true000175670100017567012023-11-302023-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 30, 2023 |

LINKBANCORP, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Pennsylvania |

001-41505 |

82-5130531 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1250 Camp Hill Bypass, Suite 202 |

|

Camp Hill, Pennsylvania |

|

17011 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 855 569-2265 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 |

|

LNKB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On November 30, 2023, LINKBANCORP, Inc., a Pennsylvania corporation ("LINK"), completed its previously announced combination with Partners Bancorp, a Maryland corporation ("Partners"), pursuant to the Agreement and Plan of Merger, dated February 22, 2023, by and between LINK and Partners (the "Merger Agreement"). At the closing, Partners merged with and into LINK, with LINK as the surviving entity (the "Merger"). On November 30, 2023, immediately following the Merger, The Bank of Delmarva, a Delaware chartered bank and a wholly-owned direct subsidiary of Partners (“TBOD”), merged with and into LINKBANK, a Pennsylvania bank and a wholly-owned subsidiary of LINK (“LINKBANK”), with LINKBANK as the surviving bank (the “TBOD Bank Merger”). On November 30, 2023, immediately following the TBOD Bank Merger, Virginia Partners Bank, a Virginia chartered bank and a wholly-owned direct subsidiary of Partners, merged with and into LINKBANK, with LINKBANK as the surviving bank.

On December 1, 2023, the Company filed a Current Report on Form 8-K reporting the completion of the Merger (the "Original Report"). This Amendment No. 1 to the Original Report is being filed with the Securities and Exchange Commission (the "Commission") solely to amend and supplement item 9.01 of the Original Report, as described in Item 9.01 below. This Amendment No. 1 makes no other amendments to the Original Report.

Item 9.01 Financial Statements and Exhibits.

|

|

(a) |

Financial statements of businesses acquired. Pursuant to General Instruction B.3 of Form 8-K, the audited consolidated financial statements of Partners as of and for the years ended December 31, 2022 and 2021, including the independent auditor's report, are not required to be filed again by this Current Report on From 8-K, because substantially the same information was previously filed in the Company's Registration Statement on Form S-4, as originally filed with the Commission on April 28, 2023 (File No. 333-271516) and as thereafter amended. The unaudited consolidated balance sheet of Partners as of September 30, 2023 and the unaudited consolidated statements of operations and cash flows for the nine months ended September 30, 2023 and 2022 are filed herewith as Exhibit 99.1 and are incorporated by reference into this item 9.01(a). |

(b) |

Pro forma financial information |

|

The unaudited pro forma condensed consolidated combined financial information as of and for the nine months ended September 30, 2023 and for the year ended December 21, 2022 is filed herewith as Exhibit 99.2 and is incorporated by reference into this item 9.01(b) |

(c) |

Shell company transactions. None. |

(d) |

Exhibits. |

|

99.1 Unaudited consolidated balance sheet of Partners as of September 30, 2023 and the unaudited consolidated statements of operations and cash flows for the nine months ended September 30, 2023 and 2022 (incorporated by reference to the Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 by Partners Bancorp filed on November 9, 2023 (File No. 001-39285)) |

|

99.2 Unaudited Pro Forma Condensed Combined Consolidated Financial Information as of and for the nine months ended September 30, 2023 and for the year ended December 31, 2022 |

|

104 Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

LINKBANCORP, INC. |

|

|

|

|

Date: |

February 15, 2024 |

By: |

/s/ Carl D. Lundblad |

|

|

|

Carl D. Lundblad

President |

EXHIBIT 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED FINANCIAL INFORMATION

The unaudited pro forma condensed combined consolidated financial information has been prepared using the acquisition method of accounting under the provisions of the Financial Accounting Standards Board (FASB) Accounting Standards Codification, ASC 805, “Business Combinations”, giving effect to LINKBANCORP, Inc.’s (“LINK”) proposed acquisition of Partners Bancorp (“Partners”). Under this method, Partners assets and liabilities as of the date of the acquisition will be recorded at their respective fair values and added to those of LINK. Any difference between the purchase price for Partners and the fair value of the identifiable net assets acquired (including core deposit intangibles) will be recorded as goodwill. The goodwill resulting from the acquisition will not be amortized to expense, but instead will be reviewed for impairment at least annually. Any core deposit intangible and other intangible assets with estimated useful lives to be recorded by LINK in connection with the acquisition will be amortized to expense over their estimated useful lives. The financial statements of LINK issued after the acquisition will reflect the results attributable to the acquired operations of Partners beginning on the date of completion of the acquisition. The merger was consummated on November 30, 2023.

The following unaudited pro forma condensed combined consolidated financial information and accompanying notes are based on and should be read in conjunction with (i) the historical audited consolidated financial statements of LINK and accompanying notes included in LINK’s Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference into LINK’s Registration Statement on Form S-4 (File No. 333-271516) as originally filed with the Securities and Exchange Commission (the “Commission”) on April 28, 2023 and as thereafter amended (the “Registration Statement”), (ii) the historical unaudited consolidated financial statements of LINK and the related notes for the nine months ended September 30, 2023 included in LINK’s Quarterly Report on Form 10-Q filed with the Commission on November 14, 2023, (iii) the historical audited consolidated financial statements of Partners and the related notes for the year ended December 31, 2022 incorporated by reference into the Registration Statement, and (iv) the historical unaudited consolidated financial statements of Partners for the nine months ended September 30, 2023, which are included in this Current Report on Form 8-K as Exhibit 99.1.

The unaudited pro forma condensed combined consolidated financial information is provided for illustrative information purposes only. The unaudited pro forma condensed combined consolidated financial information is not necessarily, and should not be assumed to be, an indication of the actual results that would have been achieved had the merger been completed as of the dates indicated or that may be achieved in the future. The unaudited pro forma condensed combined consolidated financial statements have been prepared in accordance with Article 11 of Regulation S-X, Pro Forma Information, which requires the depiction of the accounting for the transaction, which we refer to as transaction accounting adjustments.

