0001124140false00011241402025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2025

EXACT SCIENCES CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35092 | | 02-0478229 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

5505 Endeavor Lane

Madison, WI 53719

(Address of Principal Executive Offices)(Zip Code)

Registrant’s telephone number, including area code: (608) 284-5700

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | EXAS | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

2.02. Results of Operations and Financial Conditions.

On February 19, 2025, Exact Sciences Corporation announced its financial results for the quarter and full year ended December 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

9.01. Financial Statements and Exhibits.

Exhibits

The exhibits required to be filed as a part of this Current Report on Form 8-K are listed below and incorporated herein by reference.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | | |

| | Press release, dated February 19, 2025, issued by Exact Sciences Corporation, furnished herewith. |

| | | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EXACT SCIENCES CORPORATION |

| | | |

Date: February 19, 2025 | By: | /s/ Aaron Bloomer |

| | | Aaron Bloomer |

| | | Executive Vice President and Chief Financial Officer |

Investor Contact:

Derek Leckow

Exact Sciences Corp.

investorrelations@exactsciences.com

608-893-0009

Media Contact:

Steph Spanos

Exact Sciences Corp.

sspanos@exactsciences.com

608-556-4380

For Immediate Release

Exact Sciences Announces Fourth Quarter 2024 Results

Fourth quarter and 2024 highlights

•Total fourth quarter revenue of $713 million, an increase of 10%, or 11% on a core revenue basis, with Screening revenue of $553 million and Precision Oncology revenue of $161 million

•Total 2024 revenue of $2.76 billion, an increase of 10%, or 11% on a core revenue basis, with Screening revenue of $2.10 billion and Precision Oncology revenue of $655 million

•Plans to launch three new cancer tests in 2025: Cologuard PlusTM, next-generation colorectal cancer screening test, OncodetectTM, molecular residual disease test, and CancerguardTM, multi-cancer screening test

MADISON, Wis., Feb. 19, 2025 — Exact Sciences Corp. (Nasdaq: EXAS), a leading provider of cancer screening and diagnostic tests, today announced that the Company generated revenue of $713 million for the fourth quarter of 2024 and $2.76 billion for the full year of 2024, both ended December 31, 2024.

“The Exact Sciences team is off to a good start in 2025, building on the momentum we created in the fourth quarter,” said Kevin Conroy, Chairman and CEO of Exact Sciences. “This year is on track to be the most productive in company history, with continued execution from our core business and the launch of three innovative cancer tests. This will power years of growth and profitability, deepen our leadership in diagnostics, and help eradicate cancer by preventing it, detecting it earlier, and guiding personalized treatment."

Fourth quarter 2024 financial results

For the three-month period ended December 31, 2024, as compared to the same period of 2023 (where applicable):

•Total revenue was $713 million, an increase of 10%, or 11% on a core revenue basis

•Screening revenue was $553 million, an increase of 14%

•Precision Oncology revenue was $161 million, an increase of 0.4%, or 2% on a core revenue basis

•Gross margin was 69% and adjusted gross margin was 72%

•Impairment charges were $838 million, primarily reflecting changes in external factors related to the in-process research and development asset acquired as part of the Thrive acquisition

•Net loss was $865 million, or $4.67 per share, compared to a net loss of $49.8 million, or $0.27 per share

•Adjusted EBITDA was $75 million, an increase of $26 million, and adjusted EBITDA margin was 11%, an increase of nearly 300 basis points

•Operating cash flow was $47 million and free cash flow was $11 million in the fourth quarter, and full-year 2024 operating cash flow was $211 million and free cash flow was $75 million

•Cash, cash equivalents, and marketable securities were $1.04 billion at the end of the quarter

Screening primarily includes laboratory service revenue from Cologuard® tests and PreventionGenetics. Precision Oncology includes laboratory service revenue from global Oncotype DX® and therapy selection tests.

Platform and pipeline advancements

In the fourth quarter, Exact Sciences secured favorable Medicare pricing for the Cologuard Plus test, its next-generation colon cancer screening test. The Cologuard Plus test detects cancers and precancerous polyps with even greater sensitivity than the

Cologuard test while reducing false positives by nearly 40 percent. This advancement enhances the Company’s screening capabilities and reinforces its commitment to delivering high-quality, non-invasive options for patients. The Company remains on-track to launch Cologuard Plus with Medicare coverage and guideline inclusion in the second quarter of 2025.

In the fourth quarter, the Company shared new evidence from the ASCEND 2 study supporting Cancerguard, its blood-based multi-cancer screening test. The data showed at a 98.5% specificity, overall sensitivity excluding breast and prostate cancer was 62.3%. Sensitivity was 67.1% for the six most aggressive cancers (pancreas, esophagus, liver, lung, stomach, and ovary). This highlights the potential of a multi-omic test to improve early cancer detection. Additionally, Exact Sciences presented new modeling data that estimated adding multi-cancer screening to standard-of-care screening could reduce cancer mortality by 17% over 10 years. These analyses will support the planned launch of CancerguardTM EX, Exact Sciences’ MCED laboratory-developed test, in the second half of 2025. Exact Sciences will bring this test to patients through its large screening and precision oncology commercial organization and unique ExactNexusTM technology platform.

