false000178453500017845352024-01-192024-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2024

PORCH GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39142 | | 83-2587663 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

411 1st Avenue S., Suite 501 | |

Seattle, Washington | 98104 |

| (Address of principal executive offices) | (Zip Code) |

(855) 767-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 | | PRCH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry into a Material Definitive Agreement.

On, January 19, 2024, Porch Group, Inc., together with its subsidiary, Porch.com, Inc. (collectively, “Porch”), entered into a Business Collaboration Agreement (the “Agreement”) with Aon Corp. and Aon Re, Inc. (“Aon Re” and together with Aon Corp., “Aon”).

Contemporaneously with the Agreement, the parties entered into a mutual release of claims related to matters associated with Vesttoo Ltd. and its affiliates (collectively, “Vestoo”) and related fraud. Porch retains the ability to pursue non-Aon parties for claims related to Vesttoo and the related fraud, including Vesttoo itself, its officers and directors and others.

Under the Agreement, Aon will pay Porch $24.65 million in cash in January 2024, plus an additional cash payment in 2025, and will share with Porch’s insurance carrier affiliates a percentage of the brokerage revenue received by Aon Re for the placement of reinsurance contracts on their behalf that incept or renew each calendar year from 2025 through 2028.

Unless the Agreement is earlier terminated in accordance with its terms, it will remain in effect until December 31, 2028. The Agreement may be terminated by Porch upon material breach of Aon. If Porch breaches the Agreement, including by directly or indirectly placing reinsurance with brokers unaffiliated with Aon, Porch may be required to refund certain of the amounts paid by Aon to Porch (or to its affiliates) under the Agreement, subject to customary cure rights.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the actual text of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On January 25, 2024, the Company issued a press release announcing it had entered into the Agreement, a copy of which is attached as Exhibit 99.1 hereto and incorporated by reference herein.

The information contained in, or incorporated into, this Item 7.01 of this Current Report, is furnished under Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act regardless of any general incorporation language in such filings.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 10.1 *+ | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| * | | Portions of this exhibit were redacted pursuant to Item 601(b)(10) of Regulation S-K. The omitted information is not material and is the type that the Company treats as private or confidential. |

| + | | The schedules to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be furnished to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| PORCH GROUP, INC. |

| | |

| By: | /s/ Matthew Cullen |

| | Name: | Matthew Cullen |

| | Title: | General Counsel |

Date: January 25, 2024

Exhibit 10.1

| | |

| CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, INDICATED BY THE MARK “[***]”, HAS BEEN OMITTED BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) CUSTOMARILY AND ACTUALLY TREATED AS PRIVATE OR CONFIDENTIAL |

EXECUTION COPY

BUSINESS COLLABORATION AGREEMENT

THIS BUSINESS COLLABORATION AGREEMENT (this “Agreement”), dated as of January 19, 2024 (the “Effective Date”), by and among PORCH GROUP, INC., a corporation incorporated under the laws of the State of Delaware (“Porch Parent”), PORCH.COM, INC., a corporation incorporated under the laws of the State of Delaware (“Porch”, and together with Porch Parent, the “Porch Parties”), AON CORP., a corporation incorporated under the laws of the State of Delaware (“Aon”), and AON RE, INC., a corporation incorporated under the laws of the State of Illinois (“Aon Re”; each of Aon, Aon Re, Porch Parent, and Porch a “Party” and collectively the “Parties”).

WHEREAS, the Parties have resolved certain claims arising from the purchase of reinsurance by Homeowners of America Insurance Company (“HOA”), a subsidiary of Porch, from Aon affiliate White Rock Insurance (SAC) Ltd. acting in respect of its segregated account designated as “T96 – Homeowners” and, concurrently with the execution of this Agreement, are entering into the Settlement and Release Agreement together with certain of their Affiliates (each as defined herein);

WHEREAS, there are a wide set of services that Aon believes it could provide to Porch or its Affiliates in exchange for its customary compensation, including reinsurance brokerage services, executive compensation consulting services, services around the monetization of data and analytics, collaboration(s) related to data obtained or managed by Porch or its Affiliates, corporate insurance, health, wealth and talent solutions and capital advisory services;

WHEREAS, the Parties desire to enter into a broader strategic relationship related to services that Aon can provide to Porch or its Affiliates; and

WHEREAS, the Parties are entering into this Agreement in order to help facilitate the broader strategic relationship described above.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants contained herein, the Parties agree as follows:

ARTICLE I.

DEFINITIONS; INTERPRETATION

SECTION 1.01Defined Terms. As used in this Agreement, the following terms shall have the meanings specified below:

(a)“Affiliate” means, with respect to any Person, another Person that, directly or indirectly, controls, is controlled by, or is under common control with, such first Person, where “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management policies of a Person, whether through the ownership of voting securities, by contract or otherwise. For the avoidance of doubt, Porch and any Porch Reciprocal shall be considered Affiliates for purposes of this Agreement.

