0000912603 False 0000912603 2024-10-24 2024-10-24 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

(Commission File Number) 000-22496

_______________________________

RADIUS RECYCLING, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Oregon | 93-0341923 |

| (State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) |

| | |

| 299 SW Clay Street, Suite 400, Portland, Oregon | 97201 |

| (Address of Principal Executive Offices) | (Zip Code) |

(503) 224-9900

(Registrant's telephone number, including area code)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $1.00 par value | RDUS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 24, 2024, Radius Recycling, Inc issued a press release announcing its financial results for the fourth quarter and fiscal 2024. A copy of the press release is being furnished as Exhibit 99.1 to this report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | RADIUS RECYCLING, INC. |

| | | |

| | | |

| Date: October 24, 2024 | By: | /s/ Stefano R. Gaggini |

| | | Stefano R. Gaggini |

| | | Senior Vice President and Chief Financial Officer |

| | | |

EXHIBIT 99.1

Radius Recycling Reports Fourth Quarter and Fiscal 2024 Financial Results

Significant Sequential Improvement in Operating and Financial Performance in Q4

Ferrous, Nonferrous and Finished Steel Sales Volumes Up Sequentially

Radius Board Declares Quarterly Dividend

PORTLAND, Ore., Oct. 24, 2024 (GLOBE NEWSWIRE) -- Radius Recycling, Inc. (NASDAQ: RDUS) today reported results for the fourth quarter and fiscal year ended August 31, 2024.

The Company reported a net loss of $(16) million, or $(13) per ferrous ton, and a loss per share from continuing operations in the fourth quarter of fiscal 2024 of $(0.56), a significant improvement compared to the third quarter which included a material goodwill impairment charge.

Adjusted EBITDA in the fourth quarter was $17 million, or $13 per ferrous ton, nearly double as compared to the third quarter which included $7 million of insurance recoveries. Adjusted loss per share from continuing operations was $(0.41) in the fourth quarter.

The biggest drivers of the sequential performance improvement were significantly higher sales volumes for ferrous, nonferrous, and finished steel products, stronger nonferrous market conditions and prices, an expansion in recycled metal spreads, and the ramp-up to the full quarterly run rate of benefits associated with the Company’s $70 million annual cost reduction and productivity improvement program.

Nonferrous demand was strong in the fourth quarter, driving average net selling prices up 4% and sales volumes up 13%, sequentially. Ferrous sales volumes increased 12% sequentially including from seasonally higher supply flows and benefits from timing of shipments, while average net selling prices were flat in the fourth quarter as they continued to reflect the dampening effect of continued elevated levels of Chinese steel exports and subdued manufacturing activity in the U.S.

Finished steel sales volumes increased 11% sequentially, driven primarily by seasonally stronger construction activity. Rolling mill utilization was 97% in the fourth quarter compared to 88% in the prior quarter.

Tamara Lundgren, Chairman and Chief Executive Officer, said, “Our results this quarter benefited from our significant cost savings and productivity improvement program and our success in increasing ferrous, nonferrous, and finished steel sales volumes. We expect the execution of our strategic initiatives, including investments in advanced metal recovery technologies, expansion of our recycling services platform, and productivity and cost controls to continue to positively contribute to our performance.”

Ms. Lundgren continued, “Tight scrap availability has been our biggest headwind, and declines in U.S. interest rates should benefit consumer, manufacturing, and construction activity which, in turn, should lead to improved scrap supply flows. The structural demand for recycled metals remains strong, underpinned by the global transition to low carbon technologies and demand from the anticipated increase in infrastructure investment.”

| Summary Results | | | | | | | | | | | | | | | |

| ($ in millions, except per share and per ferrous ton amounts) | | | | | | | | | | | | | | | |

| | | Quarter | | | Year | |

| | | 4Q24 | | | 3Q24 | | | 4Q23 | | | 2024 | | | 2023 | |

| Revenues | | $ | 771 | | | $ | 674 | | | $ | 718 | | | $ | 2,739 | | | $ | 2,882 | |

| Gross margin (total revenues less cost of goods sold) | | $ | 52 | | | $ | 46 | | | $ | 90 | | | $ | 177 | | | $ | 308 | |

| Selling, general and administrative expense | | $ | 61 | | | $ | 62 | | | $ | 69 | | | $ | 248 | | | $ | 266 | |

| Net loss | | $ | (16 | ) | | $ | (199 | ) | | $ | (26 | ) | | $ | (266 | ) | | $ | (25 | ) |

| Net loss per ferrous ton | | $ | (13 | ) | | $ | (178 | ) | | $ | (23 | ) | | $ | (59 | ) | | $ | (6 | ) |

