Form POS AM - Post-Effective amendments for registration statement

23 February 2024 - 8:12AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on February 22, 2024

Registration No. 333-256513

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-1 ON FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

VIMEO, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

|

|

|

85-4334195

|

|

| |

(State or other jurisdiction

of incorporation or organization)

|

|

|

(I.R.S. Employer

Identification No.)

|

|

330 West 34th Street, 5th Floor

New York, New York 10001

(212) 524-8791

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jessica Tracy, Esq.

General Counsel and Secretary

Vimeo, Inc.

330 West 34th Street, 5th Floor

New York, New York 10001

(212) 524-8791

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”), other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the U.S. Securities Exchange Act of 1934.

| |

Large accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

EXPLANATORY NOTE

On May 25, 2021, Vimeo, Inc., a Delaware corporation (formerly known as Vimeo Holdings, Inc., “Vimeo,” “we,” “us,” “our,” the “Company” or the “Registrant”), completed its separation from the remaining businesses of IAC/InterActiveCorp (“IAC”) (the “Spin-off”).

Vimeo’s original registration statement on Form S-1 (File No. 333-256513) filed with the Securities and Exchange Commission (the “SEC”) on May 26, 2021 (the “Form S-1”), covered 1,263,132 shares of Vimeo common stock, par value $0.01 per share (“Vimeo Common Stock”) that may be acquired upon exercise of options (“Vimeo Options”) or stock appreciation rights (“Vimeo SARs”) to acquire shares of Vimeo Common Stock held by (1) former employees of IAC and its subsidiaries (excluding Vimeo, Inc. and its subsidiaries), (2) current employees of IAC’s subsidiaries, (3) former employees of Vimeo and its subsidiaries and (4) current and former employees of Match Group, Inc., who, in each case, are not current employees of Vimeo or a subsidiary thereof, and any such individuals’ donees, pledgees, permitted transferees, assignees, successors and others who come to hold any such equity award. The Vimeo Options are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from options to purchase shares of common stock of IAC (“IAC Options”) in connection with the separation of Vimeo from IAC. The IAC Options were granted under the IAC/InterActiveCorp 2018 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2013 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2008 Stock and Annual Incentive Plan and the IAC/InterActiveCorp 2005 Stock and Annual Incentive Plan. The Vimeo SARs are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from stock appreciation rights covering shares of common stock of Vimeo.com, Inc. in connection with the separation of Vimeo from IAC. The Vimeo SARs were granted under (a) the Vimeo, LLC 2012 Incentive Plan, (b) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2017 Incentive Plan, and (c) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2019 Incentive Plan (including the Israel Appendix). There is also registered hereunder such indeterminate number of additional shares of Vimeo Common Stock that may become issuable due to anti-dilution adjustments for changes resulting from stock splits, stock dividends, recapitalizations or similar transactions and certain other events as provided for in the terms thereof.

On March 2, 2022, Vimeo filed a Post-Effective Amendment No. 1 to Form S-1 (the “Post-Effective Amendment No. 1”) to update the Form S-1 to incorporate by reference its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, which the registrant filed with the SEC on March 1, 2022, and to update certain other information. On August 2, 2022, Vimeo filed a Post-Effective Amendment No. 2 to Form S-1 on Form S-3 (the “Post-Effective Amendment No. 2”) to convert the Form S-1 into a Registration Statement on Form S-3. The Post-Effective Amendment No. 2 contained an updated prospectus relating to the offering and sale of the shares of Vimeo Common Stock remaining available for issuance under the Form S-1. On February 21, 2024, Vimeo filed a Post-Effective Amendment No. 3 to Form S-1 on Form S-3 (the “Post-Effective Amendment No. 3”) for the purpose of including disclosure required for a registrant other than a well-known seasoned issuer, identifying the securities being registered, registering a specific amount of securities and paying the associated filing fee.

This Post-Effective Amendment No. 4 to Form S-1 on Form S-3 (“Post-Effective Amendment No. 4” and, collectively with the Form S-1, Post-Effective Amendment No. 1, Post-Effective Amendment No. 2 and Post-Effective Amendment No. 3, the “Registration Statement”) is being filed using EDGAR submission type POS AM in order to convert the Registration Statement to the proper EDGAR submission type for a non-automatic shelf registration statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 22, 2024

PROSPECTUS

VIMEO, INC.

