GDEV Inc. (NASDAQ: GDEV), an international gaming and entertainment

company (“GDEV” or the “Company”) released its unaudited financial

and operational results for the third quarter and nine months ended

September 30, 2023.

Third quarter 2023

highlights:

-

Revenue of $121 million declined by 5% year-over-year though grew

6% compared to the previous quarter.

- Bookings of $102 million declined by 6% year-over-year.

- Total comprehensive income of $24 million declined by 22%

year-over-year though grew 15% compared to the previous

quarter.

- Profit for the period, net of tax, amounted to $24 million

compared to $32 million in Q3 2022 and $20 million in the previous

quarter.

- Cash flows generated from operating activities of $8 million

compared to $60 million in Q3 2022.

- Adjusted EBITDA of $29 million compared to $45 million in Q3

2022 and $16 million in the previous quarter.

- Selling and marketing expenses of $43 million compared to $21

million in Q3 2022.

- Monthly Paying Users of 375 thousand increased by 23%

year-over-year.

“Over the last two years, the gaming industry

has encountered several challenges, both external and

industry-specific, which have reshaped the landscape for all gaming

companies,” said Andrey Fadeev, Chief Executive Officer. “GDEV has

worked diligently to adapt to this new reality by enhancing its

practices in the areas of product, marketing and team management,

and is committed to continue with these efforts moving forward. We

are pleased that our endeavors have resulted in more than a twofold

increase in investments in new players in 3Q 2023 compared to the

previous year. The rise in marketing investments has led to a 23%

year-over-year growth in monthly paying users, which is expected to

provide a strong foundation for our future growth through the end

of 2023 and beyond.”

Product updates:

- Hero Wars, our flagship global mid-core

franchise, celebrates in November the 7th anniversary of its mobile

version (Hero Wars: Alliance) and the 5th anniversary of its PC

version (Hero Wars: Dominion Era). Since their respective launches,

Hero Wars: Alliance has accumulated over $1.2 billion in bookings,

while Hero Wars: Dominion Era has exceeded $350 million in

bookings.

- Island Hoppers (formerly known as Island

Questaway), our casual farming adventure franchise, has launched

into global release in October. During the soft launch period that

started in November 2021, the game exhibited remarkable growth,

accumulating over $30 million in bookings and more than 12 million

downloads worldwide. It already ranked 7th in the Farming games

category by revenue and 5th in terms of downloads1.

- Pixel Gun 3D, our pixel shooter franchise,

recently announced its planned release on Steam in Q1 2024 with

about 260,0002 fans having already added it to their wishlists. The

mobile version of this iconic title celebrated its 10th anniversary

in 2023, during which time it has accumulated an impressive 185

million downloads and generated over $200 million in bookings

across the iOS and Android platforms.

1 September 2023, AppMagic data

2 Total wishlists in Steam as of November 2023

Third quarter and first nine months 2023

financial performance comparison

|

US$ million |

Q3 2023 |

Q3 20221 |

Change (%) |

9M 2023 |

9M 20223 |

Change (%) |

|

Revenue |

121 |

128 |

(5%) |

355 |

381 |

(7%) |

|

Platform commissions |

(28) |

(36) |

(23%) |

(84) |

(105) |

(20%) |

|

Game operation cost |

(12) |

(10) |

19% |

(39) |

(31) |

27% |

|

Selling and marketing expenses |

(43) |

(21) |

>100% |

(172) |

(112) |

53% |

|

General and administrative expenses |

(7) |

(13) |

(45%) |

(22) |

(28) |

(21%) |

|

Impairment loss on trade receivables and loans receivable |

(1) |

(2) |

(38%) |

(6) |

(6) |

(6%) |

|

Profit for the period, net of tax |

24 |

32 |

(25%) |

35 |

84 |

(58%) |

|

Total comprehensive income |

24 |

31 |

(22%) |

36 |

87 |

(58%) |

|

Adjusted EBITDA |

29 |

45 |

(35%) |

33 |

100 |

(67%) |

|

Cash flows generated from operating activities |

8 |

60 |

(86%) |

8 |

99 |

(92%) |

Third quarter 2023 financial

performance

In the third quarter of 2023, our revenue

decreased by $7 million (or 5%) year-over-year and amounted to $121

million, driven primarily by a decrease of $6 million in bookings

in the third quarter of 2023 vs the same period in 2022 while the

decrease in the change in deferred revenue in the third quarter of

2023 in the amount of $1 million was insignificant vs the same

period in 2022.