In January 2025, Exact Sciences presented data in the Journal of Surgical Oncology demonstrating the clinical strength of the Oncodetect test, its molecular residual disease and recurrence monitoring test. Results from a well-designed study of monitored colon cancer patients found those with a positive Oncodetect test were 50 times more likely to recur than those with a negative result. The study further showed Oncodetect identifies residual disease up to 10 months earlier than imaging, the current standard of care. Findings from a second clinical validation study also demonstrated promising performance of Oncodetect as an MRD test. The Company recently submitted results for reimbursement in colorectal cancer and expects to launch the Oncodetect test in the second quarter of 2025.

2025 outlook

The Company announces its full-year 2025 revenue and adjusted EBITDA guidance:

| | | | | | | | | | | |

| 2024 results | | 2025 outlook |

| Total revenue | $2.759 billion | | $3.025 - $3.085 billion |

| Screening | $2.104 billion | | $2.350 - $2.390 billion |

| Precision Oncology | $655 million | | $675 - $695 million |

| Adjusted EBITDA | $323 million | | $410 - $440 million |

Non-GAAP disclosure

In addition to the Company's financial results determined in accordance with U.S. GAAP, the Company provides non-GAAP measures that it determines to be useful in evaluating its operating performance and liquidity. The Company presents the following non-GAAP measures:

Core revenue — Core revenue is calculated to adjust for recent acquisitions and divestitures, COVID-19 testing revenue and foreign currency exchange rate fluctuations. Revenue from recent acquisitions is adjusted for the 12 months following acquisition when the periods are not comparable. To exclude the impact of change in foreign currency exchange rates from the prior period under comparison, the Company converts the current period non-U.S. dollar denominated revenue using the prior year comparative period exchange rates.

Adjusted EBITDA and adjusted EBITDA margin — The Company defines adjusted EBITDA as net loss adjusted for interest expense, income tax expense or benefit, depreciation expense, amortization of acquired intangible assets, investment income or loss, and certain other items which include significant non-cash items and other charges or benefits resulting from transactions or events that are highly variable, significant in size, and that we do not believe are indicative of ongoing or future business operations. These items are discussed in more detail below in the tables captioned “U.S. GAAP to Non-GAAP Reconciliation”. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by total revenue.

Adjusted gross profit, adjusted research and development expenses, adjusted sales and marketing expenses, adjusted general and administrative expenses, adjusted loss from operations, adjusted net loss before tax, adjusted income tax expense (benefit), adjusted net loss, and adjusted earnings per share — The Company refers to various “adjusted” amounts or measures on an “adjusted” basis, which exclude the impact of amortization of intangible assets and certain charges or benefits resulting from transactions or events that are highly variable, significant in size, and that we do not believe are indicative of ongoing or future business operations. These items are described in more detail below in the tables captioned “U.S. GAAP to Non-GAAP Reconciliation”. The Company also presents certain of these adjusted measures as a percentage of revenue including adjusted gross margin.

Free cash flow — The Company defines free cash flow as net cash used in or provided by operating activities, reduced by purchases of property, plant and equipment. Management uses free cash flow as a liquidity measure.

Management believes that presentation of non-GAAP financial measures provides supplemental information useful to investors in understanding our underlying operating results and trends. Non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability of the Company's operating results across reporting periods. Management uses this non-GAAP financial information to establish budgets, manage the Company's business, and set incentive and compensation arrangements. Free cash flow provides useful information to management and investors since it measures our ability to generate cash from business operations. Non-GAAP financial information is presented for supplemental information purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. For example, adjusted gross margin and adjusted gross profit exclude the amortization of acquired intangible assets although such measures include the revenue associated with the acquisitions. Additionally, adjusted EBITDA and other adjusted operating result metrics exclude a number of expense items that are included in net loss. As a result, positive adjusted EBITDA, adjusted operating income, or adjusted earnings per share may be achieved while a significant net loss persists. For more information on these non-GAAP financial measures, see the tables captioned “U.S. GAAP to Non-GAAP Reconciliation.” The Company presents certain forward-looking statements about the Company's future financial performance that include non-GAAP measures. These non-GAAP measures include adjustments like stock-based compensation, acquisition and integration costs including gains and losses on contingent consideration, and other significant charges or gains that are difficult to predict for future periods because the nature of the adjustments pertain to events that have not yet occurred. Additionally, management does not forecast many of the excluded items for internal use. Information reconciling forward-looking non-GAAP measures to U.S. GAAP measures is therefore not available without unreasonable effort and is not provided. The occurrence, timing, and amount of any of the items excluded from GAAP to calculate non-GAAP could significantly impact the Company's GAAP results.

