GDEV Inc. (NASDAQ: GDEV), an international gaming and entertainment

company (“GDEV” or the “Company”) released its preliminary

unaudited financial and operational results for the fourth quarter

and full year ended December 31, 2023.

Financial highlights:

Fourth quarter 2023:

- Revenue of $109 million increased

by 10% year-over-year.

- Bookings of $106 million increased

by 4% year-over-year.

- Profit for the period of $11

million in Q4 2023 vs. loss of $77 million in Q4 2022.

- Adjusted EBITDA

of $10 million in the fourth quarter 2023 compared to negative $9

million in the fourth quarter of 2022.

Full year 2023:

- Revenue of $465 million declined by

3% year-over-year.

- Bookings of $422 million declined

by 6% year-over-year.

- Profit for the period of $46

million in 2023 vs. $7 million in 2022.

- Adjusted EBITDA

of $43 million in 2023 compared to $96 million in 2022.

Fourth quarter and full year 2023

financial performance in comparison

|

US$ million |

Q4 2023 |

Q4 2022 |

Change (%) |

FY 2023 |

FY 2022 |

Change (%) |

|

Revenue |

109 |

|

99 |

|

10 |

% |

465 |

|

480 |

|

(3 |

%) |

|

Platform commissions |

(25 |

) |

(25 |

) |

(0 |

%) |

(109 |

) |

(130 |

) |

(16 |

%) |

|

Game operation cost |

(13 |

) |

(13 |

) |

(4 |

%) |

(52 |

) |

(44 |

) |

17 |

% |

|

Selling and marketing expenses |

(54 |

) |

(40 |

) |

33 |

% |

(226 |

) |

(153 |

) |

48 |

% |

|

General and administrative expenses |

(7 |

) |

(8 |

) |

(7 |

%) |

(30 |

) |

(36 |

) |

(18 |

%) |

|

Goodwill and investments in equity accounted associates'

impairment |

— |

|

(63 |

) |

(>100%) |

— |

|

(63 |

) |

(>100%) |

|

Impairment loss on trade receivables and loans receivable |

(0.4 |

) |

(24 |

) |

(98 |

%) |

(6 |

) |

(30 |

) |

(80 |

%) |

|

Profit/(loss) for the period, net of tax |

11 |

|

(77 |

) |

(>100%) |

46 |

|

7 |

|

>100% |

|

Adjusted EBITDA1 |

10 |

|

(9 |

) |

(>100%) |

43 |

|

96 |

|

(55 |

%) |

|

Cash flows generated from operating activities |

10 |

|

17 |

|

(41 |

%) |

18 |

|

116 |

|

(85 |

%) |

Fourth quarter 2023 financial

performance

In the fourth quarter of 2023, our revenue

increased by $10 million (or 10%) year-over-year and amounted to

$109 million, driven primarily by a decrease in the change in

deferred revenue in the fourth quarter of 2023 in the amount of $6

million vs. the same period in 2022, amplified by an increase of $4

million in bookings in the fourth quarter of 2023 vs. the same

period in 2022.

Platform commissions remained relatively stable

at the level of $25 million in the fourth quarter of 2023 compared

to the same period in 2022.

Game operation costs were stable at the level of

$13 million.

Selling and marketing expenses in the fourth

quarter of 2023 increased by $14 million, amounting to $54 million.

The growth was mainly due to substantially increased investments

into new players in the fourth quarter of 2023 compared to the

substantial decrease in marketing investments in 2022 driven by the

challenging market environment in that year.

General and administrative expenses remained

relatively stable decreasing by only $0.6 million in the fourth

quarter of 2023 vs. the same period in 2022.

As a result of the factors above, together with:

(i) the effect of an impairment of goodwill and investments in

equity accounted associates recorded in Q4 2022 in the amount of

$63 million vs. nil in Q4 2023; (ii) an impairment loss on trade

receivables and loans receivable recorded in Q4 2023 in the amount

of $0.4 million vs. $24 million in Q4 2022; and (iii) share of loss

of equity accounted associates of $4 million in Q4 2022 vs nil in

Q4 2023, profit for the period, net of tax, amounted to $11 million

for the fourth quarter of 2023 compared to a loss of $77 million in

the fourth quarter of 2022. Adjusted EBITDA in Q4 2023 amounted to

$10 million, an increase of $19 million compared to the respective

period of 2022 due to the same factors (other than the effect of

the goodwill and investments impairment, share of loss of

equity-accounted associates and certain other items that are

excluded from Adjusted EBITDA).

