false

0001730430

0001730430

2024-01-04

2024-01-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 4, 2024

Kiniksa Pharmaceuticals, Ltd.

(Exact name of Registrant as Specified in Its

Charter)

| Bermuda |

|

001-730430 |

|

98-1327726 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

Kiniksa Pharmaceuticals, Ltd.

Clarendon House

2 Church Street

Hamilton HM11, Bermuda

(808) 451-3453

(Address, zip code and telephone number,

including area code of principal executive offices)

Kiniksa Pharmaceuticals Corp.

100 Hayden Avenue

Lexington, MA, 02421

(781) 431-9100

(Address, zip code and telephone number,

including area code of agent for service)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which

registered |

| Class A

Common Shares $0.000273235 par value |

|

KNSA |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On January 4, 2024, Kiniksa

Pharmaceuticals, Ltd. (the “Company”) issued a press release (the “Press Release”) announcing, among other

things, that (i) its preliminary year-end 2023 cash, cash equivalents and short-term investments of $206.3 million (unaudited)

are expected to fund its current operating plan into at least 2027 and (ii) ARCALYST net revenue was $71.2 million and $233.1

million for the fourth quarter and full year 2023, respectively (unaudited).

The preliminary selected financial

results reported by the Company are unaudited, subject to adjustment, and provided as an approximation in advance of the Company’s

expected announcement of complete financial results in February 2024.

Item 7.01. Regulation FD Disclosure.

In addition to the information contained in Item 2.02, the Press

Release also announced top-line data from Cohorts 1, 2 and 3 of the Company’s Phase 2 clinical trial of abiprubart (KPL-404)

in rheumatoid arthritis. In connection with such announcement, the Company posted an investor presentation (the “Investor

Presentation”) containing data from the trial to its website at investors.kiniksa.com.

A copy of the Press Release and the Investor Presentation are furnished

with this Current Report on Form 8-K as Exhibit 99.1 and Exhibit 99.2, respectively.

The information contained in these Items 2.02 and 7.01 of this Current

Report on Form 8-K and Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any general incorporation language in such filing and except as expressly provided by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

KINIKSA PHARMACEUTICALS, LTD. |

| |

|

| Date: January 4, 2024 |

By: |

/s/ Madelyn Zeylikman |

| |

|

Madelyn Zeylikman |

| |

|

Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Kiniksa Pharmaceuticals

Provides Corporate Update

– ARCALYST®

(rilonacept) 2023 net product revenue grew ~90% year-over-year to $233.1 million (unaudited) –

– ARCALYST

2024 net product revenue expected to be $360 - $380 million –

– Abiprubart

(KPL-404) Phase 2 rheumatoid arthritis trial met the primary efficacy endpoint in Cohort 3 at the weekly dose level –

– Abiprubart

Phase 2 rheumatoid arthritis data from Cohort 4 expected in Q2 2024 –

–

Cash reserves of $206.3 million (unaudited) expected to fund operations into at least 2027–

HAMILTON,

BERMUDA – January 4, 2024 – Kiniksa

Pharmaceuticals, Ltd. (Nasdaq: KNSA) (Kiniksa), a commercial-stage biopharmaceutical company with a pipeline of immune-modulating

assets designed to target a spectrum of cardiovascular and autoimmune diseases, today provided a corporate update.

"Strong execution to date has laid

the foundation for the continued advancement of Kiniksa’s portfolio in 2024. ARCALYST 2023 net product revenue grew ~90% year-over-year

to $233.1 million, underscoring our robust commercial performance. We believe there is substantial opportunity with ARCALYST in recurrent

pericarditis and expect to drive continued revenue growth and collaboration profitability by reaching an increasing number of patients.

In fact, at the end of 2023 Kiniksa penetrated approximately 9% into the multiple-recurrence population, compared to approximately 5%

at the end of 2022,” said Sanj K. Patel, Chairman and Chief Executive Officer of Kiniksa. “Additionally, abiprubart showed

clinical effect in the first three cohorts of the Phase 2 trial in rheumatoid arthritis. Despite a high placebo response rate, the 5

mg/kg weekly dose level in Cohort 3 achieved statistical significance, but the 5 mg/kg biweekly dose level did not. We look forward to

evaluating results from Cohort 4, and we will use the totality of the data to determine next steps for the program. Importantly, our

strong financial position provides optionality to continue to invest across our business, including ARCALYST commercialization as well

as both pipeline and business development.”

Portfolio Execution

ARCALYST (IL-1α and IL-1β

cytokine trap)

| ● | ARCALYST

net product revenue was $71.2 million and $233.1 million for the fourth quarter and full

year 2023, respectively (unaudited). |

| ● | Since

launch in April 2021, more than 1,700 prescribers have written ARCALYST prescriptions

for recurrent pericarditis. |

| ● | As

of the end of the fourth quarter of 2023, average total duration of ARCALYST therapy in recurrent

pericarditis increased to approximately 23 months. |

| ● | As

of the end of the fourth quarter of 2023, approximately 9% of the target 14,000 multiple-recurrence

patients were actively on ARCALYST treatment. |

| ● | Kiniksa

increased the size of its salesforce to approximately 85 representatives by the end of 2023

to help drive further physician adoption and patient enrollments in 2024. |

| ● | Kiniksa

expects 2024 ARCALYST net product revenue of between $360 million and $380 million. |

Abiprubart (anti-CD40 monoclonal

antibody inhibitor of CD40-CD154 interaction)

| ● | Kiniksa

today announced that the Phase 2 clinical trial of abiprubart in rheumatoid arthritis met

its primary efficacy endpoint, change from baseline in Disease Activity Score of 28 Joints

Using C-reactive Protein (DAS28-CRP) versus placebo. |

| - | In

Cohorts 1 and 2 (pharmacokinetic (PK)-lead in), multiple doses of abiprubart were well-tolerated

and enabled the proof-of-concept portion of the study. Although these cohorts were not powered

for DAS28-CRP (Secondary Efficacy Endpoint), the following results were observed: |

| § | In

Cohort 1, in the abiprubart 2 mg/kg subcutaneous (SC) biweekly dosing group (n=6), the mean

change from baseline in DAS28-CRP at Week 12 was -3.16 points compared to -1.09 points in

pooled placebo recipients (n=4), (Mean Difference = -2.07, p=0.0312). |

| § | In

Cohort 2, in the abiprubart 5 mg/kg SC biweekly dosing group (n=6), the mean change from

baseline in DAS28-CRP at Week 12 was -3.44 points compared to pooled placebo recipients (n=4),

(Mean Difference = -2.35, p=0.0338). |

| - | In

Cohort 3, in the abiprubart 5 mg/kg SC weekly dosing group (n=27), the Least Squares (LS)

mean change [95% confidence interval (CI)] from baseline in DAS28-CRP at Week 12 was -2.21

[-2.62, -1.80] points compared to -1.65 [-2.07, -1.23] points in placebo recipients (n=26),

(LS Mean Difference = -0.56, p=0.0487). |

| - | In

Cohort 3, in the abiprubart 5 mg/kg SC biweekly dosing group (n=25), the LS mean change [95%

CI] from baseline in DAS28-CRP at Week 12 was -2.00 [-2.43, -1.58] points compared to -1.65

[-2.07, -1.23] points in placebo recipients (n=26), (LS Mean Difference = -0.35, p=0.2140). |

| - | Abiprubart

significantly reduced Rheumatoid Factor (a clinical marker of disease activity and autoantibody

pharmacodynamic marker of CD40 target engagement) by over 40% in both Cohort 3 dose levels. |

| - | Abiprubart

was well-tolerated, with no dose-related adverse experiences observed. |

| ● | Kiniksa

has now completed enrollment in a fourth cohort (Cohort 4) of the Phase 2 clinical trial

of abiprubart in rheumatoid arthritis. Cohort 4 will evaluate a fixed dose level administered

as a single subcutaneous injection once monthly. The company expects data from Cohort 4 in

the second quarter of 2024. |

Mavrilimumab (monoclonal antibody

inhibitor targeting GM-CSFRα)

| ● | Kiniksa

is now evaluating potential partnership opportunities to advance development of mavrilimumab,

which has generated positive data in mid-stage clinical trials across multiple indications. |

Corporate Update

| ● | Kiniksa’s

year-end 2023 cash, cash equivalents, and short-term investments of $206.3 million (unaudited)

are expected to fund its current operating plan into at least 2027. |

42nd

Annual J.P. Morgan Healthcare Conference

| ● | Sanj

K. Patel, Chief Executive Officer and Chairman of the Board of Kiniksa will provide

a corporate presentation at the 42nd Annual J.P. Morgan Healthcare Conference

on January 8, 2024, at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). A

live webcast of Kiniksa’s presentation will be accessible through the Investors &

Media section of the company’s website at www.kiniksa.com. A replay of

the webcast will also be available on Kiniksa’s website within approximately 48 hours

after the event. |

About Kiniksa

Kiniksa is a commercial-stage biopharmaceutical

company focused on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating

diseases with significant unmet medical need. Kiniksa’s immune-modulating assets, ARCALYST, abiprubart, and mavrilimumab, are based

on strong biologic rationale or validated mechanisms, target a spectrum of underserved cardiovascular and autoimmune conditions, and

offer the potential for differentiation. For more information, please visit www.kiniksa.com.

