180 Degree Capital Corp. (NASDAQ:TURN) (“180 Degree Capital”),

today announced that it has entered into a definitive agreement to

combine with Mount Logan Capital Inc. (“Mount Logan”) in an

all-stock transaction (the “Business Combination”). The surviving

entity is expected to be a Delaware corporation operating as Mount

Logan Capital Inc. (“New Mount Logan”) listed on Nasdaq under the

symbol MLCI. In connection with the Business Combination, 180

Degree Capital shareholders will receive proportionate ownership of

New Mount Logan determined by reference to 180 Degree Capital’s NAV

at closing relative to a valuation of Mount Logan of approximately

$67.4 million at signing, subject to certain pre-closing

adjustments.

Shareholders holding approximately 20% of the

outstanding shares of 180 Degree Capital and approximately 23% of

the outstanding shares of Mount Logan signed voting agreements

supporting the Business Combination, and an additional

approximately 7% and 9% of 180 Degree Capital and Mount Logan

shareholders, respectively, have provided non-binding written

indications of support for the Business Combination.

“We could not be more pleased to share today’s

announcement with our shareholders,” said Kevin M. Rendino, Chief

Executive Officer of 180 Degree Capital. “Our proposed merger with

Mount Logan is the next step in the evolution of our business since

Daniel and I took over day-to-day management of 180 Degree Capital

in 2017. In July 2024, we were introduced to and began discussions

with Mount Logan’s management team, who also founded and currently

run the credit business for BC Partners, a leading alternative

investment manager focused on private equity, credit, and real

estate, with deep networks across Europe and North America. Through

these discussions, we instantly realized similarity of thought

processes regarding investments, corporate culture, future

opportunities for growth, and focus on taking steps to unlock value

for our respective shareholders. The result of this proposed merger

will be that shareholders will now be material owners of what we

believe is a premier private credit asset manager with a regulated

insurance company.”

“We can unequivocally say that we successfully

turned around 180 Degree Capital and positioned it to have the

opportunity to pursue strategic options, including today’s

announcement,” continued Daniel B. Wolfe, President of 180 Degree

Capital. “We inherited a balance sheet comprised primarily of

privately held, venture capital investments and successfully

transitioned it to our current assets that are substantially all

securities of publicly listed companies and cash. Once we had our

balance sheet comprised substantially of public securities and

cash, we began considering a variety of options to help fuel future

growth and shareholder value creation. As we progress toward

closing, we will continue our efforts to build on our positive

public market investment performance since the inception of 180

Degree Capital through management of our portfolio for the benefit

of 180 Degree Capital’s shareholders. We will continue to work with

our portfolio company management teams constructively, including

those where we currently have representatives or nominees on boards

of directors. Monetizations are expected to occur naturally, and be

consistent with historical portfolio turnover. We are excited for

how the combination of our businesses can take each company, and

value creation for shareholders particularly, to the next

level.”

“We share in Kevin and Daniel’s excitement as we

embark on the next phase of Mount Logan’s journey together with 180

Degree Capital and its team,” said Ted Goldthorpe, CEO of Mount

Logan. “We believe the transaction is a significant milestone for

180 Degree Capital shareholders, enabled by the tremendous

turnaround executed by Kevin and Daniel, and will transition from a

balance sheet-heavy investment company into an asset-light

alternative asset management and insurance solutions business. We

believe that we have built a unique platform, which is well

positioned to take advantage of the opportunities we continue to

evaluate for the benefit of all key stakeholders including our

shareholders, investors, partners and policyholders. Coming

together in this merger is a logical and exciting next step for

both platforms that we believe will drive significant strategic and

financial benefits in both the immediate and longer-term future.

The combination creates alignment among all shareholders who will

now share in the upside of a larger, more liquid company in what we

believe is the high-growth alternative asset management and

insurance solutions space. We look forward to seeking opportunities

to accelerate our growth initiatives and enhance returns for

existing and new shareholders, while maintaining strong performance

across our private credit investment strategies for the combined

benefit of investors and policyholders.”

Mr. Rendino concluded, “Our transition to an

operating company structure also frees investors from looking at

our business relative to net assets and instead allows investors to

focus on typical operating metrics of asset managers, such as

fee-related earnings (FRE). Essentially instead of our net asset

value being a ceiling for shareholders, it now becomes what we

believe will be a floor for future value creation. This proposed

merger is the culmination of options our board of directors has

diligently evaluated to both maximize near-term value and provide

the opportunity for future growth for shareholders of 180 Degree

Capital. We couldn’t be more excited for the future as a merged

entity.”

