false

0001386301

0001386301

2023-12-01

2023-12-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report:

(Date of earliest event reported)

December 1, 2023

Research Solutions, Inc.

(Exact name of registrant as specified in its charter)

Nevada

(State or other Jurisdiction of Incorporation)

|

1-39256 |

|

11-3797644 |

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

N/A

(Address of principal

executive offices and

Zip Code)

(310) 477-0354

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each Class |

Trading Symbol(s) |

Name of each Exchange on which registered |

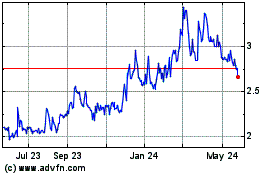

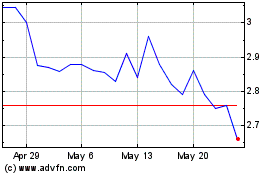

| Common stock, $0.001 par value |

RSSS |

The Nasdaq Capital Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth

company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

EXPLANATORY NOTE

On November 24, 2023, Research

Solutions, Inc., a Nevada corporation (the “Registrant”), Research Solutions Acquisition 2, LLC, a Delaware

limited liability company and a wholly-owned subsidiary of the Registrant (“Merger Sub”), Scite, Inc.,

a Delaware corporation (“Scite”), and Shareholder Representative Services LLC, a Colorado limited liability

company, solely in its capacity as the representative, agent and attorney-in-fact of Scite’s securityholders, entered into an Agreement

of Merger and Plan of Reorganization (the “Merger Agreement”), governing Scite’s merger with and into

Merger Sub (the “Merger”), with Merger Sub continuing its existence under the name “Scite, LLC”

as the surviving entity after the Merger and a wholly-owned subsidiary of the Registrant. Capitalized terms used herein but not otherwise

defined shall have the meanings ascribed to them in the Merger Agreement.

On December 1, 2023, the Registrant

filed with the Securities and Exchange Commission a Current Report on Form 8-K (the “Original 8-K”) reporting

the consummation of the Merger. This amendment to the Original 8-K amends Item 9.01 of the Original 8-K and provides the historical financial

information required pursuant to Item 9.01(a) of Form 8-K and the pro forma financial information required pursuant to Item

9.01(b) of Form 8-K.

Item 9.01. Financial Statements

and Exhibits.

(a) Financial Statements of Businesses

Acquired.

The audited balance sheet of Scite

as of June 30, 2023, and the related statement of operations, stockholders’ equity and cash flows for the fiscal years ended

June 30, 2023, along with the accompanying notes and the independent auditor's report related thereto, are included as Exhibit 99.1

to this report and incorporated by reference herein.

The unaudited interim condensed balance

sheets of Scite as of September 30, 2023 and June 30, 2023 and the related statement of operations, stockholders’ equity

and cash flows for the three months ended September 30, 2023, along with the accompanying notes, are included as Exhibit 99.2

to this report and incorporated by reference herein.

(b) Pro Forma Financial Information.

The Registrant’s unaudited pro

forma condensed combined balance sheet as of September 30, 2023 and unaudited pro forma condensed combined statement of operations

for the three months ended September 30, 2023 and the year ended June 30, 2023, along with the accompanying notes, giving effect

to the Merger, are included as Exhibit 99.3 to this report and incorporated by reference herein.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

RESEARCH SOLUTIONS, INC. |

| |

|

|

| Date: February 7, 2024 |

By: |

/s/ William Nurthen |

| |

|

William Nurthen |

| |

|

Chief Financial Officer & Secretary |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent

to the incorporation by reference in the following Registration Statement on Form S-1 (No. 333-212649), Registration Statement

on Form S-3 (No. 333-276240) and Registration Statements on Form S-8 (Nos. 333-169823, 333-185059, 333-200656, 333-214824,

333-221963, 333-235261, 333-250799, 333-261275) of Research Solutions, Inc. and Subsidiaries of our report dated February 7,

2024, relating to the financial statement of Scite, Inc. as of June 30, 2023 and for the year then ended, which is included in this

Current Report on Form 8-K/A dated February 7, 2024.

/s/ Weinberg & Company, P.A.

February 7, 2024

Los Angeles, California

Exhibit 99.1

SCITE, INC.

FINANCIAL STATEMENTS

FOR THE YEAR ENDED

JUNE 30, 2023

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Board of Directors and Shareholders

Scite, Inc.

Brooklyn, NY

Opinion on the Financial Statements

We have audited the accompanying balance sheet

of Scite, Inc. (the “Company”) as of June 30, 2023, the related statements of operations, shareholders’ equity,

and cash flows for the year then ended and the related notes (collectively referred to as the “financial statements”).

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of June 30,

2023, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally

accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our

audit. We are a public accounting firm registered with the Public Accounting Oversight Board (United States) (“PCAOB”) and

are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and

regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged

to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess

the risks of material misstatement, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Company’s auditor

since 2023.

/s/ Weinberg & Company, P.A.

Los Angeles, California

February 7, 2024

SCITE, INC.

BALANCE

SHEET

| | |

June 30,

2023 | |

| Assets | |

| | |

| Current Assets: | |

| | |

| Cash and cash equivalents | |

$ | 1,153,292 | |

| Accounts receivable | |

| 153,271 | |

| Total current assets | |

| 1,306,563 | |

| | |

| | |

| Property and equipment, net of accumulated

depreciation of $4,063 | |

| 3,177 | |

| Total assets | |

$ | 1,309,740 | |

| | |

| | |

| Liabilities and Shareholders’ Equity | |

| | |

| Current Liabilities: | |

| | |

| Accounts payable and other current liabilities | |

$ | 9,113 | |

| Deferred revenue | |

| 250,702 | |

| Total current liabilities | |

| 259,815 | |

| | |

| | |

| Shareholders’ equity: | |

| | |

| Preferred stock, Series Seed 1 and 2, $0.0001 par value,

4,996,741 shares authorized, 4,996,741 shares issued and outstanding | |

| 500 | |

| Common stock, $1.0001 par value, 14,837,676 shares authorized; 8,550,000 shares

issued; 7,446,223 shares outstanding | |

| 855 | |

| Additional paid-in capital | |

| 2,023,593 | |

| Accumulated deficit | |

| (974,913 | ) |

| Treasury stock, at cost, 1,103,777 shares | |

| (110 | ) |

| Total shareholders’ equity | |

| 1,049,925 | |

| | |

| | |

| Total liabilities and shareholders’

equity | |

$ | 1,309,740 | |

See accompanying notes to the financial statements.

SCITE, INC.

STATEMENT

OF OPERATIONS

For the Year Ended June 30, 2023

| Revenue: | |

| |

| Trade | |

$ | 923,154 | |

| Grant | |

| 198,045 | |

| Total revenue | |

| 1,121,199 | |

| Cost of revenue | |

| 199,552 | |

| Gross profit | |

| 921,647 | |

| | |

| | |

| Selling, general and administrative expenses | |

| 1,332,175 | |

| Loss before provision for income tax | |

| (410,528 | ) |

| Provision for income tax | |

| 2,276 | |

| Net loss | |

$ | (412,804 | ) |

See accompanying notes to the financial statements.

SCITE, INC.

