UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date of earliest event reported):

January 15, 2024

RF ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41332 |

|

61-1991323 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

111 Somerset, #05-06

Singapore 238164

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: +65 6904 0766

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each

exchange on

which registered |

| Units, each consisting of one share of Class A Common Stock, one redeemable warrant, and one right to receive one-tenth of one share of Class A Common Stock |

|

RFACU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Share of Class A Common Stock, par value $0.0001 per share |

|

RFAC |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

RFACW |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Rights, each right receives one-tenth of one share of Class A Common Stock |

|

RFACR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure

As previously disclosed, on

October 18, 2023, RF Acquisition Corp., a Delaware corporation (the “SPAC”) entered into an agreement and plan of merger,

as amended by (i) that certain First Amendment to Merger Agreement, dated December 1, 2023, and (ii) that certain Second Amendment to

Merger Agreement, dated December 15, 2023 (as so amended, and as it may be further amended, supplemented or otherwise modified from time

to time, the “Merger Agreement”) with GCL Global Holdings Ltd, a Cayman Islands exempted company limited by shares (“PubCo”),

Grand Centrex Limited, a British Virgin Islands business company, GCL Global Limited, a Cayman Islands exempted company limited by shares

(the “Company”), and, for the limited purposes set forth therein, RF Dynamic LLC, a Delaware limited liability company.

On

January 15, 2024, a Fortune Times magazine article (the “Article”) was published in the magazine’s January/February

2024 issue, featuring Tse Meng Ng, the Chief Executive Officer of the SPAC, which discussed, among other things, the Merger Agreement,

the SPAC and the Company. The Article was made publicly available for purchase at the Fortune Times’ product website at https://www.fortunetimes.sg/cn/?post_type=product.

An English translation of the Article is attached as Exhibit 99.1 to this Current Report on Form 8-K and the contents are incorporated

herein by reference.

The information in this Item 7.01, including Exhibit

99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by

reference into the filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general

incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information

contained in this Item 7.01, including Exhibit 99.1.

Important Information for Investors and Stockholders

This document relates to a

proposed transaction among SPAC, PubCo and the Company. This document does not constitute an offer to sell or exchange, or the solicitation

of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale

or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. PubCo intends

to file a registration statement on Form F-4 with the U.S. Securities and Exchanges Commission (the “SEC”), which will include a document that serves as a prospectus and proxy statement,

referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all SPAC stockholders. SPAC and PubCo also will

file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders

of SPAC are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will

be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information

about the proposed transaction.

Investors and security holders

will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed

or that will be filed with the SEC by SPAC through the website maintained by the SEC at www.sec.gov.

Participants in the Solicitation

SPAC, PubCo, the Company and

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from SPAC’s stockholders

in connection with the proposed transaction. A list of the names of the respective directors and executive officers of SPAC, PubCo and

the Company, and information regarding their interests in the business combination, will be contained in the proxy statement/prospectus

when available. You may obtain free copies of these documents as described in the preceding paragraph.

This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall

there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of such other jurisdiction.

Forward-Looking Statements

All statements contained in

this Current Report on Form 8-K other than statements of historical facts, contain certain statements that are forward-looking statements.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “may” or other similar expressions that predict or indicate

future events or trends or that are not statements of historical matters, but the absence of these words does not mean a statement is

not forward looking. Indications of, and guidance or outlook on, future earnings, dividends or financial position or performance are also

forward-looking statements.