Fourth quarter conference call & webcast

Company management will host a conference call and webcast on Wednesday, February 19, 2025, at 5 p.m. ET to discuss fourth quarter and full year 2024 results. The webcast will be available at exactsciences.com. Domestic callers should dial 888-330-2384 and international callers should dial +1-240-789-2701. The access code for both domestic and international callers is 4437608. A replay of the webcast will be available at exactsciences.com. The webcast, conference call, and replay are open to all interested parties.

About the Cologuard and Cologuard Plus tests

Developed in collaboration with Mayo Clinic, the Cologuard and Cologuard Plus tests are non-invasive colorectal cancer (CRC) screening options for the 110 million U.S. adults ages 45 or older who are at average risk for the disease.

The Cologuard test revolutionized CRC screening by detecting specific DNA markers and blood associated with cancer and precancer in stool, allowing patients to use the test at home without special preparation or time off. It is covered by Medicare and included in national screening guidelines from both the American Cancer Society (2018) and the U.S. Preventive Services Task Force (2021). Since its launch in 2014, the Cologuard test has been used to screen for CRC 18 million times.

Building on this success, the FDA-approved Cologuard Plus test raises the performance bar even further and features novel biomarkers, improved laboratory processes, and enhanced sample stability. The Cologuard Plus test is expected to reduce false positives by nearly 40%, to help minimize unnecessary follow-up colonoscopies. Both tests demonstrate Exact Sciences’ commitment to improving CRC screening access and outcomes. Exact Sciences expects to launch the Cologuard Plus test with Medicare coverage and guideline inclusion in 2025.

About the Oncodetect test

Molecular residual disease (MRD) refers to the presence of tumor-specific DNA in the body. These fragments of genetic information, known as circulating tumor DNA (ctDNA), are shed into the bloodstream by tumors, and their presence may indicate that cancer is present . Exact Sciences’ MRD offering leverages our in-house capabilities in whole exome sequencing to offer a tumor-informed MRD test for a personalized approach to detecting and monitoring residual cancer in patients with solid tumors. By identifying somatic genomic alterations in tumor DNA and detecting a subset in ctDNA from blood, the Oncodetect test may enable the detection of ctDNA before, during, and after treatment. This critical information can guide therapy decisions and monitor for cancer recurrence.

About the Cancerguard test

The Cancerguard test, currently in development, is designed to detect multiple cancers in their earliest stages from a single blood draw. Building upon decades of research, Exact Sciences intends to harness the additive sensitivity of multiple biomarker classes to detect more cancers in earlier stages. The Cancerguard test will utilize a streamlined and standardized imaging-based diagnostic pathway, which may result in fewer follow-up procedures. The test is being developed to provide high specificity to help minimize false positives while detecting multiple cancers, including those with the biggest toll on human health. These

features describe current development goals. The Cancerguard test has not been cleared or approved by the U.S. Food and Drug Administration or any other national regulatory authority. To learn more, visit http://www.exactsciences.com/cancerguard.

About Exact Sciences’ Precision Oncology portfolio

Exact Sciences’ Precision Oncology portfolio delivers actionable genomic insights to inform prognosis and cancer treatment after a diagnosis. In breast cancer, the Oncotype DX Breast Recurrence Score® test is the only test shown to predict the likelihood of chemotherapy benefit as well as recurrence in invasive breast cancer. The Oncotype DX test is recognized as the standard of care and is included in all major breast cancer treatment guidelines. The OncoExTra™ test applies comprehensive tumor profiling, utilizing whole exome and whole transcriptome sequencing, to aid in therapy selection for patients with advanced, metastatic, refractory, relapsed, or recurrent cancer. With an extensive panel of approximately 20,000 genes and 169 introns, the OncoExTra test is one of the most comprehensive genomic (DNA) and transcriptomic (RNA) panels available today. Exact Sciences enables patients to take a more active role in their cancer care and makes it easy for providers to order tests, interpret results, and personalize medicine by applying real-world evidence and guideline recommendations. To learn more, visit precisiononcology.exactsciences.com.

About PreventionGenetics

Founded in 2004 and located in Marshfield, Wisconsin, PreventionGenetics is a CLIA and ISO 15189:2012 accredited laboratory. PreventionGenetics delivers clinical genetic testing of the highest quality at fair prices with exemplary service to people around the world. PreventionGenetics has 25 PhD geneticists on staff and provides tests for nearly all clinically relevant genes including the powerful and comprehensive germline whole genome sequencing test, PGnome® and whole exome sequencing test, PGxome®. PreventionGenetics was acquired by Exact Sciences in December 2021.

About Exact Sciences Corp.

