false

--12-31

0001853044

0001853044

2023-11-06

2023-11-06

0001853044

AERT:ClassaOrdinarySharesParValue0.0001PerShareMember

2023-11-06

2023-11-06

0001853044

AERT:RedeemableWarrantsEachWholeWarrantExercisableForOneClassaOrdinaryShareAtExercisePriceOf11.50Member

2023-11-06

2023-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) November 6, 2023

Aeries Technology, Inc.

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

|

001-40920 |

|

98-1587626 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification Number) |

190 Elgin Avenue,

George Town, Grand Cayman

|

|

KY1-9008 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(919)

228-6404

(Registrant’s

telephone number, including area code)

Worldwide

Webb Acquisition Corp.

770

E Technology Way F13-16

Orem, UT 84997

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

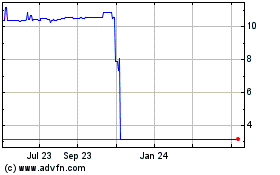

| Class A

ordinary shares, par value $0.0001 per share |

|

AERT |

|

Nasdaq

Capital Market |

| Redeemable

warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AERTW |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

INTRODUCTORY

NOTE

Business

Combination

Worldwide

Webb Acquisition Corp., a Cayman Islands exempted company (“WWAC”), previously entered into a Business Combination

Agreement, dated as of March 11, 2023 (as amended, the “Business Combination Agreement”), by and among WWAC, WWAC

Amalgamation Sub Pte. Ltd., a Singapore private company limited by shares and a direct wholly owned subsidiary of WWAC (“Amalgamation

Sub”), and AARK (defined below), pursuant to which, and subject to the terms and conditions set forth therein, Amalgamation

Sub and AARK would amalgamate and continue as one company, with AARK being the surviving entity and becoming a subsidiary of WWAC, and

as a result thereof, Aeries (defined below) would become a subsidiary of WWAC (the “Amalgamation” and together with

the transactions contemplated by the Business Combination Agreement, the “Business Combination”).

In

connection with the Business Combination, WWAC filed a registration statement on Form S-4 (File No. 333-271894) (as amended,

the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”). On October 17, 2023,

the Registration Statement was declared effective by the SEC and on October 17, 2023, WWAC filed a proxy

statement/prospectus (as subsequently supplemented, the “Proxy Statement/Prospectus”) with the Securities and Exchange

Commission (the “SEC”).

On

November 6, 2023 (the “Closing Date”), as contemplated in the Business Combination Agreement and described in the

section entitled “Proposal No.1—Business Combination Proposal” beginning on page 99 of the Proxy Statement/Prospectus,

WWAC consummated the Business Combination, following the approval by WWAC’s shareholders at the annual meeting of shareholders

held on November 2, 2023 (the “WWAC Shareholder Meeting”). The closing of the Business Combination is herein referred

to as “the Closing.” In connection with the Closing, on the Closing Date, WWAC adopted the Proposed

Amended and Restated Articles of Association (the “Amended & Restated Articles”) and changed its name from Worldwide

Webb Acquisition Corp. to Aeries Technology, Inc. (“ATI”).

As

a result of the Business Combination and upon the Closing, among other things, (i) each outstanding Class A ordinary share of WWAC automatically

became one ATI Class A ordinary share and each outstanding Class B ordinary share of WWAC was converted into one ATI Class A ordinary

share, and each outstanding warrant of WWAC automatically became one warrant to purchase one ATI Class A ordinary share at an exchange

ratio of 1.0, (2) the Class V Shareholder was issued one Class V ordinary share in ATI, (3) 5,638,530 newly issued ATI Class A ordinary

shares were issued to Innovo Consultancy DMCC, a company incorporated in Dubai, United Arab Emirates

(“Innovo”) and (4) certain holders of Class A ordinary shares who elected not to redeem such shares in connection

with the vote to approve the Business Combination Agreement were issued a number of newly issued ATI Class A ordinary shares.

The

foregoing description of the Business Combination Agreement and the Business Combination does not purport to be complete and is qualified

in its entirety by the full text of the Business Combination Agreement and each amendment thereto, which are included as Exhibits 2.1,

2.2, 2.3 and 2.4 to this Current Report on Form 8-K (this “Report”).

Amalgamation

In

connection with the Closing, Amalgamation Sub amalgamated with and into AARK pursuant to the Business

Combination Agreement, with AARK as the surviving company in the Amalgamation and, after giving effect to such Amalgamation, AARK became

a subsidiary of ATI. In connection with the Amalgamation, AARK adopted the AARK Constitution, which provides, among other things,

that (x) AARK will be managed by its directors, and (y) so long as the ATI Class V ordinary

share remains outstanding, (1) the AARK board will consist of three directors, which will consist of two independent directors of

ATI and the Sole Shareholder, and (2)(a) ATI will have the right to nominate to the AARK board the two independent directors from four

of its independent directors and (b) the Sole Shareholder and his heirs and successors will have the right to nominate the remaining

director to serve on the AARK board.

The

foregoing description of the AARK Constitution and the Amalgamation does not purport to be complete and is qualified in its entirety

by the full text of the AARK Constitution, a copy of which is filed with this Report as Exhibit 10.1 and is incorporated by reference

herein.

Pursuant

to the Amended & Restated Articles, the Sole Shareholder, if presiding over a meeting of the board of Directors of the Combined Company,

will abstain from voting on the appointment of either of the two directors of AARK who will be selected from the four independent directors

of ATI.

Forward

Purchase Agreements & Subscription Agreements

As

previously disclosed, on November 3, 2023 and November 5, 2023, WWAC entered into forward purchase agreements (each, as subsequently

amended, a “Forward Purchase Agreement”) with certain parties thereto (each,

a “Seller”) for an OTC Equity Prepaid Forward Transaction. In connection with the Forward Purchase Agreements, WWAC

entered into subscription agreements (each, a “Subscription Agreement”) with such Sellers, pursuant to which, subject

to certain limitations contained therein, each Seller agreed to purchase from WWAC that number of shares of Class A ordinary shares,

par value $0.0001 per share, of WWAC up to the Maximum Number of Shares under the applicable Forward Purchase Agreement for a purchase

price per share equal to the redemption price, as defined in Section 49.5 of the Amended and Restated Memorandum and Articles of

Association of WWAC, effective as of October 19, 2021, less the number of Recycled Shares. The aggregate number of shares purchased

by the Sellers pursuant to the Subscription Agreements and the Forward Purchase Agreements (other than the Recycled Shares) was 3,711,667.

Each

of the foregoing summaries of the Forward Purchase Agreements and the Subscription Agreements are qualified in its entirety by reference

to the text of the Form of Forward Purchase Agreement, the Form of Forward Purchase Agreement Amendment and the Form of Subscription

Agreement, copies of which are filed with this Report as Exhibit 10.27, 10.28 and 10.29, respectively, and are incorporated herein by

reference.

Non-Redemption

Agreements

Pursuant

to those certain Non-Redemption Agreements entered into on or about March 31, 2023, October 9, 2023, November 2, 2023 and November 5,

2023, in connection with the Closing (the “Non-Redemption Agreements”), ATI issued an aggregate of 1,024,335 ATI Class

A ordinary shares to the Holders who elected not to redeem their shares pursuant to the Non-Redemption Agreements, and made cash payments

certain Holders in accordance therewith.

The

foregoing summary of the Non-Redemption Agreements is qualified in its entirety by reference to the text of the Form of Non-Redemption

Agreements, copies of which are filed with this Report as Exhibits 10.10, 10.11 and 10.32, respectively.