These forward-looking

statements involve significant risks and uncertainties that could cause the actual results to differ materially, and potentially

adversely, from those expressed or implied in the forward-looking statements. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Most of these factors are outside SPAC’s and the Company’s control and are difficult

to predict. Factors that may cause such differences include, but are not limited to: (i) the occurrence of any event, change, or

other circumstances that could give rise to the termination of the Merger Agreement; (ii) the outcome of any legal proceedings that

may be instituted against SPAC and/or the Company following the announcement of the Merger Agreement and the transactions; (iii) the

inability to complete the proposed transactions, including due to failure to obtain approval of the stockholders of SPAC, certain

regulatory approvals, or the satisfaction of other conditions to closing in the Merger Agreement; (iv) the occurrence of any event,

change, or other circumstance that could give rise to the termination of the Merger Agreement or could otherwise cause the

transaction to fail to close; (v) the inability to maintain the listing of SPAC shares on the Nasdaq Stock Market following the

proposed transactions; (vi) the risk that the proposed transactions disrupt the Company’s current plans and operations as a

result of the announcement and consummation of the proposed transactions; (vii) the ability to recognize the anticipated benefits of

the proposed transactions, which may be affected by, among other things, competition, the ability of the Company to grow and manage

growth profitably, and the ability of the Company to retain its key employees; (viii) costs related to the proposed transactions;

(ix) changes in applicable laws or regulations; and (x) the possibility that the Company or SPAC may be adversely affected by other

economic, business, and/or competitive factors. The foregoing list of factors is not exclusive. Additional information concerning

certain of these and other risk factors is included under the heading “Risk Factors” in the registration statement to be

filed by PubCo with the SEC and those included under the heading “Risk Factors” in SPAC’s Annual Report on

Form 10-K filed with the SEC on April 26, 2023, and the Quarterly Reports on Form 10-Q filed with the SEC on May 26,

2023, August 23, 2023 and November 14, 2023, respectively. These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ materially from those contained herein. All subsequent written

and oral forward-looking statements concerning SPAC, PubCo and the Company, the transactions or other matters attributable to SPAC,

PubCo, the Company or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements

above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Each of SPAC, PubCo and the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions

to any forward-looking statements contained herein to reflect any change in their expectations with respect thereto or any change in

events, conditions, or circumstances on which any statement is based, except as required by law.

Item 9.01 Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RF Acquisition Corp. |

| |

|

| |

By: |

/s/ Tse Meng Ng |

| |

Name: |

Tse Meng Ng |

| |

Title: |

Chief Executive Officer |

Date: January 16, 2024

Exhibit 99.1

The information below is an

English translation of an article published on or about January 15, 2024, in the January/February 2024 issue of the Fortune Times, a magazine

published online and throughout southeast Asia. The article was originally published in Chinese. Attempts to provide an accurate translation

of the article in Chinese have been made, but slight differences may exist due to linguistic nuances.

A century ago, Bertie Charles Forbes, founder of the famous business

magazine Forbes, wrote in the first issue: “Business was originated to produce happiness, not to pile up millions.”

A hundred years later, in an interview between Times Finance Magazine

and Ng Tse Meng, Chairman of Ruifeng Wealth Management Pte Ltd and Chairman and President of RF Acquisition Corp. in Singapore, Ng Tse

Meng also talked about the meaning of wealth—"the most important thing is to make people happy". This is very similar

to Mr. Forbes’s vision of using business to create happiness. Perhaps this proves that the underlying logic of wisdom is the same.

After twenty years of ups and downs in the financial industry, for

this young man, wealth is not just a cold number, but a journey that burns with passion and explores the meaning of life. As a new-generation

wealth creator who grew up in Singapore and is also a family office manager, how does Ng Tse Meng manage wealth intelligently and create

wealth in Singapore, the world's financial center and the Asia-Pacific wealth management center? How does he have the courage to refresh

himself and start a new business from scratch?

Ng Tse Meng: Creating

wealth through happiness

Text: Song Wei Zhijun

Photography: Cai

Qingfu

The man in front of me, Ng Tse Meng, had a fair face that looked a

bit boyish and spoke fluent Chinese. When we met for the first time, it was difficult to reconcile the reality of him with his glorious

career experience. After all, most bankers give the impression that they are mature, solemn, and aloof, with a little white hair soaked

in the essence of time.

Through his speech, Ng Tse Meng delivered sincere and contagious sharing.

He was straightforward and energetic, humble and patient. The stylish shoes and socks on his feet not only revealed his taste, but also

his unconventional personality. When talking about today's hot investment fields, such as AI (artificial intelligence), digital cryptocurrency,

and NFT artwork, his thinking is open and active. He said that he usually loves to read and especially pays close attention to the news.