About ARCALYST

ARCALYST is

a weekly, subcutaneously injected recombinant dimeric fusion protein that blocks interleukin-1 alpha (IL-1α) and interleukin-1

beta (IL-1β) signaling. ARCALYST was discovered by Regeneron Pharmaceuticals, Inc. (Regeneron) and is approved by the U.S.

Food and Drug Administration (FDA) for recurrent pericarditis, cryopyrin-associated periodic syndromes (CAPS), including Familial Cold

Autoinflammatory Syndrome and Muckle-Wells Syndrome, and deficiency of IL-1 receptor antagonist (DIRA). The FDA granted Breakthrough

Therapy designation to ARCALYST for the treatment of recurrent pericarditis in 2019 and Orphan Drug exclusivity

to ARCALYST in 2021 for the treatment of recurrent

pericarditis and reduction in risk of recurrence in adults and pediatric patients 12 years

and older. The European Commission granted Orphan Drug Designation to ARCALYST for the treatment

of idiopathic pericarditis in 2021.

IMPORTANT

SAFETY INFORMATION ABOUT ARCALYST

| ● | ARCALYST

may affect your immune system and can lower the ability of your immune system to fight infections.

Serious infections, including life-threatening infections and death, have happened in patients

taking ARCALYST. If you have any signs of an infection, call your doctor right away. Treatment

with ARCALYST should be stopped if you get a serious infection. You should not begin treatment

with ARCALYST if you have an infection or have infections that keep coming back (chronic

infection). |

| ● | While

taking ARCALYST, do not take other medicines that block interleukin-1, such as Kineret®

(anakinra), or medicines that block tumor necrosis factor, such as Enbrel®

(etanercept), Humira® (adalimumab), or Remicade® (infliximab),

as this may increase your risk of getting a serious infection. |

| ● | Talk

with your doctor about your vaccine history. Ask your doctor whether you should receive any

vaccines before you begin treatment with ARCALYST. |

| ● | Medicines

that affect the immune system may increase the risk of getting cancer. |

| ● | Stop

taking ARCALYST and call your doctor or get emergency care right away if you have any symptoms

of an allergic reaction. |

| ● | Your

doctor will do blood tests to check for changes in your blood cholesterol and triglycerides. |

| ● | Common

side effects include injection-site reactions (which may include pain, redness, swelling,

itching, bruising, lumps, inflammation, skin rash, blisters, warmth, and bleeding at the

injection site), upper respiratory tract infections, joint and muscle aches, rash, ear infection,

sore throat, and runny nose. |

For

more information about ARCALYST, talk to your doctor and see the Product Information.

About Abiprubart

(KPL-404)

Abiprubart

(KPL-404) is an investigational humanized monoclonal antibody that binds to CD40 and is designed to inhibit the CD40-CD154 (CD40 ligand)

interaction, a key T-cell co-stimulatory signal critical for B-cell maturation and immunoglobulin class switching and Type 1 immune responses.

Kiniksa believes disrupting the CD40-CD154 co-stimulatory interaction is an attractive approach to addressing multiple autoimmune disease

pathologies.

About the

Phase 2 Clinical Trial of Abiprubart in Rheumatoid Arthritis

The ongoing

Phase 2 rheumatoid arthritis trial is a randomized, double-blind, placebo-controlled trial designed to evaluate pharmacokinetics, safety,

and efficacy of chronic subcutaneous administration of abiprubart and to provide optionality to evaluate abiprubart across a range of

autoimmune diseases. This trial enrolled patients with active rheumatoid arthritis who had an inadequate response or were intolerant

to a Janus kinase inhibitor (JAKi) or at least one biologic disease-modifying anti-rheumatic drug (bDMARD).

The multiple

ascending-dose PK lead-in portion randomized 8 patients each in a 3:1 ratio to receive abiprubart 2 mg/kg or placebo (Cohort 1) or 5

mg/kg or placebo (Cohort 2), administered subcutaneously biweekly over a period of 12 weeks. The primary objective of this part of the

trial was to evaluate pharmacokinetics, safety, and tolerability over 12 weeks. The secondary efficacy endpoint was change from baseline

in DAS28-CRP versus placebo.

The first part

of the proof-of-concept portion of the trial (Cohort 3) randomized 78 patients in a 1:1:1 ratio to receive abiprubart 5 mg/kg SC weekly,

abiprubart 5 mg/kg SC biweekly, or placebo over a period of 12 weeks. The final part of the proof-of-concept

portion of the trial (Cohort 4) randomized 51 patients in a 3:2 ratio to receive a fixed 600 mg loading dose on Day 1 followed by 400

mg SC every four weeks or placebo over a period of 12 weeks. The primary efficacy endpoint of the proof-of-concept portion of the trial

is change from baseline in DAS28-CRP versus placebo.

About Mavrilimumab

Mavrilimumab

is an investigational fully human monoclonal antibody that blocks activity of GM-CSF by specifically binding to the alpha subunit of

the GM-CSF receptor (GM-CSFRα). Phase 2 clinical trials of mavrilimumab in rheumatoid arthritis and giant cell arteritis achieved

their primary and secondary endpoints with statistical significance. Kiniksa is now evaluating potential partnership opportunities for

mavrilimumab.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward looking

statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“could,” “intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of these terms or other

similar expressions, although not all forward-looking statements contain these identifying words. All statements contained in this press

release that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation,

statements regarding: our expectation that ARCALYST 2024 net product revenue will be between $360 million and $380 million; our plan

to report data from Cohort 4 of our Phase 2 clinical trial of abiprubart in rheumatoid arthritis in the second quarter of 2024; our expectation

about our cash reserves funding our current operating plan into at least 2027; our expectation that we will drive continued ARCALYST

revenue growth and collaboration profitability by reaching an increasing number of patients; our beliefs about the mechanisms of our

product candidates and potential impact of their approach, including that using abiprubart to disrupt the CD40-CD154 co-stimulatory interaction

is an attractive approach to address multiple autoimmune disease pathologies; and our belief that all of our product candidates offer

the potential for differentiation.

These forward-looking statements are

based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking statements, including without limitation,

the following: delays or difficulty in enrollment of patients in, and activation or continuation of sites for, our clinical trials; delays

or difficulty in completing our clinical trials as originally designed; potential for changes between final data and any preliminary,

interim, top-line or other data from clinical trials; our inability to replicate results from our earlier clinical trials or studies;

impact of additional data from us or other companies, including the potential for our data to produce negative, inconclusive or commercially

uncompetitive results; potential undesirable side effects caused by our products and product candidates; our inability to demonstrate

safety and efficacy to the satisfaction of applicable regulatory authorities; potential for applicable regulatory authorities to not

accept our filings, delay or deny approval of any of our product candidates or require additional data or trials to support approval;

inability to successfully execute on our commercial strategy for ARCALYST; our reliance on third parties as the sole source of supply

of the drug substance and drug product used in our products and product candidates; our reliance on Regeneron as the current sole manufacturer

of ARCALYST; risks arising from our ongoing technology transfer of ARCALYST drug substance manufacturing; raw material, important ancillary

product and drug substance and/or drug product shortages; our reliance on third parties to conduct research, clinical trials, and/or

certain regulatory activities for our product candidates; complications in coordinating requirements, regulations and guidelines of regulatory

authorities across jurisdictions for our clinical trials; changes in our operating plan, business development strategy or funding requirements;

and existing or new competition.

These and other important factors discussed

in our filings with the U.S. Securities and Exchange Commission, including under the caption “Risk Factors” contained therein,

could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any

such forward-looking statements represent management’s estimates as of the date of this press release. Except as required by law,

we disclaim any intention or obligation to update or revise any forward-looking statements. These forward-looking statements should not

be relied upon as representing our views as of any date subsequent to the date of this press release.

ARCALYST® is a registered

trademark of Regeneron. All other trademarks are the property of their respective owners.

Every Second Counts!