(b)“Agreement Dispute” means any dispute, controversy or disagreement between the Parties arising out of, or relating to, any provision in this Agreement, including its negotiation, validity, interpretation, existence, breach, termination, construction or application, or the rights or obligations of, or compliance with such rights and obligations by, any Party, or the relationship between the Parties.

(c)“Applicable Law” means any domestic or foreign, federal, state or local statute, law, ordinance or code, or any written rules, regulations or administrative interpretations issued by any Governmental Authority pursuant to any of the foregoing, in each case applicable to any Party or its Affiliates and any Order of a court of competent jurisdiction applicable to the Parties or their Affiliates.

(d)“Business Day” means any day, other than a Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by law to close.

(e)“Collaboration Documents” means this Agreement, the Reinsurance Broker Agreement and the Settlement and Release Agreement.

(f)“Commercial Arrangement” means the transactions contemplated by the Collaboration Documents.

(g) “Excluded Reinsurance” means any reinsurance offered or issued by or through a facility or program established by any Government Authority, whether the purchase of such reinsurance is voluntary or compulsory, including without limitation the Texas Windstorm Insurance Association, the Florida Hurricane Catastrophe Fund, the California Earthquake Authority and any similar organization by any name.

(h)“Exclusive Reinsurance Term” means the period commencing on the Effective Date and continuing thereafter until December 31, 2028; provided, that the Exclusive Reinsurance Term shall automatically terminate upon the earlier to occur of (i) a termination of any Reinsurance Broker Agreement if such agreement is terminated by Aon Re or (ii) a For Cause Termination Event and (iii) the delivery by Aon of a Refund Notice.

(i)“Government Authority” means any government, political subdivision, court, board, commission, regulatory or administrative agency or other instrumentality thereof, whether federal, state, provincial, local or foreign and including any regulatory authority, which may be partly or wholly autonomous.

(j)A “For Cause Termination Event” shall be deemed to have occurred if a Porch Group Member party to a Reinsurance Broker Agreement terminates such Reinsurance Broker Agreement following (i) the fraud or willful misconduct of Aon Re or any of its Affiliates (or any of their respective Representatives) under or in connection with such Reinsurance Broker Agreement or (ii) a material breach and continuing failure to perform by Aon Re of its obligations under Section 3.13 (Aon Standard of Conduct) of such Reinsurance Broker Agreement (or any successor or similar provision governing Aon Re’s standard of conduct while preforming services thereunder), provided that if such breach is capable of cure, Aon shall have failed to cure such breach within 15 Business Days following its receipt of written notice of such breach from the relevant Porch Group Member (such notice providing sufficient detail about the alleged breach to give Aon Re a reasonable opportunity to cure). Prior to Porch terminating a Reinsurance Broker Agreement, Porch shall be required to confer in good faith with Aon, in person and through senior representatives, to discuss the basis of Porch’s determination that a For Cause Termination Event occurred and that Aon failed to cure the For Cause Termination Event.

(k)“Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority.

(l)“Person” means any individual, corporation (including not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization, Governmental Authority or other entity of any kind or nature.

(m)“Porch Group Members” means, collectively, HOA, Porticus Re, Porch Reciprocal, and any other insurance company that now is or hereafter becomes an Affiliate of Porch.

(n)“Porch Reciprocal” means any future reciprocal exchange formed at the direction of Porch.

(o)“Porticus Re” means Porticus Reinsurance Ltd., the Cayman Islands captive reinsurance company.

(p)“Relationship Dividend” means all Annual Fees as calculated pursuant to Section 3 of the Relationship Dividend Schedule attached hereto as Schedule 1.

(q) “Specified Agreements” means, collectively, (a) [***] and (b) [***].

(r)“White Rock Trust Account” means the trust account established pursuant to the Trust Agreement among White Rock Insurance (SAC) Ltd. acting in respect of its segregated account designated as “T96 -- Homeowners” (Account Number [***]), HOA and HSBC Bank USA, N.A.

SECTION 1.02Certain Defined Terms. Each capitalized term listed below is defined in the corresponding reference in this Agreement:

| | | | | |

| Term | Section |

Annual Fee Aon | Schedule 1 Preamble |

| Aon Payments | Section 2.02 |

| Aon Re | Preamble |

| Confidential Information | Section 4.02 |

| Effective Date | Preamble |

| HOA | Preliminary Statements |

| Minimum Rating | Section 2.08 |

| Notice | Section 4.01 |

| Net Brokerage Revenue | Schedule 1 |

| Porch | Preamble |

| Porch Parent | Preamble |

| Reinsurance Broker Agreements | Section 2.01 |

| Refunds Due | Section 2.04(c) |

| Refund Notice | Section 2.04(c) |

| Representatives | Section 4.02(b) |

| Settlement and Release Agreement | Section 2.01 |

| Terminating Agreements | Section 2.10 |

SECTION 1.03Rules of Construction. For purposes of this Agreement, except as expressly provided herein or unless the context requires otherwise, (i) the definitions of terms herein shall apply equally to the singular and plural forms of the terms defined; (ii) any pronoun shall include the corresponding masculine, feminine and neuter forms; (iii) the words “include,” “includes” and “including” shall be deemed to be followed by the phrase “without limitation”; (iv) the word “will” shall be construed to have the same meaning and effect as the word “shall”; (v) the word “or” shall be disjunctive but not