STATEMENT OF CHANGES IN SHAREHOLDERS’

EQUITY

FOR THE YEAR ENDED JUNE 30, 2023

| |

| | |

| |

| | |

| |

| | |

| |

Additional | |

| |

| |

| |

Preferred Stock | |

Common Stock | |

Treasury Stock | |

Paid-in | |

Retained | |

| |

| |

Shares | | |

Amount | |

Shares | | |

Amount | |

Shares | | |

Amount | |

Capital | |

Earnings | |

Total | |

| Balance, June 30,

2022 |

| - | | |

$ | - | |

| 8,550,000 | | |

$ | 855 | |

| (1,103,777 | ) | |

$ | (110 | ) |

$ | 73,837 | |

$ | (562,109 | ) |

$ | (487,527 | ) |

| |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | |

| | |

| | |

| Issuance of

preferred shares for cash |

| 2,909,231 | | |

| 291 | |

| - | | |

| - | |

| - | | |

| - | |

| 1,499,709 | |

| | |

| 1,500,000 | |

| |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | |

| | |

| | |

| Conversion of

notes payable and accrued interest into preferred shares |

| 2,087,510 | | |

| 209 | |

| | | |

| | |

| | | |

| | |

| 430,236 | |

| | |

| 430,445 | |

| |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | |

| | |

| | |

| Stock-based

compensation |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| 19,811 | |

| | |

| 19,811 | |

| Net loss |

| - | | |

| - | |

| - | | |

| - | |

| - | | |

| - | |

| | |

| (412,804 | ) |

| (412,804 | ) |

| Balance,

June 30, 2023 |

| 4,996,741 | | |

$ | 500 | |

| 8,550,000 | | |

$ | 855 | |

| (1,103,777 | ) | |

$ | (110 | ) |

$ | 2,023,593 | |

$ | (974,913 | ) |

$ | 1,049,925 | |

See accompanying notes to the financial statements.

SCITE, INC.

STATEMENT

OF CASH FLOWS

For the Year Ended June 30, 2023

| Cash flows from operating activities: | |

| |

| Net loss | |

$ | (412,804 | ) |

| Adjustments to reconcile net loss to

net cash used in operating activities: | |

| | |

| Depreciation | |

| 1,448 | |

| Stock based compensation | |

| 19,811 | |

| Changes in operating assets and liabilities: | |

| | |

| Accounts receivable | |

| (114,226 | ) |

| Accounts payable and other current liabilities | |

| 13,947 | |

| Deferred

revenue | |

| 66,658 | |

| Net cash provided

by used in operating activities | |

| (425,166 | ) |

| | |

| | |

| Cash flows from financing activities: | |

| | |

| Proceeds from

issuance of preferred stock | |

| 1,500,000 | |

| Net cash provided

by financing activities | |

| 1,500,000 | |

| | |

| | |

| Net increase in cash and cash equivalents | |

| 1,074,834 | |

| | |

| | |

| Cash and cash equivalents, beginning

of the year | |

| 78,458 | |

| Cash and cash equivalents, end of the

year | |

$ | 1,153,292 | |

| | |

| | |

| Supplemental disclosures of cash flow information: | |

| | |

| Cash paid during the period for: | |

| | |

| Interest | |

$ | - | |

| Income taxes paid | |

| 2,276 | |

| | |

| | |

| Noncash investing and financing activities: | |

| | |

| Conversion of notes payable and accrued

interest into preferred shares | |

$ | 430,445 | |

See

accompanying notes to the financial statements.

SCITE, INC.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2023

NOTE 1. NATURE OF BUSINESS AND SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Scite, Inc. is a Brooklyn, New York based

start-up company that helps researchers better discover, understand and evaluate research articles through Smart-Citation which are citations

that display the context of the citation and describe whether the article provides supporting or contrasting evidence.

The Company’s

citation platform called Scite, uses deep learning, natural language processing, and a network of experts to identify and promote reliable

research by evaluating the accuracy of scientific claims. Scite, can automatically classify scientific citations as supporting, refuting

or mentioning, which enables the entity to score the accuracy of scientific reports, researchers, institutions journals and scientific

fields using a measure called scite.

The Company's customers

primarily consist of research students as well as colleges and universities.

Basis of presentation

The accompanying financial statements have been

prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Use of Estimates

In preparing financial statements in conformity

with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts

of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported

amount of revenue and expenses during the reported period. Actual results could differ from these estimates.

Revenue Recognition

The Company follows Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 606, Revenue from Contracts with Customers.

The guidance requires the Company to recognize revenue to depict the transfer of services to customers in an amount that reflects the

consideration to which the Company expects to be entitled in exchange for those services. The guidance also requires disclosures related

to the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

The Company’s sources of revenue during

the year ended June 30, 2023, are as follows:

| a) | Subscription and License Revenue |

The Company derives its license revenue from

subscription agreements with customers for access to the Company’s citation platform. The Company offers monthly or annual subscriptions/licenses

to its customers. The subscription/license revenue is recognized evenly over the life of the contract as the Company considers the contract

to be one performance obligation. Contract liabilities include deferred revenues related to advanced payments for license agreements

which are amortized over the life of the contract which is typically one month to one year. Contract liabilities totaled $250,702 at

June 30, 2023, and are expected to be recognized in the next year.

During

the year ended June 30, 2023, the Company recognized grant revenue of $198,045. We concluded that payments received under these

grants represent conditional, nonreciprocal contributions, as described in ASC 958, Not-for-Profit Entities, and that the grants are

not within the scope of ASC 606, Revenue from Contracts with Customers, as the organizations providing the grants do not meet the definition

of a customer. Grant and contract funded program activities are normally billed as work progresses and revenues are recognized

as expenses specific to the grant are incurred.

Cash and Cash Equivalents

Cash and cash equivalents include unrestricted

deposits and short-term investments with an original maturity of three months or less.

Accounts Receivable

Accounts receivable are recorded at their estimated

net realizable value, net of an allowance for doubtful accounts. The Company's estimate of the allowance for doubtful accounts is based

upon historical experience, its evaluation of the current status of receivables, and unusual circumstances, if any. Accounts are considered

past due if payment is not made on a timely basis in accordance with the Company's credit terms. Accounts considered uncollectible are

charged to revenue against the allowance. As of September 30, 2023 management did not consider it necessary to record an allowance

for doubtful accounts.

Property and Equipment

Property and equipment are stated at cost. Maintenance

and repairs of property and equipment are expensed as incurred and major improvements are capitalized. Upon retirement, sale or other

disposition of property and equipment, the cost and accumulated depreciation are eliminated from the accounts and gain or loss is included

in operations. Depreciation of property and equipment is computed on the straight-line method over the useful lives of the computers

of five years.

Advertising

Advertising costs are expensed as incurred and

are included in selling, general and administrative expenses in the amount of $146,975 for the year ended June 30, 2023.

Income Taxes

The Company accounts for income taxes in accordance

with FASB ASC 70, Income Taxes, which requires the recognition of deferred income taxes for differences between the basis of assets

and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent future tax consequences

for those differences, which will either be deductible or taxable when the assets and liabilities are recovered and settled. Deferred

taxes are also recognized for operating losses that are available to offset future taxable income. A valuation allowance is established

when necessary to reduce deferred tax assets to the amount expected to be realized. Based upon all available evidence, management concluded

that it was more-likely-than-not that its deferred tax assets would not be realized, and therefore a full valuation allowance was in

place as of June 30, 2023.