Details of the Proposed Business

Combination

180 Degree Capital and Mount Logan will combine

in an all-stock transaction at an estimated $139 million pro forma

enterprise value at closing. Following completion of the

transaction, each of 180 Degree Capital and Mount Logan will be

wholly owned subsidiaries of New Mount Logan, which will be listed

on Nasdaq under the symbol MLCI. Under the terms of the definitive

agreement, shareholders of each of 180 Degree Capital and Mount

Logan will receive an amount of newly issued shares of common stock

of New Mount Logan based on the ratio of the net asset value

(“NAV”) per share of 180 Degree Capital relative to a valuation of

Mount Logan of $67.4 million at signing, subject to certain

pre-closing adjustments. Based on the estimated NAV of 180 Degree

Capital1 as of January 15, 2025, which is a 24% premium to 180

Degree Capital’s closing stock price on that date, the estimated

pro forma post-merger shareholder ownership would be approximately

40% for current 180 Degree Capital shareholders and 60% for current

Mount Logan shareholders.

The board of directors for each of 180 Degree

Capital and Mount Logan have unanimously approved the Business

Combination. The transaction, which is intended to be treated as a

tax-free reorganization for both sets of shareholders, is subject

to certain regulatory approvals and approvals by each of 180 Degree

Capital’s and Mount Logan’s shareholders. In addition, the

transaction is subject to other customary closing conditions,

including a registration statement being declared effective by the

U.S. Securities and Exchange Commission (“SEC”) relating to the

shares of New Mount Logan common stock that will be issued to the

shareholders of 180 Degree Capital and Mount Logan in the

transaction, the approval of the transaction by the shareholders of

each of 180 Degree Capital and Mount Logan, and the listing of New

Mount Logan’s common stock on Nasdaq. The transaction is expected

to be completed in mid-2025.

The foregoing description of the merger

agreement does not purport to be complete and is qualified in its

entirety by reference to the full text of the merger agreement.

Leadership and Governance

At close, Mount Logan’s Chief Executive Officer

(“CEO”), Ted Goldthorpe, is expected to serve as CEO of New Mount

Logan. New Mount Logan will have a seven‑member Board of Directors,

comprised of Mount Logan’s CEO Ted Goldthorpe, four additional

directors designated by Mount Logan, one director designated by 180

Degree Capital, and one director mutually agreed to by 180 Degree

Capital and Mount Logan. The Chairman of the Board of Directors of

New Mount Logan will be Ted Goldthorpe, currently Chairman of Mount

Logan.

Conference Call and Presentation

Information

Representatives from Mount Logan and 180 Degree

Capital will hold a conference call to discuss the transaction on

January 17, 2025, at 11am ET. The conference call can be accessed

at 1-404-975-4839 or toll-free at 1-833-470-1428 and entering the

passcode 693165. A presentation has also been prepared that

discusses the Business Combination and can be found online at

https://ir.180degreecapital.com/ir-calendar and at

https://mountlogancapital.ca/investor-relations. A recording of the

call will be available at these websites following the call.

Advisors

Fenchurch Advisory US, LP is serving as

financial advisor and Katten Muchin Rosenman LLP is serving as

legal counsel to the special committee of the board of directors of

180 Degree Capital. Proskauer Rose LLP and Osler Hoskin &

Harcourt LLP are serving as legal counsel to 180 Degree

Capital.

Dechert LLP and Wildeboer Dellelce LLP are

serving as legal counsel, and Oppenheimer & Co. is serving as

financial advisor, to Mount Logan.

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. 180

Degree Capital’s goal is that the result of its constructive

activism leads to a reversal in direction for the share price of

these investee companies, i.e., a 180-degree turn. Detailed

information about 180 Degree Capital and its holdings can be found

on its website at www.180degreecapital.com.

Press Contact:Daniel B. WolfeRobert E. Bigelow180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

About Mount Logan Capital Inc.

Mount Logan Capital Inc. is an alternative asset

management and insurance solutions company that is focused on

public and private debt securities in the North American market and

the reinsurance of annuity products, primarily through its wholly

owned subsidiaries Mount Logan Management LLC (“ML Management”) and

Ability Insurance Company (“Ability”), respectively. Mount Logan

also actively sources, evaluates, underwrites, manages, monitors

and primarily invests in loans, debt securities, and other

credit-oriented instruments that present attractive risk-adjusted

returns and present low risk of principal impairment through the

credit cycle.

ML Management was organized in 2020 as a

Delaware limited liability company and is registered with the SEC

as an investment adviser under the Investment Advisers Act of 1940,

as amended. The primary business of ML Management is to provide

investment management services to (i) privately offered investment

funds exempt from registration under the Investment Company Act of

1940, as amended (the “1940 Act”) advised by ML Management, (ii) a

non-diversified closed-end management investment company that has

elected to be regulated as a business development company, (iii)

Ability, and (iv) non-diversified closed-end management investment

companies registered under the 1940 Act that operate as interval

funds. ML Management also acts as the collateral manager to

collateralized loan obligations backed by debt obligations and

similar assets.

