Third Quarter 2023

Highlights

- Core net income up from prior quarter

- Net interest margin increased one basis point to 2.73% from

prior quarter

- Deposit growth of $71 million (up 4.1% annualized),

including $92 million for core customer deposits excluding brokered

(up 5.6% annualized)

- Expenses down 14.5%, or 6.8% excluding transaction costs,

and core efficiency ratio improved by 96 basis points from prior

quarter

- Loan delinquencies down 9.5% from prior quarter and two

consecutive quarters of net recoveries

- Regulatory capital ratios improve by 23 basis points from

prior quarter including common equity tier 1 (“CET1”) ratio up to

11.08%

- Declared dividend of $0.31 per share, up 3.3% from prior

year comparable period

- Launched new digital banking platform to improve clients’

banking experience in October

Premier Financial Corp. (Nasdaq: PFC) (“Premier” or the

“Company”) announced today 2023 third quarter results, including

net income of $24.7 million ($0.69 per diluted common share)

compared to $48.4 million ($1.35 per diluted common share), or core

$24.2 million ($0.68 per diluted common share) excluding the

insurance agency sale, for the second quarter of 2023.

“I am pleased to announce Premier’s continued improvement in net

income, net interest income, and net interest margin performance

for the third quarter,” said Gary Small, President and CEO of

Premier. “Average annualized loan growth for the quarter totaled

2.9%, consistent with our focus on serving existing client needs

while remaining very selective in the pursuit of new relationships.

Continued success in attracting customer deposits (up 5.6%

annualized for the quarter) will translate into higher loan growth

as we enter 2024.”

“Premier’s credit metrics remain steady with delinquencies down

as our consumer and commercial clients continue to manage their

resources well. Commercial line usage is drifting lower each month

as clients utilize their excess cash to reduce line balances. The

business outlook across our markets remains strong, yet

conservative. Warehouse vacancy is low and manufacturing order

boards remain robust, with labor availability as the major

constraint. Many companies are focusing on profit margins versus

growth as they work through the uncertain economic environment. The

housing market remains very tight in most markets with continuing

new job creation, a consistent theme across the network. The

Federal Reserve’s more paced approach toward interest rates in

recent months has allowed the bank, and our clients, time to

address the impacts of the higher rate environment,” added

Small.

“We at Premier will continue to build capital and make

investments designed to improve our business, our client

experience, and benefit the communities we serve,” Small continued.

“To that end, all of us at Premier are very excited to have just

concluded a major initiative focused on improving our client

experience. We’ve recently installed a new state-of-the-art digital

banking system designed to improve our clients’ banking experience

across all channels of the organization. The new digital banking

platform has transformed our mobile and online banking experience,

bringing new features and services to our clients. Now that we’ve

completed the consumer upgrades, expect to see more regarding

business banking improvements in early 2024. Premier remains

committed to providing an exceptional customer experience, and are

committed to making investments that will best serve our clients

today and in the future.”

Quarterly results

Capital, deposits and liquidity

Regulatory ratios all improved during the third quarter of 2023,

including CET1 of 11.08%, Tier 1 of 11.55% and Total Capital of

13.33%, each up 23 basis points. All of these ratios also exceed

well-capitalized guidelines pro forma for accumulated other

comprehensive income (“AOCI”), including CET1 of 8.36%, Tier 1 of

8.84% and Total Capital of 10.61%.

Total deposits increased 4.1% annualized, or $71.2 million,

during the third quarter of 2023, due to a $92.3 million increase

in customer deposits (up 5.6% annualized), offset partly by a

decrease of $21.1 million in brokered deposits. Total average

interest-bearing deposit costs increased 47 basis points to 2.54%

for the third quarter of 2023. This increase was primarily due to

brokered deposits and the migration of customers from non-interest

bearing deposits into interest-bearing deposits, including higher

cost time deposits, as customers continue to seek better yields.

Total average customer deposit costs including non-interest and

excluding brokered deposits and acquisition marks were 1.85% during

the month of September, representing a cumulative beta of 32%

compared to the change in the monthly average effective Federal

Funds rate that increased 525 basis points to 5.33% since December

2021, as reported by the Federal Reserve Economic Data.

At September 30, 2023, uninsured deposits were 32.8% of total

deposits, or 17.7% adjusting for collateralized deposits, other

insured deposits and internal company accounts. Total quantifiable

liquidity sources totaled $2.57 billion, or 204.0% of adjusted

uninsured deposits, and were comprised of the following at

September 30, 2023:

- $117.5 million of cash and cash equivalents with a 5.40%

Federal Reserve rate;

- $280.9 million of unpledged securities with an average yield of

3.05%;

- $1.3 billion of Federal Home Loan Bank (“FHLB”) borrowing

capacity with an overnight borrowing rate of 5.40%;

- $316.7 million of brokered deposits based on a Company policy

limit of 10% of deposits, with market pricing dependent on brokers

and duration;

- $70.0 million of unused lines of credit with an average

borrowing rate of 6.65%; and

- $471.4 million of borrowing capacity at the Federal Reserve

with an average rate of 5.48%.

Additional liquidity sources include deposit growth, cash

earnings in excess of dividends, loan

repayments/participations/sales, and securities cash flows, which

are estimated to be $66.5 million over the next 12 months.

Net interest income and margin

Net interest income of $54.3 million on a tax equivalent (“TE”)

basis in the third quarter of 2023 was up 0.5% from $54.1 million

in the second quarter of 2023 but down 14.5% from $63.5 million in

the third quarter of 2022. The TE net interest margin of 2.73% in

the third quarter of 2023 increased one basis point from 2.72% in

the second quarter of 2023 but decreased 67 basis points from 3.40%

in the third quarter of 2022. Results for all periods include the

impact of Paycheck Protection Program (“PPP”) as well as

acquisition marks and related accretion. Third quarter 2023

includes $142 thousand of accretion in interest income, $180

thousand of accretion in interest expense, and $4 thousand of

interest income on average balances of $553 thousand for PPP.

Excluding the impact of acquisition marks accretion and PPP

loans, core net interest income was $54.0 million, up 0.6% from

$53.7 million in the second quarter of 2023 but down 14.1% from

$62.9 million in the third quarter of 2022. Additionally, the core

net interest margin was 2.71% for the third quarter of 2023, up one

basis point from 2.70% for the second quarter of 2023 but down 65

basis points from 3.36% for the third quarter of 2022. These

results are positively impacted by the combination of loan growth

and higher loan yields, which were 5.12% for the third quarter of

2023 compared to 4.86% in the second quarter of 2023 and 4.29% in

the third quarter of 2022. Excluding the impact of PPP, balance

sheet hedges and acquisition marks accretion, loan yields were

5.16% in September 2023 for an increase of 141 basis points since

December 2021, which represents a cumulative beta of 27% compared

to the change in the monthly average effective Federal Funds rate

for the same period.

The cost of funds in the third quarter of 2023 was 2.17%, up 25

basis points from the second quarter of 2023 and up 162 basis

points from the third quarter of 2022. The increases are largely

due to the higher average deposit costs discussed above. Excluding

the impact of balance sheet hedges and acquisition marks accretion,

cost of funds were 2.24% in September 2023 for an increase of 203

basis points since December 2021, which represents a cumulative

beta of 39% compared to the change in the monthly average effective

Federal Funds rate for the same period.

“Our margin has been very consistent over the past six months as

we’ve taken steps to attract new money at the right rate, manage

the migration of existing deposits into higher rate offerings, and

have appropriately repriced loan renewals to reflect today’s

environment,” said Small. “These steps, combined with nimble

balance sheet management, will be the key to additional net

interest income and margin improvement in the future.”

