2024 – Jim Lally, President and Chief Executive Officer of Enterprise Financial Services Corp (Nasdaq: EFSC) (the “Company” or “EFSC”), commented, “I am pleased with how strong we finished 2023, although we unfortunately had an elevated level of charge-offs in the fourth quarter, with the largest charge-off attributable to a single agricultural relationship. This relationship had specific aspects that drove the loss that we believe is an isolated issue.”

Lally added, “While the charge-offs and related provision for credit losses reduced our earnings for the year, we achieved a 1.4% ROAA1 driven by a 10% increase in pre-provision net revenue (“PPNR”)1. Our consistent marketing efforts and partnership with our customers resulted in a 12% increase in net loan growth, with the increase being primarily funded with core deposits. For the full year, we reported earnings per share (“EPS”) of $5.07 and a 16.4% return on average tangible common equity1. As we look to 2024, we expect to continue to capitalize on opportunities to grow and strengthen the Company.”

1 ROATCE, tangible common equity to tangible assets, tangible book value per share, and PPNR are non-GAAP measures. EPS, ROAA and ROATCE when excluding FDIC special assessment are non-GAAP measures. Please refer to discussion and reconciliation of these measures in the accompanying financial tables.

Full-Year Highlights

For 2023, net income was $194.1 million, or $5.07 per diluted share, compared to $203.0 million, or $5.31 per diluted share, in 2022. Excluding the impact of the FDIC special assessment of $2.4 million, EPS was $5.12 for 2023. PPNR1 for 2023 was $284.8 million, compared to $258.9 million in 2022. Organic earning-asset growth and expansion of net interest income due to the increase in market interest rates were the primary contributors to the PPNR increase in 2023. Offsetting the increase in PPNR was a $37.2 million increase in the provision for credit losses in 2023 compared to 2022.

The Company’s asset sensitive balance sheet benefited from the increase in market interest rates during 2023. NIM expanded to 4.43% in 2023, from 3.89% in 2022. The increase in NIM and average interest-earning asset growth of $508.2 million resulted in total net interest income of $562.6 million in 2023, a 19% increase from $473.9 million in 2022.

Noninterest income was $68.7 million, an increase of 16% from $59.2 million in 2022. The increase was primarily due to higher volumes in tax credit income, private equity and community development income, and gains on the sale of SBA loans. Offsetting these amounts were a decrease in deposit services charges due to higher earnings credit rates, and a decrease in card services due to the full year impact of the Durbin Amendment. Total noninterest expense was $348.2 million in 2023, a 27% increase from $274.2 million in 2022. The increase was primarily from higher customer servicing deposit costs due to higher deposit balances and an increase in earnings credit rates, and an increase in compensation from a larger associate base, and annual merit increases. The core efficiency ratio2 was 53.4% in 2023, compared to 49.8% in 2022.

Nonperforming assets were 0.34% of total assets at the end of 2023, compared to 0.08% at the end of 2022. Net charge-offs were 0.37% of average loans in 2023, compared to 0.04% in 2022. The allowance for credit losses declined to 1.24% of total loans at the end of 2023, from 1.41% at the end of 2022. The decrease was primarily due to the charge-off of certain nonperforming loans and an improvement in forecasted economic factors. Excluding guaranteed portions of loans, the allowance to loans ratio was 1.35% and 1.56% at the end of 2023 and 2022, respectively. A provision for credit losses of $36.6 million was recorded in 2023 primarily due to net charge-offs in the year, compared to a benefit for credit losses of $0.6 million in 2022.

The Company maintained a strong liquidity position in 2023, with total deposits of $12.2 billion, a loan-to-deposit ratio of 89.4% and cash and investment securities of $2.9 billion. This compares to total deposits of $10.8 billion, a loan-to-deposit ratio of 89.9% and cash and investment securities of $2.6 billion at the end of 2022. Non-interest bearing deposits comprise 32.5% of total deposits at December 31, 2023, compared to 42.9% at the end of 2022. Excluding brokered certificates of deposits, core deposits as of December 31, 2023 totaled $11.7 billion, an increase of $983.4 million from the prior year.

Total shareholders’ equity was $1.7 billion and $1.5 billion as of December 31, 2023 and December 31, 2022, respectively. The increase was primarily due to net income of $194.1 million and an increase in accumulated other comprehensive income (“AOCI”) of $29.3 million. The change in AOCI was primarily due to an improvement in the fair value of available for sale investment securities due to a decline in longer-term market interest rates. The Company returned $37.4 million, or $1.00 per share, to common shareholders and $3.8 million, or $50.00 per share, to preferred shareholders in 2023.

Fourth Quarter Highlights

•Earnings - Net income in the fourth quarter 2023 was $44.5 million, a decrease of $0.1 million compared to the linked quarter and a decrease of $15.5 million from the prior year quarter. EPS was $1.16 for the fourth quarter 2023, compared to $1.17 and $1.58 for the linked and prior year quarters, respectively. Excluding the impact of the FDIC special assessment of $2.4 million, EPS was $1.21 for the fourth quarter 2023.

2 Core efficiency ratio is a non-GAAP measure. Please refer to discussion and reconciliation of this measure in the accompanying financial tables.

•PPNR - PPNR1 of $75.8 million in the fourth quarter 2023 increased $10.7 million and decreased $2.8 million from the linked and prior year quarters, respectively. The increase from the linked quarter was primarily due to an increase in noninterest income, partially offset by an increase in noninterest expense. The decrease from the prior year quarter was primarily due to an increase in customer deposit servicing costs as a result of higher market interest rates.

•Net interest income and NIM - Net interest income of $140.7 million for the fourth quarter 2023 decreased $0.9 million and increased $1.9 million from the linked and prior year quarters, respectively. NIM was 4.23% for the fourth quarter 2023, compared to 4.33% and 4.66% for the linked and prior year quarters, respectively. Compared to the linked quarter, net interest income declined due to higher deposit interest expense, partially offset by higher average loan and investment balances and expanding yields on earning assets.

•Noninterest income - Noninterest income of $25.5 million for the fourth quarter 2023 increased $13.4 million from the linked quarter and increased $8.6 million from the prior year quarter. The increase from the linked and prior year quarters was primarily due to an increase in tax credit income. Tax credit income improved due to higher volumes and from the impact on fair value from the decrease in market interest rates on projects carried at fair value.

•Loans - Total loans increased $267.3 million from the linked quarter to $10.9 billion as of December 31, 2023. Loans grew 10% on an annualized basis, from the linked quarter and 12% for the year. Average loans totaled $10.7 billion for the fourth quarter 2023, compared to $10.5 billion and $9.4 billion for the linked and prior year quarters, respectively.

•Asset quality - The allowance for credit losses to loans was 1.24% at December 31, 2023, compared to 1.34% at September 30, 2023 and 1.41% at December 31, 2022. Nonperforming assets to total assets was 0.34% at December 31, 2023, compared to 0.40% and 0.08% at September 30, 2023 and December 31, 2022, respectively. A provision for credit losses of $18.1 million was recorded in the fourth quarter 2023, compared to $8.0 million and $2.1 million for the linked and prior year quarters, respectively.

•Deposits - Total deposits increased $266.5 million from the linked quarter to $12.2 billion as of December 31, 2023. Average deposits totaled $12.2 billion for the fourth quarter 2023, compared to $11.9 billion and $11.0 billion for the linked and prior year quarters, respectively. At December 31, 2023, noninterest-bearing deposit accounts represented 32.5% of total deposits, and the loan to deposit ratio was 89.4%.

•Capital - Total shareholders’ equity was $1.7 billion and the tangible common equity to tangible assets ratio1 was 8.96% at December 31, 2023, compared to 8.43% at December 31, 2022. The tangible common equity to tangible assets ratio increased due to strong earnings growth and an increase in accumulated other comprehensive income from an improvement in the fair value of available-for-sale securities. Enterprise Bank & Trust remains “well-capitalized,” with a common equity tier 1 ratio of 12.2% and a total risk-based capital ratio of 13.2% as of December 31, 2023. The Company’s common equity tier 1 ratio and total risk-based capital ratio was 11.3% and 14.2%, respectively, at December 31, 2023.

The Company’s Board of Directors approved a quarterly dividend of $0.25 per common share, payable on March 29, 2024 to shareholders of record as of March 15, 2024. The Board of Directors also declared a cash dividend of $12.50 per share of Series A Preferred Stock (or $0.3125 per depositary share) representing a 5% per annum rate for the period commencing (and including) December 15, 2023 to (but excluding) March 15, 2024. The dividend will be payable on March 15, 2024 to shareholders of record on February 29, 2024.