Ability is a Nebraska domiciled insurer and

reinsurer of long-term care policies acquired by Mount Logan in the

fourth quarter of fiscal year 2021. Ability is unique in the

insurance industry in that its long-term care portfolio’s morbidity

risk has been largely re-insured to third parties, and Ability is

no longer insuring or re-insuring new long-term care risk.

Additional Information and Where to Find

It

In connection with the Business Combination, 180

Degree Capital intends to file with the Securities and Exchange

Commission (“SEC”) and mail to its shareholders a proxy statement

on Schedule 14A (the “Proxy Statement”). In addition, New Mount

Logan plans to file with the SEC a registration statement on Form

S-4 (the “Registration Statement”) that will register the exchange

of New Mount Logan shares in the Business Combination and include

the Proxy Statement and a prospectus of New Mount Logan (the

“Prospectus”). The Proxy Statement and the Registration Statement

(including the Prospectus) will each contain important information

about 180 Degree Capital, Mount Logan, New Mount Logan, the

Business Combination and related matters. SHAREHOLDERS OF 180

DEGREE CAPITAL AND MOUNT LOGAN ARE URGED TO READ THE PROXY

STATEMENT AND PROSPECTUS CONTAINED IN THE REGISTRATION STATEMENT

AND OTHER DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE

APPLICABLE SECURITIES REGULATORY AUTHORITIES AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT 180 DEGREE CAPITAL, MOUNT LOGAN, NEW

MOUNT LOGAN, THE BUSINESS COMBINATION AND RELATED MATTERS.

Investors and security holders may obtain copies of these documents

and other documents filed with the applicable securities regulatory

authorities free of charge through the website maintained by the

SEC at https://www.sec.gov and the website maintained by the

Canadian securities regulators at www.sedarplus.ca. Copies of the

documents filed by 180 Degree Capital are also available free of

charge by accessing 180 Degree Capital’s investor relations website

at https://ir.180degreecapital.com.

Certain Information Concerning the

Participants

180 Degree Capital, its directors and executive

officers and other members of management and employees may be

deemed to be participants in the solicitation of proxies in

connection with the Business Combination. Information about 180

Degree Capital’s executive officers and directors is available in

180 Degree Capital’s Annual Report filed on Form N-CSR for the year

ended December 31, 2023, which was filed with the SEC on February

20, 2024, and in its proxy statement for the 2024 Annual Meeting of

Shareholders (“2024 Annual Meeting”), which was filed with the SEC

on March 1, 2024. To the extent holdings by the directors and

executive officers of 180 Degree Capital securities reported in the

proxy statement for the 2024 Annual Meeting have changed, such

changes have been or will be reflected on Statements of Change in

Ownership on Forms 3, 4 or 5 filed with the SEC. These documents

are or will be available free of charge at the SEC’s website at

https://www.sec.gov. Additional information regarding the persons

who may, under the rules of the SEC, be considered participants in

the solicitation of the 180 Degree Capital shareholders in

connection with the Business Combination will be contained in the

Proxy Statement when such document becomes available.

Mount Logan, its directors and executive

officers and other members of management and employees may be

deemed to be participants in the solicitation of proxies from the

shareholders of Mount Logan in favor of the approval of the

Business Combination. Information about Mount Logan’s executive

officers and directors is available in Mount Logan’s annual

information form dated March 14, 2024, available on its website at

https://mountlogancapital.ca/investor-relations and on SEDAR+ at

https://sedarplus.ca. To the extent holdings by the directors and

executive officers of Mount Logan securities reported in Mount

Logan’s annual information form have changed, such changes have

been or will be reflected on insider reports filed on SEDI at

https://www.sedi.ca/sedi/. Additional information regarding the

persons who may, under the rules of the SEC, be considered

participants in the solicitation of the Mount Logan shareholders in

connection with the Business Combination will be contained in the

Prospectus included in the Registration Statement when such

document becomes available.

Non-Solicitation

This press release is not intended to be, and

shall not constitute, an offer to buy or sell or the solicitation

of an offer to buy or sell any securities, or a solicitation of any

vote or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the U.S. Securities Act of 1933, as

amended.