Non-interest income

Excluding insurance commissions, total non-interest income in

the third quarter of 2023 of $13.3 million was up 2.6% from $12.9

million in the second quarter of 2023 excluding the $36.3 million

gain on the sale of the insurance agency, and 0.3% from $13.2

million in the third quarter of 2022, primarily due to fluctuations

in mortgage banking and gains/losses on securities. Mortgage

banking income increased $0.3 million on a linked quarter basis but

decreased $0.7 million year-over-year, primarily as a result of

fluctuations in gain margins.

Security gains were $256 thousand in the third quarter of 2023,

partly due to increased valuations on equity securities. This

compares to gains of $64 thousand in the second quarter of 2023 and

$43 thousand in the third quarter of 2022, each primarily from

increased valuations on equity securities. Service fees in the

third quarter of 2023 were $6.9 million, a 3.4% decrease from $7.2

million in the second quarter of 2023 but a 6.1% increase from $6.5

million in the third quarter of 2022. This change was primarily due

to fluctuations in loan fees, including commercial customer swap

activity. Due to the insurance agency sale in the second quarter of

2023, there were no insurance commissions in the third quarter of

2023, compared to $4.1 million in the second quarter of 2023 and

$3.5 million in the third quarter of 2022. Wealth management income

of $1.5 million in the third quarter of 2023 was consistent with

$1.5 million in the second quarter of 2023 and up from $1.4 million

in the third quarter of 2022.

Non-interest expenses

Non-interest expenses in the third quarter of 2023 were $38.1

million, a 6.8% decrease from $40.8 million in the second quarter

of 2023, excluding transaction costs for the insurance agency sale,

and a 7.4% decrease from $41.1 million in the third quarter of

2022. Compensation and benefits were $21.8 million in the third

quarter of 2023, compared to $24.2 million in the second quarter of

2023 and $24.5 million in the third quarter of 2022. The linked

quarter decrease was primarily due to the insurance agency sale and

cost saving initiatives that began during the second quarter of

2023. The year-over-year decrease was primarily due to the

insurance agency sale, partially offset by costs related to higher

staffing levels for our 2022 growth initiatives and higher base

compensation, including 2022 mid-year adjustments and 2023 annual

adjustments. FDIC premiums decreased $0.4 million on a linked

quarter basis due to accrual true-up in the prior quarter, but

increased $0.4 million from the third quarter of 2022 primarily due

to year-over-year growth. All other non-interest expenses increased

only a net $11 thousand on a linked quarter basis and decreased a

net $0.7 million on a year-over-year basis due to the insurance

agency sale and cost saving initiatives. The efficiency ratio for

the third quarter of 2023 of 56.5% improved from 57.5% (excluding

transaction costs and the insurance agency gain on sale) in the

second quarter of 2023 due to cost saving initiatives but worsened

from 51.3% in the third quarter of 2022 due to lower revenues.

“We continue to execute on expense reductions and are pleased to

have improved our core efficiency ratio almost 100 basis points

this quarter,” said Paul Nungester, CFO of Premier. “Through the

combination of successful cost save initiatives implemented to-date

and the insurance agency sale, we have reduced our expense run-rate

11% to $152 million annualized from our beginning of the year

estimate of $170 million.”

Credit quality

Non-performing assets totaled $39.9 million, or 0.47% of assets,

at September 30, 2023, an increase from $37.6 million at June 30,

2023, and from $33.6 million at September 30, 2022. Loan

delinquencies decreased to $17.2 million, or 0.24% of loans, at

September 30, 2023, from $19.0 million at June 30, 2023, but

increased from $13.2 million at September 30, 2022. Classified

loans totaled $63.5 million, or 0.90% of loans, as of September 30,

2023, an increase from $60.5 million at June 30, 2023, and from

$45.0 million at September 30, 2022.

The 2023 third quarter results include net recoveries of $347

thousand and a total provision benefit of $0.8 million, compared

with net loan charge-offs of $154 thousand and a total provision

expense of $4.0 million for the same period in 2022. The allowance

for credit losses as a percentage of total loans was 1.14% at

September 30, 2023, compared with 1.13% at June 30, 2023, and 1.14%

at September 30, 2022. The allowance for credit losses as a

percentage of total loans excluding PPP and including unaccreted

acquisition marks was 1.17% at September 30, 2023, compared with

1.16% at June 30, 2023, and 1.19% at September 30, 2022. The

continued economic improvement following the 2020 pandemic-related

downturn has resulted in a year-over-year decrease in the allowance

percentages.

“Our commercial and credit teams have expanded their loan review

and analysis routines looking for early warning indicators of

potential stress on specific loans and categories (e.g., office),

with particular focus on ‘shocking’ the portfolio for the effect of

future repricing scenarios,” said Small.

Year to date results

For the nine-month period ended September 30, 2023, net income

totaled $91.2 million, or $2.55 per diluted common share, compared

to $76.9 million, or $2.15 per diluted common share for the nine

months ended September 30, 2022. 2023 results include the impact of

the insurance agency sale for a net gain on sale after transaction

costs of $32.6 million pre-tax, or $0.67 per diluted share

after-tax. Excluding the impact of this item, year-to-date 2023

core net income were $67.1 million, or $1.87 per diluted share.

Net interest income of $164.8 million on a TE basis for the

first nine months of 2023 was down 8.9% from $181.0 million for the

same period in 2022. The TE net interest margin of 2.78% in the

first nine months of 2023 decreased 62 basis points from 3.40% for

the same period in 2022. Results for all periods include the impact

of PPP as well as acquisition marks and related accretion. 2023

year-to-date includes $475 thousand of accretion in interest

income, $613 thousand of accretion in interest expense, and $15

thousand of interest income on average balances of $729 thousand

for PPP. Excluding the impact of acquisition marks accretion and

PPP loans, core net interest income was $163.7 million, down 6.5%

from $175.1 million in the first nine months 2022. Additionally,

the core net interest margin was 2.76% for the first nine months of

2023, down 53 basis points from 3.29% for the same period of 2022.

These results are positively impacted by the combination of loan

growth and higher loan yields, which were 4.88% for the first nine

months of 2023 compared to 4.13% for the same period in 2022. The

cost of funds in the first nine months of 2023 was 1.87%, up 154

basis points for the same period of 2022. The year-over-year

increase is largely due to utilization of higher cost FHLB

borrowings in support of loan growth in excess of deposit growth

during 2022.

Excluding insurance commissions and the $36.3 million gain on

the sale of the insurance agency, total non-interest income in the

first nine months of 2023 of $33.9 million was down 5.5% from $35.9

million for the same period of 2022. Insurance commissions were

$8.9 million in 2023 down from $12.0 million in the first nine

months of 2022 due to the insurance agency sale on June 30, 2023.

Mortgage banking income decreased $4.2 million year-over-year as a

result of a $3.1 million decrease in gains primarily from lower

production and margins, as well as a $155 thousand mortgage

servicing rights (“MSR”) valuation gain in the first nine months of

2023 compared to a $1.6 million gain for the same period of

2022.

Security losses were $1.1 million in the nine months of 2023,

primarily due to decreased valuations on equity securities. This

compares to a loss of $1.8 million from decreased valuations on

equity securities in the first nine months 2022. The company also

sold $21 million of available-for-sale (“AFS”) securities for a $27

thousand gain with average yields less than FHLB borrowing rates

during the first nine months of 2023. Service fees in the first

nine months of 2023 were $20.6 million, a 7.0% increase from $19.2

million in the first nine months of 2022, primarily due to

fluctuations in loan fees including commercial customer swap

activity and consumer activity for interchange and ATM/NSF charges.