In his opinion, it is very necessary for a qualified banking expert to maintain a global perspective by understanding diverse current

affairs trends. This involves not only understanding customer-related information, but also gaining insight into investment trends.

Merging with the games

business to drive resonance in the entrepreneurial community

Just in October this year, Ng Tse Meng's

RF Acquisition Corp. (RFAC) and RF Dynamic LLC reached a business merger agreement with Grand Centrex Ltd (GCL Asia), an Asian game distributor

and publisher headquartered in Singapore. Subsequently, it is expected that GCL Asia will be listed on Nasdaq in the United States through

the special acquisition company (SPAC), with the stock trading symbol, "GCL". GCL Asia's pre-transaction equity valuation is

approximately US$1.2 billion (approximately S$1.65 billion). The transaction includes a minimum cash condition of US$25 million.

An important reason why GCL Asia was chosen as the first acquisition

target was that since 2011, GCL Asia has distributed in Asia four of the top ten best-selling games of all time in Asia. After listing,

the company plans to continue to provide high-quality, engaging gaming experiences to Asia, leveraging its comprehensive gaming ecosystem

to bring games developed in Asia to the global market, and games developed in the United States and the European Union to the Asian market.

The company plans to use more funds to develop higher-revenue areas such as game distribution and intellectual property management, while

also expanding the marketing influence of games, especially high-budget, high-quality AAA games, and medium-budget and medium-quality

AA console games.

According to Ng Tse Meng, publishing and distribution are two critical

links in the games industry, which involve bringing games to the market, managing sales channels, and ensuring that games can be successfully

obtained and played by players. Among them, game publishing is the process of introducing games to the market. Publishers are typically

responsible for coordinating the production, marketing, sales and distribution of games. Furthermore, game distribution involves getting

games to various sales channels so that they can ultimately reach gamers. This includes physical retail stores, digital platforms, online

stores, and more.

RFAC, established in Delaware, USA in 2021, was listed on Nasdaq in

the USA with US$100 million a year later. Ng Tse Meng, who has little experience in SPAC listings, naturally paid a high cost of learning

in the process of promoting RFAC to Nasdaq. However, these costs will not be paid in vain; they will be converted into experience in expanding

the market with partners in the future.

As the main promoter of GCL Asia’s merger, Ng Tse Meng believes

that this is a strategic step to occupy the Asian, European and American games markets in the future. On one hand, it can help game publishers

in the United States and Europe manage increasingly complex Asian content and better unleash their potential in the fast-growing Asian

market; on the other hand, it can also introduce games with good reputations in Chinese-speaking regions to the United States and Europe.

He said with certainty: "Spanning multiple markets, linking the

East and the West, and breaking down cultural barriers between different countries and ethnic groups are the advantages of Singaporean

companies. This is a unique opportunity for RFAC to open a new way of thinking, be part of a company that is at an inflection point which

grows rapidly and makes profits.”

Although the outside world has varying opinions on the SPAC listing

method, on a deeper level, Ng Tse Meng hopes that through GCL Asia’s performance in the US capital market, it will bring incentives

to local innovation and entrepreneurs, and influence more local young people to break through themselves, devote themselves to innovation

and inject more confidence and development vitality into the prospects of Singapore's science and technology innovation field.

Stepping out of the

banks and starting a family office

For a long time, traditional family offices (FOs) have been

mostly concentrated in Western countries. As the economic situation in Asia rises, many new generations of super-rich people have

been created. Family offices, a "new" concept that is not new to Western society, gradually moves eastward to Asia.

Singapore has a stable business and political environment, a sound

legal system, and a strong financial, investment and wealth management talent pool. It also provides a favourable tax environment. These

are all important considerations for high-net-worth and ultra-high-net-worth individuals when they choose to set up a family office. FOs

offer a wide range of investment options for their personal wealth, including stocks, funds and other instruments. After FOs are established,

they can first apply for a Singapore Employment Pass (EP), and then apply for Singapore permanent residence or citizenship. It can be

said that setting up a FO is one of the important ways for high-net-worth individuals to immigrate to Singapore.