exclusive; (vi) the words “herein,” “hereof” and “hereunder,” and words of similar import, shall be construed to refer to this Agreement in its entirety and not to any particular provision hereof, including any Schedule, and (vii) all references herein to Articles, Sections and Schedules shall be construed to refer to Articles and Sections of, and Schedules to, this Agreement.

ARTICLE II.

COMMERCIAL ARRANGEMENT

SECTION 2.01 Contemporaneous and Future Agreements. Concurrently herewith, (i) Aon Re is entering into reinsurance intermediary-broker agreements, dated as of the Effective Date, 2024, with each of HOA and Porticus Re and (ii) the Parties are entering into that certain Settlement and Release Agreement, dated as of the Effective Date (amended, restated, supplemented or otherwise modified from time to time, the “Settlement and Release Agreement”), by and between Porch, Porch Parent, Aon and Aon Re. In addition, Porch Reciprocal will, upon formation and licensing of Porch Reciprocal and subject to Applicable Law, and any other Porch Group Member (including any insurance companies that become controlled affiliates of Porch) will enter into a reinsurance intermediary-broker agreement with Aon Re on terms substantially similar to the reinsurance intermediary-broker agreement with HOA (such reinsurance intermediary-broker agreement, together with the reinsurance intermediary-broker agreements with HOA and Porticus Re and any other Porch Group Member, collectively referred to as the “Reinsurance Broker Agreements”).

SECTION 2.02 Aon Payments. As part of the Commercial Arrangement, Aon shall pay the aggregate sum of $[***] (the “Aon Payments”) to Porch (or its designee) in the following installments on or before the following dates: (i) $[***] payable not later than the third Business Day following the Effective Date; and (ii) $[***] payable on or before [***], 2025. Each of the Aon Payments shall be made by wire transfer of immediately available funds. Porch shall provide (in writing) wire transfer instructions to Aon to enable Aon to make the Aon Payments.

SECTION 2.03 [***].

SECTION 2.04 Exclusive Reinsurance Arrangement.

(a)In further exchange for the Commercial Arrangement including the Aon Payments, Porch hereby agrees to cause the Porch Group Members to appoint and retain Aon Re under the Reinsurance Broker Agreements as the exclusive reinsurance intermediary-broker for the placement and servicing of all reinsurance of any Porch Group Member that incepts or renews during the Exclusive Reinsurance Term in accordance with the terms of this Agreement. Without limiting the generality of the foregoing, if Aon is unable, after having been afforded reasonable time, to procure reinsurance for any Porch Group Member in such amounts as is necessary for such Porch Group Member (1) to satisfy regulatory capital or Minimum Rating requirements, or (2) to stay within specified risk parameters as established by such Porch Group Member in its discretion and provided in writing to Aon Re in advance of the placement, it shall not be deemed a breach of this Section 2.04 if such Porch Group Member procures such reinsurance directly or through another reinsurance broker, provided that (i) only the relevant Porch Group Member may procure such reinsurance directly or through another reinsurance broker and only to the minimum extent reasonably necessary to satisfy the applicable regulatory capital or Minimum Rating requirements or to stay within such specified and written risk parameters, and (ii) Porch or the Porch Group Member has provided Aon at least ten (10) Business Days’ prior written notice advising Aon of the basis for its determination that Aon has been unable to procure the requisite reinsurance and its intention to procure the reinsurance directly or

through another reinsurance broker. Upon receipt of such notice, Aon shall have at least ten (10) Business Days to cure any purported issues and procure the requisite reinsurance. The conditions in the preceding sentence shall not be deemed satisfied if the Porch Group Member has not provided Aon sufficient information or timely cooperation (including written instructions) to procure a competitive quote.

(b)It shall not be deemed a breach of this Agreement and nothing in this Agreement shall prohibit or restrict any Porch Group Member from amending or otherwise modifying any reinsurance agreement in effect on the Effective Date or the performance of the duties of any broker with respect thereto that is a non-Aon broker and receipt by such broker of commissions on such unexpired reinsurance. In addition, if Porch acquires ownership or control of any insurer after the Effective Date, it shall not be deemed a breach of this Agreement and nothing in this Agreement shall prohibit or restrict such insurer from amending or otherwise modifying any reinsurance agreement in effect on the date of the acquisition or the performance of the duties of any broker with respect thereto that is a non-Aon broker and receipt by such broker on commissions on such unexpired reinsurance. It is understood that this Section 2.04(b) shall not apply to any reinsurance agreements that incept or renew during the Exclusive Reinsurance Term on or after April 1, 2024.

