Trending: Vodafone's Spanish Unit Sale Gets Muted Response from Investors

01 November 2023 - 1:07AM

Dow Jones News

1336 GMT - Vodafone Group is among the most mentioned companies

across news items over the past six hours, according to Factiva

data, after the company announced the sale of its Spanish unit for

around 5 billion euros ($5.31 billion), which received a muted

response from investors. Vodafone's sale of its Spanish unit

represents a full exit from a long-time challenging market but it

isn't huge in the overall context for the group, Berenberg analyst

Carl Murdock-Smith wrote in a note. AJ Bell's investment director

Russ Mould said that Vodafone needed to be more imaginative in

reviving its fortunes. He added that the company still needs to

simplify its business, having suffered from being in too many

markets with too little resource. Barclays analysts Maurice Patrick

and Mathieu Robilliard said that the deal raised dividend

questions, noting that the group said it would revisit its capital

allocation policy in May on the back of a sale. Shares are

currently down 1.1% at 75.87 pence. Dow Jones & Co. owns

Factiva. (ian.walker@wsj.com.)

(END) Dow Jones Newswires

October 31, 2023 09:52 ET (13:52 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

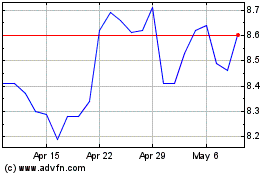

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

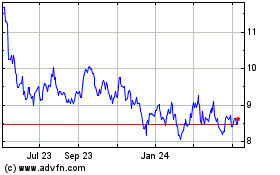

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024