Defined

Terms

Unless

the context otherwise requires, “ATI,” “we,” “us,” “our,” “Registrant,”

and the “Company” refer to Aeries Technology, Inc., a Cayman Islands exempted company (f/k/a Worldwide Webb Acquisition

Corp., a Cayman Islands exempted company), and its consolidated subsidiaries following the Closing. Unless the context otherwise

requires, references to WWAC refer to the Company, prior to the Closing. Unless the context otherwise requires, references to

“AARK” and “Aeries” means Aark Singapore Pte. Ltd., a Singapore private company limited by shares or Aeries

Technology Group Business Accelerators Pte. Ltd., an Indian private company limited by shares, respectively. All references herein

to the “Board” refer to the board of directors of the Company. Terms used in this Report but not defined herein, or for

which definitions are not otherwise incorporated by reference herein, have the meaning given to such terms in the Proxy

Statement/Prospectus in the section titled “Selected Definitions” beginning on page 1 thereof, and such definitions are

incorporated herein by reference.

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

Exchange

Agreements

Concurrently

the closing of the Business Combination the holders of Aeries shares other than AARK and the Sole Shareholder each entered into an Exchange

Agreement with ATI, Aeries and AARK (with such exchange agreements collectively, the “Exchange Agreements”). Pursuant to

the Exchange Agreements, (x) from and after the the date of the applicable Exchange Agreement and

prior to April 1, 2024, (i) with respect to the Aeries Shares, up to 20% of the number of Aeries Shares held by such Shareholder

as of the date of the Aeries Exchange Agreement (which number will be equitably adjusted in accordance with any adjustments to the Exchange

Rate) and (ii) with respect to the AARK Ordinary Shares, up to 20% of the number of AARK Ordinary Shares held by such Shareholder

as of the date of the AARK Exchange Agreement (which number will be equitably adjusted in accordance with any adjustments to the Exchange

Rate), and (y) from and after April 1, 2024, and subject to the satisfaction of the exercise conditions specified therein:

| |

● |

ATI

will have the right to purchase from any shareholder the Aeries Shares or AARK Ordinary Shares held by such shareholder (the “Exchanged

Shares”) in exchange for the delivery of the Stock Exchange Payment or, at the election of ATI, the Cash Exchange Payment. |

| |

● |

each

shareholder will be entitled to deliver Exchanged Shares in exchange for the delivery of the Stock Exchange Payment or, at the election

of the Shareholder, the Cash Exchange Payment. |

| |

● |

in

each case, the Cash Exchange Payment may only be elected in the event approval from the Reserve Bank of India is not obtained for

a Stock Exchange Payment and provided the Company has reasonable cash flow to be able to pay the Cash Exchange Payment and such Cash

Exchange Payment would not be prohibited by any then outstanding debt agreements or arrangements of the Company or any of its Subsidiaries. |

| |

● |

“Stock

Exchange Payment” means a number of Class A ordinary shares equal to the product of the number of Exchanged Shares multiplied

by the applicable Exchange Rate. |

| |

● |

“Exchange

Rate” means, at any time, the number of Class A ordinary shares for which an Exchanged Share is entitled to be exchanged

at such time. The Exchange Rate will be 14.40 in the case of Aeries Shares and 2,246 in the case of AARK Ordinary Shares, in each

case, subject to adjustment. |

| |

● |

“Cash

Exchange Payment” means an amount of cash equal to the number of Class A ordinary shares included in a Stock Exchange

Payment multiplied by the 5-day volume weighted average price of the Class A ordinary shares. |

Copies

of the Aeries Exchange Agreement and the AARK Exchange Agreement are filed with this Report as Exhibits 10.25 and 10.26 and are incorporated

herein by reference, and the foregoing description of the Exchange Agreements is qualified in its entirety by reference thereto.

Indemnification

Agreements

On

the Closing Date, the Company entered into separate indemnification agreements with all of its directors and executive officers (“Indemnification

Agreements”). These Indemnification Agreements require the Company to indemnify its directors and executive officers for

certain expenses subject to the limitations and exclusions provided therein, including attorneys’ fees, judgments, fines and settlement

amounts incurred by a director or executive officer in any action or proceeding (other than a proceeding by or in the right of the Company

to procure judgment in its favor) incurred by or on behalf of the indemnitees arising out of their services as one of the Company’s

directors or executive officers or any other company or enterprise to which the person is or was serving at the Company’s request

if the indemnitee has met the Company’s Standard of Conduct (as defined therein).

The

foregoing description of the terms of the Indemnification Agreements are qualified in their entirety by the full text of the Form of

Indemnification Agreement, a copy of which is filed as Exhibit 10.30 to this Report and is incorporated herein by reference.

Employment

Agreements with Officers

The information contained in Item 5.02(e) is incorporated herein by

reference into this item.

| Item

2.01 |

Completion

of Acquisition or Disposition of Assets. |

The

disclosure set forth in the “Introductory Note” above is incorporated by reference into this Item 2.01.

FORM

10 INFORMATION

Pursuant

to Item 2.01(f) of Form 8-K, if the registrant was a shell company, as we were immediately before the Business Combination, then the

registrant must disclose the information that would be required if the registrant were filing registration statement on Form 10. As a

result of the consummation of the Business Combination, the Company has ceased to be a shell company. Therefore, we are providing below

the information that would be included in a Form 10 if ATI were to file a Form 10. Please note that the information provided below relates

to the combined company after the Business Combination, unless otherwise specifically indicated or the context otherwise requires.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report contains certain statements that are not historical facts but are forward-looking statements within the meaning of Section 21E

of the U.S. Securities Exchange Act of 1934, as amended, and Section 27A of the U.S. Securities Act of 1933, as amended, for purposes

of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements

include but are not limited to statements regarding the anticipated benefits of the Business Combination and the anticipated impact of

the Business Combination on ATI’s business and future financial and operating results. Words such as “may,” “should,”

“will,” “believe,” “expect,” “anticipate,” “target,” “project,”

and similar phrases that denote future expectations or intent regarding ATI’s financial results, operations, and other matters

are intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties, and other

factors that may cause future events to differ materially from the forward-looking statements in this report, including but not limited

to: (i) the failure to realize the anticipated benefits of the Business Combination or those benefits taking longer than anticipated

to be realized; (ii) unexpected costs or unexpected liabilities that may result from the Business Combination; (iii) the impact of COVID-19

on ATI’s business; (iv) risks that the Business Combination disrupts current plans and operations of ATI and potential difficulties

in ATI employee retention as a result of the Business Combination; (v) the outcome of any legal proceedings that may be instituted against

ATI related to the Business Combination Agreement or the Business Combination; (vi) the ability to maintain the listing of WWAC’s

securities on the Nasdaq Capital Market; (vii) potential volatility in the price of ATI’s securities due to a variety of factors,

including economic conditions and the effects of these conditions on ATI’s clients’ businesses and levels of activity, risks

related to an economic downturn or recession in India, the United States and other countries around the world, fluctuations in earnings,

fluctuations in foreign exchange rates, ATI’s ability to manage growth, intense competition in IT services including those factors

which may affect ATI’s cost advantage, wage increases in India, the ability to attract and retain highly skilled professionals,

time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry segment

concentration, ATI’s ability to manage the international operations, withdrawal or expiration of governmental fiscal incentives,

political instability and regional conflicts, legal restrictions on raising capital or acquiring companies outside India, changes in

laws and regulations affecting ATI’s business and changes in ATI’s capital structure; (viii) the ability to implement business

plans, identify and realize additional opportunities and achieve forecasts and other expectations after the completion of the Business

Combination; (ix) the risk that ATI may never achieve or sustain profitability after the Closing; and (x) ATI’s potential need

to raise additional capital to execute its business plan, which capital may not be available on acceptable terms or at all. The forward-looking

statements contained in this Report are also subject to additional risks, uncertainties, and factors, including those described in ATI’s

most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and other documents filed or to be filed with the SEC by ATI

from time to time. The forward-looking statements included in this Report are made only as of the date hereof. None of ATI nor any of

its affiliates undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information,

future developments, subsequent events, circumstances or otherwise, except as may be required by any applicable securities laws.

