0001850902false00018509022024-01-112024-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2024

ALPHA TEKNOVA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-40538 |

|

94-3368109 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

2451 Bert Drive

Hollister, CA 95023

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (831) 637-1100

N/A

(Former name, or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.00001 per share |

|

TKNO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 11, 2024, Alpha Teknova, Inc. (the “Company”) announced a reduction in its workforce that affected approximately 15% of its current employees (the “RIF”). The Company took this step in furtherance of its effort to reduce operating expenses initiated in the fourth quarter of fiscal 2023. Total annualized cost savings from the RIF are estimated at approximately $6.4 million. The Company expects to substantially complete the RIF by February 1, 2024.

The Company expects to recognize approximately $1.2 million in total charges for severance and related benefits for employees whose employment was or will be terminated pursuant to the RIF. These are one-time termination benefits and are cash charges. The estimates of costs and expenses that the Company expects to incur in connection with the RIF are subject to a number of assumptions and actual results may differ materially from those estimates. The Company may also incur other charges or cash expenditures not currently contemplated due to events that may occur as a result of, or associated with, the RIF.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Termination of Certain Executive Officers

As part of the RIF described above in Item 2.05, on January 11, 2024, the Company informed Ken Gelhaus, its Chief Commercial Officer, and Lisa McCann, its Chief People Officer, that their employment with the Company would end at the close of business on March 1, 2024, because the Company had decided to eliminate the roles of Chief Commercial Officer and Chief People Officer. Each of Mr. Gelhaus and Ms. McCann agreed to stay with the Company through March 1, 2024, in the interests of a smooth transition. The Company thanks Mr. Gelhaus and Ms. McCann for their many valuable contributions.

Repricing of Options

On January 16, 2024, the board of directors of the Company (the “Board”) approved a stock option repricing (the “Option Repricing”), which will be effective on March 14, 2024 (the “Repricing Date”). The Option Repricing applies to outstanding options to purchase shares of common stock of the Company (the “Common Stock”) that, as of the Repricing Date, are held by employees and certain non-employee directors of the Company (the “Outstanding Options”), and were granted under the Company’s 2016 Stock Plan (as amended), 2020 Equity Incentive Plan (as amended) and 2021 Equity Incentive Plan (collectively, the “Plans”). As of the Repricing Date, all Outstanding Options will be immediately repriced such that the exercise price per share for such Outstanding Options will be reduced to the Fair Market Value (as defined in the Plans) of the Common Stock on the Repricing Date (the “New Price”), effective as of the Price Reduction Date (as defined below), provided that the holder remains employed by the Company or continues to serve as a member of the Board through such date. The “Price Reduction Date” is the earliest to occur of (i) September 14, 2025, (ii) the date of the holder’s termination of employment or service with the Company due to (x) a termination by the Company without cause or (y) the holder’s resignation for good reason, or (iii) the date on which a change in control of the Company occurs. For the avoidance of doubt, other than in event of a change in control, the reduced exercise price only applies to exercises that occur on or after the Price Reduction Date and if a holder’s employment by or service to the Company has not ended (other than due to a termination by the Company without cause or a resignation for good reason) prior to the Price Reduction Date. If a holder exercises any of his or her Repriced Options (as defined below) prior to the Price Reduction Date, the original (unmodified, current) exercise price will continue to apply. In addition, in the event that an Outstanding Option has an exercise price that is less than the New Price, such Outstanding Option will not be repriced as part of the Option Repricing. The Outstanding Options that are repriced on the Repricing Date (the “Repriced Options”) will include the Outstanding Options held by our employees (including our executive officers) and certain non-employee directors. There will be no changes to the number of shares, the vesting schedule, or the expiration date of the Repriced Options.

The Board approved the Option Repricing after careful consideration of various alternatives and a review of other applicable considerations with its independent compensation consultant and other advisors, the recommendation of the compensation committee of the Board, and the determination by a disinterested director who did not have any options subject to the repricing that the repricing was fair, just, and reasonable as to the Company and its stockholders.

The Board approved the Option Repricing, with the requirement of continued employment or service through the Price Reduction Date, to realign the value of the Repriced Options with their intended purpose, which is to retain and motivate the holders of the Repriced Options to continue to work in the best interests of the Company and its stockholders. Prior to the Option Repricing, many of the Repriced Options had exercise prices well above the recent market prices of the Common Stock.

As of January 12, 2024, stock options to purchase an aggregate of 1,635,381 shares of Common Stock were outstanding under the Plans (and held by employees not otherwise affected as part of the RIF and expected to remain with the Company through March 14, 2024) with an exercise price that is greater than $3.255, the closing price of our Common Stock on January 12, 2024. These include the following options held by the Company’s named executive officers and non-employee directors, which will be included in the Option Repricing to the extent that the Fair Market Value of the Common Stock on the Repricing Date is less than the current exercise price of such options:

|

|

|

Name and Position |

Option Shares |

Exercise Price Range of Current Options |

Stephen Gunstream, President, Chief Executive Officer, and Director |

348,750 |

$5.36-$15.09 |

Matthew Lowell, Chief Financial Officer |

324,112 |

$5.36-$16.00 |

Damon Terrill, General Counsel & Chief Administrative Officer |

118,000 |

$5.36-$15.09 |

Brett Robertson, Director |

44,251 |

$16.00 |

Alexander Vos, Director |

44,251 |

$16.00 |

The Option Repricing is subject to approval of the Company’s stockholders, which was obtained by written consent of the stockholders of the Company on January 16, 2024. The Company will file an information statement with the Securities and Exchange Commission (“SEC”) pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended, to notify the Company’s stockholders from whom consent was not solicited on behalf of the Company of the Option Repricing.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Exchange Act, which are subject to the “safe harbor” created by those sections. Forward-looking statements can be identified by words such as “expects,” “projects,” “may,” “will,” “could,” “would,” “should,” “believes,” “anticipates,” “estimates,” “intends,” “plans,” “potential,” “promise” or similar references to future periods. Examples of forward-looking statements in this Form 8-K include, without limitation, statements regarding the RIF, the effect of the RIF, anticipated charges and any anticipated cost savings associated therewith and severance packages, the Option Repricing and filing of an information statement with the SEC. Forward-looking statements are statements that are not historical facts, nor assurances of future performance. Instead, they are based on the Company’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond the Company’s control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks and uncertainties and other factors are identified and described in more detail in the Company’s filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10-Q filed with the SEC. As a result, you should not place undue reliance on any forward-looking statements. Except to the limited extent required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

Exhibit No. |

|

Description |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

ALPHA TEKNOVA, INC. |

Date: January 16, 2024 |

By: |

/s/ Stephen Gunstream |

|

|

Stephen Gunstream |

|

|

President and Chief Executive Officer |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

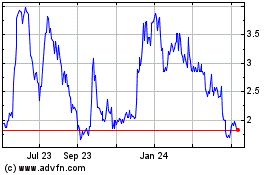

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

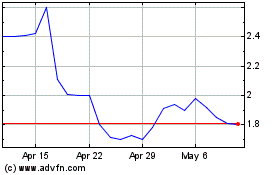

Alpha Teknova (NASDAQ:TKNO)

Historical Stock Chart

From Apr 2023 to Apr 2024