Visteon Marketing $500 Million 8 Year Bonds At 6.625-6.875% -Source

31 March 2011 - 5:20AM

Dow Jones News

Auto parts maker Visteon Corp. (VC) is planning to sell $500

million of senior unsecured bonds later this week, according to a

person familiar with the offering, who added that price guidance is

in the range of 6.625% to 6.875%.

Proceeds from the notes, which mature in 2019, with be used

along with cash on hand to retire Visteon's senior secured term

loan due 2017. The notes will be non-callable for three years.

Bank of America Merrill Lynch is leading the deal, supported by

Morgan Stanley and Citibank. Serving as joint leads are Scotia

Capital and Barclays Capital.

Jim Fisher, a spokesman for Visteon, declined to comment on the

deal.

The company was spun off from Ford Motor Co. in June 2000.

-By Katy Burne, Dow Jones Newswires; 212-416-3084;

katy.burne@dowjones.com

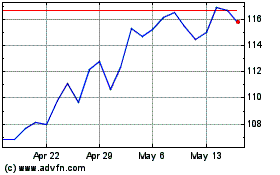

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2024 to Aug 2024

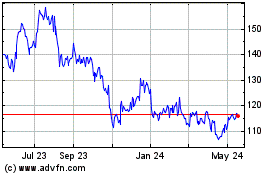

Visteon (NASDAQ:VC)

Historical Stock Chart

From Aug 2023 to Aug 2024