Business

and Properties

The

foregoing is hereby incorporated by reference to pages 206-217 of the Proxy Statement/Prospectus.

Risk

Factors

The

foregoing is hereby incorporated by reference to pages 65-91 of the Proxy Statement/Prospectus.

Financial

Information

The

foregoing is hereby incorporated by reference to pages 156-177 of the Proxy Statement/Prospectus.

Management’s

Discussion and Analysis of Financial Condition and Results of Operation

The

foregoing is hereby incorporated by reference to pages 218-232 of the Proxy Statement/Prospectus.

Directors

and Executive Officers

Directors

The

foregoing is hereby incorporated by reference to pages 244-247 of the Proxy Statement/Prospectus.

Independence

of Directors

The

foregoing is hereby incorporated by reference to pages 247 the Proxy Statement/Prospectus.

Committees

of the Board of Directors

The

foregoing is hereby incorporated by reference to pages 248-250 of the Proxy Statement/Prospectus.

Executive

Officers

The

foregoing is hereby incorporated by reference to pages 244-255 of the Proxy Statement/Prospectus.

Executive

Compensation

The

foregoing is hereby incorporated by reference to pages 233-243 of the Proxy Statement/Prospectus.

Director

Compensation

The

foregoing is hereby incorporated by reference to page 243 of the Proxy Statement/Prospectus.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth beneficial ownership of ATI ordinary shares as of November 10, 2023 by:

| |

● |

each

person known by ATI to be the beneficial owner of more than 5% of ATI’s outstanding ordinary shares; |

| |

● |

each

of ATI’s current directors and named executive officers; |

| |

● |

all

of ATI’s current directors and executive officers as a group; and |

| |

● |

the

Class V Shareholder. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she or it possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes

securities that the individual or entity has the right to acquire, such as through the exercise of warrants, within 60 days of November

10, 2023, the most recent practicable date prior to the date of this Report. Shares subject to warrants that are currently exercisable

or exercisable within 60 days of November 10, 2023, the most recent practicable date prior to the date of this Report, are considered

outstanding and beneficially owned by the person holding such warrants for the purpose of computing the percentage ownership of that

person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Except as noted

by footnote, and subject to community property laws where applicable, based on the information provided to ATI, ATI believes that the

persons and entities named in the table below have sole voting and investment power with respect to all shares shown as beneficially

owned by them.

| | |

Number of ATI Class A ordinary shares Beneficially Owned | | |

% of ATI Class A ordinary

shares Beneficially Owned | | |

Voting % in ATI | |

| Name and Address of Beneficial Owners | |

| | |

| | |

| |

| Five percent holders: | |

| | | |

| | | |

| | |

| Sandia

Capital Management, LP(1) | |

| 1,500,000 | | |

| 9.8 | % | |

| 7.3 | % |

| Innovo Consultancy DMCC(2) | |

| 5,638,530 | | |

| 37.0 | % | |

| 27.4 | % |

| Sea Otter(3) | |

| 1,458,500 | | |

| 9.6 | % | |

| 7.1 | % |

| YA II PN, Ltd.(4) | |

| 961,667 | | |

| 6.3 | % | |

| 4.7 | % |

| TCP1 LLC(5)(6) | |

| 5,100,572 | | |

| 25.6 | % | |

| 18.9 | % |

| TVGCP5 LLC(6)(7) | |

| 5,100,572 | | |

| 25.6 | % | |

| 18.9 | % |

| Meet Atul Doshi(8) | |

| –– | | |

| –– | | |

| 26.0 | % |

| | |

| | | |

| | | |

| | |

| Named Executive Officers and Directors(9) | |

| | | |

| | | |

| | |

| Sudhir Appukuttan Panikassery | |

| –– | | |

| –– | | |

| –– | |

| Unni Nambiar | |

| –– | | |

| –– | | |

| –– | |

| Ajay Khare | |

| –– | | |

| –– | | |

| –– | |

| Daniel S. Webb | |

| 560,000 | | |

| 3.7 | % | |

| 2.7 | % |

| Narayan Shetkar | |

| –– | | |

| –– | | |

| –– | |

| Venu Raman Kumar(2) | |

| 5,638,530 | | |

| 37.0 | % | |

| 27.4 | % |

| Alok Kochhar | |

| –– | | |

| –– | | |

| –– | |

| Biswajit Dasgupta | |

| –– | | |

| –– | | |

| –– | |

| Nina B. Shapiro | |

| –– | | |

| –– | | |

| –– | |

| Ramesh Venkataraman | |

| –– | | |

| –– | | |

| –– | |

| All named executive officers and directors (10 individuals) | |

| 6,198,530 | | |

| 40.7 | % | |

| 30.1 | % |

| (1) | The business address of Sandia Investment Management, LP (“Sandia”) is 201 Washington Street, Boston, MA 02108. Consists of

ATI Class A ordinary shares allocated to investors managed by Sandia. Sandia Investment Management LLC is the general partner of Sandia.

Tim Sichler serves as Founder and CIO of the general partner of Sandia, and in such capacity may be deemed to be the beneficial owner

having shared voting power and shared investment power over the securities held by Sandia. |

| (2) | The

business address of Innovo Consultancy DMCC is Unit No: 1874, DMCC Business Centre, Level

No 1, Jewellery & Gemplex 3, PO Box 62693, Dubai, United Arab Emirates. Venu Raman Kumar,

the Chairman of the Board, is the sole beneficial owner of Innovo, and as such is deemed

to have beneficial ownership of the ATI Class A ordinary shares held directly by Innovo. |

| (3) | Owned

of record by Sea Otter Securities Group, LLC (“Sea Otter Securities”) and Sea Otter Trading LLC (“Sea Otter Trading”). The business address

of each of Sea Otter Securities and Sea Otter Trading is 107 Grand St., New York, NY 10013. Sea Otter Advisors LLC is the Advisor of

Sea Otter Trading LLC and has investment and dispositive power over the shares and warrants held by these entities. Peter Smith and Nicholas

Fahey are the Managing Members of Sea Otter Advisors, LLC and may be deemed to have voting and investment control with respect to the

shares held by these entities. |

| (4) | The

business address of YA II PN, Ltd. is 1012 Springfield Ave, Mountainside, NJ 07092. YA II PN, Ltd. is a fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors Global II, LLC (“Yorkville LLC”) is the General Partner of Yorkville LP. All investment decisions for YA II PN, Ltd. are made by Yorkville LLC's President and Managing Member, Mr. Mark Angelo. |

| (5) | The

business address of TCP1 LLC is c/o Tony Pearce, 801 S 1230 E., Alpine, UT 84004. TCP1 LLC

is controlled by Mr. Tony Pearce. Mr. Pearce disclaims beneficial ownership of the securities

owned by TCP1 LLC, except to the extent of his pecuniary interest therein. |

| (6) | Includes

4,680,572 ATI Class A ordinary shares underlying 4,680,572 warrants that are exercisable

within 60 days of November 10, 2023. |

| (7) | The

business address of TVGCP5 LLC is c/o Terry Pearce, 1250 E Watkins Ln, Alpine, UT 84004. TVGCP5 LLC is controlled by Mr. Terry

Pearce. Mr. Pearce disclaims beneficial ownership of the securities owned by TVGCP5 LLC, except to the extent of his pecuniary

interest therein. |

| (8) | Meet

Atul Doshi is the sole beneficial owner of and has dispositive voting power of the ATI Class

V ordinary share held of record by NewGen Advisors and Consultants DWC-LLC. The ATI Class

V ordinary share has no economic rights, but has voting rights equal to (1) 26.0% of the

total issued and outstanding ATI Class A ordinary shares and ATI Class V ordinary share voting

together as a single class (subject to a proportionate reduction in voting power in connection

with the exchange by the Sole Shareholder of AARK ordinary shares for ATI Class A ordinary

shares pursuant to the AARK Exchange Agreement); provided, however, that such proportionate

reduction will not affect the voting rights of the ATI Class V ordinary share in the event

of (i) a threatened or actual Hostile Change of Control (as defined in the Business Combination

Agreement) and/or (ii) the appointment and removal of a director on the Board, and (2) in

certain circumstances, including the threat of a hostile change of control of ATI, 51% of

the total issued and outstanding ATI Class A ordinary shares and ATI Class V ordinary share

voting together as a class. The business address of the Class V Shareholder is 707 Al Baha,

Al Mankhoot, Dubai, UAE. |

| (9) | Unless

otherwise noted, the business address of each of the directors and officers is 60 Paya Lebar

Road, #08-13 Paya Lebar Square, Singapore. |

Certain

Relationships and Related Transactions

The

foregoing is hereby incorporated by reference to pages 255-259 of the Proxy Statement/Prospectus.