A leading provider of cancer screening and diagnostic tests, Exact Sciences gives patients and health care professionals the clarity needed to take life-changing action earlier. Building on the success of the Cologuard and Oncotype DX tests, Exact Sciences is investing in its pipeline to develop innovative solutions for use before, during, and after a cancer diagnosis. For more information, visit ExactSciences.com, follow Exact Sciences on X @ExactSciences, or find Exact Sciences on LinkedIn and Facebook.

Forward-Looking Statements

This news release contains forward-looking statements concerning our expectations, anticipations, intentions, beliefs or strategies regarding the future. These forward-looking statements are based on assumptions that we have made as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results, conditions and events to differ materially from those anticipated. Therefore, you should not place undue reliance on forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding expected future operating results; expectations for development or launching of new or improved products and services and their impact on patients; insurance reimbursement potential; our strategies, commercialization efforts, positioning, competition, resources, capabilities and expectations for future events or performance; and the anticipated benefits of our acquisitions, including estimated synergies and other financial impacts.

Important factors that could cause actual results, conditions and events to differ materially from those indicated in the forward-looking statements include, among others, the following: our ability to successfully develop and commercialize new products and services and assess potential market opportunities; our ability to successfully and profitably market our products and services; the acceptance of our products and services by patients and healthcare providers; our reliance upon certain suppliers; our ability to retain and hire key personnel; approval and maintenance of adequate reimbursement rates for our products and services within and outside of the U.S.; the amount and nature of competition for our products and services; the effects of any judicial, executive or legislative action affecting us or the healthcare system; changes in government policies, laws, regulations, and staffing; recommendations, guidelines and quality metrics issued by various organizations regarding cancer screening or our products and services; our ability to obtain and maintain regulatory approvals and comply with applicable regulations; our ability to protect and enforce our intellectual property; our success establishing and maintaining collaborative, licensing, and supplier arrangements; the results of our validation studies and clinical trials, including the risks that the results of future studies and trials may differ materially from the results of previously completed studies and trials; our ability to manage an international business and our expectations regarding our international expansion and opportunities; the potential effects of changing macroeconomic conditions and geopolitical conflict; the possibility that the anticipated benefits from our business acquisitions will not be realized in full or at all or may take longer to realize than expected; the outcome of any potential litigation or legal proceeding; and our ability to raise the capital necessary to support our operations or meet our payment obligations under our indebtedness. The risks included above are not exhaustive. Other important risks and uncertainties are described in the Risk Factors sections of our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and in our other reports filed with the Securities and Exchange Commission. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

EXACT SCIENCES CORPORATION

Selected Unaudited Financial Information

Condensed Consolidated Statements of Operations

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 713,424 | | | $ | 646,885 | | | $ | 2,758,867 | | | $ | 2,499,766 | |

| | | | | | | |

| Cost of sales | 220,831 | | | 192,964 | | | 840,150 | | | 737,564 | |

| Gross profit | 492,593 | | | 453,921 | | | 1,918,717 | | | 1,762,202 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 97,709 | | | 115,184 | | | 431,210 | | | 426,927 | |

| Sales and marketing | 244,529 | | | 216,590 | | | 894,125 | | | 827,805 | |

| General and administrative | 191,110 | | | 196,388 | | | 781,825 | | | 800,288 | |

Impairment of long-lived and indefinite-lived assets | 838,164 | | | — | | | 869,460 | | | 621 | |

| Total operating expenses | 1,371,512 | | | 528,162 | | | 2,976,620 | | | 2,055,641 | |

| | | | | | | |

| Other operating income | 2,568 | | | 6,400 | | | 9,200 | | | 78,427 | |

| Loss from operations | (876,351) | | | (67,841) | | | (1,048,703) | | | (215,012) | |

| | | | | | | |

| Other income (expense) | | | | | | | |

Investment income, net | 9,962 | | | 25,330 | | | 39,558 | | | 32,713 | |

| Interest expense | (9,577) | | | (7,865) | | | (27,016) | | | (19,447) | |

| Total other income (expense) | 385 | | | 17,465 | | | 12,542 | | | 13,266 | |

| | | | | | | |

| Net loss before tax | (875,966) | | | (50,376) | | | (1,036,161) | | | (201,746) | |

| | | | | | | |

Income tax benefit (expense) | 11,381 | | | 610 | | | 7,304 | | | (2,403) | |

| | | | | | | |

| Net loss | $ | (864,585) | | | $ | (49,766) | | | $ | (1,028,857) | | | $ | (204,149) | |

| | | | | | | |

| Net loss per share—basic and diluted | $ | (4.67) | | | $ | (0.27) | | | $ | (5.59) | | | $ | (1.13) | |

| | | | | | | |

| Weighted average common shares outstanding—basic and diluted | 185,312 | | | 181,114 | | | 184,197 | | | 180,144 | |