Regulation S-X also allows for management adjustments that could include presentation of the reasonably estimable cost savings and revenue enhancements and other transaction effects that have occurred or are reasonably expected to occur. Please note the unaudited pro forma condensed combined consolidated financial information does not include management adjustments for any potential effects of changes in market conditions, revenue enhancements or expense efficiencies, or any post-closing sale of loans or deposits among other factors.

The following unaudited pro forma condensed combined consolidated balance sheet as of September 30, 2023, combines the historical financial statements of LINK and Partners. The unaudited pro forma condensed combined consolidated financial statements give effect to the proposed acquisition as if the acquisition occurred on September 30, 2023, with respect to the balance sheet, and January 1, 2022, with respect to the statements of income for both the year ended December 31, 2022 and the nine months ended September 30, 2023. Certain reclassification adjustments have been made to Partners’ financial statements to conform to LINK’s financial statement presentation.

The unaudited pro forma condensed combined consolidated financial statements were prepared with LINK as the accounting acquirer and Partners as the accounting acquiree under the acquisition method of accounting. Accordingly, the consideration paid by LINK to complete the acquisition of Partners will be allocated to Partners’

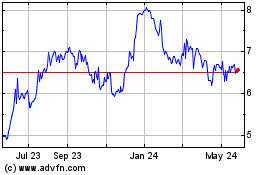

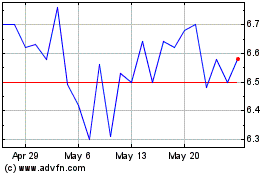

assets and liabilities based upon their estimated fair values as of the date of completion of the acquisition. The allocation is dependent upon certain valuations and other studies that have not been finalized at this time; however, preliminary significant valuations based on the fair value of the acquired assets and liabilities have been estimated and included in the unaudited condensed pro forma financial statements. The pro forma calculations, shown below, include a closing share price of $6.47, which represents the closing price of LINK’s common stock on November 30, 2023.

The unaudited pro forma condensed combined consolidated combined statements of income and earnings per share data do not include anticipated cost savings or revenue enhancements, nor do they include one-time merger-related expenses which will be expensed against income, or a one-time provision expense of $9.7 million related to ASC 326 Current Expected Credit Losses (“CECL”) allowance for credit losses for non-PCD loans. LINK is continuing to assess the two companies’ personnel, benefits plans, premises, equipment, computer systems and service contracts to determine where the companies may take advantage of redundancies or where it will be beneficial or necessary to convert to one system. Certain decisions arising from these assessments may involve canceling contracts between either LINK or Partners and certain service providers. There is no assurance that the anticipated cost savings will be realized on the anticipated time schedule or at all.

The pro forma combined basic and diluted earnings per share of LINK common stock are based on the pro forma combined net income per common share for LINK and Partners divided by the pro forma basic or diluted common shares of the combined entities. The pro forma information includes adjustments related to the fair value of assets and liabilities of Partners and is subject to adjustment as additional information becomes available and as final merger data analyses are performed.

The pro forma condensed combined consolidated balance sheet and book value per share data do include the impact of merger related expenses on the balance sheet with Partners’ after-tax charges currently estimated at $3.7 million, illustrated as a transaction adjustment to accrued other liabilities, LINK’s after-tax estimated charges of $7.2 million, illustrated as a decrease to retained earnings and to accrued other liabilities, and the one-time provision expense of $9.7 million related to CECL allowance for credit losses for non-PCD loans shown as an increase in the allowance for credit losses and a decrease in retained earnings. The pro forma combined book value per share of LINK common stock is based on the pro forma combined common stockholders’ equity of LINK and Partners divided by total pro forma common shares of the combined entities.

The unaudited pro forma data are qualified by the statements set forth under this caption and should not be considered indicative of the market value of LINK common stock or the actual or future results of operations of LINK for any period. Actual results may be materially different than the pro forma information presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Combined Pro Forma Balance Sheets as of September 30, 2023 |