Legal

Proceedings

The

foregoing is hereby incorporated by reference to page F-64 of the Proxy Statement/Prospectus.

Market

Price and Dividends on the Registrant’s Common Equity and Related Shareholder Matters

The

foregoing is hereby incorporated by reference to pages 260-269 of the Proxy Statement/Prospectus.

Market

Information and Holders

The

foregoing is hereby incorporated by reference to pages 252-254 of the Proxy Statement/Prospectus.

Recent

Sales of Unregistered Securities

The

disclosures set forth under the Introductory Note above are incorporated herein by reference.

Description

of Registrant’s Securities

The

foregoing is hereby incorporated by reference to page 260-278 the Proxy Statement/Prospectus.

Indemnification

of Directors and Officers

The

foregoing is hereby incorporated by reference to pages 250-251 the Proxy Statement/Prospectus.

Financial

Statements and Supplementary Data

The

foregoing is hereby incorporated by reference to pages F-2 to F-74 the Proxy Statement/Prospectus.

Changes

in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Financial

Statements and Exhibits

The

foregoing is incorporated by reference to Item 9.01 of this Report.

| Item

3.02 |

Unregistered

Sales of Equity Securities. |

The

information regarding unregistered sales of equity securities set forth in the Introductory Note above and Item 2.01 of this Report is

incorporated herein by reference.

| Item

3.03 | Material

Modification to Rights of Security Holders. |

On

the Closing Date, ATI’s Amended & Restated Articles became effective, which replaced WWAC’s Amended and Restated Articles

of Association in effect as of such time. The material terms of the Amended & Restated Articles and the general effect upon the rights

of holders of the ATI Class A ordinary shares are discussed in the Proxy Statement/Prospectus in the sections entitled “Proposal

No.2—Charter Proposal” beginning on page 124 of the Proxy Statement/Prospectus, which is incorporated herein by

reference.

The

ATI Class A ordinary shares and Public Warrants are listed for trading on the Nasdaq Capital Market under the symbols “AERT”

and “AERTW,” respectively. On the date of the Closing, the CUSIP numbers relating

to ATI Class A ordinary shares and Public Warrants changed to G0136H102 and G0136H110, respectively.

A

copy of the Amended & Restated Articles is included as Exhibit 3.1 to this Current Report on Form 8-K incorporated herein

by reference.

| Item

5.01 |

Changes

in Control of the Registrant. |

The

disclosure set forth under the Introductory Note and in Item 2.01 of this Report is incorporated herein by reference.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective

as of November 6, 2023, the following individuals were appointed to the Board of the Company: Sudhir Appukuttan Panikassery , Daniel

S. Webb , Venu Raman Kumar, Alok Kochhar, Biswajit Dasgupta, Nina B. Shapiro, and Ramesh Venkataraman.

The Board has three standing

committees: an audit committee; a compensation committee; and a nominating and corporate governance committee. Our audit committee and

compensation committee are composed solely of independent directors. Each committee operates under a charter approved by our board of

directors and has the composition and responsibilities described below. The charter of each committee is available on our website.

Audit

Committee

We have established an audit

committee of the board of directors. The members of our audit committee are Alok Kochhar, Biswajit Dasgupta and Nina B. Shapiro. Nina

B. Shapiro will serve as chairman of the audit committee. As required by Nasdaq listing standards and applicable SEC rules, all the directors

on the audit committee are independent.

Compensation

Committee

We

have established a compensation committee of the board of directors. The members of our compensation committee are Alok Kochhar and Nina

B. Shapiro. Alok Kochhar will serve as chairman of the compensation committee.

Nominating and Corporate Governance

Committee

We have established a nominating

and corporate governance committee of the board of directors. The members of our nominating and corporate governance committee are Alok

Kochhar, Biswajit Dasgupta, Raman Kumar and Ramesh Venkataraman . Biswajit Dasgupta will serve as the chairman of the nominating and corporate

governance committee.

Additional

information regarding, among other things, each individual’s background, board committee membership and compensatory arrangements

is contained in the Registration Statement and is incorporated herein by reference.

2023

Equity Incentive Plan

On

November 6, 2023, the Aeries Technology, Inc. 2023 Equity Incentive Plan (the “Plan”)

became effective. ATI has reserved a total of 9,031,027 ATI Class A ordinary shares for issuance pursuant to the Plan and the

maximum number of shares that may be issued pursuant to the exercise of incentive stock options or other stock awards granted under

the Plan is 9,031,027, in each case, subject to certain adjustments set forth therein.

The

information set forth in the section entitled “Proposal No. 7—Equity Incentive Plan Proposal” beginning

on page 137 of the Proxy Statement/Prospectus is incorporated herein by reference. The foregoing description of the Plan and the

information incorporated by reference in the preceding sentence does not purport to be complete and is qualified in its entirety by the

terms and conditions of the Plan, which is included as Exhibit 10.31 to this Report and is incorporated herein by reference.

(c)

Appointment of New Officers

Effective

as of November 6, 2023, the following individuals were appointed as officers of the Company: Mr. Sudhir Appukuttan Panikassery as the

Chief Executive Officer and Mr. Bhisham (Ajay) Khare as the Chief Revenue Officer & Chief Operating Officer ( Americas), among other

officers. The information related to Mr. Khare and Mr. Panikassery is discussed in the Proxy Statement/Prospectus in the sections entitled

“Management of ATI Following the Business Combination” beginning on page 244 of the Proxy Statement/Prospectus,

which is incorporated herein by reference.

On

November 6, 2023, the Company also appointed Mr. Rajeev Gopala Krishna Nair as its Chief Financial Officer, effective as of November

6, 2023.

Mr.

Nair, age 52, was an executive at McLaren Technology Acquisition Corporation (NASDAQ: MLAI) from February, 2021 to March 2023, most recently

serving as their Chief Financial Officer. In that position, he played a leadership role in their NASDAQ initial public offering in November

2021. Prior to joining McLaren Technology Acquisition Corporation, Mr. Nair formulated the AI and Machine Learning strategy and created

the AI/ML roadmap for Credit One Bank, a large credit card issuer in the United States from July 2019 to June 2020. In addition to his

corporate roles, Mr. Nair was a consultant to GE Capital, Prudential Investment Management and other Fortune 500 companies, focusing

on finance, risk management and technology from December 2004 to January 2010. Mr. Nair is currently a nominee for the Board of Directors

of Fintech Eco System Development Corp (NASDAQ: FEXD) for their contemplated business combination with Afinoz.

There

is no arrangement or understanding between Mr. Nair and any other person pursuant to which he was to be selected as an officer and there

is no family relationship between Mr. Nair and any of the Company’s director, executive officer, or any person nominated or chosen

by the Company to become a director or executive officer.

