0000718937false00007189372024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 7, 2024

STAAR Surgical Company

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware |

0-11634 |

95-3797439 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

25510 Commercentre Drive Lake Forest, California |

|

92630 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 626-303-7902

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common |

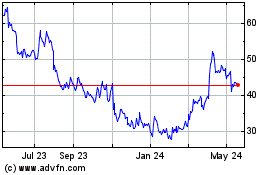

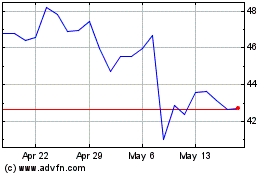

STAA |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1 933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, STAAR Surgical Company (the “Company”) published a press release reporting its financial results for the quarter ended June 28, 2024, a copy of which is furnished as Exhibit 99.1 to this report and is incorporated herein by this reference.

Item 7.01 Regulation FD Disclosure.

During a conference call and webcast scheduled to be held at 4:15 p.m. Eastern / 1:15 p.m. Pacific on August 7, 2024, the Company’s Chair of the Board, President and Chief Executive Officer, and the Company's Chief Financial Officer will discuss the Company’s results for the quarter ended June 28, 2024 and the Company’s outlook for fiscal year 2024. The Company’s slide presentation for the conference call and webcast is furnished as Exhibit 99.2 to this Current Report.

The information furnished herewith pursuant to Items 2.02 and 7.01 of this Current Report, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in Items 2.02 and 7.01 of this Current Report shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

STAAR Surgical Company |

|

August 7, 2024 |

By: |

/s/ Tom Frinzi |

|

|

Thomas G. Frinzi |

|

|

President and Chief Executive Officer |

STAAR Surgical Reports Second Quarter 2024 Results

Record Quarterly Net Sales of $99.0 Million; $100.4 Million in Constant Currency

Raises Fiscal 2024 Net Sales and Adjusted EBITDA Outlook

LAKE FOREST, CA, August 7, 2024 --- STAAR Surgical Company (NASDAQ: STAA), a leading developer, manufacturer and marketer of the EVO family of Implantable Collamer® Lenses (EVO ICL™) for myopia, astigmatism and presbyopia, today reported financial results for the second quarter ended June 28, 2024.

Second Quarter 2024 Overview

•Net sales up 7% to $99.0 million and up 9% to $100.4 million in constant currency

•ICL sales up 7% to $99.4 million and units up 3%

•Gross margin at 79.2% vs. 76.6% year ago

•Net income of $7.4 million or $0.15 per share vs. net income of $6.1 million or $0.12 per share year ago

•Adjusted EBITDA of $22.5 million or $0.45 per share vs. $18.3 million or $0.37 per share year ago

•Cash, cash equivalents and investments available for sale of $235.5 million at June 28, 2024

“STAAR Surgical reported record net sales for the second quarter of 2024, including milestone sales over $100 million on a constant currency basis,” said Tom Frinzi, President and CEO of STAAR Surgical. “We are committed to enhancing surgeon confidence and practice implementation, growing the category and seizing market share throughout the business cycle. For our surgeon customers globally, our EVO ICL technology is increasingly instrumental in enhancing their offerings, market competitiveness and practice economics. As a result, our commercial momentum is accelerating – as evidenced by these latest financial results, which are due to execution against our vital few strategic priorities.”

Mr. Frinzi continued, “For the second quarter, our ICL growth exceeded the market in all key geographies. U.S. sales were $5.5 million, up 25% year over year and 10% sequentially. In APAC, we generated 6% sales growth, including 3% growth in China. Rounding out our global performance, EMEA was also strong with sales growth of 10% in the second quarter. STAAR is truly disrupting the refractive industry to benefit our surgeon customers, their patients and our shareholders. We are moving down the diopter curve and as a result are beginning to realize our near-term goal of becoming the choice for surgeons and their patients -6D of myopia and above. Given our momentum and the opportunity before us, we are raising our outlook for net sales, now to be in the range of $340 million to $345 million and Adjusted EBITDA to be approximately $42 million for fiscal 2024.”

Second Quarter 2024 Financial Results

Net sales were $99.0 million for the second quarter of 2024, up 7% compared to $92.3 million reported in the prior year quarter. The sales increase in the second quarter was driven by ICL sales growth of $6.3 million, up 7%, and unit growth of 3% as compared to the prior year period. Other Product sales were up $0.4 million as compared to the prior year period.

Gross profit margin for the second quarter of 2024 was 79.2% of net sales compared to the prior year quarter of 76.6% of net sales. Gross margin in the second quarter was favorably impacted primarily due to changes in reserves related to cataract IOLs in the prior year quarter. The Company exited its cataract IOL business in fiscal 2023.

Operating expenses for the second quarter of 2024 were $66.5 million compared to the prior year quarter of $62.1 million. General and administrative expenses were $23.6 million compared to the prior year quarter of $18.1 million.