873,107 Shares of Common Stock, Par Value $0.01 Per Share

The 873,107 shares of common stock covered by the registration statement of which this prospectus forms a part covers options (“Vimeo Options”) and stock appreciation rights (“Vimeo SARs”) to acquire shares of the common stock of Vimeo that are held by (1) former employees of IAC/InterActiveCorp (“IAC”) and its subsidiaries (excluding Vimeo and its subsidiaries), (2) current employees of IAC’s subsidiaries, (3) former employees of Vimeo and its subsidiaries and (4) current and former employees of Match Group, Inc., who, in each case, are not current employees of Vimeo or a subsidiary thereof, and any such individuals’ donees, pledgees, permitted transferees, assignees, successors and others who come to hold any such equity award. The Vimeo Options are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from options to purchase shares of common stock of IAC (“IAC Options”) in connection with the separation of Vimeo from IAC. The IAC Options were granted under the IAC/InterActiveCorp 2018 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2013 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2008 Stock and Annual Incentive Plan and the IAC/InterActiveCorp 2005 Stock and Annual Incentive. The Vimeo SARs are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from stock appreciation rights covering shares of common stock of Vimeo.com, Inc. (“Vimeo SARs”) in connection with the separation of Vimeo from IAC. The Vimeo SARs were granted under (a) the Vimeo, LLC 2012 Incentive Plan, (b) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2017 Incentive Plan, and (c) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2019 Incentive Plan (including the Israel Appendix) (each a “Plan,” and collectively, the “Plans”). All awards are subject to the terms of the applicable Plan and the applicable award agreement. Any proceeds received by Vimeo from the exercise of stock options covered by the Plans (and issued pursuant to the offering described in this prospectus) will be used for general corporate purposes.

Our common stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “VMEO.” On February 21, 2024, the last sale price of our common stock as reported on the Nasdaq was $3.68 per share.

In reviewing this prospectus, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

10 |

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

12

|

|

|

ABOUT VIMEO

Vimeo, Inc. was incorporated as a Delaware corporation in December 2020. Vimeo is the world’s most innovative video experience platform, providing a full breadth of video tools through a software-as-a-service model. Vimeo provides a turnkey cloud-based solution that eliminates barriers to using video and solves essential video needs.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents that we have filed with the SEC that are incorporated by reference herein include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “will,” “may, “could,” “should,” “would,” “anticipates,” “estimates,” “expects,” “plans,” “projects,” “forecasts,” “intends,” “targets,” “seeks” and “believes,” as well as variations of these words, among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to Vimeo’s future results of operations and financial condition, business strategy, and plans and objectives of management for future operations.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions. Actual results could differ materially from those contained in or implied by these forward-looking statements. When considering forward-looking statements, you should keep in mind the factors described in Part I. “Item 1A. Risk Factors” and Part II. “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, incorporated by reference herein. Factors that could cause or contribute to such differences include, but are not limited to:

•

we have a history of losses,

•

our prior rapid growth may not be indicative of future performance, and our revenue has declined,

•

our limited operating history as a pure software-as-a-service (“SaaS”) company and our limited history of selling such plans through our sales force,

•

our total addressable market may prove to be smaller than we expect,

•

our ability to read data and make forecasts may be limited,

•

we may not have the right product/market fit and may not be able to attract free users or paid subscribers,

•

we may not be able to convert our free users into subscribers,

•

competition in our market is intense,

•

we may not be able to scale our business effectively,

•

we may need additional funding as we continue to grow our business,

•

the user or capabilities of artificial intelligence in our offerings may result in reputational harm and liability,

•

we may experience service interruptions,

•

hosting and delivery costs may increase unexpectedly,

•

weakened global economic conditions may harm our industry, business and results of operations,

•

our business involves hosting large quantities of user content,

•

we have been sued for hosting content that allegedly infringed on a third-party copyright,

•

we may face liability for hosting a variety of tortious or unlawful materials,

•

we have faced negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law,

•

we collect, store and process large amounts of content and personal information and any loss of or unauthorized access to such data could materially impact our business,

