0001698991false00016989912024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

ACCEL ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-38136 | 98-1350261 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

|

| 140 Tower Drive | |

| Burr Ridge | , | Illinois | 60527 |

| (Address of principal executive offices) | (Zip Code) |

(630) 972-2235

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A-1 common stock, par value $0.0001 per share | ACEL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 28, 2024, the Company issued a press release announcing its financial and operating results for the fourth quarter and year ended December 31, 2023. Copies of the Company’s press release and investor presentation are attached and furnished herewith as Exhibits 99.1 and 99.2 to this Form 8-K and are incorporated herein by reference.

Information in this report (including Exhibits 99.1 and 99.2) furnished pursuant to Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section.

The Company announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, and the Company’s investor relations website (https:// ir.accelentertainment.com) as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ACCEL ENTERTAINMENT, INC. |

| | | |

| Date: February 28, 2024 | By: | | /s/ Mathew Ellis |

| | | Mathew Ellis |

| | | Chief Financial Officer |

Accel Entertainment Announces 2023 Operating Results

Chicago, IL – February 28, 2024 – Accel Entertainment, Inc. (NYSE: ACEL) today announced certain financial and operating results for the three-months and year ended December 31, 2023.

Highlights:

•Ended 2023 with 3,961 locations; an increase of 6% compared to 2022; excluding Nebraska, locations increased 3% compared to 2022

•Ended 2023 with 25,083 gaming terminals, an increase of 7% compared to 2022; excluding Nebraska, gaming terminals increased 5% compared to 2022

•Another record year for Revenue and Adjusted EBITDA

•Revenue of $297 million for Q4 2023 and $1.2 billion for YE 2023

•Net income of $16 million for Q4 2023 and $46 million for YE 2023

•Adjusted EBITDA of $45 million for Q4 2023 and $181 million for YE 2023

•Illinois same store sales growth was 1% for Q4 2023 and 3% for YE 2023

•2023 ended with $281 million of net debt, a decrease of 12% compared to 2022

•Repurchased $14 million of Accel Class A-1 common stock for Q4 2023 and $30 million for YE 2023

Accel CEO Andy Rubenstein commented, “I am excited to report that Accel had another record-setting year in 2023. Our continued success demonstrates the long-term viability of focusing on the local gaming market. We continue to explore opportunities throughout the country to expand our reach as an industry leader and remain committed to providing value and positive returns to our investors.”

Consolidated Statements of Operations and Other Data

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total net revenues | $ | 297,068 | | | $ | 278,070 | | | $ | 1,170,420 | | | $ | 969,797 | |

| Operating income | 25,451 | | | 25,094 | | | 107,407 | | | 96,855 | |

| Income before income tax expense | 19,377 | | | 17,535 | | | 65,724 | | | 94,762 | |

| Net income | 15,988 | | | 13,406 | | | 45,603 | | | 74,102 | |

| Other Financial Data: | | | | | | | |

Adjusted EBITDA(1) | 44,577 | | | 43,309 | | | 181,445 | | | 162,392 | |

Adjusted net income (2) | 21,953 | | | 20,822 | | | 82,520 | | | 79,875 | |

| | | | | |

| (1) | Adjusted EBITDA is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; interest expense, net; emerging markets; and income tax expense. For additional information on Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, see “Non-GAAP Financial Measures—Adjusted EBITDA and Adjusted net income.” |

| (2) | Adjusted net income is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; and tax effect of adjustments. For additional information on Adjusted net income and a reconciliation of net income to Adjusted net income, see "Non-GAAP Financial Measures— Adjusted net income and Adjusted EBITDA.” |

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total net revenues by state: | | | | | | | |

| Illinois | $ | 219,297 | | | $ | 206,917 | | | $ | 867,200 | | | $ | 808,652 | |

| Montana | 39,314 | | | 35,357 | | | 154,402 | | | 79,639 | |

| Nevada | 29,241 | | | 29,630 | | | 117,074 | | | 66,989 | |

| Nebraska | 5,830 | | | 3,168 | | | 19,043 | | | 5,217 | |

| All other | 3,386 | | | 2,998 | | | 12,701 | | | 9,300 | |

| Total net revenues | $ | 297,068 | | | $ | 278,070 | | | $ | 1,170,420 | | | $ | 969,797 | |