EXACT SCIENCES CORPORATION

Selected Unaudited Financial Information

Condensed Consolidated Balance Sheets

(Amounts in thousands)

| | | | | | | | | | | |

| December 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 600,889 | | | $ | 605,378 | |

| Marketable securities | 437,137 | | | 172,266 | |

| Accounts receivable, net | 248,968 | | | 203,623 | |

| Inventory | 162,383 | | | 127,475 | |

| Prepaid expenses and other current assets | 122,046 | | | 85,627 | |

| Property, plant and equipment, net | 693,673 | | | 698,354 | |

| Operating lease right-of-use assets | 116,952 | | | 143,708 | |

| Goodwill | 2,366,676 | | | 2,367,120 | |

| Intangible assets, net | 1,009,693 | | | 1,890,396 | |

| Other long-term assets, net | 169,722 | | | 177,387 | |

| Total assets | $ | 5,928,139 | | | $ | 6,471,334 | |

| | | |

| Liabilities and stockholders' equity | | | |

Convertible notes, net, current portion | $ | 249,153 | | | $ | — | |

| Current liabilities | 483,034 | | | 514,701 | |

Convertible notes, net, less current portion | 2,321,067 | | | 2,314,276 | |

| Other long-term liabilities | 315,503 | | | 335,982 | |

| Operating lease liabilities, less current portion | 157,133 | | | 161,070 | |

| Total stockholders’ equity | 2,402,249 | | | 3,145,305 | |

| Total liabilities and stockholders’ equity | $ | 5,928,139 | | | $ | 6,471,334 | |

EXACT SCIENCES CORPORATION

U.S. GAAP to Non-GAAP Reconciliation

Core Revenue

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP | | | | | | |

| | Three Months Ended December 31, | | | | | | |

| | 2024 | | 2023 | | % Change | | | | | | |

| Screening | | $ | 552,563 | | | $ | 486,706 | | | 14 | % | | | | | | |

| Precision Oncology | | 160,861 | | | 160,179 | | | — | % | | | | | | |

| Total | | $ | 713,424 | | | $ | 646,885 | | | 10 | % | | | | | | |

| | | | | | | | | | | | |

| | Non-GAAP | | | | | | |

| | Three Months Ended December 31, | | |

| | 2024 | | 2023 (1) | | % Change | | Foreign Currency Impact (2) | | Core Revenue (3) | | % Change (3) |

| Screening | | $ | 552,563 | | | $ | 486,706 | | | 14 | % | | $ | — | | | $ | 552,563 | | | 14 | % |

| Precision Oncology | | 160,861 | | | 158,096 | | | 2 | % | | 1,179 | | | 162,040 | | | 2 | % |

| Total | | $ | 713,424 | | | $ | 644,802 | | | 11 | % | | $ | 1,179 | | | $ | 714,603 | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP | | | | | | |

| | Twelve Months Ended December 31, | | | | | | |

| | 2024 | | 2023 | | % Change | | | | | | |

| Screening | | $ | 2,103,868 | | | $ | 1,864,701 | | | 13 | % | | | | | | |

| Precision Oncology | | 654,999 | | | 629,110 | | | 4 | % | | | | | | |

| COVID-19 Testing | | — | | | 5,955 | | | (100) | % | | | | | | |

| Total | | $ | 2,758,867 | | | $ | 2,499,766 | | | 10 | % | | | | | | |

| | | | | | | | | | | | |

| | Non-GAAP | | | | | | |

| | Twelve Months Ended December 31, | | |

| | 2024 (1) | | 2023 (1) | | % Change | | Foreign Currency Impact (2) | | Core Revenue (3) | | % Change (3) |

| Screening | | $ | 2,103,868 | | | $ | 1,864,701 | | | 13 | % | | $ | — | | | $ | 2,103,868 | | | 13 | % |

| Precision Oncology | | 647,380 | | | 620,821 | | | 4 | % | | 507 | | | 647,887 | | | 4 | % |

| Total | | $ | 2,751,248 | | | $ | 2,485,522 | | | 11 | % | | $ | 507 | | | $ | 2,751,755 | | | 11 | % |

(1) Excludes revenue from COVID-19 testing, the divested Oncotype DX Genomic Prostate Score test, and the Resolution Bioscience acquisition.

(2) Foreign currency impact is calculating the change in current period non-U.S. dollar denominated revenue using the prior year comparative period exchange rates.

(3) Excludes revenue from COVID-19 testing, the divested Oncotype DX Genomic Prostate Score test, the impact of foreign currency exchange rate fluctuations, and the Resolution Bioscience acquisition.

