Mobilicom Announces $2.95 Million Registered Direct Offering

27 January 2024 - 12:30AM

Mobilicom Limited (“Mobilicom” or the “Company”)

(Nasdaq: MOB,

MOBBW, ASX: MOB), a provider of cybersecurity and robust

solutions for drones and robotics, today announced that it has

entered into a definitive agreement with certain institutional

investors for the purchase and sale of 1,903,225 of the Company’s

American Depositary Shares (ADSs) (or ADS equivalents in lieu

thereof), at an effective purchase price of $1.55 per ADS, in a

registered direct offering. Mobilicom has also agreed to issue and

sell to the investor, in a concurrent private placement,

unregistered warrants to purchase up to an aggregate of 1,903,225

ADSs. Each ADS represents two hundred seventy-five (275) ordinary

shares, no par value, of Mobilicom. The offering is expected to

close on or about January 30, 2024, subject to satisfaction of

customary closing conditions.

Ladenburg Thalmann & Co. Inc. acted as the

exclusive placement agent for the offering.

The warrants will have an exercise price of

$1.55 per ADS and will be exercisable at any time upon issuance and

will expire five (5) years from the initial exercise date.

The gross proceeds from the offering (without

taking into account any proceeds from any future exercises of

warrants issued in the concurrent private placement), before

deducting the placement agent's fees and other estimated offering

expenses payable by the Company, are expected to be $2.95 million.

Mobilicom intends to use the net proceeds for working capital and

general corporate purposes.

The ADSs and the ADSs equivalents (but not the

warrants or the ADSs underlying the warrants) are being offered by

Mobilicom pursuant to a "shelf" registration statement on Form F-3

(File No. 333-274929) originally filed with the U.S. Securities and

Exchange Commission (the "SEC") on October 10, 2023 and declared

effective by the SEC on October 23, 2023. The offering of the ADSs

and the ADSs equivalents is being made only by means of a

prospectus, including a prospectus supplement, forming a part of

the effective registration statement. A final prospectus supplement

and the accompanying prospectus relating to the ADSs and the ADSs

equivalents being offered will be filed with the SEC. Electronic

copies of the final prospectus supplement and the accompanying

prospectus may be obtained, when available, on the SEC's website

at http://www.sec.gov or by contacting Ladenburg Thalmann

& Co. Inc., Attention: Syndicate Department, 277 Park Avenue,

26th Floor, New York, New York 10172 or by calling

1-800-573-2541.

The warrants described above were offered in a

private placement under Section 4(a)(2) of the Securities Act of

1933, as amended (the "Act"), and Regulation D promulgated

thereunder and, along with the ADSs underlying the warrants, have

not been registered under the Act, or applicable state securities

laws. Accordingly, the warrants and underlying ADSs may not be

offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such

jurisdiction.

About Mobilicom

Mobilicom is a leading provider of cybersecure

robust solutions for the rapidly growing defense and commercial

drones and robotics market. Mobilicom’s large portfolio of

field-proven technologies includes cybersecurity, software,

hardware, and professional services that power, connect, guide, and

secure drones and robotics. Through deployments across the globe

with over 50 customers, including the world’s largest drone

manufacturers, Mobilicom’s end-to-end solutions are used in

mission-critical functions.

For investors, please use https://ir.mobilicom.com/

For company, please use www.mobilicom.com

Notice Regarding Forward-Looking

Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and

uncertainties. For example, the Company is using forward-looking

statements when it discusses the expected closing of this offering

and use of proceeds. All statements, other than statements of

historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will” “would,” or

the negative of these words or other similar expressions, although

not all forward-looking statements contain these words.

Forward-looking statements are based on Mobilicom Limited’s current

expectations and are subject to inherent uncertainties, risks and

assumptions that are difficult to predict. Further, certain

forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. These and other risks and

uncertainties are described more fully in the Company’s filings

with the Securities and Exchange Commission. Forward-looking

statements contained in this announcement are made as of this date,

and Mobilicom Limited undertakes no duty to update such information

except as required under applicable law.

For more information on Mobilicom, please contact:

Liad Gelfer

Mobilicom Ltd

liad.gelfer@mobilicom.com

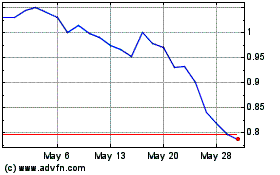

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mobilicom (NASDAQ:MOB)

Historical Stock Chart

From Jan 2024 to Jan 2025