Net Interest Income and NIM

Average Balance Sheets

The following table presents, for the periods indicated, certain information related to our average interest-earning assets and interest-bearing liabilities, as well as, the corresponding interest rates earned and paid, all on a tax-equivalent basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| ($ in thousands) | Average

Balance | | Interest

Income/

Expense | | Average Yield/ Rate | | Average

Balance | | Interest

Income/

Expense | | Average Yield/ Rate | | Average

Balance | | Interest

Income/

Expense | | Average Yield/ Rate |

| Assets | | | | | | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Loans1, 2 | $ | 10,685,961 | | | $ | 184,982 | | | 6.87 | % | | $ | 10,521,966 | | | $ | 180,382 | | | 6.80 | % | | $ | 9,423,984 | | | $ | 139,432 | | | 5.87 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Securities2 | 2,276,915 | | | 18,385 | | | 3.20 | | | 2,302,850 | | | 18,076 | | | 3.11 | | | 2,204,211 | | | 16,191 | | | 2.91 | |

| Interest-earning deposits | 420,762 | | | 5,631 | | | 5.31 | | | 335,771 | | | 4,509 | | | 5.33 | | | 367,100 | | | 3,097 | | | 3.35 | |

| Total interest-earning assets | 13,383,638 | | | 208,998 | | | 6.20 | | | 13,160,587 | | | 202,967 | | | 6.12 | | | 11,995,295 | | | 158,720 | | | 5.25 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Noninterest-earning assets | 949,166 | | | | | | | 908,273 | | | | | | | 991,273 | | | | | |

| | | | | | | | | | | | | | | | | |

| Total assets | $ | 14,332,804 | | | | | | | $ | 14,068,860 | | | | | | | $ | 12,986,568 | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Interest-bearing demand accounts | $ | 2,844,847 | | | $ | 17,248 | | | 2.41 | % | | $ | 2,672,084 | | | $ | 13,701 | | | 2.03 | % | | $ | 2,242,268 | | | $ | 4,136 | | | 0.73 | % |

| Money market accounts | 3,342,979 | | | 30,579 | | | 3.63 | | | 3,079,221 | | | 26,427 | | | 3.40 | | | 2,696,417 | | | 9,509 | | | 1.40 | |

| Savings accounts | 609,645 | | | 268 | | | 0.17 | | | 646,187 | | | 250 | | | 0.15 | | | 775,488 | | | 100 | | | 0.05 | |

| Certificates of deposit | 1,373,808 | | | 14,241 | | | 4.11 | | | 1,519,119 | | | 14,976 | | | 3.91 | | | 524,938 | | | 1,017 | | | 0.77 | |

| Total interest-bearing deposits | 8,171,279 | | | 62,336 | | | 3.03 | | | 7,916,611 | | | 55,354 | | | 2.77 | | | 6,239,111 | | | 14,762 | | | 0.94 | |

| Subordinated debentures and notes | 155,907 | | | 2,475 | | | 6.30 | | | 155,769 | | | 2,466 | | | 6.28 | | | 155,359 | | | 2,376 | | | 6.07 | |

| FHLB advances | — | | | — | | | — | | | 10,326 | | | 141 | | | 5.42 | | | 8,864 | | | 104 | | | 4.65 | |

| Securities sold under agreements to repurchase | 150,827 | | | 1,226 | | | 3.22 | | | 146,893 | | | 969 | | | 2.61 | | | 182,362 | | | 282 | | | 0.61 | |

| Other borrowings | 49,013 | | | 314 | | | 2.54 | | | 50,571 | | | 337 | | | 2.66 | | | 26,993 | | | 378 | | | 5.56 | |

| Total interest-bearing liabilities | 8,527,026 | | | 66,351 | | | 3.09 | | | 8,280,170 | | | 59,267 | | | 2.84 | | | 6,612,689 | | | 17,902 | | | 1.07 | |

| | | | | | | | | | | | | | | | | |

| Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Demand deposits | 3,992,067 | | | | | | | 4,005,923 | | | | | | | 4,763,503 | | | | | |

| Other liabilities | 160,829 | | | | | | | 134,162 | | | | | | | 119,784 | | | | | |

| Total liabilities | 12,679,922 | | | | | | | 12,420,255 | | | | | | | 11,495,976 | | | | | |

| Shareholders' equity | 1,652,882 | | | | | | | 1,648,605 | | | | | | | 1,490,592 | | | | | |

| Total liabilities and shareholders' equity | $ | 14,332,804 | | | | | | | $ | 14,068,860 | | | | | | | $ | 12,986,568 | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total net interest income | | | $ | 142,647 | | | | | | | $ | 143,700 | | | | | | | $ | 140,818 | | | |

| Net interest margin | | | | | 4.23 | % | | | | | | 4.33 | % | | | | | | 4.66 | % |

| | | | | | | | | | | | | | | | | |

1 Average balances include nonaccrual loans. Interest income includes loan fees of $3.1 million, $3.3 million, and $3.7 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively. |

2 Non-taxable income is presented on a fully tax-equivalent basis using a tax rate of approximately 25%. The tax-equivalent adjustments were $1.9 million, $2.1 million, and $2.0 million for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022, respectively. |

Net interest income for the fourth quarter was $140.7 million, a decrease of $0.9 million from the linked quarter and an increase of $1.9 million from the prior year period. Net interest income on a tax equivalent basis was $142.6 million, $143.7 million, and $140.8 million for the current, linked and prior year quarters, respectively. The decrease from the linked quarter was primarily due to the impact of rising rates and continued remixing into higher cost categories on the deposit portfolio. The increase from the prior year quarter reflects the benefit of higher market interest rates on the Company’s asset sensitive balance sheet combined with organic growth.

Interest income increased $6.2 million during the quarter primarily due to a $4.6 million increase in loan interest income and a $1.1 million increase in interest income on cash accounts. Interest on loans benefited from a 7 basis point increase in average yield and a $164.0 million increase in average loan balances, compared to the linked quarter. The average interest rate of new loan originations in the fourth quarter 2023 was 7.95%. Interest on cash accounts increased due to a $85.0 million increase in average balances.

Interest expense increased $7.1 million in the fourth quarter 2023 primarily due to increased deposit interest expense. The increase in deposit interest expense reflects higher rates paid on deposits as well as successful marketing efforts that increased average deposits. The average cost of interest-bearing deposits was 3.03%, an increase of 26 basis points compared to the linked quarter. The total cost of deposits, including noninterest-bearing demand accounts, was 2.03% during the fourth quarter 2023, compared to 1.84% in the linked quarter.

NIM, on a tax equivalent basis, was 4.23% in the fourth quarter 2023, a decrease of 10 basis points from the linked quarter and a decrease of 43 basis points from the prior year quarter. For the month of December 2023, the loan portfolio yield was 6.92% and the cost of total deposits was 2.07%.

Investments

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| ($ in thousands) | Carrying Value | | Net Unrealized Loss | | Carrying Value | | Net Unrealized Loss | | Carrying Value | | Net Unrealized Loss |

| Available-for-sale (AFS) | $ | 1,618,273 | | | $ | (150,861) | | | $ | 1,487,104 | | | $ | (235,013) | | | $ | 1,535,807 | | | $ | (193,247) | |

| Held-to-maturity (HTM) | 750,434 | | | (54,572) | | | 730,655 | | | (108,780) | | | 709,915 | | | (82,133) | |

| Total | $ | 2,368,707 | | | $ | (205,433) | | | $ | 2,217,759 | | | $ | (343,793) | | | $ | 2,245,722 | | | $ | (275,380) | |

| | | | | | | | | | | |

Investment securities totaled $2.4 billion at December 31, 2023, an increase of $150.9 million from the linked quarter. The increase was primarily due to a $84.2 million increase in the fair value of available-for-sale securities due to a decline in longer-term rates in the quarter. Investment purchases in the fourth quarter 2023 had a weighted average, tax equivalent yield of 5.4%.

The average duration of the investment portfolio was approximately 6 years at December 31, 2023. The Company utilizes the investment portfolio to lengthen the overall duration of the balance sheet. The expected cash flow from pay downs, maturities and interest over the next 12 months is approximately $325 million. The tangible common equity to tangible assets ratio adjusted for unrealized losses on held-to-maturity securities was 8.67% at December 31, 2023, compared to 7.91% at September 30, 2023.