Wealth management income of $4.5 million in the first nine months

of 2023 was up 6.7% from $4.2 million in the first nine months of

2022. Bank owned life insurance income of $3.5 million in the first

nine months of 2023 increased from $3.0 million in the first nine

months of 2022 with $0.4 million of claim gains in 2023 compared to

none in 2022.

Excluding transaction costs for the insurance agency sale,

non-interest expenses in the first nine months of 2023 were $121.7

million, essentially flat from $121.5 million in the first nine

months of 2022. Compensation and benefits were $71.6 million in the

first nine months of 2023, compared to $72.4 million in the first

nine months of 2022. The year-over-year decrease was primarily due

to the insurance agency sale on June 30, 2023, and cost saving

initiatives that began during the second quarter of 2023 partially

offset by costs related to higher staffing levels for our 2022

growth initiatives and higher base compensation, including 2022

mid-year adjustments and 2023 annual adjustments. FDIC premiums

increased $2.1 million on a year-over-year basis primarily due to

higher rates and our 2022 growth initiatives. All other

non-interest expenses decreased a net $1.1 million on a

year-over-year basis. The efficiency ratio (excluding transaction

costs and the insurance agency gain on sale) for the first nine

months of 2023 of 58.3% worsened from 52.7% in the first nine

months of 2022 due to lower revenues partly offset by cost saving

initiatives that began during the second quarter of 2023.

Results for the first nine months of 2023 include net loan

charge-offs of $1.9 million and a total provision expense of $3.5

million, compared with net loan charge-offs of $5.3 million and a

total provision expense of $11.5 million for the same period in

2022. The provision expense for both years is primarily due to

relative loan growth.

Total assets at $8.56 billion

Total assets at September 30, 2023, were $8.56 billion, compared

to $8.62 billion at June 30, 2023, and $8.24 billion at September

30, 2022. Loans receivable were $6.70 billion at September 30,

2023, compared to $6.71 billion at June 30, 2023, and $6.21 billion

at September 30, 2022. At September 30, 2023, loans receivable

increased $489.2 million on a year-over-year basis, or 7.9%.

Commercial loans excluding PPP increased by $248.3 million from

September 30, 2022, or 6.0%. Securities at September 30, 2023, were

$0.92 billion, compared to $0.97 billion at June 30, 2023, and

$1.08 billion at September 30, 2022. All securities are either AFS

or trading and are reflected at fair value on the balance sheet.

Also, at September 30, 2023, goodwill and other intangible assets

totaled $308.8 million compared to $309.9 million at June 30, 2023,

and $337.9 million at September 30, 2022, with the decreases

attributable to intangibles amortization and the insurance agency

sale.

Total non-brokered deposits at September 30, 2023, were $6.67

billion, compared with $6.58 billion at June 30, 2023, and $6.67

billion at September 30, 2022. At September 30, 2023, customer

deposits increased $92.3 million on a linked quarter basis, or 5.6%

annualized. Brokered deposits were $392.2 million at September 30,

2023, compared to $413.2 million at June 30, 2023 and $69.9 million

at September 30, 2022.

Total stockholders’ equity was $919.6 million at September 30,

2023, compared to $937.0 million at June 30, 2023, and $865.0

million at September 30, 2022. The quarterly decrease in

stockholders’ equity was primarily due to a decrease in AOCI, which

was related to $24.9 million for a negative valuation adjustment on

the AFS securities portfolio, partly offset by net earnings after

dividends. The year-over-year increase was primarily due to net

earnings after dividends including the impact the insurance agency

sale offset partly by a decrease in AOCI, which was primarily

related to $16.3 million of negative valuation adjustments on the

AFS securities portfolio. At September 30, 2023, 1,199,634 common

shares remained available for repurchase under the Company’s

existing repurchase program.

Dividend to be paid November 17

The Board of Directors declared a quarterly cash dividend of

$0.31 per common share payable November 17, 2023, to shareholders

of record at the close of business on November 10, 2023. The

dividend represents an annual dividend of 7.5 percent based on the

Premier common stock closing price on October 23, 2023. Premier has

approximately 35,731,000 common shares outstanding.

Conference call

Premier will host a conference call at 11:00 a.m. ET on

Wednesday, October 25, 2023, to discuss the earnings results and

business trends. The conference call may be accessed by calling

1-833-470-1428 and using access code 346494. Internet access to the

call is also available (in listen-only mode) at the following URL:

https://events.q4inc.com/attendee/320076724. The webcast replay of

the conference call will be available at www.PremierFinCorp.com for

one year.

About Premier Financial Corp.

Premier Financial Corp. (Nasdaq: PFC), headquartered in

Defiance, Ohio, is the holding company for Premier Bank. Premier

Bank, headquartered in Youngstown, Ohio, operates 75 branches and 9

loan offices in Ohio, Michigan, Indiana and Pennsylvania and also

serves clients through a team of wealth professionals dedicated to

each community banking branch. For more information, visit the

company’s website at PremierFinCorp.com.

Financial Statements and Highlights Follow-

Safe Harbor Statement

This document may contain certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995.

These statements may include, but are not limited to, statements

regarding projections, forecasts, goals and plans of Premier

Financial Corp. and its management, future movements of interests,

loan or deposit production levels, future credit quality ratios,

future strength in the market area, and growth projections. These

statements do not describe historical or current facts and may be

identified by words such as “intend,” “intent,” “believe,”

“expect,” “estimate,” “target,” “plan,” “anticipate,” or similar

words or phrases, or future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “may,” “can,” or similar

verbs. There can be no assurances that the forward-looking

statements included in this presentation will prove to be accurate.

In light of the significant uncertainties in the forward-looking

statements, the inclusion of such information should not be

regarded as a representation by Premier or any other persons, that

our objectives and plans will be achieved. Forward-looking

statements involve numerous risks and uncertainties, any one or

more of which could affect Premier’s business and financial results

in future periods and could cause actual results to differ

materially from plans and projections. These risks and

uncertainties include, but not limited to: financial markets, our

customers, and our business and results of operation; changes in

interest rates; disruptions in the mortgage market; risks and

uncertainties inherent in general and local banking, insurance and

mortgage conditions; political uncertainty; uncertainty in U.S.

fiscal or monetary policy; uncertainty concerning or disruptions

relating to tensions surrounding the current socioeconomic

landscape; competitive factors specific to markets in which Premier

and its subsidiaries operate; increasing competition for financial

products from other financial institutions and nonbank financial

technology companies; future interest rate levels; legislative or

regulatory rulemaking or actions; capital market conditions;

security breaches or unauthorized disclosure of confidential

customer or Company information; interruptions in the effective

operation of information and transaction processing systems of

Premier or Premier’s vendors and service providers; failures or

delays in integrating or adopting new technology; the impact of the

cessation of LIBOR interest rates and implementation of a

replacement rate; and other risks and uncertainties detailed from

time to time in our Securities and Exchange Commission (SEC)

filings, including our Annual Report on Form 10-K for the year

ended December 31, 2022 and any further amendments thereto. All

forward-looking statements made in this presentation are based on

information presently available to the management of Premier and

speak only as of the date on which they are made. We assume no

obligation to update any forward-looking statements, whether as a

result of new information, future developments or otherwise, except

as may be required by law. As required by U.S. GAAP, Premier will

evaluate the impact of subsequent events through the issuance date

of its September 30, 2023, consolidated financial statements as

part of its Quarterly Report on Form 10-Q to be filed with the SEC.

Accordingly, subsequent events could occur that may cause Premier

to update its critical accounting estimates and to revise its

financial information from that which is contained in this news

release.

