EagleBank and Fidelity & Trust Bank Merger Completed, Resulting in a $1.4 Billion Expanded Financial Services Organization

02 September 2008 - 8:00PM

PR Newswire (US)

BETHESDA, Md., Sept. 2 /PRNewswire-FirstCall/ -- Eagle Bancorp,

Inc. ("Eagle") (NASDAQ:EGBN), the parent company of EagleBank,

today announced that the acquisition of Fidelity & Trust

Financial Corporation, and the merger of Fidelity & Trust Bank

into EagleBank, became effective on August 31, 2008. (Logo:

http://www.newscom.com/cgi-bin/prnh/20050927/EAGLEBANKLOGO ) As a

result of the merger, EagleBank has aggregate assets of

approximately $1.4 billion, and loans and deposits each in excess

of $1.1 billion. The bank will now have 15 offices in the

Washington, DC metropolitan area, including 9 in Montgomery County,

Maryland, 5 in the District of Columbia and one in Northern

Virginia. "This transaction brings together two banks that have had

immense success in the Washington metropolitan region over the last

decade," said Ronald D. Paul, who will remain as Chairman and CEO

of Eagle Bancorp and EagleBank. "We are excited to be implementing

the best practices of both banks and enhancing our position in the

market by providing an expanded capacity to help local businesses

grow, including a larger lending limit, and providing our customers

with continued access to local decision makers." "I have been

involved in many mergers before," said Robert Pincus, former Board

Chairman of Fidelity & Trust Bank, who is now Vice Chairman of

the combined entity, "and I have never seen two banks that were as

compatible in their goals, employee culture and focus as EagleBank

and Fidelity. Both banks' success has been based on delivering

superior customer service to the local business community. I am

excited about the additional benefits that a larger, stronger

EagleBank will provide for our customers." At the effectiveness of

the acquisition, each share of Fidelity common stock was converted

into 0.3894 shares of Eagle common stock. As a result of the

acquisition, Eagle issued 1,638,212 shares of Eagle common stock,

not including 196,090 shares of common stock issuable upon the

exercise of options to acquire Fidelity common stock, as adjusted

in accordance with the Agreement and Plan of Merger. The value of

the transaction is $13.1 million as per the terms of the Agreement

and Plan of Merger. As previously announced on July 25, 2008, Eagle

plans to declare a 10% stock dividend after the merger, in order

that the former Fidelity shareholders would be eligible to receive

the dividend. Eagle expects to establish the record and payables

dates for the 10% stock dividend shortly. About Eagle Bancorp, Inc.

Eagle Bancorp, Inc. is the holding company for EagleBank which

commenced operations in 1998. The bank is headquartered in

Bethesda, Maryland, and conducts full service banking services

through fifteen offices, located in Montgomery County, Maryland,

Washington, D.C. and Northern Virginia. The Company focuses on

building relationships with businesses, professionals and

individuals in its marketplace. Forward looking Statements: This

press release contains forward looking statements within the

meaning of the Securities and Exchange Act of 1934, as amended,

including statements of goals, intentions, and expectations as to

future trends, plans, events or results of Company operations and

policies and regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as "may," "will," "anticipates," "believes," "expects," "plans,"

"estimates," "potential," "continue," "should," and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company's market,

interest rates and interest rate policy, competitive factors and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward-looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. Readers are cautioned against placing

undue reliance on any such forward-looking statements. The

Company's past results are not necessarily indicative of future

performance.

http://www.newscom.com/cgi-bin/prnh/20050927/EAGLEBANKLOGO

http://photoarchive.ap.org/ DATASOURCE: Eagle Bancorp, Inc.

CONTACT: Ronald D. Paul of Eagle Bancorp, Inc., +1-301-986-1800 Web

site: http://www.eaglebankmd.com/

Copyright

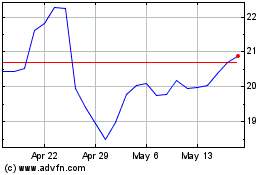

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jun 2024 to Jul 2024

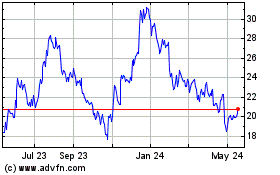

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Jul 2023 to Jul 2024