Loans

The following table presents total loans for the most recent five quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| | | | | | | | | |

| ($ in thousands) | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| C&I | $ | 2,186,203 | | | $ | 2,020,303 | | | $ | 2,029,370 | | | $ | 2,005,539 | | | $ | 1,904,654 | |

| CRE investor owned | 2,291,660 | | | 2,260,220 | | | 2,290,701 | | | 2,239,932 | | | 2,176,424 | |

| CRE owner occupied | 1,262,264 | | | 1,255,885 | | | 1,208,675 | | | 1,173,985 | | | 1,174,094 | |

| SBA loans* | 1,281,632 | | | 1,309,497 | | | 1,327,667 | | | 1,315,732 | | | 1,312,378 | |

| Sponsor finance* | 872,264 | | | 888,000 | | | 879,491 | | | 677,529 | | | 635,061 | |

| Life insurance premium finance* | 956,162 | | | 928,486 | | | 912,274 | | | 859,910 | | | 817,115 | |

| Tax credits* | 734,594 | | | 683,580 | | | 609,137 | | | 547,513 | | | 559,605 | |

| Residential real estate | 359,957 | | | 364,618 | | | 354,588 | | | 348,726 | | | 379,924 | |

| Construction and land development | 670,567 | | | 639,555 | | | 599,375 | | | 590,509 | | | 534,753 | |

| Other | 268,815 | | | 266,676 | | | 301,345 | | | 252,543 | | | 243,130 | |

| Total loans | $ | 10,884,118 | | | $ | 10,616,820 | | | $ | 10,512,623 | | | $ | 10,011,918 | | | $ | 9,737,138 | |

| | | | | | | | | |

| Total loan yield | 6.87 | % | | 6.80 | % | | 6.64 | % | | 6.33 | % | | 5.87 | % |

| | | | | | | | | |

| Variable interest rate loans to total loans | 61 | % | | 61 | % | | 62 | % | | 63 | % | | 63 | % |

|

|

| *Specialty loan category |

|

Loans totaled $10.9 billion at December 31, 2023, increasing $267.3 million, or 10% on an annualized basis, from the linked quarter. The increase was driven primarily by a C&I increase of $165.9 million, a CRE and construction increase of $68.8 million and a specialty lending increase of $35.1 million. Average line utilization was approximately 42% for the quarter ended December 31, 2023, compared to 41% for both the linked and prior year quarters, respectively.

Asset Quality

The following table presents the categories of nonperforming assets and related ratios for the most recent five quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| ($ in thousands) | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| Nonperforming loans* | $ | 43,728 | | | $ | 48,932 | | | $ | 16,112 | | | $ | 11,972 | | | $ | 9,981 | |

| Other | 5,736 | | | 6,933 | | | — | | | 250 | | | 269 | |

| Nonperforming assets* | $ | 49,464 | | | $ | 55,865 | | | $ | 16,112 | | | $ | 12,222 | | | $ | 10,250 | |

| | | | | | | | | |

| Nonperforming loans to total loans | 0.40 | % | | 0.46 | % | | 0.15 | % | | 0.12 | % | | 0.10 | % |

| Nonperforming assets to total assets | 0.34 | % | | 0.40 | % | | 0.12 | % | | 0.09 | % | | 0.08 | % |

| | | | | | | | | |

| Allowance for credit losses to loans | 1.24 | % | | 1.34 | % | | 1.34 | % | | 1.38 | % | | 1.41 | % |

| Net charge-offs (recoveries) | $ | 28,479 | | | $ | 6,856 | | | $ | 2,973 | | | $ | (264) | | | $ | 2,075 | |

| | | | | | | | | |

| *Guaranteed balances excluded | $ | 10,682 | | | $ | 5,974 | | | $ | 6,666 | | | $ | 6,835 | | | $ | 6,708 | |

Nonperforming assets decreased $6.4 million during the fourth quarter 2023 and increased $39.2 million from the prior year quarter. The decrease from the linked quarter was primarily due to a $5.2 million reduction in nonperforming loans. In the fourth quarter 2023, $32.2 million of new loans moved into nonperforming status, $24.4 million of which were charged-off in the quarter. The bulk of the charged-off amount was related to two relationships, one in the agricultural portfolio that surfaced late in the quarter and another to a commercial real

estate developer. The agricultural and commercial real estate developer relationships totaled $16.4 million and $10.0 million, respectively, of which $13.0 million and $10.0 million, respectively, were charged-off in the fourth quarter 2023. The increase in nonperforming loans from the prior year quarter was primarily due to a $30.4 million increase in real estate loans and a $3.3 million increase in C&I loans. Net charge-offs totaled 37 basis points of average loans in 2023, compared to 4 basis points in 2022.

The $43.7 million in nonperforming loans at December 31, 2023 consists primarily of 8 relationships representing 81% of total nonperforming loans that each have a balance greater than $1 million.

The provision for credit losses totaled $18.1 million in the fourth quarter 2023, compared to $8.0 million and $2.1 million in the linked and prior year quarters, respectively. The provision for credit losses in the fourth quarter primarily relates to charge-offs and loan growth, partially offset by an improvement in the economic forecast.

The allowance for credit losses to loans was 1.24% at December 31, 2023, a decrease of 10 basis points from the linked quarter.

Deposits

The following table presents deposits broken out by type for the most recent five quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| | | | | | | | | |

| ($ in thousands) | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Noninterest-bearing demand accounts | $ | 3,958,743 | | | $ | 3,852,486 | | | $ | 3,880,561 | | | $ | 4,192,523 | | | $ | 4,642,732 | |

| Interest-bearing demand accounts | 2,950,259 | | | 2,749,598 | | | 2,629,339 | | | 2,395,901 | | | 2,256,295 | |

| Money market and savings accounts | 3,994,455 | | | 3,837,145 | | | 3,577,856 | | | 3,672,539 | | | 3,399,415 | |

| Brokered certificates of deposit | 482,759 | | | 695,551 | | | 893,808 | | | 369,505 | | | 118,968 | |

| Other certificates of deposit | 790,155 | | | 775,127 | | | 638,296 | | | 524,168 | | | 411,740 | |

| Total deposit portfolio | $ | 12,176,371 | | | $ | 11,909,907 | | | $ | 11,619,860 | | | $ | 11,154,636 | | | $ | 10,829,150 | |

| | | | | | | | | |

| Noninterest-bearing deposits to total deposits | 32.5 | % | | 32.3 | % | | 33.4 | % | | 37.6 | % | | 42.9 | % |

| Total costs of deposits | 2.03 | % | | 1.84 | % | | 1.46 | % | | 0.92 | % | | 0.53 | % |

|

Total deposits at December 31, 2023 were $12.2 billion, an increase of $266.5 million and $1.3 billion from the linked and prior year quarters, respectively. Excluding brokered certificates of deposits, deposits increased $479.3 million and $983.4 million from the linked and prior year quarters, respectively. Reciprocal deposits, which are placed through third party programs to provide FDIC insurance on larger deposit relationships, totaled $1.2 billion at December 31, 2023, compared to $1.1 billion at September 30, 2023.

Total estimated insured deposits, which includes collateralized deposits, reciprocal accounts and accounts that qualify for pass-through insurance, totaled $8.3 billion, or 69% of total deposits, at the end of December 31, 2023, compared to $8.5 billion, or 71% of total deposits, in the linked quarter.

Noninterest Income

The following table presents a comparative summary of the major components of noninterest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Linked quarter comparison | | Prior year comparison |

| Quarter ended | | Quarter ended |

| ($ in thousands) | December 31, 2023 | | September 30, 2023 | | Increase (decrease) | | December 31, 2022 | | Increase (decrease) |

| Deposit service charges | 4,334 | | | 4,187 | | | $ | 147 | | | 4 | % | | $ | 4,463 | | | $ | (129) | | | (3) | % |

| Wealth management revenue | 2,428 | | | 2,614 | | | (186) | | | (7) | % | | 2,423 | | | 5 | | | — | % |

| Card services revenue | 2,666 | | | 2,560 | | | 106 | | | 4 | % | | 2,345 | | | 321 | | | 14 | % |

| Tax credit income (loss) | 9,688 | | | (2,673) | | | 12,361 | | | 462 | % | | 2,389 | | | 7,299 | | | 306 | % |

| | | | | | | | | | | | | |

| Other income | 6,336 | | | 5,397 | | | 939 | | | 17 | % | | 5,253 | | | 1,083 | | | 21 | % |

| | | | | | | | | | | | | |

| Total noninterest income | $ | 25,452 | | | $ | 12,085 | | | $ | 13,367 | | | 111 | % | | $ | 16,873 | | | $ | 8,579 | | | 51 | % |

| | | | | | | | | | | | | |

|

|

Total noninterest income for the fourth quarter 2023 was $25.5 million, an increase of $13.4 million from the linked quarter and an increase of $8.6 million from the prior year quarter. The increase from both the linked and prior year quarters was primarily due to an increase in tax credit income. Tax credit income is typically highest in the fourth quarter of each year and will vary in other periods based on transaction volumes and fair value changes on credits carried at fair value. The discount rate used in the fair value determination is the 10-year SOFR swap rate, which decreased approximately 80 basis points in the fourth quarter.