(e)

Employment Agreements with Officers

| ● | Employment

Agreement with Sudhir Appukuttan Panikassery |

On

November 6, 2023, AARK entered into an Employment Agreement with Sudhir Appukuttan Panikassery (the “Sudhir Employment Agreement”)

effective as of November 6, 2023. The material terms of the Sudhir Employment Agreement are summarized below.

Salary

and Annual Bonus. As of November 6, 2023, Mr. Panikassery’s initial base salary will be $650,000. For the 2023 fiscal year,

Mr. Panikassery is entitled to such annual bonus opportunity as described in his consulting agreement with the Company in effect immediately

prior to November 6, 2023. Commencing with the 2024 fiscal year, Mr. Panikassery will be eligible to receive a target bonus of up to

300% of his base salary based on achieving certain performance criteria which shall be determined by the Board of Directors of AARK.

Benefits.

In addition, Mr. Panikassery will participate in all retirement and welfare benefit plans, programs, arrangements and receive

other benefits that are customarily available to senior executives of AARK, subject to eligibility requirements.

Initial

Grant. Mr. Panikassery is eligible for a grant of a total of 6,651,005 options subject to time and performance based vesting

standards pursuant to the Plan and as determined by the Board of Directors of AARK.

Effect

of Termination. In the event of Mr. Panikassery’s death or disability during the term, the estate of Mr. Panikassery shall

be entitled to receive any accrued amounts or accrued benefits required to be paid or provided or which Mr. Panikassery is eligible to

receive under any plan, program, policy, practice, contract or agreement of AARK at the times provided under the applicable plan, program,

policy, practice, contract or agreement of AARK (the “Accrued Amounts”).

If,

during the term, AARK terminates Mr. Panikassery’s employment without “cause” or if he terminates his employment for

“good reason” (each as defined in the Sudhir Employment Agreement), then Mr. Panikassery will be entitled to receive any

Accrued Amounts and an amount equal to 18 months of his base salary, an amount equivalent to his annual benefits and an amount equal

to the bonus received during the immediate preceding two years, which amount shall be payable in equal installments (less applicable

withholdings and deductions) over a period of 12 months following the termination date.

Restrictive

Covenants. The Sudhir Employment Agreement contains certain restrictive covenants that apply during and after Mr. Panikassery’s

employment, including a non-solicitation agreement and an agreement to not disclose confidential information for a two-year period

following his termination of employment for any reason. The Sudhir Employment Agreement also includes a non-competition agreement for

a one-year period.

| ● | Employment

Agreement with Rajeev Gopala Krishna Nair |

On

November 6, 2023, Aeries Technology Solutions, Inc. (“Aeries Solutions”), a wholly-owned subsidiary of the Company, entered

into an Employment Agreement with Rajeev Gopala Krishna Nair (the “Rajeev Employment Agreement”) effective as of November

6, 2023. The material terms of the Rajiv Employment Agreement are summarized below.

Salary

and Annual Bonus. As of November 6, 2023, Mr. Nair’s initial base salary will be $400,000. For the 2023 fiscal year and

each fiscal year after, Mr. Nair will be eligible to receive a target bonus of up to 50% of his base salary based on achieving certain

performance criteria which shall be determined by the Board of Directors of Aeries Solutions.

Benefits.

In addition, Mr. Nair will participate in all retirement and welfare benefit plans, programs, arrangements and receive other

benefits that are customarily available to senior executives of Aeries Solutions, subject to eligibility requirements.

Initial

Grant. Mr. Nair is eligible for a grant of a total of 350,000 options subject to time and performance based vesting standards

pursuant to the Plan and as determined by the Board of Directors of Aeries Solutions.

Effect

of Termination. In the event of Mr. Nair’s death or disability during the term, the estate of Mr. Nair shall be entitled

to receive any accrued amounts or accrued benefits required to be paid or provided or which Mr. Nair is eligible to receive under any

plan, program, policy, practice, contract or agreement of Aeries Solutions at the times provided under the applicable plan, program,

policy, practice, contract or agreement of Aeries Solutions (the “Accrued Amounts”).

If,

during the term, Aeries Solutions terminates Mr. Nair’s employment without “cause” or if he terminates his employment

for “good reason” (each as defined in the Rajeev Employment Agreement), then Mr. Nair will be entitled to receive any Accrued

Amounts and an amount equal to 12 months of his base salary and an amount equivalent to his annual benefits, which amount shall be payable

in equal installments (less applicable withholdings and deductions) over a period of 12 months following the termination date.

Restrictive

Covenants. The Rajeev Employment Agreement contains certain restrictive covenants that apply during and after Mr. Nair’s

employment, including a non-solicitation agreement and an agreement to not disclose confidential information for a two-year period

following his termination of employment for any reason. The Rajiv Employment Agreement also includes a non-competition agreement for

a one-year period.

| ● | Employment

Agreement with Bhisham Khare |

On

November 6, 2023, Aeries Solutions entered into an Employment Agreement with Bhisham Khare (the “Bhisham Employment Agreement”)

effective as of November 6, 2023. The material terms of the Bhisham Employment Agreement are summarized below.

Salary

and Annual Bonus. As of November 6, 2023, Mr. Khare’s initial base salary will be $400,000. For the 2023 fiscal year, Mr.

Khare is entitled to such annual bonus opportunity as described in his employment agreement with the Company in effect immediately prior

to November 6, 2023. Commencing with the 2024 fiscal year, Mr. Khare will be eligible to receive a target bonus of up to 200% of his

base salary based on achieving certain performance criteria which shall be determined by the Board of Directors of Aeries Solutions.

Benefits.

In addition, Mr. Khare will participate in all retirement and welfare benefit plans, programs, arrangements and receive other

benefits that are customarily available to senior executives of Aeries Solutions, subject to eligibility requirements.

Initial

Grant. Mr. Khare is eligible for a grant of a total of 2,471,360 options subject to time and performance based vesting standards

pursuant to the Plan and as determined by the Board of Directors of Aeries Solutions.

Effect

of Termination. In the event of Mr. Khare’s death or disability during the term, the estate of Mr. Khare shall be entitled

to receive any accrued amounts or accrued benefits required to be paid or provided or which Mr. Khare is eligible to receive under any

plan, program, policy, practice, contract or agreement of Aeries Solutions at the times provided under the applicable plan, program,

policy, practice, contract or agreement of Aeries Solutions (the “Accrued Amounts”).

If,

during the term, Aeries Solutions terminates Mr. Khare’s employment without “cause” or if he terminates his employment

for “good reason” (each as defined in the Bhisham Employment Agreement), then Mr. Khare will be entitled to receive any Accrued

Amounts and an amount equal to 18 months of his base salary, an amount equivalent to his annual benefits and an amount equal to the bonus

received during the immediate preceding two years, which amount shall be payable in equal installments (less applicable withholdings

and deductions) over a period of 12 months following the termination date.

Restrictive

Covenants. The Bhisham Employment Agreement contains certain restrictive covenants that apply during and after Mr. Khare’s

employment, including a non-solicitation agreement and an agreement to not disclose confidential information for a two-year period

following his termination of employment for any reason. The Bhisham Employment Agreement also includes a non-competition agreement for

a one-year period.

| ● | Employment

Agreement with Unnikrishnan Nambiar |

On

November 6, 2023, Aeries Solutions entered into an Employment Agreement with Unnikrishnan Nambiar (the “Unni Employment Agreement”,

and together with the Sudhir Employment Agreement, the Rajeev Employment Agreement, the Bhisham Employment Agreement, the “Employment

Agreements”) effective as of November 6, 2023. The material terms of the Unni Employment Agreement are summarized below.

