false12-31333-2559080001756701LNKB00017567012023-11-302023-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 30, 2023

LINKBANCORP, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Pennsylvania

|

001-41505

|

82-5130531

|

|

(State or Other Jurisdiction)

|

(Commission File No.)

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

Identification No.)

|

| |

|

|

|

1250 Camp Hill Bypass, Suite 202, Camp Hill, Pennsylvania

|

17011

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (855) 569-2265

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01

|

|

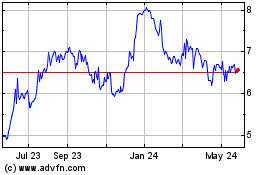

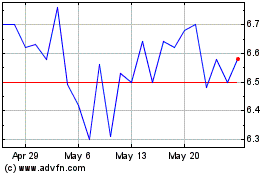

LNKB

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.01. |

Completion of Acquisition or Disposition of Assets.

|

Effective on November 30, 2023, LINKBANCORP, Inc., a Pennsylvania corporation (“LINK”), completed its previously announced combination

with Partners Bancorp, a Maryland corporation (“Partners”), pursuant to the Agreement and Plan of Merger, dated February 22, 2023, by and between LINK and Partners (the “Merger Agreement”). At the closing, Partners merged with and into LINK, with

LINK as the surviving entity (the “Merger”).

On November 30, 2023, immediately following the Merger, The

Bank of Delmarva, a Delaware chartered bank and a wholly-owned direct subsidiary of Partners (“TBOD”), merged with and into LINKBANK, a Pennsylvania bank and a

wholly-owned subsidiary of LINK (“LINKBANK”), with LINKBANK as the surviving bank (the “TBOD Bank Merger”). On November 30, 2023, immediately following the

TBOD Bank Merger, Virginia Partners Bank, a Virginia chartered bank and a wholly-owned direct subsidiary of Partners (“VPB”), merged with and into LINKBANK, with LINKBANK as the surviving bank (the “VPB Bank Merger,” and, together with the Merger and the TBOD Bank Merger, the “Transaction”).

Merger Consideration

Upon the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each

share of common stock, par value $0.01 per share, of Partners (“Partners Common Stock”) outstanding immediately prior to the Effective Time, other than certain shares held by Partners or LINK, was converted into the right to receive 1.150 shares (the

“Exchange Ratio”) of common stock, par value $0.01 per share, of LINK (“LINK Common Stock” and such consideration, the “Merger Consideration”). Holders of Partners Common Stock will receive cash in lieu of fractional shares of LINK Common Stock.

Treatment of Partners Equity Awards

Pursuant to the terms of the Merger Agreement, at the Effective Time, each

outstanding option to purchase shares of Partners Common Stock (each, a “Partners stock option”) granted under the Partners Bancorp 2021 Incentive Stock Plan,

Virginia Partners Bank 2015 Incentive Stock Option Plan, Delmar Bancorp 2014 Stock Plan, Virginia Partners Bank 2008 Incentive Stock Option Plan, Liberty Bell Bank 2004 Incentive Stock Option Plan and Liberty Bell

Bank 2004 Non-Qualified Stock Option Plan (the “Partners Plans”) was converted into an option to purchase a number of shares of LINK Common Stock equal to the

product of (x) the number of shares of Partners Common Stock subject to such Partners stock option immediately prior to the Effective Time and (y) the Exchange Ratio, at an exercise price per share (rounded to the nearest whole cent) equal to

(A) the exercise price per share of Partners Common Stock of such Partners stock option immediately prior to the Effective Time divided by (B) the Exchange Ratio. Each Partners stock option will continue to be governed by the same terms and

conditions (including vesting and exercisability terms) as were applicable to such Partners stock option immediately prior to the Effective Time.

Pursuant to the terms of the Merger Agreement, at the Effective Time, all Partners restricted stock awards granted under the Partners Plans which were outstanding on February 22, 2023 and remained outstanding as of the Effective Time accelerated in full and fully vested immediately prior to the Effective Time and

were converted into the right to receive the Merger Consideration, in accordance with the Exchange Ratio, less applicable withholding taxes. All Partners restricted stock

awards that were granted after February 22, 2023 and which were outstanding as of the Effective Time were converted into Merger Consideration on the same terms as, and were treated in the same manner as, all other shares of Partners Common Stock,

except that such shares will remain subject to the same restrictions as to transferability and forfeiture set forth in the applicable award agreement.

The foregoing description of the Transaction and the Merger Agreement does not purport to be complete and is qualified in its entirety by

reference to the full text of the Merger Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of Registrant

|

In connection with the Transaction, at the Effective Time, LINK assumed Partners’ obligations with respect to (i) $17.8 million aggregate

principal amount of 6.000% fixed-to-floating rate subordinated notes due July 1, 2030 (the “2030 Notes”) and (ii) $4.5 million aggregate principal amount of a subordinated term loan, with an interest rate of 6.875% per annum, due April 1, 2028.

The agreements pursuant to which the 2030 Notes were issued or assumed have not been filed herewith pursuant to Item 601(b)(4)(v) of

Regulation S-K under the Securities Act of 1933, as amended. LINK agrees to furnish a copy of such agreements to the Securities and Exchange Commission (the “Commission”) upon request.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Directors

In accordance with the terms of the Merger Agreement and the Bylaws Amendment (as defined under Item 5.03 below), as of the Effective

Time, the number of directors that comprise the full board of directors of LINK (the “Board”) was increased to twenty-two (22), of which (i) twelve (12) were directors of

LINK immediately prior to the Effective Time (the “LINK Designated Directors”), as determined by LINK, and (ii) ten (10) were directors of Partners immediately prior to the Effective Time (the “Partners Designated Directors”), as determined by

Partners.

Resignation of Directors

In connection with the Transaction, at the Effective Time, Brent Smith (the “Resigning Director”) resigned as a member of the Board. The

resignation of the Resigning Director was not the result, in whole or in part, of any disagreement with LINK or LINK’s management.

Continued Service of Directors; Election of Directors

The twelve LINK Designated Directors that continue to serve on the Board, in each case effective from and after the Effective Time, are

as follows: Andrew Samuel, Jennifer Delaye, Anson Flake, George Parmer, Debra Pierson, Diane Poillon, William Pommerening, Joseph C. Michetti, Jr., Kristen Snyder, David Koppenhaver, Steven Tressler, and William Jones.

The ten Partners Designated Directors that were appointed by the Board to fill the vacancies resulting from the resignation referred to

above and the increase in the size of the Board to twenty-two (22) as of the Effective Time, in each case effective from and after the Effective Time, are as follows: Mona D. Albertine, John W. Breda, Michael W. Clark, David Doane, Lloyd B. Harrison,

III, Kenneth R. Lehman, George P. Snead, James A. Tamburro, Jeffrey F. Turner, and Robert C. Wheatley (collectively, the “New Directors”).

Pursuant to the Merger Agreement and the Bylaws Amendment (as defined under Item 5.03 below), effective as of the Effective Time, Mr.

Turner, the Chairman of the Board of Partners prior to the Effective Time, was appointed Vice Chairman of LINK.

Other than the Merger Agreement and, in the case of Messrs. Harrison and Breda, certain agreements as described below, there are no

arrangements between the New Directors and any other person pursuant to which the New

Directors were selected as directors. There are no transactions in which any New Director has an interest requiring disclosure under Item

404(a) of Regulation S-K.