The following table presents a comparative summary of the major components of other income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Linked quarter comparison | | Prior year comparison |

| Quarter ended | | Quarter ended |

| ($ in thousands) | December 31, 2023 | | September 30, 2023 | | Increase (decrease) | | December 31, 2022 | | Increase (decrease) |

| BOLI | $ | 1,279 | | | $ | 822 | | | $ | 457 | | | 56 | % | | $ | 773 | | | $ | 506 | | | 65 | % |

| Community development investments | 1,027 | | | 338 | | | 689 | | | 204 | % | | 2,775 | | | (1,748) | | | (63) | % |

| Private equity fund distributions | 725 | | | 181 | | | 544 | | | 301 | % | | 433 | | | 292 | | | 67 | % |

| Servicing fees | 774 | | | 701 | | | 73 | | | 10 | % | | 181 | | | 593 | | | 328 | % |

| Swap fees | 163 | | | 54 | | | 109 | | | 202 | % | | 189 | | | (26) | | | (14) | % |

| Gain on SBA loan sales | — | | | 1,514 | | | (1,514) | | | (100) | % | | — | | | — | | | — | % |

| Miscellaneous income | 2,368 | | | 1,787 | | | 581 | | | 33 | % | | 902 | | | 1,466 | | | 163 | % |

| Total other income | $ | 6,336 | | | $ | 5,397 | | | $ | 939 | | | 17 | % | | $ | 5,253 | | | $ | 1,083 | | | 21 | % |

| | | | | | | | | | | | | |

The increase in bank-owned life insurance income in the fourth quarter 2023 compared to the linked and prior year quarters was related to a policy benefit payment. While a small portfolio of SBA loans was sold in the linked quarter, no loans were sold in the fourth quarter 2023. However, $11 million of investment securities were sold in the fourth quarter 2023 resulting in a gain of $0.2 million that is included in miscellaneous income.

Noninterest Expense

The following table presents a comparative summary of the major components of noninterest expense for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Linked quarter comparison | | Prior year comparison |

| Quarter ended | | Quarter ended |

| ($ in thousands) | December 31, 2023 | | September 30, 2023 | | Increase (decrease) | | December 31, 2022 | | Increase (decrease) |

| Employee compensation and benefits | $ | 39,651 | | | $ | 40,771 | | | $ | (1,120) | | | (3) | % | | $ | 38,175 | | | $ | 1,476 | | | 4 | % |

| Occupancy | 4,313 | | | 4,198 | | | 115 | | | 3 | % | | 4,248 | | | 65 | | | 2 | % |

| Deposit costs | 21,606 | | | 20,987 | | | 619 | | | 3 | % | | 13,256 | | | 8,350 | | | 63 | % |

| FDIC special assessment | 2,412 | | | — | | | 2,412 | | | — | % | | — | | | 2,412 | | | — | % |

| Other expense | 24,621 | | | 22,688 | | | 1,933 | | | 9 | % | | 21,470 | | | 3,151 | | | 15 | % |

| Total noninterest expense | $ | 92,603 | | | $ | 88,644 | | | $ | 3,959 | | | 4 | % | | $ | 77,149 | | | $ | 15,454 | | | 20 | % |

| | | | | | | | | | | | | |

|

|

Noninterest expense was $92.6 million for the fourth quarter 2023, a $4.0 million increase from the linked quarter, and a $15.5 million increase from the prior year quarter. Included in noninterest expense in the fourth quarter 2023 was an assessment of $2.4 million from the FDIC to recover losses in the Deposit Insurance Fund related to the 2023 bank failures. Employee compensation and benefits decreased $1.1 million from the linked quarter primarily due to lower performance-based incentive accruals and a reduction in accrued PTO from vacation usage. Deposit costs increased $0.6 million from the linked quarter, primarily due to growth in average balances that receive an earnings credit rate. Other expense increased due to higher OREO and loan workout expenses, along with an increase in charitable contributions and data processing expenses.

The increase in noninterest expense of $15.5 million from the prior year quarter was primarily due to an $8.4 million increase in variable deposit costs, an increase in the associate base, merit increases throughout 2022 and 2023, and the FDIC special assessment.

For the fourth quarter 2023, the Company’s core efficiency ratio2 was 53.1% for the quarter ended December 31, 2023, compared to 56.2% for the linked quarter and 48.1% for the prior year quarter.

Income Taxes

The Company’s effective tax rate was 19.8% in the fourth quarter 2023, compared to 21.7% and 21.5% in the linked and prior year quarters, respectively. In conjunction with the completion of the 2022 tax returns in the fourth quarter 2023, the effective tax rate was decreased due to a lower state tax apportionment. The anticipated effective tax rate for 2024 is approximately 21%.

Capital

The following table presents total equity and various EFSC capital ratios for the most recent five quarters:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| Percent | December 31, 2023* | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Shareholders’ equity | $ | 1,716,068 | | | $ | 1,611,880 | | | $ | 1,618,233 | | | $ | 1,592,820 | | | $ | 1,522,263 | |

| Total risk-based capital to risk-weighted assets | 14.2 | % | | 14.1 | % | | 14.1 | % | | 14.3 | % | | 14.2 | % |

| Tier 1 capital to risk-weighted assets | 12.7 | % | | 12.6 | % | | 12.5 | % | | 12.6 | % | | 12.6 | % |

| Common equity tier 1 capital to risk-weighted assets | 11.3 | % | | 11.2 | % | | 11.1 | % | | 11.2 | % | | 11.1 | % |

| Leverage ratio | 11.0 | % | | 10.9 | % | | 11.0 | % | | 11.1 | % | | 10.9 | % |

| Tangible common equity to tangible assets | 8.96 | % | | 8.51 | % | | 8.65 | % | | 8.81 | % | | 8.43 | % |

| | | | | | | | | |

| *Capital ratios for the current quarter are preliminary and subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review. |

Total equity was $1.7 billion at December 31, 2023, an increase of $104.2 million from the linked quarter. The increase from the linked quarter was primarily due to the current quarter’s net income of $44.5 million and a $66.8 million increase in accumulated other comprehensive income due to a net fair value increase in the Company’s fixed-rate, available-for-sale investment portfolio. Offsetting these increases were $10.3 million in common and preferred dividends. The Company’s tangible common book value per share was $33.85 at December 31, 2023, compared to $31.06 and $28.67 in the linked and prior year quarters, respectively.

The Company’s regulatory capital ratios continue to exceed the “well-capitalized” regulatory benchmark. Capital ratios for the current quarter are subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review.

Use of Non-GAAP Financial Measures

The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as tangible common equity, PPNR, ROACE, ROATCE, ROAA, PPNR return on average assets (“PPNR ROAA”), core efficiency ratio, the tangible common equity ratio, and tangible book value per common share, in this release that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

The Company considers its tangible common equity, PPNR, ROACE, ROATCE, ROAA, PPNR ROAA, core efficiency ratio, the tangible common equity ratio, and tangible book value per common share, collectively “core performance measures,” presented in this earnings release and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures exclude certain other income and expense items, such as the FDIC special assessment, merger-related expenses, facilities charges, and the gain or loss on sale of investment securities, that the Company believes to be not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated.