Diluted (loss) earnings per share from continuing

operations attributable to Radius shareholders | | | | | | | | | | | | | | | |

| Reported | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.37 | ) | | $ | (0.92 | ) |

| Adjusted(1) | | $ | (0.41 | ) | | $ | (0.59 | ) | | $ | 0.47 | | | $ | (2.68 | ) | | $ | 0.85 | |

| Adjusted EBITDA(1) | | $ | 17 | | | $ | 9 | | | $ | 49 | | | $ | 29 | | | $ | 144 | |

| Adjusted EBITDA per ferrous ton(1) (5) | | $ | 13 | | | $ | 8 | | | $ | 44 | | | $ | 7 | | | $ | 33 | |

| Cash flows from (used in) operating activities | | $ | 4 | | | $ | (1 | ) | | $ | 135 | | | $ | (53 | ) | | $ | 139 | |

| | | | | | | | | | | | | | | | |

| Ferrous sales volumes (LT, in thousands)(2) | | | 1,249 | | | | 1,112 | | | | 1,105 | | | | 4,493 | | | | 4,376 | |

| Avg. net ferrous sales prices ($/LT)(3) | | $ | 348 | | | $ | 350 | | | $ | 357 | | | $ | 358 | | | $ | 371 | |

| Nonferrous sales volumes (pounds, in millions)(2) (4) | | | 207 | | | | 183 | | | | 204 | | | | 748 | | | | 739 | |

| Avg. nonferrous sales prices ($/pound)(3) (4) | | $ | 1.08 | | | $ | 1.04 | | | $ | 0.94 | | | $ | 1.00 | | | $ | 0.96 | |

| Finished steel average net sales price ($/ST)(3) | | $ | 795 | | | $ | 817 | | | $ | 861 | | | $ | 818 | | | $ | 930 | |

| Finished steel sales volumes (ST, in thousands) | | | 140 | | | | 126 | | | | 152 | | | | 509 | | | | 521 | |

| Rolling mill utilization (%) | | | 97 | % | | | 88 | % | | | 102 | % | | | 90 | % | | | 89 | % |

LT = Long Ton, which is equivalent to 2,240 pounds

ST = Short Ton, which is equivalent to 2,000 pounds

(1) See Non-GAAP Financial Measures for reconciliation to U.S. GAAP.

(2) Ferrous and nonferrous volumes sold externally and delivered to our steel mill for finished steel production.

(3) Price information is shown after netting the cost of freight incurred to deliver the product to the customer.

(4) Nonferrous sales volumes and average nonferrous prices excludes platinum group metals (“PGMs”) in catalytic converters.

(5) May not foot due to rounding.

Fourth Quarter Fiscal 2024 Financial Review and Analysis

Results for the fourth quarter included a detriment from average inventory accounting of approximately $1 per ferrous ton, compared to a detriment of $3 per ferrous ton in the third quarter.

Results for the fourth quarter did not reflect benefits from insurance recoveries, compared to $7 million in benefits recognized in the third quarter of fiscal 2024 upon final settlement of certain property damage and business interruption matters that occurred in prior periods.

Operating cash flow in the fourth quarter was positive at $4 million. Total debt was $415 million and debt, net of cash was $409 million at the end of the quarter. Capital expenditures were $20 million in the fourth quarter, and $76 million for fiscal 2024. The effective tax rate for the fourth quarter was a benefit of 10% on GAAP results and a benefit of 33% on adjusted non-GAAP results.

During the fourth quarter, the Company returned capital to shareholders through its 122nd consecutive quarterly dividend.

Declaration of Quarterly Dividend

The Board of Directors declared a cash dividend of $0.1875 per common share, payable November 26, 2024 to shareholders of record on November 12, 2024. The Company has paid a dividend every quarter since going public in November 1993.

Analysts’ Conference Call: Fourth Quarter and Fiscal 2024 Results

A conference call and slide presentation to discuss results will be held today, October 24, 2024, at 11:30 a.m. Eastern and will be hosted by Tamara Lundgren, Chairman and Chief Executive Officer, and Stefano Gaggini, Senior Vice President and Chief Financial Officer. The call and accompanying slide presentation will be webcast and accessible under the Events Calendar on the Company’s website at: www.radiusrecycling.com/company/investors. Summary financial data is provided in the following pages. The slide presentation and related materials will be available prior to the call on the Company's website.

About Radius Recycling, Inc.