Non-GAAP Reporting Measures

We believe that net income, as defined by U.S. GAAP, is the most

appropriate earnings measurement. However, we consider core net

interest income, core net income and core pre-tax pre-provision

income to be a useful supplemental measure of our operating

performance. We define core net interest income as net interest

income on a tax-equivalent basis excluding income from PPP loans

and purchase accounting marks accretion. We define core net income

as net income excluding the after-tax impact of the insurance

agency gain on sale and related transaction costs. We define core

pre-tax pre-provision income as pre-tax pre-provision income

excluding the pre-tax impact of the insurance agency gain on sale

and related transaction costs. We believe that these metrics are

useful supplemental measures of operating performance because

investors and equity analysts may use these measures to compare the

operating performance of the Company between periods or as compared

to other financial institutions or other companies on a consistent

basis without having to account for income from PPP loans, purchase

accounting marks accretion or the insurance agency sale. Our

supplemental reporting measures and similarly entitled financial

measures are widely used by investors, equity and debt analysts and

ratings agencies in the valuation, comparison, rating and

investment recommendations of companies. Our management uses these

financial measures to facilitate internal and external comparisons

to historical operating results and in making operating decisions.

Additionally, they are utilized by the Board of Directors to

evaluate management. The supplemental reporting measures do not

represent net income or cash flow provided from operating

activities as determined in accordance with U.S. GAAP and should

not be considered as alternative measures of profitability or

liquidity. Finally, the supplemental reporting measures, as defined

by us, may not be comparable to similarly entitled items reported

by other financial institutions or other companies. Please see the

exhibits for reconciliations of our supplemental reporting

measures.

Consolidated Balance Sheets (Unaudited) Premier Financial

Corp.

September 30,

June 30,

March 31,

December 31,

September 30,

(in thousands)

2023

2023

2023

2022

2022

Assets Cash and cash equivalents Cash and amounts due

from depositories

$

70,642

$

71,096

$

68,628

$

88,257

$

67,124

Interest-bearing deposits

46,855

50,631

88,399

39,903

37,868

117,497

121,727

157,027

128,160

104,992

Available-for-sale, carried at fair value

911,184

961,123

998,128

1,040,081

1,063,713

Equity securities, carried at fair value

5,860

6,458

6,387

7,832

15,336

Securities investments

917,044

967,581

1,004,515

1,047,913

1,079,049

Loans (1)

6,696,869

6,708,568

6,575,829

6,460,620

6,207,708

Allowance for credit losses - loans

(76,513

)

(75,921

)

(74,273

)

(72,816

)

(70,626

)

Loans, net

6,620,356

6,632,647

6,501,556

6,387,804

6,137,082

Loans held for sale

135,218

128,079

119,604

115,251

129,142

Mortgage servicing rights

19,642

20,160

20,654

21,171

20,832

Accrued interest receivable

34,648

30,056

29,388

28,709

26,021

Federal Home Loan Bank stock

25,049

39,887

37,056

29,185

28,262

Bank Owned Life Insurance

172,906

171,856

170,841

170,713

169,728

Office properties and equipment

55,679

55,736

55,982

55,541

53,747

Real estate and other assets held for sale

387

561

393

619

416

Goodwill

295,602

295,602

317,988

317,988

317,948

Core deposit and other intangibles

13,220

14,298

17,804

19,074

19,972

Other assets

155,628

138,021

129,508

133,214

148,949

Total Assets

$

8,562,876

$

8,616,211

$

8,562,316

$

8,455,342

$

8,236,140

Liabilities and Stockholders’ Equity

Non-interest-bearing deposits

$

1,545,595

$

1,573,837

$

1,649,726

$

1,869,509

$

1,826,511

Interest-bearing deposits

5,127,863

5,007,358

4,969,436

4,893,502

4,836,113

Brokered deposits

392,181

413,237

154,869

143,708

69,881

Total deposits

7,065,639

6,994,432

6,774,031

6,906,719

6,732,505

Advances from FHLB

339,000

455,000

658,000

428,000

411,000

Subordinated debentures

85,197

85,166

85,123

85,103

85,071

Advance payments by borrowers

22,781

26,045

26,300

34,188

33,511

Reserve for credit losses - unfunded commitments

4,690

5,708

6,577

6,816

7,061

Other liabilities

126,002

112,889

97,835

106,795

102,032

Total Liabilities

7,643,309

7,679,240

7,647,866

7,567,621

7,371,180

Stockholders’ Equity Preferred stock

-

-

-

-

-

Common stock, net

306

306

306

306

306

Additional paid-in-capital

690,038

689,579

689,807

691,453

691,578

Accumulated other comprehensive income (loss)

(200,282

)

(168,721

)

(153,709

)

(173,460

)

(181,231

)

Retained earnings

560,945

547,336

510,021

502,909

488,305

Treasury stock, at cost

(131,440

)

(131,529

)

(131,975

)

(133,487

)

(133,998

)

Total Stockholders’ Equity

919,567

936,971

914,450

887,721

864,960

Total Liabilities and Stockholders’ Equity

$

8,562,876

$

8,616,211

$

8,562,316

$

8,455,342

$

8,236,140

(1) Includes PPP loans of:

$

526

$

577

$

791

$

1,143

$

1,181

Consolidated Statements of Income (Unaudited)

Premier Financial Corp. Three Months Ended Nine

Months Ended (in thousands, except per share amounts)

9/30/23 6/30/23 3/31/23 12/31/22 9/30/22

9/30/23

9/30/22 Interest Income: Loans

$

86,612

$

81,616

$

76,057

$

72,194

$

65,559

$

244,285

$

177,366

Investment securities

6,943

6,997

7,261

7,605

6,814

21,201

18,489

Interest-bearing deposits

652

641

444

444

221

1,737

387

FHLB stock dividends

690

905

394

482

510

1,989

743

Total interest income

94,897

90,159

84,156

80,725

73,104

269,212

196,985

Interest Expense: Deposits

34,874

26,825

21,458

13,161

6,855

83,157

11,749

FHLB advances

4,597

8,217

5,336

3,941

2,069

18,150

2,609

Subordinated debentures

1,162

1,125

1,075

1,000

868

3,362

2,326

Notes Payable

-

-

-

4

-

-

1

Total interest expense

40,633

36,167

27,869

18,106

9,792

104,669

16,685

Net interest income

54,264

53,992

56,287

62,619

63,312

164,543

180,300

Provision (benefit) for credit losses - loans

245

1,410

3,944

3,020

3,706

5,599

9,483

Provision (benefit) for credit losses - unfunded commitments

(1,018

)

(870

)

(238

)

(246

)

306

(2,126

)

2,030

Total provision (benefit) for credit losses

(773

)

540

3,706

2,774

4,012

3,473

11,513

Net interest income after provision

55,037

53,452

52,581

59,845

59,300

161,070

168,787

Non-interest Income: Service fees and other charges

6,947

7,190

6,428

6,632

6,545

20,564

19,221

Mortgage banking income

3,274

2,940

(274

)

(299

)

3,970

5,940

10,170

Gain (loss) on sale of non-mortgage loans

-

71

-

-

-

71

-

Gain (loss) on sale of available for sale securities

-

(7

)

34

1

-

27

-

Gain (loss) on equity securities

256

71

(1,445

)

1,209

43

(1,118

)

(1,760

)