Conference Call and Webcast Information

The Company will host a conference call and webcast at 10:00 a.m. Central Time on Tuesday, January 23, 2024. During the call, management will review the fourth quarter 2023 results and related matters. This press release as well as a related slide presentation will be accessible on the Company’s website at www.enterprisebank.com under “Investor Relations” prior to the scheduled broadcast of the conference call. The call can be accessed via this same website page, or via telephone at 1-888-330-2413 (Conference ID 70045, press # to reach an operator). We encourage participants to pre-register for the conference call using the following link:

https://bit.ly/EFSC4Q2023EarningsCallRegistration. Callers who pre-register will be given a conference passcode and unique PIN to gain immediate access to the call and bypass the live operator. Participants may pre-register at any time, including up to and after the call start time. A recorded replay of the conference call will be available on the website after the call’s completion. The replay will be available for at least two weeks following the conference call.

About Enterprise Financial Services Corp

Enterprise Financial Services Corp (Nasdaq: EFSC), with approximately $14.5 billion in assets, is a financial holding company headquartered in Clayton, Missouri. Enterprise Bank & Trust, a Missouri state-chartered trust company with banking powers and a wholly-owned subsidiary of EFSC, operates branch offices in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico, and SBA loan and deposit production offices throughout the country. Enterprise Bank & Trust offers a range of business and personal banking services and wealth management services. Enterprise Trust, a division of Enterprise Bank & Trust, provides financial planning, estate planning, investment management and trust services to businesses, individuals, institutions, retirement plans and non-profit organizations. Additional information is available at www.enterprisebank.com.

Enterprise Financial Services Corp’s common stock is traded on the Nasdaq Stock Market under the symbol “EFSC.” Please visit our website at www.enterprisebank.com to see our regularly posted material information.

Forward-looking Statements

Readers should note that, in addition to the historical information contained herein, this press release contains “forward-looking statements” within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, liquidity, yields and returns, loan diversification and credit management, shareholder value creation and the impact of acquisitions.

Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that

any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: the Company’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses and grow the acquired operations, as well as credit risk, changes in the appraised valuation of real estate securing impaired loans, outcomes of litigation and other contingencies, exposure to general and local economic and market conditions, high unemployment rates, higher inflation and its impacts (including U.S. federal government measures to address higher inflation), U.S. fiscal debt, budget and tax matters, and any slowdown in global economic growth, risks associated with rapid increases or decreases in prevailing interest rates, our ability to attract and retain deposits and access to other sources of liquidity, consolidation in the banking industry, competition from banks and other financial institutions, the Company’s ability to attract and retain relationship officers and other key personnel, burdens imposed by federal and state regulation, changes in legislative or regulatory requirements, as well as current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including rules and regulations relating to bank products and financial services, changes in accounting policies and practices or accounting standards, changes in the method of determining LIBOR and the phase out of LIBOR, natural disasters, terrorist activities, war and geopolitical matters (including the war in Israel and potential for a broader regional conflict and the war in Ukraine and the imposition of additional sanctions and export controls in connection therewith), or pandemics, and their effects on economic and business environments in which we operate, including the related disruption to the financial market and other economic activity, and those factors and risks referenced from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and the Company’s other filings with the SEC. The Company cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the Company’s results.

For any forward-looking statements made in this press release or in any documents, EFSC claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Readers are cautioned not to place undue reliance on any forward-looking statements. Except to the extent required by applicable law or regulation, EFSC disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made.

For more information contact

Investor Relations: Keene Turner, Senior Executive Vice President and CFO (314) 512-7233

Media: Steve Richardson, Senior Vice President (314) 995-5695

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Year ended |

| (in thousands, except per share data) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Dec 31,

2023 | | Dec 31,

2022 |

| EARNINGS SUMMARY | | | | | | | | | | | | | |

| Net interest income | $ | 140,732 | | | $ | 141,639 | | | $ | 140,692 | | | $ | 139,529 | | | $ | 138,835 | | | $ | 562,592 | | | $ | 473,903 | |

| Provision (benefit) for credit losses | 18,053 | | | 8,030 | | | 6,339 | | | 4,183 | | | 2,123 | | | 36,605 | | | (611) | |

| Noninterest income | 25,452 | | | 12,085 | | | 14,290 | | | 16,898 | | | 16,873 | | | 68,725 | | | 59,162 | |

| Noninterest expense | 92,603 | | | 88,644 | | | 85,956 | | | 80,983 | | | 77,149 | | | 348,186 | | | 274,216 | |

| Income before income tax expense | 55,528 | | | 57,050 | | | 62,687 | | | 71,261 | | | 76,436 | | | 246,526 | | | 259,460 | |

| Income tax expense | 10,999 | | | 12,385 | | | 13,560 | | | 15,523 | | | 16,435 | | | 52,467 | | | 56,417 | |

| Net income | 44,529 | | | 44,665 | | | 49,127 | | | 55,738 | | | 60,001 | | | 194,059 | | | 203,043 | |

| Preferred stock dividends | 937 | | | 938 | | | 937 | | | 938 | | | 937 | | | $ | 3,750 | | | $ | 4,041 | |

| Net income available to common shareholders | $ | 43,592 | | | $ | 43,727 | | | $ | 48,190 | | | $ | 54,800 | | | $ | 59,064 | | | $ | 190,309 | | | $ | 199,002 | |

| | | | | | | | | | | | | |

| Diluted earnings per common share | $ | 1.16 | | | $ | 1.17 | | | $ | 1.29 | | | $ | 1.46 | | | $ | 1.58 | | | $ | 5.07 | | | $ | 5.31 | |

Return on average assets1 | 1.28 | % | | 1.26 | % | | 1.44 | % | | 1.72 | % | | 1.83 | % | | 1.42 | % | | 1.52 | % |

Return on average common equity1 | 11.40 | % | | 11.00 | % | | 12.48 | % | | 14.85 | % | | 16.52 | % | | 12.39 | % | | 13.95 | % |

ROATCE1 | 14.98 | % | | 14.49 | % | | 16.53 | % | | 19.93 | % | | 22.62 | % | | 16.40 | % | | 19.10 | % |

| Net interest margin (tax equivalent) | 4.23 | % | | 4.33 | % | | 4.49 | % | | 4.71 | % | | 4.66 | % | | 4.43 | % | | 3.89 | % |

| | | | | | | | | | | | | |

| Efficiency ratio | 55.72 | % | | 57.66 | % | | 55.46 | % | | 51.77 | % | | 49.55 | % | | 55.15 | % | | 51.44 | % |

Core efficiency ratio1 | 53.06 | % | | 56.18 | % | | 54.04 | % | | 50.47 | % | | 48.10 | % | | 53.42 | % | | 49.77 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Assets | $ | 14,518,590 | | | $ | 14,025,042 | | | $ | 13,871,154 | | | $ | 13,325,982 | | | $ | 13,054,172 | | | | | |

| Average assets | $ | 14,332,804 | | | $ | 14,068,860 | | | $ | 13,671,985 | | | $ | 13,131,195 | | | $ | 12,986,568 | | | $ | 13,805,236 | | | $ | 13,319,624 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Period end common shares outstanding | 37,416 | | | 37,385 | | | 37,359 | | | 37,311 | | | 37,253 | | | | | |

| Dividends per common share | $ | 0.25 | | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.24 | | | $ | 1.00 | | | $ | 0.90 | |

Tangible book value per common share1 | $ | 33.85 | | | $ | 31.06 | | | $ | 31.23 | | | $ | 30.55 | | | $ | 28.67 | | | | | |

Tangible common equity to tangible assets1 | 8.96 | % | | 8.51 | % | | 8.65 | % | | 8.81 | % | | 8.43 | % | | | | |

Total risk-based capital to risk-weighted assets2 | 14.2 | % | | 14.1 | % | | 14.1 | % | | 14.3 | % | | 14.2 | % | | | | |

| | | | | | | | | | | | | |

1Refer to Reconciliations of Non-GAAP Financial Measures table for a reconciliation of these measures to GAAP. |

2Capital ratios for the current quarter are preliminary and subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review. |

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Year ended |

| ($ in thousands, except per share data) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Dec 31,

