2seventy bio, Inc. (Nasdaq: TSVT), announced today that Eli

Casdin, Chief Investment Officer, and Founder of Casdin Capital,

and Charles Newton, Chief Financial Officer, Lyell Immunopharma,

have been appointed as new independent members of the Company’s

Board of Directors (the “Board”), effective immediately. Casdin

Capital owns approximately 2.3% of 2seventy bio’s outstanding

shares as of 03/20/24.

“We are pleased to welcome Eli and Charlie to the 2seventy

Board,” said Dan Lynch, chair of the Board of Directors. “Eli is a

highly regarded, leading life sciences and healthcare investor and

has a deep understanding of and history with the Company. Charlie

has a track record of helping companies navigate through key value

inflection points in their pipeline. We are confident that Eli, who

adds an important shareholder perspective, and Charlie, who brings

valuable industry expertise, will be strong voices on our Board as

we advance our strategic re-alignment and reshape 2seventy to best

deliver for our patients and shareholders.”

“At a pivotal and important point in 2seventy’s business

evolution, it’s an exciting time to be more involved formally,”

said Eli Casdin. “With a commercial product positioned to reach

more patients and a great partner to accomplish that with, I look

forward to joining the board and adding my voice to the strategic

thinking and work ahead.”

“2seventy is an outstanding company comprised of a team that I

have long held in high regard,” said Charlie Newton. “I am eager to

join the Board and work with the management team as we advance

therapies that give patients a chance at more life.”

Upon the appointment of Mr. Casdin and Mr. Newton, and as

previously announced at the closing of the transaction with

Regeneron, 2seventy bio’s Board of Directors will temporarily

comprise nine members through June, until Dan Lynch steps down from

the Board and Nick Leschly becomes Chairman. With today’s

announcement, three directors are expected to stand for election at

the 2024 Annual Meeting.

Separately, the Company noted that it received a notice of

nomination from Engine Capital for two individuals to stand for

election to 2seventy’s Board of Directors at the 2024 Annual

Meeting. Engine’s two nominees were included in the Board’s

Nominating and Corporate Governance Committee process that it

undertook to identify new directors resulting in today’s

appointments of Messrs. Casdin and Newton.

The Board will present its recommendation with respect to the

election of directors in the Company’s proxy statement, which will

be filed with the Securities and Exchange Commission and mailed to

all shareholders eligible to vote at the Company’s 2024 Annual

Meeting of Shareholders, which has not yet been scheduled.

About Eli Casdin

Mr. Casdin is a significant 2seventy shareholder and has spent

the last 20 years analyzing and investing in disruptive

technologies and business models in life sciences and healthcare.

He has served as Chief Investment Officer and Founder of his

namesake research investment firm, Casdin Capital, LLC, which is

focused on the innovations in molecular medicine, since 2011.

Prior to founding Casdin Capital, Eli was a Vice President at

Alliance Bernstein “thematic” based investment group where he

researched and invested in the implications of new technologies for

the life science and healthcare sectors. His Alliance Bernstein

black book, “The Dawn of Molecular Medicine” detailed in 2011 the

early yet already accelerating wave of innovations in life

sciences, and the next wave of investment opportunities. Eli’s

prior experience includes time at Bear Stearns and Cooper Hill

Partners, a healthcare focused investment firm.

Mr. Casdin has sat on numerous public and private company

Boards, including currently on two public boards including Standard

BioTools, since April 2022 and during its merger with SomaLogic and

GeneDx following its merger with Sema4 in May 2022; He also

currently serves on several non-profit boards including The

Rockefeller University; the New York Genome Center, and Columbia

University School of General Studies.

Mr. Casdin earned a B.S. from Columbia University and an MBA

from Columbia Business School.

About Charles Newton

Mr. Newton has decades of financial and executive experience in

the healthcare industry. Since February 2021, Mr. Newton has served

as Chief Financial Officer of Lyell Immunopharma, a fully

integrated clinical-stage T-cell reprogramming company advancing a

diverse pipeline of cell therapies for patients with solid

tumors.

Prior to Lyell, he was at Bank of America Merrill Lynch, where

he served as Managing Director and Co-Head of Healthcare Investment

Banking in the Americas. He was previously with Credit Suisse as

Managing Director and Co-Head of Healthcare Investment Banking in

the Americas. Prior to that, he spent 14 years with Morgan Stanley,

ultimately becoming Managing Director and Head of Western Region

Healthcare Investment Banking. Earlier in his career, he was an

Investment Banking Analyst with Lehman Brothers and a Financial

Analyst with Mercer Global Advisors. Mr. Newton has advised on

approximately $200 billion in mergers and acquisitions and raised

nearly $60 billion in capital during his investment banking

career.

Mr. Newton has served on the Board of Coherus BioSciences since

2022. He also served on the Board of Carmot Therapeutics until its

acquisition by Roche.

Mr. Newton earned a B.S. from Miami University and an MBA from

The Tuck School at Dartmouth College.

