SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E)

OF THE SECURITIES ACT OF 1934

Franchise Group, Inc.

(Name of the Issuer)

Franchise Group, Inc.

Freedom VCM, Inc.

Freedom VCM Subco, Inc.

Freedom VCM Holdings, LLC

Freedom VCM Interco Holdings, Inc.

Brian R. Kahn

Vintage Opportunity Partners, L.P.

Vintage Capital Management LLC

Brian Kahn and Lauren Kahn Joint Tenants by

Entirety

Andrew Laurence

B. Riley Financial, Inc.

(Names of Persons Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

35180X105

(CUSIP Number of Class of Securities)

| Tiffany

McMillan-McWaters |

Brian

R. Kahn |

Bryant

R. Riley |

Andrew

Laurence |

| Franchise Group, Inc. |

Freedom VCM, Inc.

Freedom VCM Subco, Inc.

Freedom VCM Interco Holdings, Inc.

Freedom VCM Holdings, LLC

Brian R. Kahn

Vintage Opportunity Partners, L.P.

Vintage Capital Management LLC

Brian Kahn and Lauren Kahn Joint Tenants by

Entirety |

B. Riley Financial, Inc. |

|

| 109

Innovation Court, Suite J |

8529

Southpark Circle, Suite 150 |

11100

Santa Monica Blvd, Suite 800 |

627 Harland St. |

| Delaware,

OH 43015 |

Orlando,

FL 32819 |

Los

Angeles, CA 90025 |

Milton, MA 02186 |

| (740)

363-2222 |

(407)

592-8015 |

(818)

884-3737 |

(740)

363-2222 |

(Name, Address, and Telephone Numbers of Person Authorized to Receive

Notices and Communications on Behalf of the Persons Filing Statement)

With copies to

| |

|

|

|

David

W. Ghegan

Betty Linkenauger

Segaar |

David

A. Katz

Zachary S. Podolsky |

Patrick S. Brown

Sullivan & Cromwell LLP |

Russell

Leaf

Willkie

Farr & Gallagher LLP |

| Troutman

Pepper Hamilton Sanders LLP |

Wachtell,

Lipton, Rosen & Katz |

1888 Century Park East, Suite 2100 |

787

Seventh Avenue |

| 600

Peachtree Street NE, Suite 3000 |

51 West

52nd Street |

Los

Angeles, CA 90067 |

New

York, NY 10019 |

| Atlanta,

GA 30308 |

New

York, NY 10019 |

(310)

712-6003 |

(212)

728-8000 |

| (404)

885-3000 |

(212)

403-1000 |

|

|

| |

|

|

|

This statement is filed in connection with (check the appropriate box):

| a. |

x |

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. |

¨ |

The filing of a registration statement under the Securities Act of 1933. |

| c. |

¨ |

A tender offer. |

| d. |

¨ |

None of the above. |

Check the following box if the soliciting

materials or information statement referred to in checking box (a) are preliminary copies: x

Introduction

This Transaction Statement on Schedule 13E-3 (which

we refer to as this “Transaction Statement”) is being filed with the U.S. Securities and Exchange Commission (which

we refer to as the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (which

we refer to, together with the rules and regulations promulgated thereunder, as the “Exchange Act”), by (1) Franchise

Group, Inc., a Delaware corporation (which we refer to as “FRG” or the “Company”); (2) Freedom

VCM, Inc., a Delaware corporation (which we refer to as “Parent”); (3) Freedom VCM Subco, Inc., a Delaware

corporation and an indirectly wholly-owned subsidiary of Parent (which we refer to as “Merger Sub”); (4) Freedom

VCM Holdings, LLC, a Delaware limited liability company; (5) Freedom VCM Interco Holdings, Inc., a Delaware corporation; (6) Brian

R. Kahn (7) Vintage Opportunity Partners, L.P., a Delaware limited partnership; (8) Vintage Capital Management LLC, a Delaware

limited liability company (9) Brian Kahn and Lauren Kahn Joint Tenants by Entirety; (10) Andrew Laurence; and (11) B. Riley

Financial, Inc., a Delaware corporation (which we refer to as the “Guarantor” or “B. Riley”). The

persons filing this Transaction Statement are collectively referred to as the “Filing Persons”.

This Transaction Statement relates to the Agreement

and Plan of Merger, dated as of May 10, 2023 (which we refer to, as it may be amended from time to time, as the “Merger

Agreement”), by and among the Company, Parent and Merger Sub. If the Merger Agreement is adopted by the Company’s stockholders

and the other conditions under the Merger Agreement are either satisfied or waived, the Merger Sub will be merged with and into the Company

(which we refer to as the “Merger”), with the Company surviving the Merger as a wholly-owned subsidiary of Parent.