The Company follows the provisions of FASB ASC

740-10-25, which prescribes a recognition threshold and measurement attribute for the recognition and measurement of tax positions or

expected to be taken in income tax returns. FASB ASC 740-10-25 also provides guidance on de-recognition of income taxes assets and liabilities,

classification of current and deferred income taxes and liabilities, and accounting for interest and penalties associated with tax positions.

The Company has not been recently audited by

the IRS or state agencies; and accordingly, the business tax returns for the past three years are open to examination. The Company has

evaluated its tax positions and has concluded that they do not result in anything that would require either recording or disclosure in

the financial statements based upon the criteria set forth in ASC 740.

Fair Value Measurements

The Company uses various inputs in determining

the fair value of its investments and measures these assets on a recurring basis. Financial assets recorded at fair value in the balance

sheets are categorized by the level of objectivity associated with the inputs used to measure their fair value. ASC Topic 820 defines

the following levels directly related to the amount of subjectivity associated with the inputs:

Level

1 Quoted prices in active markets for identical assets or liabilities.

Level 2 Inputs,

other than the quoted prices in active markets, that is observable either directly or indirectly.

Level

3 Unobservable inputs based on the Company’s assumptions.

As of June 30, 2023, the carrying value

of financial assets and liabilities such as cash, accounts receivable, and accounts payable and other current liabilities approximates

their fair value because of the short-term maturity of these instruments. Unless otherwise noted, it is management's opinion that the

Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Concentrations of Credit Risk

The Company's financial statements that are subject

to credit risk consist primarily of cash and trade receivables. At times throughout the year, the Company's cash balances exceeded amounts

insured by the Federal Deposit Insurance Company (FDIC). However, the Company believes it is not exposed to any significant credit risk

related to these cash accounts.

At June 30, 2023, the Company had accounts

receivable from two customers which comprised 46% and 18% of its accounts receivable balance, respectively. During the year ended June 30,

2023, no customers accounted for more than 10% of the Company’s revenue.

Stock Based Compensation

The Company periodically issues stock options

to employees and non-employees in non-capital raising transactions for services and for financing costs. The Company accounts for such

grants issued and vesting based on ASC 718, Compensation-Stock Compensation whereby the value of the award is measured on the date of

grant and recognized for employees as compensation expense on the straight-line basis over the vesting period. The Company recognizes

the fair value of stock-based compensation within its Statements of Operations with classification depending on the nature of the services

rendered.

The fair value of each option grant is estimated

using the Black-Scholes option-pricing model. The Company is a private company and lacks company-specific historical and implied volatility

information. Therefore, it estimates its expected stock volatility based on the historical volatility of a publicly traded set of peer

companies within the technology industry with characteristics similar to the Company. The expected term of the Company’s stock

options has been determined utilizing the “simplified” method for awards that qualify as “plain vanilla” options.

The expected term of stock options granted to non-employees is equal to the contractual term of the option award. The risk-free interest

rate is determined by reference to the U.S. Treasury yield curve in effect at the time of grant of the award for time periods approximately

equal to the expected term of the award. Expected dividend yield is zero, based on the fact that the Company has never paid cash dividends

and does not expect to pay any cash dividends in the foreseeable future.

During the year ended June 30, 2023, shares

of common stock of the Company (the “Common Stock”) were not publicly traded. As such, during the period, the Company estimated

the fair value of common stock using an appropriate valuation methodology, in accordance with the framework of the American Institute

of Certified Public Accountants’ Technical Practice Aid, Valuation of Privately-Held Company Equity Securities Issued as Compensation.

Each valuation methodology includes estimates and assumptions that require the Company’s judgment. These estimates and assumptions

include a number of objective and subjective factors, including external market conditions, guideline public company information, the

prices at which the Company sold its preferred stock to third parties in arms’ length transactions, the rights, and preferences

of securities senior to the Common Stock at the time, and the likelihood of achieving a liquidity event such as an initial public offering

or sale. Significant changes to the assumptions used in the valuations could result in different fair values of stock options at each

valuation date, as applicable.

NOTE 2. PROPERTY AND EQUIPMENT

Property and equipment consist of the following

at June 30, 2023.

| Computers | |

$ | 7,240 | |

| Accumulated depreciation | |

| (4,063 | ) |

| | |

$ | 3,177 | |

Depreciation expense related to property and

equipment was $1,448 for the year ended June 30, 2023.

NOTE 3. STOCK OPTION PLANS

In 2018, the Company established the Scite, Inc.

Stock Incentive Plan (“The Plan”). Under the Plan, which covers all employees, officers and directors, as well as consultants

and advisors, the Company may grant Common Stock in officers and directors, as well as consultants and advisors, the Company may grant

shares of Common Stock in the form of incentive stock options (“ISO”) or non-statutory stock options (“NSO”).

Options grants generally vest over two to four years and vest options are available to exercise for 90 days following an employee's departure.

A qualified liquidation event prior to the end of the vesting schedule will trigger a full acceleration of the exercisability of outstanding

incentive awards held by some or all participants, provided that the Committee, in its sole discretion, may condition such acceleration.

The

exercise price of the options may not be granted at less than fair market value of the common stock on the date of the grant. Stock-based

compensation cost is measured at the grant date, based on the fair value of the awards that are ultimately expected to vest, and recognized

on a straight-line basis over the requisite service period, which is generally the vesting period.

The following is an analysis of options to purchase

shares of the Company's stock issued and outstanding as of June 30, 2023:

| Options outstanding at the beginning of the

year | |

| 460,050 | |

| Granted | |

| - | |

| Options exercised | |

| - | |

| Forfeited | |

| - | |

| Options outstanding at the beginning

of the year | |

| 460,050 | |

The weighted average

remaining contractual life of all options outstanding as of June 30, 2023 was 6.92 years. The remaining contractual life

for options vested and exercisable at June 30, 2023 was 6.85 years. Furthermore, the aggregate intrinsic value of options

outstanding as of June 30, 2023 was approximately $76,000, and the aggregate intrinsic value of options vested and exercisable as

of June 30, 2023 was approximately $62,000, in each case based on the fair value of the Common Stock on June 30, 2023.

During the year ended

June 30, 2023, the Company did not grant any options to employees. The total fair value of options that vested during the year ended

June 30, 2023 was $19,811 and is included in selling, general and administrative expenses in the accompanying statement of

operations. As of June 30, 2023, the amount of unvested compensation related to stock options was approximately $24,000 which

will be recorded as an expense in future periods as the options vest.

NOTE 4. PREFERRED STOCK

During

the year ended June 30, 2023, the Company issued 2,909,231 shares of Series Seed 1 Preferred Stock (as defined in that

certain Amended and Restated Certificate of Incorporation of Company (the “Charter”)) for

gross proceeds to the Company of $1,500,000. During the year ended June 30, 2023, the Company issued 2,087,510 shares of Series Seed

2 Preferred Stock (as defined in the Charter) upon the conversion of notes payable and accrued interest in the aggregate of $430,445.

