Q2false0001318008--02-01http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrent0001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-280001318008zumz:STASHLoyaltyProgramMember2024-02-030001318008us-gaap:CertificatesOfDepositMember2024-08-0300013180082023-07-290001318008srt:EuropeMember2024-08-030001318008country:AU2024-02-042024-08-030001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-07-290001318008us-gaap:AccumulatedTranslationAdjustmentMember2024-05-052024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-302023-07-290001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-302023-07-290001318008country:CA2023-01-292023-07-290001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-08-030001318008us-gaap:CashMember2024-02-030001318008us-gaap:USTreasuryAndGovernmentMember2024-08-030001318008us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-08-030001318008srt:EuropeMember2024-02-042024-08-030001318008zumz:RestrictedStockAwardsAndRestrictedStockUnitsMember2024-02-030001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-02-0300013180082024-05-040001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:VariableRateDemandObligationMember2024-02-030001318008zumz:RestrictedStockAwardsAndRestrictedStockUnitsMember2024-08-030001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-05-052024-08-030001318008us-gaap:RetainedEarningsMember2024-05-052024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-0300013180082024-02-042024-08-030001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-02-030001318008country:CA2024-05-052024-08-030001318008us-gaap:RetainedEarningsMember2023-01-280001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-290001318008us-gaap:EmployeeStockOptionMember2024-08-0300013180082021-12-202021-12-200001318008us-gaap:AccumulatedTranslationAdjustmentMember2023-07-290001318008country:CA2023-04-302023-07-290001318008us-gaap:MoneyMarketFundsMember2024-02-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-02-030001318008us-gaap:RetainedEarningsMember2024-02-030001318008us-gaap:RetainedEarningsMember2024-08-030001318008us-gaap:CashEquivalentsMember2024-02-030001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-02-042024-08-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-02-030001318008us-gaap:RetainedEarningsMember2024-02-042024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-042024-08-0300013180082023-01-292023-07-290001318008us-gaap:AccumulatedTranslationAdjustmentMember2023-01-280001318008us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-02-042024-08-030001318008us-gaap:CostOfSalesMember2023-04-302023-07-290001318008country:US2023-01-292023-07-290001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-04-302023-07-290001318008us-gaap:CertificatesOfDepositMember2024-02-030001318008us-gaap:FairValueInputsLevel1Member2024-02-030001318008us-gaap:CorporateDebtSecuritiesMember2024-02-030001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-07-290001318008us-gaap:FairValueInputsLevel2Member2024-08-030001318008zumz:SeniorSecuredCreditFacilityMember2024-02-030001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-05-040001318008zumz:STASHLoyaltyProgramMember2024-08-030001318008us-gaap:FairValueInputsLevel1Member2024-08-030001318008us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-08-030001318008country:AU2023-01-292023-07-290001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-290001318008us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-05-052024-08-030001318008us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-02-030001318008us-gaap:RetainedEarningsMember2023-04-290001318008srt:EuropeMember2023-04-302023-07-290001318008us-gaap:RetainedEarningsMember2023-04-302023-07-290001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-08-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2024-02-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:VariableRateDemandObligationMember2024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-040001318008us-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2024-02-030001318008country:US2023-04-302023-07-290001318008zumz:GiftCardsMember2024-08-030001318008srt:MinimumMember2024-08-030001318008us-gaap:CorporateDebtSecuritiesMember2024-08-030001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-05-052024-08-030001318008us-gaap:RetainedEarningsMember2023-01-292023-07-290001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-04-290001318008us-gaap:RetainedEarningsMember2023-07-290001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-280001318008us-gaap:AccumulatedTranslationAdjustmentMember2023-04-302023-07-290001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-07-290001318008us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-08-030001318008zumz:GiftCardsMember2024-02-030001318008us-gaap:FairValueInputsLevel2Member2024-02-0300013180082023-01-280001318008zumz:RestrictedStockAwardsAndRestrictedStockUnitsMember2024-02-042024-08-030001318008us-gaap:AccumulatedTranslationAdjustmentMember2023-01-292023-07-290001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-05-040001318008us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-292023-07-290001318008zumz:SeniorSecuredCreditFacilityMember2024-05-032024-05-030001318008country:US2024-08-030001318008country:US2024-02-042024-08-030001318008us-gaap:CashMember2024-08-030001318008us-gaap:USTreasuryAndGovernmentMember2024-02-030001318008zumz:SeniorSecuredCreditFacilityMember2024-05-030001318008us-gaap:CostOfSalesMember2024-05-052024-08-030001318008us-gaap:AccumulatedTranslationAdjustmentMember2024-02-042024-08-030001318008us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-302023-07-2900013180082024-05-052024-08-030001318008us-gaap:USStatesAndPoliticalSubdivisionsMember2024-08-030001318008us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-292023-07-290001318008us-gaap:MoneyMarketFundsMember2024-08-030001318008us-gaap:RetainedEarningsMember2024-05-040001318008zumz:VariableRateDemandNotesMember2024-08-030001318008srt:EuropeMember2023-01-292023-07-290001318008us-gaap:CostOfSalesMember2024-02-042024-08-030001318008us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-02-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-08-0300013180082024-02-0300013180082024-08-310001318008us-gaap:USStatesAndPoliticalSubdivisionsMember2024-02-030001318008us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMember2024-08-030001318008us-gaap:AccumulatedTranslationAdjustmentMember2024-08-030001318008zumz:SeniorSecuredCreditFacilityThroughDecemberOneTwoThousandTwentyFourMember2024-08-030001318008country:CA2024-02-042024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-052024-08-0300013180082024-08-030001318008zumz:VariableRateDemandNotesMember2024-02-030001318008us-gaap:AccumulatedTranslationAdjustmentMember2024-02-0300013180082024-02-042024-05-040001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-280001318008us-gaap:CostOfSalesMember2023-01-292023-07-290001318008srt:EuropeMember2024-05-052024-08-030001318008country:CA2024-08-030001318008country:US2024-05-052024-08-030001318008us-gaap:EmployeeStockOptionMember2024-02-0300013180082023-04-290001318008country:AU2024-08-030001318008zumz:CommercialLetterOfCreditMember2024-08-030001318008us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290001318008zumz:SeniorSecuredCreditFacilityMember2024-08-0300013180082023-04-302023-07-290001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-292023-07-290001318008us-gaap:AccumulatedTranslationAdjustmentMember2023-04-290001318008srt:MaximumMember2024-08-030001318008country:AU2023-04-302023-07-290001318008srt:MaximumMember2024-06-050001318008us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-02-042024-08-030001318008zumz:SeniorSecuredCreditFacilityMember2024-02-042024-08-030001318008us-gaap:AccumulatedTranslationAdjustmentMember2024-05-040001318008country:AU2024-05-052024-08-03xbrli:purexbrli:shareszumz:Storeiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED AUGUST 3, 2024