Radius Recycling, Inc. (formerly Schnitzer Steel Industries, Inc.) is one of the largest manufacturers and exporters of recycled metal products in North America with operating facilities located in 25 states, Puerto Rico, and Western Canada. Radius has seven deep water export facilities located on both the East and West Coasts and in Hawaii and Puerto Rico. The Company’s integrated operating platform also includes 50 stores which sell serviceable used auto parts from salvaged vehicles and receive over 4 million annual retail visits. The Company’s steel manufacturing operations produce finished steel products, including rebar, wire rod, and other specialty products. The Company began operations in 1906 in Portland, Oregon.

| |

| RADIUS RECYCLING, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| ($ in thousands, except per share amounts) |

| (Unaudited) |

| |

| | | Quarter | | | Year | |

| | | 4Q24 | | | 3Q24 | | | 4Q23 | | | 2024 | | | 2023 | |

| Revenues | | $ | 770,816 | | | $ | 673,920 | | | $ | 717,931 | | | $ | 2,738,692 | | | $ | 2,882,224 | |

| Cost of goods sold | | | 718,785 | | | | 628,390 | | | | 627,880 | | | | 2,561,591 | | | | 2,574,513 | |

| Selling, general and administrative expense | | | 60,974 | | | | 62,100 | | | | 69,217 | | | | 248,336 | | | | 265,929 | |

| Income from joint ventures | | | (397 | ) | | | (300 | ) | | | (704 | ) | | | (1,400 | ) | | | (2,090 | ) |

| Goodwill impairment charges | | | — | | | | 215,941 | | | | 39,270 | | | | 215,941 | | | | 39,270 | |

| Other asset impairment charges | | | — | | | | — | | | | 5,797 | | | | 1,476 | | | | 5,797 | |

| Restructuring charges and other exit-related activities | | | 244 | | | | 3,275 | | | | 141 | | | | 6,729 | | | | 2,730 | |

| Operating loss | | | (8,790 | ) | | | (235,486 | ) | | | (23,670 | ) | | | (293,981 | ) | | | (3,925 | ) |

| Interest expense | | | (8,917 | ) | | | (7,368 | ) | | | (5,211 | ) | | | (26,898 | ) | | | (18,589 | ) |

| Other income (expense), net | | | 66 | | | | (187 | ) | | | (273 | ) | | | (554 | ) | | | (5,562 | ) |

| Loss from continuing operations before income taxes | | | (17,641 | ) | | | (243,041 | ) | | | (29,154 | ) | | | (321,433 | ) | | | (28,076 | ) |

| Income tax benefit | | | 1,759 | | | | 44,551 | | | | 3,423 | | | | 55,285 | | | | 2,747 | |

| Loss from continuing operations | | | (15,882 | ) | | | (198,490 | ) | | | (25,731 | ) | | | (266,148 | ) | | | (25,329 | ) |

| Loss from discontinued operations, net of tax | | | (22 | ) | | | (21 | ) | | | (31 | ) | | | (76 | ) | | | (109 | ) |

| Net loss | | | (15,904 | ) | | | (198,511 | ) | | | (25,762 | ) | | | (266,224 | ) | | | (25,438 | ) |

| Net (income) loss attributable to noncontrolling interests | | | (174 | ) | | | 121 | | | | (54 | ) | | | (187 | ) | | | (353 | ) |

| Net loss attributable to Radius shareholders | | $ | (16,078 | ) | | $ | (198,390 | ) | | $ | (25,816 | ) | | $ | (266,411 | ) | | $ | (25,791 | ) |

| | | | | | | | | | | | | | | | |

| Net income (loss) per share attributable to Radius shareholders: | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | |

| Loss per share from continuing operations | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.37 | ) | | $ | (0.92 | ) |

| Net loss per share | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.38 | ) | | $ | (0.92 | ) |

| Diluted: | | | | | | | | | | | | | | | |

| Loss per share from continuing operations | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.37 | ) | | $ | (0.92 | ) |

| Net loss per share | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.38 | ) | | $ | (0.92 | ) |

| Weighted average number of common shares: | | | | | | | | | | | | | | | |

| Basic | | | 28,511 | | | | 28,479 | | | | 28,108 | | | | 28,417 | | | | 28,008 | |

| Diluted | | | 28,511 | | | | 28,479 | | | | 28,108 | | | | 28,417 | | | | 28,008 | |

| Dividends declared per common share | | $ | 0.1875 | | | $ | 0.1875 | | | $ | 0.1875 | | | $ | 0.7500 | | | $ | 0.7500 | |

| |

RADIUS RECYCLING, INC.