The increase in general and administrative expenses was due to increased compensation-related expenses, facilities costs and outside services. Selling and marketing expenses were $28.8 million compared to the prior year quarter of $32.3 million. The decrease in selling and marketing expenses was due to lower marketing, promotion and advertising activities. Research and development expenses were $14.1 million compared to the prior year quarter of $11.8 million. The increase in research and development expenses was due primarily to increased compensation-related expenses partially offset by lower clinical trial costs.

Operating income for the second quarter of 2024 was $11.9 million or 12.0% of net sales as compared to operating income of $8.6 million or 9.3% of net sales for the second quarter of 2023.

Net income for the second quarter of 2024 was $7.4 million or $0.15 income per share compared with net income of $6.1 million or $0.12 income per share for the prior year quarter. The increase in net income was attributable to higher sales and gross profit, partially offset by higher operating expense and loss on foreign currency transactions.

Cash, cash equivalents and investments available for sale at June 28, 2024, totaled $235.5 million, compared to $232.4 million at December 29, 2023.

Outlook

The Company raised its outlook for fiscal year 2024 net sales and Adjusted EBITDA. The Company now expects the following for fiscal year 2024:

•Net sales of $340 million to $345 million, increased from prior outlook for net sales of $335 million to $340 million.

•Adjusted EBITDA of approximately $42 million and Adjusted EBITDA per diluted share of approximately $0.80, increased from prior outlook of Adjusted EBITDA of approximately $39 million and Adjusted EBITDA per diluted share of approximately $0.75.

The outlook above contemplates EVO ICL sales growth in the Americas of 15% including 25% in the U.S. (prior outlook was 10%); EMEA sales growth of 6% (prior outlook was for sales consistent with fiscal year 2023); and APAC growth of 7%, including approximately 10% in China.

Earnings Webcast

The Company will host an earnings webcast today, Wednesday, August 7 at 4:15 p.m. Eastern / 1:15 p.m. Pacific to discuss its financial results and operational progress. To access the webcast please use the following link: https://staar-surgical-2q24-earnings.open-exchange.net/

The live webcast, earnings webcast presentation and an archived version of the webcast can be accessed from the investor relations section of the STAAR website at www.staar.com.

Use of Non-GAAP Financial Measures

To supplement the Company’s financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this press release and the accompanying tables include certain non-GAAP financial measures, including Adjusted EBITDA. Management uses these non-GAAP financial measures in its evaluation of Company operating performance and believes investors will find them useful in evaluating the Company’s operating performance, including cash flow generation, and in analyzing period-to-period financial performance of core business operations and underlying business trends. Non-GAAP financial measures are in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

EBITDA is a non-GAAP financial measure, which is calculated by adding interest income and expense, net; provision for income taxes; and depreciation and amortization to net income. In calculating Adjusted EBITDA and Adjusted EBITDA per diluted share, the Company further adjusts for stock-based compensation expense. As stock-based compensation is a non-cash expense that can vary significantly based on the timing, size and nature of awards granted, the Company believes that the exclusion of stock-based compensation expense can assist investors in comparisons of Company operating results with other peer companies because (i) the amount of such expense in any specific period may not directly correlate to the underlying performance of our business operations and (ii) such expense can vary significantly between periods as a result of the timing of grants of new stock-based awards, including inducement grants in connection with hiring. Additionally, the Company believes that excluding stock-based compensation from Adjusted EBITDA and Adjusted EBITDA per diluted share assists management and investors in making meaningful comparisons between the Company’s operating performance and the operating performance of other companies that may use different forms of employee compensation or different valuation methodologies for their stock-based compensation. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods. Investors should also note that such expenses will recur in the future.

The Company also presents certain financial information on a constant currency basis, which is intended to exclude the effects of foreign currency fluctuations. The Company conducts a significant part of its activities outside the U.S. It receives sales revenue and pays expenses principally in U.S. dollars, Swiss francs, Japanese yen and euros. The exchange rates between dollars and non-U.S. currencies can fluctuate greatly and can have a significant effect on the Company’s results when reported in U.S. dollars. In order to compare the Company's performance from period to period without the effect of currency, the Company will apply the same average exchange rate applicable in the prior period, or the “constant currency” rate to sales or expenses in the current period as well.

In the tables provided below, the Company has included a reconciliation of Adjusted EBITDA and Adjusted EBITDA per diluted share to net income and net income per diluted share, the most directly comparable GAAP financial measure, as well as supplemental financial information with net sales expressed in constant currency. The Company has also provided a reconciliation of forward-looking Adjusted EBITDA and Adjusted EBITDA per diluted share to net income and net income per diluted share. This represents forward-looking information, and actual results may vary. Please see the risks and assumptions referred to in the Safe Harbor section of this press release.