2023 | | Dec 31,

2022 |

| INCOME STATEMENTS | | | | | | | | | | | | | |

| NET INTEREST INCOME | | | | | | | | | | | | | |

| Interest income | $ | 207,083 | | | $ | 200,906 | | | $ | 187,897 | | | $ | 169,033 | | | $ | 156,737 | | | $ | 764,919 | | | $ | 515,082 | |

| Interest expense | 66,351 | | | 59,267 | | | 47,205 | | | 29,504 | | | 17,902 | | | 202,327 | | | 41,179 | |

| Net interest income | 140,732 | | | 141,639 | | | 140,692 | | | 139,529 | | | 138,835 | | | 562,592 | | | 473,903 | |

| Provision (benefit) for credit losses | 18,053 | | | 8,030 | | | 6,339 | | | 4,183 | | | 2,123 | | | 36,605 | | | (611) | |

| Net interest income after provision (benefit) for credit losses | 122,679 | | | 133,609 | | | 134,353 | | | 135,346 | | | 136,712 | | | 525,987 | | | 474,514 | |

| | | | | | | | | | | | | |

| NONINTEREST INCOME | | | | | | | | | | | | | |

| Deposit service charges | 4,334 | | | 4,187 | | | 3,910 | | | 4,128 | | | 4,463 | | | 16,559 | | | 18,326 | |

| Wealth management revenue | 2,428 | | | 2,614 | | | 2,472 | | | 2,516 | | | 2,423 | | | 10,030 | | | 10,010 | |

| Card services revenue | 2,666 | | | 2,560 | | | 2,464 | | | 2,338 | | | 2,345 | | | 10,028 | | | 11,551 | |

| Tax credit income (loss) | 9,688 | | | (2,673) | | | 368 | | | 1,813 | | | 2,389 | | | 9,196 | | | 2,558 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other income | 6,336 | | | 5,397 | | | 5,076 | | | 6,103 | | | 5,253 | | | 22,912 | | | 16,717 | |

| Total noninterest income | 25,452 | | | 12,085 | | | 14,290 | | | 16,898 | | | 16,873 | | | 68,725 | | | 59,162 | |

| | | | | | | | | | | | | |

| NONINTEREST EXPENSE | | | | | | | | | | | | | |

| Employee compensation and benefits | 39,651 | | | 40,771 | | | 41,641 | | | 42,503 | | | 38,175 | | | 164,566 | | | 147,029 | |

| Occupancy | 4,313 | | | 4,198 | | | 3,954 | | | 4,061 | | | 4,248 | | | 16,526 | | | 17,640 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Deposit costs | 21,606 | | | 20,987 | | | 16,980 | | | 12,720 | | | 13,256 | | | 72,293 | | | 31,082 | |

| | | | | | | | | | | | | |

| FDIC special assessment | 2,412 | | | — | | | — | | | — | | | — | | | 2,412 | | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Other expense | 24,621 | | | 22,688 | | | 23,381 | | | 21,699 | | | 21,470 | | | 92,389 | | | 78,465 | |

| | | | | | | | | | | | | |

| Total noninterest expense | 92,603 | | | 88,644 | | | 85,956 | | | 80,983 | | | 77,149 | | | 348,186 | | | 274,216 | |

| | | | | | | | | | | | | |

| Income before income tax expense | 55,528 | | | 57,050 | | | 62,687 | | | 71,261 | | | 76,436 | | | 246,526 | | | 259,460 | |

| Income tax expense | 10,999 | | | 12,385 | | | 13,560 | | | 15,523 | | | 16,435 | | | 52,467 | | | 56,417 | |

| Net income | $ | 44,529 | | | $ | 44,665 | | | $ | 49,127 | | | $ | 55,738 | | | $ | 60,001 | | | $ | 194,059 | | | $ | 203,043 | |

| Preferred stock dividends | 937 | | | 938 | | | 937 | | | 938 | | | 937 | | | 3,750 | | | 4,041 | |

| Net income available to common shareholders | $ | 43,592 | | | $ | 43,727 | | | $ | 48,190 | | | $ | 54,800 | | | $ | 59,064 | | | $ | 190,309 | | | $ | 199,002 | |

| | | | | | | | | | | | | |

| Basic earnings per common share | $ | 1.16 | | | $ | 1.17 | | | $ | 1.29 | | | $ | 1.47 | | | $ | 1.59 | | | $ | 5.09 | | | $ | 5.32 | |

| Diluted earnings per common share | $ | 1.16 | | | $ | 1.17 | | | $ | 1.29 | | | $ | 1.46 | | | $ | 1.58 | | | $ | 5.07 | | | $ | 5.31 | |

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| ($ in thousands) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 |

| BALANCE SHEETS | | | | | | | | | |

| | | | | | | | | |

| ASSETS | | | | | | | | | |

| Cash and due from banks | $ | 193,275 | | | $ | 190,806 | | | $ | 202,702 | | | $ | 210,813 | | | $ | 229,580 | |

| Interest-earning deposits | 243,610 | | | 184,245 | | | 125,328 | | | 81,241 | | | 69,808 | |

| Debt and equity investments | 2,434,902 | | | 2,279,578 | | | 2,340,821 | | | 2,338,746 | | | 2,309,512 | |

| Loans held for sale | 359 | | | 212 | | | 551 | | | 261 | | | 1,228 | |

| | | | | | | | | |

| Loans | 10,884,118 | | | 10,616,820 | | | 10,512,623 | | | 10,011,918 | | | 9,737,138 | |

| Allowance for credit losses | (134,771) | | | (142,133) | | | (141,319) | | | (138,295) | | | (136,932) | |

| Total loans, net | 10,749,347 | | | 10,474,687 | | | 10,371,304 | | | 9,873,623 | | | 9,600,206 | |

| | | | | | | | | |

| | | | | | | | | |

| Fixed assets, net | 42,681 | | | 41,268 | | | 41,988 | | | 42,340 | | | 42,985 | |

| | | | | | | | | |

| | | | | | | | | |

| Goodwill | 365,164 | | | 365,164 | | | 365,164 | | | 365,164 | | | 365,164 | |

| Intangible assets, net | 12,318 | | | 13,425 | | | 14,544 | | | 15,680 | | | 16,919 | |

| Other assets | 476,934 | | | 475,657 | | | 408,752 | | | 398,114 | | | 418,770 | |

| Total assets | $ | 14,518,590 | | | $ | 14,025,042 | | | $ | 13,871,154 | | | $ | 13,325,982 | | | $ | 13,054,172 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

| Noninterest-bearing deposits | $ | 3,958,743 | | | $ | 3,852,486 | | | $ | 3,880,561 | | | $ | 4,192,523 | | | $ | 4,642,732 | |

| Interest-bearing deposits | 8,217,628 | | | 8,057,421 | | | 7,739,299 | | | 6,962,113 | | | 6,186,418 | |

| Total deposits | 12,176,371 | | | 11,909,907 | | | 11,619,860 | | | 11,154,636 | | | 10,829,150 | |

| Subordinated debentures and notes | 155,984 | | | 155,844 | | | 155,706 | | | 155,569 | | | 155,433 | |

| FHLB advances | — | | | — | | | 150,000 | | | 100,000 | | | 100,000 | |

| | | | | | | | | |

| Other borrowings | 297,829 | | | 182,372 | | | 199,390 | | | 213,489 | | | 324,119 | |

| Other liabilities | 172,338 | | | 165,039 | | | 127,965 | | | 109,468 | | | 123,207 | |

| Total liabilities | 12,802,522 | | | 12,413,162 | | | 12,252,921 | | | 11,733,162 | | | 11,531,909 | |

| Shareholders’ equity: | | | | | | | | | |

| Preferred stock | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | |

| Common stock | 374 | | | 374 | | | 374 | | | 373 | | | 373 | |

| | | | | | | | | |

| Additional paid-in capital | 995,208 | | | 992,044 | | | 988,355 | | | 984,281 | | | 982,660 | |

| Retained earnings | 749,513 | | | 715,303 | | | 680,981 | | | 642,153 | | | 597,574 | |

| Accumulated other comprehensive loss | (101,015) | | | (167,829) | | | (123,465) | | | (105,975) | | | (130,332) | |

| Total shareholders’ equity | 1,716,068 | | | 1,611,880 | | | 1,618,233 | | | 1,592,820 | | | 1,522,263 | |

| Total liabilities and shareholders’ equity | $ | 14,518,590 | | | $ | 14,025,042 | | | $ | 13,871,154 | | | $ | 13,325,982 | | | $ | 13,054,172 | |

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Year ended |

| December 31, 2023 | | December 31, 2022 |

| ($ in thousands) | Average

Balance | | Interest

Income/

Expense | | Average Yield/ Rate | | Average

Balance | | Interest

Income/

Expense | | Average Yield/ Rate |

| Assets | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Loans1, 2 | $ | 10,324,951 | | | $ | 688,439 | | | 6.67 | % | | $ | 9,193,682 | | | $ | 456,703 | | | 4.97 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