Dividends

Each

share is entitled to dividends as and when declared by the Board of Directors of the Company in

an amount equal to 7% per annum. If an Event of Default (as defined in the Charter) should occur, the rate of the Accruing Dividends

(as defined in the Charter) shall automatically increase to ten percent from and after such Event of Default.

Voting

On any matter presented to the stockholders of

the Company for their action or consideration at any meeting of stockholders of the Company (or by written consent of stockholders in

lieu of meeting), each holder of outstanding shares of Series Seed Preferred Stock (as defined in the Charter) shall be entitled

to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of Series Seed Preferred Stock

held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter.

Conversion

Each share of Series Seed Preferred Stock

shall be convertible, at the option of the holder thereof, at any time and from time to time, and without the payment of additional consideration

by the holder thereof, into such number of fully paid and nonassessable shares of Common Stock as is determined by dividing the Series Seed

Original Issue Price (as defined in the Charter), by the applicable Conversion Price in effect at the time of conversion. The “Conversion

Price” shall initially mean, $0.5156 with respect to the Series Seed-1 Preferred Stock (as defined in the Charter), and $0.2062

per share, with respect to the Series Seed-2 Preferred Stock (as defined in the Charter).

Liquidation

In the event of any voluntary or involuntary

liquidation, dissolution or winding up of the Company or any Deemed Liquidation Event (as defined in the Charter), the holders of shares

of Series Seed Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Company available for distribution

to its stockholders, and in the event of a Deemed Liquidation Event, the holders of shares of Series Seed Preferred Stock then outstanding,

on a pari passu basis, shall be entitled to be paid out of the consideration payable to stockholders in such Deemed Liquidation Event

or out of the Available Proceeds (as defined in the Charter), as applicable, before any payment shall be made to the holders of Common

Stock by reason of their ownership thereof, an amount per share equal to the greater of (i) the applicable Original Issue Price

(as defined in the Charter), plus any Accruing Dividends accrued but unpaid thereon, whether or not declared, together with any other

dividends declared but unpaid thereon, or (ii) such amount per share as would have been payable had all shares of Series Seed

Preferred Stock been converted into Common Stock pursuant to the agreement immediately prior to such liquidation, dissolution, winding

up or Deemed Liquidation Event. If upon any such liquidation, dissolution or winding up of the Company or Deemed Liquidation Event, the

assets of the Company available for distribution to its stockholders shall be insufficient to pay the holders of shares of Series Seed

Preferred Stock the full amount to which they shall be entitled under the agreement, the holders of shares of Series Seed Preferred

Stock shall share ratably in any distribution of the assets available for distribution in proportion to the respective amounts which

would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to

such shares were paid in full.

NOTE 5. NOTES PAYABLE

As of June 30, 2022, the Company had outstanding

notes payable to certain third parties in the aggregate amount of $350,000. The notes bore interest rate of 6% per annum and were due

June 1, 2022. As of June 30, 2022, accrued interest on the notes was $75,612. During the year ended June 30, 2023, the

Company accrued interest on the notes of $4,833. In September 2022, the Company issued 2,087,510 shares of Series Seed-2 Preferred

Stock to convert the outstanding principal of $350,000 and accrued interest of $80,445, in accordance with the original conversion terms.

There was no outstanding notes payable as of September 30, 2023.

NOTE 6. COMMITMENTS & CONTINGENCIES

Sales to certain consumers may be subject to

sales tax requirements and possible audits by state taxing authorities. The Company records its estimated sales tax liability and includes

that amount as an accrued obligation until paid.

Legal Proceedings

From time to time, we are a party to claims and

legal proceedings arising in the ordinary course of business. Although management of the Company cannot predict the ultimate outcome

of these legal proceedings with certainty, it believes that the ultimate resolution of the Company’s legal proceedings, including

any amounts it may be required to pay, will not have a material effect on the Company’s financial statements.

NOTE 7. INCOME TAXES

The provision for income taxes consists of the

following for the year ended June 30, 2023:

| Current | |

| | |

| Federal | |

$ | - | |

| State | |

| 2,276 | |

| Deferred | |

| | |

| Federal | |

| - | |

| State | |

| - | |

| Provision for income tax | |

$ | 2,276 | |

The reconciliation of the effective income tax

rate to the federal statutory rate is as follows:

| Federal income tax rate | |

| 21 | % |

| State tax | |

| 5 | % |

| Change in valuation allowance | |

| (26.6 | )% |

| Provision for income tax | |

| 0.6 | % |

Deferred taxes are provided for the differences

in the tax and accounting basis of assets and liabilities as of June 30, 2023, as follows:

| Deferred tax assets | |

| | |

| Net

operating loss carryforwards | |

$ | 232,168 | |

| Total deferred

tax assets | |

| 232,168 | |

| | |

| | |

| Deferred tax liabilities | |

| | |

| Accumulated

depreciation | |

| (4,062 | ) |

| Total deferred

tax liabilities | |

| (4,062 | ) |

| | |

| | |

| Net deferred tax assets | |

| 228,106 | |

| Less: Valuation allowance | |

| (228,106 | ) |

| Net deferred tax assets | |

$ | - | |

At June 30, 2023, the Company has gross

net operating loss (“NOL”) carryforwards for federal and state income tax purposes of approximately $812,000 and $807,000,

respectively. The federal NOL’s do not expire. The state NOL’s expire between the years 2038 and 2042. The Company’s

ability to use its NOL carryforwards may be limited if it experiences an “ownership change” as defined in Section 382

(“Section 382”) of the Internal Revenue Code of 1986, as amended. An ownership change generally occurs if certain stockholders

increase their aggregate percentage ownership of a corporation’s stock by more than 50 percentage points over their lowest percentage

ownership at any time during the testing period, which is generally the three-year period preceding any potential ownership change.

At June 30, 2023, the Company had taken

no uncertain tax positions that would require disclosure under ASC 740, Accounting for Income Taxes.

NOTE 8. SUBSEQUENT EVENTS

On November 24, 2023, the Company, Research

Solutions, Inc. (NASDAQ: RSSS) and Research Solutions Acquisition 2, LLC, a Delaware limited liability company and a

wholly-owned subsidiary of the Registrant (“Merger Sub”) entered into an Agreement and Plan of Merger, governing the

Company’s merger with and into Merger Sub (the “Merger”), with Merger Sub continuing its existence under the name “Scite,

LLC” (the “Surviving Entity”) as the surviving entity after the Merger and a wholly-owned subsidiary of the Registrant

at the effective time of the Merger. The transaction closed on December 1, 2023.

Exhibit 99.2

SCITE, INC.

CONDENSED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED

SEPTEMBER 30, 2023

SCITE, INC.