In recent years, British businessman James Dyson, hedge fund godfather

Ray Dalio, Hong Kong's richest man Li Ka-shing, and Haidilao founders Zhang Yong and his wife have all set up FOs in Singapore. Led by

these high-net-worth individuals, the number of FOs in Singapore has increased from 400 at the end of 2020 to 1,100 in 2022, a nearly

three-fold increase in two years, while there were only about 50 FOs in Singapore in 2018.

Kirby Rosploc, a researcher and consultant for FOs in the United States,

believes that four out of ten FOs around the world were established in the past ten years, and the number of new ones is surprising. Among

them, the demand for FOs in Asia is particularly prominent, which is inseparable from the rapid growth of private wealth in Asia. Although

the COVID-19 epidemic has dealt a heavy blow to the global economy, Forbes reported that the number of billionaires in 70 countries around

the world reached a record 2,755 in 2021, with 1,149 billionaires from the Asia-Pacific region.

In 2019, Ng Tse Meng, who was having a smooth career in the private

banking industry, was determined to push himself out of his comfort zone. It is precisely because of the phenomenon that Asian FOs generally

have shorter development times than those in Western countries that have existed for several generations—the wealth is still in

the hands of the first- or second-generation entrepreneurs, and the value-added model mainly relies on the family business itself. As

a sensitive and experienced financial professional, he smelled opportunities for development.

No one knew that an epidemic was about to sweep the world. In his words

at the time, "In the future, as the first generation of family business leaders gets older, it is expected that there will be a huge

generational gap in the next ten to fifteen years. The transfer of wealth will inevitably lead to a stronger dependence on FOs."

For these internal and external reasons, Ng Tse Meng, his brother and

former assistant co-founded Ruifeng Wealth Management (RWM) in 2019, a multi-family office (MFO) wealth management company with a full

license issued by the Monetary Authority of Singapore. Ruifeng's business scope includes wealth management, investment advice, foreign

exchange services, financing, securities trading, immigration-related services, etc. The company also provides trust, offshore high-value

life insurances, FO, private equity, and private debt services to help clients manage wealth and risks to realize asset appreciation.

The company is committed to providing customers with customized solutions to meet their investment needs around the world. Ng Tse Meng's

many years of experience in private banking have become his entrepreneurial advantages in developing private wealth planning benefits

for families, integrating family investment needs, and helping families achieve wealth goals.

However, Ruifeng, which was established upon the trend of FOs,

soon suffered the impact of a global epidemic. The two Ng brothers worked closely together to withstand the severe test for more

than three years. From the initial three employees, they have grown to a core team of more than ten staff providing comprehensive

services to more than thirty customers.

Ng Tse Meng said that employees also left during this period, and it

was very challenging to effectively manage the team. He had a lot of "boss" experiences that he had never had before. That kind

of hard work cannot be experienced by working in a bank. Fortunately, he and his older brother complement each other, as his brother is

good at keeping the company in order, allowing him to have worry-free backend support when he is braving the front.

With the epidemic ending and the world gradually returning to normal,

the Singapore government has attracted the world's attention with its "humane" epidemic control measures. With the surge in

the number of applications for FOs, it is almost inevitable that the threshold will be raised, and policies will be tightened. In April

2022, Singapore increased the minimum asset management scale of the fund when applying for a FO from S$5 million to S$10 million, and

clearly required that at least 10% of the funds be invested in the local Singapore market. In July 2023, the Monetary Authority of Singapore

once again raised the entry threshold for a single office from the previous S$10 million to an asset management scale of S$20 million,

and required two professional investors, at least one of whom cannot be a family member. Additionally, business spending requirements

and asset investment strategy requirements have been added.