Biographical information related to the New Directors, other than for David Doane, can be found under the heading “Directors, Executive

Officers and Corporate Governance” under Item 10 in Partners’ Annual Report on Form 10-K filed with the Commission on March 29, 2023, which is incorporated herein by reference. Biographical information for David Doane can be found in Partners’

Current Report on Form 8-K filed with the Commission on November 8, 2023, which is incorporated herein by reference.

Board Committee Assignments after the Transaction

The committees of the Board are comprised of the following members, in each case effective as of the Effective Time:

|

Audit Committee

|

|

Nominating & Corporate Governance Committee

|

|

William Jones

|

Chair

|

|

David Koppenhaver

|

Chair

|

|

David Doane

|

|

|

George Snead

|

|

|

Kristen Snyder

|

|

|

Debra Pierson

|

|

|

Anson Flake

|

|

|

Jeffrey Turner

|

|

|

Robert Wheatley

|

|

|

George Parmer

|

|

| |

|

|

|

|

|

Compensation Committee

|

|

Enterprise Risk Management Committee

|

|

George Parmer

|

Chair

|

|

William Pommerening

|

Chair

|

|

Debra Pierson

|

|

|

Anson Flake

|

|

|

Steven Tressler

|

|

|

Andrew Samuel

|

|

|

Kenneth Lehman

|

|

|

Kristen Snyder

|

|

|

Mona Albertine

|

|

|

Michael Clarke

|

|

Director Compensation

Each New Director (other than Mr. Breda, who will be compensated as an employee) will be compensated for such service in accordance with

LINK’s non-employee director compensation program on the same basis as other non-employee directors, as described under “Director Compensation” in LINK’s 2023 Proxy Statement filed with the Commission on April 18, 2023.

Certain Agreements

In connection with the Transaction, Mr. Breda, was appointed as a Director of LINK and Chief Executive Officer, Delmarva Market. Mr. Breda entered into a new employment agreement with LINK and LINKBANK (the “Breda Employment Agreement”). Additionally, in connection with the Transaction, Mr. Harrison

entered into a separation and non-competition agreement with LINK (the “Harrison Agreement”). The Breda Employment Agreement and the Harrison Agreement, each of which became effective as of the Effective Time, have been previously described under the

section of the Joint Proxy Statement/Prospectus entitled “The Merger—Interests of Certain Partners Directors and Executive Officers in the Merger—Employment and Other Agreements,” which descriptions are incorporated herein by reference. The foregoing

descriptions of the Breda Employment Agreement and the Harrison Agreement do not purport to be complete and are qualified in its entirety to the full text of the Breda Employment Agreement and the Harrison Agreement, which are filed as Exhibits 10.1

and 10.2, respectively, to this Current Report and are incorporated herein by reference.

Amendment to the Supplemental Executive Retirement Plan Agreement with Andrew Samuel

Effective December 1, 2023, LINKBANK amended its Supplemental Executive Retirement Plan Agreement with Andrew Samuel, its Chief Executive

Officer, originally effective as of October 28, 2021, as amended (the “SERP”). The amendment to the SERP increases the annual normal retirement benefit payable to Mr. Samuel to $600,000. In addition, the amendment increases the benefit payable in

the event of the executive’s death prior to the commencement of benefit payments as set forth in the amendment.

The SERP was filed as an exhibit to the LINK’s Current Report on Form 8-K filed on November 3, 2021. The above description of the

amendment does not purport to be complete and is qualified in its entirety by reference to the amendment, attached as Exhibit 10.3 to this Current Report on Form

8-K.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

In connection with the Transaction and in accordance with the Merger Agreement, effective as of the Effective Time, the bylaws of LINK

were amended and restated to provide for certain arrangements related to the Board and the board of directors of LINK Bank (such amendment, the “Bylaws Amendment,” and LINK’s bylaws, as amended and restated in accordance with the Bylaws Amendment,

the “Amended and Restated Bylaws”). The Bylaws Amendment reflected in the Amended and Restated Bylaws has been previously described under the Section of the Joint Proxy

Statement/Prospectus entitled “The Merger—Governance of the Combined Company After the Merger—Boards of Directors and Committees of the Combined Company and the Combined Bank,” which description is incorporated herein by reference.

The foregoing summary and referenced description of the Bylaws Amendment and the Amended and Restated Bylaws do not purport to be

complete and are qualified in their entirety by reference to the full text of the Amended and Restated Bylaws, a copy of which is filed as Exhibit 3.1 to this Current Report and is incorporated herein by reference.

On December 1, 2023, LINK issued a press release announcing the completion of the Transaction. A copy of the press release is filed as

Exhibit 99.1 to this Current Report and is incorporated herein by reference.

At the Company's Special Meeting of Shareholders on June 22, 2023, the Company received shareholder approval of the amendment to the

Company's Articles of Incorporation as described in proposal 2 of the Company's joint proxy statement/prospectus, dated May 12, 2023. The Company filed articles of amendment to its Articles of Incorporation with the Secretary of the Commonwealth of

Pennsylvania which increased LINK’s authorized shares of common stock by 25 million to 50 million effective on November 21, 2023.

| Item 9.01. |

Financial Statements and Exhibits.

|

Financial statements of businesses acquired.

The financial statements of Partners required by Item 9.01(a) of Form 8-K will be filed by amendment to this Current

Report within 71 calendar days of the date on which this report is required to be filed.

Pro forma financial information.

The pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by amendment to this Current

Report within 71 calendar days of the date on which this report is required to be filed.

The following exhibits are filed as part of this Current Report:

|

Exhibit No.

|

Description of Filed Exhibit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, hereunto duly authorized.

| |

|

LINKBANCORP, INC.

|

| |

|

|

| |

|

|

| |

|

|

|

DATE: December 1, 2023

|

By:

|

/s/ Carl D. Lundblad

|

| |

|

Carl D. Lundblad

|

| |

|

President

|

| |

|

|

EXHIBIT 3.1

AMENDED AND RESTATED BYLAWS OF

LINKBANCORP, INC. ARTICLE I: OFFICES

Section 1.1 Registered Office. LINKBANCORP, Inc. (the “Corporation”) shall have and continuously maintain in the Commonwealth of Pennsylvania a registered office which may, but need not, be the same as

its place of business and at an address to be designated from time to time by the Board of Directors.

Section

1.3 Other Offices. The Corporation may also have offices at such other places as the Board of Directors may from time to time designate or the business of the Corporation may require.

ARTICLE II: SHAREHOLDERS’ MEETINGS

Section

2.1 Place of Meeting. All meetings of the shareholders shall be held at such time and place as may be fixed from time to time by the Board of Directors. The Board of Directors may, in its discretion, determine that the meeting may be held

solely by remote communication.

Section

2.2 Meetings of Shareholders by Remote Communication. If authorized by the Board of Directors, and subject to any guidelines and procedures adopted by the Board of Directors, shareholders not physically present at a meeting of shareholders

may participate in a meeting of shareholders by remote communication, and may be considered present in person and may vote at a meeting of shareholders held at a designated place or held solely by remote communication, subject to the conditions

imposed by applicable law.

Section 2.3 Annual Meeting. An annual meeting of shareholders, for the purpose of electing directors and transacting any other business as may be brought before the meeting, shall be held on such date and time as shall be fixed by

the Board of Directors and designated in the notice of the meeting.