At the effective time of the Merger, each outstanding share of common stock, par value $0.01 per share, of the Company (which we refer

to as “FRG Common Stock”) (other than (x) shares of FRG Common Stock and shares of FRG Series A Preferred

Stock owned by the Guarantor or any wholly-owned subsidiary of the Guarantor, Parent or any wholly-owned subsidiary of Parent, Merger

Sub, the Company or any wholly-owned subsidiary of the Company, and in each case not held on behalf of third parties, (y) shares

of FRG Common Stock that are owned by stockholders of the Company who did not vote in favor of the Merger Agreement or the Merger and

who have perfected and not withdrawn a demand for appraisal rights pursuant to Section 262 of the Delaware General Corporation Law

(which we refer to as the “DGCL”) and (z) shares of FRG Common Stock owned by Brian R. Kahn, Vintage Opportunity

Partners, L.P., Brian Kahn and Lauren Kahn Joint Tenants by Entirety and Andrew Laurence (which we refer to, each, as a “Rollover

Stockholder” and collectively, as the “Rollover Stockholders”) and subject to the Rollover Contribution Agreement,

dated as of May 10, 2023, by and among Freedom VCM Holdings, LLC and the Rollover Stockholders (such shares, the “Rollover

Shares”) (the shares of FRG Common Stock subject to clauses (x), (y) and (z) above, we refer to collectively as the

“Excluded Shares”)) will be converted into the right to receive $30.00 in cash per share, without interest (which we

refer to as the “Per Share Merger Consideration”). Following the completion of the Merger, FRG Common Stock will be

delisted from the Nasdaq Global Select Market, will be deregistered under the Exchange Act and will cease to be publicly traded.

The board of directors of the Company (which

we refer to as the “Board”) formed a special committee (which we refer to as the “Special

Committee”) consisting solely of independent and disinterested directors to, among other things, evaluate the Merger.

After reviewing the terms of the Merger Agreement with its independent legal and financial advisors, the Special Committee

unanimously (A) approved and declared advisable the Merger Agreement, the Voting Agreement, dated as of May 10, 2023, by

and among Parent, Brian R. Kahn, Vintage Opportunity Partners, L.P., Brian Kahn and Lauren Kahn Joint Tenants by Entirety and Andrew

Laurence (which we refer to as the “Voting Agreement”), and the transactions contemplated by the Merger

Agreement, (B) determined that the Merger Agreement, the Voting Agreement and the transactions contemplated by the Merger

Agreement are fair to, and in the best interests of, the Company and the holders of FRG Common Stock (other than the holders of

Excluded Shares and shares of FRG Common Stock held by Rollover Stockholders), and (C) resolved to recommend to the Board that the holders of FRG Common Stock (other than the Rollover

Stockholders) adopt the Merger Agreement at a special meeting of stockholders.

Based on the Special Committee’s

recommendation, the Board, by a unanimous vote of the Company’s directors (other Mr. Kahn who recused himself due to his

status as a Rollover Stockholder) has (i) (A) approved and declared advisable the Merger Agreement, the Voting Agreement

and the transactions contemplated by the Merger Agreement, (B) determined that the Merger Agreement, the Voting Agreement and

the transactions contemplated by the Merger Agreement were fair to, and in the best interests of, the Company and the holders of FRG

Common Stock, other than Excluded Shares and shares of FRG Common Stock held by Rollover Stockholders, and (C) resolved to recommend that the holders of FRG Common Stock adopt the Merger

Agreement at a special meeting of stockholders and (ii) directed that the Merger Agreement be submitted to the holders of FRG

Common Stock for their adoption at such special meeting.

Concurrently with the filing of this Transaction

Statement, the Company is filing a proxy statement (which we refer to as the “Proxy Statement”) under Regulation 14A

of the Exchange Act with the SEC, pursuant to which the Company is soliciting proxies from stockholders of the Company in connection with

the Merger. The Proxy Statement is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached to the Proxy Statement

as Annex A and is incorporated herein by reference. As of the date hereof, the Proxy Statement is in preliminary form, and is subject

to completion or amendment. Terms used but not defined in this Transaction Statement have the meanings assigned to them in the Proxy Statement.

Pursuant to General Instruction F to Schedule 13E-3,

the information in the Proxy Statement, including all annexes thereto, is expressly incorporated by reference herein in its entirety,

and responses to each item herein are qualified in their entirety by the information contained in the Proxy Statement. The cross-references

below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location in the Proxy Statement of the information

required to be included in response to the items of Schedule 13E-3.

While each of the Filing Persons acknowledges that

the Merger is a going private transaction for purposes of Rule 13e-3 under the Exchange Act, the filing of this Transaction Statement

shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing Person, that the Company is “controlled”

by any of the Filing Persons and/or their respective affiliates.