®

Kiniksa Investor and Media Contact

Rachel Frank

(339) 970-9437

rfrank@kiniksa.com

Exhibit 99.2

Corporate Presentation JANUARY 2024

Forward Looking Statements 2 This presentation (together with any other statements or information that we may make in connection herewith) contains forwar d - l ooking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to Kiniksa Pharmaceuticals, Ltd. (and its consolidated subsidiaries, collectively, unless con tex t otherwise requires, “Kiniksa,” “we,” “us” or “our”). In some cases, you can identify forward looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “inten d,” “goal,” “design,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” “strategy,” or “continue” or the negative of these terms or other similar expressions, although not all forward - loo king statements contain these identifying words. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward - looking statements, including without limitation, statements regarding our strategy; potential value drivers; potential indications; potential market opportunities and competitive position; ongoing, planned and potential clinical trials and othe r s tudies; timing and potential impact of clinical data; regulatory and other submissions, applications and approvals; commercial strategy and commercial activities; expected run rate for our cash, cash equ ivalents and short - term investments; expected funding of our operating plan; financial guidance; third - party collaborations and licensing; and capital allocation. These statements involve known and unknown risks, uncertainties, and other important factors that may cause our actual result s, performance or achievements to be materially different from those expressed or implied by the forward - looking statements, including, without limitation, potential delays or difficulties wi th our clinical trials; potential inability to demonstrate safety or efficacy or otherwise producing negative, inconclusive or uncompetitive results; potential for changes in final data from preliminary or int erim data; potential inability to replicate in later clinical trials positive results from earlier trials and studies; our reliance on third parties for manufacturing and conducting clinical trials, research and other s tudies; risks arising from our technology transfer of ARCALYST drug substance manufacturing; our ability to realize value from our licensing and collaboration arrangements; our ability to sou rce sufficient drug product, as needed, to meet our clinical and commercial requirements; our inability to demonstrate safety and efficacy to the satisfaction of applicable regulatory authoriti es; potential for applicable regulatory authorities to not accept our filings or to delay or deny approval of any of our product candidates or to require additional data or trials to support any such approval or authorization; delays, difficulty or inability to successfully execute on our commercial strategy for ARCALYST; potential changes in our strategy, clinical trial priority, operating plan, business developme nt strategy or funding requirements; raw materials, important ancillary product and drug substance and/or drug product shortages; substantial new or existing competition; risks arising from political and economic instability; and our ability to attract and retain qualified personnel. These and the important factors discussed in our filings with the U.S. Securities and Exchange Commission, including under th e c aption “Risk Factors” contained therein could cause actual results to differ materially from those indicated by the forward - looking statements made in this presentation. These forward - looking statements re flect various assumptions of Kiniksa's management that may or may not prove to be correct. No forward - looking statement is a guarantee of future results, performance, or achievements, and one should avoid placing undue reliance on such statements. Except as otherwise indicated, this presentation speaks as of the date of this presentation. We undertake no obligation to update any forward - lookin g statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation also may contain estimates, projections, and/or other information regarding our industry, our business and the markets for certain of our product candidates, including data regarding the estimated size of those markets, and the incidence and prevalence of certain medical conditions. Unless otherwise expressly s tat ed, we obtained such industry, business, market and other data from reports, research surveys, clinical trials, studies and similar data prepared by market research firms and other third partie s, from industry, medical and general publications, and from government data and similar sources. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is in herently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. ARCALYST is a registered trademark of Regeneron Pharmaceuticals, Inc. Kiniksa OneConnect is a trademark of Kiniksa Pharmaceuticals. All other trademarks are the property of their respective owners.

Portfolio of Immune - Modulating Assets 3 1) Approved in the U.S.; ARCALYST is also approved in the U.S. for cryopyrin - associated periodic syndromes (CAPS) and deficiency of the interleukin - 1 receptor antagonist (DIRA); 2 ) The FDA granted Breakthrough Therapy designation to ARCALYST for recurrent pericarditis in 2019; the FDA granted Orphan Drug exclusivity to ARCALYST in March 2021 for the treatment of recurrent perica rdi tis and reduction in risk of recurrence in adults and pediatric patients 12 years and older. The European Commission granted Orp han Drug designation to ARCALYST for the treatment of idiopathic pericarditis in 2021; 3) Kiniksa has worldwide rights, excluding the Mid dle East and North Africa; Kiniksa granted Huadong Medicine exclusive rights in the Asia Pacific Region, excluding Japan; 4 ) Phase 2 clinical trials of mavrilimumab in rheumatoid arthritis and giant cell arteritis achieved their primary and secondary endpoints with s tat istical significance; Kiniksa granted Huadong Medicine exclusive rights in the Asia Pacific Region, excluding Japan IL - 1 α = interleukin - 1 α; IL - 1 β = interleukin - 1 β; GM - CSFR α = granulocyte macrophage colony stimulating factor receptor alpha; OSMR β = oncostatin M receptor beta Program Target Preclinical Phase 1 Phase 2 Phase 3 Commercial CARDIOVASCULAR FRANCHISE ARCALYST ® ( rilonacept) 1,2,3 IL - 1 α & IL - 1 β Recurrent Pericarditis Mavrilimumab 4 GM - CSFR α Evaluating Potential Partnership Opportunities AUTOIMMUNE FRANCHISE Abiprubart (KPL - 404) CD40/CD154 Rheumatoid Arthritis Program Licensee Exclusive Licensed Territory OUT - LICENSING AGREEMENTS ARCALYST ( rilonacept) IL - 1α & IL - 1β Huadong Medicine Mavrilimumab GM - CSFR α Huadong Medicine Vixarelimab OSMR β Roche and Genentech Asia Pacific Region, Excluding Japan Asia Pacific Region, Excluding Japan Worldwide

ARCALYST ® IL - 1 α AND IL - 1 β CYTOKINE TRAP DISEASE AREA: Recurrent pericarditis 1 ; painful and debilitating auto - inflammatory cardiovascular disease COMPETITION 2 : First and only FDA - approved therapy for recurrent pericarditis REGULATORY: U.S. Orphan Drug exclusivity for treatment of and reduction in risk of recurrence of recurrent pericarditis ; European Commission Orphan Drug designation in idiopathic pericarditis STATUS: FDA - Approved ECONOMICS: 50/50 split on profit and third - party proceeds RIGHTS: Kiniksa has worldwide rights 3 (excluding MENA) for all indications outside those in oncology and local administration to the eye or ear 1) ARCALYST is also approved and marketed for Cryopyrin - Associated Periodic Syndromes (CAPS) and maintenance of remission of Def iciency of Interleukin - 1 Receptor Antagonist (DIRA) in the United States; 2) Drugs@FDA : ARCALYST Prescribing Information, Ilaris Prescribing Information, Kineret Prescribing Information; Kaiser et al. Rheumatol Int (2012) 32:295 – 299; Theodoropoulou et al. Pediatric Rheumatology 2015, 13(Suppl 1):P155; Fleischmann et al, 2017 ACR/ARHP Abstract 1196; Kosloski et al, J of Clin Pharm 2016, 56 (12) 1582 - 1590; Cohen et al. Arthritis Research & Therapy 2011, 13:R125; Cardiel et al. Arthritis Research & Therapy 2010, 12:R192; Hong et al. Lancet Oncol 2014, 15: 656 - 666; 3) Kiniksa granted Huadong Medicine exclusive rights in the Asia Pacific Region, excluding Japan; IL - 1 α = interleukin - 1 α ; IL - 1 β = interleukin - 1 β; MENA = Middle East North Africa 4

1) Cremer et al. American Journal of Cardiology. 2016;2311 - 2328; 2) DOF, Kiniksa Pharmaceuticals, Ltd.; 3) Brucato A, Maestroni S, Cumetti D, et al. Autoimmun Rev. 2008; 8:44 - 47; 4) Lange R, Hills L. N Engl J Med. 2004; 351: 2195 - 2202; 5) Imazio M, Cecchi E, Demichelis B, et al. Circulation. 2007; 115: 2739 - 2744; 6) Imazio et al. Circulation. 2005;112:2012 - 2016; 7) Adler et al. Circulation. 1998;97:2183 - 2185; 8) Klein A, Cremer P, Kontzias A, et al. US database study of clinical burden and unmet need in recurrent pericarditis. J Am Heart Assoc. 2021; 10:e018950. do i:10.1161/JAHA. 120.018950 ~160,000: Epidemiological analysis using large national surveillance databases to calculate the pooled annualized prevalence of pericarditis (Basis for Orphan Drug Designation approval) 2 ~40,000: Up to 30% experience at least one recurrence; some recur over multiple years 6,7 ~14,000: Nearly 50% annual turnover with ~7,000 patients entering into the pool each year 8 Approximately 14,000 recurrent pericarditis patients in the U.S. suffer from persistent underlying disease , with multiple recurrences and inadequate response to conventional therapy 1 Pericarditis ~160,000 Recurrent Pericarditis ~40,000 All figures annual period prevalence Pericarditis ~160,000 Recurrent Pericarditis ~40,000 Multiple Recurrences ~14,000 5 Pericarditis Epidemiology Of the 14,000 target population with multiple recurrences there is a high turnover of ~50% of patients each year, meaning ongoing opportunities to ensure diagnosis and targeted treatment