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 000-51300

ZUMIEZ INC.

(Exact name of registrant as specified in its charter)

|

|

|

Washington |

|

91-1040022 |

(State or other jurisdiction of |

|

(I.R.S. Employer |

incorporation or organization) |

|

Identification No.) |

4001 204th Street SW, Lynnwood, WA 98036

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (425) 551-1500

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

☐ |

Emerging growth company |

☐ |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

ZUMZ |

Nasdaq Global Select |

At August 31, 2024, there were 19,141,409 shares outstanding of common stock.

ZUMIEZ INC.

FORM 10-Q

TABLE OF CONTENTS

|

|

|

|

Part I. |

Financial Information |

|

|

|

|

|

|

Item 1. |

Condensed Consolidated Financial Statements |

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets at August 3, 2024 (unaudited) and February 3, 2024 |

3 |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of Loss for the three and six months ended August 3, 2024 and July 29, 2023 |

4 |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss) for the three and six months ended August 3, 2024 and July 29, 2023 |

5 |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of Changes in Shareholders’ Equity for the three and six months ended August 3, 2024 and July 29, 2023 |

6 |

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of Cash Flows for the six months ended August 3, 2024 and July 29, 2023 |

7 |

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements |

8 |

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

|

|

|

|

|

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

32 |

|

|

|

|

|

Item 4. |

Controls and Procedures |

32 |

|

|

|

|

Part II. |

Other Information |

|

|

|

|

|

|

Item 1. |

Legal Proceedings |

33 |

|

|

|

|

|

Item 1A. |

Risk Factors |

33 |

|

|

|

|

|

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

33 |

|

|

|

|

|

Item 3. |

Defaults Upon Senior Securities |

33 |

|

|

|

|

|

Item 4. |

Mine Safety Disclosures |

33 |

|

|

|

|

|

Item 5. |

Other Information |

33 |

|

|

|

|

|

Item 6. |

Exhibits |

34 |

|

|

|

|

Signature |

35 |

ZUMIEZ INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

February 3, 2024 |

|

|

|

(Unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

65,766 |

|

|

$ |

88,875 |

|

Marketable securities |

|

|

61,194 |

|

|

|

82,704 |

|

Receivables |

|

|

23,129 |

|

|

|

13,780 |

|

Inventories |

|

|

158,753 |

|

|

|

128,827 |

|

Prepaid expenses and other current assets |

|

|

17,939 |

|

|

|

12,401 |

|

Total current assets |

|

|

326,781 |

|

|

|

326,587 |

|

Fixed assets, net |

|

|

87,573 |

|

|

|

90,508 |

|

Operating lease right-of-use assets |

|

|

203,744 |

|

|

|

196,775 |

|

Goodwill |

|

|

15,358 |

|

|

|

15,374 |

|

Intangible assets, net |

|

|

14,196 |

|

|

|

14,200 |

|

Deferred tax assets, net |

|

|

9,928 |

|

|

|

8,623 |

|

Other long-term assets |

|

|

11,947 |

|

|

|

12,159 |

|

Total long-term assets |

|

|

342,746 |

|

|

|

337,639 |

|

Total assets |

|

$ |

669,527 |

|

|

$ |

664,226 |

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Trade accounts payable |

|

$ |

75,016 |

|

|

$ |

38,885 |

|

Accrued payroll and payroll taxes |

|

|

20,517 |

|

|

|

18,431 |

|

Operating lease liabilities |

|

|

62,759 |

|

|

|

60,885 |

|

Other current liabilities |

|

|

22,472 |

|

|

|

25,886 |

|

Total current liabilities |

|

|

180,764 |

|

|

|

144,087 |

|

Long-term operating lease liabilities |

|

|

161,663 |

|

|

|

159,877 |

|

Other long-term liabilities |

|

|

7,296 |

|

|

|

7,052 |

|

Total long-term liabilities |

|

|

168,959 |

|

|

|

166,929 |

|

Total liabilities |

|

|

349,723 |

|

|

|

311,016 |

|

Commitments and contingencies (Note 5) |

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

Preferred stock, no par value, 20,000 shares authorized; none issued and outstanding |

|

|

— |

|

|

|

— |

|

Common stock, no par value, 50,000 shares authorized; 19,360 shares issued and outstanding at August 3, 2024 and 19,833 shares issued and outstanding at February 3, 2024 |

|

|

199,763 |

|

|

|

196,144 |

|

Accumulated other comprehensive loss |

|

|

(18,844 |

) |

|

|

(19,027 |

) |

Retained earnings |

|

|

138,885 |

|

|

|

176,093 |

|

Total shareholders’ equity |

|

|

319,804 |

|

|

|

353,210 |

|

Total liabilities and shareholders’ equity |

|

$ |

669,527 |

|

|

$ |

664,226 |

|

See accompanying notes to condensed consolidated financial statements

ZUMIEZ INC.