Gain on sale of insurance agency

-

36,296

-

-

-

36,296

-

Insurance commissions

-

4,131

4,725

3,576

3,488

8,856

12,043

Wealth management income

1,509

1,537

1,485

1,582

1,355

4,531

4,246

Income from Bank Owned Life Insurance

1,050

1,015

1,417

984

983

3,482

2,961

Other non-interest income

217

102

92

543

320

412

1,051

Total Non-interest Income

13,253

53,346

12,462

14,228

16,704

79,061

47,932

Non-interest Expense: Compensation and benefits

21,813

24,175

25,658

24,999

24,522

71,646

72,397

Occupancy

3,145

3,320

3,574

3,383

3,463

10,039

10,657

FDIC insurance premium

1,346

1,786

1,288

1,276

976

4,420

2,370

Financial institutions tax

989

961

852

795

1,050

2,802

3,315

Data processing

4,010

3,640

3,863

3,882

3,121

11,513

9,899

Amortization of intangibles

1,078

1,223

1,270

1,293

1,338

3,571

4,156

Transaction costs

-

3,652

-

-

-

3,652

-

Other non-interest expense

5,671

5,738

6,286

7,400

6,629

17,695

18,689

Total Non-interest Expense

38,052

44,495

42,791

43,028

41,099

125,338

121,483

Income before income taxes

30,238

62,303

22,252

31,045

34,905

114,793

95,236

Income tax expense

5,551

13,912

4,103

5,770

6,710

23,566

18,324

Net Income

$

24,687

$

48,391

$

18,149

$

25,275

$

28,195

$

91,227

$

76,912

Earnings per common share: Basic

$

0.69

$

1.35

$

0.51

$

0.71

$

0.79

$

2.55

$

2.15

Diluted

$

0.69

$

1.35

$

0.51

$

0.71

$

0.79

$

2.55

$

2.15

Average Shares Outstanding: Basic

35,730

35,722

35,606

35,589

35,582

35,701

35,709

Diluted

35,794

35,800

35,719

35,790

35,704

35,769

35,818

Premier Financial Corp. Selected Quarterly

Information Three Months Ended Nine Months Ended

(dollars in thousands, except per share data)

9/30/23

6/30/23 3/31/23 12/31/22 9/30/22

9/30/23 9/30/22

Summary

of Operations Tax-equivalent interest income (1)

$

94,951

$

90,226

$

84,260

$

80,889

$

73,301

$

269,437

$

197,637

Interest expense

40,633

36,167

27,869

18,106

9,792

104,669

16,685

Tax-equivalent net interest income (1)

54,318

54,059

56,391

62,783

63,509

164,768

180,952

Provision expense for credit losses

(773

)

540

3,706

2,774

4,012

3,473

11,513

Non-interest income (ex securities gains/losses)

12,997

53,282

13,873

13,018

16,661

80,152

49,692

Core non-interest income (ex securities gains/losses) (2)

12,997

16,986

13,873

13,018

16,661

43,856

49,692

Non-interest expense

38,052

44,495

42,791

43,028

41,099

125,338

121,483

Core non-interest expense (2)

38,052

40,843

42,791

43,028

41,099

121,686

121,483

Income tax expense

5,551

13,912

4,103

5,770

6,710

23,566

18,324

Net income

24,687

48,391

18,149

25,275

28,195

91,227

76,912

Core net income (2)

24,687

24,230

18,149

25,275

28,195

67,066

76,912

Tax equivalent adjustment (1)

54

67

104

164

197

225

652

At Period End Total assets

$

8,562,876

$

8,616,211

$

8,562,316

$

8,455,342

$

8,236,140

Goodwill and intangibles

308,822

309,900

335,792

337,062

337,920

Tangible assets (3)

8,254,054

8,306,311

8,226,524

8,118,280

7,898,220

Earning assets

7,744,522

7,818,825

7,751,130

7,620,056

7,411,403

Loans

6,696,869

6,708,568

6,575,829

6,460,620

6,207,708

Allowance for loan losses

76,513

75,921

74,273

72,816

70,626

Deposits

7,065,639

6,994,432

6,774,031

6,906,719

6,732,505

Stockholders’ equity

919,567

936,971

914,450

887,721

864,960

Stockholders’ equity / assets

10.74

%

10.87

%

10.68

%

10.50

%

10.50

%

Tangible equity (3)

610,745

627,071

578,658

550,659

527,040

Tangible equity / tangible assets

7.40

%

7.55

%

7.03

%

6.78

%

6.67

%

Average Balances Total assets

$

8,582,219

$

8,597,786

$

8,433,100

$

8,304,462

$

8,161,389

$

8,538,248

$

7,807,013

Earning assets

7,969,363

7,951,520

7,783,850

7,653,648

7,477,795

7,904,565

7,097,421

Loans

6,763,232

6,714,240

6,535,080

6,359,564

6,120,324

6,671,687

5,726,369

Deposits and interest-bearing liabilities

7,486,595

7,538,674

7,385,946

7,278,531

7,116,910

7,470,774

6,748,783

Deposits

7,045,827

6,799,605

6,833,521

6,773,382

6,654,328

6,893,762

6,452,713

Stockholders’ equity

939,456

921,441

901,587

875,287

912,224

920,967

945,141

Goodwill and intangibles

309,330

334,862

336,418

337,207

338,583

326,771

339,946

Tangible equity (3)

630,126

586,579

565,169

538,080

573,641

594,196

605,195

Per Common Share Data Earnings per share ("EPS") - Basic

$

0.69

$

1.35

$

0.51

$

0.71

$

0.79

$

2.55

$

2.15

EPS - Diluted

0.69

1.35

0.51

0.71

0.79

2.55

2.15

EPS - Core diluted (2)

0.69

0.68

0.51

0.71

0.79

1.87

2.15

Dividends Paid

0.31

0.31

0.31

0.30

0.30

0.93

0.90

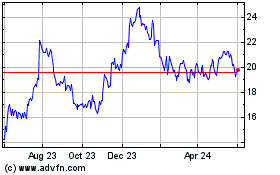

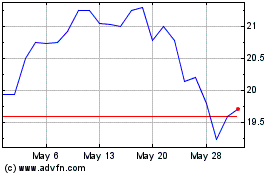

Market Value: High

$

22.89

$

21.01

$

27.80

$

30.51

$

29.36

$

27.99

$

32.52

Low

15.70

13.60

20.39

26.11

24.67

13.60

24.67

Close

17.06

16.02

20.73

26.97

25.70

17.06

25.70

Common Book Value

25.74

26.23

25.61

24.94

24.32

Tangible Common Book Value (3)

17.09

17.55

16.21

15.47

14.82

Shares outstanding, end of period (000s)

35,731

35,727

35,701

35,591

35,563

Performance Ratios (annualized) Tax-equivalent net interest

margin (1)

2.73

%

2.72

%

2.90

%

3.28

%

3.40

%

2.78

%

3.40

%

Return on average assets

1.14

%

2.26

%

0.86

%

1.21

%

1.37

%

1.43

%

1.32

%

Core return on average assets (2)

1.14

%

1.13

%

0.86

%

1.22

%

1.39

%

1.05

%

1.32

%

Return on average equity

10.43

%

21.06

%

8.07

%

11.46

%

12.26

%

13.24

%

10.88

%

Core return on average equity (2)

10.43

%

10.55

%

8.07

%

11.58

%

12.40

%

9.74

%

10.88

%

Return on average tangible equity

15.54

%

33.09

%

12.88

%

18.64

%

19.50

%

20.53

%

16.99

%

Core return on average tangible equity (2)

15.54

%

16.57

%

10.51

%

14.64

%

16.33

%

15.09

%

16.99

%

Efficiency ratio (4)

56.53

%

41.45

%

60.90

%

56.76

%

51.26

%

51.18

%

52.67

%

Core efficiency ratio (2)

56.53

%

57.49

%

60.90

%

56.76

%

51.26

%

58.33

%

52.67

%

Effective tax rate

18.36

%

22.33

%

18.44

%

18.59

%

19.22

%

20.53

%

19.24

%

Common dividend payout ratio

44.93

%

22.96

%

60.78

%

42.25

%

37.97

%

36.47

%

41.86

%

(1) Interest income on tax-exempt securities and loans has been

adjusted to a tax-equivalent basis using the statutory federal

income tax rate of 21%. (2) Core items exclude the impact of

insurance agency disposition related items. See non-GAAP

reconciliations. (3) Tangible assets = total assets less the sum of

goodwill and core deposit and other intangibles. Tangible equity =

total stockholders' equity less the sum of goodwill, core deposit

and other intangibles, and preferred stock. Tangible common book

value = tangible equity divided by shares outstanding at the end of

the period. (4) Efficiency ratio = Non-interest expense divided by

sum of tax-equivalent net interest income plus non-interest income,

excluding securities gains or losses, net.

