UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Oblong,

Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

674434 105

(CUSIP Number)

Jason M. Lynch

General Counsel

Foundry Group

645 Walnut Street

Boulder, CO 80302

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 30, 2023

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 674434 204 |

Schedule 13D |

Page 2 of 11 |

| (1) |

|

Names of reporting persons

Foundry Venture Capital 2007, L.P. |

| (2) |

|

Check the appropriate box if a member of a group (see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

WC |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

Delaware |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

24,215 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

24,215 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting person:

24,215 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row (11):

1.04% (2) |

| (14) |

|

Type of reporting person (see instructions):

PN |

| (1) | Shares are held directly by Foundry Venture Capital 2007, L.P. (“Foundry 2007”). Foundry Venture

2007, LLC (“Foundry Venture”) is the general partner of Foundry 2007. Bradley Feld ("Feld"), Seth Levine ("Levine")

and Ryan McIntyre ("McIntyre" and with Feld and Levine, the "Managing Members") are the managing members of Foundry

Venture. Foundry 2007, Foundry Venture and the Managing Members may be deemed to share power to direct the voting and disposition of the

shares. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 3 of 11 |

| (1) |

|

Names of reporting persons

Foundry Venture 2007, LLC |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

AF |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

Delaware |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

24,215 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

24,215 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

24,215 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

1.04% (2) |

| (14) |

|

Type of reporting person (see instructions):

OO |

| (1) | Shares are held directly by Foundry Venture 2007. Foundry Venture is the general partner of Foundry 2007.

The Managing Members are the managing members of Foundry Venture. Foundry 2007, Foundry Venture and the Managing Members may be deemed

to share power to direct the voting and disposition of the shares. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 4 of 11 |

| (1) |

|

Names of reporting persons

Foundry Group Select Fund, L.P. |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

WC |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

Delaware |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

91,644 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

91,644 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

91,644 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

3.95% (2) |

| (14) |

|

Type of reporting person (see instructions):

PN |

| (1) | Shares are held directly by Foundry Group Select Fund, L.P. (“Foundry Select”). Foundry Select

Fund GP, LLC (“Foundry Select GP”) is the general partner of Foundry Select. The Managing Members are the managing members

of Foundry Select GP. Foundry Select, Foundry Select GP and the Managing Members may be deemed to share power to direct the voting and

disposition of the shares held by Foundry Select. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 5 of 11 |

| (1) |

|

Names of reporting persons

Foundry Select Fund GP, LLC |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

AF |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

Delaware |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

91,644 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

91,644 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

91,644 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

3.95% (2) |

| (14) |

|

Type of reporting person (see instructions):

OO

|

| (1) | Shares are held directly by Foundry Select. Foundry Select GP is the general partner of Foundry Select.

The Managing Members are the managing members of Foundry Select GP. Foundry Select, Foundry Select GP and the Managing Members may be

deemed to share power to direct the voting and disposition of the shares held by Foundry Select. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Person for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 6 of 11 |

| (1) |

|

Names of reporting persons

Bradley A. Feld |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

AF |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

USA |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

115,859 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

115,859 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

115,859 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

4.99% (2) |

| (14) |

|

Type of reporting person (see instructions):

IN |

| (1) | Consists of 24,215 shares of Common Stock held by Foundry 2007 and 91,644 shares of Common Stock held

by Foundry Select. Foundry Venture is the general partner of Foundry 2007 and Foundry Select GP is the general partner of Foundry Select.

The Managing Members are the managing managers of each of Foundry Venture and Foundry Select GP. Foundry 2007, Foundry Venture and the

Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry 2007. Foundry Select,

Foundry Select GP and the Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry

Select. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 7 of 11 |

| (1) |

|

Names of reporting persons

Seth Levine |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

AF |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

USA |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

115,859 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

115,859 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

115,859 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

4.99% (2) |

| (14) |

|

Type of reporting person (see instructions):

IN |

| (1) | Consists of 24,215 shares of Common Stock held by Foundry 2007 and 91,644 shares of Common Stock held

by Foundry Select. Foundry Venture is the general partner of Foundry 2007 and Foundry Select GP is the general partner of Foundry Select.