1 ST RECURRENCE ~26,000 2 ND RECURRENCE ~7,000 3 RD RECURRENCE ~3,500 ≥4 TH RECURRENCE ~3,500 Treated Patients Since Launch Are Closely Associated to the 14,000 Target Population, While Prescribers Can Utilize ARCALYST Earlier in the Disease Recurrent Pericarditis Annual Epidemiology: ~40,000 Klein A, Cremer P, Kontzias A, Furqan M, Tubman R, Roy M, Magestro M. Annals of Epidemiology. 2019;36:71; 2) Lin D, Majeski C, DerSarkissian M, Magestro M, Cavanaugh C, Laliberte F, Lejune D, Mahendran M, Duh M, Klein A, Cremer P, Kontzias A, Furqan M, Tubman R, Roy M, Mage. (Nov, 2019). Real - World Clinical Characteristics and Recurrence Burden of Patients Diagnose d with Recurrent Pericarditis in the United States. Poster session presented at the American Heart Association, Philadelphia, PA.; 3) ClearView Forecasting Analysis 2019 Q1 Source: 1) Kiniksa Pharmaceuticals data on file 2023. 2) Other late line agents include anakinra, azathioprine, methotrexate ARCALYST PATIENTS BY FLARE STATUS @ INITIATION 1 IN ACTIVE FLARE ~60% NOT I N ACTIVE FLARE ~40% LOWEST SHARE MODERATE SHARE HIGH SHARE HIGH SHARE ARCALYST LABEL 14,000 TARGET POPULATION ARCALYST Usage Since Launch 6 ARCALYST PATIENTS BY PRIOR PRODUCT 1 NSAIDS and/or Colchicine Corticosteroids Other Late Line Agents 2

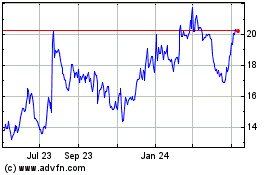

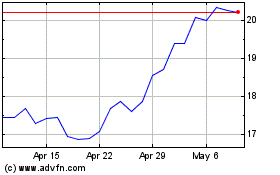

7 ARCALYST Commercial Growth in 2023: By the Numbers $233.1M ARCALYST Full - Year 2023 Net Product Revenue (unaudited) ~90% annual growth vs full - year 2022 ~9% Penetration into the 14K multiple - recurrence target population as of the end of Q4 2023 ~80% annual growth vs end of Q4 2022 $71.2M ARCALYST Q4 2023 Net Product Revenue (unaudited) ~78% annual growth vs Q4 2022

Strong Q4 2023 ARCALYST Net Product Revenue Growth 8 Total Net Revenue Growth per Quarter $ 18.7 M $ 39.9 M Q4 2021 Q4 2022 Q4 2023 Total Prescribers >1,700 Repeat Prescribers (% of Total) ~24% Payer Approval (% of Completed Cases) >90% Average Total Duration of Therapy ~23 months Patient Compliance >85% ~113% year - over - year growth ~78% year - over - year growth $71.2 1 1) ARCALYST net product revenue (unaudited)

Key Executional Priorities to Drive Greater Patient and Physician Adoption 9 Identify appropriate patients and drive a proactive mindset with physicians and patients Close the ARCALYST knowledge gap with physicians Advance the treatment paradigm Educate on duration of disease and treatment • Of target physicians who have knowledge of ARCALYST, they overwhelmingly expect to increase their prescribing of ARCALYST in next 6 months • The biggest barriers for physicians to prescribing ARCALYST are limited knowledge about the product and/or experience with the payer approval process Externally: Thought leaders are introducing treatment paradigms for recurrent pericarditis that recommend IL - 1 antagonists, such as ARCALYST, be used ahead of corticosteroids 1 Our Aim: Continue to drive the evolution of this treatment paradigm 1) Dong, Klein, Wang. Paradigm Shift in Diagnosis and Targeted Therapy in Recurrent Pericarditis. Springer Nature. 2023.; Kle in, Cremer, Kafil . Recurrent Pericarditis A Promising Future for IL - 1 Blockers in Autoinflammatory Phenotypes. Journal of the American College of Cardiology, Editorial Comment. 2023.; Thomas, Bonaventura, Vecchié , et al. Interleukin - 1 blockers for the treatment of recurrent pericarditis: pathophysiology, patient reported outcomes and perspectives. Journal of Cardiovascular Pharmacology. 2023.; Imazio , Mardigyan , Andreis, et al. New developments in the management of recurrent pericarditis. Canadian Journal of Cardiology. 2023.; Kumar, Khubber , Reyaldeen , et al. Advances in Imaging and Targeted Therapies for Recurrent Pericarditis. JAMA Cardiology Review. 2022.; Sushil, Cremer , Raisinghani . 2) HCP Market Research, Q3 2023; Kiniksa Data on File. 42% 58% 17% 83% 0% 20% 40% 60% 80% 100% Corticosteroids ARCALYST Intended Future Use Among Target Healthcare Providers 2 Decrease Stay the Same Increase

Average Total Duration of ARCALYST Therapy: ~23 Months 1 Advancing the treatment paradigm to treat continuously throughout disease duration (median 3 years 2 ) 10 ~45% Of Patients Restarted Therapy Following Initial Discontinuation (Within ~8 weeks) Average Initial Duration of Therapy ~15 Months 1 ~23 Months Average Total Duration of Therapy After Accounting for Patient Restarts 1) As of Q4 2023; 2) Lin D, Laliberté F, Majeski C, et al. Disease and economic burden associated with recurrent pericarditis in a privately insured United States population. A dv Ther . 2021;38(10):5127 - 5143. doi:10.1007/s12325 - 021 - 01868 - 7; 3) Initial continuous therapy is determined to have ended if greater than 28 days elapses beyond the exhaustion date of a patient's most recent days supplied without an observed refill of ARCALYST Median Initial Duration of Therapy ~12 Months 1

Growth in Total Patients on ARCALYST Therapy Acceleration in new - to - brand and restart patients offset higher patient stops over time 11 Time ARCALYST Patient Flow New to Brand Patients Patient Stops Patient Restarts Active Patients Strong sequential growth: >1,700 unique prescribers; ~24% of which are repeat prescribers Increases over time as base of active ARCALYST patients grows with Initial Starts and Restarts Increases over time as patient stops increase; currently ~45% after ~8 weeks Increases over time driven by new - to - brand and restart growth; as of Q4 2023, ~9% of 14K multiple recurrence target patient population Illustrative Patient Flow New Starts Patient Restarts Patient Stops Launch (2021)

Evolving ARCALYST Field Strategy Targeting an increased number of top and mid - tier physicians 12 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 12,000 13,000 14,000 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 23,000 24,000 25,000 Concentration of RP Patients Per Year Based on Claims^ 0 2 4 6 # of RP Patients Zoom in on the Long - Tail Concentration of RP Patients # of RP Patients # of HCP Specialists The recurrent pericarditis population is widely dispersed *Including targets, prospects, and opportunistic calls to non - targets ^Internal analysis based on Komodo Claims Data; includes patients with at least 1 recurrence New expansion to provide greater frequency on top tier physicians and improved coverage to the mid tier • In any given year, the 14,000 multiple recurrent pericarditis patients may present to any of the >2 0 ,000 cardiologists and >5,000 rheumatologists in US • With our field expansion, we expect to accelerate coverage and frequency among the top tier as well as the long tail of physicians who may identify recurrent pericarditis patients » Data - driven decisions ensured continued growth in collaboration profitability following the prior expansion » With the new expansion, we have the opportunity to meaningfully increase frequency on prior field targets and to reach new health care providers that have no prior field interactions # of HCP Specialists Prior expansion to create greater reach & frequency ~50 Specialty Cardiology Reps ~85 Specialty Cardiology Reps Reaching: ~6,000 top and mid tier prescribers ~70%* of RP patients nationally Reaching: ~11,000 top and mid tier prescribers ~85%* of RP patients nationally Q4 2022 Q4 2023 # of HCP Specialists Data driven expansion to field sales team

Opportunity for Continued ARCALYST Growth Remains High 13 17% 22% 24% 31% 40% 42% 2021 2022 2023 % Repeat Prescribers at Year End % of New Prescriptions from Repeat Prescribers Repeat Prescribers Represent >40% of All New Prescriptions 17% 22% 24% 0 200 400 600 800 1000 1200 1400 1600 1800 Q4 '21 Q4 '22 Q4 '23 Prescribers with ≥2 Recurrent Pericarditis Enrollments Prescribers with 1 Recurrent Pericarditis Enrollment >800 >300 >1700 Total and Repeat Prescribers of ARCALYST for Recurrent Pericarditis Patients The increase in repeat prescribers has continued to grow against the backdrop of a rapidly increasing total prescriber base ( >30 0 at YE 2021 vs >1,700 at YE 2023) As of the end of 2023, ~9% of the target 14,000 recurrent pericarditis patients with multiple - recurrences were actively on ARCAL YST treatment

Pricing, Access and Distribution Considerations • ARCALYST list price of $22,603 per month Based on first and only FDA - approved therapy for recurrent pericarditis, in - line with specialty biologics with Breakthrough Therapy and Orphan Drug designation • Helping to ensure patient affordability and access to treatment is one of our core principles and to this end, we offer a suite of programs to support affordability to eligible patients who are prescribed ARCALYST; eligible patients are able to get ARCALYST for a copay of as low as $0 • Kiniksa’s goal is to maintain rapid and broad access to ARCALYST for patients with Recurrent Pericarditis, CAPS, and DIRA • Payer mix for ARCALYST is largely commercial (~70%), Medicare (~20%), Medicaid (~10%) • Payer engagement has increased awareness of recurrent pericarditis and the differentiated value of ARCALYST • The Kiniksa OneConnect Ρ program is a personalized treatment support program for patients prescribed ARCALYST • ARCALYST is distributed through a closed network of designated specialty pharmacies and the Veterans Affairs • The distribution network for ARCALYST was developed to provide a high and consistent level of patient support with broad access. Network pharmacies provide customized services to support patients Pricing Access Distribution CAPS = Cryopyrin - Associated Periodic Syndromes ; DIRA = Deficiency of IL - 1 Receptor Antagonist 14

