Eloxx Pharmaceuticals, Inc. (NASDAQ: ELOX), a leader in ribosomal

RNA-targeted genetic therapies for rare diseases, today reported

its financial results for the three months ended June 30, 2021, and

provided a business update.

“Since the acquisition of Zikani Therapeutics in early April, we

have made tremendous progress across our portfolio of novel

therapeutic programs,” said Sumit Aggarwal, President and Chief

Executive Officer of Eloxx. “In CF, we remain on track to report

data from the ongoing Phase 2 clinical trials for ELX-02, while we

are also preparing for combination studies of ELX-02 and ivacaftor

and commencing efforts to evaluate inhaled delivery of ELX-02.

Beyond CF, we continue to advance our preclinical programs to

demonstrate the potential of our oral RMAs. We intend to provide

additional insight into these programs in the coming quarters.”

Second Quarter 2021 and Subsequent

Highlights

Class 1 Cystic Fibrosis

- Ongoing ELX-02 Phase 2 clinical

trials in CF patients affected by nonsense mutations in the CFTR

(CF transmembrane conductance regulator) gene are designed to

evaluate the safety of ELX-02 and assess short-term biological

activity in patients.

- As previously announced, based on

enrollment as of the end of June 2021, we remain on track to report

data from the monotherapy arms of the ELX-02 clinical trials in the

fourth quarter of 2021. We are continuing to enroll additional

patients to support Phase 3 clinical trial planning.

- Biological activity is being

assessed by changes in sweat chloride, a surrogate marker for

restoring CFTR activity. For comparison, Orkambi, an FDA-approved

CF agent, demonstrated mid-single digit reductions in sweat

chloride over one- to two-week study durations in a similar trial

setting.

- Patient dosing in the expansion

arm, which includes a combination of ELX-02 and the CFTR protein

potentiator, Kalydeco (ivacaftor), is expected to begin by the end

of 2021. Previously disclosed preclinical organoid experiments have

demonstrated that the addition of Kalydeco to ELX-02 can enhance

activity up to three-fold.

- Safety Review Committee has

approved advancement to highest dose level to be studied.

- Began evaluation of inhaled

(nebulizer-based) delivery of the current subcutaneous formulation

of ELX-02. Preclinical rodent studies of ELX-02 and other

aminoglycosides have demonstrated 30- to 100-fold higher drug

concentration in the lung versus plasma. This has the potential to

further improve the activity of ELX-02 as both a single agent and

in combination with other drugs.

- Received an award of up to $2.6M

from the Cystic Fibrosis Foundation to identify optimized oral

Ribosome Modulating Agents (RMAs) with our TURBO-ZM™ Platform for

further development for the treatment of CF patients with nonsense

mutations.

Recessive Dystrophic Epidermolysis Bullosa (RDEB) and Junctional

Epidermolysis Bullosa (JEB)

- Nominated ZKN-013 as the drug

candidate to move into IND-enabling studies for the treatment of

RDEB and JEB. Good Laboratory Practice (GLP) safety studies are

expected to begin by the end of 2021. We remain on track to file an

IND submission in 2022.

- In preclinical experiments,

treating RDEB patient-derived fibroblasts and keratinocytes with

ZKN-013 showed clinically relevant restoration of full-length

Collagen 7A (COL7A) across multiple genotypes in a dose dependent

manner.

- In a non-GLP animal toxicity

study, ZKN-013 demonstrated a substantial safety margin with

therapeutically sufficient drug levels in skin with chronic

dosing.

Rare Inherited and Targeted Oncology

- Continued to advance our

preclincial oncology pipeline, which is focused on rare inherited

cancers with driver nonsense mutations and cancers with driver

mutations in the ribosome.

- Our lead program is for the

treatment of patients with Familial Adenomatous Polyposis (FAP).

- We have initiated an 8-week study

in APCMin (multiple intestinal neoplasia) mice to evaluate the

potential of RMAs to treat FAP. The APCMin mouse is a

translationally validated model for drug development for FAP.

- Prior studies of erythromycin in

APCMin mice showed reductions in colon polyps that successfully

translated to demonstrating clinical efficacy.1

- This study in APCMin will

evaluate polyp number and size in ZKN013 treated mice versus

control mice. We expect to report results from this study in the

fourth quarter of 2021.

- Initiated cancer cell line and

xenograft mouse studies to evaluate the response to treatment

with RMAs to advance first-in-class onco-ribosome targeted

inhibitors for oncology therapy.

Corporate

- An underwritten public offering

of 38,333,334 shares of common stock, including the full exercise

of the underwriters’ option to purchase additional shares, at a

public offering price of $1.35 per share was closed in May 2021.

