ISRAMCO, INC. STOCKHOLDERS VOTE TO APPROVE MERGER

23 October 2019 - 3:32AM

Isramco, Inc. (NASDAQ CM: ISRL) (“Isramco” or the “Company”),

announced today that at its special meeting of stockholders held

earlier today, the Company’s stockholders voted, among other

things, in favor of the proposal to adopt the merger (the “Merger”)

contemplated by the previously announced Agreement and Plan of

Merger (the “Merger Agreement”), dated as of May 20, 2019, by and

among the Company, Naphtha Israel Petroleum Corporation Ltd.

(“Naphtha”), Naphtha Holding Ltd. (“NHL”), I.O.C. – Israel Oil

Company, LTD. (“IOC”) and Naphtha US Oil, Inc. (“Merger Sub” and,

together with Naphtha, NHL and IOC, the “Naphtha Group”), providing

for the merger of Merger Sub with and into the Company, with the

Company surviving the merger as an indirect wholly owned subsidiary

of Naphtha. If the proposed merger is completed, the holders of

shares of Isramco common stock will receive US $121.40 per share in

cash, other than (i) the shares owned by NHL or IOC, (ii) the

shares held by Isramco as treasury stock and (iii) the shares in

respect of which appraisal rights have been properly and validly

exercised under Delaware law.

Approximately 96.63% of the shares outstanding were voted in

favor of the proposal to adopt the Merger Agreement. Specifically,

approximately 87.56% of the shares of common stock outstanding held

by unaffiliated stockholders voted in favor of the proposal to

adopt the Merger Agreement, satisfying the “majority of the

minority” voting requirement set forth in the Merger Agreement.

The parties currently expect to request that the NASDAQ Capital

Market (“NASDAQ”) cease trading of shares of Isramco common stock

at 8:00 p.m. Eastern Time on October 24, 2019, and expect to

complete the merger on October 25, 2019, subject to the

satisfaction or waiver of the conditions set forth in the Merger

Agreement. If completed, the proposed merger would result in the

Company becoming a privately held company and its common stock

would be de-listed on NASDAQ.

About Naphtha

Naphtha is an Israeli public company, whose shares are listed

for trading on the Tel-Aviv Stock Exchange (TLV:NFTA). Naphtha

engages primarily, through its subsidiaries, in exploration,

development and production of oil & gas: offshore Israel and

onshore U.S. Naphtha also is engaged in the field of commercial

real-estate and hotel management, in Israel and in Europe.

About Isramco

Isramco, Inc. is an independent oil and natural gas company

engaged in the exploration, development and production of oil and

natural gas properties located onshore in the United States and

ownership of various royalty interests in oil and gas concessions

located offshore Israel. The Company also operates a well service

company that provides well maintenance, workover services, well

completion and recompletion services and production services

company that provides a full range of onshore production services

U.S. oil and gas producers and a transportation company providing

transport of liquefied petroleum products.

Forward-looking Statements

This communication contains certain forward-looking statements

that involve a number of risks and uncertainties. This

communication contains forward-looking statements related to

Isramco, the Naphtha Group and the proposed acquisition of Isramco

by the Naphtha Group and their respective affiliates. Actual

results and events in future periods may differ materially from

those expressed or implied by these forward-looking statements

because of a number of risks, uncertainties and other factors. All

statements other than statements of historical fact, including

statements containing the words “aim,” “anticipate,” “are

confident,” “estimate,” “expect,” “will be,” “will continue,” “will

likely result,” “project,” “intend,” “plan,” “believe” and other

words and terms of similar meaning, or the negative of these terms,

are statements that could be deemed forward-looking statements.

Risks, uncertainties and other factors include, but are not limited

to: (i) the occurrence of any event, change or other circumstances

that could give rise to the termination of the merger agreement;

(ii) the inability to complete the proposed merger due to the

failure to satisfy conditions to completion of the proposed merger;

(iii) the failure of the proposed merger to close for any other

reason; (iv) risks related to disruption of management’s attention

from Isramco’s ongoing business operations due to the transaction;

(v) the outcome of any legal proceedings, regulatory proceedings or

enforcement matters that may be instituted against Isramco and

others relating to the merger agreement; (vi) the risk that the

pendency of the proposed merger disrupts current plans and

operations and the potential difficulties in employee retention as

a result of the pendency of the proposed merger; (vii) the effect

of the announcement of the proposed merger on Isramco’s

relationships with its customers, operating results and business

generally; and (viii) the amount of the costs, fees, expenses and

charges related to the proposed merger. Consider these factors

carefully in evaluating the forward-looking statements. Additional

factors that may cause results to differ materially from those

described in the forward-looking statements are set forth in

Isramco’s Annual Report on Form 10–K for the fiscal year ended

December 31, 2018, filed with the SEC on March 18, 2019, and

amended on April 30, 2019, under the heading “Item 1A. Risk

Factors,” and in subsequently filed Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. The forward-looking statements

represent Isramco’s views as of the date on which such statements

were made and Isramco undertakes no obligation to publicly update

such forward-looking statements.

FOR FURTHER INFORMATION: Isramco, Inc.Attn:

Co-Chief Executive Officer / Chief Financial Officer1001 West Loop

South, Suite 750, Houston, Texas 77027www.isramcousa.com or

(713) 621-3882

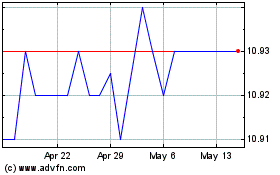

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Feb 2025 to Mar 2025

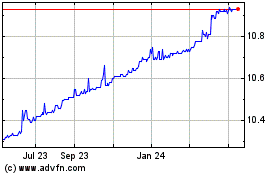

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Mar 2024 to Mar 2025