•

if our business becomes constrained by changing legal and regulatory requirements, including with respect to privacy, data security and data protection, consumer protection, and user-generated content, or enforcement by government regulators, including fines, orders or consent decrees in the U.S. or other jurisdictions in which we operate, our operating results will suffer,

•

we may experience a disruption of our business activities due to senior executive transitions,

•

we have been the target of cyberattacks by malicious actors,

•

we have faced claims that we infringe third-party intellectual property rights, and

•

the risks described in the section titled “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. You should read this prospectus and the documents that we reference and have incorporated by reference herein with the understanding that our actual future results, levels of activity, performance, and achievements may be materially different from what we expect. Any forward-looking statements only speak as of the date such statements are made, and we undertake no obligation to update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified by these cautionary statements.

THE OFFERING

873,107 shares of Vimeo Common Stock

Any proceeds received by Vimeo from the exercise of Vimeo stock options and stock appreciation rights covered by the Plans (and issued pursuant to the offering described in this prospectus) are expected to be used for general corporate purposes. These proceeds represent the exercise prices for the Vimeo stock options and stock appreciation rights. See “Use of Proceeds.”

For a discussion of risk and uncertainties involved with an investment in our common stock, see “Risk Factors” included and incorporated by reference elsewhere in this prospectus and any risk factors described in any accompanying prospectus supplement.

Vimeo Common Stock is currently listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “VMEO.”

RISK FACTORS

Investing in our common stock involves risks. Before deciding to invest in our common stock, you should carefully consider the risks described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which are incorporated by reference into this prospectus in their entirety, and may be amended, supplemented or superseded from time to time by our subsequent filings under the Exchange Act, including any subsequent Quarterly Reports on Form 10-Q. You should also consider the risk factors described in any related prospectus supplement or any documents we incorporate by reference in the future. Our business, results of operations, financial condition, and prospects could also be harmed by risks and uncertainties that are not presently known to us or that we currently believe are not material. If any of the risks actually occur, our business, results of operations, financial condition, and prospects could be materially and adversely affected. In such event, the market price of our common stock could decline.

USE OF PROCEEDS

Any proceeds received by Vimeo from the exercise of Vimeo stock options and stock appreciation rights covered by the Plans (and issued pursuant to the offering described in this prospectus) are expected to be used for general corporate purposes. These proceeds represent the exercise prices for the Vimeo stock options and stock appreciation rights. We will have broad discretion over the use of proceeds from the exercise of Vimeo stock options covered by the Plans.

PLAN OF DISTRIBUTION

Shares of Vimeo Common Stock offered hereby will be issued upon the exercise and settlement of Vimeo stock options and stock appreciation rights to purchase Vimeo Common Stock issued pursuant to the Plans.

DESCRIPTION OF CAPITAL STOCK

LEGAL MATTERS

The validity of the shares of Vimeo Common Stock has been passed upon for Vimeo by Jessica Tracy, General Counsel and Secretary of Vimeo.

EXPERTS

The consolidated financial statements of Vimeo, Inc. appearing in Vimeo, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2023, and the effectiveness of Vimeo, Inc.’s internal control over financial reporting as of December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-1 with the SEC under the Securities Act with respect to the shares of Vimeo Common Stock being offered as contemplated by this prospectus. This prospectus is a part of, and does not contain all of the information set forth in, the registration statement and the exhibits and schedules to the registration statement. For further information with respect to Vimeo and Vimeo Common Stock, please refer to the registration statement, including its exhibits and schedules. Statements made in this prospectus relating to any contract or other document filed as an exhibit to the registration statement include the material terms of such contract or other document. However, such statements are not necessarily complete, and you should refer to the exhibits attached to the registration statement for copies of the actual contract or document. You may review a copy of the registration statement, including its exhibits and schedules, on the Internet website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by Vimeo may be obtained free of charge on Vimeo’s website at www.vimeo.com. Information contained on or connected to any website referenced in this prospectus is not incorporated into this prospectus or the registration statement of which this prospectus forms a part, or in any other filings with, or any information furnished or submitted to, the SEC.