|

SELECTED OPERATING STATISTICS

|

| (Unaudited) |

| |

| | | | | | | | | | | | | | | FY | |

| | | 1Q24 | | | 2Q24 | | | 3Q24 | | | 4Q24 | | | 2024(6) | |

| Total ferrous volumes (LT, in thousands)(1) | | | 1,152 | | | | 980 | | | | 1,112 | | | | 1,249 | | | | 4,493 | |

| Total nonferrous volumes (pounds, in thousands)(1)(2) | | | 181,728 | | | | 176,477 | | | | 183,230 | | | | 206,743 | | | | 748,178 | |

| Ferrous selling prices ($/LT)(3) | | | | | | | | | | | | | | | |

| Domestic | | $ | 342 | | | $ | 391 | | | $ | 341 | | | $ | 323 | | | $ | 349 | |

| Foreign | | $ | 359 | | | $ | 381 | | | $ | 354 | | | $ | 356 | | | $ | 361 | |

| Average | | $ | 354 | | | $ | 384 | | | $ | 350 | | | $ | 348 | | | $ | 358 | |

| Ferrous sales volume (LT, in thousands) | | | | | | | | | | | | | | | |

| Domestic | | | 535 | | | | 483 | | | | 528 | | | | 504 | | | | 2,051 | |

| Foreign | | | 617 | | | | 497 | | | | 584 | | | | 744 | | | | 2,442 | |

| Total | | | 1,152 | | | | 980 | | | | 1,112 | | | | 1,249 | | | | 4,493 | |

| Nonferrous average price ($/pound)(2)(3) | | $ | 0.91 | | | $ | 0.94 | | | $ | 1.04 | | | $ | 1.08 | | | $ | 1.00 | |

| Cars purchased (in thousands)(4) | | | 64 | | | | 67 | | | | 64 | | | | 63 | | | | 258 | |

| Auto stores at period end | | | 50 | | | | 50 | | | | 50 | | | | 50 | | | | 50 | |

| Finished steel average sales price ($/ST)(3) | | $ | 831 | | | $ | 832 | | | $ | 817 | | | $ | 795 | | | $ | 818 | |

| Sales volume (ST, in thousands) | | | | | | | | | | | | | | | |

| Rebar | | | 94 | | | | 83 | | | | 83 | | | | 96 | | | | 357 | |

| Coiled products | | | 34 | | | | 30 | | | | 42 | | | | 43 | | | | 148 | |

| Merchant bar and other | | | 1 | | | | 1 | | | | 1 | | | | 1 | | | | 4 | |

| Finished steel products sold | | | 129 | | | | 114 | | | | 126 | | | | 140 | | | | 509 | |

| Rolling mill utilization(5) | | | 95 | % | | | 81 | % | | | 88 | % | | | 97 | % | | | 90 | % |

LT = Long Ton, which is equivalent to 2,240 pounds

ST = Short Ton, which is equivalent to 2,000 pounds

(1) Ferrous and nonferrous volumes sold externally and delivered to our steel mill for finished steel production.

(2) Excludes PGMs in catalytic converters.

(3) Price information is shown after netting the cost of freight incurred to deliver the product to the customer.

(4) Cars purchased by auto parts stores only.

(5) Rolling mill utilization is based on effective annual production capacity under current conditions of 580 thousand tons of finished steel products.

(6) May not foot due to rounding.

| |

| RADIUS RECYCLING, INC. |

| SELECTED OPERATING STATISTICS |

| (Unaudited) |

| |

| | | | | | | | | | | | | | | FY | |

| | | 1Q23 | | | 2Q23 | | | 3Q23 | | | 4Q23 | | | 2023 | |

| Total ferrous volumes (LT, in thousands)(1) | | | 851 | | | | 1,263 | | | | 1,157 | | | | 1,105 | | | | 4,376 | |

| Total nonferrous volumes (pounds, in thousands)(1)(2) | | | 162,720 | | | | 164,796 | | | | 207,714 | | | | 203,707 | | | | 738,937 | |

| Ferrous selling prices ($/LT)(3) | | | | | | | | | | | | | | | |

| Domestic | | $ | 313 | | | $ | 359 | | | $ | 414 | | | $ | 346 | | | $ | 360 | |

| Foreign | | $ | 356 | | | $ | 368 | | | $ | 414 | | | $ | 363 | | | $ | 376 | |

| Average | | $ | 340 | | | $ | 367 | | | $ | 413 | | | $ | 357 | | | $ | 371 | |