CONDENSED

BALANCE SHEETS

| | |

September 30,

2023

(Unaudited) | | |

June 30,

2023 | |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,359,340 | | |

$ | 1,153,292 | |

| Accounts receivable | |

| 108,001 | | |

| 153,271 | |

| Total current assets | |

| 1,467,341 | | |

| 1,306,563 | |

| | |

| | | |

| | |

| Property and equipment, net of accumulated depreciation of $4,425 and $4,063, respectively | |

| 2,815 | | |

| 3,177 | |

| Total assets | |

$ | 1,470,156 | | |

$ | 1,309,740 | |

| | |

| | | |

| | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and other current liabilities | |

$ | 23,218 | | |

$ | 9,113 | |

| Deferred revenue | |

| 266,903 | | |

| 250,702 | |

| Total liabilities | |

| 290,121 | | |

| 259,815 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred stock, Seed 1 and 2, $0.0001 par value, 4,996,741

shares authorized, 4,996,741 shares issued and outstanding as of September 30, 2023 and June 30, 2023 | |

| 500 | | |

| 500 | |

| Common stock, $1.0001 par value, 14,837,676 shares authorized; 8,550,000 shares issued; 6,457,381 and 7,446,223 shares outstanding at September 30, 2023 and June 30, 2023, respectively | |

| 855 | | |

| 855 | |

| Additional paid-in capital | |

| 2,029,205 | | |

| 2,023,593 | |

| Retained earnings (accumulated deficit) | |

| (850,398 | ) | |

| (974,913 | ) |

| Treasury stock, at cost, 2,092,619 and 1,103,777 shares at September 30, 2023 and June 30, 2023, respectively | |

| (127 | ) | |

| (110 | ) |

| Total shareholders’ equity | |

| 1,180,035 | | |

| 1,049,925 | |

| Total liabilities and shareholders’ equity) | |

$ | 1,470,156 | | |

$ | 1,309,740 | |

See accompanying notes to the condensed financial

statements.

SCITE, INC.

CONDENSED

STATEMENT OF OPERATIONS

For the Period Ended September 30, 2023

(Unaudited)

| Revenue | |

$ | 732,634 | |

| Cost of revenue | |

| 60,652 | |

| Gross profit | |

| 671,982 | |

| | |

| | |

| Selling, general and administrative expenses | |

| 547,467 | |

| | |

| | |

| Net income | |

$ | 124,515 | |

See accompanying notes to the condensed financial

statements.

SCITE, INC.

CONDENSED STATEMENT OF CHANGES IN SHAREHOLDERS’

EQUITY

FOR THE PERIOD ENDED SEPTEMBER 30, 2023

(Unaudited)

| | |

| |

| |

| |

| |

| |

| |

Additional | |

| |

| |

| | |

Preferred

Stock | |

Common

Stock | |

Treasury

Stock | |

Paid-in | |

Retained | |

| |

| | |

Shares | |

Amount | |

Shares | |

Amount | |

Shares | |

Amount | |

Capital | |

Earnings | |

Total | |

| Balance, June 30,

2023 | |

4,996,741 | |

$ | 500 | |

8,550,000 | |

$ | 855 | |

(1,103,777 | ) |

$ | (110 | ) |

$ | 2,023,593 | |

$ | (974,913 | ) |

$ | 1,049,925 | |

| | |

| |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| Cancellation of shares upon

officer’s resignation | |

| |

| | |

| |

| | |

(988,842 | ) |

| (17 | ) |

| | |

| | |

| (17 | ) |

| | |

| |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| Stock-based compensation | |

| |

| | |

| |

| | |

| |

| | |

| 5,612 | |

| | |

| 5,612 | |

| | |

| |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| Net income | |

- | |

| - | |

- | |

| - | |

- | |

| - | |

| | |

| 124,515 | |

| 124,515 | |

| | |

| |

| | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| Balance,

September 30, 2023 | |

4,996,741 | |

$ | 500 | |

8,550,000 | |

$ | 855 | |

(2,092,619 | ) |

$ | (127 | ) |

$ | 2,029,205 | |

$ | (850,398 | ) |

$ | 1,180,035 | |

See accompanying notes to the condensed financial

statements.

SCITE, INC.

CONDENSED

STATEMENT OF CASH FLOWS

For the Period Ended September 30, 2023

(Unaudited)

| Cash flows from operating activities: | |

| |

| Net income | |

$ | 124,515 | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | |

| Depreciation | |

| 362 | |

| Stock based compensation | |

| 5,612 | |

| Changes in operating assets and liabilities: | |

| | |

| Accounts receivable | |

| 45,270 | |

| Accounts payable and other current liabilities | |

| 14,105 | |

| Deferred revenue | |

| 16,201 | |

| Net cash provided by used in operating activities | |

| 206,065 | |

| | |

| | |

| Cash flows from financing activities: | |

| | |

| Repurchase of common stock | |

| (17 | ) |

| Net cash used in financing activities | |

| (17 | ) |

| | |

| | |

| Net increase in cash and cash equivalents | |

| 206,048 | |

| | |

| | |

| Cash and cash equivalents, beginning of the year | |

| 1,153,292 | |

| Cash and cash equivalents, end of the period | |

$ | 1,359,340 | |

| | |

| | |

| Supplemental disclosures of cash flow information: | |

| | |

| Cash paid during the period for: | |

| | |

| Interest | |

$ | - | |

| Income taxes paid | |

| 432 | |

See accompanying notes to the condensed financial

statements.

SCITE, INC.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED SEPTEMBER 30, 2023

NOTE 1. NATURE OF BUSINESS AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Nature of Business

Scite, Inc. is a Brooklyn, New York based

start-up company that helps researchers better discover, understand and evaluate research articles through Smart-Citation which are citations

that display the context of the citation and describe whether the article provides supporting or contrasting evidence.

The Company’s citation

platform called Scite, uses deep learning, natural language processing, and a network of experts to identify and promote reliable research

by evaluating the accuracy of scientific claims. Scite, can automatically classify scientific citations as supporting, refuting or mentioning,

which enables the entity to score the accuracy of scientific reports, researchers, institutions journals and scientific fields using a

measure called scite.

The Company's customers

primarily consist of research students as well as colleges and universities.

Basis of presentation

The accompanying financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

and have been presented under the historical cost basis. In the opinion of management, the unaudited interim condensed financial statements

reflect all adjustments, which include only normal recurring adjustments necessary for the fair statement of the balances and results

for the periods presented. Operating results for the three months ended September 30, 2023 are not necessarily indicative of the

results that may be expected for the year ending June 30, 2024.

Use of Estimates

In preparing financial statements in conformity

with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts

of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported

amount of revenue and expenses during the reported period. Actual results could differ from these estimates.

Revenue Recognition

The Company follows Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. The guidance requires the Company to recognize revenue to depict the transfer of services to customers in an amount that reflects

the consideration to which the Company expects to be entitled in exchange for those services. The guidance also requires disclosures

related to the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

The Company’s sources of revenue during

the period ended September 30, 2023, consist of Subscription and License Revenue. The Company derives its license revenue from subscription

agreements with customers for access to the Company’s citation platform. The Company offers monthly or annual subscriptions/licenses

to its customers. The subscription/license revenue is recognized evenly over the life of the contract as the Company considers the contract

to be one performance obligation. Contract liabilities include deferred revenues related to advanced payments for license agreements which

are amortized over the life of the contract which is typically one month to one year. Contract liabilities totaled $226,903 at September 30,

2023, and are expected to be recognized in the next year.

Income Taxes

The Company accounts for income taxes in accordance

with FASB ASC 70, Income Taxes, which requires the recognition of deferred income taxes for differences between the basis of assets

and liabilities for financial statement and income tax purposes. Deferred tax assets and liabilities represent future tax consequences

for those differences, which will either be deductible or taxable when the assets and liabilities are recovered and settled. Deferred

taxes are also recognized for operating losses that are available to offset future taxable income. A valuation allowance is established

when necessary to reduce deferred tax assets to the amount expected to be realized. Based upon all available evidence, management concluded

that it was more-likely-than-not that its deferred tax assets would not be realized, and therefore a full valuation allowance was in place

as of September 30, 2023. For the period ending September 30, 2023, the Company has enough outstanding net operating loss carryforwards

to offset any taxable income during the period.