Vimeo is subject to the information and reporting requirements of the Exchange Act and, in accordance with the Exchange Act, files periodic reports, proxy statements and other information with the SEC.

We intend to furnish holders of Vimeo Common Stock with annual reports containing consolidated financial statements prepared in accordance with GAAP and audited and reported on, with an opinion expressed, by an independent registered public accounting firm.

You should rely only on the information contained in this prospectus or to which this prospectus has referred you. We have not authorized any person to provide you with different information or to make any representation not contained in this prospectus.

INFORMATION INCORPORATED BY REFERENCE

We “incorporate by reference” certain documents we have filed with the SEC, which means that we are disclosing important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus, and any information contained in this prospectus or in any document incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent that a statement contained in any prospectus supplement or free writing prospectus provided to you by us modifies or supersedes the original statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to be a part of this prospectus. The following documents filed with the SEC are hereby incorporated by reference in this prospectus:

•

•

•

the description of our securities filed as Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 1, 2022, including any amendments or reports filed for the purpose of updating this description; and

•

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination or completion of the offering of securities under this prospectus shall be deemed to be incorporated by reference in this prospectus and to be a part hereof from the date of filing such reports and other documents. We are not, however, incorporating by reference any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 (including exhibits furnished under Item 9.01 in connection with information furnished under Item 2.02 or Item 7.01) of Form 8-K.

We hereby undertake to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been incorporated by reference in this prospectus, other than exhibits to such documents, unless such exhibits have been specifically incorporated by reference thereto. Requests for such copies should be directed to our Investor Relations department, at the following address:

Vimeo, Inc.

Attn: Investor Relations

330 West 34th Street, 5th Floor

New York, New York 10001

(212) 524-8791

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses Of Issuance And Distribution

The following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being registered hereby:

| |

SEC registration fee

|

|

|

|

$ |

0(1) |

|

|

| |

Legal fees and expenses

|

|

|

|

$ |

50,000 |

|

|

| |

Accounting fees and expenses

|

|

|

|

$ |

50,000 |

|

|

| |

Financial printing and miscellaneous expenses

|

|

|

|

$ |

50,000 |

|

|

| |

Total

|

|

|

|

$ |

150,000 |

|

|

(1)

$6,068.37 was previously paid.

Item 15. Indemnification Of Directors And Officers

Section 145 of the Delaware General Corporation Law (which we refer to as the “DGCL”) provides that a corporation may indemnify directors and officers, as well as other employees and individuals, against expenses (including attorney fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which such person is made a party by reason of such person being or having been a director, officer, employee or agent of the corporation. Section 145 of the DGCL also permits a corporation to pay expenses incurred by a director or officer in advance of the final disposition of a proceeding, subject to receipt of an undertaking by such director or officer to repay such amount if it shall be ultimately determined that such person is not entitled to be indemnified by the corporation. The DGCL provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under any by-laws, agreement, vote of stockholders or disinterested directors or otherwise.

The organizational documents of the Registrant provide for indemnification of the Company’s directors and officers (and their legal representatives), and of those serving at the request of the relevant board of directors or officers as an employee or agent of the corporation, or as a director, officer, employee or agent of another corporation, partnership, joint venture or other enterprise, to the fullest extent authorized by the DGCL, except that the relevant corporation shall indemnify a person for a proceeding (or part thereof) initiated by such person only if the proceeding (or part thereof) was authorized by the relevant board of directors. The by-laws of the Registrant specifically provide for mandatory advancement of expenses to persons entitled to indemnification in defending any action, suit or proceeding in advance of its final disposition; provided, that, if the DGCL so requires, such persons provide an undertaking to repay such amounts advanced if it is ultimately determined that such person is not entitled to indemnification. From time to time, the directors and officers of the Registrant may be provided with indemnification agreements that are consistent with or greater than the foregoing provisions and, to the extent such directors and officers serve as executive officers or directors of subsidiaries of the Registrant, consistent with the indemnification provisions of the charter documents of such subsidiaries. The Registrant has adopted (or may adopt) policies of directors’ and officers’ liability insurance to insure directors and officers against the costs of defense, settlement and/or payment of judgments under certain circumstances. The Registrant believes that the agreements and arrangements described above are necessary to attract and retain qualified persons as directors and officers.

Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation is not personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability: (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders; (ii) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; (iii) for unlawful payments of dividends or unlawful

stock repurchases or redemptions; or (iv) for any transaction from which the director derived an improper personal benefit. The certificate of incorporation of the Registrant provides for such limitation of liability.

The Spin-off-related agreements filed as exhibits to this Registration Statement may contain provisions regarding indemnification of the Registrant’s directors and officers against certain liabilities.

Item 16. Exhibits and Financial Statement Schedules

(a) The exhibits listed below in the “Exhibit Index” are filed as part of, or are incorporated by reference in, this registration statement.

(b) Exhibit Index

EXHIBIT INDEX

| |

Exhibit No.

|

|

|

Description of Document

|

|

| |

2.1#

|

|

|

Separation Agreement by and between IAC/InterActiveCorp and Vimeo, Inc., dated as of May 24, 2021 (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K, filed with the SEC on May 27, 2021)*

|

|

| |

2.2#

|

|

|

Amended and Restated Agreement and Plan of Merger, dated as of March 12, 2021 by and among Vimeo, Inc., Stream Merger Sub, Inc. and Vimeo.com, Inc. (incorporated by reference to Annex G of the Spin-off S-4, filed with the SEC on March 12, 2021)*

|

|

| |

5.1

|

|

|

|

|

| |

23.1

|

|

|

|

|

| |

23.2

|

|

|

|

|

| |

24.1#

|

|

|

|

|

| |

24.2#

|

|

|

|

|

| |

24.3#

|

|

|

|

|

| |

99.1#

|

|

|

|

|

| |

101.INS#

|

|

|

XBRL Instance Document

|

|

| |

101.SCH#

|

|

|

XBRL Taxonomy Extension Schema Document

|

|

| |

101.CAL#

|

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

| |

101.DEF#

|

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

| |

101.LAB#

|

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

| |

101.PRE#

|

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

| |

107

|

|

|

|

|

*

Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and similar attachments have been omitted. The Company hereby agrees to furnish a copy of any omitted schedule or similar attachment to the Securities and Exchange Commission upon request.

#

Previously filed.

Item 17. Undertakings

The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933 (the “Securities Act”);

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(6) That, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Post-Effective Amendment No. 4 to be signed on its behalf by the undersigned, thereunto duly authorized in the City of New York, State of New York, on February 22, 2024.

| |

|

|

|

VIMEO, INC.

|

|

| |

|

|

|

By:

|

|

|

/s/ Jessica Tracy

Name: Jessica Tracy

Title:

General Counsel and Secretary

|

|

IN WITNESS WHEREOF and pursuant to the requirements of the Securities Act, this Post-Effective Amendment No. 4 has been signed by the following persons in the capacities and on the date indicated above.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Adam Gross

Adam Gross

|

|

|

Interim Chief Executive Officer & Director

(Principal Executive Officer)

|

|

| |

/s/ Gillian Munson

Gillian Munson

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

|

| |

*

Glenn Schiffman

|

|

|

Chairman of the Board of Directors

|

|

| |

*

Alesia J. Haas

|

|

|

Director

|

|

| |

*

Jay Herratti

|

|

|

Director

|

|

| |

*

Ida Kane

|

|

|

Director

|

|

| |

*

Mo Koyfman

|

|

|

Director

|

|

| |

*

Alexander von Furstenberg

|

|

|

Director

|

|

*By:

/s/ Jessica Tracy

Jessica Tracy

Attorney-in-Fact

Exhibit 5.1

February 22, 2024

Vimeo, Inc.