Key Business Metrics

| | | | | | | | | | | | | | | |

Locations (1) | As of December 31, | | |

| 2023 | | 2022 | | | | |

| Illinois | 2,762 | | | 2,648 | | | | | |

| Montana | 609 | | | 610 | | | | | |

| Nevada | 352 | | | 340 | | | | | |

| Nebraska | 238 | | | 143 | | | | | |

| Total locations | 3,961 | | | 3,741 | | | | | |

| | | | | | | | | | | | | | | |

Gaming terminals (1) | As of December 31, | | |

| 2023 | | 2022 | | | | |

| Illinois | 15,276 | | | 14,397 | | | | | |

| Montana | 6,276 | | | 6,108 | | | | | |

| Nevada | 2,704 | | | 2,645 | | | | | |

| Nebraska | 827 | | | 391 | | | | | |

| Total gaming terminals | 25,083 | | | 23,541 | | | | | |

| | | | | |

| (1) | Based on a combination of third-party portal data and data from our internal systems. This metric is utilized by Accel to continually monitor growth from existing locations, organic openings, acquired locations, and competitor conversions. |

| |

Consolidated Statements of Cash Flows Data

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) | 2023 | | 2022 |

| | | |

| Net cash provided by operating activities | $ | 132,530 | | | $ | 107,999 | |

| Net cash used in investing activities | (59,793) | | (189,263) |

| Net cash (used in) provided by financing activities | (35,239) | | 106,591 |

Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended

December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net income | $ | 15,988 | | | $ | 13,406 | | | $ | 45,603 | | | $ | 74,102 | |

| Adjustments: | | | | | | | |

Amortization of intangible assets and route and customer acquisition costs(1) | 5,386 | | | 5,206 | | | 21,211 | | | 17,484 | |

Stock-based compensation(2) | 2,443 | | | 1,884 | | | 9,416 | | | 6,840 | |

(Gain) loss on change in fair value of contingent earnout shares(3) | (2,524) | | | (47) | | | 8,539 | | | (19,544) | |

| | | | | | | |

Other expenses, net(4) | 1,446 | | | 1,426 | | | 6,453 | | | 9,320 | |

Tax effect of adjustments(5) | (786) | | | (1,053) | | | (8,702) | | | (8,327) | |

| Adjusted net income | 21,953 | | | 20,822 | | | 82,520 | | | 79,875 | |

| Depreciation and amortization of property and equipment | 9,992 | | | 8,720 | | | 37,906 | | | 29,295 | |

| Interest expense, net | 8,598 | | | 7,606 | | | 33,144 | | | 21,637 | |

Emerging markets(6) | (142) | | | 979 | | | (948) | | | 2,598 | |

| Income tax expense | 4,176 | | | 5,182 | | | 28,823 | | | 28,987 | |

| | | | | | | |

| Adjusted EBITDA | $ | 44,577 | | | $ | 43,309 | | | $ | 181,445 | | | $ | 162,392 | |

(1)Amortization of intangible assets and route and customer acquisition costs consist of upfront cash payments and future cash payments to third-party sales agents to acquire the location partners that are not connected with a business acquisition, as well as the amortization of other intangible assets. We amortize the upfront cash payment over the life of the contract, including expected renewals, beginning on the date the location goes live, and recognizes non-cash amortization charges with respect to such items. Future or deferred cash payments, which may occur based on terms of the underlying contract, are generally lower in the aggregate as compared to established practice of providing higher upfront payments, and are also capitalized and amortized over the remaining life of the contract. Future cash payments do not include cash costs associated with renewing customer contracts as we do not generally incur significant costs as a result of extension or renewal of an existing contract. Location contracts acquired in a business combination are recorded at fair value as part of the business combination accounting and then amortized as an intangible asset on a straight-line basis over the expected useful life of the contract of 15 years. “Amortization of intangible assets and route and customer acquisition costs” aggregates the non-cash amortization charges relating to upfront route and customer acquisition cost payments and location contracts acquired, as well as the amortization of other intangible assets.

(2)Stock-based compensation consists of options, restricted stock units, performance-based stock units, and warrants.

(3)(Gain) loss on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving certain exchange conditions, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation.

(4)Other expenses, net consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses.

(5)Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations.

(6)Emerging markets consist of the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing. Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first. We currently view Iowa and Pennsylvania as emerging markets. Prior to April 2023, Nebraska was considered an emerging market. Prior to July 2022, Georgia was considered an emerging market.