CONDENSED CONSOLIDATED STATEMENTS OF LOSS

(In thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

August 3, 2024 |

|

|

July 29, 2023 |

Net sales |

|

$ |

210,179 |

|

$ |

194,438 |

|

$ |

387,567 |

|

$ |

377,325 |

Cost of goods sold |

|

|

138,385 |

|

|

132,760 |

|

|

263,874 |

|

|

266,290 |

Gross profit |

|

|

71,794 |

|

|

61,678 |

|

|

123,693 |

|

|

111,035 |

Selling, general and administrative expenses |

|

|

72,187 |

|

|

72,171 |

|

|

144,240 |

|

|

142,881 |

Operating loss |

|

|

(393) |

|

|

(10,493) |

|

|

(20,547) |

|

|

(31,846) |

Interest income, net |

|

|

1,128 |

|

|

775 |

|

|

2,449 |

|

|

1,632 |

Other (expense) income, net |

|

|

(179) |

|

|

423 |

|

|

(946) |

|

|

(118) |

Income (loss) before income taxes |

|

|

556 |

|

|

(9,295) |

|

|

(19,044) |

|

|

(30,332) |

Benefit from (provision for) income taxes |

|

|

1,403 |

|

|

(786) |

|

|

(1,417) |

|

|

(3,441) |

Net loss |

|

$ |

(847) |

|

$ |

(8,509) |

|

$ |

(17,627) |

|

$ |

(26,891) |

Basic loss per share |

|

$ |

(0.04) |

|

$ |

(0.44) |

|

$ |

(0.91) |

|

$ |

(1.40) |

Diluted loss per share |

|

$ |

(0.04) |

|

$ |

(0.44) |

|

$ |

(0.91) |

|

$ |

(1.40) |

Weighted average shares used in computation of loss per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

19,284 |

|

|

19,311 |

|

|

19,375 |

|

|

19,254 |

Diluted |

|

|

19,284 |

|

|

19,311 |

|

|

19,375 |

|

|

19,254 |

See accompanying notes to condensed consolidated financial statements

ZUMIEZ INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

August 3, 2024 |

|

July 29, 2023 |

|

|

August 3, 2024 |

|

July 29, 2023 |

Net loss |

|

$(847) |

|

$(8,509) |

|

|

$(17,627) |

|

$(26,891) |

Other comprehensive income (loss), net of tax and reclassification adjustments: |

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

184 |

|

385 |

|

|

(712) |

|

771 |

Net change in fair value of available-for-sale debt securities |

|

997 |

|

135 |

|

|

895 |

|

465 |

Other comprehensive income, net |

|

1,181 |

|

520 |

|

|

183 |

|

1,236 |

Comprehensive income (loss) |

|

$334 |

|

$(7,989) |

|

|

$(17,444) |

|

$(25,655) |

See accompanying notes to condensed consolidated financial statements

ZUMIEZ INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated

Other

Comprehensive |

|

|

Retained |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Earnings |

|

|

Total |

|

Balance at May 4, 2024 |

|

|

20,318 |

|

|

$ |

198,047 |

|

|

$ |

(20,025 |

) |

|

$ |

159,313 |

|

|

$ |

337,335 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(847 |

) |

|

|

(847 |

) |

Other comprehensive income, net |

|

|

— |

|

|

|

— |

|

|

|

1,181 |

|

|

|

— |

|

|

|

1,181 |

|

Issuance and exercise of stock-based awards |

|

|

(13 |

) |

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

1,718 |

|

|

|

— |

|

|

|

— |

|

|

|

1,718 |

|

Repurchase of common stock |

|

|

(945 |

) |

|

|

— |

|

|

|

— |

|

|

|

(19,581 |

) |

|

|

(19,581 |

) |

Balance at August 3, 2024 |

|

|

19,360 |

|

|

$ |

199,763 |

|

|

$ |

(18,844 |

) |

|

$ |

138,885 |

|

|

$ |

319,804 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated

Other

Comprehensive |

|

|

Retained |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Earnings |

|

|

Total |

|

Balance at April 29, 2023 |

|

|

19,782 |

|

|

$ |

190,599 |

|

|

$ |

(19,077 |

) |

|

$ |

220,321 |

|

|

$ |

391,843 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,509 |

) |

|

|

(8,509 |

) |

Other comprehensive income, net |

|

|

— |

|

|

|

— |

|

|

|

520 |

|

|

|

— |

|

|

|

520 |

|

Issuance and exercise of stock-based awards |

|

|

27 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation expense |

|

|

— |

|

|

|

1,570 |

|

|

|

— |

|

|

|

— |

|

|

|

1,570 |

|

Balance at July 29, 2023 |

|

|

19,809 |

|

|

$ |

192,169 |

|

|

$ |

(18,557 |

) |

|

$ |

211,812 |

|

|

$ |

385,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated

Other

Comprehensive |

|

|

Retained |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Earnings |

|

|

Total |

|

Balance at February 3, 2024 |

|

|

19,833 |

|

|

$ |

196,144 |

|

|

$ |

(19,027 |

) |

|

$ |

176,093 |

|

|

$ |

353,210 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17,627 |

) |

|

|

(17,627 |

) |

Other comprehensive income, net |

|

|

— |

|

|

|

— |

|

|

|

183 |

|

|

|

— |

|

|

|

183 |

|

Issuance and exercise of stock-based awards |

|

|

472 |

|

|

|

228 |

|

|

|

— |

|

|

|

— |

|

|

|

228 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

3,391 |

|

|

|

— |

|

|

|

— |

|

|

|

3,391 |

|

Repurchase of common stock |

|

|

(945 |

) |

|

|

— |

|

|

|

— |

|

|

|

(19,581 |

) |

|

|

(19,581 |

) |

Balance at August 3, 2024 |

|

|

19,360 |

|

|

$ |

199,763 |

|

|

$ |

(18,844 |

) |

|

$ |

138,885 |

|

|

$ |

319,804 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Accumulated

Other

Comprehensive |

|

|

Retained |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Loss |

|

|

Earnings |

|

|

Total |

|

Balance at January 28, 2023 |

|

|

19,489 |

|

|

$ |

188,418 |

|

|

$ |

(19,793 |

) |

|

$ |

238,703 |

|

|

$ |

407,328 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,891 |

) |

|

|

(26,891 |

) |

Other comprehensive income, net |

|

|

— |

|

|

|

— |

|

|

|

1,236 |

|

|

|

— |

|

|

|

1,236 |

|

Issuance and exercise of stock-based awards |

|

|

320 |

|

|

|

275 |

|

|

|

— |

|

|

|

— |

|

|

|

275 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

3,476 |

|

|

|

— |

|

|

|

— |

|

|

|

3,476 |

|

Repurchase of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Balance at July 29, 2023 |