Section

2.4 Special Shareholders’ Meetings. Special meetings of the shareholders may be called at any time by the Chairman of the Board of Directors, the Chief Executive Officer, the President, or a majority of the Board of Directors. At any time,

upon written request of any person who has called a special meeting, it shall be the duty of the Secretary to fix the time of the meeting which, if the meeting is called pursuant to a statutory right, shall be held not more than sixty (60) days after

the receipt of the request. If the Secretary neglects or refuses to fix the time of the meeting, the person or persons calling the meeting may do so.

Section

2.5 Shareholder Nominations and Proposals. (a) Except as otherwise provided by applicable statute or these Bylaws, the proposal of business to be considered by the shareholders may be made at an annual meeting of shareholders (i) by or at

the direction of the Board of Directors; (ii) pursuant to the Corporation’s notice of meeting (or any supplement thereto); or

(iii) by any shareholder of the Corporation who (A) is a shareholder of record at the time of giving of notice

provided for in subsection (b) of this Section 2.5 and will be such at the time of the meeting; (B) is entitled to vote at the meeting; and (C) complies with the notice and other procedures set forth in subsection (b) of this Section 2.5.

For business (including, but not limited to, director nominations) to be properly brought before an annual meeting

by a shareholder pursuant to clause (iii) of subsection (a) of this Section 2.5, the shareholder or shareholders of record intending to propose the business (the “proposing shareholder”) must have given written notice of the proposing shareholder’s nomination or proposal, either by personal delivery or by United States mail to the Secretary no earlier one hundred twenty (120)

calendar days and no later than ninety (90) calendar days prior to the first anniversary of the previous year’s annual meeting. If the Corporation did not hold an annual meeting the previous year or if the current year’s meeting is called for a date

that is not within thirty (30) days of the anniversary of the previous year’s annual meeting, notice must be received no later than ten (10) calendar days following the day on which public announcement of the date of the annual meeting is first made.

In no event will an adjournment or postponement of an annual meeting of shareholders begin a new time period for giving a proposing shareholder’s notice as provided above.

A proposing shareholder’s notice shall include as to each matter the proposing shareholder

proposes to bring before either an annual or special meeting:

|

(i)

|

name and address of the proposing shareholder;

|

|

(ii)

|

the class and number of shares of the Corporation held by the proposing shareholder;

|

|

(iii)

|

if the notice regards a nomination of a candidate for election as director: (A) the name, age, and business and residence address of the

candidate; (B) the principal occupation or employment of the candidate; and (C) the class and number of shares of the Corporation beneficially owned by the candidate; and

|

|

(iv)

|

if the notice regards a proposal other than a nomination of a candidate for election as director, a brief description of the business desired to

be brought before the meeting, and the material interest of the proposing shareholder in such proposal.

|

Section 2.6 Record Date for

Shareholder Action. The Board of Directors may fix a time, not more than ninety (90) days prior to the date of any meeting of shareholders, or the date fixed for the payment of any dividend or distribution, or the date for the allotment of

rights, or the date when any change or conversion or exchange of shares will be made or go into effect, as a record date for the determination of the shareholders entitled to notice of, and to vote at, any such meeting, or entitled to receive payment

of any such dividend or distribution, or to receive any such allotment of rights, or to exercise the rights in respect to any such change, conversion or exchange of shares. In such case, only such shareholders as shall be shareholders of record on

the date so fixed shall be entitled to notice of, or to vote at, such meeting or to receive payment of such dividend or to receive such allotment of rights or to exercise such rights, as the case may be, notwithstanding any transfer of any shares on

the books of the Corporation after any record date fixed as aforesaid. The Board of Directors may close the books of the Corporation against transfers of shares during the whole or any part of such period, and in such case written or printed notice

thereof shall be mailed at least ten (10) days before closing thereof to each shareholder of record at the address appearing on the records of the Corporation or supplied by him or her to the Corporation for the purpose of notice. While the stock

transfer books of the Corporation are closed, no transfer of shares shall be made thereon. If no record date is fixed by

the Board of Directors for the determination of shareholders entitled to receive notice of, and

vote at, a shareholders’ meeting, transferees of shares which are transferred on the books of the Corporation within ten (10) days next preceding the date of such meeting shall not be entitled to notice of or to vote at such meeting.

Section

2.7 Notice. Written or printed notice of any annual or special meeting of shareholders shall be given not less than ten (10) days before the date of the meeting, unless a greater period of notice is required by law. Such notice shall state:

|

(a)

|

the time and date of the meeting;

|

|

(b)

|

the place of the meeting (if any);

|

|

(c)

|

the means of any remote communication by which shareholders and proxy holders may be considered present and may vote at the meeting; and

|

|

(d)

|

the purpose or purposes for which the meeting is called if (i) the meeting is a special meeting or (ii) notice of the meeting’s purpose is

required by the Pennsylvania Business Corporation Law of 1988 (the “BCL”).

|

Upon the written request of any person entitled to call a special meeting to the Secretary at the

registered office of the Corporation, it shall be the duty of the Secretary to fix the date of the meeting not more than sixty (60) days after the receipt of the request and give notice thereof.

Notice as provided by this Section 2.7 or otherwise under the BCL shall be given to a

shareholder:

|

(a)

|

by first class or express mail (or by bulk mail with at least 20 days’ notice before the meeting), postage prepaid, or courier service, charges

prepaid, to the shareholder’s postal address appearing on the books of the Corporation; or

|

|

(b)

|

by email or other electronic communication to the number or address supplied by the shareholder to the Corporation for the purpose of notice.

|

Any person entitled to notice of a meeting may file a written waiver of notice with the Secretary

either before or after the time of the meeting. The participation or attendance at a meeting of a person entitled to notice constitutes waiver of notice, except where the person attends for the specific purpose of objecting to the lawfulness of the

convening of the meeting.

Section

2.8 Voting Lists. The officer or agent having charge of the share transfer records for shares of the Corporation shall prepare an alphabetical list of all shareholders entitled to notice of the meeting, with the address of and the number of

shares held by each shareholder. The list shall be produced and kept open at the time and place of the meeting and shall be subject to the inspection of any shareholder during the whole time of the meeting. The original share register or transfer

book, or a duplicate thereof kept in the Commonwealth of Pennsylvania, shall be prima facie evidence as to who are the shareholders entitled to examine the list or share register or transfer book or to vote at any meeting of shareholders.

Section

2.9 Quorum of Shareholders. The presence, in person or by proxy, of shareholders

entitled to cast at least a majority of the votes which all shareholders are entitled to cast

on the particular matter shall constitute a quorum for purposes of considering such matter, and unless otherwise provided by statute, the acts of such shareholders at a duly organized meeting shall be the acts of the shareholders. If, however, any

meeting of shareholders cannot be organized because of lack of a quorum, those present, in person or by proxy, shall have the power, except as otherwise provided by statute, to adjourn the meeting to such time and place as they may determine, without

notice other than an announcement at the meeting, until the requisite number of shareholders for a quorum shall be present, in person or by proxy, except that in the case of any meeting called for the election of directors, such meeting may be

adjourned only for periods not exceeding fifteen (15) days as the holders of a majority of the shares present, in person or by proxy, shall direct, and those who attend the second of such adjourned meetings, although less than a quorum, shall

nevertheless constitute a quorum for the purpose of electing directors. At any adjourned meeting at which a quorum shall be present or so represented, any business may be transacted which might have been transacted at the original meeting if a quorum

had been present. The shareholders present, in person or by proxy, at a duly organized meeting can continue to do business until adjournment, notwithstanding the withdrawal of enough shareholders to leave less than a quorum.

