UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-39559

Lixiang Education Holding Co., Ltd.

(Exact name of registrant as specified in its charter)

No. 818 Hua Yuan Street

Liandu District, Lishui City, Zhejiang Province,

323000

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Lixiang Education Announces Unaudited Half

Year 2023

Financial Results

Lishui, China, October 31, 2023

— Lixiang Education Holding Co., Ltd. (NASDAQ: LXEH) (the “Company”), a prestigious international and vocational education

service provider in China, today announced its unaudited financial results for the first half year of 2023.

First Half Year 2023 Financial Highlights of the

Company

| ● | For the vocational education, the number of total

students has increased by 693 or 62.3% for the semester commenced in March 2023, compared with semester commenced in March 2022, as the

enrollment of new students. For the high school education, the number of total students has increased by 79 or 17.7% for the semester

commenced in the March 2023, compared with semester commenced in March 2022, as the enrollment of new students; |

| ● | Net revenue for the six months ended June 30,

2023 were RMB26.0 million (US$3.6 million), an increase of RMB 3.2 million by 14.2% compared with RMB22.8 million for the same period

ended June 30, 2022, primarily driven by the increase tuition and accommodation income of our vocational education of RMB5.8 million and

high school education of RMB2.5 million, partially offset by the decrease of comprehensive service for flexible employment of RMB5.2 million. |

| ● | Loss from operations for the six months ended

June 30, 2023 was RMB6.5 million (US$0.9 million), a decrease of RMB5.0 million or 43.5% compared with RMB11.5 million for the same period

ended June 30, 2022, due to the increase of gross profit of RMB0.7 million and the decrease of operating expenses of RMB4.3 million. |

First Half Year 2023 Financial Results

Net Revenues

Net revenues for the six months ended June 30,

2023 were RMB26.0 million (US$3.6 million), compared with RMB22.8 million for the same period ended June 30, 2022.

Tuition and accommodation income

For the vocational education, revenue contribution

for the period was RMB12.7 million, primarily from Langfang School, an increase of RMB5.8 million by 82.7% compared with RMB7.0 million

for the same period ended June 30, 2022, primarily due to the combined effect of enrollment of new students, and the increase tuition

fee per students in the new semester.

For the high school education, revenue contribution

for the period was RMB8.0 million from Qingtian International School, an increase of RMB2.5 million by 44.7% compared with RMB5.6 million

for the same period ended June 30, 2022 primary attribute to the enrollment of new students.

Comprehensive service for flexible employment

Revenue from comprehensive service for flexible employment

was RMB0.8 million for the six months ended June 30, 2023, decreased by RMB5.2 million from RMB5.9 million for the six months ended June

30, 2022, primarily due to depressed economic situation in the post-epidemic which led to the temporary decrease of employment demand

in the first half year 2023. We are still striking to seek potential clients so as to bridge the supply and demand gap between the employers

and talents.

Sales of meal, uniforms and learning materials

Revenue contribution for the period was RMB1.7 million,

compared with RMB3.0 million for the same period in 2022 as students have bought less uniforms and learning materials from Langfang School.

Others

Other revenue of RMB2.8 million primary consisted

of consulting services of oversea students’ enrollment in the first half year of 2023 of RMB1.3 million, rental income of RMB0.7

million from third parties and RMB0.4 million from our related party for the six months ended June 30, 2023. Revenue of RMB1.3 million

for the six months ended June 30, 2022 was primarily consisted of consulting services of oversea students’ enrollment in the first

half year of 2022 of RMB0.7 million and rental income of RMB0.4 million from related party.

Cost of Revenues

Cost of revenues for the six months ended June 30,

2023 was RMB19.9 million (US$2.7 million), increased by RMB2.5 million from RMB17.4 million for the same period ended June 30, 2022.

The increase in cost of revenues was mainly included: (i) the increase salary, bonus, social security and welfare benefits of teachers

by RMB3.3 million, primary attribute to our teachers structure optimization and we raised salary to motivate teachers’ incentive;

(ii) the increase rental cost and other utilities charge by RMB0.6 million, partially offset by the decrease of salary and welfare for

interns from comprehensive service for flexible employment of RMB 1.6 million, which was in line with the decrease of revenue from comprehensive

service for flexible employment.