Reconciliation of Debt to Net Debt

| | | | | | | | | | | |

| As of December 31, |

| (in thousands) | 2023 | | 2022 |

| Debt, net of current maturities | $ | 514,091 | | | $ | 518,566 | |

| Plus: Current maturities of debt | 28,483 | | 23,466 |

| Less: Cash and cash equivalents | (261,611) | | (224,113) |

| Net debt | $ | 280,963 | | | $ | 317,919 | |

Conference Call

Accel will host an investor conference call on February 28, 2024 at 4:30 p.m. Central time (5:30 p.m. Eastern time) to discuss these financial and operating results. Interested parties may join the live webcast by registering at https://www.netroadshow.com/events/login?show=6a462f7f&confId=59904 or accessing the webcast via the company’s investor relations website: ir.accelentertainment.com. Following completion of the call, a replay of the webcast will be posted on Accel’s investor relations website.

About Accel

Accel is a leading distributed gaming operator in the United States and a preferred partner for local business owners in the markets it serves. Accel offers turnkey full-service gaming solutions to authorized non-casino locations such as bars, restaurants, convenience stores, truck stops, and fraternal and veteran establishments across the country. Accel installs, maintains, operates and services gaming terminals and related equipment for its location partners as well as redemption devices, stand-alone ATMs and amusement devices, including jukeboxes, dartboards, pool tables, and other entertainment related equipment. Accel also designs and manufactures gaming terminals and related equipment.

Media Contact:

Eric Bonach

Abernathy MacGregor

212-371-5999

ejb@abmac.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA and capital expenditures. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and

services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”).

Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other press releases or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this press release does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this press release.

Non-GAAP Financial Information

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”), including Adjusted EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA, Adjusted net income, and Net Debt are non-GAAP financial measures and are key metrics used to monitor ongoing core operations. Management of Accel believes Adjusted EBITDA, Adjusted net income, and Net Debt enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitates company-to-company and period-to-period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items, represents certain nonrecurring items that are unrelated to core performance, or excludes non-core operations. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance.

Adjusted EBITDA, Adjusted net income, and Net Debt

Although Accel excludes amortization of intangible assets and route and customer acquisition costs from Adjusted EBITDA and Adjusted net income, Accel believes that it is important for investors to understand that these route, customer and other intangible assets contribute to revenue generation. Any future acquisitions may result in amortization of intangible assets and route and customer acquisition costs.

Adjusted EBITDA, Adjusted net income, and Net Debt are not recognized terms under GAAP. These non-GAAP financial measures exclude some, but not all, items that affect net income, and these measures may vary among companies. These non-GAAP financial measures are unaudited and have important limitations as an analytical tool, should not be viewed in isolation and do not purport to be alternatives to net income as indicators of operating performance.

ACCEL ENTERTAINMENT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | |

(in thousands, except per share amounts) | Years ended December 31, |

| 2023 | | 2022 | | 2021 |

| Revenues: | | | | | |

| Net gaming | $ | 1,113,573 | | | $ | 925,009 | | | $ | 705,784 | |

| Amusement | 23,973 | | | 21,106 | | | 16,667 | |

| Manufacturing | 13,353 | | | 7,621 | | | — | |

| ATM fees and other | 19,521 | | | 16,061 | | | 12,256 | |

| Total net revenues | 1,170,420 | | | 969,797 | | | 734,707 | |

| Operating expenses: | | | | | |

| Cost of revenue (exclusive of depreciation and amortization expense shown below) | 809,524 | | | 666,126 | | | 494,032 | |

| Cost of manufacturing goods sold (exclusive of depreciation and amortization expense shown below) | 7,671 | | | 4,775 | | | — | |

| General and administrative | 180,248 | | | 145,942 | | | 110,818 | |

| Depreciation and amortization of property and equipment | 37,906 | | | 29,295 | | | 24,636 | |

| Amortization of intangible assets and route and customer acquisition costs | 21,211 | | | 17,484 | | | 22,040 | |

| Other expenses, net | 6,453 | | | 9,320 | | | 12,989 | |

| Total operating expenses | 1,063,013 | | | 872,942 | | | 664,515 | |

| Operating income | 107,407 | | | 96,855 | | | 70,192 | |

| Interest expense, net | 33,144 | | | 21,637 | | | 12,702 | |

| Loss (gain) on change in fair value of contingent earnout shares | 8,539 | | | (19,544) | | | 9,762 | |