Platform commissions decreased by 23% in the third quarter of

2023 compared with the same period in 2022. The decrease in

platform commissions was primarily due to a 8% decrease in

revenue

3 The amounts presented for the three and nine months ended

September 30, 2022 are different to those previously reported for

these periods earlier. This is due to the fact that the Group had

previously presented the operation of its Russian subsidiaries

incorrectly as discontinued operations. The operations disposed of

did not qualify for discontinued operations presentation, since the

Russian subsidiaries did not represent a separate operating segment

of the Group and accordingly the criteria in order to be classified

as discontinued operations were not met. Accordingly, the amounts

for the three and nine months ended September 30, 2022 are being

restated in order to correct the classification of the financial

results of the Russian subsidiaries to the continuing

operations.

generated from in-game purchases when compared

to the prior period. This was amplified by an increasing portion of

revenue derived from our PC platform, which is associated with

lower commissions compared to mobile and social networks.

Game operation costs increased by $2 million (or

19%) in the third quarter of 2023 vs. the same period in 2022,

reaching $12 million. The increase in game operating cost was

primarily due to an increase in average salaries of our employees

as a result of the relocation of personnel from Russia in the

second half of 2022.

Selling and marketing expenses in the second

quarter of 2023 increased by $22 million, amounting to $43 million.

The growth was mainly due to substantially increased investments

into new players in the third quarter of 2023 compared to the

substantial decrease in marketing investments in 2022 driven by the

general saturation of the market in that year.

General and administrative expenses decreased by

$6 million in the third quarter of 2023 vs. the same period in

2022. The decrease was primarily driven by the loss on disposal of

our former Russian subsidiaries in the amount of $5 million in the

third quarter of 2022 vs. nil in the third quarter of 2023.

As a result of the factors above, total

comprehensive income amounted to $24 million for the third quarter

of 2023 compared to total comprehensive income of $31 million in

the third quarter of 2022. Profit for the period, net of tax

amounted to $24 million compared to the $32 million in the third

quarter of 2022. Adjusted EBITDA amounted to $29 million, a

decrease of $16 million compared to the respective period of

2022.

Cash flows generated from operating activities

amounted to $8 million in the third quarter of 2023, a decrease

from $60 million in the same period of 2022. The decrease is

mostly due to a substantial increase in cash outflows associated

with more investments into new players in 2023 together with

decrease in cash inflows from bookings generated in the third

quarter of 2023 compared with the same period in 2022.

First nine months 2023 financial

performance

In the first nine months of 2023 our revenue

decreased by $25 million (7%) year-over-year and amounted to $355

million, driven primarily by a decrease in bookings in the amount

of $32 million (9%) year-over-year. This was partially offset by an

increase of $6 million in change of deferred revenues during the

first nine months of 2023 vs. the same period in the prior

year.

Platform commissions decreased by 20% in the

first nine months of 2023 compared with the same period of 2022.

The decrease in platform commissions was primarily due to a 9%

decrease in the revenue generated from in-game purchases when

compared to the prior period. This was amplified by an increasing

portion of revenue being derived from our PC platform, which is

associated with lower commissions compared to mobile and social

networks.

Game operation costs increased by $8 million

(27%) in the first nine months of 2023 vs. the same period in 2022

to reach $39 million. The increase in game operating cost was

primarily due to an increase in average employee salaries as a

result of the relocation of personnel from Russia in the second

half of 2022. This was amplified by increased software support

expenses related to an increase in the scale of our games.

Selling and marketing expenses in the first nine

months of 2023 increased by $60 million, amounting to $172 million.

The growth can mainly be attributed to considerably more

investments into new players in the first nine months of 2023

compared to the substantial decrease in marketing investments in

2022 driven by the general saturation of the market in 2022.

General and administrative expenses decreased by

$6 million in the first nine months of 2023 compared to the same

period in 2022. The decrease was primarily driven by the loss on

disposal of our former Russian subsidiaries in the amount of $5

million in the third quarter of 2022 vs. nil in the first nine

months of 2023.