|

|

19,809 |

|

|

$ |

192,169 |

|

|

$ |

(18,557 |

) |

|

$ |

211,812 |

|

|

$ |

385,424 |

|

See accompanying notes to condensed consolidated financial statements

ZUMIEZ INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(17,627 |

) |

|

$ |

(26,891 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation, amortization and accretion |

|

|

11,052 |

|

|

|

10,881 |

|

Noncash lease expense |

|

|

32,169 |

|

|

|

34,380 |

|

Deferred taxes |

|

|

(1,688 |

) |

|

|

(4,060 |

) |

Stock-based compensation expense |

|

|

3,391 |

|

|

|

3,476 |

|

Impairment of long-lived assets |

|

|

298 |

|

|

|

338 |

|

Other |

|

|

949 |

|

|

|

84 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

|

(7,067 |

) |

|

|

(1,113 |

) |

Inventories |

|

|

(30,665 |

) |

|

|

(21,721 |

) |

Prepaid expenses and other assets |

|

|

(937 |

) |

|

|

(3,807 |

) |

Trade accounts payable |

|

|

34,650 |

|

|

|

30,150 |

|

Accrued payroll and payroll taxes |

|

|

2,102 |

|

|

|

(1,676 |

) |

Income taxes payable |

|

|

(1,346 |

) |

|

|

(1,044 |

) |

Operating lease liabilities |

|

|

(36,817 |

) |

|

|

(38,783 |

) |

Other liabilities |

|

|

(3,886 |

) |

|

|

(4,480 |

) |

Net cash used in operating activities |

|

|

(15,422 |

) |

|

|

(24,266 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Additions to fixed assets |

|

|

(6,266 |

) |

|

|

(11,879 |

) |

Purchases of marketable securities |

|

|

(1,967 |

) |

|

|

(1,850 |

) |

Sales and maturities of marketable securities and other investments |

|

|

24,145 |

|

|

|

12,284 |

|

Net cash provided by (used in) investing activities |

|

|

15,912 |

|

|

|

(1,445 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from revolving credit facilities |

|

|

3,220 |

|

|

|

25,682 |

|

Payments on revolving credit facilities |

|

|

(3,220 |

) |

|

|

(25,682 |

) |

Proceeds from issuance and exercise of stock-based awards |

|

|

357 |

|

|

|

460 |

|

Payments for tax withholdings on equity awards |

|

|

(130 |

) |

|

|

(185 |

) |

Repurchase of common stock, including taxes |

|

|

(19,581 |

) |

|

|

— |

|

Net cash (used in) provided by financing activities |

|

|

(19,354 |

) |

|

|

275 |

|

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

|

(213 |

) |

|

|

179 |

|

Net decrease in cash, cash equivalents, and restricted cash |

|

|

(19,077 |

) |

|

|

(25,257 |

) |

Cash, cash equivalents, and restricted cash, beginning of period |

|

|

94,284 |

|

|

|

88,453 |

|

Cash, cash equivalents, and restricted cash, end of period |

|

$ |

75,207 |

|

|

$ |

63,196 |

|

Supplemental disclosure on cash flow information: |

|

|

|

|

|

|

Cash paid during the period for income taxes |

|

$ |

1,805 |

|

|

$ |

1,520 |

|

Accrual for purchases of fixed assets |

|

|

3,326 |

|

|

|

1,784 |

|

Accrual for repurchase of common stock |

|

|

479 |

|

|

|

— |

|

See accompanying notes to condensed consolidated financial statements

ZUMIEZ INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Nature of Business and Basis of Presentation

Nature of Business—Zumiez Inc., including its wholly owned subsidiaries, (the “Company,” “we,” “us,” “its” and “our”) is a leading specialty retailer of apparel, footwear, accessories and hardgoods for young men and women who want to express their individuality through the fashion, music, art and culture of action sports, streetwear, and other unique lifestyles. We operate under the names Zumiez, Blue Tomato and Fast Times. We operate ecommerce websites at zumiez.com, zumiez.ca, blue-tomato.com and fasttimes.com.au. At August 3, 2024, we operated 750 stores; 592 in the United States (“U.S.”), 86 in Europe, 46 in Canada, and 26 in Australia.

Fiscal Year—We use a fiscal calendar widely used by the retail industry that results in a fiscal year consisting of a 52- or 53-week period ending on the Saturday closest to January 31. Each fiscal year consists of four 13-week quarters, with an extra week added to the fourth quarter every five or six years. The three months ended August 3, 2024 and July 29, 2023 were 13-week periods. The six months ended August 3, 2024 and July 29, 2023 were 26-week periods.

Basis of Presentation—The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial reporting. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The unaudited condensed consolidated financial statements include the accounts of Zumiez Inc. and its wholly-owned subsidiaries. All significant intercompany transactions and balances are eliminated in consolidation.

In our opinion, the unaudited condensed consolidated financial statements contain all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the condensed consolidated balance sheets, operating results and cash flows for the periods presented.

The financial data at February 3, 2024 is derived from audited consolidated financial statements, which are included in our Annual Report on Form 10-K for the year ended February 3, 2024, and should be read in conjunction with the audited consolidated financial statements and notes thereto. Interim results are not necessarily indicative of results for the full fiscal year due to seasonality and other factors.

Use of Estimates—The preparation of financial statements in conformity with U.S. GAAP requires estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements as well as the reported amounts of revenues and expenses during the reporting period. These estimates can also affect supplemental information disclosed by us, including information about contingencies, risk and financial condition. Actual results could differ from these estimates and assumptions.