The Company follows the provisions of FASB ASC

740-10-25, which prescribes a recognition threshold and measurement attribute for the recognition and measurement of tax positions or

expected to be taken in income tax returns. FASB ASC 740-10-25 also provides guidance on de-recognition of income taxes assets and liabilities,

classification of current and deferred income taxes and liabilities, and accounting for interest and penalties associated with tax positions.

The Company has not been recently audited by the

IRS or state agencies; and accordingly, the business tax returns for the past three years are open to examination. The Company has evaluated

its tax positions and has concluded that they do not result in anything that would require either recording or disclosure in the financial

statements based upon the criteria set forth in ASC 740.

Fair Value Measurements

The Company uses various inputs in determining

the fair value of its investments and measures these assets on a recurring basis. Financial assets recorded at fair value in the balance

sheets are categorized by the level of objectivity associated with the inputs used to measure their fair value. ASC Topic 820 defines

the following levels directly related to the amount of subjectivity associated with the inputs:

| Level 1 | |

Quoted prices in active markets for identical assets or liabilities. |

| Level 2 | |

Inputs, other than the quoted prices in active markets, that is observable either directly or indirectly. |

| Level 3 | |

Unobservable inputs based on the Company’s assumptions. |

As of June 30, 2023, the carrying value of

financial assets and liabilities such as cash, accounts receivable, and accounts payable and other current liabilities approximates their

fair value because of the short-term maturity of these instruments. Unless otherwise noted, it is management's opinion that the Company

is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Concentrations of Credit Risk

The Company's financial statements that are subject

to credit risk consist primarily of cash and trade receivables. At times throughout the year, the Company's cash balances exceeded amounts

insured by the Federal Deposit Insurance Company (FDIC). However, the Company believes it is not exposed to any significant credit risk

related to these cash accounts.

At September 30, 2023 the Company had accounts

receivable from three customers which comprised 19%, 15% and 10% of its accounts receivable balance, respectively. At June 30, 2023,

the Company had accounts receivable from two customers which comprised 46% and 18% of its accounts receivable balance, respectively. During

the period ended September 30, 2023, no customers accounted for more than 10% of the Company’s revenue.

Stock Based Compensation

The Company periodically issues stock options

to employees and non-employees in non-capital raising transactions for services and for financing costs. The Company accounts for such

grants issued and vesting based on ASC 718, Compensation-Stock Compensation whereby the value of the award is measured on the date of

grant and recognized for employees as compensation expense on the straight-line basis over the vesting period. The Company recognizes

the fair value of stock-based compensation within its Statements of Operations with classification depending on the nature of the services

rendered.

The fair value of each option grant is estimated

using the Black-Scholes option-pricing model. The Company is a private company and lacks company-specific historical and implied volatility

information. Therefore, it estimates its expected stock volatility based on the historical volatility of a publicly traded set of peer

companies within the technology industry with characteristics similar to the Company. The expected term of the Company’s stock options

has been determined utilizing the “simplified” method for awards that qualify as “plain vanilla” options. The

expected term of stock options granted to non-employees is equal to the contractual term of the option award. The risk-free interest rate

is determined by reference to the U.S. Treasury yield curve in effect at the time of grant of the award for time periods approximately

equal to the expected term of the award. Expected dividend yield is zero, based on the fact that the Company has never paid cash dividends

and does not expect to pay any cash dividends in the foreseeable future.

During the period ended September 30, 2023,

shares of common stock of the Company (the “Common Stock”) were not publicly traded. As such, during the period, the Company

estimated the fair value of common stock using an appropriate valuation methodology, in accordance with the framework of the American

Institute of Certified Public Accountants’ Technical Practice Aid, Valuation of Privately-Held Company Equity Securities Issued

as Compensation. Each valuation methodology includes estimates and assumptions that require the Company’s judgment. These estimates

and assumptions include a number of objective and subjective factors, including external market conditions, guideline public company information,

the prices at which the Company sold its preferred stock to third parties in arms’ length transactions, the rights, and preferences

of securities senior to the Common Stock at the time, and the likelihood of achieving a liquidity event such as an initial public offering

or sale. Significant changes to the assumptions used in the valuations could result in different fair values of stock options at each

valuation date, as applicable.

NOTE 2. PROPERTY AND EQUIPMENT

Property and equipment consist of the following at September 30,

2023 and June 30, 2023.

| Computers | |

$ | 7,240 | | |

$ | 7,240 | |

| Accumulated depreciation | |

| (4,425 | ) | |

| (4,063 | ) |

| | |

$ | 2,815 | | |

$ | 3,177 | |

Depreciation expense related to property and equipment

was $362 for the period ended September 30, 2023.

NOTE 3. STOCK OPTION PLANS

In 2018, the Company established the Scite, Inc.

Stock Incentive Plan ("The Plan"). Under the Plan, which covers all employees, officers and directors, as well as consultants

and advisors, the Company may grant shares of Common Stock in officers and directors, as well as consultants and advisors, the Company

may grant shares of Common Stock in the form of incentive stock options ("ISO") or non-statutory stock options ("NSO").

Options grants generally vest over two to four years and vest options are available to exercise for 90 days following an employee's departure.

A qualified liquidation event prior to the end of the vesting schedule will trigger a full acceleration of the exercisability of outstanding

incentive awards held by some or all participants, provided that the Committee, in its sole discretion, may condition such acceleration.

The exercise price of the options may not be granted

at less than fair market value of the common stock on the date of the grant. Stock-based compensation cost is measured at the grant date,

based on the fair value of the awards that are ultimately expected to vest, and recognized on a straight-line basis over the requisite

service period, which is generally the vesting period.

The following is an analysis of options to purchase

shares of the Company's stock issued and outstanding as of September 30, 2023:

| Options outstanding at the beginning of the period | |

| 460,050 | |

| Granted | |

| - | |

| Options exercised | |

| - | |

| Forfeited | |

| - | |

| Options outstanding at the beginning of the period | |

| 460,050 | |

The weighted average

remaining contractual life of all options outstanding as of September 30, 2023 was 6.67 years. The remaining contractual

life for options vested and exercisable at September 30, 2023 was 6.6 years. Furthermore, the aggregate intrinsic value

of options outstanding as of September 30, 2023 was approximately $76,000, and the aggregate intrinsic value of options vested and

exercisable as of September 30, 2023 was approximately $62,000, in each case based on the fair value of the Common Stock on September 30,

2023.

During the period ended

September 30, 2023, the Company did not grant any options to employees. The total fair value of options that vested during the year

ended September 30, 2023 was $5,612 and is included in selling, general and administrative expenses in the accompanying statement

of operations. As of September 30, 2023, the amount of unvested compensation related to stock options was approximately $18,000 which

will be recorded as an expense in future periods as the options vest.