Forward-Looking Statements

This press release, and oral statements made

from time to time by representatives of 180 Degree Capital and

Mount Logan, may contain statements of a forward-looking nature

relating to future events within the meaning of federal securities

laws. Forward-looking statements may be identified by words such as

“anticipates,” “believes,” “could,” “continue,” “estimate,”

“expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,”

“project,” “would,” “forecasts,” “seeks,” “future,” “proposes,”

“target,” “goal,” “objective,” “outlook” and variations of these

words or similar expressions (or the negative versions of such

words or expressions). Forward-looking statements are not

statements of historical fact and reflect Mount Logan’s and 180

Degree Capital’s current views about future events. Such

forward-looking statements include, without limitation, statements

about the benefits of the Business Combination involving Mount

Logan and 180 Degree Capital, including future financial and

operating results, Mount Logan’s and 180 Degree Capital’s plans,

objectives, expectations and intentions, the expected timing and

likelihood of completion of the Business Combination, and other

statements that are not historical facts, including but not limited

to future results of operations, projected cash flow and liquidity,

business strategy, payment of dividends to shareholders of New

Mount Logan, and other plans and objectives for future operations.

No assurances can be given that the forward-looking statements

contained in this press release will occur as projected, and actual

results may differ materially from those projected. Forward-looking

statements are based on current expectations, estimates and

assumptions that involve a number of risks and uncertainties that

could cause actual results to differ materially from those

projected. These risks and uncertainties include, without

limitation, the ability to obtain the requisite Mount Logan and 180

Degree Capital shareholder approvals; the risk that Mount Logan or

180 Degree Capital may be unable to obtain governmental and

regulatory approvals required for the Business Combination (and the

risk that such approvals may result in the imposition of conditions

that could adversely affect New Mount Logan or the expected

benefits of the Business Combination); the risk that an event,

change or other circumstance could give rise to the termination of

the Business Combination; the risk that a condition to closing of

the Business Combination may not be satisfied; the risk of delays

in completing the Business Combination; the risk that the

businesses will not be integrated successfully; the risk that the

cost savings and any other synergies from the Business Combination

may not be fully realized or may take longer to realize than

expected; the risk that any announcement relating to the Business

Combination could have adverse effects on the market price of Mount

Logan’s common stock or 180 Degree Capital’s common stock;

unexpected costs resulting from the Business Combination; the

possibility that competing offers or acquisition proposals will be

made; the risk of litigation related to the Business Combination;

the risk that the credit ratings of New Mount Logan or its

subsidiaries may be different from what the companies expect; the

diversion of management time from ongoing business operations and

opportunities as a result of the Business Combination; the risk of

adverse reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of

the Business Combination; competition, government regulation or

other actions; the ability of management to execute its plans to

meet its goals; risks associated with the evolving legal,

regulatory and tax regimes; changes in economic, financial,

political and regulatory conditions; natural and man-made

disasters; civil unrest, pandemics, and conditions that may result

from legislative, regulatory, trade and policy changes; and other

risks inherent in Mount Logan’s and 180 Degree Capital’s

businesses. Forward-looking statements are based on the estimates

and opinions of management at the time the statements are made.

Readers should carefully review the statements set forth in the

reports, which 180 Degree Capital has filed or will file from time

to time with the SEC and Mount Logan has filed or will file from

time to time on SEDAR+.

Neither Mount Logan nor 180 Degree Capital

undertakes any obligation, and expressly disclaims any obligation,

to publicly update any forward-looking statement, whether as a

result of new information, future events or otherwise, except as

required by law. Any discussion of past performance is not an

indication of future results. Investing in financial markets

involves a substantial degree of risk. Investors must be able to

withstand a total loss of their investment. The information herein

is believed to be reliable and has been obtained from sources

believed to be reliable, but no representation or warranty is made,

expressed or implied, with respect to the fairness, correctness,

accuracy, reasonableness or completeness of the information and

opinions. The references and link to the website

www.180degreecapital.com and mountlogancapital.ca have been

provided as a convenience, and the information contained on such

websites are not incorporated by reference into this press release.

Neither 180 Degree Capital nor Mount Logan is responsible for the

contents of third-party websites.

1. Daily estimated NAVs used for the discount

calculation outside of quarter-end dates are determined as

prescribed in 180’s Valuation Procedures for Level 3 assets.

Non-investment-related assets and liabilities used to determine

estimated daily NAV are those reported as of the end of the prior

quarter. Estimated NAV as of January 15, 2025, does not include

transaction fees and expenses related to the Business Combination

incurred during the period between signing and closing.

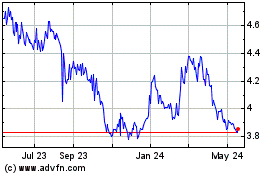

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Dec 2024 to Jan 2025

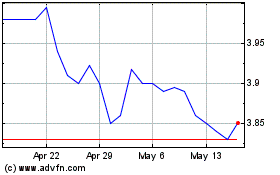

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Jan 2024 to Jan 2025