The Managing Members are the managing managers of each of Foundry Venture and Foundry Select GP. Foundry 2007, Foundry Venture and the

Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry 2007. Foundry Select,

Foundry Select GP and the Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry

Select. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 8 of 11 |

| (1) |

|

Names of reporting persons

Ryan McIntyre |

| (2) |

|

Check the appropriate box if a member of a group

(see instructions)

(a) ¨

(b) x |

| (3) |

|

SEC use only |

| (4) |

|

Source of funds (see instructions):

AF |

| (5) |

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or organization

USA |

|

Number of

shares

beneficially

owned by

each

reporting

person

with: |

|

(7) |

|

Sole voting power:

0 |

| |

(8) |

|

Shared voting power:

115,859 (1) |

| |

(9) |

|

Sole dispositive power:

0 |

| |

(10) |

|

Shared dispositive power:

115,859 (1) |

| (11) |

|

Aggregate amount beneficially owned by each reporting

person:

115,859 (1) |

| (12) |

|

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class represented by amount in Row

(11):

4.99% (2) |

| (14) |

|

Type of reporting person (see instructions):

IN |

| (1) | Consists of 24,215 shares of Common Stock held by Foundry 2007 and 91,644 shares of Common Stock held

by Foundry Select. Foundry Venture is the general partner of Foundry 2007 and Foundry Select GP is the general partner of Foundry Select.

The Managing Members are the managing managers of each of Foundry Venture and Foundry Select GP. Foundry 2007, Foundry Venture and the

Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry 2007. Foundry Select,

Foundry Select GP and the Managing Members may be deemed to share power to direct the voting and disposition of the shares held by Foundry

Select. |

| (2) | This percentage is calculated based upon 2,728,600 shares of Common Stock outstanding as of June 30, 2023,

as reported by the Issuer directly to the Reporting Persons on June 30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged

by the Reporting Persons for Exchange Warrants as described below. |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 9 of 11 |

Explanatory Note: This Amendment No. 1

(the “Amendment”), which amends the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”)

on February 22, 2021 (the “Original Schedule 13D”) filed on behalf of Foundry Group Select Fund, L.P. (“Foundry Select”),

Foundry Select Fund GP, LLC (“Foundry Select GP”), Foundry Venture Capital 2007, L.P. (“Foundry 2007”), Foundry

Venture 2007, LLC (“Foundry Venture”), Bradley Feld ("Feld"), Seth Levine ("Levine") and Ryan McIntyre

("McIntyre" and together with Foundry Select, Foundry Select GP, Foundry 2007, Foundry Venture, Feld and Levine, collectively,

the “Reporting Persons”), relates to the Common Stock, par value $0.0001 per share (“Common Stock”) of Oblong,

Inc., a Delaware corporation (the “Issuer”). Information reported in the Original Schedule 13D remains in effect except to

the extent that it is amended, restated or superseded by information contained in this Amendment. Capitalized terms used but not defined

in this Amendment have the respective meanings set forth in the Original Schedule 13D. All references in the Original Schedule 13D and

this Amendment shall be deemed to refer to the Original Schedule 13D as amended and supplemented by this Amendment.

| Item 2. | Identity and Background |

Item 2(b) of the Original Schedule 13D is hereby

amended and restated in its entirety as follows:

| (b) | The address of the principal place of business of each of the Reporting Persons is c/o Foundry Group,

645 Walnut Street, Boulder, CO 80302. |

| Item 4. | Purpose of Transaction |

Item 4 of the Original Schedule 13D is hereby

amended and supplemented by adding the following at the end of Item 4:

On June 30, 2023, the Issuer entered into an exchange

agreement (the “Exchange Agreement”) with Foundry Select and Foundry 2007 (the “Exchanging Stockholders”), pursuant

to which, effective July 3, 2023, the Issuer exchanged an aggregate of 406,776 shares of the Issuer’s Common Stock, owned by the

Exchanging Stockholders for pre-funded warrants (the “Exchange Warrants”) to purchase an aggregate of 406,776 shares of Common

Stock (subject to adjustment in the event of stock splits, recapitalizations and other similar events affecting Common Stock), with an

exercise price of $0.0001 per share, as described more fully below.

Immediately after the closing of the transactions

contemplated by the Exchange Agreement, the Exchanging Stockholders owned an aggregate of 115,859 shares of Common Stock representing

approximately 4.99% of the total number of issued and outstanding Common Stock as of such date.

| Item 5. | Interest in Securities of the Issuer |

Item 5 of the Original Schedule 13D is hereby

amended and restated in its entirety as follows:

(a), (b) The responses

of the Reporting Persons with respect to Rows 7 through 13 of their respective cover pages to this Schedule 13D are incorporated herein

by reference.

The Reporting Persons beneficially own,

in the aggregate, 115,859 shares of Common Stock, representing approximately 4.99% of the outstanding shares of Common Stock, based upon

2,728,600 shares of Common Stock outstanding as of June 30, 2023, as reported by the Issuer directly to the Reporting Persons on June

30, 2023, minus an aggregate of 406,776 shares of Common Stock exchanged by the Reporting Persons for Exchange Warrants as described above.