EXACT SCIENCES CORPORATION

U.S. GAAP to Non-GAAP Reconciliation

Adjusted EBITDA

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (864,585) | | $ | (49,766) | | $ | (1,028,857) | | $ | (204,149) |

Interest expense (1) | 9,577 | | 7,865 | | 27,016 | | 19,447 |

Income tax (benefit) expense | (11,381) | | (610) | | (7,304) | | 2,403 |

Investment income, net | (9,962) | | (25,330) | | (39,558) | | (32,713) |

| Depreciation and amortization | 53,147 | | 54,172 | | 214,859 | | 206,608 |

Stock-based compensation (2) | 57,787 | | 66,466 | | 254,930 | | 271,218 |

Acquisition and integration costs (3) | (1,664) | | (3,616) | | 1,172 | | (11,762) |

Impairment of long-lived and indefinite-lived assets (4) | 838,164 | | — | | 869,460 | | 621 |

Gain on sale of asset and divestiture related costs (5) | (2,568) | | (4,311) | | (9,200) | | (74,833) |

Restructuring and business transformation (6) | 6,866 | | 4,837 | | 18,537 | | 5,744 |

License agreement termination (7) | — | | — | | 25,843 | | — |

Legal settlement (8) | — | | — | | (3,500) | | 36,186 |

| Adjusted EBITDA | $ | 75,381 | | $ | 49,707 | | $ | 323,398 | | $ | 218,770 |

Adjusted EBITDA margin | 11 | % | | 8 | % | | 12 | % | | 9 | % |

EXACT SCIENCES CORPORATION

U.S. GAAP to Non-GAAP Reconciliation

U.S. GAAP to Non-GAAP Measures

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2024 |

| | Gross Profit | | Research & Development Expenses | | Sales & Marketing Expenses | | General & Administrative Expenses | | Loss from Operations | | Net Loss Before Tax | | Income Tax Benefit (Expense) | | Net Loss | | Net Loss Per Share |

| Reported | | $ | 492,593 | | $ | 97,709 | | $ | 244,529 | | $ | 191,110 | | $ | (876,351) | | | $ | (875,966) | | | $ | 11,381 | | | $ | (864,585) | | | $ | (4.67) | |

Reported percent of revenue | | 69% | | 14% | | 34% | | 27% | | | | | | | | | | |

| Amortization of acquired intangible assets | | 20,768 | | (1,384) | | (1,924) | | (26) | | 24,102 | | | 24,102 | | | (3,939) | | | 20,163 | | | 0.11 | |

Acquisition and integration costs (3) | | — | | — | | — | | 1,664 | | (1,664) | | | (1,664) | | | (12) | | | (1,676) | | | (0.01) | |

Impairment of long-lived and indefinite-lived assets (4) | | — | | — | | — | | — | | 838,164 | | | 838,164 | | | (8,398) | | | 829,766 | | | 4.48 | |

Gain on sale of asset and divestiture related costs (5) | | — | | — | | — | | — | | (2,568) | | | (2,568) | | | — | | | (2,568) | | | (0.01) | |

Restructuring and business transformation (6) | | — | | (114) | | (1,829) | | (4,923) | | 6,866 | | | 6,866 | | | 51 | | | 6,917 | | | 0.04 | |

Adjusted (non-GAAP) | | $ | 513,361 | | $ | 96,211 | | $ | 240,776 | | $ | 187,825 | | $ | (11,451) | | | $ | (11,066) | | | $ | (917) | | | $ | (11,983) | | | $ | (0.06) | |

Adjusted percent of revenue (non-GAAP) | | 72 | % | | 13 | % | | 34 | % | | 26 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2024 |

| | Gross Profit | | Research & Development Expenses | | Sales & Marketing Expenses | | General & Administrative Expenses | | Loss from Operations | | Net Loss Before Tax | | Income Tax Benefit (Expense) | | Net Loss | | Net Loss Per Share |

| Reported | | $ | 1,918,717 | | $ | 431,210 | | | $ | 894,125 | | | $ | 781,825 | | | $ | (1,048,703) | | | $ | (1,036,161) | | | $ | 7,304 | | | $ | (1,028,857) | | | $ | (5.59) | |

Reported percent of revenue | | 70 | % | | 16 | % | | 32 | % | | 28 | % | | | | | | | | | | |

| Amortization of acquired intangible assets | | 84,068 | | (3,293) | | (7,694) | | (103) | | 95,158 | | | 95,158 | | | (2,106) | | | 93,052 | | | 0.51 | |

Acquisition and integration costs (3) | | — | | — | | — | | (1,172) | | 1,172 | | | 1,172 | | | (9) | | | 1,163 | | | 0.01 | |

Impairment of long-lived and indefinite-lived assets (4) | | — | | — | | — | | — | | 869,460 | | | 869,460 | | | (8,398) | | | 861,062 | | | 4.67 | |

Gain on sale of asset and divestiture related costs (5) | | — | | — | | — | | — | | (9,200) | | | (9,200) | | | — | | | (9,200) | | | (0.05) | |

Restructuring and business transformation (6) | | 200 | | (6,688) | | (2,051) | | (9,598) | | 18,537 | | | 18,537 | | | (135) | | | 18,402 | | | 0.10 | |

License agreement termination (7) | | — | | (25,843) | | — | | — | | 25,843 | | | 25,843 | | | (63) | | | 25,780 | | | 0.14 | |

Legal settlement (8) | | — | | — | | — | | 3,500 | | (3,500) | | | (3,500) | | | 26 | | | (3,474) | | | (0.02) | |

