false

0001853044

0001853044

2024-04-05

2024-04-05

0001853044

AERT:ClassOrdinarySharesParValue0.0001PerShareMember

2024-04-05

2024-04-05

0001853044

AERT:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-04-05

2024-04-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 5, 2024

Aeries Technology, Inc.

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

|

001-40920 |

|

98-1587626 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification Number) |

60 Paya Lebar Road, #08-13

Paya Lebar Square

Singapore |

|

409051 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(919)

228-6404

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A ordinary shares, par value $0.0001 per share |

|

AERT |

|

Nasdaq

Capital Market |

| Redeemable

warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AERTW |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Introductory

Note

As

previously described in a current report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on November

13, 2023, as amended by those current reports on Form 8-K/A filed on November 30, 2023 and December 13, 2023 (as amended, the “Closing

Report”), on November 6, 2023, pursuant to the Business Combination Agreement dated March 11, 2023 (as amended, the “Business

Combination Agreement”), by and among Worldwide Webb Acquisition Corp. (“WWAC”), WWAC Amalgamation Sub Pte. Ltd., a

direct wholly owned subsidiary of WWAC (the “Amalgamation Sub”), and Aark Singapore Pte. Ltd., a Singapore private company

(“AARK”), the Amalgamation Sub and AARK amalgamated and continued as one company, with AARK being the surviving entity and

becoming a subsidiary of WWAC, and WWAC changed its corporate name to Aeries Technology, Inc. (the “Company”).

As

contemplated by the Business Combination Agreement, concurrently with the closing of the business combination pursuant to the Business

Combination Agreement, Mr. Venu Raman Kumar and the holders of ordinary shares of Aeries Technology Group Business Accelerators Pte.

Ltd., a subsidiary of AARK (“Aeries”) other than AARK (the “Exchanging Aeries Holders”), entered into Exchange

Agreements with the Company. These Exchange Agreements are referred to herein as the “AARK Exchange Agreement” and the “Aeries

Exchange Agreement”, respectively, and collectively as the “Exchange Agreements”.

As

described in greater detail in the Closing Report, pursuant to the Exchange Agreements, from and after April 1, 2024, and subject to

the satisfaction of the applicable exercise conditions specified therein, the Company, on one side, and Mr. Kumar or each Exchanging

Aeries Holder, on the other side, may exercise a call or put exchange right to exchange the ordinary shares of AARK or Aeries owned by

Mr. Kumar or such Exchanging Aeries Holder, as applicable, for either cash or Class A ordinary shares (“Class A Ordinary Shares”)

of the Company in accordance with the exchange ratio specified in the applicable Exchange Agreement. However, the cash exchange payment

may only be elected in the event that approval from the Reserve Bank of India is not obtained for a stock exchange payment, and provided

that the Company has reasonable cash flow to be able to pay the cash exchange payment and such cash exchange payment would not be prohibited

by any outstanding debt agreements or arrangements of the Company or any of its subsidiaries.

On

March 26, 2024, the audit committee of the board of directors of the Company determined that the exercise conditions in the Exchange

Agreements with respect to Mr. Kumar and one of the Exchanging Aeries Holders, Bhisham Khare, had been satisfied.

Item

3.02 Unregistered Sales of Equity Securities.

To

the extent required by Item 3.02 of Form 8-K, the information contained in Item 8.01 of this current report on Form 8-K below is incorporated

by reference herein.

The

issuance of 21,337,000 Class A Ordinary Shares pursuant to the AARK Exchange Agreement to Mr. Kumar has been conducted in reliance

on an exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended, on the basis that Mr. Kumar

is an accredited investor and the Company did not engage in any general solicitation in connection with such offer and

sale.

Item

5.01 Changes in Control of Registrant.

To

the extent required by Item 5.01 of Form 8-K, the information contained in Item 8.01 of this current report on Form 8-K below is incorporated

by reference herein.