Section 2.10 Conduct of Meetings. The Board of Directors, as it shall deem appropriate, may adopt by resolution rules and regulations for the conduct of meetings of the shareholders. At every meeting of the shareholders, the

President, the Chief Executive Officer, or the Chairman of the Board of Directors, or in his or her absence or inability to act, a director or officer designated by the Board of Directors, shall serve as the presiding officer of the meeting. The

Secretary or, in his or her absence or inability to act, the person whom the presiding officer of the meeting shall appoint secretary of the meeting, shall act as secretary of the meeting and keep the minutes thereof.

The presiding officer shall determine the order of business and, in the absence of a rule

adopted by the Board of Directors, shall establish rules for the conduct of the meeting. The presiding officer shall announce the close of the polls for each matter voted upon at the meeting, after which no ballots, proxies, votes, changes, or

revocations will be accepted. Polls for all matters before the meeting will be deemed to be closed upon final adjournment of the meeting.

Section

2.11 Judge of Election. In advance of any meeting of shareholders, the Board of Directors may appoint judges of election, who need not be shareholders, to act at such meeting or any adjournment thereof. If judges of election are not so

appointed, the presiding officer of any such meeting may, and on the request of any shareholder or his proxy shall, make such appointment at the meeting. The number of judges shall be one (1) or three (3). No person who is a candidate for office

shall act as a judge. If there are three (3) judges of election, the decision, act, or certificate of a majority shall be the decision, act, or certificate of all.

Each judge of election shall determine the number of shares outstanding and the voting power of

each, the shares represented at the meeting, the existence of a quorum, the authenticity, validity, and effect of proxies, receive votes or ballots, hear and determine all challenges and questions in any way arising in connection with the right to

vote, count and tabulate all votes, determine the result, and do such acts as may be proper to conduct the election or vote with fairness to all shareholders. Each judge of election shall perform his or her duties impartially, in good faith, to the

best of his or her ability, and as expeditiously as is practical.

On request of the presiding officer or any shareholder or shareholders’ proxy, each judge shall

make a report in writing of any challenge or question or matter determined by such judge and execute a certificate of any fact found by him or her.

Section

2.12 Voting Of Shares. Except as may be otherwise provided by statute or by the Articles of Incorporation, at every shareholders meeting, every shareholder entitled to vote at the meeting shall have the right to one vote for every share

having voting power standing in his or her name on the books of the Corporation on the record date fixed for the meeting. No share shall be voted at any meeting if any installment is due and unpaid thereon.

Except to the extent provided otherwise by applicable law, the Articles of Incorporation, or

these Bylaws, when a quorum is present at any meeting, a majority of the votes cast shall decide any question brought before such meeting. A majority of the votes cast at a meeting of shareholders duly called and at which a quorum is present shall be

sufficient to elect a director. The shareholders of the Corporation shall not have the right to cumulate their votes for the election of directors of the Corporation.

Section 2.13 Voting by Proxy or Nominee. Every shareholder entitled to vote at a meeting of shareholders may authorize another person or persons to act for him by proxy. Every proxy shall be executed in writing by the shareholder or

his duly authorized attorney-in-fact and filed with the Secretary of the Corporation. A proxy, unless coupled with an interest, shall be revocable at will, notwithstanding any other agreement or any provision in the proxy to the contrary, but the

revocation of a proxy shall not be effective until notice thereof has been given to the Secretary of the Corporation. No unrevoked proxy shall be valid after eleven (11) months from the date of its execution, unless a longer time is expressly

provided therein, but in no event shall a proxy, unless coupled with an interest, be voted after three (3) years from the date of its execution. A proxy shall not be revoked by the death or incapacity of the maker, unless before the vote is counted

or the authority is exercised, written notice of such death or incapacity is given to the Secretary of the Corporation.

Section

2.14 Action by Shareholders Without a Meeting. Any action required or permitted to be taken at an annual or special meeting of the shareholders may be taken without a meeting if, prior or after the action, a consent or consents thereto are

signed by all of the shareholders who would be entitled to vote at a meeting for such purpose. The consent or consents shall be filed with the Secretary of the Corporation for inclusion with the records of meetings of shareholders of the Corporation.

ARTICLE III: DIRECTORS

Section

3.1 Powers. The business and affairs of the Corporation shall be managed by its Board of Directors, which may exercise all such powers of the Corporation and do all such lawful acts and things as are not by statute or by the Articles of

Incorporation or by these Bylaws directed or required to be exercised and done by the shareholders.

Section

3.2 Number of Directors. At any regular meeting or at any special meeting called for that purpose, a majority of the entire Board of Directors may establish, increase or decrease the number of directors; provided, that the number of

directors shall be not less than three (3) nor more than twenty-four (24). No decrease in the number of directors shall have the effect of shortening the term of any incumbent director.

Section

3.3 Term of Office. At the first annual meeting of shareholders and at each annual meeting thereafter, the holders of shares entitled to vote in the election of directors shall elect directors to hold office until the next succeeding annual

meeting and until his successor has been selected and qualified or until the director’s earlier death, resignation, or removal.

Section

3.4 Removal by Shareholders. Any or all of the directors may be removed from office at any time with cause by a vote of the shareholders entitled to elect them. If one or more directors are so removed at a meeting of shareholders, the

shareholders may elect new directors at the same meeting.

Section 3.5 Removal by the Board of Directors. The Board of Directors may declare vacant the office of a director who has been judicially declared of unsound mind or who has been convicted of an offense punishable by imprisonment for

a term of more than one (1) year or for any other proper cause which these Bylaws may specify or if, within sixty (60) days or such other time as these Bylaws may specify after notice of his or her selection, he or she does not accept the office

either in writing or by attending a meeting of the Board of Directors and fulfill such other requirements of qualification as these Bylaws may specify.

Section

3.6 Resignation. A director may resign at any time by giving notice in writing or by electronic transmission to the Corporation. A resignation is effective when the notice is received by the Corporation unless the notice specifies a future

date. Acceptance of the resignation shall not be required to make the resignation effective. The pending vacancy may be filled in accordance with Section 3.7 of these Bylaws before the effective date, but the successor shall not take office until the

effective date.

Section

3.7 Vacancies. A vacancy on the Board of Directors resulting from the removal of a director in accordance with Section 3.4 of these Bylaws may be filled by the shareholders at an annual or special meeting of shareholders. A director elected

by the shareholders to fill a vacancy which resulted from the removal of a director shall hold office for the remaining term of his or her predecessor and until his or her successor is elected and qualified.

A vacancy on the Board of Directors resulting from any cause other than an increase in the number

of directors or the removal of a director in accordance with Section 3.4 of these Bylaws may be filled by a majority of the remaining directors, whether or not sufficient to constitute a quorum. A vacancy on the Board of Directors resulting from an

increase in the number of directors may be filled by a majority of the entire Board of Directors. A director elected by the board of directors to fill a vacancy serves until the next annual meeting of shareholders and until his or her successor is

elected and qualified.