Gross Profit

As a result of the foregoing, gross profit for the

first half year of 2023 was RMB6.1 million, increased slightly, compared with the gross profit of RMB5.4 million for the same period ended

June 30, 2022.

Operating Expenses

Total operating expenses for the first half year

of 2023 were RMB12.6 million (US$1.7 million), compared with RMB16.9 million for the same period ended June 30, 2022. The decrease was

mainly due to the decrease of general and administrative expenses.

General and administrative expense for the first

half year of 2023 was RMB12.2 million (US$1.7 million), decreased by RMB3.7 million compared with that for the same period of 2022. The

decrease general and administrative expense was mainly included: (i) the decrease salary, bonus, social security and welfare benefits

of RMB2.8 million due to the our management structure optimization and expense control; (ii) the decrease of lease expenses of RMB0.5

million due to the decrease of rental market price in the post-epidemic.

Sales and marketing expenses for the first half year

of 2023 was RMB0.4 million (US$0.06 million), decrease by RMB0.6 million compared with that for the same period of 2022. The decrease

of sales and marketing expenses was primarily due to the decreased training expense of marketing personnel.

Other Income, net

Total net other income for the first half year of

2023 was RMB1.2 million (US$0.2 million), compared with RMB9.1 million for the same period ended June 30, 2022. The decrease was

due to the decrease government grants of RMB4.1 million received by Langfang School and Qingtian International School to support the development

of schools; in addition, the Company also received government grants for the successful listing on NASDAQ of RMB5.0 million in the first

half of 2022.

Net Loss

Net loss for the first half year of 2023 was RMB8.2

million (US$1.1 million), compared with net loss of RMB5.0 million for the same period ended June 30, 2022.

Net Loss Attributed to Ordinary Shares

Basic and diluted net loss per share attributable

to ordinary shareholders of the Company from for the first half year of 2023 were RMB0.12, compared with basic and diluted net loss per

share of RMB0.07 for the same period ended June 30, 2022.

Basic and diluted net loss per ADS attributable to

ADS holders of the Company for the first half year of 2023 were RMB0.62, compared with basic and diluted net loss per ADS of RMB0.38 for

the same period ended June 30, 2022.

Cash and Working Capital

As of June 30, 2023, the Company had total cash and

cash equivalents and short-term investment balances of RMB240.1 million (US$33.1 million), a decrease of RMB6.6 million from RMB246.8

million as of December 31, 2022. The decrease was mainly due to our repayment of borrowing from Lianwai School, partially offset by the

advance tuition and accommodation fees paid by students and proceeds from bank loans.

Exchange Rate Information

This announcement contains translations of certain

RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from

Renminbi to U.S. dollars are made at a rate of RMB7.2513 to US$1.00, the rate in effect as of June 30, 2023 published by the Federal Reserve

Board.

Safe Harbor Statement

This announcement contains statements that may constitute

“forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “aims,” “future,” “intends,” “plans,” “believes,”

“estimates,” “likely to,” and similar statements. The Company may also make written or oral forward-looking statements

in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders,

in announcements and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements

that are not historical facts, including statements about the Company’s beliefs, plans, and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially

from those contained in any forward-looking statement, including but not limited to the following: the Company’s strategies, future

business development, and financial condition and results of operations; the expected growth of the Chinese private education market;

Chinese governmental policies relating to private educational services and providers of such services; the Company’s ability to

maintain and enhance its brand. Further information regarding these and other risks is included in the Company’s filings with the

SEC. All information provided in this announcement is as of the date of this announcement, and the Company does not undertake any obligation

to update any forward-looking statement, except as required under applicable law.

Lixiang Education Holding Co., Ltd.

CONSOLIDATED BALANCE SHEETS

(RMB, except share data and per share data,

or otherwise noted)

| | |

As of | |

| | |

December 31,

2022 | | |

June 30,

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

(Audited) | | |

(Unaudited) | | |

(Unaudited) | |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 246,761,548 | | |

| 240,123,032 | | |

| 33,114,480 | |

| Accounts receivable, net | |

| 430,960 | | |

| 568,976 | | |

| 78,465 | |

| Amounts due from a related party | |

| - | | |

| 322,600 | | |

| 44,489 | |

| Inventories | |

| 1,163,776 | | |

| 1,001,425 | | |

| 138,103 | |

| Prepayments and other current assets | |

| 81,197,804 | | |

| 77,371,153 | | |

| 10,669,970 | |

| Total current assets | |

| 329,554,088 | | |

| 319,387,186 | | |

| 44,045,507 | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 160,129,657 | | |