About STAAR Surgical

STAAR, which has been dedicated solely to ophthalmic surgery for over 40 years, designs, develops, manufactures and markets implantable lenses for the eye. These lenses are intended to provide visual freedom for patients, lessening or eliminating the reliance on glasses or contact lenses. All of these lenses are foldable, which permits the surgeon to insert them through a small incision. STAAR’s lens used in refractive surgery is called an Implantable Collamer® Lens or “ICL,” which includes the EVO ICL™ product line. More than 3,000,000 ICLs have been sold to date and STAAR markets these lenses in over 75 countries. To learn more about the ICL go to: EVOICL.com. Headquartered in Lake Forest, CA, the company operates manufacturing and packaging facilities in Aliso Viejo, CA, Monrovia, CA and Nidau, Switzerland. For more information, please visit the Company’s website at www.staar.com.

Safe Harbor

All statements that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections, anticipated financial results, estimates and outlook (including as to net sales, Adjusted EBITDA, and Adjusted EBITDA per diluted share), plans, strategies, and objectives of management for 2024 and beyond or prospects for achieving such plans, expectations for sales, revenue, margin, expenses or earnings, and any statements of assumptions underlying any of the foregoing, including those relating to financial performance in the upcoming quarter, fiscal year 2024 and beyond. Important factors that could cause actual results

to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to global economic conditions, as well as the factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 29, 2023 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this press release and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the impact of COVID-19; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before or after approval, or to take enforcement action; international conflicts, trade disputes and substantial dependence on demand from Asia; and the willingness of surgeons and patients to adopt a new or improved product and procedure.

We intend to use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Such disclosures will be included on our website in the ‘Investor Relations’ sections. Accordingly, investors should monitor such portions of our website, in addition to following our press releases, SEC filings and public conference calls and webcasts.

|

|

CONTACT: |

Investors & Media |

|

Brian Moore |

|

Vice President, Investor Relations and Corporate Development |

|

(626) 303-7902, Ext. 3023 |

|

bmoore@staar.com |

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

|

(in 000's) |

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

June 28, 2024 |

|

|

December 29, 2023 |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

192,776 |

|

|

$ |

183,038 |

|

Investments available for sale |

|

|

42,424 |

|

|

|

37,688 |

|

Accounts receivable trade, net |

|

|

93,800 |

|

|

|

94,704 |

|

Inventories, net |

|

|

39,282 |

|

|

|

35,130 |

|

Prepayments, deposits, and other current assets |

|

|

15,535 |

|

|

|

14,709 |

|

Total current assets |

|

|

383,817 |

|

|

|

365,269 |

|

Investments available for sale |

|

|

265 |

|

|

|

11,703 |

|

Property, plant, and equipment, net |

|

|

77,500 |

|

|

|

66,835 |

|

Finance lease right-of-use assets, net |

|

|

109 |

|

|

|

183 |

|

Operating lease right-of-use assets, net |

|

|

34,971 |

|

|

|

34,387 |

|

Goodwill |

|

|

1,786 |

|

|

|

1,786 |

|

Deferred income taxes |

|

|

5,078 |

|

|

|

5,190 |

|

Other assets |

|

|

9,219 |

|

|

|

3,339 |

|

Total assets |

|

$ |

512,745 |

|

|

$ |

488,692 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

19,059 |

|

|

$ |

13,557 |

|

Obligations under finance leases |

|

|

125 |

|

|

|

165 |

|

Obligations under operating leases |

|

|

4,648 |

|

|

|

4,202 |

|

Allowance for sales returns |

|

|

7,225 |

|

|

|

6,174 |

|

Other current liabilities |

|

|

35,113 |

|

|

|

40,938 |

|

Total current liabilities |

|

|

66,170 |

|

|

|

65,036 |

|

|

|

|

|

|

|

|

Obligations under finance leases |

|

|

- |

|

|

|

42 |

|

Obligations under operating leases |

|

|

31,499 |

|

|

|

31,425 |

|

Deferred income taxes |

|

|

1,056 |

|

|

|

1,077 |

|

Asset retirement obligations |

|

|

109 |

|

|

|

103 |

|

Pension liability |

|

|

4,808 |

|

|

|

5,055 |

|

Total liabilities |

|

|

103,642 |

|

|

|

102,738 |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock |

|

|

492 |

|

|

|

488 |

|

Additional paid-in capital |

|

|

457,402 |

|

|

|

436,947 |

|

Accumulated other comprehensive loss |

|

|

(5,463 |

) |

|

|

(4,113 |

) |

Accumulated deficit |

|

|

(43,328 |

) |

|

|

(47,368 |

) |

Total stockholders' equity |

|

|

409,103 |

|

|

|

385,954 |

|

Total liabilities and stockholders' equity |

|

$ |

512,745 |

|

|

$ |

488,692 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's except for per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year to Date |