Securities2 | 2,291,552 | | | 71,129 | | | 3.10 | | | 2,100,687 | | | 54,822 | | | 2.61 | |

| Interest-earning deposits | 260,214 | | | 13,430 | | | 5.16 | | | 1,074,165 | | | 10,599 | | | 0.99 | |

| Total interest-earning assets | 12,876,717 | | | 772,998 | | | 6.00 | | | 12,368,534 | | | 522,124 | | | 4.22 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Noninterest-earning assets | 928,519 | | | | | | | 951,090 | | | | | |

| | | | | | | | | | | |

| Total assets | $ | 13,805,236 | | | | | | | $ | 13,319,624 | | | | | |

| | | | | | | | | | | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Interest-bearing demand accounts | $ | 2,559,238 | | | $ | 46,976 | | | 1.84 | % | | $ | 2,318,363 | | | $ | 7,038 | | | 0.30 | % |

| Money market accounts | 3,043,794 | | | 92,976 | | | 3.05 | | | 2,781,579 | | | 19,306 | | | 0.69 | |

| Savings accounts | 668,368 | | | 975 | | | 0.15 | | | 819,043 | | | 305 | | | 0.04 | |

| Certificates of deposit | 1,198,551 | | | 42,796 | | | 3.57 | | | 569,272 | | | 3,509 | | | 0.62 | |

| Total interest-bearing deposits | 7,469,951 | | | 183,723 | | | 2.46 | | | 6,488,257 | | | 30,158 | | | 0.46 | |

| Subordinated debentures and notes | 155,702 | | | 9,781 | | | 6.28 | | | 155,160 | | | 9,166 | | | 5.91 | |

| FHLB advances | 54,615 | | | 2,752 | | | 5.04 | | | 33,467 | | | 599 | | | 1.79 | |

| Securities sold under agreements to repurchase | 168,745 | | | 3,647 | | | 2.16 | | | 211,039 | | | 506 | | | 0.24 | |

| Other borrowings | 71,738 | | | 2,424 | | | 3.38 | | | 22,812 | | | 750 | | | 3.29 | |

| Total interest-bearing liabilities | 7,920,751 | | | 202,327 | | | 2.55 | | | 6,910,735 | | | 41,179 | | | 0.60 | |

| | | | | | | | | | | |

| Noninterest-bearing liabilities: | | | | | | | | | | | |

| Demand deposits | 4,131,163 | | | | | | | 4,805,549 | | | | | |

| Other liabilities | 130,201 | | | | | | | 104,581 | | | | | |

| Total liabilities | 12,182,115 | | | | | | | 11,820,865 | | | | | |

| Shareholders' equity | 1,623,121 | | | | | | | 1,498,759 | | | | | |

| Total liabilities and shareholders' equity | $ | 13,805,236 | | | | | | | $ | 13,319,624 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total net interest income | | | $ | 570,671 | | | | | | | $ | 480,945 | | | |

| Net interest margin | | | | | 4.43 | % | | | | | | 3.89 | % |

| | | | | | | | | | | |

1 Average balances include nonaccrual loans. Interest income includes loan fees of $13.8 million and $16.7 million for the years ended December 31, 2023 and December 31, 2022, respectively. |

2 Non-taxable income is presented on a fully tax-equivalent basis using a tax rate of approximately 25%. The tax-equivalent adjustments were $8.1 million and $7.0 million for the years ended December 31, 2023 and December 31, 2022, respectively. |

| | | | | | | | | | | |

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| ($ in thousands) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 |

| LOAN PORTFOLIO | | | | | | | | | |

| Commercial and industrial | $ | 4,672,559 | | | $ | 4,448,535 | | | $ | 4,360,862 | | | $ | 4,032,189 | | | $ | 3,859,882 | |

| Commercial real estate | 4,803,571 | | | 4,794,355 | | | 4,802,293 | | | 4,699,302 | | | 4,628,371 | |

| Construction real estate | 760,425 | | | 723,796 | | | 671,573 | | | 663,264 | | | 611,565 | |

| Residential real estate | 372,188 | | | 376,120 | | | 368,867 | | | 364,059 | | | 395,537 | |

| Other | 275,375 | | | 274,014 | | | 309,028 | | | 253,104 | | | 241,783 | |

| Total loans | $ | 10,884,118 | | | $ | 10,616,820 | | | $ | 10,512,623 | | | $ | 10,011,918 | | | $ | 9,737,138 | |

| | | | | | | | | |

| DEPOSIT PORTFOLIO | | | | | | | | | |

| Noninterest-bearing demand accounts | $ | 3,958,743 | | | $ | 3,852,486 | | | $ | 3,880,561 | | | $ | 4,192,523 | | | $ | 4,642,732 | |

| Interest-bearing demand accounts | 2,950,259 | | | 2,749,598 | | | 2,629,339 | | | 2,395,901 | | | 2,256,295 | |

| Money market and savings accounts | 3,994,455 | | | 3,837,145 | | | 3,577,856 | | | 3,672,539 | | | 3,399,415 | |

| Brokered certificates of deposit | 482,759 | | | 695,551 | | | 893,808 | | | 369,505 | | | 118,968 | |

| Other certificates of deposit | 790,155 | | | 775,127 | | | 638,296 | | | 524,168 | | | 411,740 | |

| Total deposits | $ | 12,176,371 | | | $ | 11,909,907 | | | $ | 11,619,860 | | | $ | 11,154,636 | | | $ | 10,829,150 | |

| | | | | | | | | |

| AVERAGE BALANCES | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Loans | $ | 10,685,961 | | | $ | 10,521,966 | | | $ | 10,284,873 | | | $ | 9,795,045 | | | $ | 9,423,984 | |

| | | | | | | | | |

| Securities | 2,276,915 | | | 2,302,850 | | | 2,297,995 | | | 2,288,451 | | | 2,204,211 | |

| Interest-earning assets | 13,383,638 | | | 13,160,587 | | | 12,756,653 | | | 12,189,750 | | | 11,995,295 | |

| Assets | 14,332,804 | | | 14,068,860 | | | 13,671,985 | | | 13,131,195 | | | 12,986,568 | |

| Deposits | 12,163,346 | | | 11,922,534 | | | 11,387,813 | | | 10,913,489 | | | 11,002,614 | |

| Shareholders’ equity | 1,652,882 | | | 1,648,605 | | | 1,621,337 | | | 1,568,451 | | | 1,490,592 | |

Tangible common equity1 | 1,202,872 | | | 1,197,486 | | | 1,169,091 | | | 1,115,052 | | | 1,035,896 | |

| | | | | | | | | |

| YIELDS (tax equivalent) | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Loans | 6.87 | % | | 6.80 | % | | 6.64 | % | | 6.33 | % | | 5.87 | % |

| Securities | 3.20 | | | 3.11 | | | 3.06 | | | 3.03 | | | 2.91 | |

| Interest-earning assets | 6.20 | | | 6.12 | | | 5.97 | | | 5.69 | | | 5.25 | |

| Interest-bearing deposits | 3.03 | | | 2.77 | | | 2.26 | | | 1.56 | | | 0.94 | |

| Deposits | 2.03 | | | 1.84 | | | 1.46 | | | 0.92 | | | 0.53 | |

| Subordinated debentures and notes | 6.30 | | | 6.28 | | | 6.27 | | | 6.28 | | | 6.07 | |

| FHLB advances and other borrowed funds | 3.06 | | | 2.76 | | | 3.45 | | | 2.60 | | | 1.39 | |

| Interest-bearing liabilities | 3.09 | | | 2.84 | | | 2.40 | | | 1.72 | | | 1.07 | |

| Net interest margin | 4.23 | | | 4.33 | | | 4.49 | | | 4.71 | | | 4.66 | |

| | | | | | | | | |

|

1Refer to Reconciliations of Non-GAAP Financial Measures table for a reconciliation of these measures to GAAP.