All information contained in, or incorporated by

reference into, this Transaction Statement concerning each Filing Person has been supplied by such Filing Person. No Filing Person, including

the Company, is responsible for the accuracy of any information supplied by any other Filing Person.

Item 1. Summary Term Sheet (Regulation M-A Item 1001)

The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

Item 2. Subject Company Information (Regulation M-A Item

1002)

(a) Name

and address. The Company’s name, and the address and telephone number of its principal executive offices are:

Franchise Group, Inc.

109 Innovation Court, Suite J

Delaware, Ohio 43015

(740) 363-2222

(b) Securities.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Questions and Answers About the Special

Meeting and the Merger—How many votes do I have?”

“The Special Meeting—Record Date and

Quorum”

“Other Important Information Regarding the

Company—Security Ownership of Certain Beneficial Owners and Management”

(c) Trading

market and price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Other Important Information Regarding the

Company—Market Price of Common Stock and Dividends”

(d) Dividends.

The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Other Important Information Regarding the

Company—Market Price of Common Stock and Dividends”

(e) Prior

public offerings. Not applicable.

(f) Prior

stock purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Other Important Information Regarding the

Company—Certain Transactions in the Shares of FRG Common Stock”

Item 3. Identity and Background of Filing Person (Regulation

M-A Item 1003)

(a) – (b) Name

and Address of Each Filing Person; Business and Background of Entities. The information set forth in the Proxy Statement under the

following captions is incorporated herein by reference:

“Summary Term Sheet—Parties to the

Merger”

“Parties to the Merger”

“Other Important Information Regarding the

Company”

“Other Important Information Regarding Parent”

“Where You Can Find More Information”

(c) Business

and Background of Natural Persons. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“Other Important Information Regarding the

Company”

“Other Important Information Regarding Parent”

“Where You Can Find More Information”

Set forth below are the names, the present

principal occupations or employment, telephone number and the name, principal business, and address of any corporation or other

organization in which such occupation or employment is conducted and the five–year employment history of each of the Filing

Persons (other than the Company). During the past five years, none of the persons or entities described have been (1) convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (2) party to any judicial or administrative

proceeding (except for matters that were dismissed without sanction or settlement) that resulted in a judgment, decree or final

order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws or a

finding of any violation of federal or state securities laws. Each person identified is a United States citizen. Mr. Kahn is

(i) the sole director and executive officer of Parent, Merger Sub, Freedom VCM Holdings, LLC and Freedom VCM Interco Holdings,

Inc.; (ii) the President and Chief Executive Officer of the Company; and (iii) the investment manager of Vintage Capital

Management LLC, which is the general partner of Vintage Opportunity Partners, L.P., a Delaware limited partnership. By virtue of his status as the investment manager of Vintage Capital Management LLC, Mr. Kahn is the sole controlling person of Vintage

Capital Management LLC and Vintage Capital Opportunity Partners, L.P.

| |

|

|

|

|

| Name |

|

Business Address |

|

Employment History |

Freedom VCM, Inc.,

Freedom VCM Subco, Inc.,

Freedom VCM Holdings, LLC,

Freedom VCM Interco Holdings, Inc.,

Vintage Opportunity Partners, L.P.,

Vintage Capital Management LLC, and

Brian Kahn and Lauren Kahn Joint Tenants by Entirety |

|

c/o Brian R. Kahn

Vintage Capital Management, LLC

8529 Southpark Circle, Suite 150

Orlando, FL 32819

(407) 592-8015 |

|

N/A |

| |

|

|

|

|

| Brian R. Kahn |

|

8529 Southpark Circle, Suite 150

Orlando, FL 32819

(407) 592-8015 |

|

Director of the Company since 2018; the Company’s President and Chief Executive Officer since October 2019; investment manager of Vintage Capital Management LLC since 1998. |

| |

|

|

|

|

| Andrew M. Laurence |

|

8529 Southpark Circle, Suite 150

Orlando, FL 32819

(407) 592-8015 |

|

The Company’s Executive Vice President since October 2019; partner of Vintage Capital Management LLC since January 2010; director on the Company’s Board from September 2018 until May 2021. |

| |

|

|

|

|

| B. Riley Financial, Inc. |

|

11100 Santa Monica Blvd, Suite 800

Los Angeles, CA 90025

(310) 9669-1444 |

|

N/A |

B. Riley

B. Riley is a Delaware

corporation with a principal place of business located at 11100 Santa Monica Blvd., Suite 800, Los Angeles, California 90025.