This undoubtedly makes it more difficult to establish a single-family

office. Ruifeng’s strategic choice is to establish a multi-family office. Compared with a single-family office, Ng Tse Meng believes

that the combination of multi-family office (MFO) plus variable capital company (VCC) has become another option. The MFO+VCC architectural

design is only suitable for multi-family offices, and the two complement each other and are regarded as a "golden combination."

MFOs can provide resource and professional knowledge-sharing services

for families, and achieve optimal resource allocation and synergy through integration. In addition, the use of MFOs can help reduce total

costs. Compared with single-family offices, MFOs can share costs, reduce duplication of investment, and achieve economic benefits through

large-scale operations.

Behind the booming FO market in Singapore, Ng Tse Meng foresees that

FOs will also face a "shuffle" in the market in the future. Currently, there are more than a thousand FOs in Singapore, but

not all of them perform well. The owners of the FOs are also shrewd businessmen. Annual operating costs, rental and salaries for FOs average

nearly S$1 million a year.

"Operational efficiency and maintenance costs are important considerations,"

Ng Tse Meng said. "Next, there will be mergers and acquisitions between FOs, with the big ones merging with the smaller ones, and

the strong ones eating up the weak ones. The ones that survive in the end are mostly FOs with strong and excellent long-term investment

philosophies."

After ten years of sharpening

a sword, Xiao Ming tests his edge

Ng Tse Meng grew up in a relaxed

atmosphere within a Chinese family. He diligently studied and gained admission to Nanyang Technological University, choosing the emerging

field of hotel management. "Emerging" represented opportunities; in fact, almost none of his classmates who graduated in hotel

management are currently working in the hotel industry.

In the banking sector, Ng Tse Meng learned by doing various tasks

and favors, even those beyond his job description. He didn't mind, and inadvertently built a network of influential connections. In

2011, with accumulated banking experience, he began leading a team when Swiss bank BSI established a new North Asia team in

Singapore to expand its Asian business scope, and Ng Tse Meng was the leader. His team members, mostly seasoned veterans in banking,

found his greatest advantage to be his proficiency in Mandarin, coupled with his sunny disposition. He was entering the burgeoning

Chinese market at the perfect time.

According to data from the Chinese National Bureau of Statistics, in

2010, China's Gross Domestic Product (GDP) reached 39.8 trillion yuan, surpassing Japan's annual economic output for the first time, making

China the world's second-largest economy. With great courage, Ng Tse Meng ventured abroad and BSI became one of the pioneering foreign

banks to enter the Chinese market. Initially, due to cultural and habitual differences, the young Ng Tse Meng found himself in some amusing

situations. Once, during a business dinner in China, only after devouring the first three courses, he realized that they were just the

starters, and the main hot dishes were yet to come. He felt uneasy, but this experience allowed him to comprehend the business culture

behind the local dining table, transforming into valuable experiences for the future.

Over the past decade, Ng Tse Meng's close interactions between China

and Singapore have granted him an in-depth understanding of everything from the macroeconomic development to the intriguing lifestyle

differences. Having settled in Shanghai for a long time and shifting from being a visitor to feeling like a local, Ng Tse Meng has even

managed to engage in conversations in the local "Yangjingbang" Shanghainese dialect. This achievement stems from his diligence

and dedication, shaping him into someone who truly understands both sides—a "China expert." His Chinese clients fondly

refer to him as "Xiao Ming."

An essential mission of an FO is the transfer of wealth. Money Mind

projects a massive intergenerational wealth transfer of around US$15.4 trillion globally by 2030. Research from Wealth-X indicates that

approximately 12% of this, about US$1.9 trillion, will be transferred to heirs in Asia. This wealth encompasses ownership of businesses,

properties, and other assets, as well as broader family financial concerns such as charitable funds and art collections. Given the common

pitfalls in the transfer process, there's an urgent need to enhance financial education for beneficiaries.

Over the eventful and dynamic past two decades, Ng Tse Meng devoted

himself to cultivating the Chinese market. In tandem with the burgeoning Chinese economy during the same period, he built a mature and

stable clientele in China. Given this trend, Ng Tse Meng pays close attention to China's intergenerational wealth transfer. His current

and future focus lies in understanding how to effectively serve China's high-net-worth individuals concerning estate planning and inheritance,

leveraging his understanding and judgment of the Chinese market.