| | | | | |

| Loss on debt extinguishment | — | | | — | | | 1,152 | |

| Income before income tax expense | 65,724 | | | 94,762 | | | 46,576 | |

| Income tax expense | 20,121 | | | 20,660 | | | 15,017 | |

| Net income | $ | 45,603 | | | $ | 74,102 | | | $ | 31,559 | |

| Earnings per common share: | | | | | |

| Basic | $ | 0.53 | | | $ | 0.82 | | | $ | 0.34 | |

| Diluted | 0.53 | | | 0.81 | | | 0.33 | |

| Weighted average number of shares outstanding: | | | | | |

| Basic | 85,949 | | | 90,629 | | | 93,781 | |

| Diluted | 86,803 | | | 91,229 | | | 94,638 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

ACCEL ENTERTAINMENT, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

(in thousands, except par value and share amounts) | December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 261,611 | | | $ | 224,113 | |

| Accounts receivable, net | 13,467 | | | 11,166 | |

| Prepaid expenses | 6,287 | | | 7,407 | |

| Inventories | 7,681 | | | 6,941 | |

| | | |

| Interest rate caplets | 8,140 | | | 8,555 | |

| Investment in convertible notes | — | | | 32,065 | |

| Other current assets | 15,408 | | | 8,965 | |

| Total current assets | 312,594 | | | 299,212 | |

| Property and equipment, net | 260,813 | | | 211,844 | |

| Noncurrent assets: | | | |

| Route and customer acquisition costs, net | 19,188 | | | 18,342 | |

| Location contracts acquired, net | 176,311 | | | 189,343 | |

| Goodwill | 101,554 | | | 100,707 | |

| Other intangible assets, net | 20,542 | | | 22,979 | |

| Interest rate caplets, net of current | 4,871 | | | 11,364 | |

| Other assets | 17,020 | | | 8,978 | |

| Total noncurrent assets | 339,486 | | | 351,713 | |

| Total assets | $ | 912,893 | | | $ | 862,769 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Current maturities of debt | $ | 28,483 | | | $ | 23,466 | |

| | | |

| Current portion of route and customer acquisition costs payable | 1,505 | | | 1,487 | |

| Accrued location gaming expense | 9,350 | | | 7,791 | |

| Accrued state gaming expense | 18,364 | | | 16,605 | |

| Accounts payable and other accrued expenses | 36,012 | | | 22,302 | |

| Accrued compensation and related expenses | 12,648 | | | 10,607 | |

| Current portion of consideration payable | 3,288 | | | 7,647 | |

| Total current liabilities | 109,650 | | | 89,905 | |

| Long-term liabilities: | | | |

| Debt, net of current maturities | 514,091 | | | 518,566 | |

| Route and customer acquisition costs payable, less current portion | 4,955 | | | 5,137 | |

| Consideration payable, less current portion | 4,201 | | | 6,872 | |

| Contingent earnout share liability | 31,827 | | | 23,288 | |

| Other long-term liabilities | 7,015 | | | 3,390 | |

| Deferred income tax liability | 42,750 | | | 37,021 | |

| Total long-term liabilities | 604,839 | | | 594,274 | |

| Stockholders’ equity: | | | |

Preferred Stock, par value of $0.0001; 1,000,000 shares authorized; 0 shares issued and outstanding at December 31, 2023 and December 31, 2022 | — | | | — | |

| Class A-1 Common Stock, par value $0.0001; 250,000,000 shares authorized; 95,016,960 shares issued and 84,123,385 shares outstanding at December 31, 2023; 94,504,051 shares issued and 86,674,390 shares outstanding at December 31, 2022 | 8 | | | 9 | |