Aggregate gross proceeds from the offering were approximately

$51.75 million, before deducting underwriting discounts and

commissions and offering expenses.

- Pedro Huertas, M.D., Ph.D.,

joined Eloxx as a Senior Adviser. Dr. Huertas previously served as

CMO of Eloxx. He has also served as CMO of Inozyme Pharma and

Sentien Biotechnologies and in various roles at Pfizer, Shire,

Massachusetts General Hospital, and Genzyme.

Second Quarter 2021 Financial Results

For the three months ended June 30, 2021, we incurred a net loss

of $36.1 million or $0.54 per share, which includes $4.0 million in

stock-based compensation. For the same period in the prior year, we

incurred a net loss of $7.9 million, or $0.20 per share. Results

for the second quarter of 2021 included a $22.7 million acquired

in-process research and development expense related to the

acquisition of Zikani.

Our research and development expenses (R&D) were $5.7

million for the three months ended June 30, 2021, which includes

$0.1 million in stock-based compensation. For the same period in

the prior year, R&D expenses were $3.7 million. The increase in

R&D expenses was primarily related to an increase in expenses

related to the continued development of ELX-02 as a result of the

suspension of our clinical trials due to the impact of the COVID-19

pandemic in the prior year period and an increase in salaries and

other personnel related costs, partially offset by a decrease in

stock-based compensation expense.

Our general and administrative (G&A) expenses were $7.4

million for the three months ended June 30, 2021, which includes

$3.9 million in stock-based compensation. For the same period in

the prior year, G&A expenses were $3.8 million. The increase

was primarily related to an increase in stock-based compensation

expense, an increase in salaries and other personnel-related costs

associated with the merger with Zikani, as well as an increase in

expenses attributable principally to infrastructure related costs

including legal, accounting and other professional fees.

As of June 30, 2021, we had cash and cash equivalents of $56.7

million, which we expect will be sufficient to fund our operations

into the first quarter of 2023.

1 J Mol Med (Berl) 2016 Apr;94(4):469-82) and Int J Cancer 2020

Feb 15;146(4):1064-1074)

About Eloxx Pharmaceuticals

Eloxx Pharmaceuticals, Inc. is engaged in the science of

ribosome modulation, leveraging its innovative TURBO-ZMTM chemistry

technology platform in an effort to develop novel Ribosome

Modulating Agents (RMAs) and its library of Eukaryotic Ribsome

Selective Glycosides (ERSGs). Eloxx’s lead investigational product

candidate, ELX-02, is a small molecule drug candidate designed to

restore production of full-length functional proteins. ELX-02 is in

clinical development, focusing on cystic fibrosis. Eloxx also has

preclinical programs focused on select rare diseases, including

inherited diseases, cancer caused by nonsense mutations, kidney

diseases, including autosomal dominant polycystic kidney disease,

as well as rare ocular genetic disorders.

For more information, please visit www.eloxxpharma.com.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements other than statements of present and

historical facts contained in this press release, including without

limitation, statements regarding our expected cash burn and future

financial results, the expected timing of trials and results from

clinical studies of our product candidates and the potential of our

product candidate to treat nonsense mutations are forward-looking

statements. Forward-looking statements can be identified by the

words “aim,” “may,” “will,” “would,” “should,” “expect,” “explore,”

“plan,” “anticipate,” “could,” “intend,” “target,” “project,”

“contemplate,” “believe,” “estimate,” “predict,” “potential,”

“seeks,” or “continue” or the negative of these terms similar

expressions, although not all forward-looking statements contain

these words.

Forward-looking statements are based on management's current

plans, estimates, assumptions and projections based on information

currently available to us. Forward-looking statements are subject

to known and unknown risks, uncertainties and assumptions, and

actual results or outcomes may differ materially from those

expressed or implied in the forward-looking statements due to

various important factors, including, but not limited to: our

ability to progress any product candidates in preclinical or

clinical trials; the uncertainty of clinical trial results and the

fact that positive results from preclinical studies are not always

indicative of positive clinical results; the scope, rate and

progress of our preclinical studies and clinical trials and other

research and development activities; the competition for patient

enrollment from drug candidates in development; the impact of the

global COVID-19 pandemic on our clinical trials, operations,

vendors, suppliers, and employees; our ability to obtain the

capital necessary to fund our operations; the cost of filing,

prosecuting, defending and enforcing any patent claims and other

intellectual property rights; our ability to obtain financial in

the future through product licensing, public or private equity or

debt financing or otherwise; general business conditions,

regulatory environment, competition and market for our products;

and business ability and judgment of personnel, and the

availability of qualified personnel and other important factors

discussed under the caption “Risk Factors” in our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2021, as any

such factors may be updated from time to time in our other filings

with the SEC, accessible on the SEC’s website at www.sec.gov and

the “Financials & Filings” page of our website at

https://investors.eloxxpharma.com/financial-information/sec-filings

All forward-looking statements speak only as of the date of this

press release and, except as required by applicable law, we have no

obligation to update or revise any forward-looking statements

contained herein, whether as a result of any new information,

future events, changed circumstances or otherwise.