Premier Financial

Corp. Yield Analysis (dollars in thousands)

Three

Months Ended Nine Months Ended 9/30/23 6/30/23

3/31/23 12/31/22 9/30/22

9/30/23 9/30/22

Average

Balances Interest-earning assets: Loans receivable (1)

$

6,763,232

$

6,714,240

$

6,535,080

$

6,359,564

$

6,120,324

$

6,671,687

$

5,726,369

Securities

1,137,730

1,155,451

1,190,359

1,236,511

1,262,435

1,160,987

1,266,681

Interest Bearing Deposits

38,210

36,730

35,056

29,884

68,530

36,677

84,745

FHLB stock

30,191

45,099

30,353

28,386

27,414

35,214

19,626

Total interest-earning assets

7,969,363

7,951,520

7,790,848

7,654,345

7,478,703

7,904,565

7,097,421

Non-interest-earning assets

612,856

646,266

642,252

650,117

682,686

633,683

709,592

Total assets

$

8,582,219

$

8,597,786

$

8,433,100

$

8,304,462

$

8,161,389

$

8,538,248

$

7,807,013

Deposits and Interest-bearing Liabilities: Interest bearing

deposits

$

5,490,945

$

5,195,727

$

5,078,510

$

4,901,412

$

4,846,419

$

5,256,571

$

4,688,047

FHLB advances and other

355,576

653,923

467,311

419,761

377,533

491,861

210,908

Subordinated debentures

85,179

85,146

85,114

85,084

85,049

85,147

85,019

Notes payable

13

-

-

304

-

4

143

Total interest-bearing liabilities

5,931,713

5,934,796

5,630,935

5,406,561

5,309,001

5,833,583

4,984,117

Non-interest bearing deposits

1,554,882

1,603,878

1,755,011

1,871,970

1,807,909

1,637,191

1,764,666

Total including non-interest-bearing deposits

7,486,595

7,538,674

7,385,946

7,278,531

7,116,910

7,470,774

6,748,783

Other non-interest-bearing liabilities

156,168

137,671

145,567

150,644

132,255

146,507

113,089

Total liabilities

7,642,763

7,676,345

7,531,513

7,429,175

7,249,165

7,617,281

6,861,872

Stockholders' equity

939,456

921,441

901,587

875,287

912,224

920,967

945,141

Total liabilities and stockholders' equity

$

8,582,219

$

8,597,786

$

8,433,100

$

8,304,462

$

8,161,389

$

8,538,248

$

7,807,013

IEAs/IBLs

134

%

134

%

138

%

142

%

141

%

136

%

142

%

Interest Income/Expense Interest-earning

assets: Loans receivable (2)

$

86,618

$

81,622

$

76,063

$

72,201

$

65,564

$

244,303

$

177,385

Securities (2)

6,991

7,058

7,359

7,762

7,006

21,408

19,122

Interest Bearing Deposits

652

641

444

444

221

1,737

387

FHLB stock

690

905

394

482

510

1,989

743

Total interest-earning assets

94,951

90,226

84,260

80,889

73,301

269,437

197,637

Deposits and Interest-bearing Liabilities: Interest bearing

deposits

$

34,874

$

26,825

$

21,458

$

13,161

$

6,855

$

83,157

$

11,749

FHLB advances and other

4,597

8,217

5,336

3,941

2,069

18,150

2,609

Subordinated debentures

1,162

1,125

1,075

1,001

868

3,362

2,326

Notes payable

-

-

-

3

-

-

1

Total interest-bearing liabilities

40,633

36,167

27,869

18,106

9,792

104,669

16,685

Non-interest bearing deposits

-

-

-

-

-

-

-

Total including non-interest-bearing deposits

40,633

36,167

27,869

18,106

9,792

104,669

16,685

Net interest income

$

54,318

$

54,059

$

56,391

$

62,783

$

63,509

$

164,768

$

180,952

Less: PPP income

(4

)

(5

)

(6

)

(6

)

(26

)

(15

)

(3,827

)

Less: Acquisition marks accretion

(322

)

(380

)

(387

)

(554

)

(608

)

(1,088

)

(2,051

)

Core net interest income

$

53,992

$

53,674

$

55,998

$

62,223

$

62,875

$

163,665

$

175,074

Annualized Average Rates Interest-earning

assets: Loans receivable

5.12

%

4.86

%

4.66

%

4.54

%

4.29

%

4.88

%

4.13

%

Securities (3)

2.46

%

2.44

%

2.47

%

2.51

%

2.22

%

2.46

%

2.01

%

Interest Bearing Deposits

6.83

%

6.98

%

5.07

%

5.94

%

1.29

%

6.31

%

0.61

%

FHLB stock

9.14

%

8.03

%

5.19

%

6.79

%

7.44

%

7.53

%

5.05

%

Total interest-earning assets

4.77

%

4.54

%

4.33

%

4.23

%

3.92

%

4.54

%

3.71

%

Deposits and Interest-bearing Liabilities: Interest bearing

deposits

2.54

%

2.07

%

1.69

%

1.07

%

0.57

%

2.11

%

0.33

%

FHLB advances and other

5.17

%

5.03

%

4.57

%

3.76

%

2.19

%

4.92

%

1.65

%

Subordinated debentures

5.46

%

5.29

%

5.05

%

4.71

%

4.08

%

5.26

%

3.65

%

Notes payable

-

-

-

3.95

%

-

-

0.93

%

Total interest-bearing liabilities

2.74

%

2.44

%

1.98

%

1.34

%

0.74

%

3.59

%

0.67

%

Non-interest bearing deposits

-

-

-

-

-

-

-

Total including non-interest-bearing deposits

2.17

%

1.92

%

1.51

%

1.00

%

0.55

%

1.87

%

0.33

%

Net interest spread

2.03

%

2.10

%

2.35

%

2.89

%

3.18

%

0.95

%

3.04

%

Net interest margin (4)

2.73

%

2.72

%

2.90

%

3.28

%

3.40

%

2.78

%

3.40

%

Core net interest margin (4)

2.71

%

2.70

%

2.88

%

3.25

%

3.36

%

2.76

%

3.29

%

(1) Includes average PPP loans of:

$

553

$

673

$

965

$

1,160

$

1,889

$

729

$

15,790

(2) Interest on certain tax exempt loans and securities is not

taxable for Federal income tax purposes. In order to compare the

tax-exempt yields on these assets to taxable yields, the interest

earned on these assets is adjusted to a pre-tax equivalent amount

based on the marginal corporate federal income tax rate of 21%. (3)

Securities yield = annualized interest income divided by the

average balance of securities, excluding average unrealized

gains/losses. (4) Net interest margin is tax equivalent net

interest income divided by average interest-earning assets. Core

net interest margin represents net interest margin excluding PPP

and acquisition marks accretion.

