0001675634false00016756342023-10-052023-10-05iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 5, 2023

SHIFTPIXY, INC. |

(Exact name of registrant as specified in its charter) |

Wyoming | | 47-4211438 |

(State of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

4101 NW 25th Street, Miami, Florida | | 33142 |

(Address of principal executive offices) | | (Zip Code) |

(888) 798-9100

(Registrant's telephone number, including area code)

Commission File No. 001-37954

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered under Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | | PIXY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 5, 2023, ShiftPixy, Inc. (the “Company”), entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional investor, pursuant to which the Company agreed to issue and sell to the investor (i) in a registered direct offering, 1,350,000 shares (the “Shares”) of Common Stock, par value $0.0001 per share of the Company (the “Common Stock”) at a price of $1.10 per share, and pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 915,000 shares of Common Stock at a price of $1.0999 per share and an exercise price of $0.0001 per share of Common Stock, and (ii) in a concurrent private placement, common stock purchase warrants (the “Private Placement Warrants”), exercisable for an aggregate of up to 2,265,000 shares of Common Stock, at an exercise price of $1.10 per share of Common Stock.

The securities to be issued in the registered direct offering were offered pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-269477), initially filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), on January 31, 2023, and declared effective on February 13, 2023.

The Pre-Funded Warrants are exercisable upon issuance and will remain exercisable until all the Pre-Funded Warrants are exercised in full.

The Private Placement Warrants (and the shares of Common Stock issuable upon the exercise of the Private Placement Warrants) were not registered under the Securities Act and were offered pursuant to an exemption from the registration requirements of the Securities Act provided under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act.

The Private Placement Warrants will become exercisable six months from issuance and will expire five years and six months from the issuance date, and in certain circumstances may be exercised on a cashless basis.

The closing of the registered direct offering and the private placement offering (collectively, the “Offering) is anticipated to occur on October 10, 2023. The gross proceeds of the Offering are approximately $2.5 million before deducting fees to the Company’s financial advisor and other offering expenses payable by the Company. The Company intends to use the net proceeds from the Offering for working capital purposes and general corporate purposes.

Pursuant to the terms of the Purchase Agreement, the Company is required within 90 days of the closing to file a registration statement on Form S-3 (or any other available form) registering the resale of the shares of Common Stock issuable upon the exercise of the Private Placement Warrants. The Company is required to use commercially reasonable efforts to cause such registration to become effective within 30 days (60 days in the event the registration statement is reviewed by the Commission) of the filing of such registration statement, and to keep the registration statement effective as specified in the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, from the closing, until 45 days thereafter, subject to certain exceptions, the Company may not issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, or file any registration statement or any amendment or supplement thereto, other than a prospectus supplement for the Offering and the registration statement for the resale of the shares of Common Stock issuable upon the exercise of the Private Placement Warrants. In addition, the Company agreed, until the six-month anniversary of the Purchase Agreement, subject to certain exceptions, not to enter into any Variable Rate Transaction, as such term is defined in the Purchase Agreement.

In connection with the Offering, on October 5, 2023, the Company entered into a financial advisory agreement (the “Advisory Agreement”) with A.G.P./Alliance Global Partners (the “Financial Advisor”). Pursuant to the terms of the Advisory Agreement, the Company will pay the Financial Advisor a cash fee equal to 7.0% of the gross proceeds of the Offering and will reimburse the Financial Advisor for accountable legal expenses incurred in connection with the Offering in the amount of $75,000.

The foregoing does not purport to be a complete description of each of the Advisory Agreement, Purchase Agreement, Pre-Funded Warrant, and the Private Placement Warrant and is qualified in its entirety by reference to the full text of the form of each of such document, which are filed as Exhibits 10.1, 10.2, 10.3, and 10.4, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Sichenzia Ross Ference Carmel LLP, securities counsel to the Company and Bailey Stock Harmon Cottam Lopez LLP, corporate counsel to the Company, delivered opinions as to the legality of the issuance and sale of the Shares, Pre-Funded Warrants and shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, a copy of each which is filed as Exhibit 5.1 and 5.2 to this Current Report on Form 8-K.

Item 3.02 Unregistered Sale of Equity Securities.

The applicable information set forth in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the Private Placement Warrants is incorporated herein by reference.

Item 8.01 Other Events.

On October 6, 2023, the Company issued a press release announcing the Offering. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SHIFTPIXY, INC. | |

| | | |

Date: October 10, 2023 | By: | /s/ Scott W. Absher | |

| | Scott W. Absher | |

| | Chief Executive Officer | |

nullnullnullnullnullnullnull

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

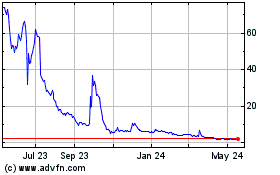

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Nov 2024 to Dec 2024

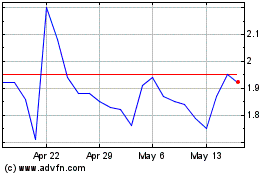

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Dec 2023 to Dec 2024