Salary

and Annual Bonus. As of November 6, 2023, Mr. Nambiar’s initial base salary will be $300,000. For the 2023 fiscal year,

Mr. Nambiar is entitled to such annual bonus opportunity as described in his employment agreement with the Company in effect immediately

prior to November 6, 2023. Commencing with the 2024 fiscal year, Mr. Nambiar will be eligible to receive a target bonus of up to 200%

of his base salary based on achieving certain performance criteria which shall be determined by the Board of Directors of Aeries Solutions.

Benefits.

In addition, Mr. Nambiar will participate in all retirement and welfare benefit plans, programs, arrangements and receive other

benefits that are customarily available to senior executives of Aeries Solutions, subject to eligibility requirements.

Initial

Grant. Mr. Nambiar is eligible for a grant of a total of 1,060,847 options subject to time and performance based vesting standards

pursuant to the Plan and as determined by the Board of Directors of Aeries Solutions.

Effect

of Termination. In the event of Mr. Nambiar’s death or disability during the term, the estate of Mr. Nambiar shall be entitled

to receive any accrued amounts or accrued benefits required to be paid or provided or which Mr. Nambiar is eligible to receive under

any plan, program, policy, practice, contract or agreement of Aeries Solutions at the times provided under the applicable plan, program,

policy, practice, contract or agreement of Aeries Solutions (the “Accrued Amounts”).

If,

during the term, Aeries Solutions terminates Mr. Nambiar’s employment without “cause” or if he terminates his employment

for “good reason” (each as defined in the Unni Employment Agreement), then Mr. Nambiar will be entitled to receive any Accrued

Amounts and an amount equal to 18 months of his base salary, an amount equivalent to his annual benefits and an amount equal to the bonus

received during the immediate preceding two years, which amount shall be payable in equal installments (less applicable withholdings

and deductions) over a period of 12 months following the termination date.

Restrictive

Covenants. The Unni Employment Agreement contains certain restrictive covenants that apply during and after Mr. Nambiar’s

employment, including an agreement to not disclose confidential information.

In

addition, the executives entered into indemnification agreements with the Company which requires the Company to indemnify the executive

against certain liabilities that may arise as a result of their status or service as an officer. The information under Item 1.01 under

subsection titled “Indemnification Agreements” is incorporated herein by reference.

| Item

5.03 |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

Amendment

to Articles of Association

At

the WWAC Shareholder Meeting, WWAC’s shareholders considered and approved, among other items, “Proposal No.2—Charter

Proposal” (the “Charter Proposal”), which is described in greater detail beginning on page 124 in the Proxy

Statement/Prospectus. The Amended & Restated Articles, which became effective upon Closing on November 6, 2023, includes the amendments

proposed by the Charter Proposal.

The

material terms of the Amended & Restated Articles and the general effect upon the rights of holders of WWAC’s capital stock

are discussed in the Proxy Statement/Prospectus in the sections entitled “Description of ATI Securities” beginning

on page 260, which is incorporated herein by reference.

In

addition, the disclosure set forth under Item 3.03 in this Report is incorporated herein by reference. A copy of the Amended & Restated

Articles is included as Exhibit 3.1 to this Report and incorporated herein by reference.

Change

in Fiscal Year

In

connection with the consummation of the Business Combination, on the Closing Date, ATI changed its fiscal year from a year ending December

31 to a year ending March 31, to conform its fiscal year end to that of AARK. The change to ATI’s fiscal year is effective as of

the Closing. Going forward, ATI will file annual and quarterly reports based on the March 31 fiscal year-end.

| Item

5.05 |

Amendments

to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. |

On the Closing Date, the Board

adopted a new Code of Business Conduct and Ethics applicable to all of the Company’s directors and employees. A copy of the Code

of Business Conduct and Ethics is available on the investor relations portion of the Company’s website at www.https://ir.aeriestechnology.com/corporate-governance/documents-charters.

The foregoing description of the Code of Business Conduct and Ethics does not purport to be complete and is qualified in its entirety

by the full text of the Code of Business Conduct and Ethics, a copy of which is attached to this Report as Exhibit 14.1 and incorporated

herein by reference.

| Item

5.06 |

Change

in Shell Company Status. |

As

a result of the Business Combination, the Company ceased being a shell company. Reference is made to “Introductory Note”

and Item 2.01 of this Report, which is incorporated herein by reference.

On November 7, 2023, the

Company issued a press release announcing the closing of the Business Combination. Additionally, on November 13, 2023, the

Company issued a press release announcing the appointment of Rajeev Nair to the position of Chief Financial Officer and Daniel Webb to

the position of Chief Investment Officer. Copies of the press releases are filed hereto as Exhibit 99.1 and Exhibit 99.2 and incorporated

by reference herein.

The

information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed”

for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section, and shall not be deemed to

be incorporated by reference into the filings of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any general incorporation language in such filings. This Current Report on 8-K will not be deemed an admission as to the materiality

of any information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2.

| Item

9.01. | Financial Statements and Exhibits. |

| (a) | Financial

Statements of Business Acquired. |

The

audited carve-out consolidated financial statements of AARK as of and for the years ended March 31, 2023 and 2022 and the related

notes are included in the Proxy Statement/Prospectus beginning on page F-66, which is incorporated herein by reference.

The

unaudited condensed consolidated financial statements of AARK as of and for the three months ended June 30, 3023 and 2022 and the related

notes are included in the Proxy Statement/Prospectus beginning on page F-46, which is incorporated herein by reference.

| (b) | Pro

Forma Financial Information. |

The

unaudited pro forma condensed combined financial information of ATI as of and for the six months ended June 30, 2023 and for the year

ended December 31, 2023 is included in the Proxy Statement/Prospectus in the section entitled “Unaudited Pro Forma Condensed Combined

Financial Information” beginning on page 68 of the Proxy Statement/Prospectus, which is incorporated herein by reference.

Exhibit

No. |

|

Description |

| 2.1 |

|

Business

Combination Agreement, dated as of March 11, 2023, by and among Worldwide Webb Acquisition Corp., WWAC Amalgamation Sub Pte. Ltd.

and Aark Singapore Pte. Ltd. (incorporated by reference to Exhibit 2.1 to the Company’s current report on Form 8-K filed with

the SEC on March 13, 2023). |

| 2.2 |

|

Amendment

No. 1 to Business Combination Agreement, dated June 30, 2023, by and among Worldwide Webb Acquisition Corp., WWAC Amalgamation Sub

Pte. Ltd. and Aark Singapore Pte. Ltd. (incorporated by reference to Exhibit 2.1 to the Company’s current report on Form 8-K

filed with the SEC on July 5, 2023). |

| 2.3 |

|

Amendment

No. 2 to Business Combination Agreement, dated October 9, 2023, by and among Worldwide Webb Acquisition Corp., WWAC Amalgamation

Sub Pte. Ltd. and Aark Singapore Pte. Ltd. (incorporated by reference to Exhibit 2.1 to the Company’s current report on Form

8-K filed with the SEC on October 10, 2023). |

| 2.4 |

|

Amendment

No. 3 to Business Combination Agreement, dated as of October 29, 2023, by and among Worldwide Webb Acquisition Corp., WWAC Amalgamation

Sub Pte. Ltd. and Aark Singapore Pte. Ltd. (incorporated by reference to Exhibit 2.1 to the Company’s current report on Form