Restricted Cash—Cash and cash equivalents that are restricted as to withdrawal or use under the terms of certain contractual agreements are recorded as restricted cash in other current assets and other long-term assets on our condensed consolidated balance sheets. The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statement of cash flows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

February 3, 2024 |

|

Cash and cash equivalents |

|

$ |

|

65,766 |

|

|

$ |

|

88,875 |

|

Restricted cash included in other current assets and other long-term assets |

|

|

|

9,441 |

|

|

|

|

5,409 |

|

Total cash, cash equivalents, and restricted cash as shown in the statement of cash flows |

|

$ |

|

75,207 |

|

|

$ |

|

94,284 |

|

As of August 3, 2024, restricted cash included in other current assets and other long-term assets amounted to $4.0 million and $5.4 million, respectively. As of July 29, 2023, restricted cash amounting to $5.4 million were all classified as other long-term assets Restricted cash represents amounts held as insurance collateral and collateral for bank guarantees on certain store operating leases.

Effective as of May 3, 2024, we terminated the Credit Agreement and standby letters of credit have been transitioned to restricted deposits with the Bank. See Note 6 Revolving Credit Facilities and Debt for details of termination.

Recent Accounting Standards—We review recent account pronouncements on a quarterly basis and have excluded discussion of those that are not applicable and those that we determined did not have, or are not expected to have, a material impact on the condensed consolidated financial statements.

In November 2023, the FASB issued Accounting Standards Update ("ASU") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires enhanced disclosures around significant segment expenses. This ASU is effective for fiscal years beginning after December 15, 2023, and interim periods beginning after December 15, 2024. The ASU requires public entities to adopt this new guidance on a retrospective basis. The Company is currently evaluating the effect that the new ASU will have on its disclosures and expects to adopt effective for fiscal 2025.

In December 2023, the FASB issued Accounting Standards Update ("ASU") 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires business entities to expand their annual disclosures of income taxes paid and the effective rate reconciliation. The ASU is effective for fiscal years beginning after December 15, 2024.The Company is currently evaluating the effect that the new ASU will have on its disclosures and expects to adopt effective for fiscal 2025.

On December 20, 2021, the Organization for Economic Co-operation and Development ("OECD") has published a proposal to establish a new global minimum corporate tax rate of 15%, commonly referred to as Pillar Two. While the U.S. has not yet adopted the Pillar Two framework into law, several countries in which we operate have enacted tax legislation based on the Pillar Two framework with certain components of the minimum tax rules effective beginning in fiscal year 2024 and further rules becoming effective beginning in fiscal year 2025. These rules are not expected to materially impact the Company’s Consolidated Financial Statements, considering the Company does not have material operations in jurisdictions with tax rates lower than the Pillar Two minimum rate. The Company will continue to monitor U.S. and global legislative action related to Pillar Two for potential impacts.

2. Revenue

The following table disaggregates net sales by geographic region (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

United States |

|

$ |

|

166,186 |

|

|

$ |

149,991 |

|

|

$ |

|

300,057 |

|

|

$ |

285,541 |

|

Europe |

|

|

|

28,320 |

|

|

|

29,488 |

|

|

|

|

57,890 |

|

|

|

62,999 |

|

Canada |

|

|

|

10,148 |

|

|

|

9,682 |

|

|

|

|

18,974 |

|

|

|

18,116 |

|

Australia |

|

|

|

5,525 |

|

|

|

5,277 |

|

|

|

|

10,646 |

|

|

|

10,669 |

|

Net sales |

|

$ |

|

210,179 |

|

|

$ |

194,438 |

|

|

$ |

|

387,567 |

|

|

$ |

377,325 |

|

Net sales for the three months ended August 3, 2024 included a $0.6 million increase due to the change in foreign exchange rates, which consisted of a $0.3 million increase in Europe, and a $0.3 million increase in Canada. Net sales for the six months ended August 3, 2024 included a $0.7 million increase due to the change in foreign exchange rates, which consisted of a $0.3 million increase in Canada, a $0.2 million increase in Europe and a $0.2 million increase in Australia.

Our contract liabilities include deferred revenue related to our customer loyalty program and gift cards. The current liability for gift cards was $2.7 million at August 3, 2024 and $4.3 million at February 3, 2024, respectively. Deferred revenue related to our STASH loyalty program was $1.1 million and $1.0 million at August 3, 2024 and February 3, 2024, respectively.

3. Cash, Cash Equivalents and Marketable Securities

The following tables summarize the estimated fair value of our cash, cash equivalents and marketable securities and the gross unrealized holding gains and losses (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Holding

Gains |

|

|

Gross

Unrealized

Holding

Losses |

|

|

Estimated

Fair Value |

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

31,499 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

31,499 |

|

Money market funds |

|

|

31,375 |

|

|

|

— |

|

|

|

— |

|

|

|

31,375 |

|

Corporate debt securities |

|

|

2,892 |

|

|

|

— |

|

|

|

— |

|

|

|

2,892 |

|

Total cash and cash equivalents |

|

|

65,766 |

|

|

|

— |

|

|

|

— |

|

|

|

65,766 |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

16,199 |

|

|

|

— |

|

|

|

(2,282 |

) |

|

|

13,917 |

|

Corporate debt securities |

|

|

24,241 |

|

|

|

— |

|

|

|

(359 |

) |

|

|

23,882 |

|

State and local government securities |

|

|

1,400 |

|

|

|

— |

|

|

|

(13 |

) |

|

|

1,387 |

|

Certificate of deposits |

|

|

18,568 |

|

|

|

— |

|

|

|

— |

|

|

|

18,568 |

|

Variable-rate demand notes |

|

|

3,440 |

|

|

|

— |

|

|

|

— |

|

|

|

3,440 |

|

Total marketable securities |

|

$ |

63,848 |

|

|

$ |

— |

|

|

$ |

(2,654 |

) |

|

$ |

61,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 3, 2024 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Holding