Adjusted (non-GAAP) | | $ | 2,002,985 | | | $ | 395,386 | | | $ | 884,380 | | | $ | 774,452 | | | $ | (51,233) | | | $ | (38,691) | | | $ | (3,381) | | | $ | (42,072) | | | $ | (0.23) | |

Adjusted percent of revenue (non-GAAP) | | 73 | % | | 14 | % | | 32 | % | | 28 | % | | | | | | | | | | |

EXACT SCIENCES CORPORATION

U.S. GAAP to Non-GAAP Reconciliation

U.S. GAAP to Non-GAAP Measures

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Gross Profit | | Research & Development Expenses | | Sales & Marketing Expenses | | General & Administrative Expenses | | Loss from Operations | | Net Loss Before Tax | | Income Tax Benefit (Expense) | | Net Loss | | Net Loss Per Share |

| Reported | | $ | 453,921 | | $ | 115,184 | | | $ | 216,590 | | | $ | 196,388 | | | $ | (67,841) | | | $ | (50,376) | | | $ | 610 | | | $ | (49,766) | | | $ | (0.27) | |

Reported percent of revenue | | 70 | % | | 18 | % | | 34 | % | | 30 | % | | | | | | | | | | |

| Amortization of acquired intangible assets | | 21,100 | | (261) | | (1,924) | | (26) | | 23,311 | | | 23,311 | | | (571) | | | 22,740 | | | 0.13 | |

Acquisition and integration costs (3) | | — | | — | | — | | 3,616 | | (3,616) | | | (3,616) | | | 38 | | | (3,578) | | | (0.02) | |

Gain on sale of asset and divestiture related costs (5) | | — | | — | | — | | (89) | | (4,311) | | | (4,311) | | | 45 | | | (4,266) | | | (0.02) | |

Restructuring and business transformation (6) | | 60 | | (4,049) | | (282) | | (446) | | 4,837 | | | 4,837 | | | (51) | | | 4,786 | | | 0.03 | |

Adjusted (non-GAAP) | | $ | 475,081 | | | $ | 110,874 | | | $ | 214,384 | | | $ | 199,443 | | | $ | (47,620) | | | $ | (30,155) | | | $ | 71 | | | $ | (30,084) | | | $ | (0.17) | |

Adjusted percent of revenue (non-GAAP) | | 73 | % | | 17 | % | | 33 | % | | 31 | % | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 |

| | Gross Profit | | Research & Development Expenses | | Sales & Marketing Expenses | | General & Administrative Expenses | | Loss from Operations | | Net Loss Before Tax | | Income Tax Benefit (Expense) | | Net Loss | | Net Loss Per Share |

| Reported | | $ | 1,762,202 | | $ | 426,927 | | | $ | 827,805 | | | $ | 800,288 | | | $ | (215,012) | | | $ | (201,746) | | | $ | (2,403) | | | $ | (204,149) | | | $ | (1.13) | |

Reported percent of revenue | | 70 | % | | 17 | % | | 33 | % | | 32 | % | | | | | | | | | | |

| Amortization of acquired intangible assets | | 83,316 | | (1,047) | | (7,694) | | (103) | | 92,160 | | | 92,160 | | | (2,542) | | | 89,618 | | | 0.50 | |

Acquisition and integration costs (3) | | — | | (492) | | — | | 12,254 | | (11,762) | | | (11,762) | | | 123 | | | (11,639) | | | (0.06) | |

Impairment of long-lived and indefinite-lived assets (4) | | — | | — | | — | | — | | 621 | | | 621 | | | (7) | | | 614 | | | — | |

Gain on sale of asset and divestiture related costs (5) | | — | | — | | — | | (1,594) | | (74,833) | | | (74,833) | | | 46 | | | (74,787) | | | (0.42) | |

Restructuring and business transformation (6) | | 60 | | (4,772) | | (282) | | (630) | | 5,744 | | | 5,744 | | | (60) | | | 5,684 | | | 0.03 | |

Legal settlement (8) | | — | | — | | — | | (36,186) | | 36,186 | | | 36,186 | | | (485) | | | 35,701 | | | 0.20 | |

Adjusted (non-GAAP) | | $ | 1,845,578 | | | $ | 420,616 | | | $ | 819,829 | | | $ | 774,029 | | | $ | (166,896) | | | $ | (153,630) | | | $ | (5,328) | | | $ | (158,958) | | | $ | (0.88) | |

Adjusted percent of revenue (non-GAAP) | | 74 | % | | 17 | % | | 33 | % | | 31 | % | | | | | | | | | | |

(1) Interest expense includes net gains recorded of $10.3 million for each of the twelve months ended December 31, 2024 and 2023, from the settlement of convertible notes. The gains represent the difference between (i) the fair value of the consideration transferred and (ii) the sum of the carrying value of the debt at the time of the exchange.