Cash flows generated from operating activities

amounted to $10 million in the fourth quarter of 2023, a decrease

from $17 million in the same period of 2022. The decrease is mostly

due to a substantial increase in cash outflows associated with more

investments into new players in the fourth quarter of 2023,

partially offset by an increase in cash inflows from bookings

generated in the fourth quarter of 2023 compared with the same

period in 2022.

Full year 2023 financial

performance

In 2023 our revenue decreased by $15 million

(3%) year-over-year and amounted to $465 million, driven primarily

by a decrease in bookings in the amount of $28 million (6%)

year-over-year. This was partially offset by an increase of $13

million in change of deferred revenues during 2023 vs. 2022.

Platform commissions decreased by 16% in 2023

compared with 2022. The decrease in platform commissions was

primarily due to a 6% decrease in the revenue generated from

in-game purchases when compared to the prior period. This was

amplified by an increasing share of revenue being derived from our

PC platform which is associated with lower commissions in

comparison with other platforms.

Game operation costs increased by $8 million

(17%) in 2023 vs. 2022 to reach $52 million. The increase in game

operation cost was primarily due to an increase in average employee

salaries as a result of the relocation of personnel from Russia in

the second half of 2022. This was amplified by increased software

support expenses related to an increase in the scale of our

games.

Selling and marketing expenses in 2023 increased

by $73 million, amounting to $226 million. The growth can mainly be

attributed to considerably more investments into new players in

2023 compared to the substantial decrease in marketing investments

in 2022 driven by the challenging market environment in 2022.

General and administrative expenses decreased by

$7 million in 2023 compared to 2022. The decrease was primarily

driven by the loss on disposal of our former Russian subsidiaries

in the amount of $5 million in the third quarter of 2022 vs. nil in

2023.

As a result of the factors above, together with

(i) the effect of an impairment of goodwill and investments in

equity accounted associates recorded in 2022 in the amount of $63

million vs. nil in 2023; (ii) an impairment loss on trade

receivables and loans receivable recorded in 2023 in the amount of

$6 million vs. $30 million in 2022; (iii) change in the fair value

of share warrant obligation and other financial instruments of $11

million in 2023 vs. $3 million in 2022; and (iv) share of loss of

equity accounted associates of $0.5 million in 2023 vs. $10 million

in 2022, we recorded profit for the period, net of tax, of $46

million for 2023, compared to $7 million in 2022. Adjusted EBITDA

amounted to $43 million, a decrease of $53 million compared with

2022 due to the same factors (other than the effect of the goodwill

and investments impairment, share of loss of equity-accounted

associates and certain other items that are excluded from Adjusted

EBITDA).

Cash flows generated from operating activities

amounted to $18 million in 2023, compared to $116 million in 2022.

The decrease is mostly due to a substantial increase in cash

outflows associated with more investments into new players in 2023

together with decrease in cash inflows from bookings generated in

2023 compared with 2022.

Fourth quarter and full year 2023

operational performance comparison

|

|

Q4 2023 |

Q4 20223 |

Change (%) |

FY 2023 |

FY 20223 |

Change (%) |

|

Bookings ($ million) |

106 |

|

102 |

|

4 |

% |

422 |

|

449 |

|

(6 |

%) |

|

Share of advertising |

6.5 |

% |

4.3 |

% |

2.2 p.p. |

7.2 |

% |

4.5 |

% |

2.7 p.p. |

|

MPU (thousand) |

359 |

|

316 |

|

13 |

% |

377 |

|

335 |

|

13 |

% |

|

ABPPU ($) |

92 |

|

103 |

|

(11 |

%) |

86 |

|

107 |

|

(19 |

%) |

Bookings increased by 4% year-over-year in the

fourth quarter of 2023 and decreased by 6% year-over-year in 2023.

