0001718405

false

0001718405

2023-10-26

2023-10-26

0001718405

HYMC:ClassCommonStockParValue0.0001PerShareMember

2023-10-26

2023-10-26

0001718405

HYMC:WarrantsToPurchaseCommonStockMember

2023-10-26

2023-10-26

0001718405

HYMC:WarrantsToPurchaseCommonStockOneMember

2023-10-26

2023-10-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 26, 2023

HYCROFT

MINING HOLDING CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38387 |

|

82-2657796 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

4300

Water Canyon Road, Unit 1

Winnemucca,

Nevada 89445

(Address

of principal executive offices) (Zip code)

(775)

304-0260

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

HYMC |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

HYMCW |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

HYMCL |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01. Regulation FD Disclosure.

On

October 26, 2023, Hycroft Mining Holding Corporation (the “Company”) issued a press release announcing that the Company will

undertake a reverse stock split of the Company’s outstanding shares of Class A common stock, par value $0.0001 per share (“Common

Stock”), at a ratio of 1-for-10 (the “Reverse Stock Split”). The Reverse Stock Split is expected to be effective on

November 14, 2023, immediately after the close of trading on the Nasdaq Capital Market (the “Effective Time”), such that

the Common Stock is expected to begin trading on the Nasdaq Capital Market on a Reverse Stock Split-adjusted basis on November 15, 2023.

No

fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive

fractional shares will receive a cash payment in lieu of such fractional shares.

On

February 24, 2023 and May 24, 2023, the Company’s Board of Directors (the “Board”) and the Company’s stockholders,

respectively, approved an amendment to the Company’s Second Amended and Restated Certificate of Incorporation, as amended, to effectuate

a reverse stock split of the Company’s outstanding Common Stock, at a ratio of no less than 1-for-10 and no more than 1-for-25,

with such ratio to be determined at the sole discretion of the Board. On October 24, 2023, the Board approved the Reverse Stock Split

at a ratio of 1-for-10.

A

copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The

information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K.

Item

9.01 Financial Statement and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

October 26, 2023 |

HYCROFT

MINING HOLDING CORPORATION |

| |

|

|

| |

By: |

/s/

Rebecca A. Jennings |

| |

|

Rebecca

A. Jennings |

| |

|

Senior

Vice President and General Counsel |

Exhibit 99.1

Hycroft

Mining Announces Reverse Stock Split

WINNEMUCCA,

NV, October 26, 2023 – Hycroft Mining Holding Corporation (Nasdaq: HYMC) (“Hycroft” or “the

Company”) announces that the Company will undertake a Reverse Stock Split of its Class A Common Stock (“Common

Stock”) at a ratio of 1-for-10 (the “Reverse Stock Split”). The Reverse Stock Split is expected to become

effective immediately after the close of trading on the Nasdaq Capital Market (the “Nasdaq”) on November 14, 2023 (the

“Effective Date”) and the Common Stock is expected to begin trading on the Nasdaq on a Reverse Stock Split-adjusted

basis on November 15, 2023, under the new CUSIP number 44862P208.

“We

have been pursuing various strategies to regain compliance with Nasdaq’s minimum bid price requirement; however, given the timing

of these strategies and current market conditions, we believe that implementing a reverse stock split is the most effective course of

action to regain compliance at this juncture,” stated Diane Garrett, President and CEO of Hycroft. “Ensuring our listing

remains intact is of significant importance to us. We believe that by promptly addressing the uncertainty regarding our listing and alleviating

the overhang on our share price associated with this uncertainty, we will be better positioned to maximize value for our existing shareholders,

the Hycroft Mine, and future investors.”

Stockholder

approval for the Reverse Stock Split was obtained at the Company’s annual meeting of stockholders on May 24, 2023. After careful

consideration in light of current market conditions, the Company’s Board of Directors approved the Reverse Stock Split ratio of

1-for-10. The Company believes maintaining its Nasdaq listing will situate Hycroft more favorably and potentially attract a broader group

of institutional and retail investors. With a strong treasury of $106.9 million at the end of the third quarter of 2023, a world-class

asset, a successful ongoing exploration program, and a highly experienced management team, the Company believes it is well-positioned

to deliver value for its shareholders.

About

the Reverse Stock Split

The

Company’s transfer agent, Continental Stock Transfer & Trust Company (“Continental”), will serve as the exchange

agent for the Reverse Stock Split. Contact information can be found on the Company’s website at www.hycroftmining.com/contact/transfer-agent/.

As

a result of the Reverse Stock Split, every 10 pre-split shares of common stock outstanding

will become one share of Common Stock.

Registered

stockholders holding pre-Reverse Stock Split shares of the Company’s Common Stock electronically in book-entry form are not required

to take any action to receive post-Reverse Stock Split shares. Those stockholders who hold their shares in brokerage accounts or in “street

name” will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to each broker’s particular

processes, and will not be required to take any action in connection with the Reverse Stock Split. Stockholders holding shares of the

Company’s Common Stock in certificate form will receive a transmittal letter from Continental with instructions as soon as practicable

after the Effective Date.