|

|

|

% of Sales |

|

|

June 28, 2024 |

|

|

% of Sales |

|

|

June 30, 2023 |

|

|

Fav (Unfav) Amount |

|

|

% |

|

|

% of Sales |

|

|

June 28, 2024 |

|

|

% of Sales |

|

|

June 30, 2023 |

|

|

Fav (Unfav) Amount |

|

|

% |

|

Net sales |

|

|

100.0 |

% |

|

$ |

99,005 |

|

|

|

100.0 |

% |

|

$ |

92,306 |

|

|

$ |

6,699 |

|

|

|

7.3 |

% |

|

|

100.0 |

% |

|

$ |

176,361 |

|

|

|

100.0 |

% |

|

$ |

165,834 |

|

|

$ |

10,527 |

|

|

|

6.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

20.8 |

% |

|

|

20,593 |

|

|

|

23.4 |

% |

|

|

21,580 |

|

|

|

987 |

|

|

|

4.6 |

% |

|

|

20.9 |

% |

|

|

36,914 |

|

|

|

22.6 |

% |

|

|

37,546 |

|

|

|

632 |

|

|

|

1.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

79.2 |

% |

|

|

78,412 |

|

|

|

76.6 |

% |

|

|

70,726 |

|

|

|

7,686 |

|

|

|

10.9 |

% |

|

|

79.1 |

% |

|

|

139,447 |

|

|

|

77.4 |

% |

|

|

128,288 |

|

|

|

11,159 |

|

|

|

8.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

23.9 |

% |

|

|

23,641 |

|

|

|

19.6 |

% |

|

|

18,097 |

|

|

|

(5,544 |

) |

|

|

(30.6 |

)% |

|

|

26.6 |

% |

|

|

46,869 |

|

|

|

21.8 |

% |

|

|

36,195 |

|

|

|

(10,674 |

) |

|

|

(29.5 |

)% |

Selling and marketing |

|

|

29.1 |

% |

|

|

28,819 |

|

|

|

35.0 |

% |

|

|

32,277 |

|

|

|

3,458 |

|

|

|

10.7 |

% |

|

|

31.5 |

% |

|

|

55,527 |

|

|

|

35.4 |

% |

|

|

58,631 |

|

|

|

3,104 |

|

|

|

5.3 |

% |

Research and development |

|

|

14.2 |

% |

|

|

14,054 |

|

|

|

12.7 |

% |

|

|

11,755 |

|

|

|

(2,299 |

) |

|

|

(19.6 |

)% |

|

|

15.6 |

% |

|

|

27,434 |

|

|

|

13.3 |

% |

|

|

22,065 |

|

|

|

(5,369 |

) |

|

|

(24.3 |

)% |

Total selling, general, and administrative expenses |

|

|

67.2 |

% |

|

|

66,514 |

|

|

|

67.3 |

% |

|

|

62,129 |

|

|

|

(4,385 |

) |

|

|

(7.1 |

)% |

|

|

73.7 |

% |

|

|

129,830 |

|

|

|

70.5 |

% |

|

|

116,891 |

|

|

|

(12,939 |

) |

|

|

(11.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

12.0 |

% |

|

|

11,898 |

|

|

|

9.3 |

% |

|

|

8,597 |

|

|

|

3,301 |

|

|

|

38.4 |

% |

|

|

5.4 |

% |

|

|

9,617 |

|

|

|

6.9 |

% |

|

|

11,397 |

|

|

|

(1,780 |

) |

|

|

(15.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

1.4 |

% |

|

|

1,422 |

|

|

|

1.9 |

% |

|

|

1,775 |

|

|

|

(353 |

) |

|

|

(19.9 |

)% |

|

|

1.7 |

% |

|

|

2,951 |

|

|

|

2.2 |

% |

|

|

3,597 |

|

|

|

(646 |

) |

|

|

(18.0 |

)% |

Loss on foreign currency transactions |

|

|

-3.1 |

% |

|

|

(3,049 |

) |

|

|

-2.0 |

% |

|

|

(1,890 |

) |

|

|

(1,159 |

) |

|

|

(61.3 |

)% |

|

|

-3.0 |

% |

|

|

(5,346 |

) |

|

|

-1.1 |

% |

|

|

(1,856 |

) |

|

|

(3,490 |

) |

|

|

(188.0 |

)% |

Royalty income |

|

|

0.0 |

% |

|

|

- |

|

|

|

0.0 |

% |

|

|

- |

|

|

|

- |

|

|

|

0.0 |

% |

|

|

0.3 |

% |

|

|

508 |

|

|

|

0.0 |

% |

|

|

- |

|

|

|

508 |

|

|

|

0.0 |

% |

Other income, net |

|

|

0.1 |

% |

|

|

63 |

|

|

|

0.0 |

% |

|

|

10 |

|

|

|

53 |

|

|

|

530.0 |

% |

|

|

0.2 |

% |

|

|

393 |

|

|

|

0.0 |

% |

|

|

73 |

|

|

|

320 |

|

|

|

438.4 |

% |

Total other income (expense), net |

|

|

-1.6 |

% |

|

|

(1,564 |

) |

|

|

-0.1 |

% |

|

|

(105 |

) |

|

|

(1,459 |

) |

|

|

(1389.5 |

)% |

|

|

-0.8 |

% |

|

|

(1,494 |

) |

|

|

1.1 |

% |

|

|

1,814 |

|

|

|

(3,308 |

) |

|

|

(182.4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