Section

3.8 Meetings of Directors. An annual meeting of directors shall be held immediately and without notice after and at the place of the annual meeting of shareholders. Other regular meetings of the directors may be held at such times and

places within or outside the Commonwealth of Pennsylvania as the directors may fix by resolution.

Special meetings of the Board of Directors may be called by the President, by the Chief Executive

Officer, by the Chairman of the Board of Directors, if any, by the Secretary, by any two directors, or by one director if there is only one director.

Section

3.9 Remote Communication. The Board of Directors may permit any or all directors to participate in any meeting by, or conduct the meeting through the use of, any means of communication by which all directors participating may simultaneously

hear each other during the meeting. A director participating in a meeting by this means is considered to be present in person at the meeting.

Section

3.10 Notice. Regular meetings of the Board of Directors may be held without notice of the date, time, place (if any), or purpose of the meeting. All special meetings of the Board of Directors shall be held upon not less than one (1) day’s

notice. Such notice shall state:

|

(a)

|

the time and date of the meeting;

|

|

(b)

|

the place of the meeting (if any); and

|

|

(c)

|

the means of any remote communication by which directors may participate at the meeting.

|

Notice as provided by this Section 3.10 shall be given to a director personally, by telephone or

voice mail, by first-class mail, by messenger or delivery service, or by electronic transmission.

A director entitled to notice of a meeting may deliver a waiver of notice to the Corporation in

writing or by electronic transmission either before or after the time of the meeting. A director’s participation or attendance at a meeting shall constitute a waiver of notice.

Section

3.11 Quorum of Directors. At all meetings of the Board of Directors, a majority of the directors shall constitute a quorum for the transaction of business, and the acts of a majority of the directors present at a meeting in person or by

conference telephone or similar communications equipment at which a quorum is present in person or by such communications equipment shall be the acts of the Board of Directors, except as may be otherwise specifically provided by statute or by the

Articles of Incorporation or by these Bylaws. If a quorum shall not be present in person or by communications equipment at any meeting of the directors, the directors present may adjourn the meeting from time to time, without notice other than

announcement at the meeting, until a quorum shall be present or as permitted herein.

Section

3.12 Compensation. Directors may receive a stated salary for their services or a fixed sum and expenses for attendance at regular and special meetings, or any combination of the foregoing as may be determined from time to time by resolution

of the Board of Directors, and nothing contained herein shall be construed to preclude any director from serving the Corporation in any other capacity and receiving compensation therefor.

Section

3.13 Action by Directors Without a Meeting. Any action required or permitted to be taken at a meeting of the Board of Directors or any committee thereof may be taken without a meeting if, before or after the action, a consent or consents in

writing or other record form is signed by, or email approval is received from, all of the directors in office, or all the committee members then appointed. The written consents must be filed with the minutes of the proceedings of the Board of

Directors.

Section

3.14 Committees of the Board of Directors. The Board of Directors, by resolution adopted by a majority, may designate one or more directors to constitute an Executive

Committee, an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, or

any other committee to serve at the pleasure of the Board and to exercise the authority of the Board of Directors to the extent provided in the resolution establishing the committee and permitted by law. A committee of the Board of Directors shall

not have the authority to:

|

(a)

|

submit to shareholders any action requiring the approval of shareholders under the BCL, the Articles of Incorporation, or these Bylaws;

|

|

(b)

|

create a vacancy, either by removing a director or increasing the number of directors, or fill a vacancy on the Board of Directors;

|

|

(c)

|

adopt, amend, or repeal any provision of these Bylaws;

|

|

(d)

|

amend or repeal any resolution of the Board of Directors that by its terms may only be amended or repealed by the Board of Directors; or

|

|

(e)

|

take action on matters to which exclusive authority is given to another committee by these Bylaws or resolution of the Board of Directors.

|

The designation of a committee of the Board of Directors and the delegation thereto of authority shall not operate to relieve

the Board of Directors, or any member thereof, of any responsibility imposed by law.

Section 3.16 Audit

Committee. The Board of Directors shall have the power and authority to appoint an Audit Committee, whose purpose and power shall be, to the extent permitted by law, to (a) retain, oversee and terminate, as necessary, the auditors of the

company; (b) oversee the company's accounting and financial reporting processes and the audit and preparation of the company's financial statements; (c) exercise such other powers and authority as are set forth in the charter of the Audit Committee;

and (d) exercise such other powers and authority as shall from time to time be assigned thereto by resolution of the Board of Directors.

Section 3.17 Board Composition; Chairman Position and Succession.

(a) For all purposes of this Section 3.17, unless specified otherwise, capitalized terms shall have the meanings ascribed to them in the Agreement and Plan of

Merger, dated as of February 22, 2023, by and between the Corporation and Partners Bancorp, as the same may be amended from time to time.

(b) The Board of Directors has resolved that, effective as of the Effective Time, (i) Mr. Joseph C. Michetti, Jr. shall continue to serve as Chairman of the

Board of Directors of the Corporation, and Mr. Jeffrey F. Turner shall become the Vice Chairman of the Board of Directors of the Corporation, and (ii) Mr. Turner shall be the successor to Mr. Michetti, Jr. as the Chairman of the Board of Directors of

the Corporation, with such succession to be effective September 18, 2024, or any such earlier date as of which Mr. Michetti, Jr. ceases for any reason to serve in the position of Chairman of the Board of Directors of the Corporation.

(c) Effective as of the Effective Time, the Board of Directors of the Corporation shall be comprised

of twenty-two (22) directors, of which twelve (12) shall be members of the Board of Directors of the Corporation as of immediately prior to the Effective

Time, designated by the Corporation (the “Continuing LINK Directors”), and ten (10) shall be members of the Board of Directors of Partners as of immediately prior to the Effective Time, designated by Partners (the “Continuing Partners Directors”).

Each director of the Corporation immediately after the Effective Time shall hold office until his or her successor is elected and qualified or otherwise in accordance with the articles of incorporation and bylaws of the Corporation.

(d) At the next two (2) annual meetings of shareholders of the Corporation after the Effective Time, each Continuing LINK Director and each Continuing

Partners Director shall be nominated to the board of directors of the Corporation each for a term of one (1) year and the Corporation shall recommend that its stockholders vote in favor of the election of each such nominee.

(e) This Section 3.17 shall remain in effect until the date that is two (2) years after the Effective Date (the “Expiration Date”), provided, however, that this Section 3.17 may be amended or

waived by the approval of at least eighty percent (80%) of the members of the Corporation’s Board of Directors then in office. In the event of any inconsistency between any provision of this Section 3.17 and any other provision of these Bylaws or the

Corporation’s other constituent documents, the provisions of this Section 3.17 shall control.