2024 ARCALYST Net Product Revenue Guidance Well - positioned to expand the breadth and depth of ARCALYST in recurrent pericarditis 15 2021 2022 2023 2024 $122.5M $38.5M 1 $233.1M 2 $ 360 - 380 M ~ 59 % year - over - year growth at the midpoint Expected Net Product Sales 1) 9 Months of Commercial Availability; 2) ARCALYST net product revenue (unaudited)

Summary of ARCALYST Profit Share Arrangement with Regeneron 1 1) Subject to description contained in definitive agreement; 2) Global net sales for CAPS, DIRA and recurrent pericarditis re cog nized as revenue on Kiniksa’s income statement; 3) Profit Split - Eligible Cost of Goods Sold = total cost of goods sold - amortization of Regeneron milestone payment * Kiniksa exclusively licensed rights for the development and commercialization of ARCALYST in APAC (ex - Japan) to Huadong Medicine CAPS = Cryopyrin - Associated Periodic Syndromes; DIRA = Deficiency of the Interleukin - 1 Receptor Antagonist; MENA =Middle East a nd North Africa; APAC = Asia Pacific Region Kiniksa Operating Income from ARCALYST • Kiniksa is responsible for sales and distribution of ARCALYST in all approved indications in the United States. • Kiniksa’s license to ARCALYST includes worldwide rights * , excluding MENA , for all applications other than those in oncology and local administration to the eye or ear. • Kiniksa covers 100% of development expenses related to approval of additional indications. • Kiniksa evenly splits profits on ARCALYST sales and licensing proceeds with Regeneron 16 Minus Marketing & Commercial Expenses that Exceeded Specified Limits (if any) Minus R&D Expenses for Additional Indications or Other Studies Required for Approval Collaboration Expenses (Booked as a separate line item within OpEx ) Minus 50% of ARCALYST Collaboration Operating Profit and 50% of ARCALYST Licensing Proceeds ARCALYST Collaboration Operating Profit Minus 100% of Regulatory & Certain Other Expenses Minus Marketing & Commercial Expenses (Subject to Specified Limits) Minus 100% of Field Force Expenses Minus 100% of Profit Split Eligible Cost of Goods Sold 3 ARCALYST Net Sales (CAPS + DIRA + Recurrent Pericarditis) 2

ANTI - CD40 MONOCLONAL ANTIBODY INHIBITOR OF THE CD40 - CD154 COSTIMULATORY INTERACTION Sources: 1) Muralidharan et al. Preclinical immunopharmacologic assessment of KPL - 404, a novel, humanized, non - depleting antagonistic anti - CD40 monoclonal antibody. J Pharmacol Exp Ther . 2022, 381(1):12 - 21. 2) Samant M, Ziemniak J, Paolini JF. First - in - Human Phase 1 Randomized Trial with the Anti - CD40 Monoclonal Antibody KPL - 404: Safety, Tolerability, Re ceptor Occupancy, and Suppression of T - Cell - Dependent Antibody Response. J Pharmacol Exp Ther . 2023 Dec;387(3):306 - 314. 3) Elgueta , et al. Immunol Rev 2009, 229 (1), 152 - 172; 4) Peters, et al. Semin Immunol 2009, 21 (5) 293 - 300 RO = receptor occupancy; TDAR = T - cell Dependent Antibody Response DISEASE AREA: Rheumatoid Arthritis; a chronic inflammatory disorder affecting many joints; External proof - of - concept previously established in broad range of autoimmune diseases: Sjogren’s disease, systemic lupus, solid organ transplant and Graves’ disease 1,2 SCIENTIFIC RATIONALE 3 ,4 : Attractive target for blocking T - cell dependent, B - cell – mediated autoimmunity STATUS: Phase 2 proof - of - concept study of chronic subcutaneous administration ongoing; data from Cohort 4 expected in Q2 2024 ECONOMICS: Negligible clinical and regulatory milestones and royalty on annual net sales RIGHTS: Worldwide ABIPRUBART (KPL - 404) 17

CD40/CD154 Interaction: Essential Immune Pathway for T - Cell Priming and T - Cell Dependent B - Cell Responses • CD40 ligation on DCs induces cell maturation by promoting antigen presentation and enhancing their costimulatory activity • Mature DCs stimulate activated T - cells to increase IL - 2 production that facilitates T - helper cells (Th) and cytolytic T - Lymphocyte (CTL) expansion • CD40 - stimulated DCs also secrete cytokines favoring Th1 cell differentiation and promoting Th cell migration to sites of inflammation • CD40 ligation also provides a pro - inflammatory signal within the mononuclear phagocyte system • Humoral immunity is dependent on a thriving B cell population and activation by Th cells; blockade of CD40/CD40L interaction has been shown to completely ablate primary and secondary TDAR response • CD40 is expressed on the surface of dendritic cells, B - cells, antigen - presenting cells and non - immune cell types • Its ligand, CD40L (CD154), is expressed by activated T - cells, platelets, and other cell types • CD40 engagement triggers B - cell intercellular adhesion, sustained proliferation, expansion, differentiation, and antibody isotype switching leading to affinity maturation, which is essential for generation of memory B cells and long - lived plasma cells • B - cells require contact - dependent stimulus from T cells through CD40/CD40L interaction independent of cytokines to trigger growth and differentiation Sources: Elgueta et al., Immunol Rev, 2009; Peters et al., Semin Immunol, 2009; Kambayashi et al., Nature Reviews: Immunology, 14, 2014; Desmet et al., Nature Reviews: Immunology, 12, 2012 18

Abiprubart Phase 2 Trial in Rheumatoid Arthritis S tudy to evaluate the efficacy, dose response, PK, and safety of chronic SC dosing over a 12 - week treatment duration 19 1) The 5 mg/kg SC q2wk group will receive weekly administrations of alternating active investigational product and matching blin ded placebo 2) The Cohort 4 Abiprubart 400mg SC q4wk group includes a 600mg loading dose on Day 1 SC = subcutaneous; qwk = every week; q2wk = every other week; q4wk = every four weeks; AUC = Area Under the Curve; RF = Rheumatoid Factor; ACPA = a nt i - citrullinated protein antibodies, PD = Pharmacodynamics; PK = Pharmacokinetics; R = Randomization PHARMACOKINETICS (PK) LEAD - IN PROOF - OF - CONCEPT Cohort 1 PK Lead - In: Cohorts 1 - 2 • Each cohort sequentially randomized 8 patients in a 3:1 ( active:placebo ) ratio; placebo recipients from Cohorts 1 and 2 were pooled • Primary Endpoints: • Incidence of treatment - emergent adverse events (TEAEs) • Pharmacokinetics ( C max , AUC (0 - t) ) • Secondary Efficacy Endpoint: • Change from baseline in DAS28 - CRP at Week 12 Cohort 2 R Abiprubart 2 mg/kg SC q2wk Abiprubart 5 mg/kg SC q2wk Abiprubart 5mg/kg SC q2wk 1 Abiprubart 5 mg/kg SC qwk Placebo SC qwk Proof of Concept: Cohorts 3 - 4 • Cohort 3 randomized 78 patients in a 1:1:1 ratio (n~26/arm) • Cohort 4 randomized 51 patients in a 3:2 ratio (n=~20 - 30/arm ) • Primary Efficacy Endpoint: • Change from baseline in DAS28 - CRP at Week 12 • Secondary Endpoints : • Incidence of treatment - emergent adverse events (TEAEs) • Pharmacokinetics ( C max , AUC (0 - t) ) • Patients with active RA who have been treated with a biological disease - modifying anti - rheumatic drug ( bDMARDs ) AND/OR Janus kinase inhibitor ( JAKi ) therapy for RA for ≥ 3 months and who have had inadequate response or have had to discontinue bDMARD and/or JAKi therapy due to intolerance or toxicity, regardless of treatment duration. • Six or more swollen joints and ≥ 6 tender joints at screening and baseline line visits; levels of high sensitivity C - reactive protein ≥ 5 mg/L; seropositivity for serum RF and/or ACPA at screening. PATIENT POPULATION: DISEASE CRITERIA: Cohort 3 Abiprubart 400 mg SC q4wk 2 Placebo SC q4wk Cohort 4 R