| Ferrous sales volume (LT, in thousands) | | | | | | | | | | | | | | | |

| Domestic | | | 432 | | | | 444 | | | | 548 | | | | 528 | | | | 1,952 | |

| Foreign | | | 418 | | | | 819 | | | | 609 | | | | 577 | | | | 2,424 | |

| Total | | | 851 | | | | 1,263 | | | | 1,157 | | | | 1,105 | | | | 4,376 | |

| Nonferrous average price ($/pound)(2)(3) | | $ | 0.90 | | | $ | 0.99 | | | $ | 1.01 | | | $ | 0.94 | | | $ | 0.96 | |

| Cars purchased (in thousands)(4) | | | 69 | | | | 72 | | | | 78 | | | | 67 | | | | 286 | |

| Auto stores at period end | | | 51 | | | | 50 | | | | 50 | | | | 50 | | | | 50 | |

| Finished steel average sales price ($/ST)(3) | | $ | 1,015 | | | $ | 943 | | | $ | 924 | | | $ | 861 | | | $ | 930 | |

| Sales volume (ST, in thousands) | | | | | | | | | | | | | | | |

| Rebar | | | 101 | | | | 84 | | | | 97 | | | | 108 | | | | 390 | |

| Coiled products | | | 16 | | | | 24 | | | | 43 | | | | 43 | | | | 126 | |

| Merchant bar and other | | | 1 | | | | 1 | | | | 2 | | | | 1 | | | | 5 | |

| Finished steel products sold | | | 118 | | | | 109 | | | | 142 | | | | 152 | | | | 521 | |

| Rolling mill utilization(5) | | | 81 | % | | | 75 | % | | | 97 | % | | | 102 | % | | | 89 | % |

LT = Long Ton, which is equivalent to 2,240 pounds

ST = Short Ton, which is equivalent to 2,000 pounds

(1) Ferrous and nonferrous volumes sold externally and delivered to our steel mill for finished steel production.

(2) Excludes PGMs in catalytic converters.

(3) Price information is shown after netting the cost of freight incurred to deliver the product to the customer.

(4) Cars purchased by auto parts stores only.

(5) Rolling mill utilization is based on effective annual production capacity under current conditions of 580 thousand tons of finished steel products.

| |

| RADIUS RECYCLING, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| ($ in thousands) |

| (Unaudited) |

| |

| | | August 31, 2024 | | | August 31, 2023 | |

| Assets | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 5,552 | | | $ | 6,032 | |

| Accounts receivable, net | | | 258,157 | | | | 210,442 | |

| Inventories | | | 293,932 | | | | 278,642 | |

| Other current assets | | | 51,486 | | | | 55,224 | |

| Total current assets | | | 609,127 | | | | 550,340 | |

| Property, plant and equipment, net | | | 672,192 | | | | 706,805 | |

| Operating lease right-of-use assets | | | 123,546 | | | | 115,686 | |

| Goodwill | | | 13,105 | | | | 229,419 | |

| Other assets | | | 115,799 | | | | 113,699 | |

| Total assets | | $ | 1,533,769 | | | $ | 1,715,949 | |

| | | | | | | |

| Liabilities and Equity | | | | | | |

| Current liabilities: | | | | | | |

| Short-term borrowings | | $ | 5,688 | | | $ | 5,813 | |

| Accounts Payable | | | 202,498 | | | | 209,423 | |

| Environmental liabilities | | | 13,232 | | | | 13,743 | |

| Operating lease liabilities | | | 19,262 | | | | 19,835 | |

| Other current liabilities | | | 75,890 | | | | 75,116 | |

| Total current liabilities | | | 316,570 | | | | 323,930 | |

| Long-term debt, net of current maturities | | | 409,082 | | | | 243,579 | |

| Environmental liabilities, net of current portion | | | 52,417 | | | | 53,034 | |

| Operating lease liabilities, net of current maturities | | | 104,246 | | | | 96,086 | |

| Other long-term liabilities | | | 25,714 | | | | 87,661 | |

| Total liabilities | | | 908,029 | | | | 804,290 | |

| | | | | | | |

| Total Radius Recycling, Inc. ("Radius") shareholders' equity | | | 623,112 | | | | 908,180 | |