|

10.4 |

% |

|

|

10,334 |

|

|

|

9.2 |

% |

|

|

8,492 |

|

|

|

1,842 |

|

|

|

21.7 |

% |

|

|

4.6 |

% |

|

|

8,123 |

|

|

|

8.0 |

% |

|

|

13,211 |

|

|

|

(5,088 |

) |

|

|

(38.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

3.0 |

% |

|

|

2,955 |

|

|

|

2.6 |

% |

|

|

2,428 |

|

|

|

(527 |

) |

|

|

(21.7 |

)% |

|

|

2.3 |

% |

|

|

4,083 |

|

|

|

2.7 |

% |

|

|

4,437 |

|

|

|

354 |

|

|

|

8.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

7.4 |

% |

|

|

7,379 |

|

|

|

6.6 |

% |

|

|

6,064 |

|

|

|

1,315 |

|

|

|

21.7 |

% |

|

|

2.3 |

% |

|

|

4,040 |

|

|

|

5.3 |

% |

|

|

8,774 |

|

|

|

(4,734 |

) |

|

|

(54.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share - basic |

|

|

|

|

|

0.15 |

|

|

|

|

|

|

0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

0.08 |

|

|

|

|

|

|

0.18 |

|

|

|

|

|

|

|

Net income per share - diluted |

|

|

|

|

|

0.15 |

|

|

|

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

0.08 |

|

|

|

|

|

|

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

|

|

|

49,127 |

|

|

|

|

|

|

48,418 |

|

|

|

|

|

|

|

|

|

|

|

|

49,018 |

|

|

|

|

|

|

48,333 |

|

|

|

|

|

|

|

Weighted average shares outstanding - diluted |

|

|

|

|

|

49,811 |

|

|

|

|

|

|

49,516 |

|

|

|

|

|

|

|

|

|

|

|

|

49,529 |

|

|

|

|

|

|

49,524 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's) |

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year to Date |

|

|

|

June 28, 2024 |

|

|

June 30, 2023 |

|

|

June 28, 2024 |

|

|

June 30, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

7,379 |

|

|

$ |

6,064 |

|

|

$ |

4,040 |

|

|

$ |

8,774 |

|

Adjustments to reconcile net income to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

1,522 |

|

|

|

1,285 |

|

|

|

2,759 |

|

|

|

2,398 |

|

Amortization of long-lived intangibles |

|

|

- |

|

|

|

164 |

|

|

|

- |

|

|

|

171 |

|

Accretion/Amortization of investments available for sale |

|

|

(166 |

) |

|

|

(841 |

) |

|

|

(286 |

) |

|

|

(1,824 |

) |

Deferred income taxes |

|

|

(1 |

) |

|

|

18 |

|

|

|

60 |

|

|

|

75 |

|

Change in net pension liability |

|

|

(53 |

) |

|

|

(614 |

) |

|

|

(146 |

) |

|

|

(627 |

) |

Stock-based compensation expense |

|

|

9,042 |

|

|

|

8,423 |

|

|

|

15,381 |

|

|

|

14,488 |

|

Change in asset retirement obligation |

|

|

20 |

|

|

|

(107 |

) |

|

|

20 |

|

|

|

(107 |

) |

Loss on disposal of property and equipment |

|

|

26 |

|

|

|

24 |

|

|

|

26 |

|

|

|

24 |

|

Provision for sales returns and bad debts |

|

|

951 |

|

|

|

1,381 |

|

|

|

1,079 |

|

|

|

1,004 |

|

Inventory provision |

|

|

378 |

|

|

|

3,016 |

|

|

|

1,024 |

|

|

|

3,630 |

|

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(29,401 |

) |

|

|

(31,234 |

) |

|

|

436 |

|

|

|

(32,344 |

) |

Inventories |

|

|

(869 |

) |

|

|

(462 |

) |

|

|

(4,871 |

) |

|

|

(4,382 |

) |

Prepayments, deposits and other assets |

|

|

(1,600 |

) |

|

|

1,584 |

|

|

|

(7,085 |

) |

|

|

(2,665 |

) |

Accounts payable |

|

|

2,099 |

|

|

|

1,721 |

|

|

|

3,618 |

|

|

|

(1,447 |

) |

Other current liabilities |

|

|

260 |

|

|

|

3,272 |

|

|

|

(4,788 |

) |

|

|

1,432 |

|

Net cash provided by (used in) operating activities |

|

|

(10,413 |

) |

|

|

(6,306 |

) |

|

|

11,267 |

|

|

|

(11,400 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of property and equipment |

|

|

(6,236 |

) |

|

|

(3,014 |

) |

|

|

(11,438 |

) |

|

|

(5,915 |

) |

Purchase of investments available for sale |

|

|

(20,249 |

) |

|

|

(15,157 |

) |

|

|

(20,249 |

) |

|

|

(42,602 |

) |

Proceeds from sale or maturity of investments available for sale |

|

|

5,817 |

|

|

|

28,343 |

|

|

|

27,206 |

|

|

|

68,622 |

|

Net provided by (used in) investing activities |

|

|

(20,668 |

) |

|

|

10,172 |

|

|

|

(4,481 |

) |

|

|

20,105 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Repayment of finance lease obligations |

|

|

(42 |

) |

|

|

(40 |

) |

|

|

(82 |

) |

|

|

(82 |

) |

Repurchase of employee common stock for taxes withheld |

|

|

(167 |

) |

|

|

(135 |

) |

|

|

(1,396 |

) |

|

|

(1,984 |

) |

Proceeds from vested restricted stock and exercise of stock options |

|

|

372 |

|

|

|

1,477 |

|

|

|

5,697 |

|

|

|

2,007 |

|

Net cash provided by (used in) financing activities |

|

|

163 |

|

|

|

1,302 |

|

|

|

4,219 |

|

|

|

(59 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

(330 |

) |

|

|

(441 |

) |

|

|

(1,267 |

) |

|

|

(431 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

|

(31,248 |

) |

|

|

4,727 |

|

|

|

9,738 |

|

|

|

8,215 |

|

Cash and cash equivalents, at beginning of the period |

|

|

224,024 |

|

|

|

89,968 |

|

|

|

183,038 |

|

|

|

86,480 |

|

Cash and cash equivalents, at end of the period |

|

$ |

192,776 |

|

|

$ |

94,695 |

|

|

$ |

192,776 |

|

|

$ |

94,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's except for per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

|

Q1-22 |

|

|

Q2-22 |

|

|

Q3-22 |

|

|

Q4-22 |

|

|

2022 |

|

|

Q1-23 |

|

|

Q2-23 |

|

|

Q3-23 |

|

|

Q4-23 |

|

|

2023 |

|

|

Q1-24 |

|

|

Q2-24 |

|

|

2024 Outlook(2) |

|

Net income (loss) - (as reported) |

|

$ |

27,511 |

|

|

$ |

9,602 |

|

|

$ |

13,038 |

|

|

$ |

10,262 |

|

|

$ |

6,763 |

|

|

$ |

39,665 |

|

|

$ |

2,710 |

|

|

$ |

6,064 |

|

|

$ |

4,817 |

|

|

$ |

7,756 |

|

|

$ |

21,347 |

|

|

$ |

(3,339 |

) |

|

$ |

7,379 |

|

|

$ |

- |

|

Provision (benefit) for income taxes |

|

|

3,793 |

|

|

|

1,925 |

|

|

|

2,431 |

|

|

|

2,315 |

|

|

|

(784 |

) |

|

|

5,887 |

|

|

|

2,009 |

|

|

|

2,428 |

|

|

|

1,929 |

|

|

|

5,983 |

|

|

|

12,349 |

|

|

|

1,128 |

|

|

|

2,955 |

|

|

|

5,100 |

|

Other (income) expense, net |

|

|

2,035 |

|

|

|

586 |

|

|

|

1,551 |

|

|

|

1,128 |

|

|

|

(5,015 |

) |

|

|

(1,750 |

) |

|

|

(1,919 |

) |

|

|

105 |

|

|

|

(451 |

) |

|

|

(3,334 |

) |

|

|

(5,599 |

) |

|

|

(70 |

) |

|

|

1,564 |

|

|

|

(2,100 |

) |

Depreciation |

|

|

3,608 |

|

|

|

994 |

|

|

|

1,030 |

|

|

|

1,077 |

|

|

|

1,380 |

|

|

|

4,481 |

|

|

|

1,113 |

|

|

|

1,285 |

|

|

|

1,345 |

|

|

|

1,368 |

|

|

|

5,111 |

|

|

|

1,237 |

|

|

|

1,522 |

|

|

|

5,800 |

|

Amortization of intangible assets |

|

|

34 |

|

|

|

8 |

|

|

|

7 |

|

|

|

7 |

|

|

|

6 |

|

|

|

28 |

|

|

|

7 |

|

|

|

10 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

13 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Stock-based compensation |

|

|

14,605 |

|

|

|

3,894 |

|

|

|

5,754 |

|

|

|

5,727 |

|

|

|

4,996 |

|

|

|

20,371 |

|

|

|

6,065 |

|

|

|

8,423 |

|

|

|

8,846 |

|

|

|

182 |

|

|

|

23,516 |

|

|

|

6,339 |

|

|

|

9,042 |

|

|

|

33,000 |

|

Adjusted EBITDA |

|

$ |

51,586 |

|

|

$ |

17,009 |

|

|

$ |

23,811 |

|

|

$ |

20,516 |

|

|

$ |

7,346 |

|

|

$ |

68,682 |

|

|

$ |

9,985 |

|

|

$ |

18,315 |

|

|

$ |

16,484 |

|

|

$ |

11,953 |

|

|

$ |

56,737 |

|

|

$ |

5,295 |

|

|

$ |

22,462 |

|

|

$ |

41,800 |

|

Adjusted EBITDA as a % of Revenue |

|

|

22.4 |

% |

|

|

26.9 |

% |

|

|

29.4 |

% |

|

|

27.0 |

% |

|

|

11.5 |

% |

|

|

24.2 |

% |

|

|

13.6 |

% |

|

|

19.8 |

% |

|

|

20.5 |

% |

|

|

15.7 |

% |

|

|

17.6 |

% |

|

|

6.8 |

% |

|

|

22.7 |

% |

|

|

12.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, diluted - (as reported) |

|

$ |

0.56 |

|

|

$ |

0.19 |

|

|

$ |

0.26 |

|

|

$ |

0.21 |

|

|

$ |

0.14 |

|

|

$ |

0.80 |

|

|

$ |

0.05 |

|

|

$ |

0.12 |

|

|

$ |

0.10 |

|

|

$ |

0.16 |

|

|

$ |

0.43 |

|

|

$ |

(0.07 |

) |

|

$ |

0.15 |

|

|

$ |

- |

|

Provision (benefit) for income taxes |

|

|

0.08 |

|

|

|

0.04 |

|

|

|

0.05 |

|

|

|

0.05 |

|

|

|

(0.02 |

) |

|

|

0.12 |

|

|

|

0.04 |

|

|

|

0.05 |

|

|

|

0.04 |

|

|

|

0.12 |

|

|

|

0.25 |

|

|

|

0.02 |

|

|

|

0.06 |

|

|

|

0.10 |

|

Other (income) expense, net |

|

|

0.04 |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.02 |

|

|

|

(0.10 |

) |

|

|

(0.04 |

) |

|

|

(0.04 |

) |

|

|

- |

|

|

|

(0.01 |

) |

|

|

(0.07 |

) |

|

|

(0.11 |

) |

|

|

- |

|

|

|

0.03 |

|

|

|

(0.04 |

) |

Depreciation |

|

|

0.07 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.09 |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.10 |

|

|

|

0.03 |

|

|

|

0.03 |

|

|

|

0.11 |

|

Amortization of intangible assets |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Stock-based compensation |

|

|

0.30 |

|

|

|

0.08 |

|

|

|

0.12 |

|

|

|

0.12 |

|

|

|

0.10 |

|

|

|

0.41 |

|

|

|

0.12 |

|

|

|

0.17 |

|

|

|

0.18 |

|

|

|

- |

|

|

|

0.48 |

|

|

|

0.13 |

|

|

|

0.18 |

|

|

|

0.63 |

|

Adjusted EBITDA per share, diluted(1) |

|

$ |

1.04 |

|

|

$ |

0.35 |

|

|

$ |

0.48 |

|

|

$ |

0.41 |

|

|

$ |

0.15 |

|

|

$ |

1.39 |

|

|

$ |

0.20 |

|

|

$ |

0.37 |

|

|

$ |

0.33 |

|

|

$ |

0.24 |

|

|

$ |

1.15 |

|

|

$ |

0.11 |

|

|

$ |

0.45 |

|

|

$ |

0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - Diluted |

|

|

49,456 |

|

|

|

49,288 |

|

|

|

49,223 |

|

|

|

49,549 |

|

|

|

49,389 |

|

|

|

49,380 |

|

|

|

49,500 |

|

|

|

49,516 |

|

|

|

49,370 |

|

|

|

49,242 |

|

|

|

49,427 |

|

|

|

49,275 |

|

|

|

49,811 |

|

|

|

52,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted EBITDA per diluted share may not add due to rounding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) 2024 Adjusted EBITDA Outlook line items are all approximations and assumes breakeven Net Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ICL Sales by Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year |

|

|

Three Months Ended |

|

ICL Sales by Region(5) |

|

2021 |

|

|

2022 |

|

|

2023 |

|

|

March 31, 2023 |

|

|

June 30, 2023 |

|

|

September 29, 2023 |

|

|

December 29, 2023 |

|

|

March 29, 2024 |

|

|

June 28, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas(1) |

|

$ |

14,054 |

|

|

$ |

20,114 |

|

|

$ |

22,233 |

|

|

$ |

5,566 |

|

|

$ |

5,954 |

|

|

$ |

5,449 |

|

|

$ |

5,264 |

|

|

$ |

6,260 |

|

|

$ |

6,794 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA(2) |

|

|

37,343 |

|

|

|

36,715 |

|

|

|

39,318 |

|

|

|

10,180 |

|

|

|

9,782 |

|

|

|

9,253 |

|

|

|

10,103 |

|

|

|

11,299 |

|

|

|

10,727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APAC(3) |

|

|

161,508 |

|

|

|

212,883 |

|

|

|

257,876 |

|

|

|

54,879 |

|

|

|

77,376 |

|

|

|

66,367 |

|

|

|

59,254 |

|

|

|

59,592 |

|

|

|

81,844 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global ICL Sales |

|

$ |

212,905 |

|

|

$ |

269,712 |

|

|

$ |

319,427 |

|

|

$ |

70,625 |

|

|

$ |

93,112 |

|

|

$ |

81,069 |

|

|

$ |

74,621 |

|

|

$ |

77,151 |

|

|

$ |

99,365 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global ICL Sales Growth |

