Current Report Filing (8-k)

27 April 2023 - 8:05PM

Edgar (US Regulatory)

false12-31000185448000018544802023-04-252023-04-250001854480us-gaap:CommonStockMember2023-04-252023-04-250001854480fiac:RedeemableWarrantsIncludedAsPartOfTheUnitsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150Member2023-04-252023-04-250001854480fiac:SharesOfClassACommonStockIncludedAsPartOfTheUnitsMember2023-04-252023-04-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 26, 2023 (April 25, 2023)

FOCUS IMPACT ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

Delaware

|

001-40977

|

86-2433757

|

|

(State or other jurisdiction of incorporation

or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

250 Park Avenue Ste 911

New York, NY

(Address of principal executive offices)

|

|

10177

(Zip Code)

|

(212) 213-0243

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on

which registered

|

|

Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant

|

FIACU

|

The Nasdaq Stock Market LLC

|

|

Shares of Class A common stock included as part of the units

|

FIAC

|

The Nasdaq Stock Market LLC

|

|

Redeemable warrants included as part of the units, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50

|

FIACW

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On April 25, 2023, Focus Impact Acquisition Corp. (the “Company”) held a special meeting of stockholders (the “Extension Meeting”) to amend the Company’s amended and restated certificate of incorporation to (i) extend the date (the “Termination Date”) by which FIAC has to consummate a business combination from May 1, 2023 (the “Original Termination Date”) to August 1, 2023 (the “Charter Extension Date”) and to allow the Company, without another shareholder vote, to elect to extend the Termination Date to consummate a business combination on a monthly

basis for up to nine times by an additional one month each time after the Charter Extension Date, by resolution of the Company’s board of directors if requested by the Sponsor, and upon five days’ advance notice prior to the applicable Termination

Date, until May 1, 2024, or a total of up to twelve months after the Original Termination Date, unless the closing of the Company’s initial business combination shall have occurred prior to such date (such amendment, the “Extension Amendment” and such proposal, the “Extension Amendment Proposal”) and (ii) remove the limitation that the Company may not redeem shares of public stock to the extent that such redemption would result in the Company having net tangible assets (as determined in accordance with Rule

3a51-1(g)(1) of the Securities Exchange Act of 1934, as amended, of less than $5,000,000 (such amendment, the “Redemption Limitation Amendment” and such proposal, the “Redemption Limitation Amendment Proposal”). The shareholders of the Company approved the Extension Amendment Proposal and the Redemption

Limitation Amendment at the Extension Meeting and on April 26, 2023, the Company filed the Extension Amendment and the Redemption Limitation Amendment with the Secretary of State of Delaware.

The foregoing description is qualified in its entirety by reference to the Extension Amendment and the Redemption Limitation Amendment, copies of which are attached as Exhibits 3.1 and

3.2 hereto and are incorporated by reference herein.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders.

|

On April 25, 2023, the Company held the Extension Meeting to approve the Extension Amendment Proposal, the Redemption Limitation Amendment Proposal and a proposal to allow the

adjournment of the Extension Meeting to a later date or dates, if necessary, (1) to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Extension Meeting, there were insufficient ordinary shares of

the Company represented (either in person or by proxy) to approve the Extension Amendment Proposal or the Redemption Limitation Amendment Proposal or (2) where the board of the Company has determined it is otherwise necessary (the “Adjournment Proposal”), each as more fully described in the definitive proxy statement filed by the Company with the Securities and Exchange Commission on April 5, 2023. As there

were sufficient votes to approve each of the Extension Amendment Proposal and the Redemption Limitation Amendment Proposal, the Adjournment Proposal was not presented to shareholders.

Holders of 24,255,187 ordinary shares of the Company held of record as of March 23, 2023, the record date for the Extension Meeting, were present in person or by proxy at the meeting,

representing approximately 84.37% of the voting power of the Company’s ordinary shares as of the record date for the Extension Meeting, and constituting a quorum for the transaction of business.

The voting results for the proposals were as follows:

The Extension Amendment Proposal

|

For

|

|

Against

|

|

Abstain

|

|

23,291,632

|

|

963,555

|

|

0

|

The Redemption Limitation Amendment Proposal

|

For

|

|

Against

|

|

Abstain

|

|

23,291,651

|

|

963,536

|

|

0

|

In connection with the vote to approve the Extension Amendment Proposal and the Redemption Limitation Amendment Proposal,

the holders of 17,297,209 shares of Class A common stock, par value $0.0001 per share, of the Company properly exercised their

right to redeem their shares for cash at a redemption price of approximately $10.40 per share, for an aggregate redemption amount of approximately $179,860,588.

| Item 9.01. |

Financial Statements and Exhibits

|

|

Exhibit No.

|

|

Description

|

|

|

|

Amendment to Amended and Restated Certificate of Incorporation (Extension Amendment).

|

|

|

|

Amendment to Amended and Restated Certificate of Incorporation (Redemption Limitation Amendment).

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

| |

|

| |

FOCUS IMPACT ACQUISITION CORP.

|

| |

|

| |

By:

|

/s/ Carl Stanton

|

| |

Name:

|

Carl Stanton

|

| |

Title:

|

Chief Executive Officer

|

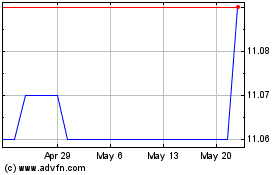

Focus Impact Acquisition (NASDAQ:FIAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

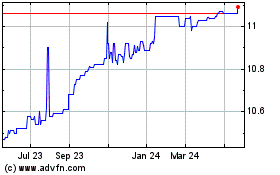

Focus Impact Acquisition (NASDAQ:FIAC)

Historical Stock Chart

From Nov 2023 to Nov 2024