(f) From and after the Effective Time through the Expiration Date, no vacancy on the Board of Directors of the Corporation created by the cessation of service

of a director shall be filled by the applicable Board of Directors and the applicable Board of Directors shall not nominate any individual to fill such vacancy, unless (x) in the case of a vacancy created by the cessation of service of a Continuing

LINK Director, not less than a majority of the Continuing LINK Directors have approved the appointment or nomination (as applicable) of the individual appointed or nominated (as applicable) to fill such vacancy, in which case the Continuing Partners

Directors shall vote to approve the appointment or nomination (as applicable) of such individual, and (y) in the case of a vacancy created by the cessation of service of a Continuing Partners Director, not less than a majority of the Continuing

Partners Directors have approved the appointment or nomination (as applicable) of the individual appointed or nominated (as applicable) to fill such vacancy, in which case the Continuing LINK Directors shall vote to approve the appointment or

nomination (as applicable) of such individual; provided, that any such appointment or nomination pursuant to clause (x) or (y) shall be made in accordance with applicable law and the rules of the Nasdaq Stock Market (or other national securities

exchange on which the Corporation’s securities are listed). For purposes of this Section 3.17(f), the terms “Continuing LINK Directors” and “Continuing Partners Directors” shall mean, respectively, the directors of the Corporation and Partners who

were selected to be directors of the Corporation by the Corporation or Partners, as the case may be, as of the Effective Time, pursuant to the Merger Agreement, and any directors of the Corporation who were subsequently appointed or nominated and

elected to fill a vacancy created by the cessation of service of a Continuing LINK Director or a Continuing Partners Director, as applicable, pursuant to this Section 3.17(f).

ARTICLE IV: OFFICERS

Section

4.1 Positions and Election. The officers of the Corporation shall be elected by the Board of Directors and shall be a President, a Treasurer, and a Secretary. At its option, the Board of Directors may elect a Chairman of the Board of

Directors. The Board of Directors may also elect one or more Vice Presidents and such other officers and appoint such agents as it shall deem necessary, who shall hold their offices for such terms, have such authority and perform such duties as may

from time to time be prescribed by the Board of Directors. Any two (2) or more offices may be held by the same person.

Officers shall be elected annually at the meeting of the Board of Directors held after each

annual meeting of shareholders. Each officer shall serve until a successor is elected and qualified or until the death, resignation, or removal of that officer. Vacancies or new offices shall be filled at the next regular or special meeting of the

Board of Directors. Election or appointment of an officer or agent shall not of itself create contract rights. The compensation of all officers of the Corporation shall be fixed by the Board of Directors.

Section

4.2 Removal and Resignation. Any officer elected by the Board of Directors may be removed, with or without cause, at any regular or special meeting of the Board of Directors by the affirmative vote of the majority of the directors in

attendance where a quorum is present. Removal shall be without prejudice to the contract rights, if any, of the officer so removed.

Any officer may resign at any time by delivering notice in writing or by electronic

transmission to the Secretary of the Corporation. Resignation is effective when the notice is delivered unless the notice provides a later effective date. Any vacancies may be filled in accordance with Section

4.1 of these Bylaws.

Section

4.3 Powers and Duties of Officers. The powers and duties of the officers of the Corporation shall be as provided from time to time by resolution of the Board of Directors or by direction of an officer authorized by the Board of Directors to

prescribe the duties of other officers. In the absence of such resolution, the respective officers shall have the powers and shall discharge the duties customarily and usually held and performed by like officers of corporations similar in

organization and business purposes to the Corporation subject to the control of the Board of Directors.

Section

4.4 Authority to Execute Agreements. All agreements of the Corporation shall be executed on behalf of the Corporation by (a) the Chief Executive Officer; (b) the President; (c) such other officer or employee of the Corporation authorized in

writing by the Chief Executive Officer or the President, with such limitations or restrictions on such authority as the Chief Executive Officer or the President deems appropriate; or (d) such other person as may be authorized by the Board of

Directors.

ARTICLE V: INDEMNIFICATION

Section

5.1 Indemnification. (a) The Corporation shall indemnify any director, officer and/or employee, or any former director, officer and/or employee, who was or is a party to, or is

threatened to be made a party to, or who is called to be a witness in connection with, any

threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation) by reason of the fact that such person is or was a director, officer

and /or employee of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another Corporation, partnership, joint venture, trust or other enterprise, against expenses (including

attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in, or not opposed to,

the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction

or upon a plea of nolo contendere or its equivalent, shall not of itself create a presumption that the person did not act in good faith and in a manner which he reasonably believed to be in, or not opposed to, the best interests of the Corporation,

and, with respect to any criminal action or proceeding, had reasonable cause to believe that his conduct was unlawful.

(b) The Corporation shall indemnify any director, officer and/or employee, who was or is a party to, or is threatened by to be made a party to, or who is called as a witness in connection with any threatened, pending

or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer and/or employee or agent of another Corporation, partnership, joint venture,

trust or other enterprise against amounts paid in settlement and expenses (including attorney’s fees) actually and reasonably incurred by him in connection with the defense or settlement of, or serving as a witness in, such action or suit if he

acted in good faith and in a manner he reasonably believed to be in, or not opposed to, the best interests of the Corporation and except that no indemnification shall be made in respect of any such claim, issue or matter as to which such person

shall have been adjudged to be liable for misconduct in the performance of his duty to the Corporation.

(c) Except as may be otherwise ordered by a court, there shall be a presumption that any director, officer and/or employee is entitled to indemnification as provided in this Section 5.1 unless either a majority

of the directors who are not involved in such proceedings (the “disinterested directors”) or, if there are less than three (3) disinterested

directors, the holders of one-third of the outstanding shares of the Corporation determine that the person is not entitled to such presumption by certifying such determination in writing to the Secretary of the Corporation. In such event the

disinterested director(s) or, in the event of certification by shareholders, the Secretary of the Corporation shall request of independent counsel, who may be the outside general counsel of the Corporation, a written opinion as to whether or not

the parties involved are entitled to indemnification under this Section 5.1.

(d) Indemnification under this Article 5 shall not be made in any case where the act or failure to act giving rise to the claim for indemnification is determined by a court to have constituted willful misconduct

or recklessness.

Section 5.2 Advancement of Expenses. Expenses incurred in defending a civil or criminal action, suit or proceeding may be paid by the Corporation in advance of the final disposition of such action, suit or proceeding as

authorized in the manner provided under subsection (c) of Section 5.1 upon receipt of an undertaking by or on behalf of the director, officer and/or

employee to repay such amount if it shall ultimately be determined that he or

she is not entitled to be indemnified by the Corporation.

Section

5.3 Non-Exclusivity of Indemnification Rights. The indemnification provided by this Article 5 shall not be deemed exclusive of any other rights to which a person seeking indemnification may be entitled under any agreement, vote of

shareholders or disinterested directors, or otherwise, both as to action in his official capacity while serving as a director, officer and/or employee and as to action in another capacity while holding such office, and shall continue as to a person

who has ceased to be a director, officer and/or employee and shall inure to the benefit of the heirs and personal representatives of such a person.

Section

5.4 Insurance. The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer and/or employee of the Corporation, or is or was serving at the request of the Corporation as a

director, officer, employee or agent of a corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as

such, whether or not the Corporation would have the power to indemnify him or her against such liability under the provisions of this Article 5.