This can be attributed to the fact that 2022 was characterized by

significantly lower marketing investments into the acquisition of

new players who could potentially provide support to bookings in

2023. However, our significant investment into marketing in 2023

resulted in an increase in MPU by 13% both in the fourth quarter

and full year 2023, which in turn is expected to positively impact

our bookings in the future. As a result, we recorded a moderate

growth of bookings in the fourth quarter of 2023 vs. the same

period of 2022.

The share of advertisement sales as a percentage

of total bookings increased in both the fourth quarter and full

year 2023 to 6.5% and 7.2% respectively, compared to 4.3% and 4.5%

in the respective periods of 2022. The increase was driven by

substantially increased monthly active users (due to increased

investments into new players) as well as by the successful

implementation of advertisement functionality in Island Hoppers

from the start of the second quarter of 2023.

|

Split of bookings by platform |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

Mobile |

57 |

% |

60 |

% |

62 |

% |

63 |

% |

|

PC |

43 |

% |

40 |

% |

38 |

% |

37 |

% |

In 2023, the share of PC versions of our games increased by 1

p.p., while the distribution of bookings across platforms changed

by 3 p.p. in favor of PC versions in the fourth quarter of

2023.

|

Split of bookings by geography |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

US |

34 |

% |

34 |

% |

35 |

% |

33 |

% |

|

Asia |

24 |

% |

24 |

% |

24 |

% |

26 |

% |

|

Europe |

27 |

% |

22 |

% |

25 |

% |

21 |

% |

|

Other2 |

15 |

% |

20 |

% |

16 |

% |

20 |

% |

Our split of bookings by geography both in the

fourth quarter and 2023 as a whole vs. the respective periods in

2022 remained broadly similar, with a certain increase in the share

of Europe bookings.

Note:

Due to rounding, the numbers presented throughout this document

may not precisely add up to the totals. The period-over-period

percentage changes are based on the actual numbers and may

therefore differ from the percentage changes if those were to be

calculated based on the rounded numbers.

The figures in this release are preliminary and unaudited. The

Company’s 2023 Annual Report on Form 20-F, which will include the

Company’s audited financial statements as of and for the year ended

December 31, 2023, is expected to be published within the

prescribed filing period.

About GDEV

GDEV is a gaming and entertainment powerhouse,

focused on growing and enhancing its portfolio of studios. With a

diverse range of subsidiaries including Nexters, Cubic Games, and

Dragon Machines, among others, GDEV strives to create games that

will inspire and engage millions of players for many years. Its

franchises, such as Hero Wars, Island Hoppers, Pixel Gun 3D, Throne

Rush and others have accumulated hundreds of millions of installs

worldwide. For more information, please visit gdev.inc

Contacts:

Investor RelationsRoman Safiyulin | Chief Corporate Development

Officerinvestor@gdev.inc

Cautionary statement regarding

forward-looking statements

Certain statements in this press release may

constitute “forward-looking statements” for purposes of the federal

securities laws. Such statements are based on current expectations

that are subject to risks and uncertainties. In addition, any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements.

The forward-looking statements contained in this

press release are based on the Company’s current expectations and

beliefs concerning future developments and their potential effects

on the Company. There can be no assurance that future developments

affecting the Company will be those that the Company has

anticipated. Forward-looking statements involve a number of risks,

uncertainties (some of which are beyond the Company’s control) or

other assumptions. You should carefully consider the risks and

uncertainties described in the “Risk Factors” section of the

Company’s 2022 Annual Report on Form 20-F, filed by the Company on

June 26, 2023, and other documents filed by the Company from

time to time with the Securities and Exchange Commission. Should

one or more of these risks or uncertainties materialize, or should

any of the Company’s assumptions prove incorrect, actual results

may vary in material respects from those projected in these

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and the Company

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities

laws.