Baseline Demographics (Cohort 3) 1 20 Abiprubart 5mg/kg SC qwk (n=27) Abiprubart 5mg/kg SC q2wk (n=25) Placebo (n=26) Total (n=78) Mean Age (Years) 58.5 60.0 57.6 58.7 Sex % (Male/Female) 18.5/81.5 20.0/80.0 7.7/92.3 15.4/84.6 Race White %; (n) 92.6 (n=25) 92.0 (n=23) 92.3 (n=24) 92.3 (n=72) Black or African American %; (n) 3.7 (n=1) 8.0 (n=2) 7.7 (n=2) 6.4 (n=5) Asian %; (n) 3.7 (n=1) 0 0 1.3 (n=1) Country 2 United States %; (n) 29.6 (n=8) 28.0 (n=7) 38.5 (n=10) 32.1 (n=25) Bulgaria %; (n) 0 4.0 (n=1) 11.5 (n=3) 5.1 (n=4) Czechia %; (n) 11.1 (n=3) 4.0 (n=1) 3.8 (n=1) 6.4 (n=5) Georgia %; (n) 7.4 (n=2) 12.0 (n=3) 11.5 (n=3) 10.3 (n=8) Hungary %; (n) 18.5 (n=5) 4.0 (n=1) 3.8 (n=1) 9.0 (n=7) Poland %; (n) 25.9 (n=7) 28.0 (n=7) 19.2 (n=5) 24.4 (n=19) South Africa %; (n) 7.4 (n=2) 20.0 (n=5) 11.5 (n=3) 12.8 (n=10) 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis includes all pa tie nts having reached Week 12, and follow - up to Week 24 is ongoing; 2) Cohorts 1 and 2 were conducted entirely in the United States

Baseline Disease Characteristics were Balanced Across Treatment Arms (Cohort 3) 1 21 Abiprubart 5mg/kg SC qwk (n=27) Abiprubart 5mg/kg SC q2wk (n=25) Placebo (n=26) Total (n=78) DAS28 - CRP Score DAS28 - CRP 2 5.58 5.92 5.98 5.82 Tender Joint Count - 28 2 13.4 16.1 15.4 14.9 Swollen joints - 28 (mean) 10.1 12.2 12.0 11.4 Patient Global Assessment 2 6.68 6.49 6.73 6.64 C - Reactive Protein (mg/L) 2 16.00 18.72 26.74 20.45 Mean Duration of Rheumatoid Arthritis (years) 12.24 13.50 15.47 13.72 Rheumatoid factor (IU/mL) 2 165.21 183.45 154.62 167.53 Anti - Cyclic Citrullinated Peptide %; (n) Positive 74.1 (n=20) 80.0 (n=20) 76.9 (n=20) 76.9 (n=60) Negative 22.2 (n=6) 20.0 (n=5) 23.1 (n=6) 21.8 (n=17) Intermediate 3.7 (n=1) 0 0 1.3 (n=1) 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis includes all pa tie nts having reached Week 12, and follow - up to Week 24 is ongoing; 2) Mean

Phase 2 Clinical Trial of Abiprubart in Rheumatoid Arthritis Met Primary Efficacy Endpoint (Change from Baseline in DAS28 - CRP vs P lacebo at Week 12) 22 Cohorts 1 & 2 DAS28 - CRP Mean Change from Baseline Cohort 3 DAS28 - CRP LS Mean Change from Baseline 1 Cohort 1: in the abiprubart 2 mg/kg SC biweekly dosing group (n=6), mean change from baseline in DAS28 - CRP at Week 12 was - 3.16 points compared to - 1.09 points in pooled placebo recipients (n=4), (Mean Difference = - 2.07, p=0.0312) Cohort 2: in the abiprubart 5 mg/kg SC biweekly dosing group (n=6), mean change from baseline in DAS28 - CRP at Week 12 was - 3.44 points compared to - 1.09 points in pooled placebo recipients (n=4), (Mean Difference = - 2.35, p=0.0338) In the abiprubart 5 mg/kg SC weekly dosing group (n=27), LS mean change [95% (CI)] from baseline in DAS28 - CRP at Week 12 was - 2.21 [ - 2.62, - 1.80] points compared to - 1.65 [ - 2.07, - 1.23] points in placebo recipients (n=26), (LS Mean Difference = - 0.56, p=0.0487) I n the abiprubart 5 mg/kg SC biweekly dosing group (n=25), LS mean change [95% CI] from baseline in DAS28 - CRP at Week 12 was - 2.00 [ - 2.43, - 1.58] points compared to - 1.65 [ - 2.07, - 1.23] points in placebo recipients (n=26), (LS Mean Difference = - 0.35, p=0.2140) 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis includes all pa tie nts having reached Week 12, and follow - up to Week 24 is ongoing ; DAS28 - CRP = Disease Activity Score of 28 Joints Using C - reactive Protein; SC = Subcutaneous; LS = Least Squares; CI = Confidence Interval 0 2 4 6 8 10 12 Study Week -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 D A S 2 8 - C R P C h a n g e f r o m B a s e l i n e ( ' S E ) Cohort 1 & 2 DAS28-CRP Change from Baseline Placebo (n=4) 2mg/kg q2wk (n=6) 5mg/kg q2wk (n=6) DAS28 - CRP Mean Change from Baseline (SE) 0 2 4 6 8 10 12 Study Week -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 D A S 2 8 - C R P C h a n g e f r o m B a s e l i n e ( ' S E ) Cohort 3 DAS28-CRP Change from Baseline 5mg/kg qwk (n=27) 5mg/kg q2wk (n=25) Placebo (n=26) DAS28 - CRP LS Mean Change from Baseline (SE)

DAS28 - CRP Scores Over Time (Cohort 3) 1 23 DAS28 - CRP Score Through Week 24 DAS28 - CRP LS Mean Change from Baseline Through Week 24 Patients Achieving DAS28 Low Disease Activity or Remission 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis include s a ll patients having reached Week 12, and follow - up to Week 24 is ongoing ; DAS28 - CRP = Disease Activity Score of 28 Joints Using C - reactive Protein; Low Disease Activity = patients achieving DAS28 - CRP lo w disease activity (≥2.6 and < 3.2); Remission = patients achieving DAS28 - CRP remission (< 2.6) Percentage of Patients 0 2 4 8 12 14 16 20 24 Study Week 2.5 3 3.5 4 4.5 5 5.5 6 6.5 D A S 2 8 - C R P ( ' S E ) Cohort 3 DAS28-CRP P r i m a r y E n d p o i n t 5mg/kg qwk 5mg/kg q2wk Placebo DAS28 - CRP (SE) 0 2 4 8 12 14 16 20 24 Study Week -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 0 0.5 C h a n g e F r o m B a s e l i n e i n D A S 2 8 - C R P ( ' S E ) Cohort 3 Change From Baseline in DAS28-CRP P r i m a r y E n d p o i n t 5mg/kg qwk 5mg/kg q2wk Placebo Change from Baseline in DAS28 - CRP (SE) Primary Endpoint I Patients: 78 78 78 78 78 67 56 40 26 Patients: 78 78 78 78 78 67 56 40 26 Patients: 78 78 78 78 78 67 56 40 26 On Treatment Washout On Treatment Washout On Treatment Washout Primary Analysis I Primary Analysis I

ACR Responders Over Time (Cohort 3) 1 24 ACR20 Patients: 78 78 78 78 78 67 56 40 2 6 ACR50 ACR70 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis includes all patients having reached Week 12, and follow - up to Week 2 4 is ongoing ; ACR20 = a composite measure defined as an improvement of 20% in the number of tender and swollen joints and a 20% improvement in three of the following five criteria: patient global assessment, physician global assessment, functional ability measure [most often Health Assessment Questionnaire (HAQ)], visual analog pain scale, and eryt hro cyte sedimentation rate or C - reactive protein (CRP); ACR50 and ACR70 = the same instruments as ACR20 with improvement levels defined as 50% and 70%, respectively, versus 20% for ACR20. Patients: 78 78 78 78 78 67 56 40 2 6 Patients: 78 78 78 78 78 67 56 40 2 6 0 2 4 8 12 14 16 20 24 Study Week 0 10 20 30 40 50 60 70 80 90 100 P e r c e n t a g e A C R 5 0 R e s p o n d e r s Cohort 3 ACR50 Responders Over Time P r i m a r y E n d p o i n t 5mg/kg qwk 5mg/kg q2wk Placebo Primary Analysis I Percentage ACR50 Responders 0 2 4 8 12 14 16 20 24 Study Week 0 10 20 30 40 50 60 70 80 90 100 P e r c e n t a g e A C R 2 0 R e s p o n d e r s Cohort 3 ACR20 Responders Over Time P r i m a r y E n d p o i n t 5mg/kg qwk 5mg/kg q2wk Placebo Primary Analysis I Percentage ACR20 Responders Primary Analysis I Percentage ACR70 Responders On Treatment Washout On Treatment Washout On Treatment Washout

25 Abiprubart Significantly Reduced Disease - Related Inflammatory Markers (Cohort 3) 1 Rheumatoid Factor Geometric Mean Ratio to Baseline C - Reactive Protein Geometric Mean Ratio to Baseline Patients: 78 78 78 78 78 67 56 40 26 1) Modified Intention to Treat ( mITT ) analysis population (all randomized subjects who received at least one dose of study drug and had a baseline assessment and at least one post - baseline assessment for the primary efficacy endpoint); the Phase 2 study of abiprubart in rheumatoid arthritis is ongoing, this topline analysis includes all pa tie nts having reached Week 12, and follow - up to Week 24 is ongoing On Treatment Washout RF Ratio to Baseline Patients: 78 78 78 78 78 67 56 40 26 On Treatment Washout CRP Ratio to Baseline Primary Analysis I Primary Analysis I