|

($ In Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. |

|

|

Partners Bancorp |

|

|

Transaction Accounting Adjustments |

|

|

LINKBANCORP, Inc. Pro Forma Combined |

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing cash equivalents |

|

$ |

5,447 |

|

|

$ |

15,674 |

|

|

$ |

- |

|

|

$ |

21,121 |

|

|

Interest-bearing deposits with other institutions |

|

|

62,532 |

|

|

|

23,141 |

|

|

|

(1,961 |

) |

(1) |

|

83,712 |

|

|

Federal funds sold |

|

|

- |

|

|

|

9,816 |

|

|

|

- |

|

|

|

9,816 |

|

|

Cash and cash equivalents |

|

|

67,979 |

|

|

|

48,631 |

|

|

|

(1,961 |

) |

|

|

114,649 |

|

|

Certificates of deposit with other banks |

|

|

249 |

|

|

|

- |

|

|

|

|

|

|

249 |

|

|

Securities available for sale, at fair value |

|

|

78,779 |

|

|

|

121,920 |

|

|

|

(921 |

) |

(3) |

|

199,778 |

|

|

Securities held to maturity |

|

|

37,266 |

|

|

|

- |

|

|

|

- |

|

|

|

37,266 |

|

|

Loans held for sale |

|

|

- |

|

|

|

354 |

|

|

|

- |

|

|

|

354 |

|

|

Loans receivable |

|

|

978,912 |

|

|

|

1,297,504 |

|

|

|

(64,538 |

) |

(4) |

|

2,211,878 |

|

|

Less: Allowance for credit losses - loans |

|

|

(9,964 |

) |

|

|

(16,075 |

) |

|

|

2,078 |

|

(5) |

|

(23,961 |

) |

|

Net loans |

|

|

968,948 |

|

|

|

1,281,429 |

|

|

|

(62,460 |

) |

|

|

2,187,917 |

|

|

Investments in restricted bank stock |

|

|

3,107 |

|

|

|

5,640 |

|

|

|

- |

|

|

|

8,747 |

|

|

Premises and equipment, net |

|

|

6,414 |

|

|

|

14,116 |

|

|

|

2,821 |

|

(6) |

|

23,351 |

|

|

Right-of-Use Asset - Premises |

|

|

9,727 |

|

|

|

6,078 |

|

|

|

- |

|

|

|

15,805 |

|

|

Bank-owned life insurance |

|

|

24,732 |

|

|

|

19,064 |

|

|

|

- |

|

|

|

43,796 |

|

|

Goodwill |

|

|

35,842 |

|

|

|

9,582 |

|

|

|

13,424 |

|

(1) |

|

58,848 |

|

|

Other intangible assets, net |

|

|

873 |

|

|

|

1,185 |

|

|

|

24,159 |

|

(7) |

|

26,217 |

|

|

Deferred income taxes, net |

|

|

6,880 |

|

|

|

9,429 |

|

|

|

7,659 |

|

(8) |

|

23,968 |

|

|

Accrued interest receivable and other assets |

|

|

14,899 |

|

|

|

15,605 |

|

|

|

(1,191 |

) |

(9) |

|

29,313 |

|

|

TOTAL ASSETS |

|

$ |

1,255,695 |

|

|

$ |

1,533,033 |

|

|

$ |

(18,470 |

) |

|

$ |

2,770,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand, noninterest bearing |

|

$ |

210,404 |

|

|

$ |

508,793 |

|

|

$ |

- |

|

|

$ |

719,197 |

|

|

Interest bearing |

|

|

831,368 |

|

|

|

814,236 |

|

|

|

(3,595 |

) |

(10) |

|

1,642,009 |

|

|

Total deposits |

|

|

1,041,772 |

|

|

|

1,323,029 |

|

|

|

(3,595 |

) |

|

|

2,361,206 |

|

|

Other borrowings |

|

|

15,000 |

|

|

|

30,396 |

|

|

|

- |

|

|

|

45,396 |

|

|

Subordinated debt, net |

|

|

40,354 |

|

|

|

22,249 |

|

|

|

(1,179 |

) |

(11) |

|

61,424 |

|

|

Operating lease liabilities |

|

|

9,728 |

|

|

|

6,944 |

|

|

|

- |

|

|

|

16,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued interest payable and other liabilities |

|

|

7,490 |

|

|

|

6,756 |

|

|

|

12,991 |

|

(12) |

|

27,237 |

|

|

Total liabilities |

|

|

1,114,344 |

|

|

|

1,389,374 |

|

|

|

8,217 |

|

|

|

2,511,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

162 |

|

|

|

180 |

|

|

|

27 |

|

(1)(2) |

|

369 |

|

|

Surplus |

|

|

127,856 |

|

|

|

88,809 |

|

|

|

44,289 |

|

(1)(2) |

|

260,954 |

|

|

Retained earnings |

|

|

19,062 |

|

|

|

70,916 |

|

|

|

(87,764 |

) |

(2)(5)(12) |

|

2,214 |

|

|

Accumulated other comprehensive loss |

|

|

(5,729 |

) |

|

|

(16,761 |

) |

|

|

16,761 |

|

(2) |

|

(5,729 |

) |

|

Total equity attributable to parent |

|

|

141,351 |

|

|

|

143,144 |

|

|

|

(26,687 |

) |

(2) |

|

257,808 |

|

|

Noncontrolling interest in consolidated subsidiary |

|

|

- |

|

|

|

515 |

|

|

|

- |

|

|

|

515 |

|

|

TOTAL SHAREHOLDERS' EQUITY |

|

|

141,351 |

|

|

|

143,659 |

|

|

|

(26,687 |

) |

|

|

258,323 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

$ |

1,255,695 |

|

|

$ |

1,533,033 |

|

|

$ |

(18,470 |

) |

|

$ |

2,770,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares outstanding |

|

|

16,235,871 |

|

|

|

17,985,577 |

|

|

|

2,697,608 |

|

(1) |

|

36,919,056 |

|

|

Book value per share |

|

$ |

8.71 |

|

|

$ |

7.99 |

|

|

|

|

|

$ |

7.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Pro Forma Combined Statements of Income for nine months ended September 30, 2023 |

|

($ In Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. |

|

|

Partners Bancorp |

|

|

Transaction Accounting Adjustments |

|

|

LINKBANCORP, Inc. Pro Forma Combined |

|

INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, including fees |

|

$ |

37,330 |

|

|

$ |

51,493 |

|

|

$ |

6,834 |

|

(4) |

$ |

95,657 |

|

Investment securities |

|

|

3,204 |

|

|

|

2,614 |

|

|

|

1,358 |

|

(3) |

|

7,176 |

|

Interest bearing deposits and other |

|

|

- |

|

|

|

1,664 |

|

|

|

- |

|

|

|

1,664 |

|

Federal funds sold and other |

|

|

1,561 |

|

|

|

823 |

|

|

|

- |

|

|

|

2,384 |

|

Total interest and dividend income |

|

|

42,095 |

|

|

|

56,594 |

|

|

|

8,192 |

|

|

|

106,881 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

15,193 |

|

|

|

8,906 |

|

|

|

449 |

|

(10) |

|

24,548 |

|

Other borrowings |

|

|

1,196 |

|

|

|

2,401 |

|

|

|

- |

|

|

|

3,597 |

|

Subordinated debt |

|

|

1,311 |

|

|

|

- |

|

|

|

467 |

|

(11) |

|

1,778 |

|

Total interest expense |

|

|

17,700 |

|

|

|

11,307 |

|

|

|

916 |

|

|

|

29,923 |

|

NET INTEREST INCOME BEFORE (CREDIT TO) PROVISION FOR

CREDIT LOSSES |

|

|

24,395 |

|

|

|

45,287 |

|

|

|

7,276 |

|

|

|

76,958 |

|

(Credit to) provision for credit losses |

|

|

(549 |

) |

|

|

396 |

|

|

|

- |

|

|

|

(153 |

) |

NET INTEREST INCOME AFTER (CREDIT TO) PROVISION FOR

CREDIT LOSSES |

|

|

24,944 |

|

|

|

44,891 |

|

|

|

7,276 |

|

|

|

77,111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

Service fees on deposit accounts |

|

|

593 |

|

|

|

795 |

|

|

|

- |

|

|

|

1,388 |

|

Bank-owned life insurance |

|

|

488 |

|

|

|

- |

|

|

|

- |

|

|

|

488 |

|

Net realized gains (losses) on the sales of debt securities, available for sale |