(2) Represents stock-based compensation expense and 401(k) match expense. The Company matches a portion of Exact Sciences employees' contributions annually in the form of the Company's common stock.

(3) Represents acquisition and related integration costs incurred as a result of the Company's business combinations. Acquisition costs represent legal and professional fees incurred to execute the transaction. There were no acquisition costs incurred for the three and twelve months ended December 31, 2024 and there was an insignificant amount incurred for the three and twelve months ended December 31, 2023 related to the acquisition of Resolution Bioscience, Inc. Integration-related costs represent expenses incurred outside regular business operations, specifically relating to the integration of businesses acquired through a business combination. This includes any gain or loss on contingent consideration liabilities, severance and accelerated

vesting of stock awards, and professional services. The remeasurement of the contingent consideration liabilities resulted in a gain of $1.0 million and $3.3 million for the three and twelve months ended December 31, 2024, respectively, and a gain of $5.0 million and a gain of $18.0 million for the three and twelve months ended December 31, 2023, respectively. The Company also incurred severance costs and professional service fees which were not significant for the three and twelve months ended December 31, 2024 and 2023. The majority of the professional service fees relate to the integration of information technology systems.

(4) Represents impairment charges on the Company’s long-lived and indefinite-lived assets. For the three months ended December 31, 2024, this primarily includes an impairment charge recorded related to the in-process research and development asset acquired as part of our acquisition of Thrive. For the three and twelve months ended December 31, 2024 this also includes impairment charges recorded on building leases and corresponding leasehold improvements at certain of our domestic facilities. For the three and twelve months ended December 31, 2023, the Company recorded insignificant impairment charges related to building leases that were vacated during the year.

(5) Relates to the sale of the intellectual property and know-how related to the Company's Oncotype DX Genomic Prostate Score test to MDxHealth SA in August 2022 and the subsequent Second Amendment to the Asset Purchase Agreement related to the sale in August 2023. For the three and twelve months ended December 31, 2024, this represents the remeasurement of the associated contingent consideration. For the three months ended December 31, 2023, this represents the remeasurement of the associated contingent consideration and an insignificant amount of legal and professional fees. For the twelve months ended December 31, 2023, this represents a gain of $3.1 million from additional cash and equity consideration received, a $73.3 million contingent consideration gain, and an insignificant amount of legal and professional service fees.

(6) Includes costs associated with the Company's business transformation program intended to consolidate operations, achieve targeted cost reductions, and focus resources on its key strategic priorities. For the three and twelve months ended December 31, 2024, this primarily includes severance costs and accelerated stock-based compensation expense related to the closure of domestic facilities and related consulting services. For the three and twelve months ended December 31, 2023, this primarily includes severance and accelerated stock-based compensation costs associated with the closure of one of the Company's domestic laboratory facilities.

(7) Represents termination related charges incurred due to the termination of the Company's license and sponsored research agreements with The Translational Genomics Research Institute related to its Targeted Digital Sequencing technology, which resulted in the recognition of termination related charges in the second quarter of 2024.

(8) Represents charges incurred in connection with settlements with counterparties related to the Medicare Date of Service Rule Investigation and the Federal Anti-Kickback Statute and False Claims Act qui tam lawsuit.

EXACT SCIENCES CORPORATION

U.S. GAAP to Non-GAAP Reconciliation

Operating Cash Flow to Free Cash Flow

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Net cash provided by operating activities | | $ | 47,063 | | | $ | 69,549 | | | $ | 210,536 | | | $ | 156,119 | |

Net cash provided by (used in) investing activities | | (41,872) | | | (66,767) | | | (442,155) | | | 49,679 | |

| Net cash provided by financing activities | | 10,499 | | | 10,037 | | | 231,874 | | | 159,766 | |

| Effects of exchange rate changes on cash and cash equivalents | | (3,721) | | | 1,947 | | | (3,294) | | | 1,321 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | 11,969 | | | 14,766 | | | (3,039) | | | 366,885 | |

| Cash, cash equivalents and restricted cash, beginning of period | | 594,667 | | | 594,909 | | | 609,675 | | | 242,790 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 606,636 | | | $ | 609,675 | | | $ | 606,636 | | | $ | 609,675 | |

| | | | | | | | |

| Reconciliation of free cash flow: | | | | | | | | |

Net cash provided by operating activities | | $ | 47,063 | | | $ | 69,549 | | | $ | 210,536 | | | $ | 156,119 | |

| Purchases of property, plant and equipment | | (36,316) | | | (34,922) | | | (135,989) | | | (124,190) | |

| Free cash flow | | $ | 10,747 | | | $ | 34,627 | | | $ | 74,547 | | | $ | 31,929 | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

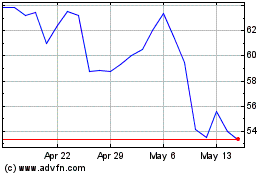

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Feb 2024 to Feb 2025