180 Degree Capital Corp. Notes Average Discount of Net Asset Value Per Share to Stock Price for Sixth Month of Initial Measurement Period of Its Discount Management Program

01 July 2024 - 11:00PM

180 Degree Capital Corp. (“180 Degree Capital”) (NASDAQ: TURN),

noted today that the average discount between its estimated daily

net asset value per share (“NAV”) and its daily closing stock price

during June 2024 and year-to-date through the end of June 2024,

were approximately 16% and 19%, respectively.1 This discount

was approximately 16% on June 28, 2024, last trading date in the

month.

As previously disclosed in a press release on

November 13, 2023, 180 Degree Capital’s Board of Directors has set

two measurement periods of 1) January 1, 2024 to December 31, 2024,

and 2) January 1, 2025 to June 30, 2025, in which it will evaluate

the average discount between TURN’s estimated daily NAV and its

closing stock price pursuant to a Discount Management Program.

Should TURN’s common stock trade at an average daily discount to

NAV of more than 12% during either of these measurement periods,

180 Degree Capital’s Board will consider all available options at

the end of each measurement period including, but not limited to, a

significant expansion of 180 Degree Capital’s current stock buyback

program of up to $5 million, cash distributions reflecting a return

of capital to shareholders, or a tender offer.

“June 2024 and the second quarter of 2024

overall continued to be tough for microcapitalization stocks and

the majority of 180 Degree Capital’s holdings,” said Kevin M.

Rendino, Chief Executive Officer of 180 Degree Capital. “The market

is dominated by just a few mega cap holdings and this period

reminds me very much of the dot.com bubble of 1999 and 2000. Along

that line, our friends at 22V Research recently noted, ‘Relative to

the S&P the drawdown in the Russell is now a 0.3rd %tile event

at -42.7%. The only drawdown worse occurred in 1999. And it wasn’t

worse by much.’ I know that at some point, just like then, the

market will broaden out which we believe will allow many of our

companies to generate significant upside in value. You will note

the continued purchase of our stock by our management team during

the quarter. We wouldn’t do that if we didn’t believe our NAV had

significant upside in the not too distant future.”

“We are encouraged by the prospects for many of

our portfolio holdings in the second half of 2024 based on what we

believe are meaningful potential catalysts that could drive

significant appreciation in value for our holdings,” continued Mr.

Rendino. “We saw the first of these catalysts with our portfolio

holding Synchronoss Technologies, Inc. (SNCR), that announced on

Friday, June 28, 2024, the retirement of its outstanding preferred

stock and a portion of its outstanding debt, both at discounts to

full value. This deleveraging coupled with a reduction in the

interest rate for its remaining debt will provide meaningful cost

savings for SNCR. This development was well received by public

market investors and SNCR closed up over 18% for the day. We

believe there are additional value-creating catalysts for SNCR,

including, but not limited to, the receipt of a $28 million tax

refund currently expected in late Q3 2024 or early Q4 2024. We have

identified similar types of catalysts for all of our holdings that

serve as the basis for our investment thesis in each. While it

often takes longer than we would like for these catalysts to occur,

our permanent capital affords the ability to remain invested if we

believe such catalysts will occur.”

“SNCR is also a perfect example of how we use

constructive activism to help companies achieve value-creating

catalysts,” continued Daniel B. Wolfe, President of 180 Degree

Capital. “We are on SNCR’s Board of Directors and are an active

member of its committee tasked with opportunistically retiring its

preferred stock. With comScore, Inc. (SCOR), we nominated and

successfully negotiated the addition of Matthew McLaughlin to

SCOR’s Board of Directors. We are currently working on other

efforts of constructive activism with some of our other holdings

that could lead to the nomination of directors and/or driving

strategic alternatives processes. In short, we do not and will not

sit back hoping that catalysts occur that could drive appreciation

in value. We are actively working with management teams and boards

of directors to make them happen. We historically said this would

be a major focus of our efforts in 2024, and that remains where we

are spending significant time and attention.”

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 and its holdings

can be found on its website at www.180degreecapital.com.

Press Contact:Daniel B. WolfeRobert E. Bigelow180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Mo ShafrothRF BinderMorrison.shafroth@rfbinder.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 is not responsible for the contents of third-party

websites.

1. Daily estimated NAVs used for the discount

calculation outside of quarter-end dates are determined as

prescribed in 180’s Valuation Procedures for Level 3 assets.

Non-investment-related assets and liabilities used to determine

estimated daily NAV are those reported as of the end of the prior

quarter.

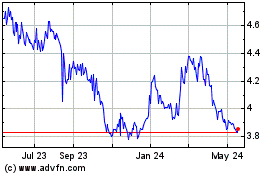

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Dec 2024 to Jan 2025

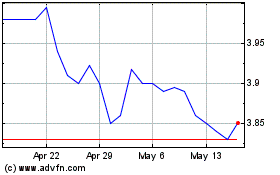

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Jan 2024 to Jan 2025