Each of the Reporting Persons expressly

disclaims beneficial ownership of all of the shares of Common Stock included in this Amendment, other than the shares of Common Stock

held of record by such Reporting Person, and expressly disclaim status as a “group” for purposes of this Amendment. The filing

of this Amendment shall not be construed as an admission that any such person is, for the purposes of sections 13(d) or 13(g) of the Exchange

Act of 1934, as amended, the beneficial owner of any securities covered by this Amendment.

| CUSIP No. 674434 204 |

Schedule 13D |

Page 10 of 11 |

| (c) | Except as set forth herein, none of the Reporting Persons has engaged in any transaction with respect

to the Common Stock during the last sixty days. |

| (d) | To the best knowledge of the Reporting Persons, no one other than the Reporting Persons, or the partners,

members, affiliates or shareholders of the Reporting Persons, is known to have the right to receive, or the power to direct the receipt

of, dividends from, or proceeds from the sale of, the shares of Common Stock reported herein as beneficially owned by the Reporting Persons. |

| (e) | The Reporting Persons ceased to be the beneficial owners of more than five percent of the Common Stock

on July 3, 2023. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 of the Original Schedule 13D is hereby

amended and supplemented by adding the following at the end of Item 6:

Exchange Agreement

The description of the Exchange Agreement in Item

4 is incorporated by reference herein.

Pre-Funded Warrants to Purchase Common Stock

The Exchange Warrants are exercisable at any time,

except that the Exchange Warrants are not exercisable by the Exchanging Stockholders if, upon giving effect or immediately prior thereto,

the Exchanging Stockholders would beneficially own more than 4.99% of the total number of issued and outstanding Common Stock, which percentage

may change at the holders’ election to any other number less than or equal to 19.99% upon 61 days’ notice to the Issuer. The

holders of the Exchange Warrants will not have the right to vote on any matter submitted to the Issuer’s holders of Common Stock,

except to the extent required by Delaware law.

The foregoing descriptions are qualified in their

entirety by the full text of the Exchange Agreement and form of Exchange Warrant, which are filed herewith as Exhibits C and D and incorporated

herein by reference.

| Item 7. | Material to Be Filed as Exhibits |

Item 7 of the Original Schedule 13D is hereby

amended and supplemented by adding the following at the end of Item 7:

| C. | Exchange Agreement, dated as of June 30, 2023, between Oblong, Inc. and Foundry Venture Capital 2007, L.P.

and Foundry Group Select Fund, L.P. (incorporated by reference to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K (File

No. 001-35376), filed on July 5, 2023). |

| D. | Form of Pre-Funded Warrant to Purchase Common Stock (incorporated by reference to Exhibit 4.1 to the Issuer’s

Current Report on Form 8-K (File No. 001-35376), filed on July 5, 2023). |

| CUSIP No. 674434 204 |

Schedule 13D |

Page 11 of 11 |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Foundry Venture Capital 2007, L.P. |

|

| |

|

| By: |

Foundry Venture 2007, LLC |

|

| Its: |

General Partner |

|

| |

|

|

| By: |

/s/ Bradley A. Feld |

|

| |

Bradley A. Feld, Managing Member |

|

| |

|

|

| Foundry Venture 2007, LLC |

|

| |

|

|

| By: |

/s/ Bradley A. Feld |

|

| |

Bradley A. Feld, Managing Member |

|

| |

|

|

| Foundry Group Select Fund, L.P. |

|

| |

|

|

| By: |

Foundry Select Fund GP, LLC |

|

| Its: |

General Partner |

|

| |

|

|

| By: |

/s/ Bradley A. Feld |

|

| |

Bradley A. Feld, Managing Member |

|

| |

|

|

| Foundry Select Fund GP, LLC |

|

| |

|

|

| By: |

/s/ Bradley A. Feld |

|

| |

Bradley A. Feld, Managing Member |

|

| |

|

|

| /s/ Bradley

A. Feld |

|

| Bradley A. Feld |

|

| |

|

|

| /s/ Seth Levine |

|

| Seth Levine |

|

| |

|

|

| /s/ Ryan McIntyre |

|

| Ryan McIntyre |

|

The original statement shall be signed

by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person

by his authorized representative (other than an executive officer or general partner of the filing person), evidence of the representative's

authority to sign on behalf of such person shall be filed with the statement: provided, however, that a power of attorney for this purpose

which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement

shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions

of fact

constitute Federal criminal violations (See 18 U.S.C. 1001)

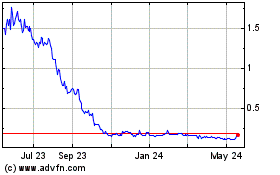

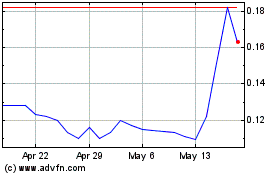

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Dec 2023 to Dec 2024