Premier Financial Corp.

Deposits and Liquidity (dollars in thousands)

As of and

for the Three Months Ended 9/30/23 6/30/23 3/31/23

12/31/22 9/30/22

Ending Balances Non-interest-bearing demand

deposits

$

1,545,595

$

1,573,837

$

1,649,726

$

1,869,509

$

1,826,511

Savings deposits

709,938

748,392

775,186

797,376

817,853

Interest-bearing demand deposits

580,069

594,325

646,329

653,960

665,974

Money market account deposits

1,279,551

1,282,721

1,342,451

1,493,729

1,463,600

Time deposits

925,353

904,717

856,720

768,678

630,077

Public funds, ICS and CDARS deposits

1,632,952

1,477,203

1,348,750

1,179,759

1,258,610

Brokered deposits

392,181

413,237

154,869

143,708

69,881

Total deposits

$

7,065,639

$

6,994,432

$

6,774,031

$

6,906,719

$

6,732,505

Average Balances Non-interest-bearing demand deposits

$

1,554,882

$

1,603,878

$

1,755,011

$

1,871,970

$

1,807,909

Savings deposits

728,545

762,074

782,215

806,653

825,673

Interest-bearing demand deposits

575,744

603,572

637,423

651,685

681,247

Money market account deposits

1,278,381

1,311,177

1,430,905

1,418,549

1,493,019

Time deposits

912,579

872,991

825,652

685,453

610,708

Public funds, ICS and CDARS deposits

1,573,213

1,399,749

1,232,230

1,235,772

1,204,968

Brokered deposits

422,483

246,164

170,085

103,300

30,804

Total deposits

$

7,045,827

$

6,799,605

$

6,833,521

$

6,773,382

$

6,654,328

Average Rates Non-interest-bearing demand deposits

0.00

%

0.00

%

0.00

%

0.00

%

0.00

%

Savings deposits

0.03

%

0.02

%

0.02

%

0.02

%

0.02

%

Interest-bearing demand deposits

0.11

%

0.10

%

0.07

%

0.07

%

0.07

%

Money market account deposits

2.02

%

1.73

%

1.54

%

0.81

%

0.40

%

Time deposits

2.68

%

2.27

%

1.83

%

1.05

%

0.58

%

Public funds, ICS and CDARS deposits

4.18

%

3.71

%

3.32

%

2.41

%

1.38

%

Brokered deposits

5.36

%

4.92

%

4.19

%

3.32

%

2.37

%

Total deposits

1.98

%

1.58

%

1.26

%

0.78

%

0.41

%

Other Deposits Data Loans/Deposits Ratio

94.8

%

95.9

%

97.1

%

93.5

%

92.2

%

Uninsured deposits %

32.8

%

31.5

%

32.3

%

35.3

%

35.5

%

Adjusted uninsured deposits % (1)

17.7

%

17.3

%

19.6

%

22.2

%

22.2

%

Top 20 depositors %

14.1

%

12.4

%

12.1

%

5.4

%

11.3

%

Public funds %

18.8

%

17.5

%

16.5

%

14.8

%

15.9

%

Average account size (excluding brokered)

$

27.1

$

26.7

$

27.0

$

27.8

$

27.5

Securities Data Held-to-maturity (HTM) at fair value

$

-

$

-

$

-

$

-

$

-

Available-for-sale (AFS) at fair value (2)

911,184

961,123

998,128

1,040,081

1,063,713

Equity investment at fair value (3)

5,860

6,458

6,387

7,832

15,336

Total securities at fair value

$

917,044

$

967,581

$

1,004,515

$

1,047,913

$

1,079,049

Cash+Securities/Assets

12.1

%

12.6

%

13.6

%

13.9

%

14.4

%

Projected AFS cash flow in next 12 months

$

66,495

$

64,687

$

73,184

$

73,319

$

76,119

AFS average life (years)

6.5

6.5

6.4

6.5

6.6

Liquidity Sources Cash and cash equivalents

$

117,497

$

121,727

$

157,027

$

128,160

$

104,992

Unpledged securities at fair value

280,916

298,471

211,468

288,134

342,979

FHLB borrowing capacity

1,311,091

1,542,459

1,358,650

1,528,978

1,217,516

Brokered deposits (Company policy limit of 10%)

316,697

288,719

524,889

549,370

605,552

Bank and parent lines of credit

70,000

70,000

70,000

70,000

70,000

Federal Reserve - Discount Window and BTFP (4)

471,395

491,141

129,918

44,471

-

Total

$

2,567,596

$

2,812,517

$

2,451,952

$

2,609,113

$

2,341,039

Total liquidity to adjusted uninsured deposits ratio

204.0

%

230.5

%

183.2

%

168.9

%

155.4

%

(1) Adjusted for collateralized deposits, other insured

deposits and intra-company accounts. (2) Mark-to-market included in

accumulated other comprehensive income. (3) Mark-to-market included

in net income each quarter. (4) Includes borrowing capacity related

to unpledged securities at par value in excess of fair value under

Bank Term Funding Program.

Premier Financial Corp. Loans

and Capital (dollars in thousands)

9/30/23 6/30/23

3/31/23 12/31/22 9/30/22

Loan Portfolio Composition

Residential real estate

$

1,797,676

$

1,711,632

$

1,624,331

$

1,535,574

$

1,478,360

Residential real estate construction

51,637

111,708

141,209

176,737

119,204

Total residential loans

1,849,313

1,823,340

1,765,540

1,712,311

1,597,564

Commercial real estate

2,820,410

2,848,410

2,813,441

2,762,311

2,674,078

Commercial construction

502,502

472,328

440,510

428,743

398,044

Commercial excluding PPP

1,038,939

1,068,795

1,060,351

1,054,037

1,041,423

Core commercial loans (1)

4,361,851

4,389,533

4,314,302

4,245,091

4,113,545

Consumer direct/indirect

203,800

210,390

212,299

213,405

212,790

Home equity and improvement lines

269,053

272,792

271,676

277,613

272,367

Total consumer loans

472,853

483,182

483,975

491,018

485,157

Deferred loan origination fees

12,326

11,936

11,221

11,057

10,261

Core loans (1)

6,696,343

6,707,991

6,575,038

6,459,477

6,206,527

PPP loans

526

577

791

1,143

1,181

Total loans

$

6,696,869

$

6,708,568

$

6,575,829

$

6,460,620

$

6,207,708

Loans held for sale

$

135,218

$

128,079

$

119,631

$

115,251

$

129,142

Core residential loans (1)

1,984,531

1,951,419

1,885,171

1,827,562

1,726,706

Total loans including loans held for sale but excluding PPP

6,831,561

6,836,070

6,694,669

6,574,728

6,335,669

Undisbursed construction loan funds - residential

$

82,689

$

102,198

$

157,934

$

209,306

$

231,598

Undisbursed construction loan funds - commercial

284,610

353,455

446,294

463,469

493,199

Undisbursed construction loan funds - total

367,299

455,653

604,228

672,775

724,797

Total construction loans including undisbursed funds

$

921,438

$

1,039,689

$

1,185,947

$

1,278,255

$

1,242,045

Gross loans (2)