(c)Except as contemplated by Sections 2.04(a) and (b), in the event that during the Exclusive Reinsurance Term any Porch Group Member (a) terminates or replaces Aon Re, or otherwise withdraws its appointment, as exclusive reinsurance-intermediary broker, or (b) utilizes a third-party to place (including any co-broking arrangement), or directly places on its own behalf (other than coverage directly from its controlled captive or Excluded Reinsurance), any portion of its reinsurance, then upon written notice by Aon to Porch (a “Refund Notice”) Porch shall, subject to Section 2.12(c), promptly pay to Aon an amount equal to (i) all Aon Payments paid to Porch or its Affiliates as of the date of the Refund Notice, plus (iii) the total Relationship Dividends paid to Porch or its Affiliates as of the date of the Refund Notice, minus (v) $[***] minus (iv) the following:

(A)if the Refund Notice is delivered during calendar year 2024, an amount equal to [***]% of the total Aon Payments and Relationship Dividends paid by Aon as of the date of the Refund Notice in excess of $[***];

(B) if the Refund Notice is delivered during calendar year 2025, an amount equal to [***]% of the total Aon Payments and Relationship Dividends paid by Aon as of the date of the Refund Notice in excess of $[***];

(C)if the Refund Notice is delivered during calendar year 2026, an amount equal to [***]% of the total Aon Payments and Relationship Dividends paid by Aon as of the date of the Refund Notice in excess of $[***];

(D)if the Refund Notice is delivered during calendar year 2027, an amount equal to [***]% of the total Aon Payments and Relationship Dividends paid by Aon as of the date of the Refund Notice in excess of $[***];

(E)if the Refund Notice is delivered during calendar year 2028, an amount equal to [***]% of the total Aon Payments and Relationship Dividends paid by Aon as of the date of the Refund Notice in excess of $[***].

To enable Aon to determine when it may be appropriate to submit a Refund Notice to Porch, Porch shall be obligated to promptly inform Aon of any instance in which Porch (a) terminates or replaces Aon Re, or otherwise withdraws its appointment, as exclusive reinsurance-intermediary broker, or (b) utilizes a third-

party to place (including any co-broking arrangement), or directly places on its own behalf (other than coverage directly from its controlled captive or Excluded Reinsurance), any portion of its reinsurance.

In the event that any portion of the amounts set forth above become due to Aon (“Refunds Due”) and are not promptly paid to Aon, Aon may pursue legal claims against the Porch Parties, or take other steps reasonably necessary, to collect the Refunds Due and the Porch Parties agree to reimburse Aon for any and all costs and expenses (including reasonable attorneys’ fees) associated with the collection of the Refunds Due. The rights of Aon provided under this Section 2.04(c) are the sole and exclusive remedy against the Porch Parties arising out of or relating in any way to a breach of Section 2.04(a).

SECTION 2.05 Relationship Dividend. The Parties agree to the terms and conditions set forth in the Relationship Dividend Schedule attached hereto and made a part hereof as Schedule 1.

SECTION 2.06 Payment of Outstanding Premium and Brokerage. Porch will pay, and will cause HOA to pay, to Aon Re all outstanding premium and brokerage on reinsurance contracts in effect on the Effective Date. All such payments will be made by no later than the fifteenth Business Day after the Effective Date (to the extent currently or past due on such date). It is understood that any premium or brokerage that is not yet due on HOA’s existing reinsurance contracts as of the Effective Date shall be paid in 2024 pursuant to the applicable contract terms.

SECTION 2.07 [***].

SECTION 2.08 Financial Stability Rating; Reinsurance Structure. Subject to Section 2.11, Porch agrees (i) to use commercially reasonable efforts to cause HOA, Porch Reciprocal and any other insurance companies that are or become controlled affiliates of Porch to maintain, at all times during the Exclusive Reinsurance Term, a Financial Stability Rating not less than “A (Excellent)” from Demotech, Inc. or other rating by any rating agency not less than the minimum rating required for property insurance for the property securing any first mortgage loan insured by the Federal National Mortgage Association or Federal Home Loan Mortgage Corporation (such rating, a “Minimum Rating”), and (ii) to cause HOA, Porch Reciprocal and any other insurance companies that are or become controlled affiliates of Porch to maintain a reinsurance structure (one or more reinsurance contracts) in accordance with all applicable rating agency metrics for a Minimum Rating. The sole and exclusive remedy available to Aon for breach of this Section 2.08 shall be a refund by Porch of Aon Payments paid to Porch and its Affiliates and the Relationship Dividend as set out in Section 2.04(c).