|

|

(2,370 |

) |

|

|

- |

|

|

|

- |

|

|

|

(2,370 |

) |

Gains on sale of loans |

|

|

296 |

|

|

|

455 |

|

|

|

- |

|

|

|

751 |

|

Other |

|

|

905 |

|

|

|

2,158 |

|

|

|

- |

|

|

|

3,063 |

|

Total non-interest income |

|

|

(88 |

) |

|

|

3,408 |

|

|

|

- |

|

|

|

3,320 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

12,350 |

|

|

|

17,337 |

|

|

|

- |

|

|

|

29,687 |

|

Occupancy |

|

|

2,104 |

|

|

|

4,194 |

|

|

|

109 |

|

(6) |

|

6,407 |

|

Merger & system conversion related expenses |

|

|

1,679 |

|

|

|

1,617 |

|

|

|

(3,296 |

) |

(12) |

|

- |

|

Other |

|

|

7,414 |

|

|

|

9,768 |

|

|

|

3,110 |

|

(7) |

|

20,292 |

|

Total noninterest expense |

|

|

23,547 |

|

|

|

32,916 |

|

|

|

(77 |

) |

|

|

56,386 |

|

Income before income tax expense |

|

|

1,309 |

|

|

|

15,383 |

|

|

|

7,353 |

|

|

|

24,045 |

|

Income tax expense |

|

|

276 |

|

|

|

3,943 |

|

|

|

1,765 |

|

(8) |

|

5,984 |

|

NET INCOME |

|

|

1,033 |

|

|

|

11,440 |

|

|

|

5,588 |

|

|

|

18,061 |

|

NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTEREST |

|

|

- |

|

|

|

192 |

|

|

|

- |

|

|

|

192 |

|

NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS |

|

$ |

1,033 |

|

|

$ |

11,632 |

|

|

$ |

5,588 |

|

|

$ |

18,253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

|

$ |

0.06 |

|

|

$ |

0.65 |

|

|

|

|

|

$ |

0.50 |

|

Diluted earnings per common share |

|

$ |

0.06 |

|

|

$ |

0.65 |

|

|

|

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

|

$ |

0.23 |

|

|

$ |

0.12 |

|

|

|

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

|

15,984,151 |

|

|

|

17,985,000 |

|

|

|

2,698,185 |

|

(1) |

|

36,667,336 |

|

Diluted weighted average common shares outstanding |

|

|

15,984,151 |

|

|

|

17,993,000 |

|

|

|

2,698,185 |

|

(1) |

|

36,675,336 |

|

Consolidated Statements of Comprehensive Income: |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Available to LINKBANCORP, Inc. |

|

|

1,033 |

|

|

|

11,440 |

|

|

|

5,588 |

|

|

|

18,061 |

|

Components of other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale securities, net of tax |

|

|

(1,902 |

) |

|

|

(3,680 |

) |

|

|

3,680 |

|

|

|

(1,902 |

) |

Securities gains realized in net income, net of tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Unrealized gain on cash flow hedges |

|

|

2,578 |

|

|

|

- |

|

|

|

- |

|

|

|

2,578 |

|

Comprehensive Income Available to LINKBANCORP, Inc. |

|

$ |

1,709 |

|

|

$ |

7,760 |

|

|

$ |

9,268 |

|

|

$ |

20,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Pro Forma Combined Statements of Income for twelve months ended December 31, 2022 |