| 157,455,394 | | |

| 21,714,092 | |

| Land use rights, net | |

| 35,820,632 | | |

| 35,347,283 | | |

| 4,874,613 | |

| Intangible assets, net | |

| 218,957 | | |

| 201,953 | | |

| 27,851 | |

| Goodwill | |

| 70,369,837 | | |

| 70,369,837 | | |

| 9,704,444 | |

| Deferred tax assets | |

| 5,252,747 | | |

| 5,323,473 | | |

| 734,140 | |

| Right-of-use assets | |

| 7,580,536 | | |

| 5,512,290 | | |

| 760,180 | |

| Total non-current assets | |

| 279,372,366 | | |

| 274,210,230 | | |

| 37,815,320 | |

| TOTAL ASSETS | |

| 608,926,454 | | |

| 593,597,416 | | |

| 81,860,827 | |

| LIABILITIES | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 67,500,000 | | |

| 77,838,142 | | |

| 10,734,371 | |

| Accounts payable | |

| 2,929,014 | | |

| 1,556,503 | | |

| 214,652 | |

| Deferred revenue, current | |

| 9,368,156 | | |

| 14,163,342 | | |

| 1,953,214 | |

| Salary and welfare payable | |

| 3,426,908 | | |

| 2,390,336 | | |

| 329,642 | |

| Amounts due to a related party | |

| 323,400 | | |

| - | | |

| - | |

| Taxes payable | |

| 850,183 | | |

| 950,808 | | |

| 131,122 | |

| Income tax payable | |

| 57,831 | | |

| 12,143 | | |

| 1,675 | |

| Long-term loans and borrowings, current | |

| 3,925,000 | | |

| 2,500,000 | | |

| 344,766 | |

| Operating lease liabilities-current | |

| 3,866,910 | | |

| 4,041,884 | | |

| 557,401 | |

| Accrued liabilities and other current liabilities | |

| 18,262,186 | | |

| 19,973,839 | | |

| 2,754,519 | |

| Amounts due to Affected Entity (1), current | |

| 23,584,906 | | |

| 653,542 | | |

| 90,128 | |

| Total current liabilities | |

| 134,094,494 | | |

| 124,080,539 | | |

| 17,111,490 | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Amounts due to Affected Entity (1), non-current | |

| 216,176,563 | | |

| 216,176,563 | | |

| 29,812,111 | |

| Operating lease liabilities, non-current | |

| 3,558,380 | | |

| 1,736,734 | | |

| 239,507 | |

| Long-term loans and borrowings, non-current | |

| 1,606,250 | | |

| - | | |

| - | |

| Total non-current liabilities | |

| 221,341,193 | | |

| 217,913,297 | | |

| 30,051,618 | |

| TOTAL LIABILITIES | |

| 355,435,687 | | |

| 341,993,836 | | |

| 47,163,108 | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | | |

| | |

| Ordinary shares (USD$0.0001 par value; 500,000,000 and 500,000,000 shares authorized, 66,667,000 and 66,667,000 shares issued and outstanding as of December 31, 2022 and June 30 2023, respectively) | |

| 45,198 | | |

| 45,198 | | |

| 6,233 | |

| Additional paid-in capital | |

| 305,460,907 | | |

| 304,368,905 | | |

| 41,974,391 | |

| Statutory reserve | |

| 60,201,702 | | |

| 60,468,183 | | |

| 8,338,944 | |

| Accumulated other comprehensive income | |

| 5,514,488 | | |

| 13,469,025 | | |

| 1,857,463 | |

| Accumulated deficit | |

| (118,280,159 | ) | |

| (126,638,600 | ) | |

| (17,464,262 | ) |

| Total Company’s shareholders’ equity | |

| 252,942,136 | | |

| 251,712,711 | | |

| 34,712,769 | |

| Non-controlling interests | |

| 548,631 | | |

| (109,131 | ) | |

| (15,050 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 253,490,767 | | |

| 251,603,580 | | |

| 34,697,719 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| 608,926,454 | | |

| 593,597,416 | | |

| 81,860,827 | |

| (1) | As a result of the effectiveness of the Implementation Rules,

the Company would no longer be able to use its power under the contractual arrangements to direct the relevant activities that would

most significantly affect the economic performance of Liandu Foreign Language School (“Affected Entity”), and hence, has

lost control on August 31, 2021 over the Affected Entity. |

Lixiang Education Holding Co., Ltd.

UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME

(RMB, except share data and per share data,

or otherwise noted)

| | |

For the six months ended | |

| | |

June 30, | |

| | |

2022 | | |

2023 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| | |

| | |

| | |

| |

| Net revenues | |

| 22,752,114 | | |

| 25,990,713 | | |

| 3,584,283 | |

| Cost of revenue | |

| (17,383,875 | ) | |

| (19,910,243 | ) | |

| (2,745,748 | ) |

| Gross profit | |

| 5,368,239 | | |

| 6,080,470 | | |

| 838,535 | |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| (15,834,126 | ) | |

| (12,162,114 | ) | |

| (1,677,232 | ) |

| Sales and marketing expenses | |

| (1,039,481 | ) | |

| (414,238 | ) | |

| (57,126 | ) |

| Total operating expenses | |

| (16,873,607 | ) | |

| (12,576,352 | ) | |

| (1,734,358 | ) |

| Loss from operations | |

| (11,505,368 | ) | |

| (6,495,882 | ) | |

| (895,823 | ) |

| Interest expense | |

| (2,740,633 | ) | |

| (3,144,694 | ) | |

| (433,673 | ) |

| Interest income | |

| 42,698 | | |

| 85,746 | | |

| 11,825 | |

| Other income, net | |

| 9,090,339 | | |

| 1,235,168 | | |

| 170,337 | |

| Loss before income tax expense | |

| (5,112,964 | ) | |

| (8,319,662 | ) | |

| (1,147,334 | ) |

| Income tax benefit | |

| 63,233 | | |

| 69,940 | | |

| 9,645 | |

| Loss from continuing operations, net of tax | |

| (5,049,731 | ) | |

| (8,249,722 | ) | |

| (1,137,689 | ) |

| Net loss | |

| (5,049,731 | ) | |

| (8,249,722 | ) | |

| (1,137,689 | ) |

| Less: net loss attributable to non-controlling interests | |

| (137,784 | ) | |

| (157,762 | ) | |

| (21,756 | ) |

| Loss attributable to the Company’s shareholders | |

| (4,911,947 | ) | |

| (8,091,960 | ) | |

| (1,115,933 | ) |

| | |

| | | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 10,309,159 | | |

| 7,954,537 | | |

| 1,096,981 | |

| Total comprehensive income (loss) | |

| 5,259,428 | | |

| (295,185 | ) | |

| (40,708 | ) |

| Less: total comprehensive loss attributable to non-controlling interests | |

| - | | |

| (157,762 | ) | |

| (21,756 | ) |

| Total comprehensive income (loss) attributable to the Company’s shareholders | |

| 5,259,428 | | |

| (137,423 | ) | |

| (18,952 | ) |

| | |

| | | |

| | | |

| | |

| Loss per ordinary share attributable to Company’s shareholders from continuing operations, basic and diluted | |

| (0.07 | ) | |

| (0.12 | ) | |

| (0.02 | ) |

| Weighted average number of ordinary shares, basic and diluted | |

| 66,667,000 | | |

| 66,667,000 | | |

| 66,667,000 | |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Lixiang Education Holding Co., Ltd. |

| |

|

|

| |

By: |

/s/ Fen Ye |

| |

|

Fen Ye |

| |

|

Chairlady of Board of Directors |

| |

|

|

| Date: October 31, 2023 |

|

|

6

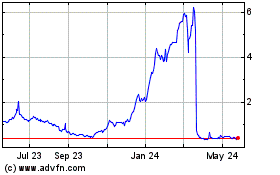

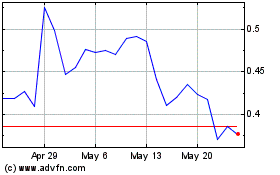

Lixiang Education (NASDAQ:LXEH)

Historical Stock Chart

From Apr 2024 to May 2024

Lixiang Education (NASDAQ:LXEH)

Historical Stock Chart

From May 2023 to May 2024