Gains |

|

|

Gross

Unrealized

Holding

Losses |

|

|

Estimated

Fair Value |

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

38,188 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

38,188 |

|

Money market funds |

|

|

11,322 |

|

|

|

— |

|

|

|

— |

|

|

|

11,322 |

|

Corporate debt securities |

|

|

39,374 |

|

|

|

— |

|

|

|

(9 |

) |

|

|

39,365 |

|

Total cash and cash equivalents |

|

|

88,884 |

|

|

|

— |

|

|

|

(9 |

) |

|

|

88,875 |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

17,610 |

|

|

|

— |

|

|

|

(2,834 |

) |

|

|

14,776 |

|

Corporate debt securities |

|

|

41,218 |

|

|

|

1 |

|

|

|

(948 |

) |

|

|

40,271 |

|

State and local government securities |

|

|

6,525 |

|

|

|

— |

|

|

|

(105 |

) |

|

|

6,420 |

|

Certificates of deposit |

|

|

16,607 |

|

|

|

— |

|

|

|

— |

|

|

|

16,607 |

|

Variable-rate demand notes |

|

|

4,630 |

|

|

|

— |

|

|

|

— |

|

|

|

4,630 |

|

Total marketable securities |

|

$ |

86,590 |

|

|

$ |

1 |

|

|

$ |

(3,887 |

) |

|

$ |

82,704 |

|

All of our marketable securities have an effective maturity date or weighted average life of five years or less at the time of purchase and may be liquidated, at our discretion, prior to maturity.

The following tables summarize the gross unrealized holding losses and fair value for investments in an unrealized loss position, and the length of time that individual securities have been in a continuous loss position (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

|

Less Than 12 Months |

|

|

12 Months or Greater |

|

|

Total |

|

|

|

Fair Value |

|

|

Unrealized

Losses |

|

|

Fair Value |

|

|

Unrealized

Losses |

|

|

Fair Value |

|

|

Unrealized

Losses |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

— |

|

|

|

— |

|

|

|

13,917 |

|

|

|

(2,282 |

) |

|

|

13,917 |

|

|

|

(2,282 |

) |

Corporate debt securities |

|

|

— |

|

|

|

— |

|

|

|

22,881 |

|

|

|

(359 |

) |

|

|

22,881 |

|

|

|

(359 |

) |

State and local government securities |

|

|

— |

|

|

|

— |

|

|

|

1,387 |

|

|

|

(13 |

) |

|

|

1,387 |

|

|

|

(13 |

) |

Total marketable securities |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

38,185 |

|

|

$ |

(2,654 |

) |

|

$ |

38,185 |

|

|

$ |

(2,654 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 3, 2024 |

|

|

|

Less Than 12 Months |

|

|

12 Months or Greater |

|

|

Total |

|

|

|

Fair Value |

|

|

Unrealized

Losses |

|

|

Fair Value |

|

|

Unrealized

Losses |

|

|

Fair Value |

|

|

Unrealized

Losses |

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate debt securities |

|

$ |

29,093 |

|

|

$ |

(9 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

29,093 |

|

|

$ |

(9 |

) |

Total cash and cash equivalents |

|

|

29,093 |

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

|

29,093 |

|

|

|

(9 |

) |

Marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

— |

|

|

|

— |

|

|

|

14,777 |

|

|

|

(2,834 |

) |

|

|

14,777 |

|

|

|

(2,834 |

) |

Corporate debt securities |

|

|

— |

|

|

|

— |

|

|

|

37,878 |

|

|

|

(948 |

) |

|

|

37,878 |

|

|

|

(948 |

) |

State and local government securities |

|

|

— |

|

|

|

— |

|

|

|

6,420 |

|

|

|

(105 |

) |

|

|

6,420 |

|

|

|

(105 |

) |

Total marketable securities |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

59,075 |

|

|

$ |

(3,887 |

) |

|

$ |

59,075 |

|

|

$ |

(3,887 |

) |

4. Leases

At August 3, 2024, we had operating leases for our retail stores, certain distribution and fulfillment facilities, vehicles and equipment. Our remaining lease terms vary from under one month to eleven years, with varying renewal and termination options.

The following table presents components of lease expense (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Operating lease expense |

|

$ |

20,174 |

|

|

$ |

19,864 |

|

|

$ |

36,812 |

|

|

$ |

37,630 |

|

Variable lease expense |

|

|

1,256 |

|

|

|

728 |

|

|

|

4,633 |

|

|

|

3,780 |

|

Total lease expense (1) |

|

$ |

21,430 |

|

|

$ |

20,592 |

|

|

$ |

41,445 |

|

|

$ |

41,410 |

|

(1)Total lease expense includes short-term lease expense and sublease income which is immaterial to the Company. Total lease expense does not include right-of-use asset impairment charges, common area maintenance charges and other non-lease components.

Supplemental cash flow information related to leases is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

|

|

Operating cash flows from operating leases |

|

$ |

(36,817 |

) |

|

$ |

(38,783 |

) |

Right-of-use assets obtained in exchange for new operating lease liabilities |

|

|

46,978 |

|

|

|

32,900 |

|

Weighted-average remaining lease term and discount rate were as follows:

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Weighted-average remaining lease term |

|

|

4.8 |

|

|

|

4.9 |

|

Weighted-average discount rate |

|

|

4.3 |

% |

|

|

2.9 |

% |

At August 3, 2024, the maturities of our operating leases liabilities are as follows (in thousands):

|

|

|

|

|

Fiscal 2024 |

|

$ |

35,556 |

|

Fiscal 2025 |

|

|

67,139 |

|

Fiscal 2026 |

|

|

45,876 |

|

Fiscal 2027 |

|

|

35,437 |

|

Fiscal 2028 |

|

|

21,466 |

|

Fiscal 2029 |

|

|

12,932 |

|

Thereafter |

|

|

30,220 |

|

Total minimum lease payments |

|

|

248,626 |

|

Less: interest |

|

|

(24,204 |

) |

Present value of lease obligations |

|

|

224,422 |

|

Less: current portion |

|

|

(62,759 |

) |

Long-term lease obligations (1) |

|

$ |

161,663 |

|

(1)Amounts in the table do not include contingent rent, common area maintenance charges and other non-lease components.

At August 3, 2024, we have excluded from the table above $1.1 million of operating leases that were contractually executed, but had not yet commenced. These operating leases are expected to commence by the end of fiscal 2024.

5. Commitments and Contingencies

Purchase Commitments—At August 3, 2024, we had outstanding purchase orders to acquire merchandise from vendors of $231.4 million. We have an option to cancel these commitments with no notice prior to shipment, except for certain private label and international purchase orders in which we are obligated to repay contractual amounts upon cancellation.

Litigation—We are involved from time to time in claims, proceedings and litigation arising in the ordinary course of business. We have made accruals with respect to these matters, where appropriate, which are reflected in our condensed consolidated financial statements. For some matters, the amount of liability is not probable or the amount cannot be reasonably estimated and therefore accruals have not been made. We may enter into discussions regarding settlement of these matters, and may enter into settlement agreements, if we believe settlement is in the best interest of our shareholders.

On October 14, 2022, former employee Seana Neihart filed a representative action under California’s Private Attorneys General Act, California Labor Code section 2698 et seq (“PAGA”), against us. An answer to the complaint was filed on December 8, 2022. A first amended complaint was filed on February 8, 2023 adding Jessica King as a plaintiff. The lawsuit alleges a series of wage and hour violations under California’s Labor Code. Zumiez has answered the complaint. We are in the process of investigating the claims and we intend to vigorously defend ourselves.

Insurance Reserves—We use a combination of third-party insurance and self-insurance for a number of risk management activities including workers’ compensation, general liability and employee-related health care benefits. We maintain reserves for our self-insured losses, which are estimated based on historical claims experience and actuarial and other assumptions. The self-insurance reserve at August 3, 2024 and February 3, 2024 was $1.4 million and $1.7 million, respectively.

6. Revolving Credit Facilities and Debt

We were previously parties to a Credit Agreement with Wells Fargo Bank, N.A. (the “Bank”) that provided us with a senior secured credit facility (“credit facility”) for working capital and other general corporate purposes of up to $25.0 million through December 1, 2024. Effective as of May 3, 2024 (the “Termination Date”), we terminated the Credit Agreement with the Bank. There were no borrowings or open commercial letters of credit outstanding under the credit facility as of the Termination Date. At the time

of the Termination Date, there were $3.4 million in issued, but undrawn, standby letters of credit that have been transitioned to restricted deposits with the Bank.

There were no early termination penalties incurred by us in connection with the termination of the Credit Agreement. As referenced above, there were no borrowings or open commercial letters of credit outstanding under the credit facility and we believe that our significant sources of liquidity continue to be funds generated by our operating activities and available cash, cash equivalents and current marketable securities. Termination of the Credit Agreement allows us to discontinue paying an unused commitment fee of 0.50% of the credit facility amount per annum.

There were no borrowings outstanding under the credit facility at February 3, 2024. We had open commercial letters of credit outstanding of less than $0.5 million at August 3, 2024 and no open commercial letters of credit outstanding as of February 3, 2024. We had $2.7 million in issued, but undrawn, standby letters of credit at August 3, 2024 and $3.5 million in issued, but undrawn, standby letters of credit at February 3, 2024

7. Fair Value Measurements

We apply the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement:

•Level 1— Quoted prices in active markets for identical assets or liabilities;

•Level 2— Quoted prices for similar assets or liabilities in active markets or inputs that are observable; and

•Level 3— Inputs that are unobservable.

The following tables summarize assets measured at fair value on a recurring basis (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

31,375 |

|

|

$ |

— |

|

|

$ |

— |

|

Corporate debt securities |

|

|

— |

|

|

|

2,892 |

|

|

|

— |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

— |

|

|

|

13,917 |

|

|

|

— |

|

Corporate debt securities |

|

|

— |

|

|

|

23,882 |

|

|

|

— |

|

Certificates of deposit |

|

|

— |

|

|

|

18,568 |

|

|

|

|

State and local government securities |

|

|

— |

|

|

|

1,387 |

|

|

|

— |

|

Variable-rate demand notes |

|

|

— |

|

|

|

3,440 |

|

|

|

— |

|

Long-term assets: |

|

|

|

|

|

|

|

|

|

Money market funds |

|

|

9,441 |

|

|

|

— |

|

|

|

— |

|

Total |

|

$ |

40,816 |

|

|

$ |

64,086 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 3, 2024 |

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

11,322 |

|

|

$ |

— |

|

|

$ |

— |

|

Corporate debt securities |

|

|

— |

|

|

|

39,365 |

|

|

|

— |

|

Marketable securities: |

|

|

|

|

|

|

|

|

|

U.S. treasury and government agency securities |

|

|

— |

|

|

|

14,776 |

|

|

|

— |

|

Corporate debt securities |

|

|

— |

|

|

|

40,271 |

|

|

|

— |

|

Certificates of deposit |

|

|

— |

|

|

|

16,607 |

|

|

|

— |

|

State and local government securities |

|

|

— |

|

|

|

6,420 |

|

|

|

— |

|

Variable-rate demand notes |

|

|

— |

|

|

|

4,630 |

|

|

|

— |

|

Other long-term assets: |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Money market funds |

|

|

5,409 |

|

|

|

— |

|

|

|

— |

|

Total |

|

$ |

16,731 |

|

|

$ |

122,069 |

|

|

$ |

— |

|

The Level 2 marketable securities include U.S treasury and government agency securities, corporate debt securities, state and local municipal securities and variable-rate demand notes. Fair values are based on quoted market prices for similar assets or liabilities or determined using inputs that use readily observable market data that are actively quoted and can be validated through external sources, including third-party pricing services, brokers and market transactions. We review the pricing techniques and methodologies of the independent pricing service for Level 2 investments and believe that its policies adequately consider market activity, either based on specific transactions for the security valued or based on modeling of securities with similar credit quality, duration, yield and structure that were recently traded. We monitor security-specific valuation trends and we make inquiries with the pricing service about material changes or the absence of expected changes to understand the underlying factors and inputs and to validate the reasonableness of the pricing.