Reflecting on the process of achieving success, it becomes evident

that Ng Tse Meng's success stems from his selfless dedication, treating clients and colleagues with genuine sincerity. Despite experiencing

instances where employees he personally nurtured departed, taking client resources with them, he continues to work with an open and inclusive

mindset alongside colleagues and younger generations.

Regarding these "betrayals," Ng Tse Meng doesn't dwell on

them much. He simply remarks, "What can be taken away isn't really worth regretting. What can't be taken away is my reputation and

trust." Indeed, the trust he painstakingly accumulated step by step with his clients hasn't been easily shattered by short-term gains.

Recalling the impact of the subprime crisis in 2008, some clients remained loyal, steadfastly following his path of development, unwaveringly

believing in him.

A successful private banker certainly possesses unique personal charisma.

Ng Tse Meng, educated in English but fluent in Chinese, often reflects Eastern philosophy and cultural traits. He attributes this partly

to his love for reading martial arts novels, which he believes has shaped his character.

During his youth, he thoroughly read the works of Jin Yong and Gu Long,

iconic authors in the martial arts fiction genre. These seemingly casual interests quietly enriched his accumulation of knowledge about

traditional Eastern culture. Jin Yong, using martial arts fiction to illustrate life, influenced countless loyal readers like Ng Tse Meng,

who enjoyed classics like "The Legend of the Condor Heroes." Through these novels, he gained deep insights into Song and Yuan

dynasty history. He mentioned that discussing Jin Yong's works became a great icebreaker, whether in business settings or with friends

in Shanghai. The scenes from these novels subconsciously influenced his interactions, helping him navigate social situations with better

understanding, facilitating communication by grasping nuances, and comprehending others' perspectives and intentions more easily.

Turning crisis into opportunity

In 2022, when RF Acquisition Corp. (RFAC) successfully went public

on Nasdaq, his tears turned into laughter - "The dream finally came true!" What seemed like an incidental decision at the time

paved the way for new business development strategies for the company's future, complementing Ruifeng Wealth Management's family office

business. From a contemporary perspective, it's akin to bridging the public and private domain traffic, forging a new trajectory for business

growth.

Reflecting on the early days of the pandemic, he said, "All work

suddenly came to a halt. Unable to travel, colleagues were all stuck in Singapore, unexpectedly granting us ample time for desk work,

leading to the development of new IPO services and merger and acquisition operations." As they say, the beginning is always the hardest.

He chuckled, mentioning that the development process was also a learning curve. Just the legal compliance review alone incurred a significant

"cost of learning," later realizing it could have been accomplished at less than half the cost. The successful merger with GCL

Asia will be a testament to his approach to operating in the capital markets.

The process of investing in businesses is a journey of breaking through

self-awareness and continuously learning diverse specialized fields. Identifying a high-quality enterprise compels one to delve into learning

all aspects of that industry due to the intricate demands within the merger and acquisition processes. Through this, the team focuses

on researching investment products and the underlying industry sectors, inadvertently enriching their knowledge base in investments. Over

time, this has also formulated Ruifeng Wealth Management's unique set of investment principles.

In excellent financial investment institutions, the core remains centered

around people. Often, investors aren't just investing in a business model or product, but in the founding team. From an investor's standpoint,

venture capital requires exits, but talent requires ongoing investment.

For Ruifeng Wealth's investment team, considering the limitations of

time and energy, it's impossible for one investor to cover all investment products. Hence, teamwork becomes pivotal in this scenario.

Unity in thoughts and actions, mutual recognition, and trust among team members ensure the smooth progression of projects.

Ng Tse Meng hasn't set a definitive wealth target for himself. He

finds more joy in the process of making money through his interests; naturally, wealth follows. In quiet moments, he enjoys reading

and appreciating art. In January 2023, he purchased a local artwork, "Realm of Shadows" by Boo Sze Yang, for $15,000,

which still adorns the walls of Ruifeng's office. He appreciates the hidden thoughts and emotions in the abstract modern painting,

whether within or beyond the city, drawing endless inspiration from the artistry behind urban landscapes.