Abiprubart was Well - Tolerated in Phase 2 RA Trial (Cohort 3 Data) 1 26 1) Safety Population: All randomized subjects who received at least one dose of study drug; 2) all categories are represented in percentages; 3 ) Defined as any event not present before exposure to study drug or any event already present that worsens in either intensity or frequency after exposure to study drug during treatment period; 4 ) Definitely related or possibly related, as assessed by the investigator; 5 ) Each subject has only been represented with the maximum severity; 5) Monaural deafness at Week 12, not related, resolved with pulse - dose steroids Category 2 Abiprubart 5mg/kg SC qwk (n=27) Abiprubart 5mg/kg SC q2wk (n=25) Placebo (n=26) Treatment Emergent Adverse Events (TEAEs) 3 48.1 (n=13) 28.0 (n=7) 30.8 (n=8) Drug Related TEAE 4 7.4 (n=2) 8.0 (n=2) 7.7 (n=2) TEAEs by Maximum severity 5 48.1 (n=13) 28.0 (n=7) 30.8 (n=8) Mild 33.3 (n=9) 16.0 (n=4) 15.4 (n=4) Moderate 14.8 (n=4) 12.0 (n=3) 15.4 (n=4) Severe 0 0 0 Potentially Life Threatening 0 0 0 Fatal 0 0 0 Serious TEAEs (SAE) 3.7 (n=1) 5 0 0 Drug - Related SAEs 3 0 0 0 TEAEs Leading to Death 0 0 0 TEAEs Leading to Dose Interruption 3.7 (n=1) 0 3.8 (n=1) TEAEs Leading to Treatment Discontinuation 0 0 0 TEAEs of Special Interest 0 4.0 (n=1) 0 Injection Site Reaction 3.7 (n=1) 4.0 (n=1) 0

Modeling data 3 place 400 mg q4wk dose level ( Cohort 4) intermediate between 2 mg/kg q2wk and 5 mg/kg q2wk PK - Modeling and Dose Simulations for Abiprubart Phase 2 RA Study 27 Complete RO & TDAR Suppression 2 1) The Cohort 4 KPL - 404 400mg SC q4wk group includes a 600mg loading dose on Day 1; 2) Serum concentration predicted based on Ph ase 1 data; 3) PK model generated based on PK data from Cohorts 1 - 3 of the abiprubart Phase 2 trial in Rheumatoid Arthritis as well as Phase 1 data from healthy v olunteers RO = receptor occupancy; TDAR = T - Cell Dependent Antibody Response 1

Potential for Evaluation of Abiprubart in a Range of Autoimmune Diseases CD40/CD154 interaction has been implicated in a number of devastating diseases Sources: 2019 numbers: https://unos.org/data/transplant - trends/; Hunter et al. Prevalence of rheumatoid arthritis in the United States adult population in healthcare claims databases, 2004 - 2014; Rheumatol Int. 2017 Sep;37(9):1551 - 1557; Overall Prevalence: Maciel et al, Arthritis Care Res (Hoboken) 2017; Qin et al, Ann Rheum Dis 2015; UpToDate; Baldini et al. Prevalence of Severe Extra - Glandular Manifestations in a Large Cohort of Patients with Primary Sjögren’s Syndrome; 2012 ACR/ARHP Annual Meeting, ABSTRACT NUMBER: 2185; Wallin et al. The prevalence of MS in the United States A population - based estimate using health claims data, Neurology, March 5, 2019; Somers et al.; Prevalenc e of Systemic Lupus Erythematosus in the United States: Preliminary Estimates from a Meta - Analysis of the Centers for Disease Co ntrol and Prevention Lupus Registries; 2019 ACR/ARP Annual Meeting ABSTRACT NUMBER: 2886; Garg et al. JAMA Dermatol. 2017;153(8):760 - 764. doi:10.1001/jamad ermatol.2017.0201 Sex - and Age - Adjusted Population Analysis of Prevalence Estimates for Hidradenitis Suppurativa in the United S tates; MayoClinic.org; Yale J Biol Med. 2013 Jun; 86(2): 255 – 260. N Engl J Med 2016;375:2570 - 81; https://www.diabetesresearch.org/diabe tes - statistics; Nephcure.org; Kitiyakara C, Eggers P, Kopp JB. Twenty - one - year trend in ESRD due to focal segmental glomerulosclerosis in the United States. Am J Kidney Dis. 2004 Nov;44(5):815 - 25; Rachakonda et al. J Am Acad Dermatol . 2014 Mar;70(3):512 - 6. doi : 10.1016/j.jaad.2013.11.013. Epub 2014 Jan 2. Psoriasis prevalence among adults in the United States; Yeung et al. Psoriasis severity and the prevalence of maj or medical co - morbidities: a population - based study; JAMA Dermatol. 2013 Oct 1; 149(10): 1173 – 1179; Hoover et al. Kidney Int. 2016 Sep; 90(3): 487 – 492. Insights into the Epidemiology and Management of Lupus Nephritis from the U.S. Rheumatologist’s Perspective. 0 200 400 600 800 Focal Segmental Glomerulosclerosis Kidney Transplant Lupus Nephritis * Hidradenitis Suppurativa * Sjogren’s Syndrome * Systemic Lupus Erythematosus * Rheumatoid Arthritis Multiple Sclerosis Type 1 Diabetes * Addressable US Prevalence (in thousands) Addressable US Prevalence (in thousands) Immune Thrombocytopenic Purpura * Kidney Transplant Myasthenia Gravis Sjogren’s Syndrome * Systemic Lupus Erythematosus Psoriasis Graves’ Disease Rheumatoid Arthritis * Multiple Sclerosis * 0 200 400 600 800 Indications with Published Data Indications with Pending Data & Trials Ongoing *Indications evaluated with subcutaneous administration • Robust d ata or proof - of - concept supporting mechanism • Differentiation vs. c ompetitors • Commercial a ttractiveness INDICATION SELECTION CRITERIA 28

Financials Third Quarter 2023

Third Quarter 2023 Financial Results 30 Income Statement Three Months Ended September 30, 2023 2022 Product Revenue $64.8M $33.4M License and Collaboration Revenue $2.2M $65.7M Total Revenue $67.0M $99.1M Cost of Goods Sold $9.1M $6.9M Collaboration Expenses 1 $17.3M $4.6M Research and Development $17.1M $16.5M Selling, General and Administrative $34.5M $24.7M Total Operating Expenses $78.0M $52.7M Income Tax Benefit (Provision) $(5.4M) $177.4M Net Income (Loss) $(13.9M) $224.1M Cash reserves of $206.3M 3 expected to fund current operating plan into at least 2027 1) Subject to the terms of the definitive agreements between Kiniksa and Regeneron; 50% of ARCALYST Collaboration Operating Prof it plus 50% of ARCALYST Licensing Proceeds; 2) Profit Split - Eligible Cost of Goods Sold = total cost of goods sold - amortization of Regeneron milestone payment 3) As used herein the term, "Cash Reserves" means our cash, cash equivalents, and short - term investments (unaudited) as of Decem ber 31, 2023 RP = Recurrent Pericarditis, CAPS = Cryopyrin - Associated Periodic Syndromes, DIRA = Deficiency of Interleukin - 1 Receptor Antagon ist Collaboration Expenses 1 Three Months Ended September 30, 2023 2022 ARCALYST Net Sales (RP + CAPS + DIRA) $ 64.8 M $33.4M Profit Split - Eligible Cost of Goods Sold 2 ($8.8M) ($6.7M) Commercial, Marketing, Regulatory and Other Expenses ($ 21.4 M) ($17.5M) ARCALYST Collaboration Operating Profit $ 34.6 M $9.2M ARCALYST Licensing Proceeds $0.0M $0.0M Collaboration Expenses 1 $ 17.3 M $4.6M Balance Sheet September 30, 2023 December 31, 2022 Cash, Cash Equivalents and Short - term Investments $201.1M $190.6M

Appendix ARCALYST (rilonacept)

Role of IL - 1α and IL - 1β in the Autoinflammatory Cycle of Recurrent Pericarditis The Autoinflammatory Cycle of Recurrent Pericarditis: Tissue damage caused by IL - 1α and IL - 1β in the pericardium stimulates additional IL - 1α and IL - 1β, thereby creating a cycle of perpetual pericardial inflammation CRP, C - reactive protein; DAMPs, damage - associated molecular patterns; IL, interleukin; PAMPs, pathogen - associated molecular patterns; WBC, white blood cell. In addition to inflammatory cytokines such as IL - 6, promotion and progression of the inflammatory process in pericarditis is due to IL - 1α and IL - 1β 32