| Noncontrolling interests | | | 2,628 | | | | 3,479 | |

| Total equity | | | 625,740 | | | | 911,659 | |

| Total liabilities and equity | | $ | 1,533,769 | | | $ | 1,715,949 | |

| | | | | | | | | |

Non-GAAP Financial Measures

This press release contains performance based on adjusted diluted earnings per share from continuing operations attributable to Radius shareholders, adjusted EBITDA, adjusted EBITDA per ferrous ton, and adjusted selling, general, and administrative expense which are non-GAAP financial measures as defined under SEC rules. As required by SEC rules, the Company has provided a reconciliation of these measures for each period discussed to the most directly comparable U.S. GAAP measure. Management believes that providing these non-GAAP financial measures adds a meaningful presentation of our results from business operations excluding adjustments for goodwill impairment charges, restructuring charges and other exit-related activities, charges for legacy environmental matters (net of recoveries), amortization of capitalized cloud computing implementation costs, other asset impairment charges, business development costs not related to ongoing operations including pre-acquisition expenses, and the income tax benefit allocated to these adjustments, items which are not related to underlying business operational performance, and improves the period-to-period comparability of our results from business operations. We believe that presenting debt, net of cash is useful to investors as a measure of our leverage, as cash and cash equivalents can be used, among other things, to repay indebtedness. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, the most directly comparable U.S. GAAP measures.

| | | | | | | | |

| Reconciliation of adjusted diluted earnings (loss) per share from continuing operations attributable to Radius shareholders | | | | | | | |

| ($ per share) | | Quarter | | | Year | |

| | | 4Q24 | | | 3Q24 | | | 4Q23 | | | 2024 | | | 2023 | |

| As reported | | $ | (0.56 | ) | | $ | (6.97 | ) | | $ | (0.92 | ) | | $ | (9.37 | ) | | $ | (0.92 | ) |

| Charges for legacy environmental matters, net, per share(1) | | | 0.01 | | | | 0.01 | | | | 0.14 | | | | 0.04 | | | | 0.37 | |

| Goodwill impairment charges, per share | | | — | | | | 7.58 | | | | 1.40 | | | | 7.60 | | | | 1.40 | |

| Restructuring charges and other exit-related activities, per share | | | — | | | | 0.11 | | | | — | | | | 0.24 | | | | 0.10 | |

| Other asset impairment charges, per share(3) | | | — | | | | — | | | | 0.21 | | | | 0.07 | | | | 0.40 | |

| Business development costs, per share | | | — | | | | — | | | | — | | | | 0.01 | | | | 0.02 | |

| Income tax expense (benefit) allocated to adjustments, per share(4) | | | 0.13 | | | | (1.34 | ) | | | (0.35 | ) | | | (1.27 | ) | | | (0.50 | ) |

| Effect of dilutive shares, per share(5) | | | — | | | | — | | | | (0.01 | ) | | | — | | | | (0.02 | ) |

| Adjusted(6) | | $ | (0.41 | ) | | $ | (0.59 | ) | | $ | 0.47 | | | $ | (2.68 | ) | | $ | 0.85 | |

| Reconciliation of adjusted EBITDA and adjusted EBITDA per ferrous ton | | | | | | | | | | | | | | | |

| ($ in millions) | | Quarter | | | Year | |

| | | 4Q24 | | | 3Q24 | | | 4Q23 | | | 2024 | | | 2023 | |

| Net loss | | $ | (16 | ) | | $ | (199 | ) | | $ | (26 | ) | | $ | (266 | ) | | $ | (25 | ) |

| Plus interest expense | | | 9 | | | | 7 | | | | 5 | | | | 27 | | | | 19 | |

| Plus income tax benefit | | | (2 | ) | | | (45 | ) | | | (3 | ) | | | (55 | ) | | | (3 | ) |

| Plus depreciation and amortization | | | 25 | | | | 24 | | | | 23 | | | | 97 | | | | 90 | |

| Plus goodwill impairment charge | | | — | | | | 216 | | | | 39 | | | | 216 | | | | 39 | |

| Plus restructuring charges and other exit-related activities | | | — | | | | 3 | | | | — | | | | 7 | | | | 3 | |

| Plus other asset impairment charges(3) | | | — | | | | — | | | | 6 | | | | 2 | | | | 11 | |

| Plus charges for legacy environmental matters, net(1) | | | — | | | | — | | | | 4 | | | | 1 | | | | 10 | |

| Plus amortization of cloud computing software costs(2) | | | — | | | | — | | | | — | | | | 1 | | | | — | |

| Plus business development costs | | | — | | | | — | | | | — | | | | — | | | | — | |

| Adjusted EBITDA(6) | | $ | 17 | | | $ | 9 | | | $ | 49 | | | $ | 29 | | | $ | 144 | |