NOTE 4. PREFERRED STOCK

Series Seed 1 Convertible Preferred Stock

(the “Seed 1 Preferred”) consists of $0.0001 par value, 7% cumulative dividend, voting, participating preferred

stock, 2,909,231 shares are authorized. As of September 30, 2023, and June 30, 2023, there were 2,909,231 shares

outstanding.

Series Seed 2 Convertible Preferred Stock

(the “Seed 2 Preferred”) consists of $0.0001 par value, 7% cumulative dividend, voting, participating preferred

stock, 2,087,510 shares are authorized. As of September 30, 2023, and June 30, 2023, there were 2,087,510 shares

outstanding.

Dividends

Each share is entitled to dividends as and when

declared by the Board in an amount equal to 7% per annum. If an Event of Default (as

defined in that certain Amended and Restated Certificate of Incorporation of Company (the “Charter”)) should occur, the rate

of the Accruing Dividends (as defined in the Charter) shall automatically increase to ten percent from and after such Event of Default.

Voting

On any matter presented to the stockholders of

the Company for their action or consideration at any meeting of stockholders of the Company (or by written consent of stockholders in

lieu of meeting), each holder of outstanding shares of Series Seed Preferred Stock (as defined in the Charter) shall be entitled

to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of Series Seed Preferred Stock

held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter.

Conversion

Each share of Series Seed Preferred Stock

shall be convertible, at the option of the holder thereof, at any time and from time to time, and without the payment of additional consideration

by the holder thereof, into such number of fully paid and nonassessable shares of Common Stock as is determined by dividing the Series Seed

Original Issue Price (as defined in the Charter), by the applicable Conversion Price in effect at the time of conversion. The “Conversion

Price” shall initially mean, $0.5156 with respect to the Series Seed-1 Preferred Stock (as defined in the Charter), and $0.2062

per share, with respect to the Series Seed-2 Preferred Stock (as defined in the Charter).

Liquidation

In the event of any voluntary or involuntary liquidation,

dissolution or winding up of the Company or any Deemed Liquidation Event (as defined in the Charter), the holders of shares of Series Seed

Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Company available for distribution to its stockholders,

and in the event of a Deemed Liquidation Event, the holders of shares of Series Seed Preferred Stock then outstanding, on a pari

passu basis, shall be entitled to be paid out of the consideration payable to stockholders in such Deemed Liquidation Event or out of

the Available Proceeds (as defined in the Charter), as applicable, before any payment shall be made to the holders of Common Stock by

reason of their ownership thereof, an amount per share equal to the greater of (i) the applicable Original Issue Price (as defined

in the Charter), plus any Accruing Dividends accrued but unpaid thereon, whether or not declared, together with any other dividends declared

but unpaid thereon, or (ii) such amount per share as would have been payable had all shares of Series Seed Preferred Stock been

converted into Common Stock pursuant to the agreement immediately prior to such liquidation, dissolution, winding up or Deemed Liquidation

Event. If upon any such liquidation, dissolution or winding up of the Company or Deemed Liquidation Event, the assets of the Company available

for distribution to its stockholders shall be insufficient to pay the holders of shares of Series Seed Preferred Stock the full amount

to which they shall be entitled under the agreement, the holders of shares of Series Seed Preferred Stock shall share ratably in

any distribution of the assets available for distribution in proportion to the respective amounts which would otherwise be payable in

respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full.

NOTE 5. COMMITMENTS & CONTINGENCIES

Sales to certain consumers may be subject to sales

tax requirements and possible audits by state taxing authorities. The Company records its estimated sales tax liability and includes that

amount as an accrued obligation until paid.

Legal Proceedings

From time to time, we are a party to claims and

legal proceedings arising in the ordinary course of business. Although management of the Company cannot predict the ultimate outcome of

these legal proceedings with certainty, it believes that the ultimate resolution of the Company’s legal proceedings, including any

amounts it may be required to pay, will not have a material effect on the Company’s financial statements.

NOTE 6. SUBSEQUENT EVENTS

On November 24, 2023, the Company, Research

Solutions, Inc. (NASDAQ: RSSS) and Research Solutions Acquisition 2, LLC, a Delaware limited liability company and a wholly-owned

subsidiary of the Registrant (Merger Sub) entered into an Agreement and Plan of Merger governing the Company’s merger with

and into Merger Sub (the “Merger”), with Merger Sub continuing its existence under the name “Scite, LLC” (the

“Surviving Entity”) as the surviving entity after the Merger and a wholly-owned subsidiary of the Registrant at the effective

time of the Merger. The transaction closed on December 1, 2023.

EXHIBIT 99.3

UNAUDITED

PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

On

November 24, 2023, Research Solutions, Inc., a Nevada corporation (the “Registrant”, “Company”, or

“Research Solutions”), Research Solutions Acquisition 2, LLC, a Delaware limited liability company and a wholly-owned subsidiary

of the Registrant (“Merger Sub”), Scite, Inc. a Delaware corporation (“Scite”), and Shareholder Representative

Services LLC, a Colorado limited liability company, solely in its capacity as the representative, agent and attorney-in-fact of Scite’s

securityholders (the “Stockholder Representative”), entered into an Agreement of Merger and Plan of Reorganization (the “Merger

Agreement”), governing Scite’s merger with and into Merger Sub (the “Merger”), with Merger Sub continuing its

existence under the name “Scite, LLC” (the “Surviving Entity”) as the surviving entity after the Merger and a

wholly-owned subsidiary of the Registrant. Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to

them in the Merger Agreement.

The

unaudited pro forma condensed combined statements of operations for the year ended June 30, 2023 and the unaudited pro forma condensed

combined balance sheet as of September 30, 2023 illustrate the estimated effect of the acquisition of Scite on the Company's financial

statements. The unaudited pro forma condensed combined financial statements are based on certain estimates and assumptions made with

respect to the combined operations of Research Solutions and Scite, which the Company believes are reasonable. The unaudited pro forma

condensed combined financial statements are presented for illustrative purposes only and do not purport to be indicative of the results

of operations or financial position of Research Solutions or Scite that actually would have been achieved had the acquisition of Scite

been completed on the assumed dates, or to project the Company's results of operations or financial position for any future date or period.

The unaudited pro forma condensed combined statement of operations gives pro forma effect to the acquisition as if it had occurred on

July 1, 2022. The unaudited pro forma condensed combined balance sheet gives pro forma effect to the acquisition as if it had occurred

on September 30, 2023.

The unaudited pro forma condensed combined financial information should be read in conjunction with the accompanying notes to the unaudited pro forma condensed combined financial statements. In addition, the unaudited pro forma condensed combined financial information was based on and should be read in conjunction with the following:

| · | The

Research Solutions audited consolidated financial statements as of and for the year ended June 30, 2023, and the notes thereto included

in the Company's Annual Report on Form 10-K filed with the United States Securities and Exchange Commission (“SEC”)

on September 15, 2023; and |

| · | The

Scite audited financial statements as of and for the year ended June 30, 2023, and the notes thereto, included in the Form 8-K/A,

of which this exhibit is a part. |

For

income tax purposes, the acquisition is a taxable business combination. The Research Solutions tax basis in the assets acquired and liabilities

assumed will be equal to fair market value as of the acquisition date, and thus the basis for financial reporting and tax purposes will

generally be the same and no temporary differences are expected.