Item

8.01 Other Events.

Exchange

of AARK Shares by Mr. Kumar

On

April 5, 2024, Mr. Kumar exchanged an aggregate amount of 9,500 ordinary shares of AARK for 21,337,000 Class A Ordinary Shares (the

“Exchange”). Mr. Kumar is the Chairman of the board of directors of the Company.

On

April 5, 2024, following the Exchange, the Company had 36,956,004 Class A Ordinary Shares and 1 Class V ordinary share (“Class

V Ordinary Share”) outstanding. Following the Exchange, Mr. Kumar’s beneficial ownership percentage of Class A Ordinary

Shares remained at 73.8%, while his voting power increased from 26.7% to 72.0% of all votes

attached to the total issued and outstanding Class A Ordinary Shares and the Class V Ordinary Share, subject to the special voting

rights of the Class V Ordinary Share regarding certain extraordinary events discussed below.

As

a result of the Exchange, and in accordance with the Amended and Restated Memorandum of Association of the Company (the “Charter”),

the number of votes represented by the sole Class V Ordinary Share was reduced from 51.0% to 1.3% of all votes attached to the total

issued and outstanding Class A Ordinary Shares and the Class V Ordinary Share. This reduction will not affect the voting rights of the

Class V Ordinary Share in the event of extraordinary events set forth in the Charter, including a hostile change of control or an appointment

or removal of a director, where the Class V Ordinary Share will have a number of votes representing 51.0% of all votes attached to the

total issued and outstanding Class A Ordinary Shares and the Class V Ordinary Share.

The

Class V Ordinary Share is owned by NewGen Advisors and Consultants DWC-LLC (the “Class V Ordinary Shareholder”), which

is owned by a business associate of Mr. Kumar. Mr. Kumar does not have control over the Class V Ordinary Shareholder, and the Class

V Ordinary Shareholder will not receive any compensation in connection with its ownership of the Class V Ordinary Share. Although

the Class V Ordinary Shareholder is not required by contract or otherwise to vote in a manner that is beneficial to Mr. Kumar and

may vote the Class V Ordinary Share in its sole discretion, given the business relationship between the Class V Ordinary Shareholder

and Mr. Kumar, Mr. Kumar believes that the Class V Ordinary Shareholder could protect the interests of Mr. Kumar from extraordinary

events, such as a hostile takeover or board contest, prior to the exchange of all ordinary shares of AARK by Mr. Kumar.

AARK

is classified as a subsidiary of the Company, as the Company holds the right to appoint two out of the three directors on AARK’s

board of directors, thereby possessing the ability to control the activities conducted by AARK in the ordinary course of business. Following

the Exchange, the Company’s economic interest in AARK increased from 38.24% to 96.91%, while Mr. Kumar and the Exchanging Aeries

Holders collectively retained 3.09% of the economic interests in AARK.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: April

9, 2024 |

AERIES

TECHNOLOGY, INC.

A

Cayman Islands exempted company |

| |

|

| |

By: |

/s/

Sudhir Appukuttan Panikassery |

| |

Name: |

Sudhir Appukuttan

Panikassery |

| |

Title: |

Chief Executive

Officer and Director |

v3.24.1.u1

Cover

|

Apr. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Apr. 05, 2024

|

| Entity File Number |

001-40920

|

| Entity Registrant Name |

Aeries Technology, Inc.

|

| Entity Central Index Key |

0001853044

|

| Entity Tax Identification Number |

98-1587626

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

60 Paya Lebar Road

|

| Entity Address, Address Line Two |

#08-13

|

| Entity Address, Address Line Three |

Paya Lebar Square

|

| Entity Address, City or Town |

Singapore

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

409051

|

| City Area Code |

(919)

|

| Local Phone Number |

228-6404

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

AERT

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable

warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

AERTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AERT_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AERT_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

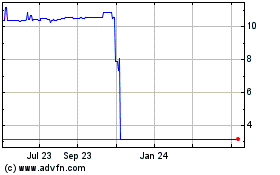

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Mar 2024 to Mar 2025