| | | | | | | | | | | | | | | | |

| Ferrous sales volume (LT, in thousands) | | | 1,249 | | | | 1,112 | | | | 1,105 | | | | 4,493 | | | | 4,376 | |

| Adjusted EBITDA per ferrous ton sold ($/LT) | | $ | 13 | | | $ | 8 | | | $ | 44 | | | $ | 7 | | | $ | 33 | |

| Reconciliation of adjusted selling, general and administrative expense: | | | | | | | | | | | | | | | |

| ($ in millions) | | Quarter | | | Year | |

| | | 4Q24 | | | 3Q24 | | | 4Q23 | | | 2024 | | | 2023 | |

| As reported | | $ | 61 | | | $ | 62 | | | $ | 69 | | | $ | 248 | | | $ | 266 | |

| Charges for legacy environmental matters, net(1) | | | — | | | | — | | | | (4 | ) | | | (1 | ) | | | (10 | ) |

| Adjusted(6) | | $ | 61 | | | $ | 62 | | | $ | 65 | | | $ | 247 | | | $ | 255 | |

| Reconciliation of debt, net of cash | | | | | | | | | |

| ($ in thousands) | | | | | | | | | |

| | | August 31, 2024 | | | May 31, 2024 | | | August 31, 2023 | |

| Short-term borrowings | | $ | 5,688 | | | $ | 5,734 | | | $ | 5,813 | |

| Long-term debt, net of current maturities | | | 409,082 | | | | 405,514 | | | | 243,579 | |

| Total debt | | | 414,770 | | | | 411,248 | | | | 249,392 | |

| Less: cash and cash equivalents | | | 5,552 | | | | 25,189 | | | | 6,032 | |

| Total debt, net of cash | | $ | 409,218 | | | $ | 386,059 | | | $ | 243,360 | |

LT = Long Ton, which is equivalent to 2,240 pounds

(1) Legal and environmental charges, net of recoveries, for legacy environmental matters including those related to the Portland Harbor Superfund site and to other legacy environmental loss contingencies.

(2) Amortization of cloud computing software costs consists of expense recognized in cost of goods sold and selling, general, and administrative expense resulting from amortization of capitalized implementation costs for cloud computing IT systems. This expense is not included in depreciation and amortization. No amortization of cloud computing software costs was incurred prior to the first quarter of fiscal 2024; therefore, prior period Adjusted EBITDA amounts are not impacted.

(3) For the years ended August 31, 2024 and 2023, other asset impairment charges included $1 million ($0.02 per share) and $5 million ($0.19 per share), respectively, reported within “Other expense, net” on the Consolidated Statement of Operations.

(4) Income tax allocated to the aggregate adjustments reconciling reported and adjusted diluted earnings (loss) per share from continuing operations attributable to Radius shareholders is determined based on a tax provision calculated with and without the adjustments.

(5) For the quarter and year ended August 31, 2023, adjusted diluted earnings (loss) per share from continuing operations attributable to Radius shareholders reflects the inclusion of an incremental 86 thousand and 238 thousand common stock equivalent shares, respectively, attributable to dilutive restricted stock unit, performance share, and deferred stock unit awards that were antidilutive for the purpose of calculating the comparable GAAP loss per share measure.

(6) May not foot due to rounding.

Forward-Looking Statements

Statements and information included in this press release by Radius Recycling, Inc. (formerly Schnitzer Steel Industries, Inc.) that are not purely historical are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and are made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Except as noted herein or as the context may otherwise require, all references in this press release to “we,” “our,” “us,” “the Company,” “Radius Recycling,” and “Radius” refer to Radius Recycling, Inc. and its consolidated subsidiaries.

Forward-looking statements in this press release include statements regarding future events or our expectations, intentions, beliefs, and strategies regarding the future, which may include statements regarding the impact of equipment upgrades, equipment failures, and facility damage on production, including timing of repairs and resumption of operations; the realization of insurance recoveries; the Company’s outlook, growth initiatives, or expected results or objectives, including pricing, margins, volumes, and profitability; completion of acquisitions and integration of acquired businesses; the progression and impact of investments in processing and manufacturing technology improvements and information technology systems; the impacts of supply chain disruptions, inflation, and rising interest rates; liquidity positions; our ability to generate cash from continuing operations; trends, cyclicality, and changes in the markets we sell into; strategic direction or goals; targets; changes to manufacturing and production processes; the realization of deferred tax assets; planned capital expenditures; the cost of and the status of any agreements or actions related to our compliance with environmental and other laws; expected tax rates, deductions, and credits; the impact of sanctions and tariffs, quotas, and other trade actions and import restrictions; the impact of pandemics, epidemics, or other public health emergencies; the impact of labor shortages or increased labor costs; obligations under our retirement plans; benefits, savings, or additional costs from business realignment, cost containment, and productivity improvement programs; the potential impact of adopting new accounting pronouncements; and the adequacy of accruals.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “outlook,” “target,” “aim,” “believes,” “expects,” “anticipates,” “intends,” “assumes,” “estimates,” “evaluates,” “may,” “will,” “should,” “could,” “opinions,” “forecasts,” “projects,” “plans,” “future,” “forward,” “potential,” “probable,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking.

