SonoSite, Inc. (Nasdaq:SONO), the world leader and

specialist in bedside and point-of-care ultrasound, today reported

financial results for the third quarter and nine months ended

September 30, 2010.

REVENUE

Revenue increased 28% in the third quarter to $68.5 million and

increased 18% for the nine months of 2010 to $186.1 million, as

compared to the prior year.

Revenue included $8.7 million for the third quarter and nine

months from the recently acquired VisualSonics (VSI).

Excluding VSI, revenue in the third quarter was $59.8 million,

an increase of 12% compared to the third quarter of 2009, and

$177.4 million, an increase of 12% for the nine months just

ended.

THIRD QUARTER HIGHLIGHTS:

- Sustained revenue improvement in the US

hospital channel, which was up 13% for the quarter.

- Stabilization in Europe resulted in

strengthening overall international sales.

- VisualSonics, a new acquisition, is off

to a strong start and on track to meet projected six month revenue

expectations; VSI revenues grew 30% organically in Q3.

- Stable pricing helped gross margins

increase 1.2 percentage points in the quarter.

- Operating expense rationalization was

implemented.

- Solid early market progress with the

new Advanced Needle Visualization software upgrade.

EBIT and EBITDAS

Third Quarter

Third quarter EBIT reflects non-recurring charges of $2.2

million, including charges related to acquisition and

restructuring, and a revenue charge of $0.8 million.

Excluding these charges, third quarter EBIT was $7.3 million, or

11% of revenue, representing an increase of 50% compared to the

prior year. Including these charges, EBIT for the third quarter was

$5.1 million, or 7% of revenue.

Additionally, excluding non-recurring charges, third quarter

EBITDAS was $11.9 million, up 55%.

Nine Months Results

For the first nine months of 2010, non-recurring charges were

$4.7 million.

Excluding these charges, EBIT was $18.6 million or 10% of

revenue, an increase of 86% compared to the prior year. Including

these charges, EBIT was $13.9 million, or 7% of revenue, up 104%

over the nine months of 2009.

Additionally, excluding non-recurring charges, EBITDAS for the

first nine months was $28.7 million, up 54%.

For the nine months, cash flow from operations was $17.5 million

compared to $8.9 million from the prior year, representing an

increase of $8.6 million or 96% over the prior year.

EPS

Excluding non-recurring charges, EPS was $0.18 per share for the

third quarter and $0.51 per share for the first nine months of

2010.

Including non-recurring charges, EPS was $0.07 per share for the

third quarter, versus a loss of $0.01 per share in 2009. In the

first nine months of 2010 EPS was $0.27 per share compared to $0.06

per share in the prior year’s first nine months.

Over the first nine months of 2010, the weighted average of

fully-diluted outstanding shares was 15.3 million compared to 17.7

million in the prior year. Over this period, the Company

repurchased 4.2 million shares in the open market pursuant to its

previously announced share repurchase program. At quarter end,

fully-diluted shares were 14.1 million.

COMMENTARY

“We had a good quarter and made substantial overall progress on

the business model as well as future strategy steps,” said Kevin M.

Goodwin, SonoSite’s President and CEO. “We saw sustained revenue

growth in the US hospital channel, and we are on track to meet our

revenue expectations for VisualSonics. In addition, we saw an

improvement internationally as sales increased somewhat faster for

the quarter. We also implemented actions to reduce structural

operating expenses to enable expansion of forward operating

margins.”

Mr. Goodwin continued, “We continued introducing our Advanced

Needle Visualization upgrade, a new proprietary algorithm for

improving needle visualization for steep and deep nerve blocks.

This point-of-care advance has become a key differentiator for us

across the point-of-care marketplace and is gaining strong

worldwide success.”

“We also recently formed a new strategic partnership with the

National Basketball Association (NBA) to drive awareness among

sports medicine providers of the benefits of ultrasound

visualization. We see this initiative as a great opportunity to

drive visibility in musculoskeletal medicine,” said Mr.

Goodwin.

The NBA’s Chief of Medical Affairs, Dr. Jace Provo, commented,

“SonoSite is a proven industry leader and their products will help

NBA and NBA D-League teams diagnose and treat injuries in the best

and easiest way possible. Our players are competing at the highest

level, so it is a tremendous opportunity for our team doctors and

athletic trainers to attend special seminars and learn about

SonoSite’s unique diagnostic ultrasound products for the overall

benefit of our players and our game.”