ARTICLE VI: SHARE CERTIFICATES AND TRANSFER

Section 6.1 Certificates Representing Shares. The share certificates of the Corporation shall state:

|

(a)

|

the name of the Corporation and that the Corporation is organized under the laws of the Commonwealth of Pennsylvania;

|

|

(b)

|

the name of the person to whom issued;

|

|

(c)

|

the number and class of shares and the designation of the series, if any, that the certificate represents; and

|

|

(d)

|

the par value of each share or a statement that such shares are without par value, as the case may be.

|

The share certificates shall be signed by the Chief Executive Officer, the President or a Vice President and the Secretary or

the Treasurer or any other person properly authorized by the Board of Directors, and shall bear the corporate seal, which seal may be a facsimile engraved or printed. Where the certificate is signed by a transfer agent or a registrar, the signature

of any corporate officer on such certificate may be a facsimile, engraved or printed. In case any officer who has signed, or whose facsimile signature has been placed upon, any share certificate shall have ceased to be such officer because of death,

resignation or otherwise before the certificate is issued, it may be issued by the Corporation with the same effect as if the officer had not ceased to be such at the date of its issue. No share shall be issued until the consideration therefor, fixed

as provided by law, has been fully paid.

Notwithstanding anything herein to the contrary, any or all classes and series of shares, or any

part thereof, may be represented by uncertificated shares to the extent determined by the Board

of Directors, except that shares represented by a certificate that is issued and outstanding shall

continue to be represented thereby until the certificate is surrendered to the Corporation. The Corporation shall, after the issuance or transfer of uncertificated shares, send to the registered owner of uncertificated shares a written notice

containing the information required to be set forth or stated on certificates pursuant to the law of the Commonwealth of Pennsylvania. Except as otherwise expressly provided by law, the rights and obligations of the holders of uncertificated shares

and the rights and obligations of the holders of certificates representing shares of the same class and series shall be identical.

Section

6.2 Transfers Of Shares. Shares of the Corporation shall be transferable in the manner prescribed by law and in these Bylaws. Transfers of shares shall be made on the books of the Corporation only by the holder of record thereof, by such

person’s attorney lawfully made in writing and, in the case of certificated shares, upon the surrender of the certificate thereof, which shall be cancelled before a new certificate or uncertificated shares shall be issued. No transfer of shares shall

be valid as against the Corporation for any purpose until it shall have been entered in the share records of the Corporation by an entry showing from and to whom the shares were transferred.

Section

6.3 Registered Shareholders. The Corporation may treat the holder of record of any shares issued by the Corporation as the holder in fact thereof, for purposes of voting those shares, receiving distributions thereon or notices in respect

thereof, transferring those shares, exercising rights of dissent with respect to those shares, exercising or waiving any preemptive right with respect to those shares, entering into agreements with respect to those shares in accordance with the laws

of the Commonwealth of Pennsylvania, or giving proxies with respect to those shares.

Section 6.4 Lost or Replacement Certificates. Except where shares are to be uncertificated, where a shareholder of the Corporation alleges the loss, theft or destruction of one or more certificates for shares of the Corporation and

requests the issuance of a substitute certificate therefor, the Board of Directors may direct a new certificate of the same tenor and for the same number of shares to be issued to such person upon such person's making of an affidavit in form

satisfactory to the Board of Directors setting forth the facts in connection therewith, provided that prior to the receipt of such request the Corporation shall not have either registered a transfer of such certificate or received notice that such

certificate has been acquired by a bona fide purchaser. When authorizing such issue of a new certificate the Board of Directors may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost, stolen or

destroyed certificate, or his or her heirs or legal representatives, as the case may be, to advertise the same in such manner as it shall require and/or give the Corporation a bond in such form and with surety or sureties, with fixed or open penalty,

as shall be satisfactory to the Board of Directors, as indemnity for any liability or expense which it may incur by reason of the original certificate remaining outstanding.

ARTICLE VII: DISTRIBUTIONS

Section

7.1 Declaration. The Board of Directors may, from time to time, at any duly convened regular or special meeting or by unanimous consent in writing, declare and pay dividends upon the outstanding shares of capital stock of the Corporation in

cash, property or shares of the Corporation, as long as any dividend shall not be in violation of law or the Articles of Incorporation.

Section 7.2 Record Date For Distributions And Share Dividends. For the purpose of determining shareholders entitled to receive a distribution by the Corporation (other than a distribution involving a purchase or

redemption by the Corporation of any of its own shares) or a share dividend, the Board of Directors may, at the time of declaring the distribution or share dividend, set a date no more than sixty (60) days prior to the date of the distribution or

share dividend as the record date. If no record date is fixed, the record date shall be the date on which the resolution of the Board of Directors authorizing the distribution or share dividend is adopted.

ARTICLE VIII: MISCELLANEOUS

Section

8.1 Instruments. All checks, drafts, or other instruments for payment of money or notes of the Corporation shall be signed by an officer or officers or any other person or persons as shall be determined from time to time by resolution of

the Board of Directors.

Section

8.2 Fiscal Year. The fiscal year of the Corporation shall be as determined by the Board of Directors.

Section

8.3 Conflict With Applicable Law Or Articles Of Incorporation. Unless the context requires otherwise, the general provisions, rules of construction, and definitions of the BCL shall govern the construction of these Bylaws. These Bylaws are

adopted subject to any applicable law and the Articles of Incorporation. Whenever these Bylaws may conflict with any applicable law or the Articles of Incorporation, such conflict shall be resolved in favor of such law or the Articles of

Incorporation.

Section

8.4 Invalid Provisions. If any one or more of the provisions of these Bylaws, or the applicability of any provision to a specific situation, shall be held invalid or unenforceable, the provision shall be modified to the minimum extent

necessary to make it or its application valid and enforceable, and the validity and enforceability of all other provisions of these Bylaws and all other applications of any provision shall not be affected thereby.

Section

8.5 Books and Records. Any records maintained by the Corporation in the regular course of its business, including its share ledger, books of account, and minute books, may be maintained on any information storage device or method; provided

that the records so kept can be converted into clearly legible paper form within a reasonable time. The Corporation shall so convert any records so kept upon the request of any person entitled to inspect such records pursuant to applicable law.

Section 8.6 Notices and Waivers. Whenever, under the provisions of applicable law or of the Articles of Incorporation or of these Bylaws, written notice is required to be given to any person, it may be given to such person either

personally or by sending a copy thereof through the mail by first class or express mail postage prepaid, or courier service, charges prepaid, facsimile transmission, email or other electronic communication, to his or her address appearing on the

books of the Corporation or supplied by him or her to the Corporation for the purpose of notice. Unless otherwise provided in the Articles of Incorporation or these Bylaws, (a) if the notice is sent by mail or courier service, it shall be deemed to

have been given to the person entitled thereto when deposited in the United States mail or the courier service for transmission to such person and (b) if notice is sent by facsimile transmission, email or other electronic communication, it shall have

been deemed to have been given to the person entitled thereto when

sent. Such notice shall specify the place, day and hour of the meeting and, in the case of a

special meeting of shareholders, the general nature of the business to be transacted.

Any written notice required to be given to any person may be waived in writing signed by the

person entitled to such notice whether before or after the time stated therein. Attendance of any person entitled to notice whether in person or by proxy, at any meeting shall constitute a waiver of notice of such meeting, except where any person

attends a meeting for the express purpose of objecting to the transaction of any business because the meeting was not lawfully called or convened. Where written notice is required of any meeting, the waiver thereof must specify the purpose only if it

is for a special meeting of the shareholders.

ARTICLE IX: AMENDMENT OF BYLAWS

Section

9.1. Shareholders. These Bylaws may be amended, repealed, or otherwise altered at any regular or special meeting of the shareholders at which a quorum is present, by the affirmative vote of the holders of two-thirds of the issued and

outstanding shares of the Corporation entitled to vote at such meeting. The notice of any meeting, at which action shall be taken to alter the Bylaws, shall include a copy of the proposed amendment or a summary of the changes proposed to be made.