Set forth below are the

names, present principal occupations or employment and material occupations, positions, offices or employments for the past five years

of each officer and director of B. Riley. Each such person is a U.S. Citizen. Unless otherwise indicated, the current business address

of each person is 11100 Santa Monica Blvd. Suite 800, Los Angeles, CA 90025, and his or her telephone number is (310) 966-1444. During

the past five years, none of the persons described have been (i) convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors) or (ii) party to any judicial or administrative proceeding (except for matters that were dismissed without

sanction or settlement) that resulted in a judgment, decree or final order enjoining the person from future violations of, or prohibiting

activities subject to, federal or state securities laws or a finding of any violation of federal or state securities laws.

| Name |

|

Position |

|

Employment History |

| Bryant R. Riley |

|

Co-Chief Executive Officer |

|

B. Riley’s Chairman and Co-Chief Executive Officer since June 2014 and July 2018 respectively, and director on the B. Riley board of directors (the “B. Riley Board”) since August 2009; B. Riley’s Chief Executive Officer from June 2014 to July 2018; Chairman of B. Riley Principal Merger Corp. from April 2019 to February 2020; Chairman of B. Riley Principal Merger Corp. II from May 2020 to November 2020; and Chairman of B. Riley Principa1 150 Merger Corp. from June 2020 to July 2022. Mr. Riley currently serves as Chairman of B. Riley Principal 250 Merger Corp. since May 2021. Mr. Riley served as director of Select Interior Concepts, Inc. from November 2019 until October 2021. Mr. Riley previously served on the board of Babcock & Wilcox Enterprises, Inc. from April 2019 to September 2020, Sonim Technologies, Inc. from October 2017 to March 2019 and the Company from September 2018 through March 2020. . |

| |

|

|

|

|

| Thomas J. Kelleher |

|

Co-Chief Executive Officer |

|

B. Riley’s Co-Chief Executive Officer since July 2018 and as a member of B. Riley Board since October 2015. He also previously served as President of B. Riley from August 2014 to July 2018. |

| |

|

|

|

|

| Kenneth Young |

|

President |

|

B. Riley’s President since July 2018, and previously served as a director of B. Riley from May 2015 to October 2016. Mr. Young also has served as Chief Executive Officer of B. Riley Principal Investments, LLC since October 2016. He previously served as Chief Executive Officer of B. Riley Principal Merger Corp., from October 2018 to February 2020. Mr. Young has served on the board of Charah Solutions, Inc. since August 2021. Mr. Young serves as Chairman and has been a member of the board at Babcock & Wilcox Enterprises, Inc. since September 2020 and Chief Executive Officer since November 2018. Mr. Young served as a member of the board of Sonim Technologies, Inc. from 2018 to February 2022. He also served on the board of bebe stores, inc. from January 2018 to April 2019, Globalstar, Inc. from November 2015 to December 2018, Orion Energy Systems, Inc. from August 2017 to May 2020, and the Company from 2018 to 2020. |

| |

|

|

|

|

| Phillip J. Ahn |

|

Chief Financial Officer and Chief Operating Officer |

|

B. Riley’s Chief Financial Officer and Chief Operating Officer since April 2013. |

| |

|

|

|

|

| Andrew Moore |

|

Chief Executive Officer of B. Riley Securities, Inc. |

|

B. Riley Securities, Inc.’s Chief Executive Officer since July 2018, and previously served as President of B. Riley Securities, Inc. from 2016 to 2018. |

| |

|

|

|

|

| Alan N. Forman |

|

Executive Vice President, General Counsel and Secretary |

|

B. Riley’s Executive Vice President, General Counsel and Secretary since May 2015. |

| |

|

|

|

|

| Howard Weitzman |

|

Senior Vice President, Chief Accounting Officer |

|

B. Riley’s Senior Vice President, Chief Accounting Officer since December 2009. |

| |

|

|

|

|

| Robert L. Antin |

|

Director |

|

Member of B. Riley’s Board since June 2017. Mr. Antin has served as a Chief Executive Officer and President at VCA Inc. since its inception in 1986. Mr. Antin has served on the board of directors of Rexford Industrial Realty, Inc. (since July 2013 and Heska Corporation since November 2020. |

| Tammy Brandt |

|

Director |

|

Member of B. Riley’s Board since December 20, 2021. Since February 2023, Ms. Brandt has served as a senior member of the legal team at Creative Artists Agency. From March 2021 to January 2023, Ms. Brandt served as Chief Legal Officer; Head of Business and Legal Affairs at FaZe Clan Inc. Ms. Brandt has served on the Lambda Legal West Coast Leadership Board since 2019. From 2018 to June 2022, Ms. Brandt served on the Board of Cayton Children’s Museum. From May 2017 to May 2021, Ms. Brandt served as Chief Legal Officer at Dreamscape Immersive. |