About 2seventy bio

Our name, 2seventy bio, reflects why we do what we do - TIME.

Cancer rips time away, and our goal is to work at the maximum speed

of translating human thought into action – 270 miles per hour – to

give the people we serve more time. With a deep understanding of

the human body’s immune response to tumor cells and how to

translate cell therapies into practice, we’re applying this

knowledge to deliver the first FDA-approved CAR T cell therapy for

multiple myeloma to as many patients as possible. Importantly, we

remain focused on accomplishing our mission by staying genuine and

authentic to our “why” and keeping our people and culture top of

mind every day.

For more information, visit www.2seventybio.com.

Follow 2seventy bio on social media: X (Twitter) and

LinkedIn.

2seventy bio is a trademark of 2seventy bio, Inc.

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. The forward-looking statements set forth in this press

release include statements about our plans and strategies; and

statements about our upcoming 2024 Annual Meeting of Stockholders

(the “2024 Annual Meeting”), uncertainties regarding future actions

that may be taken by Engine Capital LP in connection with the

company’s 2024 Annual Meeting. In addition, statements containing

words such as “guidance,” “may,” “believe,” “anticipate,” “expect,”

“intend,” “plan,” “project,” “projections,” “business outlook,” and

“estimate” or similar expressions constitute forward-looking

statements. Actual results may differ materially from the results

predicted, and reported results should not be considered an

indication of future performance. These forward-looking statements

involve risks and uncertainties regarding the company’s future

financial performance; could cause actual results or developments

to differ materially from those indicated due to a number of

factors affecting the Company’s operations, markets, products and

services; and are based on current expectations, estimates and

projections about the company’s industry, financial condition,

operating performance and results of operations, including certain

assumptions related thereto. Potential risks and uncertainties that

could affect the company’s operating and financial results are

described in the Company’s annual report on Form 10-K for the

fiscal year ending December 31, 2023 filed with the Securities and

Exchange Commission (http://www.sec.gov) on March 7, 2024, as such

risks and uncertainties may be updated from time to time in the

Company’s quarterly reports on Form 10-Q filed with the Securities

and Exchange Commission, including, without limitation, information

under the captions “Risk Factors” and “Management's Discussion and

Analysis of Financial Condition and Results of Operations.” These

risks and uncertainties include, among others: our limited

independent operating history and the risk that our accounting and

other management systems may not be prepared to meet the financial

reporting and other requirements of operating as an independent

public company; the risk that our BLAs and INDs will not be

accepted for filing by the FDA on the timeline that we expect, or

at all; the risk that Abecma will not be as commercially successful

as we may anticipate; the risk that our strategic realignment to

focus on the development and commercialization of Abecma may not be

as successful as anticipated, may fail to achieve the anticipated

cost savings, and may cause disruptions in our business that could

make it difficult to achieve our strategic objectives; the risk

that may not be able to successfully or timely complete the Asset

Sale; and the risk that we are unable to manage our operating

expenses or cash use for operations; and any future actions that

may be taken by activist stockholders. The company does not intend

to revise or update the information set forth in this press

release, except as required by law, and may not provide this type

of information in the future.

Important Stockholder Information

The Company plans to file with the Securities and Exchange

Commission and mail to its stockholders a proxy statement and

accompanying WHITE proxy card in connection with the Company’s 2024

Annual Meeting of Stockholders (the “2024 Annual Meeting”). The

proxy statement will contain important information about the

company, the 2024 Annual Meeting and related matters. INVESTORS AND

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER

RELEVANT SOLICITATION MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE

THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. The company,

its directors and certain of its executive officers may be deemed

to be participants in the solicitation of proxies from the

company’s stockholders in connection with the matters to be

considered at the company’s 2024 Annual Meeting. Information

concerning the company’s directors and executive officers will be

included in the proxy statement when filed. The proxy statement and

other relevant solicitation materials (when they become available),

and any and all documents filed by the company with the Securities

and Exchange Commission, may be obtained by investors and

stockholders free of charge on the Securities and Exchange

Commission's web site at www.sec.gov. Copies will also be available

free of charge on the company's website at www.2seventybio.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240320941015/en/

Investors: Elizabeth Pingpank Hickin, 860-463-0469

Elizabeth.pingpank@2seventybio.com Media: Jenn Snyder,

617-448-0281 Jenn.snyder@2seventybio.com

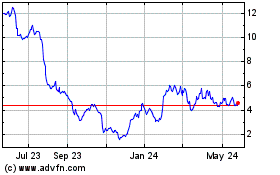

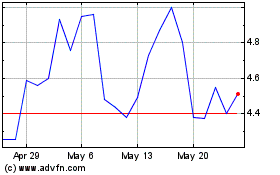

2seventy bio (NASDAQ:TSVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

2seventy bio (NASDAQ:TSVT)

Historical Stock Chart

From Feb 2024 to Feb 2025