As a result of the factors above, we recorded a

total comprehensive income of $36 million for the first nine months

of 2023, compared to a total comprehensive income of $87 million in

the first nine months of 2022. Profit for the period, net of tax

amounted to $35 million compared to the $84 million in the first

nine months of 2022. Adjusted EBITDA amounted to $33 million, a

decrease of $67 million compared to the respective period in

2022.

Cash flows generated from operating activities

amounted to $8 million in the first nine months of 2023, compared

to $99 million vs. the same period of 2022. The decrease is mostly

due to a substantial increase in cash outflows associated with more

investments into new players in 2023 together with decrease in cash

inflows from bookings generated in the first nine months of 2023

compared with the same period in 2022.

Third quarter and first nine months 2023

operational performance comparison

|

|

Q3 2023 |

Q3 20223 |

Change (%) |

9M 2023 |

9M 20223 |

Change (%) |

|

Bookings ($ million) |

102 |

108 |

(6%) |

316 |

347 |

(9%) |

|

Share of advertising |

7.4% |

4.4% |

3.0 p.p. |

7.4% |

4.5% |

2.9 p.p. |

|

MPU (thousand) |

375 |

305 |

23% |

383 |

341 |

13% |

|

ABPPU ($) |

84 |

113 |

(26%) |

85 |

108 |

(22%) |

Bookings declined by 6% year-over-year in the

third quarter of 2023 and by 9% year-over-year in the first nine

months of 2023. This can be attributed to the fact that the first

nine months of 2022 – and 2022 as a whole – were characterized by

significantly lower marketing investments into the acquisition of

new players who could potentially provide support to bookings in

the first nine months of 2023. However, our significant investment

into marketing in the first nine months of 2023 resulted in an

increase in MPU by 23% and 13% in the third quarter and first nine

months of 2023, respectively, which in turn is expected to

positively impact our bookings in the future.

The share of advertisement sales as a percentage

of total bookings increased in both the third quarter and first

nine months of 2023 to 7.4%, compared to 4.4% and 4.5% in the

respective periods of 2022. The increase was driven by

substantially increased monthly active users (due to increased

investments into new players) as well as by the successful

implementation of advertisement functionality in Island Hoppers

from the start of the second quarter of 2023.

|

Split of bookings by platform |

Q3 2023 |

Q3 2022 |

9M 2023 |

9M 2022 |

|

Mobile |

63% |

63% |

63% |

64% |

|

PC |

37% |

37% |

37% |

36% |

In the first nine months of 2023, the share of PC versions of

our games increased by 1 p.p., while the distribution of bookings

across platforms remained largely consistent throughout the third

quarter of 2023.

|

Split of bookings by geography |

Q3 2023 |

Q3 2022 |

9M 2023 |

9M 2022 |

|

US |

35% |

35% |

36% |

33% |

|

Asia |

23% |

25% |

24% |

26% |

|

Europe |

26% |

20% |

25% |

21% |

|

Other1 |

16% |

20% |

15% |

20% |

Our split of bookings by geography both in the

third quarter and first nine months of 2023 vs. the respective

periods in 2022 remained broadly similar, with a moderate increase

in the share of Europe bookings.

Note:

Due to rounding, the numbers presented throughout this document

may not precisely add up to the totals. The period-over-period

percentage changes are based on the actual numbers and may

therefore differ from the percentage changes if those were to be

calculated based on the rounded numbers.

About GDEV

GDEV is a gaming and entertainment powerhouse,

focused on growing and enhancing its portfolio of studios. With a

diverse range of subsidiaries including Nexters, Cubic Games, and

Dragon Machines, among others, GDEV strives to create games that

will inspire and engage millions of players for many years. Its

franchises, such as Hero Wars, Island Hoppers, Pixel Gun 3D, Throne

Rush and others have accumulated hundreds of millions of installs

worldwide. For more information, please visit gdev.inc

Contacts:

Investor RelationsRoman Safiyulin | Chief Corporate Development

Officer investor-at-gdev.inc

Cautionary statement regarding

forward-looking statements

Certain statements in this press release may

constitute “forward-looking statements” for purposes of the federal

securities laws. Such statements are based on current expectations

that are subject to risks and uncertainties. In addition, any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements.