| |

|

|

|

|

| Robert D’Agostino |

|

Director |

|

Member of B. Riley’s Board since October 2015. Mr. D’Agostino has served as President of Q-mation, Inc. since 1999. |

| |

|

|

|

|

| Renée E. LaBran |

|

Director |

|

Member of B. Riley’s Board since August 11, 2021. Ms. LaBran co-founded Rustic Canyon Partners and has served from 2006 to 2021 as partner with Rustic Canyon/Fontis Partners. Ms. LaBran has been a board member of Iconic Sports Acquisition Corp since October 2021; Idealab, Inc. since March 2015, and was previously on the board of directors of Sambazon, Inc. from 2009 to 2021, and TomboyX from 2018 to 2019. Ms. LaBran is an Adjunct Professor at UCLA Anderson School of Management’s MBA program. |

| |

|

|

|

|

| Randall E. Paulson |

|

Director |

|

Member of B. Riley’s Board since June 18, 2020. Mr. Paulson currently serves on the board of directors of Testek Inc. and Dash Medical Holdings. Mr. Paulson served as managing principal of Odyssey Investment Partners, LLC from 2005 to 2019. |

| |

|

|

|

|

| Michael J. Sheldon |

|

Director |

|

Member of B. Riley’s Board since July 2017. Mr. Sheldon served as CEO of Deutsch North America, from January 2015 until December 2019. |

| |

|

|

|

|

| Mimi Walters |

|

Director |

|

Member of B. Riley’s Board since July 12, 2019. Ms. Walters served from 2015 to 2019 as the U.S. Representative for California’s 45th Congressional District. |

Item 4. Terms of the Transaction (Regulation M-A Item 1004)

(a) Material

terms.

(1) Tender

offer. Not applicable

(2) Merger

or Similar Transactions.

(i) The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Effective Time of

the Merger”

“Special Factors—Payment of Merger

Consideration”

“The Merger Agreement—Closing and Effective

Time of the Merger”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“The Merger Agreement—Conditions to

the Merger”

(ii) The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Payment of Merger

Consideration”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“The Merger Agreement—Surrender and

Payment Procedures”

(iii) The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Opinion of Special

Committee’s Financial Advisor”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—New Management Arrangements”

“Special Factors—Unaudited Prospective

Financial Information of the Company”

(iv) The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Questions and Answers About the Special

Meeting and the Merger”

“The Merger Agreement—Other Covenants

and Agreements—The Special Meeting”

“The Special Meeting—Vote Required”

“The Special Meeting—Management Stockholders’

Obligation to Vote in Favor of the Merger”

“The Voting Agreement”

(v) The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

(vi) The

information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Special Factors—Accounting Treatment”

(vii) The

information set forth in the Proxy Statement under the following caption is incorporated herein by reference:

“Special Factors—Material U.S. Federal

Income Tax Consequences of the Merger”

(c) Different

terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“Special Factors—Guarantee”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“The Merger Agreement—Directors’

and Officers’ Indemnification and Insurance”

“The Voting Agreement”

“The Rollover Agreement”

(d) Appraisal

rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Appraisal Rights”

“Annex C—Section 262 of the General

Corporation Law of the State of Delaware”

(e) Provisions

for unaffiliated security holders. The information set forth in the Proxy Statement under the following caption is incorporated herein

by reference:

“Special Factors—Provisions for Unaffiliated

Stockholders”

(f) Eligibility

for listing or trading. Not applicable.

Item 5. Past Contacts, Transactions, Negotiations and Agreements

(Regulation M-A Item 1005)

(a)(1) – (2) Transactions.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Background of the

Merger”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“Other Important Information Regarding the

Company—Certain Transactions in the Shares of FRG Common Stock”

“The Voting Agreement”

“The Rollover Agreement”

(b) – (c) Significant

corporate events; Negotiations or contacts. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“Summary Term Sheet”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“Special Factors—Financing of the Merger”

“Special Factors—Guarantee”

“The Merger Agreement”

“The Voting Agreement”

Annex A—Agreement and Plan of Merger

Annex D—Voting Agreement

Annex E—Rollover Agreement

Annex F—Guarantee

(e) Agreements

involving the subject company’s securities. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—Financing of the Merger”

“The Merger Agreement”

“The Voting Agreement”

“The Rollover Agreement”

“The Special Meeting—Vote Required”

“The Special Meeting—Management Stockholders’

Obligation to Vote in Favor of the Merger”

“Other Important Information Regarding the

Company—Certain Transactions in the Shares of FRG Common Stock”

Annex A—Agreement and Plan of Merger

Annex D—Voting Agreement

Annex E—Rollover Agreement

Annex F—Guarantee

Item 6. Purposes of the Transaction, and Plans or Proposals

(Regulation M-A Item 1006)