SECTION 2.09 Additional Reinsurance Brokerage Services. As part of the reinsurance broker relationship and for no additional cost (so long as such services are typically provided to reinsurance broking clients), Aon agrees to provide Porch, HOA, the Porch Reciprocal, and any other applicable Porch Affiliates, upon request, customary reinsurance broker services and any related Aon products and services, including ImpactOnDemand, ReMetrica, AIR and RMS modeling (subject to third-party license terms and conditions), Catastrophe Management, Actuarial, Market Analysis, Rating Agency Advisory, Aon’s Research Forum, Impact Forecasting, Cat Score, ABConnect, FAConnect, MarketReView, and other similar current and future products, each to the extent that they would have typically been provided as part of an ongoing reinsurance brokerage relationship.

SECTION 2.10 [***].

SECTION 2.11 Limitations. The Parties acknowledge that the obligations of any Porch Group Member to (i) appoint and utilize Aon Re as an exclusive reinsurance broker, (ii) purchase reinsurance or (iii) maintain Minimum Ratings are and remain subject to (x) limitations imposed by Applicable Law and (y) the proper exercise of fiduciary duties by the directors and officers of such Porch Group Members. Notwithstanding the foregoing, in the event that any Porch Group Member does not appoint and utilize Aon

Re as an exclusive reinsurance broker, purchase reinsurance or maintain Minimum Ratings as provided in this Agreement, then the sole and exclusive remedy available to Aon shall be a refund by Porch of Aon Payments paid to Porch and its Affiliates and the Relationship Dividend as set out in Section 2.04(c).

SECTION 2.12 No Equitable Remedies; No Recourse Against Porch Group Members; Opportunity to Cure.

(a)The Parties acknowledge and agree that in no event shall any Party shall be entitled to equitable relief (e.g. specific performance or injunctive relief) for any breach or threatened breach of any provision of this Article II.

(b)For the avoidance of doubt, no Porch Group Member shall have any liability of any nature for any obligations or liabilities of any Porch Party arising under or relating in any way to this Agreement. To the extent any Porch Group Member has any obligations or incurs any liabilities under this Agreement, Aon shall be permitted to seek recourse only from the Porch Parties and only the Porch Parties shall be responsible to Aon for such liabilities.

(c)Anything to the contrary notwithstanding, if any Party breaches any provision of this Article II (including Sections 2.04 and 2.08), and such breach is capable of cure, then the Party shall have 15 Business Days following its receipt of written notice of such breach to cure such breach before the exercise of any remedies in respect of such breach under this Agreement.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

SECTION 3.01 Representations and Warranties.

(a)Each of the Parties represents and warrants to the other Parties as of the Effective Date that (i) the execution, delivery and performance by it of this Agreement and the other Collaboration Documents to which it is a party and the consummation of the transactions contemplated hereunder and thereby do not, and will not, contravene or conflict with any Applicable Law of any Governmental Authority having jurisdiction over it, or constitute a default under, or result in the breach of, any indenture, mortgage, deed of trust, charge, lien, or any contract, agreement or other instrument to which it is a party or which may be applicable to it; (ii) this Agreement and the other Collaboration Documents to which it is a party was duly authorized, executed and delivered by it and is a legal and binding obligation of it and is enforceable in accordance with its terms, except as limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or other similar rights and by general equity principles; and (iii) no action is pending or threatened against it by any other Person, which would reasonably be expected to result in a material adverse effect on the ability of it to perform its obligations under this Agreement or any of the other Collaboration Documents to which it is a party.

(b)[***].

(c)Porch represents and warrants to the Aon Parties as of the Effective Date that it has the authority and ability to make the assignment to Aon set forth in Section 2.03.

ARTICLE IV.

MISCELLANEOUS

SECTION 4.01 Notices. Each Party shall deliver all notices, requests, consents, claims, demands, waivers, and other communications under this Agreement (each, a “Notice”) in writing and addressed to the

applicable Party at its address set forth under its name on the signature page to this Agreement (or to such other address that the receiving Party may designate from time to time in accordance with this Section). Each Party shall deliver all Notices by personal delivery, nationally recognized overnight courier (with all fees prepaid), email (with confirmation of transmission), or certified or registered mail (in each case, return receipt requested, postage prepaid). Except as otherwise provided in this Agreement, a Notice is effective only (a) upon receipt by the receiving Party and (b) if the Party giving the Notice has complied with the requirements of this Section.

SECTION 4.02 Confidentiality.

(a)This Agreement (including the terms and conditions of this Agreement) and all communications and/or negotiations related hereto are intended to be confidential to the Parties hereto, and except as specifically provided herein, no Party shall publish, reproduce, transmit or disclose any of the information contained in this Agreement or any related communication (hereinafter “Confidential Information”) to any non-party without the prior written consent of the non-disclosing Parties. “Confidential Information” shall, as to any Party, not include (i) any information that is or becomes generally available to and known by the public other than as a result of, directly or indirectly, any breach of this Section by such Party or any of its Representatives or (ii) the existence of this Agreement and the fact that the Parties have entered into a settlement regarding matters relating to the Vesttoo Fraud under this Agreement and/or the Settlement and Release Agreement.