The historical consolidated financial statements of the Company have been adjusted in the unaudited pro forma condensed combined financial statements to give effect to pro forma events that are (1) directly attributable to the acquisition, (2) factually supportable, and (3) with respect to the unaudited condensed combined statement of operations, expected to have a continuing impact on the combined results. The unaudited pro forma condensed combined financial information does not reflect any operating cost synergy savings that the combined company may achieve as a result of the acquisition, or the costs necessary to achieve these operating synergies.

Research Solutions, Inc.

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

As of September 30, 2023

| | |

RSSS | | |

Scite | | |

Transaction

Adjustments | | |

Pro-Forma

Combined | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Current Assets | |

| | | |

| | | |

| | | |

| | |

| Cash and equivalents | |

| 9,882,064 | | |

| 1,359,340 | | |

| (7,305,493 | )(a) | |

| 3,935,911 | |

| Accounts receivable | |

| 6,460,188 | | |

| 108,001 | | |

| 260,523 | (b) | |

| 6,828,712 | |

| Prepaid expenses and other current assets | |

| 1,481,590 | | |

| - | | |

| 55,802 | (b) | |

| 1,537,392 | |

| Total Current Assets | |

| 17,823,842 | | |

| 1,467,341 | | |

| (6,989,168 | ) | |

| 12,302,015 | |

| | |

| | | |

| | | |

| | | |

| | |

| Property and Equipment | |

| 982,625 | | |

| 7,240 | | |

| - | | |

| 989,865 | |

| Accumulated depreciation | |

| (891,299 | ) | |

| (4,424 | ) | |

| - | | |

| (895,723 | ) |

| Property and Equipment, net | |

| 91,326 | | |

| 2,816 | | |

| - | | |

| 94,142 | |

| | |

| | | |

| | | |

| | | |

| | |

| Goodwill | |

| 3,238,794 | | |

| - | | |

| 13,091,400 | (c) | |

| 16,330,194 | |

| | |

| | | |

| | | |

| | | |

| | |

| Intangible assets, net of accumulated amortization | |

| 2,528,259 | | |

| - | | |

| 8,644,167 | (c) | |

| 11,172,426 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Assets | |

| 1,033 | | |

| - | | |

| - | | |

| 1,033 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Assets | |

$ | 23,683,254 | | |

$ | 1,470,157 | | |

$ | 14,746,399 | | |

$ | 39,899,810 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities & Equity | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| 8,541,564 | | |

| 20,016 | | |

| 177,680 | (b) | |

| 8,739,260 | |

| Customer Advances | |

| - | | |

| - | | |

| - | | |

| - | |

| Deferred revenue | |

| 6,387,470 | | |

| 266,903 | | |

| 1,050,919 | (b) | |

| 7,705,292 | |

| Other Liabilities | |

| - | | |

| 3,203 | | |

| - | | |

| 3,203 | |

| Total Current Liabilities | |

| 14,929,034 | | |

| 290,122 | | |

| 1,228,599 | | |

| 16,447,755 | |

| | |

| | | |

| | | |

| | | |

| | |

| Long-Term Liabilities | |

| 1,867,043 | | |

| | | |

| 7,194,000 | (d) | |

| 9,061,043 | |

| | |

| | | |

| | | |

| | | |

| | |

| Stockholders' Equity | |

| 6,887,177 | | |

| 1,180,035 | | |

| 6,323,800 | (e) | |

| 14,391,012 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 23,683,254 | | |

$ | 1,470,157 | | |

$ | 14,746,399 | | |

$ | 39,899,810 | |

Research Solutions, Inc.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

For the Year Ended June 30, 2023

| | |

RSSS | | |

Scite | | |

Pro-forma

Adjustments | | |

Pro-Forma

Combined | |

| Revenue | |

$ | 37,703,452 | | |

$ | 1,121,199 | | |

$ | 0 | | |

$ | 38,824,651 | |

| Cost of Revenue | |

| 23,002,561 | | |

| 199,552 | | |

| - | | |

| 23,202,113 | |

| Gross profit | |

| 14,700,891 | | |

| 921,647 | | |

| - | | |

| 15,622,538 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administration | |

| 14,409,634 | | |

| 1,315,224 | | |

| - | | |

| 15,724,858 | |

| Depreciation and amortization | |

| 52,649 | | |

| 1,448 | | |

| 903,333 | (f) | |

| 957,430 | |

| Total Operating Expenses | |

| 14,462,283 | | |

| 1,316,672 | | |

| 903,333 | | |

| 16,682,288 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (Loss) from Operations | |

| 238,608 | | |

| (395,025 | ) | |

| (903,333 | ) | |

| (1,059,750 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| 338,617 | | |

| (15,503 | ) | |

| - | | |

| 323,114 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations before provision for income taxes | |

| 577,225 | | |

| (410,528 | ) | |

| - | | |

| (1,382,864 | ) |

| Provision for income taxes | |

| 5,602 | | |

| 2,276 | | |

| - | | |

| 7,878 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) | |

$ | 571,623 | | |

$ | (412,804 | ) | |

$ | 0 | | |

$ | (1,390,742 | ) |

Research Solutions, Inc.

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

For the Three Months Ended September 30, 2023

| | |

RSSS | | |

Scite | | |

Pro-forma

Adjustments | | |

Pro-Forma

Combined | |

| Revenue | |

$ | 10,060,971 | | |

$ | 732,634 | | |

| - | | |

$ | 10,793,605 | |

| Cost of Revenue | |

| 6,029,406 | | |

| 60,652 | | |

| - | | |

| 6,090,058 | |

| Gross profit | |

| 4,031,565 | | |

| 671,982 | | |

| - | | |

| 4,703,547 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administration | |

| 5,070,897 | | |

| 547,675 | | |

| - | | |

| 5,618,572 | |

| Depreciation and amortization | |

| 59,620 | | |

| 362 | | |

| 225,833 | (f) | |

| 285,815 | |

| Total Operating Expenses | |

| 5,130,517 | | |

| 548,037 | | |

| 225,833 | | |

| 5,904,387 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (Loss) from Operations | |

| (1,098,952 | ) | |

| 123,945 | | |

| (225,833 | ) | |

| (1,200,840 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| 139,365 | | |

| 1,002 | | |

| - | | |

| 140,367 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations before provision for income taxes | |

| (959,587 | ) | |

| 124,947 | | |

| (225,833 | ) | |

| (1,060,473 | ) |

| Provision for income taxes | |

| 29,402 | | |

| 432 | | |

| - | | |

| 29,834 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (loss) | |

$ | (988,989 | ) | |

$ | 124,515 | | |

$ | (225,833 | ) | |

$ | (1,090,307 | ) |

Research Solutions, Inc.

NOTES TO CONDENSED COMBINED PRO FORMA UNAUDITED FINANCIAL STATEMENTS

Unaudited Pro Forma Condensed Financial Information

The preliminary allocation of the purchase price used in the unaudited pro forma condensed financial statements is based upon preliminary estimates. The preliminary estimated fair values of certain assets and liabilities have been determined by management with the assistance of a third-party valuation firm. Our estimates and assumptions are subject to change during the measurement period, which is up to one year from the acquisition date, as the Company finalizes the valuations of certain tangible and intangible assets acquired and liabilities assumed in connection with the Acquisition.