|

($ In Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc. |

|

|

Partners Bancorp |

|

|

Transaction Accounting Adjustments |

|

|

LINKBANCORP, Inc. Pro Forma Combined |

|

INTEREST AND DIVIDEND INCOME |

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, including fees |

$ |

36,396 |

|

|

$ |

55,570 |

|

|

$ |

12,217 |

|

(4) |

$ |

104,183 |

|

Investment securities |

|

3,335 |

|

|

|

2,917 |

|

|

|

1,811 |

|

(3) |

|

8,063 |

|

Interest bearing deposits and other |

|

533 |

|

|

|

3,380 |

|

|

|

- |

|

|

|

3,913 |

|

Federal funds sold and other |

|

- |

|

|

|

793 |

|

|

|

- |

|

|

|

793 |

|

Total interest and dividend income |

|

40,264 |

|

|

|

62,660 |

|

|

|

14,028 |

|

|

|

116,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

5,337 |

|

|

|

4,654 |

|

|

|

2,559 |

|

(9) |

|

12,550 |

|

Other borrowings |

|

441 |

|

|

|

613 |

|

|

|

- |

|

|

|

1,054 |

|

Subordinated debt |

|

1,501 |

|

|

|

1,397 |

|

|

|

716 |

|

(10) |

|

3,614 |

|

Total interest expense |

|

7,279 |

|

|

|

6,664 |

|

|

|

3,275 |

|

|

|

17,218 |

|

NET INTEREST INCOME BEFORE PROVISION FOR

CREDIT LOSSES |

|

32,985 |

|

|

|

55,996 |

|

|

|

10,753 |

|

|

|

99,734 |

|

Provision for credit losses |

|

1,290 |

|

|

|

1,348 |

|

|

|

- |

|

|

|

2,638 |

|

NET INTEREST INCOME AFTER PROVISION FOR

CREDIT LOSSES |

|

31,695 |

|

|

|

54,648 |

|

|

|

10,753 |

|

|

|

97,096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

Service fees on deposit accounts |

|

832 |

|

|

|

989 |

|

|

|

- |

|

|

|

1,821 |

|

Bank-owned life insurance |

|

497 |

|

|

|

452 |

|

|

|

- |

|

|

|

949 |

|

Net realized gains (loss) on the sales of debt securities, available for sale |

|

13 |

|

|

|

(5 |

) |

|

|

- |

|

|

|

8 |

|

Gains on sale of loans |

|

753 |

|

|

|

- |

|

|

|

- |

|

|

|

753 |

|

Other |

|

862 |

|

|

|

3,765 |

|

|

|

- |

|

|

|

4,627 |

|

Total non-interest income |

|

2,957 |

|

|

|

5,201 |

|

|

|

- |

|

|

|

8,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

16,224 |

|

|

|

22,454 |

|

|

|

- |

|

|

|

38,678 |

|

Occupancy |

|

2,119 |

|

|

|

3,839 |

|

|

|

145 |

|

(6) |

|

6,103 |

|

Merger & system conversion related expenses |

|

973 |

|

|

|

1,400 |

|

|

|

(2,373 |

) |

(12) |

|

- |

|

Other |

|

8,516 |

|

|

|

14,157 |

|

|

|

4,608 |

|

(7) |

|

27,281 |

|

Total non-interest expense |

|

27,832 |

|

|

|

41,850 |

|

|

|

2,380 |

|

|

|

72,062 |

|

Income before income tax expense |

|

6,820 |

|

|

|

17,999 |

|

|

|

8,373 |

|

|

|

33,192 |

|

Income tax expense |

|

1,222 |

|

|

|

4,512 |

|

|

|

2,010 |

|

(8) |

|

7,744 |

|

NET INCOME |

|

5,598 |

|

|

|

13,487 |

|

|

|

6,363 |

|

|

|

25,448 |

|

NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTEREST |

|

- |

|

|

|

128 |

|

|

|

- |

|

|

|

128 |

|

NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS |

$ |

5,598 |

|

|

$ |

13,615 |

|

|

$ |

6,363 |

|

|

$ |

25,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.49 |

|

|

$ |

0.76 |

|

|

|

|

|

$ |

0.80 |

|

Diluted earnings per common share |

$ |

0.49 |

|

|

$ |

0.76 |

|

|

|

|

|

$ |

0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share |

$ |

0.30 |

|

|

$ |

0.12 |

|

|

|

|

|

$ |

0.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

|

11,310,386 |

|

|

|

17,961,000 |

|

|

|

2,722,185 |

|

(1) |

|

31,993,571 |

|

Diluted weighted average common shares outstanding |

|

11,310,386 |

|

|

|

17,993,000 |

|

|

|

2,722,185 |

|

(1) |

|

32,025,571 |

|

Consolidated Statements of Comprehensive (Loss) Income: |

|

|

|

|

|

|

|

|

|

|

|

Net Income Available to LINKBANCORP, Inc. |

|

5,598 |

|

|

|

13,615 |

|

|

|

6,363 |

|

|

|

25,576 |

|

Components of other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale securities, net of tax |

|

(8,173 |

) |

|

|

(13,400 |

) |

|

|

13,400 |

|

|

|

(8,173 |

) |

Securities (losses) gains realized in net income, net of tax |

|

(10 |

) |

|

|

4 |

|

|

|

(4 |

) |

|

|

(10 |

) |

Comprehensive (Loss) Income Available to LINKBANCORP, Inc. |

$ |

(2,585 |

) |

|

$ |

219 |

|

|

$ |

19,759 |

|

|

$ |

17,393 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Pro Forma Per Share Data |

|

For The Nine Months Ended September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc.

Historical |

|

|

Partners

Bancorp Historical |

|

|

Pro Forma Combined |

|

|

Pro Forma Equivalent Partners Bancorp

Share (A) |

|

For The Nine Months Ended September 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share (Basic) |

|

$ |

0.06 |

|

|

$ |

0.65 |

|

|

$ |

0.50 |

|

|

$ |

0.57 |

|

Net income per share (Diluted) |

|

$ |

0.06 |

|

|

$ |

0.65 |

|

|

$ |

0.50 |

|

|

$ |

0.57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per share |

|

$ |

0.23 |

|

|

$ |

0.12 |

|

|

$ |

0.35 |

|

|

$ |

0.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Pro Forma Per Share Data |

|

For The Twelve Months Ended December 31, 2022 |

|

($ in Thousands, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKBANCORP, Inc.

Historical |

|

|

Partners

Bancorp Historical |

|

|

Pro Forma Combined |

|

|

Pro Forma Equivalent Partners Bancorp

Share (A) |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

For the year ended December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share (Basic) |

|

$ |

0.49 |

|

|

$ |

0.76 |

|

|

$ |

0.80 |

|

|

$ |

0.91 |

|

Net income per share (Diluted) |

|

$ |

0.49 |

|

|

$ |

0.76 |

|

|

$ |

0.80 |

|

|

$ |

0.91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Dividends Per Share |

|

$ |

0.30 |

|

|

$ |

0.12 |

|

|

$ |

0.42 |

|

|

$ |

0.48 |

|

(A)The pro forma equivalent Partner per share amount is calculated by multiplying the pro forma combined Partner per share amount by the exchange ratio of 1.15 in accordance with the definitive merger agreement.

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED COMBINED FINANCIAL STATEMENTS

(1)Upon the terms and subject to the conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.01 per share, of Partners (“Partners Common Stock”) outstanding immediately prior to the Effective Time, other than certain shares held by Partners or LINK, was converted into the right to receive 1.150 shares (the “Exchange Ratio”) of common stock, par value $0.01 per share, of LINK (“LINK Common Stock” and such consideration, the “Merger Consideration”). Holders of Partners Common Stock will receive cash in lieu of fractional shares of LINK Common Stock.