(b) Use

of securities acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—New Management Arrangements”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Certain Effects of

the Merger for Parent”

“Special Factors—Certain Effects on

the Company if the Merger Is Not Completed”

“Special Factors—Payment of Merger

Consideration”

“Special Factors—Financing of the Merger”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“Delisting and Deregistration of FRG Common

Stock”

(c)(1) – (8) Plans.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—New Management Arrangements”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Certain Effects of

the Merger for Parent”

“Special Factors—Certain Effects on

the Company if the Merger Is Not Completed”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“Special Factors—Financing of the Merger”

“The Merger Agreement—Effects of the

Merger; Directors and Officers; Articles of Incorporation; Bylaws”

“The Merger Agreement—Closing and Effective

Time of the Merger”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“The Merger Agreement—Conduct of the

Company’s Business During the Pendency of the Merger”

“The Voting Agreement”

“The Rollover Agreement”

“Other Important Information Regarding the

Company—Directors and Executive Officers of the Company”

“Other Important Information Regarding the

Company—Market Price of Common Stock and Dividends”

“Delisting and Deregistration of Common Stock”

Annex A—Agreement and Plan of Merger

Annex D—Voting Agreement

Annex E—Rollover Agreement

Item 7. Purposes, Alternatives, Reasons and Effects (Regulation

M-A Item 1013)

(a) Purposes.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—New Management Arrangements”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Certain Effects of

the Merger for Parent”

(b) Alternatives.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

(c) Reasons.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Opinion of the Special

Committee’s Financial Advisor”

“Special Factors—Unaudited Prospective

Financial Information of the Company”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Certain Effects of

the Merger for Parent”

Annex B—Opinion of Jefferies LLC

(d) Effects.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Plans for the Company

After the Merger”

“Special Factors—New Management Arrangements”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Certain Effects of

the Merger for Parent”

“Special Factors—Certain Effects on

the Company if the Merger Is Not Completed”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“Special Factors—Material U.S. Federal

Income Tax Consequences of the Merger”

“Special Factors—Accounting Treatment”

“Special Factors—Financing of the Merger”

“Special Factors—Fees and Expenses”

“Special Factors—Payment of Merger

Consideration”

“The Merger Agreement—Effects of the

Merger; Directors and Officers; Articles of Incorporation; Bylaws”

“The Merger Agreement—Treatment of

Capital Stock”

“The Merger Agreement—Treatment of

Company Equity Awards”

“The Merger Agreement—Conduct of the

Company’s Business During the Pendency of the Merger”

“Other Important Information Regarding the

Company—Market Price of FRG Common Stock and Dividends”

“Delisting and Deregistration of FRG Common

Stock”

Annex A—Agreement and Plan of Merger

Item 8. Fairness of the Transaction (Regulation M-A Item

1014)

(a) – (b) Fairness;

Factors considered in determining fairness. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Opinion of the Special

Committee’s Financial Advisor”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

Annex B—Opinion of Jefferies LLC

Presentation of Jefferies LLC to the Special Committee, dated

as of April 14, 2023, is attached hereto as Exhibit (c)(1) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 19, 2023, is attached hereto as Exhibit (c)(2) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 26, 2023, is attached hereto as Exhibit (c)(3) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 28, 2023, is attached hereto as Exhibit (c)(4) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of May 8, 2023, is attached hereto as Exhibit (c)(5) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of May 9, 2023, is attached hereto as Exhibit (c)(6) and is incorporated herein by reference.

(c) Approval

of security holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of Consortium

Members as to the Fairness of the Merger”

“The Merger Agreement—Conditions to

the Merger”

“The Special Meeting—Vote Required”

Annex A—Agreement and Plan of Merger

(d) Unaffiliated

representative. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Opinion of the Special

Committee’s Financial Advisor”

(e) Approval

of directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Opinion of the Special

Committee’s Financial Advisor”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“The Merger (The Merger Agreement Proposal—Proposal

1)”

(f) Other

offers. Not applicable.

Item 9. Reports, Opinions, Appraisals and Negotiations (Regulation

M-A Item 1015)

(a) – (c) Report,

opinion or appraisal; Preparer and summary of the report, opinion or appraisal; Availability of documents. The information set forth

in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Opinion of the Special

Committee’s Financial Advisor”

“Where You Can Find More Information”

Annex B – Opinion of Jefferies LLC

Presentation of Jefferies LLC to the Special Committee, dated

as of April 14, 2023, is attached hereto as Exhibit (c)(1) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 19, 2023, is attached hereto as Exhibit (c)(2) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 26, 2023, is attached hereto as Exhibit (c)(3) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of April 28, 2023, is attached hereto as Exhibit (c)(4) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of May 8, 2023, is attached hereto as Exhibit (c)(5) and is incorporated herein by reference.