No

fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive

fractional shares will receive a cash payment in lieu of such fractional shares.

The

Reverse Stock Split will not affect the number of authorized shares of Common Stock, the par value of the Common Stock, or modify any

rights or preferences of the shares of the Company’s Common Stock. Proportionate adjustments will be made to the exercise prices

and the number of shares underlying the Company’s outstanding equity awards and warrants, as applicable.

Additional

information about the Reverse Stock Split can be found in Hycroft’s definitive proxy statement filed with the U.S. Securities and

Exchange Commission (the “SEC”) on April 13, 2023, which is available on the SEC’s website at www.sec.gov and

on Hycroft’s website at www.hycroftmining.com.

About

Hycroft Mining Holding Corporation

Hycroft

Mining Holding Corporation is a US-based gold and silver company developing the Hycroft Mine, one of the world’s largest precious

metals deposits located in northern Nevada, a Tier-One mining jurisdiction. After a long history of oxide heap leaching operations, the

Company is focused on completing the technical studies to transition the Hycroft Mine into a large-scale milling operation for processing

the sulfide ore. In addition, the Company is engaged in a robust exploration drill program to unlock the full potential of our expansive

+64,000-acre land package, of which less than 10% has been explored.

For

further information, please contact:

Fiona Grant Leydier

Vice

President, Investor Relations

E:

info@hycroftmining.com

T:

+1 (775) 437-5912 x 101

www.hycroftmining.com

Cautionary

Note Regarding Forward-Looking Statements

This

news release contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act

of 1933, as amended, Section 21E of the United States Securities Exchange Act of 1934, as amended, or the United States Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein and public

statements by our officers or representatives, that address activities, events or developments that our management expects or

anticipates will or may occur in the future, are forward- looking statements, including but not limited to such things as future

business strategy, plans and goals, competitive strengths and expansion and growth of our business. The words

“estimate”, “plan”, “anticipate”, “expect”, “intend”,

“believe” “target”, “budget”, “may”, “can”, “will”,

“would”, “could”, “should”, “seeks”, or “scheduled to” and similar words

or expressions, or negatives of these terms or other variations of these terms or comparable language or any discussion of strategy

or intention identify forward-looking statements. Forward-looking statements address activities, events, or developments that the

Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions.

Forward-looking statements include, but are not limited to (i) risks related to changes in our operations at the Hycroft Mine,

including risks associated with the cessation of mining operations at the Hycroft Mine; uncertainties concerning estimates of

mineral resources; risks related to a lack of a completed feasibility study; and risks related to our ability to re-establish

commercially feasible mining operations; (ii) industry related risks including fluctuations in

the price of gold and silver; the commercial success of, and risks related to, our exploration and development activities;

uncertainties and risks related to our reliance on contractors and consultants; availability and cost of equipment, supplies,

energy, or reagents. The exploration target does not represent, and should not be construed to be, an estimate of a mineral resource

or mineral reserve, as ranges of potential tonnage and grade (or quality) of the exploration target are conceptual in nature; there

has been insufficient exploration of the relevant property or properties to estimate a mineral resource; and it is uncertain if

further exploration will result in the estimation of a mineral resource. These risks may include the following, and the occurrence

of one or more of the events or circumstances alone or in combination with other events or circumstances may have a material adverse

effect on the Company’s business, cash flows, financial condition, and results of operations. Please see our “Risk

Factors” outlined in our Annual Report on Form 10-K for the year ended December 31, 2022, our Quarterly Report on Form 10-Q

for the periods ended June 30, 2023, and other reports filed with the SEC for more information about these and other risks. You are

cautioned against attributing undue certainty to forward-looking statements. Although we have attempted to identify important

factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on

assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees

of future performance and that actual results, performance, or achievements may differ materially from those made in or suggested by

the forward-looking statements in this news release. In addition, even if our results, performance, or achievements are consistent

with the forward-looking statements contained in this news release, those results, performance or achievements may not be indicative

of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not to place

undue reliance on these forward-looking statements. Any forward-looking statements made in this news release speak only as of the

date of those statements. We undertake no obligation to update those statements or publicly announce the results of any revisions to

any of those statements to reflect future events or developments.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockOneMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

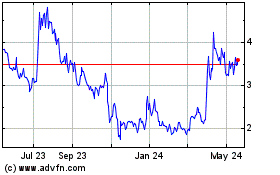

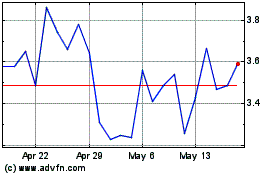

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Mar 2024 to Mar 2025