(b)Notwithstanding the foregoing, any Party may disclose Confidential Information:

(i)on a reasonable need-to-know basis to its Affiliates and its and its Affiliates respective directors, members, officers, employees, accountants, auditors, tax advisors, financial advisors, insurers (and their respective reinsurers and agents), lenders, investors, liquidators, and shareholders, attorneys (collectively, “Representatives”);

(ii)to its or its Affiliates regulators (including the Texas Department of Insurance and the Bermuda Monetary Authority);

(iii)to the extent required to enforce the terms of this Agreement;

(iv)to the extent required by discovery request, subpoena, question during testimonial proceedings, or similar procedure, provided that prior to any such disclosure, the disclosing Party shall: (a) use reasonable efforts to provide the non-disclosing Parties with timely advance written notice of its intent to so disclose; (b) use reasonable efforts to minimize the amount of Confidential Information to be provided in a manner consistent with the interests of the non-disclosing Party and the requirements of the Governmental Authority involved; and (c) use reasonable efforts to extent practicable to secure confidential treatment of the Confidential Information to be provided;

(v)to the extent required by law or the rules of any stock exchange upon which any Party’s (or any of their respective Affiliates’) securities are listed;

(vi)to the extent required for the purpose of financial reporting or other disclosure requirements, including the U.S. Securities and Exchange Commission and regulatory filings; or

(vii)to the extent mutually agreed upon in a writing signed by the Parties.

(c)Each Party acknowledges and agrees that money damages might not be a sufficient remedy for any material breach or threatened material breach of this Section 4.02 by such Party or its

Representatives. Therefore, in addition to all other remedies available at law (which no Party waives by the exercise of any rights hereunder), the non-breaching Party shall be entitled to seek specific performance and injunctive and other equitable relief as a remedy for any such material breach or threatened material breach, and the Parties hereby waive any requirement for the securing or posting of any bond or the showing of actual monetary damages in connection with such claim. Each Party shall be responsible for any breach of this Section 4.02 caused by any of its Representatives.

SECTION 4.03 Binding Agreement; Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and assigns. None of the Parties may assign any of its rights or delegate any of its duties under this Agreement without the prior written consent of the other Parties. Any attempted assignment or delegation in violation of the terms of this Section 4.03 shall be null and void.

SECTION 4.04 Governing Law. This Agreement, and all matters arising out of or relating to this Agreement, whether sounding in contract, tort, or statute are governed by, construed in accordance with, and enforced under the laws of the State of New York, without giving effect to the conflict of laws provisions thereof to the extent such principles or rules would require or permit the application of the laws of any jurisdiction other than those of the State of New York.

SECTION 4.05 Dispute Resolution.

(a) In the case of any Agreement Disputes (other than any Agreement Dispute in respect of a breach or threatened breach of Section 4.02(a) where a Party is seeking specific performance as contemplated by Section 4.02(c)), the Parties shall first attempt in good faith to resolve all such Agreement Disputes by informal discussions before initiating any legal action. Representatives of each Party shall meet to discuss the resolution of the Agreement Dispute. If they are unable to do so within thirty (30) days of notice from one Party to the other Party regarding the Agreement Dispute and requesting a meeting, the Agreement Dispute shall be escalated to the senior divisional management of each Party, and if unresolved at the end of ten (10) Business Days thereafter, any Party may commence a legal proceeding with respect to such Agreement Dispute in accordance with the terms and conditions of Section 4.05(b).

(b) Each Party irrevocably and unconditionally agrees that it will not commence any action, litigation, or proceeding of any kind whatsoever against any other Party in any way arising from or relating to this Agreement and all contemplated transactions, including, but not limited to, contract, equity, tort, fraud, and statutory claims, in any forum other than the US District Court for the Southern District of New York or, if such court does not have subject matter jurisdiction, the courts of the State of New York sitting in New York County, and any appellate court from any thereof. Each Party irrevocably and unconditionally submits to the exclusive jurisdiction of such courts and agrees to bring any such action, litigation, or proceeding only in the US District Court for the Southern District of New York or, if such court does not have subject matter jurisdiction, the courts of the State of New York sitting in New York County. Each Party agrees that a final judgment in any such action, litigation, or proceeding is conclusive and may be enforced in other jurisdiction by suit on the judgment or in any other manner provided by law.