8-K filed with the SEC on October 30, 2023). |

| 3.1 |

|

Amended

& Restated Memorandum and Articles of Association of Aeries Technology, Inc. |

| 4.1 |

|

Warrant

Agreement, dated October 22, 2021, between the Company and Continental Stock Transfer & Trust Company, as warrant agent (incorporated

by reference to Exhibit 4.1 to the Company’s current report on Form 8-K filed with the SEC on October 25, 2021). |

| 4.2 |

|

Specimen

Warrant Certificate (included in Exhibit 4.1 herein). |

| 10.1 |

|

Constitution

of AARK Singapore Pte. LTD. |

| 10.2 |

|

Letter

Agreement, dated October 22, 2021, among the Company, its officers and directors and Worldwide Webb Acquisition Sponsor LLC (incorporated

by reference to the Exhibit 10.1 to the Company’s current report on Form 8-K filed with the SEC on October 25, 2021). |

| 10.3 |

|

Letter

Agreement Amendment, April 10, 2023 among the Company, its officers and directors and Worldwide Webb Acquisition Sponsor LLC (incorporated

by reference to the Exhibit 10.3 to the Company’s current report on Form 8-K filed with the SEC on April 12, 2023). |

| 10.4 |

|

Letter

Agreement Amendment, dated as of October 26, 2023 (incorporated by reference to the Exhibit 10.2 to the Company’s current report

on Form 8-K filed with the SEC on October 30, 2023). |

| 10.5 |

|

Registration

Rights Agreement, dated October 22, 2021, among the Company and certain security holders named therein (incorporated by reference

to the Exhibit 10.3 to the Company’s current report on Form 8-K filed with the SEC on October 25, 2021). |

| 10.6 |

|

Registration

Rights Agreement Amendment, dated as of October 26, 2023 among the Company and certain security holders named therein (incorporated

by reference to the Exhibit 10.3 to the Company’s current report on Form 8-K filed with the SEC on October 30, 2023). |

| 10.7 |

|

Form

of Investment Agreement among the Registrant, Worldwide Webb Acquisition Sponsor LLC and the anchor investors (incorporated by reference

to Exhibit 10.10 to the Company’s registration statement on Form S-1 filed with the SEC on October 13, 2021). |

| 10.8 |

|

Form

of Investment Agreement Amendment (incorporated by reference to Exhibit 10.1 to the Company’s current report on Form 8-K filed

with the SEC on April 12, 2023). |

| 10.9 |

|

Form

of Investment Agreement Amendment (incorporated by reference to Exhibit 10.1 to the Company’s current report on Form 8-K filed

with the SEC on October 30, 2023). |

| 10.10 |

|

Form

of Non-Redemption Agreement (incorporated by reference to Exhibit 10.1 to the Company’s current report on Form 8-K filed with

the SEC on April 3, 2023). |

| 10.11 |

|

Form

of Non-Redemption Agreement (incorporated by reference to Exhibit 10.2 to the Company’s current report on Form 8-K filed with

the SEC on October 11, 2023). |

| 10.12 |

|

Share

Purchase Agreement dated March 20, 2020 by and between Aeries Technology Products and Strategies Private Limited, Aeries Technology

Group Business Accelerators Private Limited and Stratus Technologies Private Limited (incorporated by reference to Exhibit 10.15

to the Company’s registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.13 |

|

Share

Purchase Agreement dated March 20, 2020, by and between Aeries Technology Products and Strategies Private Limited, Aeries Technology

Group Business Accelerators Private Limited and Aeries Technology Solutions, Inc. (incorporated by reference to Exhibit 10.16 to

the Company’s registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.14 |

|

Aeries

Management Stock Option Plan 2019, as amended on September 30, 2022 (incorporated by reference to Exhibit 10.17 to the Company’s

registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.15 |

|

Form

of Grant Letter under the Aeries Management Stock Option Plan 2019 (incorporated by reference to Exhibit 10.18 to the Company’s

registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.16 |

|

Form

of Vesting Letter under the Aeries Management Stock Option Plan 2019 (incorporated by reference to Exhibit 10.19 to the Company’s

registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.17 |

|

Aeries

Employees Stock Option Plan 2020, as amended on July 22, 2022 (incorporated by reference to Exhibit 10.20 to the Company’s

registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.18 |

|

Form

of Grant Letter under the Aeries Employees Stock Option Plan 2020 (incorporated by reference to Exhibit 10.21 to the Company’s

registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.19 |

|

Consultancy

Services Agreement dated April 1, 2020, by and between ATG Business Solutions Private Limited and Mr. Sudhir Appukuttan Panikassery

(incorporated by reference to Exhibit 10.22 to the Company’s registration statement on Form S-4 filed with the SEC on October

11, 2023). |

| 10.20 |

|

Consultancy

Services Agreement dated April 1, 2020 and April 1, 2022, by and between Aeries Technology Group Business Accelerators Private Limited

and Mr. Sudhir Appukuttan Panikassery (incorporated by reference to Exhibit 10.23 to the Company’s registration statement on

Form S-4 filed with the SEC on October 11, 2023).*** |

| 10.21 |

|

Employment

Letter dated July 1, 2015 by and between Aeries Technology Solutions, Inc. and Mr. Bhisham Khare (incorporated by reference to Exhibit

10.24 to the Company’s registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.22 |

|

Employment

Letter dated June 1, 2022, by and between ATG Business Solutions Private Limited and Mr. Unnikrishnan Nambiar (incorporated by reference

to Exhibit 10.25 to the Company’s registration statement on Form S-4 filed with the SEC on October 11, 2023). |

| 10.23 |

|

Credit

Agreement dated May 26, 2023 by and between ATG Business Solutions Private Limited and Kotak Mahindra Bank Limited (incorporated

by reference to Exhibit 10.26 to the Company’s registration statement on Form S-4 filed with the SEC on October 11, 2023).*** |

| 10.24 |

|

Loan

Agreement dated July 10, 2015 and amended on April 18, 2020, by and between ATG Business Solutions Private Limited and Mr. Vaibhav

Rao (incorporated by reference to Exhibit 10.27 to the Company’s registration statement on Form S-4 filed with the SEC on October

11, 2023). |

| 10.25 |

|

Exchange

Agreement by and among Aeries Technology, Inc., Aeries Technology Group Business Accelerators Private Limited and certain security

holders named therein. |

| 10.26 |

|

Exchange

Agreement by and among Aeries Technology, Inc., Aark Singapore Pte. Ltd. and certain security holders named therein. |

| 10.27 |

|

Form

of Forward Purchase Agreement (incorporated by reference to Exhibit 10.1 to the Company’s current report on Form 8-K filed

with the SEC on November 3, 2023). |

| 10.28 |

|

Form

of Forward Purchase Agreement Amendment (incorporated by reference to Exhibit 10.1 to the Company’s current report on Form

8-K filed with the SEC on November 6, 2023). |

| 10.29 |

|

Form

of Subscription Agreement (incorporated by reference to Exhibit 10.3 to the Company’s current report on Form 8-K filed with

the SEC on November 6, 2023). |

| 10.30 |

|

Form

of Indemnification Agreement by and between the Registrant and its officers and directors. |

| 10.31 |

|

ATI

2023 Equity Incentive Plan. |

| 10.32 |

|

Form

of Non-Redemption Agreement (incorporated by reference to Exhibit 10.2 to the Company’s current report on Form 8-K filed with

the SEC on November 3, 2023). |

| 14.1 |

|

Code

of Business Conduct and Ethics. |

| 21.1 |

|

List

of Subsidiaries of ATI. |

| 99.1 |

|

Press Release issued by ATI on November 7, 2023. |

| 99.2 |

|

Press Release issued by ATI on November 13, 2023. |

| 104 |

|

Cover

Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

| *** | Certain

identified information has been excluded from this exhibit because the Company does not believe it is material and is the type that the

Company customarily treats as private and confidential. Redacted information is indicated by “[***]”. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

November 13, 2023 |

AERIES

TECHNOLOGY, INC.

A

Cayman Islands exempted company |

| |

|

| |

By: |

/s/

Sudhir Appukuttan Panikassery |

| |

Name: |

Sudhir

Appukuttan Panikassery |

| |

Title: |

Chief

Executive Officer and Director |

Exhibit 3.1

THE

COMPANIES ACT (As Revised)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

AMENDED

AND RESTATED

MEMORANDUM

AND ARTICLES OF ASSOCIATION

OF

AERIES

TECHNOLOGY, INC.