RHAPSODY Design Screening Period Run - In Period a (12 - week) Double - Blind, Placebo - Controlled, Randomized - Withdrawal (RW) Period (Event Driven) Long - Term Extension (LTE) (up to 24 months) Loading Dose 320 mg SC Randomization 1:1 Primary Efficacy Endpoint Time - to - First - Adjudicated Pericarditis - Recurrence End of Treatment End of Study Tapering of background pericarditis medications to monotherapy rilonacept Blinded Rilonacept 160 mg SC weekly Blinded Placebo SC weekly Open - Label Rilonacept 160 mg SC weekly Blinded Rilonacept 160 mg SC weekly a The duration of the run - in period was concealed from patients, so that they were blinded to the timing of randomization b For each patient in the LTE , a decision was made 18 months after the most recent pericarditis recurrence (Qualifying or RW period) based on clinical status and one of the following actions was taken at the investigator’s discretion: • Continue rilonacept on - study OR • Suspend rilonacept treatment and remain on - study for observation (rilonacept rescue for recurrence allowed) OR • Discontinue the LTE completely (no further observation) Study Exit Continued Open - Label Rilonacept Off - treatment Observation 18 months after the most recent pericarditis event (qualifying or RW period) b Median rilonacept treatment duration prior to the LTE (RI+RW) was 9 months (range, 3 - 14) Event - Driven Pivotal Study Adapted from: Imazio M, Klein AL, et al. Prolonged Rilonacept Treatment in Rhapsody Long - term Extension Provided Persistent Reduction of Pericarditis Recurrence Risk. Poster 2223 (Presented at AHA Scientific Sessions 2022) After closure of event - driven RW period, 15 patients still in RI transitioned directly to LTE instead of being randomized 33

RHAPSODY Long - Term Extension Data Demonstrated Rilonacept Treatment Beyond 18 months Resulted in Continued Treatment Response 1 1) Imazio M, Klein AL, et al. Prolonged Rilonacept Treatment in Rhapsody Long - term Extension Provided Persistent Reduction of Pericarditi s Recurrence Risk. Poster 2223 (Presented at AHA Scientific Sessions 2022) 34

Appendix Out - Licensing Agreements

Out - Licensing Agreements 36 Partnership with Huadong Medicine Gives Kiniksa Opportunity to Expand Footprint into Asia Pacific Region (Excluding Japan) • In February 2022, Kiniksa announced a strategic collaboration with Huadong to develop and commercialize ARCALYST and mavrilim uma b in Greater China, South Korea, Australia and 18 other countries, excluding Japan • Kiniksa received a $22M upfront payment and is eligible to receive up to approximately $640M in specified development, regula tor y and sales - based milestone along with tiered royalty payments • Collaboration provided non - dilutive capital, cost - sharing, and additional resources to help accelerate development and commercia lization efforts License Agreement with Roche Genentech for Global Rights to Develop and Commercialize Vixarelimab • Kiniksa has received $100 million in upfront and near - term payments: • $80 million, which was received following the transaction’s closing in Q3 2022 • $20 million, which was received following Kiniksa's last delivery of certain drug supplies to Genentech in Q1 2023 • Kiniksa is eligible to receive up to approximately $600 million in certain clinical, regulatory, and sales - based milestones, bef ore fulfilling upstream financial obligations, of which approximately $585 million remains • Kiniksa is also eligible to receive royalties on annual net sales ranging from low - double digits to mid - teens, before fulfilling upstream financial obligations • Proceeds from the transaction to help grow cardiovascular franchise and build autoimmune franchise

Appendix Abiprubart

Abiprubart Does Not Cause Platelet Activation or Aggregation in vitro 38 • At least three first - generation IgG1 anti - CD154 mAbs * were associated with thromboembolic events in humans and NHPs 1 • Mechanism: Activation of platelets through cross - linking mediated by IgG - Fc/FcyRIIa interaction • Platelet activation observed in vivo with anti - CD154 mAbs with active Fc region • Platelet activation in vitro by anti - CD40 mAbs requires presence of sCD154 and active Fc region • Absence of an active Fc - region prevents platelet activation 1,2 Abiprubart Alone and in Combination with sCD154 does not increase Platelet Aggregation Amplitude (%) *ruplizumab/hu5c8, toralizumab/IDEC - 131, ABI793 Sources: 1) Law & Grewal, Advances in Experimental Medicine and Biology, vol 647. Springer; 2) Shock et al., Arthritis Resear ch & Therapy 17, Article Number: 234 (2015); 3) KNSA in - house data Abiprubart did not cause upregulation of the cell - surface platelet activation marker CD62P Abiprubart did not induce platelet aggregation in the presence (or absence) of soluble CD154 3 Positive controls: • G28.5: anti - CD40 mAb – causes sCD40L - dependent platelet activation (Langer et al., Thromb Haemost 2005; 93(06): 1137 - 1146) • Anti - CD9: mAb – causes sCD40L - independent platelet activation • IV.3 - anti - FcyRIIa antibody Abiprubart Alone and in Combination with sCD154 does not increase CD62P Expression on the Platelet Surface

Abiprubart Does Not Reduce B cell Numbers, Activate B Cells, or Induce B Cell Proliferation in vitro 39 * Marken et al, Arthritis Res Ther . 2021 Jan 21;23(1):36. doi : 10.1186/s13075 - 021 - 02425 - x. Abiprubart does not induce B cell proliferation in vitro Abiprubart does not induce B cell activation Abiprubart does not reduce B cell numbers in activated PBMCs in vitro PBMCs were cultured in the presence of 10 μg/ml IgG4 isotype control or anti - CD40 Abs Abiprubart, or the agonistic aCD40 mAb, G28 - 5 (16 – 18 h of cell culture) PBMCs were labeled with a cell proliferation tracker dye (Tag - it Violet) and cultured for 5 days in the presence of 10 μg/ml IgG4 isotype control Ab or anti - CD40 Abs — Abiprubart and G28 - 5. Cells were left untreated (media control) or stimulated with anti - CD3/CD28 cross - linking reagent ImmunoCult (IC) G28.5: agonistic aCD40 mAb PBMCs were cultured in the presence of 10 μg/ml IgG4 isotype control or anti - CD40 Abs Abiprubart, or G28 - 5 (16 – 18 h of cell culture). Cells were left unstimulated (media control) or stimulated with CD3/CD28 cross - linker IC or F(ab′)2 goat anti - human IgM (anti - IgM)

Abiprubart Demonstrated Prolonged Suppression of TDAR Response in a Non - Human Primate Model Source: Muralidharan et al. Preclinical immunopharmacologic assessment of KPL - 404, a novel, humanized, non - depleting antagonistic anti - CD40 monoclonal antibody. J Pharmacol Exp Ther . 2022, 381(1):12 - 21 TDAR = T - cell dependent antibody response; KLH = keyhole limpet hemocyanin Mean Abiprubart PK (Intravenous Dosing) Mean Abiprubart Receptor Occupancy (RO) Mean KLH IgG Showed linear pharmacokinetic profile with low variability between non - human primate subjects (n=7) Abiprubart achieved 100% receptor occupancy for 2 weeks in all animals at 5mg/kg and 4 weeks in all animals at 10mg/kg Complete suppression of primary T - cell dependent antigen response correlated with 100% receptor occupancy 40

Final Data from Abiprubart Single - Ascending - Dose Phase 1 Study Pharmacokinetic profiles for abiprubart 41 Source : Samant M, Ziemniak J, Paolini JF. First - in - Human Phase 1 Randomized Trial with the Anti - CD40 Monoclonal Antibody KPL - 404: Safety, Tolerability, Re ceptor Occupancy, and Suppression of T - Cell - Dependent Antibody Response. J Pharmacol Exp Ther . 2023 Dec;387(3):306 - 314. S D = standard deviation (upward bars depicted); IV = intravenous; SC = subcutaneous; LLOQ = lower limit of quantitation; ADA = an ti - drug antibody LLOQ Visit Day Abiprubart Serum Concentration (µg/mL) Geometric mean ц SD Complete RO First Detected IgG ADA: 0.03 mg/kg IV 0.3 mg/kg IV 1 mg/kg IV 3 mg/kg IV 10 mg/kg IV 1 mg/kg SC 5 mg/kg SC

Final Data from Abiprubart Single - Ascending - Dose Phase 1 Study T - Cell Dependent Antibody Response (TDAR) for KLH antigen challenge KLH - Specific IgG Level (units/mL) Mean ± SE Source: Samant M, Ziemniak J, Paolini JF. First - in - Human Phase 1 Randomized Trial with the Anti - CD40 Monoclonal Antibody KPL - 404: Safety, Tolerability, Re ceptor Occupancy, and Suppression of T - Cell - Dependent Antibody Response. J Pharmacol Exp Ther . 2023 Dec;387(3):306 - 314. KLH = keyhole limpet hemocyanin 42 1 mg/kg IV 3 mg/kg IV 10 mg/kg IV 1 mg/kg SC 5 mg/kg SC Pooled placebo IV Pooled placebo SC Primary KLH Challenge Secondary KLH Challenge* *Only IV cohorts were rechallenged with KLH on day 29

Corporate Presentation JANUARY 2024

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |