Filed

by Coincheck Group B.V.

pursuant

to Rule 425 under the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12

under

the Securities Exchange Act of 1934

Subject

Company: Thunder Bridge Capital Partners IV, Inc.

(Commission

File No.: 001-40555)

Date:

March 5, 2024

Announcement of Subsidiary’s Release

TOKYO, March 4, 2024 – Coincheck, Inc., a subsidiary of

Monex Group, Inc., issued the following press release today.

Attachment: Summary of Coincheck, Inc. press release

Coincheck and Fanpla entered into an agreement for an IEO

~ Aiming to Create an Economy of ‘Direct to Fan’ Connections

Between Artists and Fans, and Make New Fan Experiences~

|

Contact:

|

Akiko Kato

Corporate Communications Office

Monex Group, Inc.

+81-3-4323-3983 |

Yuki Nakano, Taishi Komori

Investor Relations, Financial Control Department

Monex Group, Inc.

+81-3-4323-8698 |

This material is an English translation of a Japanese announcement made on the date above. Although the Company intended to faithfully

translate the Japanese document into English, the accuracy and correctness of this English translation is not guaranteed and thus you

are encouraged to refer to the original Japanese document. This translation was made as a matter of record only and does not constitute

an offer to sell or to solicit an offer to buy securities in the U.S.

【Press Release】

March 4th, 2024

Coincheck, Inc.

Coincheck and Fanpla entered into an agreement

for an IEO

〜Aiming

to Create an Economy of ‘Direct to Fan’ Connections

Between Artists and Fans, and Make New Fan Experiences〜

Coincheck, Inc. (Headquartered in Shibuya-ku, Tokyo;

Satoshi Hasuo, Representative Director & President; hereinafter “Coincheck”), which operates the “Coincheck”

service, the No.1 crypto asset trading service in Japan for app downloads for five consecutive years, is pleased to announce that we have

signed a contract with Fanpla, Inc. (Head office: Shibuya, Tokyo; Takemichi Hirai, Representative Director; hereinafter “Fanpla”)

for an Initial Exchange Offering (IEO).

Fanpla will

be responsible for issuing and selling the new crypto asset, which is subcontracted by Fanplus, Inc. (Headquartered in Shibuya-ku,

Tokyo; Motoshi Sato, Representative Director; hereinafter “Fanplus”). Fanplus is a wholly-owned subsidiary of m-up Holdings,

Inc. (Headquartered in Shibuya-ku, Tokyo; Koichiro Mito, Representative Director; hereinafter “m-up holdings”).

The main purpose of this project is to issue tokens that will be used by more than 300 fan clubs and fan sites operated by Fanplus, which

currently has over 2.5 million paying members. Additionally, Emoote Pte. Ltd., (Yuji Kumagai, CEO; comugi, Co-founder & Researcher,

hereinafter “Emoote”), a company that leads global business creation in the web3 space

through specialized fund management, will also be participating in the project team as a partner.

The IEO is part of a project that aims to

create a “Direct to Fan” economic model. This model will connect artists and creators directly with fans to create a new

platform for “Fan activities (Oshi katsu)” where both content creators and consumers can participate. The project plans

to use web3 digital technology to build this economic model.

m-up holdings, Fanplus, Fanpla, Emoote and Coincheck

have joined forces to connect artists and fans to the web3 space and create new fan experiences through this IEO.

Fanplus is a core company of the m-up holdings Group,

known for its strength in developing tools and content that facilitate interaction between artists

and fans through digital devices. Fanpla plans to launch a new crypto asset that will serve as a medium for fan experiences related to

artists and talents managed by Fanplus.

IEOs are frameworks whereby a crypto asset exchange

acts as the main party for screening the project and selling the issuer tokens in accordance with Japanese laws and regulations. Five

IEOs have been completed or announced in Japan up to date, and two of those, including Japan’s first IEO, were conducted on Coincheck’s

IEO platform, “Coincheck IEO.”

Details on the utility and use cases of the new crypto

asset, as well as the schedule for the IEO and the name and ticker of the newly sold crypto asset, will be announced as they are determined.

Comment from Motoshi Sato (Representative Director

of Fanplus, Inc.):

Fanplus, Inc. has been supporting artists by providing

services in line with the needs of the times, such as fan club services since the days of feature phones, ticket sales, e-tickets, ticket

trades, merchandise e-commerce, artist apps, live streaming apps, and NFT markets. We have walked together with artists through these

services.

Now, foreseeing further advancements in technology

and changes in the relationship between artists and fans, we aim to create new experiences using WEB3 technology. I am very pleased to

announce this project with the support of strong partners like Coincheck, Emoote, and Fanpla.

Of course, we want fans and artists to enjoy even

more, but we will also strive to provide services that will contribute to increasing the passion in Japan’s music industry for the sake

of future artists and fans as well.

Comment from Yuji Kumagai (CEO of Emoote Pte. Ltd.):

The keyword

for the future of Web3 and crypto is “mass adoption. “At Emoote, in addition to our investment business with a track record

in investments like STEPN, we started our support business in 2023 to create Web3 projects that leverage the distinctive cultures and

values of Japan and Asia.

The projects

of Fanplus, a company that continues to lead the fan club business and music industry, as well as Fanpla, are exactly at the heart of

Entertainment × Web3 and aim for mass adoption. With the support of Coincheck, we will assist in areas such as tokenomics design,

marketing, and service planning.

Comment from Tomoyuki Isaka (Deputy President and

Executive Director of Coincheck, Inc.):

We are very pleased to join the IEO project with

a team led by Fanplus, a company with a wealth of achievements and experience in fan club management for artists.

In this project, we aim to create a “Direct

to Fan”economy that directly connects artists and fans by utilizing the dynamics of tokens. For example, we

aim to intensify the shared passion between fans and artists, as if they were running up onto the stage together from the artists’ first

audition.

As the leading company with the No.1 domestic IEO

track record, Coincheck will connect all kinds of economic spheres and contribute to the healthy development of the crypto/web3 industry.

About Fanpla, Inc.

Established in 2006, Fanpla mainly operates in the

music and entertainment sectors, with a rich track record of offering a variety of business-to-business services in response to changes

in society, such as the spread of the internet and technological advancements. In collaboration with Fanplus, Fanpla is developing a next-generation

platform that leverages web3 technology to create attractive new fan experiences and return value to artists.

Fanpla website: https://fanpla.co.jp/

About Coincheck, Inc.

Coincheck, Inc. operates the crypto asset

trading service “Coincheck,” which has been “Japan’s No.1*” downloaded trading app for five

consecutive years. The company’s mission is “Making Exchange of New Value Easier” by providing better services

based on the latest technology and advanced security measures. Coincheck aims to make the “exchange of new value”

created by crypto assets and blockchain more easily accessible to its customers.

*This data is supported by App Tweak and refers to

domestic crypto asset trading apps from January 2019 to December 2023.

For inquiries from the press regarding this release,

please contact

Coincheck, Inc. PR Group

Mail: pr@coincheck.com

Additional Information and Where to Find It

In connection with the business combination agreement among Coincheck,

Inc. (“Coincheck”), Coincheck Group B.V. (“CCG”), Thunder Bridge Capital Partners IV, Inc. (“Thunder Bridge

IV”) and others with regards to the proposed transaction, the parties intend to file relevant materials with the Securities and

Exchange Commission, including a registration statement on Form F-4 to be filed by Coincheck Group, B.V. with the SEC, which will include

a proxy statement/prospectus of Thunder Bridge IV, and will file other documents regarding the proposed transaction with the SEC. Thunder

Bridge IV’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus

and the amendments thereto and the definitive proxy statement and documents incorporated by reference therein filed in connection with

the proposed business combination, as these materials will contain important information about CCG, Coincheck, Thunder Bridge IV and the

proposed business combination. Promptly after the Form F-4 is declared effective by the SEC, Thunder Bridge IV will mail the definitive

proxy statement/prospectus and a proxy card to each shareholder entitled to vote at the meeting relating to the approval of the business

combination and other proposals set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors

and stockholders of Thunder Bridge IV are urged to carefully read the entire registration statement and proxy statement/prospectus, when

they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents,

because they will contain important information about the proposed transaction. The documents filed by Thunder Bridge IV with the SEC

may be obtained free of charge at the SEC’s website at www.sec.gov, or by directing a request to Thunder Bridge Capital Partners

IV, Inc., 9912 Georgetown Pike, Suite D203, Great Falls, Virginia 22066, Attention: Secretary, (202) 431-0507.

Participants in the Solicitation

Thunder Bridge IV and its directors and executive officers may be deemed

participants in the solicitation of proxies from its shareholders with respect to the business combination. A list of the names of those

directors and executive officers and a description of their interests in Thunder Bridge IV will be included in the proxy statement/prospectus

for the proposed business combination when available at www.sec.gov. Information about Thunder Bridge IV’s directors and executive

officers and their ownership of Thunder Bridge IV common stock is set forth in Thunder Bridge IV prospectus, dated June 29, 2021, as modified

or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of

the participants in the proxy solicitation will be included in the proxy statement/prospectus pertaining to the proposed business combination

when it becomes available. These documents can be obtained free of charge from the source indicated above.

CCG, Coincheck and their respective directors and executive officers

may also be deemed to be participants in the solicitation of proxies from the shareholders of Thunder Bridge IV in connection with the

proposed business combination. A list of the names of such directors and executive officers and information regarding their interests

in the proposed business combination will be included in the proxy statement/prospectus for the proposed business combination.

Forward Looking Statements

This communication contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products

and services; and other statements identified by words such as “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited

to, statements regarding Coincheck’s industry and market sizes, future opportunities for CCG, Coincheck and Thunder Bridge IV, Coincheck’s

estimated future results and the proposed business combination between Thunder Bridge IV and Coincheck, including the implied enterprise

value, the expected transaction and ownership structure and the likelihood, timing and ability of the parties to successfully consummate

the proposed transaction. Such forward-looking statements are based upon the current beliefs and expectations of our management and are

inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict

and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these

forward-looking statements.

In addition to factors previously disclosed in Thunder Bridge IV’s

reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual

results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking

statements: inability to meet the closing conditions to the business combination, including the occurrence of any event, change or other

circumstances that could give rise to the termination of the definitive agreement; the inability to complete the transactions contemplated

by the definitive agreement due to the failure to obtain approval of Thunder Bridge IV’s shareholders, the failure to achieve the

minimum amount of cash available following any redemptions by Thunder Bridge IV shareholders, redemptions exceeding a maximum threshold

or the failure to meet The Nasdaq Stock Market’s initial listing standards in connection with the consummation of the contemplated

transactions; costs related to the transactions contemplated by the definitive agreement; a delay or failure to realize the expected benefits

from the proposed transaction; risks related to disruption of management’s time from ongoing business operations due to the proposed

transaction; changes in the cryptocurrency and digital assets markets in which Coincheck competes, including with respect to its competitive

landscape, technology evolution or regulatory changes; changes in domestic and global general economic conditions, risk that Coincheck

may not be able to execute its growth strategies, including identifying and executing acquisitions; risks related to the ongoing COVID-19

pandemic and response; risk that Coincheck may not be able to develop and maintain effective internal controls; and other risks and uncertainties

indicated in Thunder Bridge IV’s final prospectus, dated June 29, 2021, for its initial public offering, and the proxy statement/prospectus

relating to the proposed business combination, including those under “Risk Factors” therein, and in Thunder Bridge IV’s

other filings with the SEC. Thunder Bridge IV and Coincheck caution that the foregoing list of factors is not exclusive.

Actual results, performance or achievements may differ materially,

and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements

are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned

not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and

other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other

factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information

about Thunder Bridge IV and Coincheck or the date of such information in the case of information from persons other than Thunder Bridge

IV or Coincheck, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring

after the date of this communication. Forecasts and estimates regarding Coincheck’s industry and end markets are based on sources

we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized,

pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy,

consent, or authorization with respect to any securities or in respect of the proposed business combination. This press release shall

also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

5

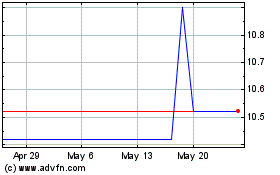

Thunder Bridge Captial P... (NASDAQ:THCPU)

Historical Stock Chart

From Apr 2024 to May 2024

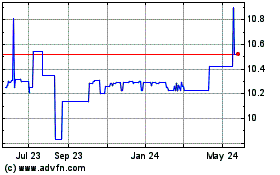

Thunder Bridge Captial P... (NASDAQ:THCPU)

Historical Stock Chart

From May 2023 to May 2024