Pursuant to the terms of the Merger Agreement, at the Effective Time, each outstanding option to purchase shares of Partners Common Stock (each, a “Partners stock option”) granted under the

Partners Bancorp 2021 Incentive Stock Plan, Virginia Partners Bank 2015 Incentive Stock Option Plan, Delmar Bancorp 2014 Stock Plan, Virginia Partners Bank 2008 Incentive Stock Option Plan, Liberty Bell Bank 2004 Incentive Stock Option Plan and Liberty Bell Bank 2004 Non-Qualified Stock Option Plan (the “Partners Plans”) was converted into an option to purchase a number of shares of LINK Common Stock equal to the product of (x) the number of shares of Partners Common Stock subject to such Partners stock option immediately prior to the Effective Time and (y) the Exchange Ratio, at an exercise price per share (rounded to the nearest whole cent) equal to (A) the exercise price per share of Partners Common Stock of such Partners stock option immediately prior to the Effective Time divided by (B) the Exchange Ratio. Each Partners stock option will continue to be governed by the same terms and conditions (including vesting and exercisability terms) as were applicable to such Partners stock option immediately prior to the Effective Time.

Pursuant to the terms of the Merger Agreement, at the Effective Time, all Partners restricted stock awards granted under the Partners Plans which were outstanding on February 22, 2023 and remained outstanding as of the Effective Time accelerated in full and fully vested immediately prior to the Effective Time and were converted into the right to receive the Merger Consideration, in accordance with the Exchange Ratio, less applicable withholding taxes. All Partners restricted stock awards that were granted after February 22, 2023 and which were outstanding as of the Effective Time were converted into Merger Consideration on the same terms as, and were treated in the same manner as, all other shares of Partners Common Stock, except that such shares will remain subject to the same restrictions as to transferability and forfeiture set forth in the applicable award agreement.

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

(dollars in thousands, except per share data)

|

|

Partners Bancorp

Book Value September 30, 2023 |

|

|

Fair Value Adjustments |

|

|

Partners Bancorp

Fair Value

September 30, 2023 |

|

Assets acquired |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

38,815 |

|

|

$ |

- |

|

|

$ |

38,815 |

|

Federal funds sold |

|

|

9,816 |

|

|

|

- |

|

|

|

9,816 |

|

Securities available for sale, at fair value |

|

|

121,920 |

|

|

|

(921 |

) |

(3) |

|

120,999 |

|

Loans held for sale |

|

|

354 |

|

|

|

- |

|

|

|

354 |

|

Loans receivable |

|

|

1,297,504 |

|

|

|

(64,538 |

) |

(4) |

|

1,232,966 |

|

Allowance for credit losses - loans |

|

|

(16,075 |

) |

|

|

11,772 |

|

(5) |

|

(4,303 |

) |

Loans receivable, net |

|

|

1,281,429 |

|

|

|

(52,766 |

) |

|

|

1,228,663 |

|

Restricted stock |

|

|

5,640 |

|

|

|

- |

|

|

|

5,640 |

|

Premises and equipment |

|

|

14,116 |

|

|

|

2,821 |

|

(6) |

|

16,937 |

|

Accrued interest receivable |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Core deposit intangibles |

|

|

- |

|

|

|

25,344 |

|

(7) |

|

25,344 |

|

Deferred tax asset |

|

|

9,429 |

|

|

|

5,602 |

|

(8) |

|

15,031 |

|

Right-of-use-asset -- premises |

|

|

6,078 |

|

|

|

- |

|

|

|

6,078 |

|

Other assets |

|

|

34,669 |

|

|

|

(1,191 |

) |

|

|

33,478 |

|

Total assets acquired |

|

|

1,522,266 |

|

|

|

(21,111 |

) |

|

|

1,501,155 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities assumed |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

1,323,029 |

|

|

|

(3,595 |

) |

(9) |

|

1,319,434 |

|

Borrowings |

|

|

30,396 |

|

|

|

- |

|

(10) |

|

30,396 |

|

Subordinated debt |

|

|

22,249 |

|

|

|

(1,179 |

) |

(11) |

|

21,070 |

|

Accrued interest payable |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Operating lease liabilities |

|

|

6,944 |

|

|

|

- |

|

|

|

6,944 |

|

Other liabilities |

|

|

6,756 |

|

|

|

3,780 |

|

(12) |

|

10,536 |

|

Total liabilities assumed |

|

|

1,389,374 |

|

|

|

(994 |

) |

|

|

1,388,380 |

|

Net assets acquired |

|

|

|

|

|

|

|

|

112,775 |

|

|

|

|

|

|

|

|

|

|

|

Consideration paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock consideration: |

|

|

|

|

|

|

|

|

|

Common shares of Partners Bancorp |

|

|

|

|

|

|

|

|

17,985,577 |

|

Exchange Ratio |

|

|

|

|

|

|

|

|

1.150 |

|

LINKBANCORP, Inc. common stock issued (excludes fractional shares) |

|

|

|

|

|

|

|

|

20,683,185 |

|

LINKBANCORP, Inc. stock price on acquisition date |

|

|

|

|

|

|

|

$ |

6.47 |

|

Purchase price assigned to Partners Bancorp common shares |

|

|

|

|

|

|

|

|

133,820 |

|

Cash in lieu of fractional shares |

|

|

|

|

|

|

|

$ |

2 |

|

|

|

|

|

|

|

|

|

|

|

Restricted stock consideration: |

|

|

|

|

|

|

|

|

|

Partners Bancorp restricted common shares |

|

|

|

|

|

|

|

|

297,726 |

|

LINKBANCORP, Inc. stock price on acquisition date |

|

|

|

|

|

|

|

$ |

6.47 |

|

Total purchase price assigned to Partners Bancorp restricted shares |

|

|

|

|

|

|

|

$ |

1,926 |

|

|

|

|

|

|

|

|

|

|

|

Cash paid in exchange for Partners Bancorp stock options |

|

|

|

|

|

|

|

$ |

33 |

|

|

|

|

|

|

|

|

|

|

|

|

Total consideration |

|

|

|

|

|

|

|

$ |

135,781 |

|

Goodwill |

|

|

|

|

|

|

|

$ |

23,006 |

|

(2)Balance sheet adjustments to reflect the reversal of Partners’ historical equity accounts to APIC and record the purchase price consideration for common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