SECTION 4.06 WAIVER OF JURY TRIAL. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY THAT MAY ARISE UNDER THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

SECTION 4.07 Amendments and Waivers. No amendment of any provision of this Agreement shall be effective unless it is in writing and signed by the Parties hereto, and no waiver of any provision of this Agreement, nor consent to any departure by any Party from it, shall be effective unless it is in writing and signed by the affected Party, and then such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given. No failure on the part of a Party to exercise, and no delay in exercising, any right or remedy under this Agreement shall operate as a waiver by such Party, nor shall any single or partial exercise of any right or remedy under this Agreement preclude any other or further exercise thereof or the exercise of any other right or remedy.

SECTION 4.08 Joint Drafting. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, the language shall be construed as mutually chosen by the Parties to express their mutual intent, and no rule of strict construction shall be applied against any Party.

SECTION 4.09 Expenses. All costs and expenses incurred in connection with this Agreement and each other agreement, document, and instrument contemplated by this Agreement and the transactions contemplated hereby and thereby shall be paid by the Party incurring such costs and expenses.

SECTION 4.10 Headings. The headings in this Agreement are for reference purposes only and are not intended to be part of or to affect the meaning or interpretation of this Agreement.

SECTION 4.11 Entire Agreement. This Agreement and the other Collaboration Documents, including any exhibits and schedules hereto or thereto, contain all of the terms, conditions and representations and warranties agreed upon or made by the Parties relating to the subject matter of this Agreement and supersede all prior and contemporaneous agreements, negotiations, correspondence, undertakings and communications of the Parties or their representatives, oral or written, respecting such subject matter.

SECTION 4.12 Severability. Any provision or term of this Agreement which is invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective only to the extent of such invalidity, illegality or unenforceability without invalidating the remaining provisions hereof or affecting the validity, legality or enforceability of such provision in any other jurisdiction. The Parties shall endeavor in good-faith negotiations to replace the invalid, illegal or unenforceable provisions with valid provisions the economic effect of which comes as close as possible to that of the invalid, illegal or unenforceable provisions. Without limiting the generality of the foregoing, this Section shall apply to any Party that is prohibited or restricted by Applicable Law from performing any of its obligations under the terms of this Agreement, including any obligation to cause any Affiliate to take any action required by the terms of this Agreement in the event that such Affiliate is prohibited or restricted from taking such action by Applicable Law.

SECTION 4.13 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[remainder of page intentionally left blank; signature pages follow]

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date first above written.

PORCH GROUP, INC.

By: /s/ Matt Ehrlichman

Name: Matt Ehrlichman

Title: Chief Executive Officer

Address for Notices:

411 1st Avenue South, Suite 501

Seattle, Washington 98104

Attention: Matt Ehrlichman

PORCH.COM, INC.

By: /s/ Matt Ehrlichman

Name: Matt Ehrlichman

Title: Chief Executive Officer

Address for Notices:

411 1st Avenue South, Suite 501

Seattle, Washington 98104

Attention: Matt Ehrlichman

AON CORP.

By: /s/ Colby Alexis

Name: Colby Alexis

Title: Vice President and Secretary

Address for Notices:

Aon Service Corporation

200 E. Randolph Street

Chicago, IL 60601

Attention: Aon Law & Compliance Department

[Signature Page to Business Collaboration Agreement]

AON RE, INC.

By: /s/ Colby Alexis

Name: Colby Alexis

Title: Vice President and Secretary

Address for Notices:

Aon Service Corporation

200 E. Randolph Street

Chicago, IL 60601

Attention: Aon Law & Compliance Department

[Signature Page to Business Collaboration Agreement]

SCHEDULE 1

RELATIONSHIP DIVIDEND SCHEDULE

Exhibit 99.1

Exhibit 99.1

Porch Group Receives $25m with Signing of Strategic Agreement with Aon

SEATTLE, Jan 25, 2024 (BUSINESS WIRE) – Porch Group, Inc. (“Porch”, “Porch Group” or “the Company”) (NASDAQ: PRCH), a leading vertical software company reinventing the home services and insurance industries, today announced it signed a strategic business collaboration agreement with Aon Corp. and Aon Re, Inc. (“Aon”) to provide a variety of services to Porch Group companies, resulting in payments to Porch of approximately $25 million upfront and an expected approximately $5 million over the following four years. Aon Re, Inc. is a leading reinsurance broker and provides a wide variety of services for insurance and non-insurance companies.

Reinsurance brokers are specialists who arrange reinsurance coverage for insurance companies. Porch was seeking a strong partner who could both deliver strong outcomes with reinsurance placements and importantly, provide other services across Porch Group such as data modeling and more. Aon and Porch Group will work together to place 2024 reinsurance coverage at the upcoming renewal on April 1, 2024.

As part of this agreement, the parties also signed a release of claims arising from the Vesttoo fraud. Porch has not released any claims against non-Aon parties related to these matters and intends to vigorously pursue recovery.

“We think Aon is the right partner for us. They are a well-known name in the insurance industry who can provide a variety of important services to help across our business. Porch and our insurance carrier have worked with Aon for many years and we are excited to expand this relationship with Aon as our sole partner for certain services through 2028.” Matt Ehrlichman, Chief Executive Officer.

