Investors Title Company (NASDAQ: ITIC) today announced its

results for the quarter ended March 31, 2012. The Company reported

net income of $1,432,139, or $0.67 per diluted share, compared with

$1,019,207, or $0.46 per diluted share, for the prior year

period.

Total revenues increased 11.9% versus the prior year period to

$22,414,274, primarily due to a 10.1% increase in net premiums

written. Historically low interest rates drove a substantial

increase in refinance activity versus the prior year period.

Purchase activity was up as well, although to a lesser extent. New

industry-wide premium charges for North Carolina that went into

effect during the quarter also contributed to growth in premium

revenue.

Total expenses increased 9.6% versus the prior year period,

primarily due to increases in variable expenses such as commissions

and the provision for claims, which fluctuate with premium volumes.

The provision for claims as a percentage of net premiums written

was 8.3% versus 4.0% in the prior year period due to an increase in

volume in states with a higher average loss ratio, and an

abnormally low claims expense in the prior year period. In

addition, the Company continues to benefit from long-term

reductions in operating expenses such as occupancy and operating

costs in its branches due to an emphasis on expense control over

the past few years.

Chairman J. Allen Fine added, “We are pleased with the uptick in

mortgage lending activity and our first quarter results. Operating

expenses were largely in line with recent quarterly trends

adjusting for the improvement in activity levels, although we

expect them to trend higher as we increase our investment in a

number of software development initiatives. Our balance sheet

remains very strong, and we continue to focus on long-term

opportunities to enhance our competitive strengths and market

presence.”

Investors Title Company is engaged through its subsidiaries in

the business of issuing and underwriting title insurance policies.

The Company also provides investment management services to

individuals, companies, banks and trusts, as well as services in

connection with tax-deferred exchanges of like-kind property.

Certain statements contained herein may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include,

among other statements, any predictions regarding future agency

expansion or increasing operational efficiency. These statements

involve a number of risks and uncertainties that could cause actual

results to differ materially from anticipated and historical

results. Such risks and uncertainties include, without limitation:

the cyclical demand for title insurance due to changes in the

residential and commercial real estate markets; the occurrence of

fraud, defalcation or misconduct; variances between actual claims

experience and underwriting and reserving assumptions; declines in

the performance of the Company’s investments; government

regulation; and other considerations set forth under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2011, as filed with the Securities and

Exchange Commission, and in subsequent filings.

Investors Title Company and Subsidiaries

Consolidated Statements of Income For the Three Months

Ended March 31, 2012 and 2011 (Unaudited)

Three Months Ended March 31

2012

2011

Revenues: Net premiums written $

19,667,420 $

17,865,588 Investment income - interest and dividends

977,261 899,372 Net realized gain (loss) on investments

192,881 (26,160 ) Other

1,576,712

1,283,220 Total Revenues

22,414,274

20,022,020

Operating Expenses: Commissions to

agents

11,192,127 10,879,586 Provision for claims

1,631,359 721,626 Salaries, employee benefits and payroll

taxes

4,990,632 4,691,996 Office occupancy and operations

927,038 963,927 Business development

393,447 387,547

Filing fees, franchise and local taxes

351,922 214,113

Premium and retaliatory taxes

414,794 405,473 Professional

and contract labor fees

400,537 308,524 Other

167,279 103,021 Total Operating Expenses

20,469,135 18,675,813

Income

Before Income Taxes 1,945,139 1,346,207

Provision For Income Taxes

513,000 327,000

Net Income $

1,432,139 $ 1,019,207

Basic Earnings Per

Common Share $

0.68 $ 0.46

Weighted

Average Shares Outstanding - Basic 2,100,835

2,234,480

Diluted Earnings Per Common

Share $

0.67 $ 0.46

Weighted Average

Shares Outstanding - Diluted 2,128,788

2,239,500

Investors Title Company and Subsidiaries Consolidated

Balance Sheets As of March 31, 2012 and December 31,

2011 (Unaudited) March

31, 2012 December 31, 2011

Assets Investments in

securities: Fixed maturities, available-for-sale, at fair value $

87,142,860 $ 85,407,365 Equity securities,

available-for-sale, at fair value

26,824,431 22,549,975

Short-term investments

8,571,468 14,112,262 Other

investments

5,628,864 3,631,714 Total

investments

128,167,623 125,701,316 Cash and cash

equivalents

16,465,383 18,042,258 Premiums and fees

receivable, net

7,143,066 6,810,000 Accrued interest and

dividends

962,560 1,108,156 Prepaid expenses and other

assets

2,713,752 2,743,517 Property, net

3,469,310 3,553,216

Total Assets $

158,921,694 $ 157,958,463

Liabilities and

Stockholders' Equity Liabilities: Reserves for claims $

38,285,000 $ 37,996,000 Accounts payable and accrued

liabilities

10,513,737 12,330,383 Current income taxes

payable

148,262 640,533 Deferred income taxes, net

1,445,108 479,363 Total liabilities

50,392,107 51,446,279

Stockholders'

Equity: Common stock - no par value (shares authorized

10,000,000; 2,097,564 and 2,107,681 shares issued and outstanding

as of March 31, 2012 and December 31, 2011, respectively, excluding

291,676 shares for 2012 and 2011 of common stock held by the

Company's subsidiary)

1 1 Retained earnings

99,841,101 99,003,018 Accumulated other comprehensive income

8,688,485 7,509,165 Total stockholders' equity

108,529,587 106,512,184

Total

Liabilities and Stockholders' Equity $

158,921,694 $ 157,958,463

Investors Title Company and Subsidiaries Net Premiums

Written By Branch and Agency For the Three Months Ended

March 31, 2012 and 2011 (Unaudited)

Three Months Ended March 31

2012

% 2011 %

Branch $

4,822,792 24.5 $ 3,696,280 20.7

Agency

14,844,628 75.5

14,169,308 79.3

Total $

19,667,420 100.0 $ 17,865,588

100.0

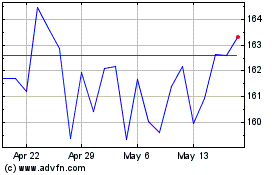

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

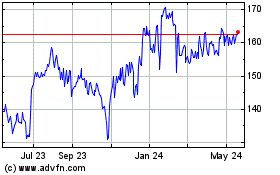

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024