Presentation of Jefferies LLC to the Special Committee, dated

as of May 9, 2023, is attached hereto as Exhibit (c)(6) and is incorporated herein by reference.

The reports, opinions or appraisals referenced

in this Item 9 will be made available for inspection and copying at the principal executive offices of the Company during its regular

business hours by any interested equity security holder of the Company or representative who has been so designated in writing.

Item 10. Source and Amounts of Funds or Other Consideration

(Regulation M-A Item 1007)

(a) – (b) Source

of funds; Conditions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Financing of the Merger”

“The Merger Agreement—Financing”

“Special Factors—Guarantee”

The Second Lien Credit Agreement, dated as of March 10,

2021, among the Company, certain affiliates of the Company, the lenders party thereto from time to time and Alter Domus (US) LLC

(c) Expenses.

The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Fees and Expenses”

“The Merger Agreement—Termination Fees

and Expenses”

“The Special Meeting—Solicitation of

Proxies; Payment of Solicitation Expenses”

(d) Borrowed

funds. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Financing of the Merger”

“The Merger Agreement—Financing”

The Second Lien Credit Agreement, dated as of March 10,

2021, among the Company, certain affiliates of the Company, the lenders party thereto from time to time and Alter Domus (US) LLC

Item 11. Interest in Securities of the Subject Company (Regulation

M-A Item 1008)

(a) Securities

ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger”

“Other Important Information Regarding the

Company—Security Ownership of Certain Beneficial Owners and Management”

(b) Securities

transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Other Important Information Regarding the

Company—Certain Transactions in the Shares of Common Stock”

Item 12. The Solicitation or Recommendation (Regulation

M-A Item 1012)

(d) Intent

to tender or vote in a going-private transaction. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“The Special Meeting—Management Stockholders’

Obligation to Vote in Favor of the Merger”

“The Special Meeting—Vote Required”

“The Voting Agreement”

“The Rollover Agreement”

Annex D—Voting Agreement

Annex E—Rollover Agreement

(e) Recommendation

of others. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Reasons for the Merger;

Recommendation of the Special Committee and the Board; Fairness of the Merger”

“Special Factors—Position of the Consortium

Members as to the Fairness of the Merger”

“Special Factors—Purpose and Reasons

of the Consortium Members for the Merger”

“The Merger (The Merger Agreement Proposal—Proposal

1)”

Item 13. Financial Information (Regulation M-A Item 1010)

(a) Financial

statements. The audited consolidated financial statements set forth in Item 8 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the financial statements set forth in Item 1 of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended April 1, 2023 are incorporated herein by reference.

The information set forth in the Proxy Statement

under the following captions is incorporated herein by reference:

“Special Factors—Certain Effects of

the Merger”

“Special Factors—Unaudited Prospective

Financial Information of the Company”

“Other Important Information Regarding the

Company—Book Value per Share”

“Where You Can Find More Information”

(b) Pro

forma information. Not applicable.

Item 14. Persons/Assets, Retained, Employed, Compensated or

Used (Regulation M-A Item 1009)

(a) – (b) Solicitations

or recommendations; Employees and corporate assets. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference:

“Summary Term Sheet”

“Questions and Answers About the Special

Meeting and the Merger”

“Special Factors—Background of the

Merger”

“Special Factors—Fees and Expenses”

“The Special Meeting—Solicitation of

Proxies; Payment of Solicitation Expenses”

Item 15. Additional Information (Regulation M-A Item 1011)

(b) Golden

Parachute Compensation. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary Term Sheet”

“Special Factors—Interests of Executive

Officers and Directors of the Company in the Merger—Golden Parachute Compensation”

“Merger-Related Executive Compensation Arrangements

(The Merger-Related Compensation Proposal—Proposal 3)”

(c) Other

material information. The information set forth in the Proxy Statement, including all annexes thereto, is incorporated herein by reference.

Item 16. Exhibits (Regulation M-A Item 1016)

(a)(1) Preliminary Proxy Statement of Franchise Group, Inc. (the “Proxy Statement”) (incorporated herein by reference to the Schedule 14A filed concurrently with the SEC).

(a)(2) Form of

Proxy Card.*

(a)(3) Letter

to Franchise Group, Inc. Stockholders (incorporated herein by reference to the Proxy Statement).

(a)(4) Notice

of Special Meeting of Stockholders (incorporated herein by reference to the Proxy Statement).

(a)(5) Press Release, dated May 10, 2023 (incorporated herein by reference to Exhibit 99.2 to the Company’s Current Report on Form 8-K filed on May 10, 2023).