Presentation of Non-IFRS Financial

Measures

In addition to the results provided in

accordance with IFRS throughout this press release, the Company has

provided the non-IFRS financial measure “Adjusted EBITDA” (the

“Non-IFRS Financial Measure”). The Company defines Adjusted EBITDA

as the profit/loss for the period, net of tax as presented in the

Company's financial statements in accordance with IFRS, adjusted to

exclude (i) goodwill and investments in equity accounted

associates' impairment, (ii) loss on disposal of subsidiaries,

(iii) income tax expense, (iv) finance income and expenses other

than foreign exchange gains and losses and bank charges, (v) change

in fair value of share warrant obligations and other financial

instruments, (vi) share of loss of equity-accounted associates,

(vii) depreciation and amortization, (viii) share-based payments

expense and (ix) certain non-cash or other special items that we do

not consider indicative of our ongoing operating performance. The

Company uses this Non-IFRS Financial Measure for business planning

purposes and in measuring its performance relative to that of its

competitors. The Company believes that this Non-IFRS Financial

Measure is a useful financial metric to assess its operating

performance from period-to-period by excluding certain items that

the Company believes are not representative of its core business.

This Non-IFRS Financial Measure is not intended to replace, and

should not be considered superior to, the presentation of the

Company’s financial results in accordance with IFRS. The use of the

Non-IFRS Financial Measure terms may differ from similar measures

reported by other companies and may not be comparable to other

similarly titled measures.

Reconciliation of the profit/(loss) for

the period to the Adjusted EBITDA

|

US$ million |

Q4 2023 |

Q4 2022 |

FY 2023 |

FY 2022 |

|

Profit/(loss) for the period, net of tax |

11 |

|

(77 |

) |

46 |

|

7 |

|

|

Adjust for: |

|

|

|

|

|

Income tax expense |

1 |

|

(0.7 |

) |

4 |

|

4 |

|

|

Loss on disposal of subsidiaries |

— |

|

— |

|

— |

|

5 |

|

|

Adjusted finance (income)/expenses3 |

(3 |

) |

(0.8 |

) |

(5 |

) |

(1 |

) |

|

Change in fair value of sharewarrant obligations and other

financial instruments |

(1 |

) |

(0.3 |

) |

(11 |

) |

(3 |

) |

|

Share of loss of equity-accounted associates |

— |

|

4 |

|

0.5 |

|

10 |

|

|

Depreciation and amortization |

2 |

|

2 |

|

6 |

|

7 |

|

|

Share-based payments |

0.3 |

|

0.7 |

|

2 |

|

4 |

|

|

Impairment of intangible assets |

— |

|

0.1 |

|

— |

|

0.5 |

|

|

Goodwill and investments in equity accounted associates'

impairment |

— |

|

63 |

|

— |

|

63 |

|

|

Adjusted EBITDA |

10 |

|

(9 |

) |

43 |

|

96 |

|

1 The Adjusted EBITDA for the full year and the quarter ended

December 31, 2023 and the respective composition of reconciling

items between the profit for the year, net of tax and the Adjusted

EBITDA presented elsewhere in this press release may differ from

the respective numbers that we previously presented due to an

adjustment to the Company’s definition of the Adjusted EBITDA in

regard to foreign exchange gains and losses and certain other

financial expenses.2 Starting from the second quarter of 2022 the

“FSU” category was merged with the “Other” category due to the

substantial decrease of its share in the total bookings and lower

strategic importance as a result of user acquisition investment

suspension as of February 2022.3 Adjusted finance income/expenses

consist of finance income and expenses other than foreign exchange

gains and losses and bank charges, net.

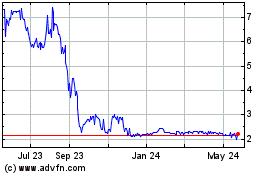

GDEV (NASDAQ:GDEV)

Historical Stock Chart

From Nov 2024 to Dec 2024

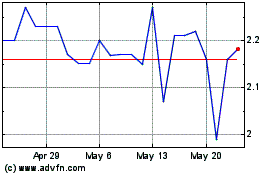

GDEV (NASDAQ:GDEV)

Historical Stock Chart

From Dec 2023 to Dec 2024