$

7,051,842

$

7,152,285

$

7,168,836

$

7,122,338

$

6,922,244

Fixed rate loans %

49.8

%

49.8

%

49.5

%

48.8

%

48.7

%

Floating rate loans %

15.8

%

15.9

%

13.4

%

14.3

%

16.0

%

Adjustable rate loans repricing within 1 year %

2.9

%

1.5

%

2.0

%

2.6

%

0.8

%

Adjustable rate loans repricing over 1 year %

31.5

%

32.8

%

35.1

%

34.3

%

34.5

%

Commercial Real Estate Loans Composition Non owner

occupied excluding office

$

1,023,585

$

1,012,400

$

947,442

$

934,760

$

905,512

Non owner occupied office

207,869

225,046

220,668

222,300

203,565

Owner occupied excluding office

597,303

603,650

609,203

578,514

570,662

Owner occupied office

106,761

107,240

109,014

108,087

105,224

Multifamily

627,602

633,909

661,996

660,823

637,701

Agriculture land

119,710

123,104

122,384

125,384

122,416

Other commercial real estate

137,580

143,061

142,734

132,443

128,998

Total commercial real estate loans

$

2,820,410

$

2,848,410

$

2,813,441

$

2,762,311

$

2,674,078

Capital Balances Total equity

$

919,567

$

936,971

$

914,450

$

887,721

$

864,960

Less: Regulatory goodwill and intangibles

303,740

304,818

330,711

331,981

332,839

Less: Accumulated other comprehensive income/(loss) ("AOCI")

(200,282

)

(168,721

)

(153,709

)

(173,460

)

(181,231

)

Common equity tier 1 capital ("CET1")

816,109

800,874

737,448

729,200

713,352

Add: Tier 1 subordinated debt

35,000

35,000

35,000

35,000

35,000

Tier 1 capital

851,109

835,874

772,448

764,200

748,352

Add: Regulatory allowances

80,791

80,812

80,003

78,780

76,530

Add: Tier 2 subordinated debt

50,000

50,000

50,000

50,000

50,000

Total risk-based capital

$

981,900

$

966,686

$

902,451

$

892,980

$

874,882

Total risk-weighted assets

$

7,364,534

$

7,381,940

$

7,370,704

$

7,355,979

$

7,385,877

Capital Ratios CET1 Ratio

11.08

%

10.85

%

10.01

%

9.91

%

9.66

%

CET1 Ratio including AOCI

8.36

%

8.56

%

7.92

%

7.55

%

7.20

%

Tier 1 Capital Ratio

11.55

%

11.32

%

10.48

%

10.39

%

10.13

%

Tier 1 Capital Ratio including AOCI

8.84

%

9.04

%

8.39

%

8.03

%

7.68

%

Total Capital Ratio

13.33

%

13.10

%

12.24

%

12.14

%

11.85

%

Total Capital Ratio including AOCI

10.61

%

10.81

%

10.16

%

9.78

%

9.39

%

(1) Core loans represents total loans excluding undisbursed

loan funds, deferred loan origination fees and PPP loans. Core

commercial loans represents total commercial real estate,

commercial and commercial construction excluding commercial

undisbursed loan funds, deferred loan origination fees and PPP

loans. Core residential loans represents total loans held for sale,

one to four family residential real estate and residential

construction excluding residential undisbursed loan funds and

deferred loan origination fees. (2) Gross loans represent total

loans including undisbursed construction funds but excluding

deferred loan origination fees.

Premier Financial Corp.

Loan Delinquency Information (dollars in thousands)

Total

Balance Current 30 to 89 days past due % of

Total Non Accrual Loans % of Total

September 30, 2023 One to four family residential real estate

$

1,797,676

$

1,778,106

$

7,857

0.44

%

$

11,713

0.65

%

Construction

921,438

921,438

-

0.00

%

-

0.00

%

Commercial real estate

2,820,410

2,809,421

24

0.00

%

10,965

0.39

%

Commercial

1,039,465

1,025,632

1,670

0.16

%

12,163

1.17

%

Home equity and improvement

269,053

263,806

3,471

1.29

%

1,776

0.66

%

Consumer finance

203,800

196,754

4,200

2.06

%

2,846

1.40

%

Gross loans

$

7,051,842

$

6,995,157

$

17,222

0.24

%

$

39,463

0.56

%

June 30, 2023 One to four family residential real estate

$

1,711,632

$

1,694,024

$

7,320

0.43

%

$

10,288

0.60

%

Construction

1,039,689

1,039,404

285

0.03

%

-

0.00

%

Commercial real estate

2,848,410

2,833,765

596

0.02

%

14,049

0.49

%

Commercial

1,069,372

1,057,057

4,290

0.40

%

8,025

0.75

%

Home equity and improvement

272,792

267,617

2,945

1.08

%

2,230

0.82

%

Consumer finance

210,390

204,404

3,587

1.70

%

2,399

1.14

%

Gross loans

$

7,152,285

$

7,096,271

$

19,023

0.27

%

$

36,991

0.52

%

September 30, 2022 One to four family residential real

estate

$

1,478,360

$

1,464,319

$

6,232

0.42

%

$

7,809

0.53

%

Construction

1,242,045

1,242,045

-

0.00

%

-

0.00

%

Commercial real estate

2,674,078

2,660,068

116

0.00

%

13,894

0.52

%

Commercial

1,042,604

1,034,898

338

0.03

%

7,368

0.71

%

Home equity and improvement

272,367

267,077

3,144

1.15

%

2,146

0.79

%

Consumer finance

212,790

207,453

3,417

1.61

%

1,920

0.90

%

Gross loans

$

6,922,244

$

6,875,860

$

13,247

0.19

%

$

33,137

0.48

%

Loan Risk Ratings Information (dollars in thousands)

Total Balance Pass Rated Special Mention %

of Total Classified % of Total September

30, 2023 One to four family residential real estate

$

1,786,659

$

1,775,530

$

422

0.02

%

$

10,707

0.60

%

Construction

921,438

913,605

7,833

0.85

%

-

0.00

%

Commercial real estate

2,819,121

2,738,398

54,523

1.93

%

26,200

0.93

%

Commercial

1,034,943

982,927

31,930

3.09

%

20,086

1.94

%

Home equity and improvement

267,106

265,975

-

0.00

%

1,131

0.42

%

Consumer finance

203,584

200,965

-

0.00

%

2,619

1.29

%

PCD loans

18,991

13,374

2,814

14.82

%

2,803

14.76

%

Gross loans

$

7,051,842

$

6,890,774

$

97,522

1.38

%

$

63,546

0.90

%

June 30, 2023 One to four family residential real estate

$

1,700,468

$

1,689,666

$

484

0.03

%

$

10,318

0.61

%

Construction

1,039,689

1,031,356

8,333

0.80

%

-

0.00

%

Commercial real estate

2,847,035

2,797,688

20,751

0.73

%

28,596

1.00

%

Commercial

1,063,744

1,021,403

27,376

2.57

%

14,965

1.41

%

Home equity and improvement

270,722

269,038

-

0.00

%

1,684

0.62

%

Consumer finance

210,158

207,963

-

0.00

%

2,195

1.04

%

PCD loans

20,469

13,981

3,786

18.50

%

2,702

13.20

%

Gross loans

$

7,152,285

$

7,031,095

$

60,730

0.85

%

$

60,460

0.85

%

September 30, 2022 One to four family residential real

estate

$

1,466,470

$

1,458,082

$

1,267

0.09

%

$

7,121

0.49

%

Construction

1,242,045

1,240,745

1,300

0.10

%

-

0.00

%

Commercial real estate

2,672,451

2,584,984

65,233

2.44

%

22,234

0.83

%

Commercial

1,036,441

1,009,384

20,106

1.94

%

6,951

0.67

%

Home equity and improvement

269,786

268,384

-

0.00

%

1,402

0.52

%

Consumer finance

212,493

210,602

-

0.00

%

1,891

0.89

%

PCD loans