UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File No. 001-39621

OPTHEA LIMITED

(Translation of registrant’s name into English)

Level 4

650 Chapel Street

South Yarra, Victoria, 3141

Australia

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

OPTHEA LIMITED |

|

(Registrant) |

|

|

|

|

By: |

/s/ Frederic Guerard |

|

Name: |

Frederic Guerard |

|

Title: |

Chief Executive Officer |

Date: 09/23/2024

Exhibit 99.1

ASX, Nasdaq and Media Release

September 23, 2024

Opthea Joins the S&P/ASX 300 Index

Melbourne, Australia, and Princeton, NJ, US, September 23, 2024 -- Opthea Limited (ASX/NASDAQ: OPT, “Opthea”, the “Company”), a clinical-stage biopharmaceutical company developing novel therapies to treat highly prevalent and progressive retinal diseases, including wet age-related macular degeneration (wet AMD), today announced that the Company joins the S&P/ASX 300 Index, effective Monday, September 23, 2024, prior to market open in Australia.

“Opthea’s addition to the S&P/ASX 300 Index reflects the Company’s strengthened balance sheet with proceeds from the recent financing completed in July 2024. We also reached a significant milestone by completing enrollment of close to 2,000 patients in the sozinibercept Phase 3 wet AMD program,” said Frederic Guerard, PharmD, Chief Executive Officer of Opthea. “We believe our inclusion in the S&P/ASX 300 Index may further diversify the Company’s institutional shareholder base as we progress our Phase 3 pivotal program to anticipated topline data readouts of COAST in early Q2 calendar year 2025 and ShORe in mid calendar year 2025 and prepare the organization for a potential US FDA approval and launch.”

The S&P/ASX indices measure the performance of ASX-listed companies across various sizes, industries, themes, and strategies. Each index is designed to represent a certain segment of the Australian equities market. The S&P/ASX 300 index, which is rebalanced semi-annually in March and September, measures the performance of 300 of Australia’s largest securities listed on the ASX by float-adjusted market capitalization. The index includes the large-cap, mid-cap, and small-cap components of the S&P/ASX index family.

About Opthea

Opthea (ASX/NASDAQ:OPT) is a biopharmaceutical company developing novel therapies to address the unmet need in the treatment of highly prevalent and progressive retinal diseases, including wet age-related macular degeneration (wet AMD) and diabetic macular edema (DME).

Opthea’s lead product candidate, sozinibercept, is being evaluated in two fully enrolled pivotal Phase 3 clinical trials (COAST, NCT04757636, and ShORe, NCT04757610) for use in combination with standard-of-care anti-VEGF-A monotherapies to improve overall efficacy and deliver superior vision gains compared to standard-of-care anti-VEGF-A agents.

To learn more, visit our website at www.opthea.com and follow us on X and LinkedIn.

Inherent risks of Investment in Biotechnology Companies

There are a number of inherent risks associated with the development of pharmaceutical products to a marketable stage. The lengthy clinical trial process is designed to assess the safety and efficacy of a drug prior to commercialization and a significant proportion of drugs fail one or both of these criteria. Other risks include uncertainty of patent protection and proprietary rights, whether patent applications and issued patents will offer adequate protection to enable product development, the obtaining of necessary drug regulatory authority approvals and difficulties caused by the rapid advancements in technology. Companies such as Opthea are dependent on the success of their research and development projects and on the ability to attract funding to support these activities. Investment in research and development projects cannot be assessed on the same fundamentals as trading and manufacturing enterprises. Therefore, investment in companies specializing in drug development must be regarded as highly speculative. Opthea strongly recommends that professional investment advice be sought prior to such investments.

Forward Looking Statements

This ASX announcement contains certain forward-looking statements, including within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “expect”, “believe”, “should”, “could”, “may”, “will”, “plan” and other similar expressions are intended to identify forward-looking statements. Forward-looking statements in this ASX announcement include statements regarding the Company’s continued efforts to advance its BLA preparations for FDA approval, the Company’s commercialization potential and timing of the progress update of the Company’s drug product PPQ campaign. Forward-looking statements, opinions and estimates provided in this ASX announcement are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current conditions. Forward-looking statements are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. They involve known and unknown risks and uncertainties and other factors, many of which are beyond the control of Opthea and its directors and management and may involve significant elements of subjective judgment and assumptions as to future events that may or may not be correct. These statements may be affected by a range of variables which could cause actual results or trends to differ materially, including but not limited to future capital requirements, the development, testing, production, marketing and sale of drug treatments, regulatory risk and potential loss of regulatory approvals, ongoing clinical studies to demonstrate sozinibercept safety, tolerability and therapeutic efficacy, clinical research organization and labor costs, intellectual property protections, and other factors that are of a general nature which may affect the future operating and financial performance of the Company including risk factors set forth in Opthea’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 30, 2024, and other future filings with the SEC. Actual results, performance or achievement may vary materially from any projections and forward-looking statements and the assumptions on which those statements are based. Subject to any continuing obligations under applicable law or any relevant ASX listing rules, Opthea disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statements in this ASX announcement to reflect any change in expectations in relation to any forward-looking statements or any change in events, conditions or circumstances on which any such statement is based, except as otherwise required by applicable law.

Authorized for release to ASX by Frederic Guerard, CEO

|

|

Investor Inquiries |

Join our email database to receive program updates: |

PJ Kelleher LifeSci Advisors LLC Email: pkelleher@lifesciadvisors.com Phone: 617-430 7579 Media Inquiries Silvana Guerci-Lena NorthStream Global Partners silvana@nsgpllc.com |

Tel: +61 (0) 3 9826 0399 Email: info@opthea.com Web: www.opthea.com Source: Opthea Limited |

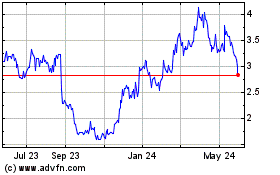

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

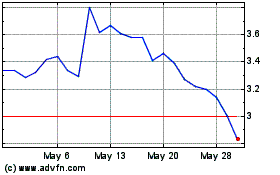

Opthea (NASDAQ:OPT)

Historical Stock Chart

From Dec 2023 to Dec 2024