Section

9.2 Board of Directors. The Board of Directors may also make, amend, or repeal these Bylaws at any regular or special meeting of the Board of Directors at which a quorum is present, by a majority vote of the members attending, except with

respect to any provision that the Articles of Incorporation, these Bylaws, or the BCL requires action by the shareholders and is subject to the power of the shareholders to change such action.

15

EXHIBIT 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT is

dated this 22nd day of February 2023, to be effective as of the Effective Date as defined in Section 25 below, by and among LINKBANCORP, Inc., a Pennsylvania corporation (the “Corporation”), LINKBANK, a Pennsylvania chartered bank (the “Bank”), and

John W. Breda, an adult individual (“Executive”). The Corporation, the Bank and the Executive are each referred to herein as a “Party” and, collectively, the “Parties.”

WITNESSETH:

WHEREAS, the Corporation and

Partners Bancorp (“Partners”) have entered into an Agreement and Plan of Merger, dated as of February 22, 2023 (the “Merger Agreement”), pursuant to which Partners shall merge with and into the Corporation, with the Corporation as the surviving

entity, and The Bank of Delmarva, the wholly-owned subsidiary of Partners, shall merge with and into the Bank, with the Bank surviving (the “Merger”); and

WHEREAS, Executive is presently

the President and Chief Executive Officer of Partners Bancorp, a Maryland corporation (“Partners”) and The Bank of Delmarva and is a party to an employment agreement with Partners Bancorp and The Bank of Delmarva, dated as of December 13, 2018, as

amended (the “Prior Agreement”); and

WHEREAS, pursuant to the terms of

the Merger Agreement, the parties desire to enter into this Agreement in order to induce Executive to continue employment with, and to provide further incentive for Executive to achieve the financial and performance objectives of, the Corporation and

the Bank; and

WHEREAS, in exchange for the

consideration described herein, including the Retention Bonus set forth in Section 5(g), the Prior Agreement shall terminate as of the Effective Date, and this Agreement shall supersede and replace the Prior Agreement as of the Effective Date.

AGREEMENT:

NOW, THEREFORE, in consideration

of the mutual covenants herein contained, and upon the other terms and conditions hereinafter provided, the parties hereby agree, effective the Effective Date, as follows:

1. Employment. The Bank and the Corporation hereby employ Executive

and Executive hereby accepts employment with the Bank and the Corporation, under the terms and conditions set forth in this Agreement.

2. Duties of Executive. Executive shall serve as the Chief Executive

Officer, Delmarva Market of the Bank. Executive shall report to the Chief Executive Officer of the Corporation and shall serve as a director and/or officer of any subsidiary of the Corporation or the Bank to which Executive shall be elected or

appointed. Executive shall have such other duties and hold such other titles as may be provided by the bylaws of the Bank and the Corporation and as may be assigned to him from time to time by the Boards of Directors of the Bank and the

Corporation (collectively, the “Boards”).

3. Employment in Other Employment. Except as set forth herein,

Executive shall devote all of his working time, ability and attention to the business of the Bank and the Corporation and/or their subsidiaries or affiliates, during the term of this Agreement. Executive shall notify the Chief Executive Officer of

the Corporation in writing before Executive engages in any other business or commercial duties or pursuit including, but not limited to, directorships of other companies. Under no circumstances may Executive engage in any business or commercial

activities, duties or pursuits which compete with the business or commercial activities of the Bank and the Corporation and/or any of their respective subsidiaries or affiliates, nor may Executive serve as a director or officer or in any other

capacity in a company which competes with the Bank and the Corporation and/or any of their respective subsidiaries or affiliates. Executive shall not be precluded, however, from engaging in voluntary or philanthropic endeavors, from engaging in

activities designed to maintain and improve his professional skills, or from engaging in activities incident or necessary to personal investments, so long as they are not in conflict with or detrimental to Executive’s rendition of services on

behalf of the Bank and the Corporation and/or any of their respective subsidiaries or affiliates.

4. Term of Agreement.

(a) The term of Executive’s employment under this Agreement shall commence as of the Effective Date and shall continue through the June 30, 2026 (the “Employment Period”), unless

terminated earlier pursuant to Section 4(b) hereof.

(b) Notwithstanding the provisions of Section 4(a) of this Agreement, the Bank and the Corporation may terminate Executive’s employment at any time with or without Cause (as defined

herein) upon written notice from the Boards to Executive. As used in this Agreement, “Cause” shall mean any of the following:

|

(i)

|

Executive’s conviction of or plea of guilty or nolo contendere to a felony, a crime of falsehood or a crime involving moral turpitude, or the

actual incarceration of Executive for a period of ten (10) consecutive days or more;

|

|

(ii)

|

Executive’s failure to follow the good faith lawful instructions of the Boards, after written notice from the Bank and the Corporation and a

failure to cure such violation within thirty (30) days of said written notice;

|

|

(iii)

|

Executive’s willful failure to substantially perform Executive’s duties to the Bank and the Corporation, other than a failure resulting from

Executive’s incapacity because of physical or mental illness, as provided in subsection (d) of this Section 4, after written notice from the Bank and the Corporation and a failure to cure such violation within thirty (30) days of said

written notice;

|

|

(iv)

|

Executive’s willful violation of the provisions of this Agreement, after written notice from the Bank and the Corporation and a failure to cure

such violation within thirty (30) days of said written notice;

|

|

(v)

|

dishonesty or gross negligence of Executive in the performance of his duties; provided Executive shall be given written notice from the Bank and

the Corporation of the alleged gross negligence and thirty (30) days in which to cure such violation, if such violation is curable;

|

|

(vi)

|

Executive’s removal or prohibition from being an institutional-affiliated party by a final order of an appropriate federal or state banking

agency pursuant to Section 8(e) or 8(g) of the Federal Deposit Insurance Act or any other federal or state regulation;

|

|

(vii)

|

Executive’s breach of fiduciary duty involving personal gain; or

|

|

(viii)

|

the willful violation by Executive of any law, rule or regulation governing banks or bank officers or any final cease and desist order issued by

a bank regulatory authority.

|

If Executive’s employment with the Bank and the Corporation is terminated for Cause, all of Executive’s rights under this Agreement

shall cease as of the effective date of such termination, except for the right to receive the Accrued Benefits (as defined herein) and the rights under Section 20 hereof with respect to arbitration. As used in this Agreement, “Accrued Benefits”

means (i) accrued but unpaid salary through the effective date of termination, (ii) any accrued but unused vacation time as of the effective date of termination, to the extent required by applicable law or the terms of any paid time-off policy of the

Bank or the Corporation in effect from time to time, (iii) unreimbursed expenses (if any), in accordance with the expense reimbursement policies and procedures of the Bank and the Corporation in effect from time to time, (iv) Executive’s Retention

Bonus set forth in Section 5(g) below; and (v) other payments, entitlements or benefits, if any, in accordance with terms of the applicable plans, programs, arrangements or other agreements of the Bank and the Corporation (other than any severance

plan or policy) as to which Executive held rights to such payments, entitlements or benefits, whether as a participant, beneficiary or otherwise on the date of termination.