(a)(6) Current Report on Form 8-K, dated May 10, 2023 (included in Schedule 14A filed on May 10, 2023 and incorporated herein by reference).

(a)(7) Current Report on Form 8-K, dated May 11, 2023 (included in Schedule 14A filed on May 11, 2023 and incorporated herein by reference).

(b)(1) The Second Lien Credit Agreement, dated as of March 10, 2021, among the Company, certain affiliates of the Company, the lenders party thereto from time to time and Alter Domus (US) LLC (incorporated herein by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K filed on March 15, 2021).

(c)(1) Presentation of Jefferies LLC to the Special Committee, dated as of April 14, 2023.

(c)(2) Presentation of Jefferies LLC to the Special Committee, dated as of April 19, 2023.

(c)(3) Presentation of Jefferies LLC to the Special Committee, dated as of April 26, 2023.

(c)(4) Presentation of Jefferies LLC to the Special Committee, dated as of April 28, 2023.

(c)(5) Presentation of Jefferies LLC to the Special Committee, dated as of May 8, 2023.

(c)(6) Presentation of Jefferies LLC to the Special Committee, dated as of May 9, 2023.

(c)(7) Opinion of Jefferies LLC, dated May 9, 2023 (incorporated herein by reference to Annex B of the Proxy Statement).

(d)(1) Agreement and Plan of Merger, dated as of May 10, 2023, by and among Franchise Group, Inc., Freedom VCM, Inc. and Freedom VCM Subco, Inc. (incorporated herein by reference to Annex A of the Proxy Statement).

(d)(2) Voting Agreement, dated as of May 10, 2023, by and among Freedom VCM, Inc., Franchise Group, Inc., Brian R. Kahn, Vintage Opportunity Partners, L.P., Brian Kahn and Lauren Kahn Joint Tenants by Entirety and Andrew Laurence (incorporated herein by reference to Annex D of the Proxy Statement).

(d)(3) Rollover Contribution Agreement, dated as of May 10, 2023, by and among Freedom VCM Holdings, LLC, Brian R. Kahn, Vintage Opportunity Partners, L.P., Brian Kahn and Lauren Kahn Joint Tenants by Entirety and Andrew Laurence (incorporated herein by reference to Annex E of the Proxy Statement).

(d)(4) Limited Guarantee, dated as of May 10, 2023, by B. Riley Financial, Inc. in favor of Franchise Group, Inc. (incorporated herein by reference to Annex F of the Proxy Statement).

(f) Section 262 of the General Corporation Law of the State of Delaware (incorporated herein by reference to Annex C of the Proxy Statement).

(g) None.

107 Filing Fee Table.

| * | To be filed by amendment |

SIGNATURE

After due inquiry and to the best of each of the

undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated as of June 8, 2023

| |

FRANCHISE GROUP, INC. |

| |

|

|

| |

By: |

/s/ Eric Seeton |

| |

|

Name: Eric Seeton |

| |

|

Title: Chief Financial Officer |

| |

|

|

| |

FREEDOM VCM, INC. |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: President |

| |

|

|

| |

FREEDOM VCM SUBCO, INC. |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: President |

| |

|

|

| |

FREEDOM VCM HOLDINGS, LLC |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: President |

| |

|

|

| |

FREEDOM VCM INTERCO HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/

Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: President |

| |

|

|

| |

BRIAN R. KAHN |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name:

Brian R. Kahn |

| |

|

|

| |

VINTAGE OPPORTUNITY PARTNERS, L.P. |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: Manager |

[Signature Page to SC 13e-3]

| |

VINTAGE CAPITAL MANAGEMENT LLC |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

Title: Manager |

| |

|

|

| |

BRIAN KAHN AND LAUREN KAHN JOINT TENANTS BY ENTIRETY |

| |

|

|

| |

By: |

/s/ Brian R. Kahn |

| |

|

Name: Brian R. Kahn |

| |

|

|

| |

By: |

/s/ Lauren Kahn |

| |

|

Name: Lauren Kahn |

| |

|

|

| |

B. RILEY FINANCIAL, INC. |

| |

|

|

| |

By: |

/s/ Bryant R. Riley |

| |

|

Name: Bryant R. Riley |

| |

|

Title: Co-Chief Executive Officer |

[Signature Page to SC 13e-3]

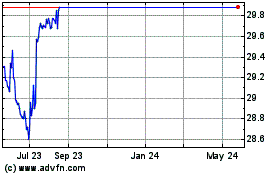

Franchise (NASDAQ:FRG)

Historical Stock Chart

From Apr 2024 to May 2024

Franchise (NASDAQ:FRG)

Historical Stock Chart

From May 2023 to May 2024