Contact

InvestorsJohn

Woolfordjohn.woolford@westwicke.com443.213.0506

MediaLaureen Cassidylaureen@outcomescg.com

| ELOXX

PHARMACEUTICALS, INC. AND SUBSIDIARIES |

|

| UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

| (Amounts in

thousands, except share and per share data) |

|

| |

|

|

|

|

|

| |

|

June 30, 2021 |

|

December 31, 2020 |

|

|

ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

56,734 |

|

$ |

24,668 |

|

|

Restricted cash |

|

|

246 |

|

|

56 |

|

|

Prepaid expenses and other current assets |

|

|

1,579 |

|

|

1,169 |

|

|

Total current assets |

|

|

58,559 |

|

|

25,893 |

|

| Property and

equipment, net |

|

|

185 |

|

|

133 |

|

| Operating

lease right-of-use asset |

|

|

1,866 |

|

|

421 |

|

| Other

long-term assets |

|

|

- |

|

|

30 |

|

|

Total assets |

|

$ |

60,610 |

|

$ |

26,477 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,024 |

|

$ |

481 |

|

|

Accrued expenses |

|

|

3,302 |

|

|

2,886 |

|

|

Current portion of long-term debt |

|

|

5,686 |

|

|

5,239 |

|

|

Advances from collaboration partners |

|

|

3,411 |

|

|

805 |

|

|

Current portion of operating lease liability |

|

|

753 |

|

|

389 |

|

|

Taxes payable |

|

|

34 |

|

|

38 |

|

|

Total current liabilities |

|

|

15,210 |

|

|

9,838 |

|

| Long-term

debt |

|

|

3,637 |

|

|

6,376 |

|

| Operating

lease liability |

|

|

1,120 |

|

|

33 |

|

| Total

liabilities |

|

|

19,967 |

|

|

16,247 |

|

| Total

stockholders’ equity |

|

|

40,643 |

|

|

10,230 |

|

|

Total liabilities and stockholders' equity |

|

$ |

60,610 |

|

$ |

26,477 |

|

| |

|

|

|

|

|

| ELOXX

PHARMACEUTICALS, INC. AND SUBSIDIARIES |

| UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Amounts in

thousands, except share and per share data) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

5,704 |

|

|

$ |

3,738 |

|

|

$ |

9,777 |

|

|

$ |

8,505 |

|

|

General and administrative |

|

|

7,355 |

|

|

|

3,848 |

|

|

|

11,696 |

|

|

|

8,854 |

|

|

In process research and development |

|

|

22,670 |

|

|

|

— |

|

|

|

22,670 |

|

|

|

— |

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,994 |

|

|

Total operating expenses |

|

|

35,729 |

|

|

|

7,586 |

|

|

|

44,143 |

|

|

|

21,353 |

|

| Loss from

operations |

|

|

(35,729 |

) |

|

|

(7,586 |

) |

|

|

(44,143 |

) |

|

|

(21,353 |

) |

| Other

expense, net |

|

|

329 |

|

|

|

301 |

|

|

|

609 |

|

|

|

480 |

|

| Net

loss |

|

$ |

(36,058 |

) |

|

$ |

(7,887 |

) |

|

$ |

(44,752 |

) |

|

$ |

(21,833 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

|

$ |

(0.54 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.84 |

) |

|

$ |

(0.54 |

) |

| Weighted

average number of common shares used in computing net loss per

share, basic and diluted |

|

|

66,389,865 |

|

|

|

40,129,304 |

|

|

|

53,357,401 |

|

|

|

40,101,789 |

|

SOURCE: Eloxx Pharmaceuticals, Inc.

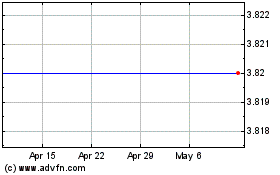

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

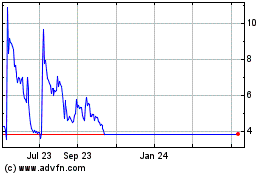

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Jul 2023 to Jul 2024