We may make other forward-looking statements from time to time, including in reports filed with the Securities and Exchange Commission, press releases, presentations, and on public conference calls. All forward-looking statements we make are based on information available to us at the time the statements are made, and we assume no obligation to update any forward-looking statements, except as may be required by law. Our business is subject to the effects of changes in domestic and global economic conditions and a number of other risks and uncertainties that could cause actual results to differ materially from those included in, or implied by, such forward-looking statements. Some of these risks and uncertainties are discussed in “Item 1A. Risk Factors” of Part I of our most recent Annual Report on Form 10-K. Examples of these risks include: potential environmental cleanup costs related to the Portland Harbor Superfund site or other locations; the impact of goodwill impairment charges; the impact of equipment upgrades, equipment failures, and facility damage on production; failure to realize or delays in realizing expected benefits from capital and other projects, including investments in processing and manufacturing technology improvements and information technology systems; the cyclicality and impact of general economic conditions; the impact of inflation and interest rate, and foreign currency fluctuations; changing conditions in global markets including the impact of sanctions and tariffs, quotas, and other trade actions and import restrictions; increases in the relative value of the U.S. dollar; economic and geopolitical instability including as a result of military conflict; volatile supply and demand conditions affecting prices and volumes in the markets for raw materials and other inputs we purchase; significant decreases in recycled metal prices; imbalances in supply and demand conditions in the global steel industry; difficulties associated with acquisitions and integration of acquired businesses; supply chain disruptions; reliance on third-party shipping companies, including with respect to freight rates and the availability of transportation; the impact of impairment of assets other than goodwill; the impact of pandemics, epidemics, or other public health emergencies; inability to achieve or sustain the benefits from productivity, cost savings, and restructuring initiatives; inability to renew facility leases; customer fulfillment of their contractual obligations; potential limitations on our ability to access capital resources and existing credit facilities; restrictions on our business and financial covenants under the agreement governing our bank credit facilities; the impact of consolidation in the steel industry; product liability claims; the impact of legal proceedings and legal compliance; the impact of climate change; the impact of not realizing deferred tax assets; the impact of tax increases and changes in tax rules; the impact of one or more cybersecurity incidents; the impact of increasing attention to environmental, social, and governance matters; translation risks associated with fluctuation in foreign exchange rates; the impact of hedging transactions; inability to obtain or renew business licenses and permits; environmental compliance costs and potential environmental liabilities; increased environmental regulations and enforcement; compliance with climate change and greenhouse gas emission laws and regulations; the impact of labor shortages or increased labor costs; reliance on employees subject to collective bargaining agreements; and the impact of the underfunded status of multiemployer plans in which we participate.

Company Contact:

| Investor Relations: |

| Michael Bennett |

| (503) 323-2811 |

| mcbennett@rdus.com |

| |

| Company Info: |

| www.radiusrecycling.com |

| ir@rdus.com |

v3.24.3

Cover

|

Oct. 24, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 24, 2024

|

| Entity File Number |

000-22496

|

| Entity Registrant Name |

RADIUS RECYCLING, INC.

|

| Entity Central Index Key |

0000912603

|

| Entity Tax Identification Number |

93-0341923

|

| Entity Incorporation, State or Country Code |

OR

|

| Entity Address, Address Line One |

299 SW Clay Street, Suite 400

|

| Entity Address, City or Town |

Portland

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97201

|

| City Area Code |

503

|

| Local Phone Number |

224-9900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $1.00 par value

|

| Trading Symbol |

RDUS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

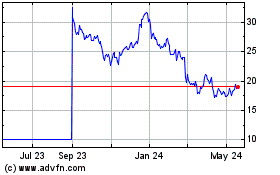

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Nov 2024 to Dec 2024

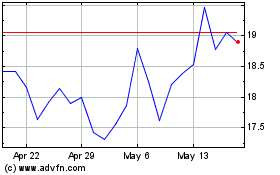

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Dec 2023 to Dec 2024