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| (in thousands, except per share data) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 |

| ASSET QUALITY | | | | | | | | | |

| Net charge-offs (recoveries) | $ | 28,479 | | | $ | 6,856 | | | $ | 2,973 | | | $ | (264) | | | $ | 2,075 | |

| Nonperforming loans | 43,728 | | | 48,932 | | | 16,112 | | | 11,972 | | | 9,981 | |

| Classified assets | 185,389 | | | 184,393 | | | 108,065 | | | 110,384 | | | 99,122 | |

| Nonperforming loans to total loans | 0.40 | % | | 0.46 | % | | 0.15 | % | | 0.12 | % | | 0.10 | % |

| Nonperforming assets to total assets | 0.34 | % | | 0.40 | % | | 0.12 | % | | 0.09 | % | | 0.08 | % |

| Allowance for credit losses to total loans | 1.24 | % | | 1.34 | % | | 1.34 | % | | 1.38 | % | | 1.41 | % |

| Allowance for credit losses to loans, excluding guaranteed loans | 1.35 | % | | 1.47 | % | | 1.48 | % | | 1.53 | % | | 1.56 | % |

| Allowance for credit losses to nonperforming loans | 308.2 | % | | 290.5 | % | | 877.1 | % | | 1,155.2 | % | | 1,371.9 | % |

| Net charge-offs (recoveries) to average loans -annualized | 1.06 | % | | 0.26 | % | | 0.12 | % | | (0.01) | % | | 0.09 | % |

| | | | | | | | | |

| WEALTH MANAGEMENT | | | | | | | | | |

| Trust assets under management | $ | 2,235,073 | | | $ | 2,129,408 | | | $ | 1,992,563 | | | $ | 1,956,146 | | | $ | 1,885,394 | |

| | | | | | | | | |

| | | | | | | | | |

| SHARE DATA | | | | | | | | | |

| Book value per common share | $ | 43.94 | | | $ | 41.19 | | | $ | 41.39 | | | $ | 40.76 | | | $ | 38.93 | |

Tangible book value per common share1 | $ | 33.85 | | | $ | 31.06 | | | $ | 31.23 | | | $ | 30.55 | | | $ | 28.67 | |

| Market value per share | $ | 44.65 | | | $ | 37.50 | | | $ | 39.10 | | | $ | 44.59 | | | $ | 48.96 | |

| Period end common shares outstanding | 37,416 | | | 37,385 | | | 37,359 | | | 37,311 | | | 37,253 | |

| Average basic common shares | 37,421 | | | 37,405 | | | 37,347 | | | 37,305 | | | 37,257 | |

| Average diluted common shares | 37,554 | | | 37,520 | | | 37,495 | | | 37,487 | | | 37,415 | |

| | | | | | | | | |

| CAPITAL | | | | | | | | | |

Total risk-based capital to risk-weighted assets2 | 14.2 | % | | 14.1 | % | | 14.1 | % | | 14.3 | % | | 14.2 | % |

Tier 1 capital to risk-weighted assets2 | 12.7 | % | | 12.6 | % | | 12.5 | % | | 12.6 | % | | 12.6 | % |

Common equity tier 1 capital to risk-weighted assets2 | 11.3 | % | | 11.2 | % | | 11.1 | % | | 11.2 | % | | 11.1 | % |

Tangible common equity to tangible assets1 | 8.96 | % | | 8.51 | % | | 8.65 | % | | 8.81 | % | | 8.43 | % |

| | | | | | | | | |

1Refer to Reconciliations of Non-GAAP Financial Measures table for a reconciliation of these measures to GAAP. |

2Capital ratios for the current quarter are preliminary and subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review. |

ENTERPRISE FINANCIAL SERVICES CORP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended | | Year ended |

| ($ in thousands) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Dec 31,

2023 | | Dec 31,

2022 |

| CORE EFFICIENCY RATIO | | | | |

| Net interest income (GAAP) | $ | 140,732 | | | $ | 141,639 | | | $ | 140,692 | | | $ | 139,529 | | | $ | 138,835 | | | $ | 562,592 | | | $ | 473,903 | |

| Tax equivalent adjustment | 1,915 | | | 2,061 | | | 2,062 | | | 2,041 | | | 1,983 | | | 8,079 | | | 7,042 | |

| | | | | | | | | | | | | |

| Noninterest income (GAAP) | 25,452 | | | 12,085 | | | 14,290 | | | 16,898 | | | 16,873 | | | 68,725 | | | 59,162 | |

| Less gain on sale of investment securities | 220 | | | — | | | — | | | 381 | | | — | | | 601 | | | — | |

| Less gain (loss) on sale of other real estate owned | — | | | — | | | 97 | | | 90 | | | — | | | 187 | | | (93) | |

| Core revenue (non-GAAP) | 167,879 | | | 155,785 | | | 156,947 | | | 157,997 | | | 157,691 | | | 638,608 | | | 540,200 | |

| | | | | | | | | | | | | |

| Noninterest expense (GAAP) | 92,603 | | | 88,644 | | | 85,956 | | | 80,983 | | | 77,149 | | | 348,186 | | | 274,216 | |

| Less FDIC special assessment | 2,412 | | | — | | | — | | | — | | | — | | | 2,412 | | | — | |

| Less amortization on intangibles | 1,108 | | | 1,118 | | | 1,136 | | | 1,239 | | | 1,299 | | | 4,601 | | | 5,367 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Core noninterest expense (non-GAAP) | 89,083 | | | 87,526 | | | 84,820 | | | 79,744 | | | 75,850 | | | 341,173 | | | 268,849 | |

| | | | | | | | | | | | | |

| Core efficiency ratio (non-GAAP) | 53.06 | % | | 56.18 | % | | 54.04 | % | | 50.47 | % | | 48.10 | % | | 53.42 | % | | 49.77 | % |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter ended |

| (in thousands, except per share data) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 |

| TANGIBLE COMMON EQUITY, TANGIBLE BOOK VALUE PER SHARE AND TANGIBLE COMMON EQUITY RATIO |

| Shareholders’ equity | $ | 1,716,068 | | | $ | 1,611,880 | | | $ | 1,618,233 | | | $ | 1,592,820 | | | $ | 1,522,263 | |

| Less preferred stock | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | |

| Less goodwill | 365,164 | | | 365,164 | | | 365,164 | | | 365,164 | | | 365,164 | |

| Less intangible assets | 12,318 | | | 13,425 | | | 14,544 | | | 15,680 | | | 16,919 | |

| Tangible common equity (non-GAAP) | $ | 1,266,598 | | | $ | 1,161,303 | | | $ | 1,166,537 | | | $ | 1,139,988 | | | $ | 1,068,192 | |

| Less net unrealized losses on HTM securities, after tax | 41,038 | | | 81,367 | | | 53,611 | | | 48,630 | | | 61,435 | |

| Tangible common equity adjusted for unrealized losses on HTM securities (non-GAAP) | $ | 1,225,560 | | | $ | 1,079,936 | | | $ | 1,112,926 | | | $ | 1,091,358 | | | $ | 1,006,757 | |

| | | | | | | | | |

| Common shares outstanding | 37,416 | | | 37,385 | | | 37,359 | | | 37,311 | | | 37,253 | |

| Tangible book value per share (non-GAAP) | $ | 33.85 | | | $ | 31.06 | | | $ | 31.23 | | | $ | 30.55 | | | $ | 28.67 | |

| | | | | | | | | |

| Total assets | $ | 14,518,590 | | | $ | 14,025,042 | | | $ | 13,871,154 | | | $ | 13,325,982 | | | $ | 13,054,172 | |

| Less goodwill | 365,164 | | | 365,164 | | | $ | 365,164 | | | 365,164 | | | 365,164 | |

| Less intangible assets | 12,318 | | | 13,425 | | | $ | 14,544 | | | 15,680 | | | 16,919 | |

| Tangible assets (non-GAAP) | $ | 14,141,108 | | | $ | 13,646,453 | | | $ | 13,491,446 | | | $ | 12,945,138 | | | $ | 12,672,089 | |

| | | | | | | | | |

| Tangible common equity to tangible assets (non-GAAP) | 8.96 | % | | 8.51 | % | | 8.65 | % | | 8.81 | % | | 8.43 | % |

| Tangible common equity to tangible assets adjusted for unrealized losses on HTM securities (non-GAAP) | 8.67 | % | | 7.91 | % | | 8.25 | % | | 8.43 | % | | 7.94 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year ended |

| ($ in thousands) | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | | Dec 31,

2023 | | Dec 31,

2022 |

| RETURN ON AVERAGE TANGIBLE COMMON EQUITY (ROATCE) | | | | |

| Average shareholder’s equity | $ | 1,652,882 | | | $ | 1,648,605 | | | $ | 1,621,337 | | | $ | 1,568,451 | | | $ | 1,490,592 | | | $ | 1,623,121 | | | $ | 1,498,759 | |

| Less average preferred stock | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | | | 71,988 | |