Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

10 May 2023 - 10:43PM

Edgar (US Regulatory)

Filed pursuant to Rule 497(a)

Registration No. 333-265533

Rule 482ad

OXFORD SQUARE CAPITAL CORP.

ANNOUNCES TRANSFERABLE RIGHTS OFFERING

GREENWICH, CT, May 10, 2023—Oxford

Square Capital Corp. (NASDAQ: OXSQ) (“we,” “us,” “our,” “OXSQ” or the “Company”)

announced today that its Board of Directors has approved the terms of a transferable rights offering to purchase shares of its common

stock. Ladenburg Thalmann & Co. Inc. will act as the Dealer Manager for the offering.

The Company will issue to

stockholders of record as of 5:00 p.m., New York City time, on May 23, 2023 transferable rights to subscribe for an aggregate of up to

16,633,723 shares of the Company’s common stock. Each record date stockholder will be issued one transferable right for every three

shares of the Company’s common stock owned on the record date. The rights entitle each holder to acquire at the subscription price

one share of the Company’s common stock for every right held (the “Primary Subscription”). An application has been submitted

for the rights to be listed for trading on the Nasdaq Global Select Market under the symbol “OXSQR” with trading anticipated

to begin on or around May 26, 2023. Rights may be exercised at any time during the subscription period, which commences on May 24, 2023,

and ends at 5:00 p.m., New York City time, on June 14, 2023, the expiration date, unless the subscription period is extended by the Company

(the “Expiration Date”).

Record date stockholders

who fully exercise all rights issued to them are entitled to subscribe for additional shares of the Company’s common stock that

were not subscribed for by other holders in the Primary Subscription, on the terms and subject to the conditions that will be set forth

in the prospectus for this offering, including as to pro-ration. In addition, any rights holders who were not record date stockholders

who exercise rights are entitled to subscribe for such additional shares that are not otherwise subscribed for by record date stockholders

pursuant to their over-subscription privilege, on terms and subject to the conditions that will be set forth in the prospectus for this

offering, including as to pro-ration. These over-subscription privileges are referred to as the “Over-Subscription Privilege”.

Members of senior management

of the Company, who own approximately 3.26 million shares of the Company’s common stock, have indicated that they intend to fully exercise

their Primary Subscription rights.

The subscription price for

the shares to be issued pursuant to the rights will be the greater of (1) 92.5% of the volume-weighted average of the sales prices of

the Company’s shares of common stock on the Nasdaq Global Select Market for the five consecutive trading days preceding the Expiration

Date and (2) 95.0% of the last reported net asset value of the Company. The subscription price will be determined on the Expiration Date.

The Company has the ability to terminate the rights offering at any time prior to delivery of the rights and the shares of the Company’s

common stock offered thereby. If this rights offering is terminated, all rights will expire without value, and no amounts paid to acquire

rights on the Nasdaq Global Select Market or otherwise would be returned.

| IMPORTANT DATES* |

|

|

| Record Date |

|

May 23, 2023 |

| Subscription Period |

|

from May 24 to June 14, 2023 |

| Rights expected to begin trading on NASDAQ |

|

May 26, 2023 |

| Last day it is expected that rights can be traded |

|

June 13, 2023 |

| Expiration Date |

|

June 14, 2023 at 5:00 p.m. New York City Time |

| Deadline for Delivery of Subscription Certificates and Payment for Shares |

|

June 14, 2023 at 5:00 p.m. New York City Time |

| Deadline for Delivery of Notice of Guaranteed Delivery |

|

June 14, 2023 at 5:00 p.m. New York City Time |

| Confirmations Mailed to Participants |

|

June 21, 2023 |

| Final Payment Date** |

|

June 28, 2023 |

* All end dates subject to extension if the Company

extends the Expiration Date.

** Any additional amount due (in the event the subscription price exceeds the estimated subscription price)

The Company intends to use

the net proceeds from the sale of shares of its common stock pursuant to the exercise of rights issued in this offering primarily (i)

to repay outstanding indebtedness, (ii) to fund investments in debt securities and CLO investments in accordance with the Company’s

investment objective and (iii) for general corporate purposes.

The offering will be made only by means of a prospectus

supplement and accompanying prospectus, which, along with exercise instructions, is expected to be mailed to shareholders on or about

May 23, 2023. The definitive terms of the offer, including the estimated subscription price, will be contained in the Company’s

prospectus supplement for the offering.

The information herein

is not complete and is subject to change. This document is not an offer to sell any securities and is not soliciting an offer to buy any

securities in any jurisdiction where the offer or sale is not permitted. This document is not an offering, which can only be made by a

prospectus supplement and accompanying prospectus. Investors should consider the Company’s investment objectives and policies, risks,

charges and expenses carefully before investing. The Company’s prospectus supplement and accompanying prospectus will contain this

and additional information about the Company and additional information about the offering, and should be read carefully before investing.

For further information regarding the offering, or to obtain a copy of the prospectus supplement and accompanying prospectus, when available,

please contact the Company’s information agent: Alliance Advisors, LLC, by calling (toll-free) at 1-888-490-5078, by email at oxsq@allianceadvisors.com,

or by mail at 200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003.

About Oxford Square Capital Corp.

Oxford Square Capital Corp. is a publicly-traded business

development company principally investing in syndicated bank loans and debt and equity tranches of collateralized loan obligation (“CLO”)

vehicles. CLO investments may also include warehouse facilities, which are financing structures intended to aggregate loans that may be

used to form the basis of a CLO vehicle.

Forward-Looking Statements

This press release contains forward-looking statements

subject to the inherent uncertainties in predicting future results and conditions. Any statements that are not statements of historical

fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,”

“estimates” and similar expressions) should also be considered to be forward-looking statements. These statements are not

guarantees of future performance, conditions or results and involve a number of risks and uncertainties. Certain factors could cause actual

results and conditions to differ materially from those projected in these forward-looking statements. These factors are identified from

time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update such statements to reflect

subsequent events, except as may be required by law.

Contact:

Bruce Rubin

203-983-5280

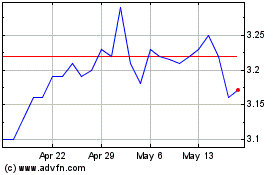

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

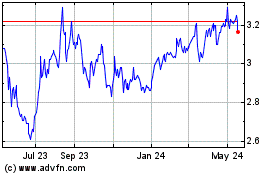

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Jan 2024 to Jan 2025