An investment guru once said, "Money is not everything. Make sure

it works for you, not that you work for money." Wealth itself is just a number; it's the process of wealth creation that brings him

the most joy. It brings to mind a famous line from TVB Hong Kong dramas' golden age: "In life, the most important thing is to be

happy!" Though seemingly simple, achieving happiness ultimately requires wisdom in life.

As the interview concluded, the sky had darkened. Amidst a misty rain,

on the rooftop garden of his new residence, Ng Tse Meng looked out at the cloud-covered Marina Bay Sands hotel, creating a picturesque

scene. From the top-tier apartments of Orchard Road to the Marina Bay, the most captivating central spot of this enchanting city, silently

embodies the power of wealth. Despite twenty years of navigating the financial sphere, Ng Tse Meng, having already accumulated wealth,

isn't rushing to define success. With a childlike heart, he aims to continue contributing to Singapore's venture capital industry, transcending

the lower levels of Maslow's hierarchy to pursue individual potential and self-actualization.

Biography of Ng Tse Meng: Success Requires Time to Define

Ng Tse Meng was born in Singapore to a businessman father and a mother

who was a Chinese language teacher. His grandparents originally came from Fujian, China, and the Ng family roots have been grounded in

Singapore for three generations. He graduated from Nanyang Technological University (NTU) in Singapore with a Bachelor's degree in Business.

After graduating, Ng Tse Meng almost became a car salesman after a

job interview at a car dealership. However, just before officially signing the contract, he received an acceptance letter for a banking

position, thus stepping into the banking industry. Within a few years, owing to his proficiency in Mandarin, he was assigned by Citibank

to handle training operations in China.

Accumulating 16 years of wealth management experience in private banking,

Ng Tse Meng worked for prominent European and American banks such as Citibank, Credit Suisse, BSI, and Pictet. In 2019, he founded Ruifeng

Wealth Management, a family office, growing the initial three-member team to over ten members.

In March 2022, under his leadership, RF Acquisition Corp. (RFAC) successfully

went public on Nasdaq for US$100 million. In October 2023, Ng Tse Meng's companies, RFAC and RF Dynamic, signed a merger agreement with

Grand Centrex Ltd (GCL Asia), a Singapore-based Asian game distributor and publisher. Subsequently, it is expected that GCL Asia will

go public on Nasdaq through the Special Purpose Acquisition Company (SPAC) merger.

Ng Tse Meng earnestly builds genuine trust and rapport with his clients.

He is diligent, with an adventurous spirit in his character. Faced with setbacks, he perseveres, fueled by curiosity about the world and

love for life, continuously pushing his limits. In 2011, he was honoured with the “Outstanding Young Private Banker” award

by Private Banking International (PBI). Besides his professional endeavours, he gives back to society. During Tongji Hospital's 155th

anniversary, he made a humble donation to contribute to charity. Last year, Ruifeng donated to the Hwa Chong Alumni Association (HCAA)

soccer team, supporting the spirit of alumni promoting education at Hwa Chong Institution.

On the path to financial freedom, the value of a person is more important

than the value of a single asset. Ng Tse Meng hasn't set a definitive wealth target for himself, believing that the definition of success

isn't singular and requires time to define. He finds more joy in the process of making money through his interests, naturally leading

to wealth accumulation.

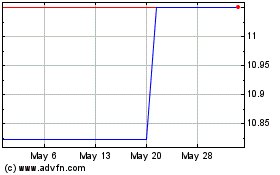

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Oct 2024 to Nov 2024

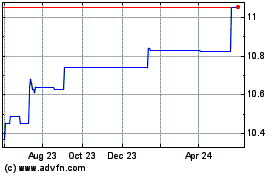

RF Acquisition (NASDAQ:RFACU)

Historical Stock Chart

From Nov 2023 to Nov 2024