Assets and liabilities recognized or disclosed at fair value on the consolidated financial statements on a nonrecurring basis include items such as fixed assets, operating lease right-of-use-assets, goodwill, other intangible assets and other assets. These assets are measured at fair value if determined to be impaired. During the three months ended August 3, 2024, we recognized $0.1 in impairment losses related to fixed assets and no material impairment for three months ended July 29, 2023. During the six months ended August 3, 2024, we recognized $0.2 million in impairment losses related to fixed assets and $0.3 impairment losses for six months ended July 29, 2023. During the three and six months ended August 3, 2024, we recognized $0.1 million in impairment losses related to operating lease right-of-use assets. During the three months ended July 29, 2023, we recognized no material impairment losses related to operating lease right-of-use assets. During the six months ended July 29, 2023, we recognized $0.1 million in impairment losses related to operating lease right-of-use assets.

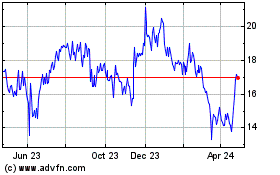

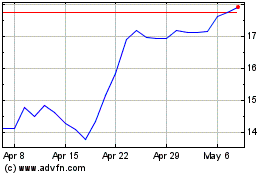

8. Stockholders’ Equity

Share Repurchase—On June 5, 2024, Zumiez Inc. approved the repurchase of up to an aggregate of $25 million of its Common Stock (the “Repurchase Program”). The repurchases will be made from time to time on the open market at prevailing market prices. The Repurchase Program is expected to continue through June 30, 2025, unless the time period is extended or shortened by the Board of Directors. As of August 3, 2024, there remains $5.6 million available to repurchase common stock under the share repurchase program.

The following table summarizes common stock repurchase activity during the six months ended August 3, 2024 (in thousands, except per share amounts):

|

|

|

|

|

|

|

|

|

Number of shares repurchased |

|

|

945 |

|

Average price per share of repurchased shares (with commission) |

|

$ |

20.55 |

|

Total cost of shares repurchased |

|

$ |

19,421 |

|

Accumulated Other Comprehensive Loss —The components of accumulated other comprehensive loss and the adjustments to other comprehensive income (loss) for amounts reclassified from accumulated other comprehensive loss into net loss are as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation

adjustments (3) |

|

|

Net unrealized

losses

on

available-for-

sale

debt securities |

|

|

Accumulated other

comprehensive loss |

|

Three months ended August 3, 2024: |

|

|

|

|

|

|

|

|

|

Balance at May 4, 2024 |

|

$ |

(17,042 |

) |

|

$ |

(2,983 |

) |

|

$ |

(20,025 |

) |

Other comprehensive income, net (1) |

|

|

184 |

|

|

|

997 |

|

|

|

1,181 |

|

Balance at August 3, 2024 |

|

$ |

(16,858 |

) |

|

$ |

(1,986 |

) |

|

$ |

(18,844 |

) |

Three months ended July 29, 2023: |

|

|

|

|

|

|

|

|

|

Balance at April 29, 2023 |

|

$ |

(14,715 |

) |

|

$ |

(4,362 |

) |

|

$ |

(19,077 |

) |

Other comprehensive income, net (1) |

|

|

385 |

|

|

|

135 |

|

|

|

520 |

|

Balance at July 29, 2023 |

|

$ |

(14,330 |

) |

|

$ |

(4,227 |

) |

|

$ |

(18,557 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation

adjustments (3) |

|

|

Net unrealized losses

on

available-for-

sale

investments |

|

|

Accumulated other

comprehensive

loss |

|

Six months ended August 3, 2024: |

|

|

|

|

|

|

|

|

|

Balance at February 3, 2024 |

|

$ |

(16,146 |

) |

|

$ |

(2,881 |

) |

|

$ |

(19,027 |

) |

Other comprehensive income (loss), net (2) |

|

|

(712 |

) |

|

|

895 |

|

|

|

183 |

|

Balance at August 3, 2024 |

|

$ |

(16,858 |

) |

|

$ |

(1,986 |

) |

|

$ |

(18,844 |

) |

Six months ended July 29, 2023: |

|

|

|

|

|

|

|

|

|

Balance at January 28, 2023 |

|

$ |

(15,101 |

) |

|

$ |

(4,692 |

) |

|

$ |

(19,793 |

) |

Other comprehensive income, net (2) |

|

|

771 |

|

|

|

465 |

|

|

|

1,236 |

|

Balance at July 29, 2023 |

|

$ |

(14,330 |

) |

|

$ |

(4,227 |

) |

|

$ |

(18,557 |

) |

(1)Other comprehensive loss before reclassifications was $0.1 million, net of taxes for net unrealized losses on available-for-sale investments for the three months ended August 3, 2024. Other comprehensive income before reclassifications was $0.1 million, net of taxes for net unrealized losses on available-for-sale investments for the three months ended July 29, 2023. There were no net unrealized losses, net of taxes, reclassified from accumulated other comprehensive loss for the three months ended August 3, 2024 and July 29, 2023, respectively.

(2)Other comprehensive income before reclassifications was $0.9 million, net of taxes for net unrealized losses on available-for-sale investments for the six months ended August 3, 2024. Other comprehensive income before reclassifications was $0.5 million, net of taxes for net unrealized losses on available-for-sale investments for the six months ended July 29, 2023.

There were no net unrealized losses, net of taxes, reclassified from accumulated other comprehensive loss for the six months ended August 3, 2024 and July 29, 2023, respectively.

(3)Foreign currency translation adjustments are not adjusted for income taxes as they relate to permanent investments in our international subsidiaries.

9. Equity Awards

We maintain several equity incentive plans under which we may grant incentive stock options, non-qualified stock options, stock bonuses, restricted stock awards, restricted stock units and stock appreciation rights to employees (including officers), non-employee directors and consultants.