330 West 34th Street, 5th Floor

New York, NY 10001

Re: Post-Effective Amendment No. 4 to Form S-1 on Form S-3

Ladies and Gentlemen:

This opinion is furnished in connection with the filing with the Securities

and Exchange Commission (the “SEC”) of a Post-Effective Amendment No. 4 to Form S-1 on Form S-3 (Registration

No. 333-256513) (as amended, the “Registration Statement”) by Vimeo, Inc. (the “Company”) under the

Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of 1,263,132 shares (the “Shares”)

of the Company’s common stock, par value $0.01 per share (“Common Stock”), that may be acquired upon the exercise of

options (“Company Options”) or stock appreciation rights (“Company SARs”) to acquire shares of Common Stock held

by (1) former employees of IAC/InterActiveCorp (“IAC”) and its subsidiaries (excluding the Company and its subsidiaries),

(2) current employees of IAC’s subsidiaries, (3) former employees of the Company and its subsidiaries and (4) current

and former employees of Match Group, Inc., who, in each case, are not employees of the Company or a subsidiary of the Company, and

any such individual’s donees, pledgees, permitted transferees, assignees, successors and others who come to hold any such equity

award. The Company Options are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from options

to purchase shares of common stock of IAC (“IAC Options”) in connection with the separation of the Company from IAC. The IAC

Options were granted under the IAC/InterActiveCorp 2018 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2013 Stock and Annual

Incentive Plan, the IAC/InterActiveCorp 2008 Stock and Annual Incentive Plan and the IAC/InterActiveCorp 2005 Stock and Annual Incentive

Plan. The Company SARs are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from stock appreciation

rights covering shares of common stock of Vimeo.com, Inc. in connection with the separation of the Company from IAC. The Company

SARs were granted under the Vimeo, LLC 2012 Incentive Plan, the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2017 Incentive Plan and

the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2019 Incentive Plan (including the Israel Appendix). The Vimeo, Inc. 2021 Stock

and Annual Incentive Plan, IAC/InterActiveCorp 2018 Stock and Annual Incentive Plan, IAC/InterActiveCorp 2013 Stock and Annual

Incentive Plan, IAC/InterActiveCorp 2008 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2005 Stock and Annual Incentive

Plan, Vimeo, LLC 2012 Incentive Plan, Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2017 Incentive Plan and the Vimeo.com, Inc. (f/k/a

Vimeo, Inc.) 2019 Incentive Plan (including the Israel Appendix) together are the “Plans”.

I have acted as counsel to the Company in connection with certain matters

relating to the Plans and the registration of the Shares. I have reviewed such corporate proceedings relating thereto and have examined

such records, certificates and other documents and considered such questions of law as I have deemed necessary in giving this opinion,

including:

(i) the Company’s Amended

and Restated certificate of incorporation, as of May 25, 2021 (the “Certificate of Incorporation”);

(ii) the Company’s Amended

and Restated by-laws, as of May 25, 2021 (the “By-laws”);

(iii) copies of the Plans; and

(iv) the Registration Statement.

In examining the foregoing documents, I have assumed all signatures

are genuine, that all documents purporting to be originals are authentic, that all copies of documents conform to the originals, that

the representations and statements included therein are accurate and that there will be no changes in applicable law between the date

of this opinion and the dates on which the Shares are issued or delivered pursuant to the Registration Statement.

I have relied as to certain matters on information obtained from public

officials, officers of the Company and other sources I believe to be responsible.

Based on the foregoing, it is my opinion that when the Registration

Statement has been declared effective by the SEC and the Shares have been issued, delivered and paid for in the manner contemplated by

and upon the terms and conditions set forth in the Registration Statement and in accordance with the provisions of the Plans, the Shares

will be validly issued, fully paid and non-assessable.

The Company is a Delaware corporation, and while I am not engaged in

the practice of law in the State of Delaware, I am generally familiar with the Delaware General Corporation Law as presently in effect

and have made such inquiries as I considered necessary to render this opinion. I am a member of the Bar of the State of New York and express

no opinion as to the laws of any jurisdiction other than the federal laws of the United States, the laws of the State of New York and

the Delaware General Corporation Law.

