Visteon Closes $350 Million Term Loan

10 January 2006 - 9:05AM

PR Newswire (US)

VAN BUREN TOWNSHIP, Mich., Jan. 9 /PRNewswire-FirstCall/ -- Visteon

Corporation (NYSE:VC) today announced that it has closed on a new

18-month secured term loan of $350 million. The new term loan,

which will expire on June 20, 2007, replaces the company's $300

million secured short-term revolving credit facility that expired

on Dec. 15, 2005. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) The new

term loan was made a part of the company's existing $775 million

five-year facility agreement. The terms and conditions of the

agreement were also modified to align various covenants with

Visteon's restructuring initiatives and to make changes to the

consolidated leverage ratios. Visteon also amended its $250 million

delayed draw term loan agreement, which also expires in June 2007,

to reflect substantially the same terms and conditions. The new

limits on the consolidated leverage ratios are as follows: 4.75 for

the quarters ending Dec. 31, 2005 and March 31, 2006; 5.25 for the

quarter ending June 30, 2006; 4.25 for the quarter ending Sept. 30,

2006; 3.00 for the quarter ending Dec. 31, 2006; 2.75 for the

quarter ending March 31, 2007; and 2.50 thereafter. Visteon

Corporation is a leading global automotive supplier that designs,

engineers and manufactures innovative climate, interior, electronic

and lighting products for vehicle manufacturers, and also provides

a range of products and services to aftermarket customers. With

corporate offices in Van Buren Township, Mich. (U.S.); Shanghai,

China; and Kerpen, Germany; the company has more than 170

facilities in 24 countries and employs approximately 50,000 people.

This press release contains "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward- looking statements are not guarantees of future results

and conditions but rather are subject to various factors, risks and

uncertainties that could cause our actual results to differ

materially from those expressed in these forward-looking

statements, including the automotive vehicle production volumes and

schedules of our customers, and in particular Ford's vehicle

production volumes; our ability to satisfy our future capital and

liquidity requirements and comply with the terms of our existing

credit agreements or obtain any necessary waivers or amendments

thereto; the financial distress of our suppliers; our ability to

implement, and realize the anticipated benefits of, restructuring

and other cost-reduction initiatives and our successful execution

of internal performance plans and other productivity efforts;

charges resulting from restructurings, employee reductions,

acquisitions or dispositions; our ability to offset or recover

significant material surcharges; the effect of pension and other

post-employment benefit obligations; as well as those factors

identified in our filings with the SEC (including our Quarterly

Report on Form 10-Q for the quarter ended September 30, 2005). We

assume no obligation to update these forward-looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Jim Fisher,

+1-734-710-5557, , or Investor Inquiries: Derek Fiebig,

+1-734-710-5800, , both of Visteon Corporation Web site:

http://www.visteon.com/

Copyright

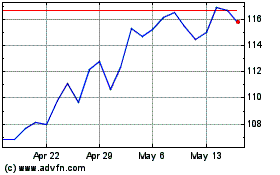

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

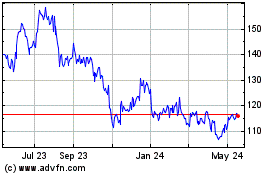

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024