2010 FINANCIAL OUTLOOK

The company is maintaining its outlook and is providing the

following guidance for the full year 2010, which now includes the

impact of the VSI acquisition:

- Core business revenue growth of 10 –

12%. The inclusion of $17.0 million of estimated revenue from VSI

will aid overall revenue growth to a projected 18-19%;

- reaffirmed

gross margins in a range of 70-71%;

- reaffirmed

core business EBIT margins of 11 – 13%. Including $7.0 million in

transaction costs, amortization and stock compensation expenses

from the VSI acquisition, we project EBIT margins of 8-9% with

higher overall revenue;

- reaffirmed

core business EBITDAS margins of 16 – 18%. We are projecting a

positive contribution from VSI, and overall EBITDAS margins of

15-17%; and

- full-year effective tax rate of 36%

compared to prior guidance of 40%.

Non-GAAP Measures

This release includes discussions of EBIT, EBITDAS and EPS

excluding certain charges; these are non-GAAP financial measures.

SonoSite believes these measures are a useful complement to results

provided in accordance with GAAP. “EBITDAS” refers to operating

income (EBIT) before depreciation, amortization and stock-based

compensation.

Conference Call Information

SonoSite will hold a conference call on October 21 at 1:30 p.m.

PT/4:30 p.m. ET. The call will be broadcast live and can be

accessed via http://www.sonosite.com/company/investors. A

replay of the audio webcast will be available beginning October 21,

2010, 5:30 pm PT and will be available until November 4, 2010, 9:59

pm PT by dialing (719) 457-0820 or toll-free (888) 203-1112. The

confirmation code 7304277 is required to access the replay. The

call will also be archived on SonoSite’s website.

About SonoSite

SonoSite, Inc. (www.sonosite.com) is the innovator and world

leader in bedside and point-of-care ultrasound and an industry

leader in ultra high-frequency micro-ultrasound technology and

impedance cardiography equipment. Headquartered near Seattle, the

company is represented by fourteen subsidiaries and a global

distribution network in over 100 countries. SonoSite’s small,

lightweight systems are expanding the use of ultrasound across the

clinical spectrum by cost-effectively bringing high-performance

ultrasound to the point of patient care.

Forward-looking Information and the

Private Litigation Reform Act of 1995

Certain statements in this press release relating to our future

financial position and operating results are “forward-looking

statements” for the purposes of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on the opinions and estimates

of our management at the time the statements are made and are

subject to risks and uncertainties that could cause actual results

to differ materially from those expected or implied by the

forward-looking statements. These statements are not guaranties of

future performance, are based on potentially inaccurate assumptions

and are subject to known and unknown risks and uncertainties,

including, without limitation, the risk that the acquisition of

VisualSonics will not yield the expected potential benefits, our

ability to manufacture, market and sell our newest products, our

ability to manage expenses, spending patterns in the hospital

market, healthcare reform, prolonged adverse conditions in the U.S.

or world economies or SonoSite’s industry and the other factors

contained in Item 1A. “Risk Factors” section of our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission. We caution readers not to place undue reliance upon

these forward-looking statements that speak only as to the date of

this release. We undertake no obligation to publicly revise any

forward-looking statements to reflect new information, events or

circumstances after the date of this release or to reflect the

occurrence of unanticipated events.

SonoSite, Inc. Selected Financial Information

Condensed Consolidated

Statements of Income (in thousands except per share data)

(unaudited) Three Months Ended Nine Months Ended September

30, September 30, 2010 2009 2010

2009 Revenue $ 68,538 $ 53,571 $

186,064 $ 157,661 Cost of revenue 19,675

16,021 53,150 48,033 Gross

margin 48,863 37,550 132,914 109,628 Gross margin percentage 71.3 %

70.1 % 71.4 % 69.5 % Operating expenses: Research and

development 8,455 6,497 23,263 21,569 Sales, general and

administrative 35,320 28,764 95,745 82,151 Licensing income and

litigation settlement - - -

(924 ) Total operating expenses 43,775 35,261 119,008

102,796 Operating income (EBIT) 5,088 2,289 13,906 6,832

Other loss, net (3,799 ) (3,013 )

(8,498 ) (5,487 ) Income (loss) before income taxes

1,289 (724 ) 5,408 1,345 Income tax provision (benefit)

347 (483 ) 1,208 298

Net income (loss) $ 942 $ (241 ) $ 4,200 $ 1,047

Net income (loss) per share: Basic $ 0.07 $

(0.01 ) $ 0.28 $ 0.06 Diluted $ 0.07 $ (0.01 )

$ 0.27 $ 0.06 Weighted average common and

potential common shares outstanding: Basic 13,676

17,308 14,844 17,203

Diluted 14,147 17,308 15,347

17,650 Reconciliation of Non-GAAP

Measures: Operating income (EBIT) $ 5,088 $ 2,289 $ 13,906 $ 6,832

Adjustments to EBIT: Acquisiton and integration costs 752

2,601 3,257 3,180 Restructuring and other non-recurring charges

1,484 - 1,484 -

Non-GAAP Adjusted EBIT 7,324 4,890 18,647

10,012 Other loss, net (3,799 ) (3,013 ) (8,498 ) (5,487 )