I hereby consent to the filing of this opinion as Exhibit 5.1

to the aforementioned Registration Statement and to the reference to my name under the heading “Legal Matters” in the Registration

Statement and any amendments thereto. In giving such consent, I do not thereby admit that I am in the category of persons whose consent

is required under Section 7 of the Securities Act.

| |

Very truly yours, |

| |

|

| |

/s/ Jessica Tracy |

| |

Jessica Tracy |

| |

General Counsel & Secretary |

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We

consent to the reference to our firm under the caption “Experts” in the Registration Statement (Form S-3 No. 333-256513)

and related Prospectus of Vimeo, Inc. for the registration of its common stock and to the incorporation by reference therein of our

reports dated February 21, 2024, with respect to the consolidated financial statements of Vimeo, Inc., and the effectiveness

of internal control over financial reporting of Vimeo, Inc. included in its Annual Report (Form 10-K) for the year ended December 31,

2023, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

New York, New York

February 22, 2024

EX-FILING

FEES

Calculation

of Filing Fee Tables

Post-Effective

Amendment to Form S-1 on Form S-3

(Form Type)

Vimeo, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward

Securities

| |

|

Security Type |

|

Security

Class

Title |

|

|

Fee

Calculation

or Carry

Forward Rule |

|

|

Amount

Registered |

|

|

Proposed

Maximum

Offering

Price

Per Unit |

|

|

Maximum

Aggregate

Offering Price |

|

|

Fee Rate |

|

|

Amount of

Registration Fee |

|

| Fees to Be Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees Previously Paid |

|

Equity |

|

Shares of common stock,

par value $0.01 per share |

|

|

|

457(c) and 457(f) |

(1) |

|

|

1,263,132 |

(1)(2) |

|

|

|

|

$ |

55,622,017.62 |

(3) |

|

|

0.0001091 |

|

|

$ |

6,068.37 |

|

| |

|

Total Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

55,622,017.62 |

|

|

|

|

|

|

$ |

6,068.37 |

|

| |

|

Total Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

6,068.37 |

|

| |

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

| |

|

Net Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.00 |

|

| (1) |

Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional shares of common stock, par value $0.01 per share, of Vimeo, Inc. (“Vimeo” and such shares of common stock, “Vimeo Common Stock”) that may become issuable due to anti-dilution adjustments for changes resulting from stock splits, stock dividends, recapitalizations or similar transactions and certain other events as provided for in the terms thereof. |

| (2) |

This registration statement covers shares of Vimeo Common Stock that may be acquired upon exercise of options (“Vimeo Options”) or stock appreciation rights (“Vimeo SARs”) to acquire shares of Vimeo Common Stock held by (1) former employees of IAC/InterActiveCorp (“IAC”) and its subsidiaries (excluding Vimeo and its subsidiaries), (2) current employees of IAC’s subsidiaries, (3) former employees of Vimeo and its subsidiaries and (4) current and former employees of Match Group, Inc., who, in each case, are not current employees of Vimeo or a subsidiary of Vimeo, and any such individuals’ donees, pledgees, permitted transferees, assignees, successors and others who come to hold any such equity award. The Vimeo Options are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from options to purchase shares of common stock of IAC (“IAC Options”) in connection with the separation of Vimeo from IAC. The IAC Options were granted under the IAC/InterActiveCorp 2018 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2013 Stock and Annual Incentive Plan, the IAC/InterActiveCorp 2008 Stock and Annual Incentive Plan and the IAC/InterActiveCorp 2005 Stock and Annual Incentive Plan. The Vimeo SARs are outstanding under the Vimeo, Inc. 2021 Stock and Annual Incentive Plan and were converted from stock appreciation rights covering shares of common stock of Vimeo.com, Inc. in connection with the separation of Vimeo from IAC. The Vimeo SARs were granted under (a) the Vimeo, LLC 2012 Incentive Plan, (b) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2017 Incentive Plan, and (c) the Vimeo.com, Inc. (f/k/a Vimeo, Inc.) 2019 Incentive Plan (including the Israel Appendix). |

| (3) |

Such value equals the product of (a) 1,263,132 (the maximum number of shares of Vimeo common stock calculated pursuant to Note 1 above), multiplied by (b) $44.04, the average of the high and low prices of the Vimeo Common Stock as reported on The Nasdaq Global Select Market on May 25, 2021. |

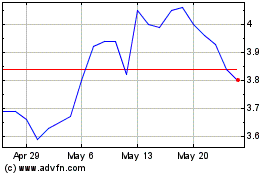

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From Apr 2024 to May 2024

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From May 2023 to May 2024