4 Starting from the second quarter of 2022 the “FSU” category

was merged with the “Other” category due to the substantial

decrease of its share in the total bookings and lower strategic

importance as a result of user acquisition investment suspension as

of February 2022.

The forward-looking statements contained in this

press release are based on the Company’s current expectations and

beliefs concerning future developments and their potential effects

on the Company. There can be no assurance that future developments

affecting the Company will be those that the Company has

anticipated. Forward-looking statements involve a number of risks,

uncertainties (some of which are beyond the Company’s control) or

other assumptions. You should carefully consider the risks and

uncertainties described in the “Risk Factors” section of the

Company’s 2022 Annual Report on Form 20-F, filed by the Company on

June 26, 2023, and other documents filed by the Company from

time to time with the Securities and Exchange Commission. Should

one or more of these risks or uncertainties materialize, or should

any of the Company’s assumptions prove incorrect, actual results

may vary in material respects from those projected in these

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and the Company

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

Presentation of Non-IFRS Financial

Measures

In addition to the results provided in

accordance with IFRS throughout this press release, the Company has

provided the non-IFRS financial measure “Adjusted EBITDA” (the

“Non-IFRS Financial Measure”). The Company defines Adjusted EBITDA

as the profit for the period, net of tax as presented in the

Company's financial statements in accordance with IFRS, adjusted to

exclude (i) goodwill and investments in equity accounted

associates' impairment, (ii) loss on disposal of subsidiaries,

(iii) income tax expense, (iv) finance income, (v) financial assets

measured at fair value through profit or loss, (vi) interest

expense, (vii) unwinding of discount on the put option liability,

(viii) change in fair value of share warrant obligations and other

financial instruments, (ix) share of loss of equity-accounted

associates, (x) depreciation and amortization, (xi) share-based

payments and (xii) certain non-cash or other special items that we

do not consider indicative of our ongoing operating performance.

The Company uses this Non-IFRS Financial Measure for business

planning purposes and in measuring its performance relative to that

of its competitors. The Company believes that this Non-IFRS

Financial Measure is a useful financial metric to assess its

operating performance from period-to-period by excluding certain

items that the Company believes are not representative of its core

business. This Non-IFRS Financial Measure is not intended to

replace, and should not be considered superior to, the presentation

of the Company’s financial results in accordance with IFRS. The use

of the Non-IFRS Financial Measure terms may differ from similar

measures reported by other companies and may not be comparable to

other similarly titled measures.

Reconciliation of the profit for the

period to the Adjusted EBITDA

|

US$ million |

Q3 2023 |

Q3 20223 |

9M 2023 |

9M 20223 |

|

Profit for the period, net of tax |

24 |

32 |

35 |

84 |

|

Adjust for: |

|

|

|

|

|

Income tax expense |

2 |

2 |

3 |

4 |

|

Finance income |

(0.8) |

(0.5) |

(4) |

(0.9) |

|

Financial assets at FVTPL - net change in fair value |

2 |

0 |

2 |

0 |

|

Interest expense |

0 |

0 |

0.1 |

0.1 |

|

Unwinding of discount on the put option liability |

0.1 |

0.1 |

0.3 |

0.2 |

|

Change in fair value of sharewarrant obligations and other

financial instruments |

0.8 |

5 |

(10) |

(2) |

|

Share of loss of equity-accounted associates |

0 |

4 |

0.5 |

6 |

|

Depreciation and amortization |

2 |

2 |

5 |

5 |

|

Share-based payments |

0.7 |

1 |

2 |

3 |

|

Impairment of intangible assets |

0 |

0.3 |

0 |

0.5 |

|

Adjusted EBITDA |

29 |

45 |

33 |

100 |

Investor Relations

Roman Safiyulin | Chief Corporate Development Officer

investor-at-gdev.inc

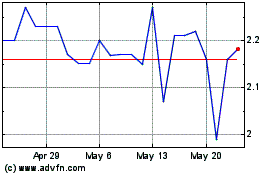

GDEV Omc (NASDAQ:GDEV)

Historical Stock Chart

From Apr 2024 to May 2024

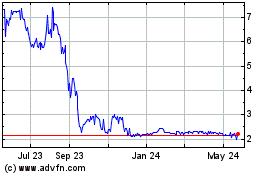

GDEV Omc (NASDAQ:GDEV)

Historical Stock Chart

From May 2023 to May 2024