Adjusted income before income taxes 3,525 1,877 10,149 4,525

Adjusted income tax provision 948 1,253

2,267 1,003 Adjusted net

income $ 2,577 $ 624 $ 7,882 $ 3,522

Non-GAAP Adjusted net income per share, diluted $ 0.18

$ 0.04 $ 0.51 $ 0.20 Non-GAAP

Adjusted EBIT $ 7,324 $ 4,890 $ 18,647

$ 10,012 Adjustments for EBITDAS: Depreciation and

amortization 2,528 1,537 5,818 3,648 Stock-based compensation

2,037 1,258 4,245

4,983 Non-GAAP Adjusted EBITDAS $ 11,889 $

7,685 $ 28,710 $ 18,643

Condensed

Consolidated Balance Sheets (in thousands) (unaudited)

September 30, December 31, 2010 2009

Cash and cash equivalents $ 71,749 $ 183,065 Short-term

investment securities - 74,682 Accounts receivable, net 68,918

71,347 Inventories 38,506 32,216 Deferred tax asset, current 8,183

7,350 Prepaid expenses and other current assets 15,862

12,034 Total current assets 203,218 380,694

Property and equipment, net 9,615 9,160 Investment in

Carticept 8,000 - Deferred tax asset, net 738 775 Intangible

assets, net 90,858 27,920 Other assets 5,139

4,425 Total assets $ 317,568 $ 422,974

Accounts payable $ 9,110 $ 6,175 Accrued expenses 28,920 25,923

Deferred revenue 5,799 5,504 Total

current liabilities 43,829 37,602 Long-term debt, net 96,245

92,905 Deferred tax liability, net 5,268 5,083 Deferred revenue

15,777 18,081 Other non-current liabilities 16,319

14,873 Total liabilities 177,438 168,544

Shareholders' equity: Common stock and additional paid-in

capital 295,405 287,537 Accumulated deficit (154,747 ) (32,753 )

Accumulated other comprehensive loss (528 ) (354 )

Total shareholders' equity 140,130 254,430

Total liabilities and shareholders' equity $ 317,568

$ 422,974

Condensed Consolidated Statements of

Cash Flow (in thousands) (unaudited) Nine Months Ended

September 30, 2010 2009 Operating activities: Net income $

4,200 $ 1,047 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

5,818 3,648 Stock-based compensation 4,245 4,983 Deferred income

tax provision (1,918) 1,216 Amortization of debt discount and debt

issuance costs 4,335 3,792 Non-cash gain on litigation settlement -

(924) Gain on convertible debt repurchase - (1,339) Other

adjustments (847) 436 Changes in working capital 1,671 (3,949) Net

cash provided by operating activities 17,504 8,910 Investing

activities: Purchase of investment securities, net 74,777 33,939

Purchases of property and equipment (1,898) (2,290) Investment in

Carticept Medical Inc. (8,000) - Purchase of VisualSonic, Inc, net

of cash acquired (61,217)

-

Purchase of Cardio Dynamics, net of cash acquired - (8,185) Payment

of LumenVu contingent consideration (425) - Earn-out consideration

for SonoMetric acquisition

-

(387) Net cash provided by investing activities 3,237 23,077

Financing activities: Excess tax benefit from stock-based

compensation 847 - Proceeds from exercise of stock based awards

4,263 2,828 Minimum tax withholding on stock-based awards (1,065)

(1,285) Stock repurchase including transaction costs (126,104) -

Repayment of VisualSonics, Inc. long-term debt (8,871) - Purchase

of convertible debt - (25,750) Purchase of warrants - (1,325) Net

cash used in financing activities (130,930) (25,532) Effect

of exchange rate changes on cash and cash equivalents (1,127)

(4,679) Net change in cash and cash equivalents (111,316)

1,776 Cash and cash equivalents at beginning of period 183,065

209,258 Cash and cash equivalents at end of period $ 71,749 $

211,034

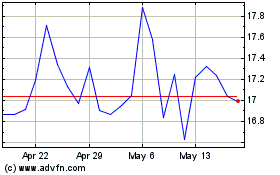

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jun 2024 to Jul 2024

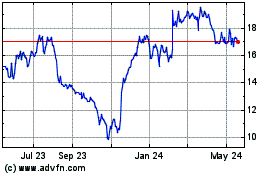

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Jul 2023 to Jul 2024