(adopted

by special resolution dated November 2, 2023 and effective on NOVEMBER 6, 2023)

THE

COMPANIES ACT (As Revised)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

AMENDED

AND RESTATED

MEMORANDUM

OF ASSOCIATION

OF

AERIES

TECHNOLOGY, INC.

(adopted

by special resolution dated November 2, 2023 and effective on November 6, 2023)

| 1 | The

name of the Company is Aeries Technology, Inc. |

| 2 | The

Registered Office of the Company shall be at the offices of Walkers Corporate Limited, 190

Elgin Avenue, George Town, Grand Cayman KY1-9008, Cayman Islands, or at such other place

within the Cayman Islands as the Directors may decide. |

| 3 | The

objects for which the Company is established are unrestricted and the Company shall have

full power and authority to carry out any object not prohibited by the laws of the Cayman

Islands. |

| 4 | The

liability of each Member is limited to the amount, if any, unpaid on such Member’s

shares. |

| 5 | The

share capital of the Company is US$50,500.0001 divided into 500,000,000 Class A ordinary

shares of a par value of US$0.0001 each, 1 Class V ordinary share of a par value of US$0.0001

and 5,000,000 preference shares of a par value of US$0.0001 each. |

| 6 | The

Company has power to register by way of continuation as a body corporate limited by shares

under the laws of any jurisdiction outside the Cayman Islands and to be deregistered in the

Cayman Islands. |

| 7 | Capitalised

terms that are not defined in this Amended and Restated Memorandum of Association bear the

respective meanings given to them in the Amended and Restated Articles of Association of

the Company. |

THE

COMPANIES ACT (As Revised)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

AMENDED

AND RESTATED

ARTICLES

OF ASSOCIATION

OF

AERIES

TECHNOLOGY, INC.

(adopted

by special resolution dated November 2, 2023 and effective on November 6, 2023)

| 1.1 | In

the Articles Table A in the First Schedule to the Statute does not apply and, unless there

is something in the subject or context inconsistent therewith: |

| |

“AARK” |

means Aark Singapore Pte. Ltd., a Singapore private company limited by shares, with company registration number 200602001D.

|

| |

“AARK

Ordinary Shares” |

means the ordinary shares of AARK, par value SGD1.00 per share.

|

| |

“Aeries” |

means Aeries Technology Group Business Accelerators Private Limited, an Indian private company limited by shares, with company registration number U74999MH2014PTC257474, and a subsidiary of the Company.

|

| |

“Aeries

Shares” |

means the ordinary shares, in the capital of Aeries, par value of INR 10 per share.

|

| |

“Affiliate” |

in respect of a person, means any other person that, directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such person, and (a) in the case of a natural person, shall include, without limitation, such person’s spouse, parents, children, siblings, mother-in-law and father-in-law and brothers and sisters-in-law, whether by blood, marriage or adoption or anyone residing in such person’s home, a trust for the benefit of any of the foregoing, a company, partnership or any natural person or entity wholly or jointly owned by any of the foregoing and (b) in the case of an entity, shall include a partnership, a corporation or any natural person or entity which directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such entity.

|

| |

“Applicable

Law” |

means,

with respect to any person, all provisions of laws, statutes, ordinances, rules, regulations, permits, certificates, judgments, decisions,

decrees or orders of any governmental authority applicable to such person. |

| |

“Articles” |

means these amended and restated articles of association of the Company.

|

| |

“Audit

Committee” |

means the audit committee of the board of Directors established pursuant to the Articles, or any successor committee.

|

| |

“Auditor” |

means the person for the time being performing the duties of auditor of the Company (if any).

|

| |

“Change

of Control” |

means the occurrence of any of the following events: (a) any person or any group of persons acting together which would constitute a “group” for purposes of Section 13(d) of the U.S. Securities Exchange Act of 1934 or any successor provisions thereto is or becomes the beneficial owner, directly or indirectly, of securities of the Company representing more than 50% of the combined voting power of the Company’s then outstanding voting securities; (b) there is consummated a merger or consolidation of the Company with any other corporation or other entity, and, immediately after the consummation of such merger or consolidation, the voting securities of the Company immediately prior to such merger or consolidation do not continue to represent or are not converted into more than 50% of the combined voting power of the then outstanding voting securities of the person resulting from such merger or consolidation; or (c) the Members approve a plan of complete liquidation or dissolution of the Company or there is consummated an agreement or series of related agreements for the sale, lease or other disposition, directly or indirectly, by the Company of substantially all of the assets of the Company and its subsidiaries (including Aark), taken as a whole.

|

| |

“Class

A Share” |

means a Class A ordinary share of a par value of US$0.0001 in the share capital of the Company.

|

| |

“Class

V Share” |

means the Class V ordinary share of a par value of US$0.0001 in the share capital of the Company.

|

| |

“Clearing

House” |

means a clearing house recognised by the laws of the jurisdiction in which the Shares (or depositary receipts therefor) are listed or quoted on a stock exchange or interdealer quotation system in such jurisdiction.

|

| |

“Company” |

means the above named company.

|

| |

“Company’s

Website” |

means the website of the Company and/or its web-address or domain name (if any).

|

| |

“Compensation

Committee” |

means the compensation committee of the board of Directors established pursuant to the Articles, or any successor committee.

|

| |

“Designated

Stock Exchange” |

means any United States national securities exchange on which the securities of the Company are listed for trading, including the Nasdaq Capital Market.

|

| |

“Directors” |

means

the directors for the time being of the Company. |

| |

“Dividend” |

means any dividend (whether interim or final) resolved to be paid on Shares pursuant to the Articles.

|

| |

“Effective

Date” |

means November 6, 2023.

|

| |

“Electronic

Communication” |

means a communication sent by electronic means, including electronic posting to the Company’s Website, transmission to any number, address or internet website (including the website of the Securities and Exchange Commission) or other electronic delivery methods as otherwise decided and approved by the Directors.

|

| |

“Electronic

Record” |

has the same meaning as in the Electronic Transactions Act.

|

| |

“Electronic

Transactions Act” |

means the Electronic Transactions Act (As Revised) of the Cayman Islands.

|

| |

“Exchange” |

means the transfer of Aeries Shares held by parties other than AARK and/or AARK Ordinary Shares held by parties other than the Company, for Class A Shares or cash pursuant to exchange agreements between the Company and such parties.

|

| |

“Exchange

Act” |

means the United States Securities Exchange Act of 1934, as amended, or any similar U.S. federal statute and the rules and regulations of the Securities and Exchange Commission thereunder, all as the same shall be in effect at the time.

|

| |

“Hostile

Change of Control” |

means a Change of Control which has not been approved by a Special Resolution at or before the earlier of (a) a public announcement by any person of the intention to obtain a sufficient number of the Company’s then outstanding voting securities as would upon their acquisition constitute a Change of Control or (b) upon a Change of Control and during the continuation thereof.

|

| |

“Indemnified

Person” |

has the meaning assigned to such term in Article 44.1.

|

| |

“Independent

Director” |

has the same meaning as in the rules and regulations of the Designated Stock Exchange or in Rule 10A-3 under the Exchange Act, as the case may be.

|

| |

“Member” |

has the same meaning as in the Statute.

|

| |

“Memorandum” |

means the amended and restated memorandum of association of the Company.

|

| |

“Nominating

Committee” |

means the nominating committee of the board of Directors established pursuant to the Articles, or any successor committee.

|

| |

“Officer” |

means a person appointed to hold an office in the Company.

|

| |

“Ordinary

Resolution” |

means

a resolution passed by a simple majority of the Members as, being entitled to do so, vote in person or, where proxies are allowed,

by proxy at a general meeting, and includes a unanimous written resolution. In computing the majority when a poll is demanded regard