|

September 30, 2023 |

|

Transaction accounting adjustment for common stock |

|

|

|

|

|

|

|

|

Reversal of Partners common stock |

|

|

|

|

|

|

$ |

(180 |

) |

|

|

|

|

|

|

|

|

|

Number of LINK common shares issued |

|

|

|

|

20,683,185 |

|

|

|

|

Par value of LINK common stock |

|

|

|

$ |

0.01 |

|

|

|

|

Par value of LINK common shares issued for merger |

|

|

|

|

|

|

|

207 |

|

Total transaction accounting adjustment for common stock |

|

|

|

|

|

|

$ |

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

|

September 30, 2023 |

|

Transaction accounting adjustment for APIC |

|

|

|

|

|

|

|

|

Reversal of Partners common stock to APIC |

|

|

|

|

|

|

$ |

180 |

|

Reversal of Partners retained earnings to APIC |

|

|

|

|

|

|

|

70,916 |

|

Reversal of Partners accumulated other comprehensive loss to APIC |

|

|

|

|

|

|

|

(16,761 |

) |

Common shares of Partners Bancorp, Inc. |

|

|

|

|

17,985,577 |

|

|

|

|

Exchange ratio |

|

|

|

|

1.1500 |

|

|

|

|

LINKBANCORP, Inc. common stock issued |

|

|

|

|

20,683,185 |

|

|

|

|

LINKBANCORP, Inc. stock price on acquisition date, November 30, 2023 |

|

|

|

$ |

6.47 |

|

|

|

|

Purchase price consideration for common stock |

|

|

|

$ |

133,820 |

|

|

|

|

Cash in lieu of fractional shares |

|

|

|

|

2 |

|

|

|

|

Total purchase price |

|

|

|

|

133,822 |

|

|

|

|

Par value of LINKBANCORP, Inc. shares issued for merger at $0.01 per share |

|

|

|

|

(207 |

) |

|

|

|

APIC adjustment for LINKBANCORP, Inc. shares issued |

|

|

|

|

133,613 |

|

|

|

|

Less: Partners Equity |

|

|

|

|

(143,659 |

) |

|

|

|

Plus: Partners goodwill |

|

|

|

|

- |

|

|

|

|

Net adjustment to APIC for stock consideration |

|

|

|

|

|

|

|

(10,046 |

) |

Total transaction accounting adjustment for APIC |

|

|

|

|

|

|

$ |

44,289 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

September 30, 2023 |

|

Transaction accounting adjustment for retained earnings |

|

|

|

|

|

|

|

Reversal of Partners retained earnings |

|

|

|

|

|

$ |

(70,916 |

) |

Acquisition activity - LINK merger costs |

|

|

|

|

|

|

(7,154 |

) |

Provision for loan losses for Non-PCD loans |

|

|

|

|

|

|

(9,694 |

) |

Total transaction accounting adjustment for retained earnings |

|

|

|

|

|

$ |

(87,764 |

) |

|

|

|

|

|

|

|

Balance Sheet |

|

(Dollars in thousands, except per share data) |

|

September 30, 2023 |

|

Transaction accounting adjustment for accumulated other comprehensive loss |

|

|

|

Reversal of Partners' accumulated other comprehensive loss |

|

$ |

16,761 |

|

Total transaction accounting adjustment for accumulated other comprehensive loss |

|

$ |

16,761 |

|

(3)Balance sheet and statements of income adjustment to reflect a fair value discount of $921 thousand for securities available for sale to reflect the selling price of securities sold contemporaneous with the Merger. Statements of income adjustment include securities available for sale negative fair value adjustment of $4.7 million to an accreting discount which will be accreted into income based on the expected life of the securities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Investment securities available for sale |

|

|

|

|

|

|

|

|

|

Investment securities available for sale fair value adjustment |

|

$ |

(921 |

) |

|

$ |

1,358 |

|

|

$ |

1,811 |

|

Total balance sheet adjustments for securities available for sale |

|

$ |

(921 |

) |

|

$ |

1,358 |

|

|

$ |

1,811 |

|

(4)Balance sheet adjustment to reflect the fair value discount for acquired PCD and non-PCD loans of $64.5 million of which $71.3 million is assigned to loans, $4.3 million is assigned to the allowance for credit losses (recorded to ACL in footnote 5) and the reversal of deferred loan fees, net of $2.5 million. The following table also includes the statements of income impact of Non-PCD and PCD Accruing loans amortization impact which will be recognized over the expected life of the loans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Fair value adjustments on loans acquired |

|

|

|

|

|

|

|

|

|

HFI Non-PCD loans fair value |

|

$ |

(48,306 |

) |

|

$ |

4,883 |

|

|

$ |

8,648 |

|

HFI PCD Accruing loans non-credit fair value |

|

|

(21,972 |

) |

|

|

1,951 |

|

|

|

3,569 |

|

HFI PCD Non-accruing loans non-credit fair value |

|

|

(1,025 |

) |

|

|

- |

|

|

|

- |

|

Total fair value adjustment assigned to loans |

|

|

(71,303 |

) |

|

|

6,834 |

|

|

|

12,217 |

|

Reversal of deferred loan fees, net |

|

|

2,462 |

|

|

|

- |

|

|

|

- |

|

Gross-up for PCD accruing allowance for credit losses |

|

|

4,145 |

|

|

|

- |

|

|

|

- |

|

Gross-up for PCD non-accruing allowance for credit losses |

|

|

158 |

|

|

|

- |

|

|

|

- |

|

Total adjustments to loans |

|

$ |

(64,538 |

) |

|

$ |

6,834 |

|

|

$ |

12,217 |

|

(5)Balance sheet adjustment for the reversal of Partners’ existing allowance for loan losses of $16.1 million. Balance sheet adjustment of $4.3 million for PCD loan fair value assigned to the allowance for credit losses. Balance sheet and equity adjustment for the CECL allowance for credit losses of $9.7 million for acquired non-PCD loans (known as the “CECL Credit Double Count”). The pro forma statements of income do not include a one-time provision expense of $2.1 million related to CECL allowance for credit losses for non-PCD loans as it is shown as a direct retained earnings adjustment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Allowance for loan credit losses |