|

|

51 |

% |

|

|

27 |

% |

|

|

18 |

% |

|

|

20 |

% |

|

|

19 |

% |

|

|

13 |

% |

|

|

22 |

% |

|

|

9 |

% |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas ICL Sales Growth |

|

|

59 |

% |

|

|

43 |

% |

|

|

11 |

% |

|

|

42 |

% |

|

|

12 |

% |

|

|

5 |

% |

|

|

(8 |

)% |

|

|

12 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA ICL Sales Growth |

|

|

45 |

% |

|

|

(2 |

)% |

|

|

7 |

% |

|

|

12 |

% |

|

|

(11 |

)% |

|

|

14 |

% |

|

|

18 |

% |

|

|

11 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APAC ICL Sales Growth |

|

|

51 |

% |

|

|

32 |

% |

|

|

21 |

% |

|

|

20 |

% |

|

|

26 |

% |

|

|

13 |

% |

|

|

26 |

% |

|

|

9 |

% |

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global ICL Unit Growth |

|

|

48 |

% |

|

|

33 |

% |

|

|

19 |

% |

|

|

20 |

% |

|

|

21 |

% |

|

|

14 |

% |

|

|

19 |

% |

|

|

2 |

% |

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year |

|

|

Three Months Ended |

|

ICL Sales by Country(4)(5) |

|

2021 |

|

|

2022 |

|

|

2023 |

|

|

March 31, 2023 |

|

|

June 30, 2023 |

|

|

September 29, 2023 |

|

|

December 29, 2023 |

|

|

March 29, 2024 |

|

|

June 28, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

China |

|

$ |

107,130 |

|

|

$ |

147,967 |

|

|

$ |

185,404 |

|

|

$ |

35,042 |

|

|

$ |

61,288 |

|

|

$ |

48,262 |

|

|

$ |

40,813 |

|

|

$ |

38,460 |

|

|

$ |

63,345 |

|

Growth |

|

|

50 |

% |

|

|

38 |

% |

|

|

25 |

% |

|

|

25 |

% |

|

|

33 |

% |

|

|

14 |

% |

|

|

30 |

% |

|

|

10 |

% |

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Japan |

|

$ |

28,688 |

|

|

$ |

32,623 |

|

|

$ |

36,352 |

|

|

$ |

9,203 |

|

|

$ |

8,563 |

|

|

$ |

9,091 |

|

|

$ |

9,495 |

|

|

$ |

10,227 |

|

|

$ |

9,735 |

|

Growth |

|

|

56 |

% |

|

|

14 |

% |

|

|

11 |

% |

|

|

6 |

% |

|

|

13 |

% |

|

|

12 |

% |

|

|

16 |

% |

|

|

11 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Korea |

|

$ |

15,173 |

|

|

$ |

17,940 |

|

|

$ |

19,853 |

|

|

$ |

6,656 |

|

|

$ |

3,316 |

|

|

$ |

4,886 |

|

|

$ |

4,996 |

|

|

$ |

6,725 |

|

|

$ |

3,973 |

|

Growth |

|

|

36 |

% |

|

|

18 |

% |

|

|

11 |

% |

|

|

19 |

% |

|

|

(15 |

)% |

|

|

1 |

% |

|

|

39 |

% |

|

|

1 |

% |

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

9,478 |

|

|

$ |

15,070 |

|

|

$ |

17,168 |

|

|

$ |

4,396 |

|

|

$ |

4,446 |

|

|

$ |

4,162 |

|

|

$ |

4,164 |

|

|

$ |

5,039 |

|

|

$ |

5,541 |

|

Growth |

|

|

58 |

% |

|

|

59 |

% |

|

|

14 |

% |

|

|

71 |

% |

|

|

10 |

% |

|

|

6 |

% |

|

|

(8 |

)% |

|

|

15 |

% |

|

|

25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Americas includes the United States, Canada and Latin American countries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) EMEA includes Spain, Germany, United Kingdom, European, Middle East and Africa Distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) APAC includes China, Japan, South Korea, India and the rest of Asia Pacific distributors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) ICL Sales by country includes countries representing more than 5% of total ICL sales in the most recently completed fiscal year |

|

|

|

|

(5) ICL sales do not include IOL, injector or other sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Constant Currency Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in 000's) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

As Reported |

|

|

Constant Currency |

|

Sales |

|

June 28, 2024 |

|

|

Effect of Currency |

|

|

Constant Currency |

|

|

June 30, 2023 |

|

|

$ Change |

|

|

% Change |

|

|

$ Change |

|