About Porch Group

Seattle-based Porch Group, Inc., the vertical software and insurance platform for the home, provides software and services to approximately 30,700 home services companies such as home inspectors, mortgage companies and loan officers, title companies, moving companies, real estate agencies, utility companies, and warranty companies. Through these relationships and its multiple brands, Porch Group provides a moving concierge service to homebuyers, helping them save time and make better decisions on critical services, including insurance, warranty, moving, security, TV/internet, home repair and improvement, and more. To learn more about Porch Group, visit porchgroup.com or porch.com.

Investor Relations Contact:

Lois Perkins, Head of Investor Relations

Porch Group, Inc.

Loisperkins@porch.com

Forward-Looking Statements

Certain statements in this release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Although the Company believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, assumptions, and other factors which could cause actual results to differ materially

from those expressed or implied by such forward-looking statements. Generally, statements that are not historical facts, including statements concerning the Company’s possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends,” or similar expressions.

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management at the time they are made, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) expansion plans and opportunities, and managing growth, to build a consumer brand; (2) the incidence, frequency, and severity of weather events, extensive wildfires, and other catastrophes; (3) economic conditions, especially those affecting the housing, insurance, and financial markets; (4) expectations regarding revenue, cost of revenue, operating expenses, and the ability to achieve and maintain future profitability; (5) existing and developing federal and state laws and regulations, including with respect to insurance, warranty, privacy, information security, data protection, and taxation, and management’s interpretation of and compliance with such laws and regulations; (6) the Company’s reinsurance program, which includes the use of a captive reinsurer, the success of which is dependent on a number of factors outside management’s control, along with reliance on reinsurance to protect against loss; (7) the uncertainty and significance of the known and unknown effects on the Company's insurance carrier subsidiary, Homeowners of America Insurance Company (“HOA”), and the Company due to the termination of a reinsurance contract following the allegations of fraud against Vesttoo Ltd. (“Vesttoo”), including, but not limited to, the outcome of Vesttoo’s Chapter 11 bankruptcy proceedings; the Company's ability to successfully pursue claims arising out of the alleged fraud, the costs associated with pursuing the claims, and the timeframe associated with any recoveries; HOA's ability to obtain and maintain adequate reinsurance coverage against excess losses; HOA’s ability to stay out of regulatory supervision and maintain its financial stability rating; and HOA’s ability to maintain a healthy surplus; (8) uncertainties related to regulatory approval of insurance rates, policy forms, insurance products, license applications, acquisitions of businesses, or strategic initiatives, including the reciprocal restructuring, and other matters within the purview of insurance regulators; (9) reliance on strategic, proprietary relationships to provide the Company with access to personal data and product information, and the ability to use such data and information to increase transaction volume and attract and retain customers; (10) the ability to develop new, or enhance existing, products, services, and features and bring them to market in a timely manner; (11) changes in capital requirements, and the ability to access capital when needed to provide statutory surplus; (12) the increased costs and initiatives required to address new legal and regulatory requirements arising from developments related to cybersecurity, privacy, and data governance and the increased costs and initiatives to protect against data breaches, cyber-attacks, virus or malware attacks, or other infiltrations or incidents affecting system integrity, availability, and performance; (13) retaining and attracting skilled and experienced employees; (14) costs related to being a public company; and (15) other risks and uncertainties discussed in Part I, Item 1A, “Risk Factors,” in the Company’s Annual Report on Form 10-K (“Annual Report”) for the year ended December 31, 2022, in Part II, Item 1A, “Risk Factors,” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023,

as well as those discussed in subsequent reports filed with the Securities and Exchange Commission (“SEC”), all of which are available on the SEC’s website at www.sec.gov.

Nothing in this release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. Unless specifically indicated otherwise, the forward-looking statements in this release do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this release. The Company does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law.

v3.23.4

Document and Entity Information

|

Jan. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 19, 2024

|

| Entity Registrant Name |

PORCH GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39142

|

| Entity Tax Identification Number |

83-2587663

|

| Entity Address, Address Line One |

411 1st Avenue S.

|

| Entity Address, Address Line Two |

Suite 501

|

| Entity Address, City or Town |

Seattle

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98104

|

| City Area Code |

855

|

| Local Phone Number |

767-2400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

PRCH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001784535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

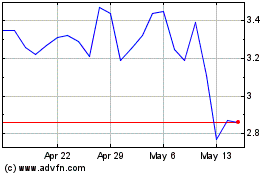

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Apr 2024 to May 2024

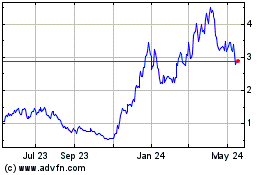

Porch (NASDAQ:PRCH)

Historical Stock Chart

From May 2023 to May 2024