|

|

|

|

|

|

|

|

|

Reversal of existing allowance for credit losses |

|

$ |

16,075 |

|

|

$ |

- |

|

|

$ |

- |

|

PCD Accruing allowance for credit losses |

|

|

(4,145 |

) |

|

|

- |

|

|

|

- |

|

PCD Non-Accruing allowance for credit losses |

|

|

(158 |

) |

|

|

- |

|

|

|

- |

|

Total adjustments to allowance for credit losses excluding CECL ACL for non-PCD loans |

|

|

11,772 |

|

|

|

- |

|

|

|

- |

|

CECL ACL for Non-PCD loans ("CECL Credit Double Count") |

|

|

(9,694 |

) |

|

|

- |

|

|

|

- |

|

Total adjustments to allowance for credit losses excluding CECL ACL for non-PCD loans |

|

$ |

2,078 |

|

|

$ |

- |

|

|

$ |

- |

|

(6)Balance sheet and statements of income adjustment to reflect the fair value of premises of $6.3 million and amortized over the expected life using the straight-line method over 40 years. Balance sheet adjustment to reflect the write off of obsolete fixed assets of $3.5 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Premises and equipment |

|

|

|

|

|

|

|

|

|

Premise fair value |

|

$ |

6,340 |

|

|

$ |

109 |

|

|

$ |

145 |

|

Write off of fixed assets |

|

|

(3,520 |

) |

|

|

- |

|

|

|

|

Total adjustments for premise and equipment |

|

$ |

2,821 |

|

|

$ |

109 |

|

|

$ |

145 |

|

(7)Balance sheet adjustment to reflect the reversal of the existing core deposit intangible asset. Balance sheet and statements of income adjustment to intangible assets to reflect the fair value of $25.3 million for acquired core deposit intangible asset and the related amortization adjustment based upon the sum-of-the years method over 10 years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Core deposit intangible asset |

|

|

|

|

|

|

|

|

|

Reversal of old core deposit intangible |

|

$ |

(1,185 |

) |

|

$ |

- |

|

|

$ |

- |

|

Core deposit intangible asset |

|

|

25,344 |

|

|

|

3,110 |

|

|

|

4,608 |

|

Total core deposit intangible asset |

|

$ |

24,159 |

|

|

$ |

3,110 |

|

|

$ |

4,608 |

|

(8)Balance sheet adjustment to reflect the net deferred tax asset, at a rate of 24.00%, related to fair value adjustments, CECL allowance for credit losses for Non-PCD Loans, deferred tax asset adjustment to conform to LINK’s tax position, and tax benefits related to LINK one-time merger related charges. The related statements of income adjustments to transaction adjustments using an effective tax rate of 24.00% for book income tax expense. The following table excludes the deferred tax impact related to the CECL double count and merger expenses contained within the transaction accounting adjustments which contributed $2,057 to deferred taxes.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Tax impact |

|

|

|

|

|

|

|

|

|

Fair value adjustments |

|

$ |

10,063 |

|

|

$ |

974 |

|

|

$ |

1,440 |

|

Reversal of existing deferred fees, net |

|

|

(591 |

) |

|

|

- |

|

|

|

- |

|

Reversal of existing allowance for credit losses |

|

|

(3,870 |

) |

|

|

- |

|

|

|

- |

|

Reversal of merger related expenses LINK and Partners |

|

|

- |

|

|

|

790 |

|

|

|

1,140 |

|

Total tax impact |

|

$ |

5,602 |

|

|

$ |

1,764 |

|

|

$ |

2,580 |

|

(9)Balance sheet adjustment to reflect the write off of prepaid expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

Ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Other Assets |

|

|

|

|

|

|

|

|

|

Write off of prepaid expenses |

|

$ |

(1,191 |

) |

|

$ |

- |

|

|

$ |

- |

|

Total adjustments to other assets |

|

$ |

(1,191 |

) |

|

$ |

- |

|

|

$ |

- |

|

(10)Balance sheet and statements of income adjustment to reflect the fair value discount of $3.6 million on interest-bearing time deposit liabilities based on current interest rates for similar instruments. The adjustment will be recognized using an amortization method based upon the maturities of the deposit liabilities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Certificates of Deposit |

|

|

|

|

|

|

|

|

|

Reversal of existing certificate of deposit discount |

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

- |

|

Certificate of deposit fair value |

|

|

(3,596 |

) |

|

|

449 |

|

|

|

2,559 |

|

Total adjustment for certificates of deposits |

|

$ |

(3,595 |

) |

|

$ |

449 |

|

|

$ |

2,559 |

|

(11)Balance sheet and statements of income adjustment to reflect the reversal of existing debt issuance costs of $293 thousand and the fair value discount of $1.5 million for subordinated debt. The adjustment will be recognized using an amortization method based upon the maturities of the subordinated debt.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Income |

|

|

|

|

|

|

Nine Months |

|

|

Twelve Months |

|

|

|

Balance Sheet |

|

|

Ended |

|

|

ended |

|

|

|

September 30, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

Subordinated debt |

|

|

|

|

|

|

|

|

|

Reversal of debt issuance costs |

|

$ |

293 |

|

|

$ |

- |

|

|

$ |

- |

|

Subordinated debt fair value |

|

|

(1,472 |

) |

|

|

467 |

|

|

|

716 |

|

Total adjustments for subordinated debt |

|

$ |

(1,179 |

) |

|

$ |

467 |

|

|

$ |

716 |

|