| Additional paid-in capital | 203,046 | | | 194,157 | |

| Treasury stock, at cost | (112,070) | | | (81,697) | |

| Accumulated other comprehensive income | 7,936 | | | 12,240 | |

| Accumulated earnings | 99,484 | | | 53,881 | |

| Total stockholders' equity | 198,404 | | | 178,590 | |

| Total liabilities and stockholders' equity | $ | 912,893 | | | $ | 862,769 | |

Fourth Quarter 2023 Earnings Presentation February 2024

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA and capital expenditures. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming term inals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming termina ls and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; unfavorable macroeconomic conditions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, uncertainty with respect to the U.S. federal budget, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other presentations or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this presentation. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Annual Report on Form 10-K filed by Accel with the SEC, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA, Adjusted net income, and Net Debt. Adjusted EBITDA is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; tax effect of adjustments; depreciation and amortization of property and equipment; interest expense; emerging markets; and income tax expense. Adjusted net income is defined as net income plus amortization of intangible assets and route and customer acquisition costs; (gain) loss on change in fair value of contingent earnout shares; stock-based compensation expense; other expenses, net; and tax effect of adjustments. Net Debt is defined as debt, net of current maturities plus current maturities of debt less cash and cash equivalents. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. See the slide entitled “Non-GAAP to GAAP Reconciliation” on page 9 for additional information. 2

Accel at a Glance 1. Calculated as Net Gaming Revenue in the period divided by the number of operational days. There were 217 and approximately 347 operational days for the years ended December 31, 2020 and 2021, respectively. 2. Calculated as of December 31, 2023. Net Debt is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non- GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” 3. November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of December 31, 2023, the Company has purchased a total of 11,409,197 shares under the plan at a cost of $118 million. Strong Track Record of Growth Disciplined Stewards of Capital As of December 31, 2023, Accel owned and operated 25,083 gaming terminals across 3,961 locations in Illinois, Montana, Nevada and Nebraska Average Daily Net Gaming Revenue(1) ($ in thousands) Long, recurring agreements Continued strong customer engagement Firm backlog of contracted locations waiting to go-live High Quality Service Company in Gaming Vertical Contracted, Recurring Revenue 3 Balance sheet strength Conservative net leverage $281 million of Net Debt(2) Almost 60% through the $200 million share repurchase program(3) $458 $658 $882 $1,125 $1,383 $2,030 $2,534 $3,051 2016 2017 2018 2019 2020 2021 2022 2023

Q4 and YE 2023 Highlights • Another record year for Revenue and Adjusted EBITDA • Q4 Revenue of $297 million, an increase of 7% compared to Q4 2022 • YE 2023 Revenue of $1.2 billion, an increase of 21% compared to YE 2022 − Illinois same store sales(1) grew 1% compared to Q4 2022, and 3% compared to YE 2022 • Q4 Adjusted EBITDA(2) of $45 million, an increase of 3% compared to Q4 2022 • YE 2023 Adjusted EBITDA(2) of $181 million, an increase of 12% compared to YE 2022 • Repurchased $14 million of Accel Class A-1 Common Stock in Q4 2023, $30 million in YE 2023, and $118 million since the repurchase program was announced in November 2021(3) 4 1. Calculated as the change in Hold-per-day (HPD). HPD is calculated by dividing the difference between cash deposited in all gaming terminals at each licensed establishment and tickets issued to players at each licensed establishment by the number of locations in operation each day during the period being measured. 2. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to our non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” 3. On November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of December 31, 2023, the Company has purchased a total of 11,409,197 shares under the plan at a cost of $118 million.

$35 $43 $41 $43$46 $47 $44 $45 Q1 Q2 Q3 Q4 2022 2023 $197 $228 $267 $278$293 $293 $287 $297 Q1 Q2 Q3 Q4 2022 2023 Accel Quarterly KPIs 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” Locations (#) Terminals (#) Revenue ($ in millions) Adjusted EBITDA(1) ($ in millions) 5 2,565 2,572 2,596 2,648 585 586 610 332 335 340 8 140 143 2,663 2,690 2,724 2,762 620 610 611 609 345 355 352 352 165 197 219 238 2,565 3,793 3,497 3,852 3,657 3,906 3,741 3,961 Q1 Q2 Q3 Q4 2022 IL 2022 MT 2022 NV 2022 NE 2023 IL 2023 MT 2023 NV 2023 NE 1 2 2022 I 2022 MT 2022 N 2022 NE 202 I 202 MT 202 N 202 NE

2023 Results 6 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measures to its most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” 2. Presented as cash spend. 3. Net Debt is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measures to its most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” Note: Numbers may not total due to rounding. Percent change may not recalculate due to rounding. $ in millions Q4 2022 Q4 2023 % Change YE 2022 YE 2023 % Change Locations 3,741 3,961 6% 3,741 3,961 6% Terminals 23,541 25,083 7% 23,541 25,083 7% Revenue $278 $297 7% $970 $1,170 21% Adj EBITDA(1) $43 $45 3% $162 $181 12% CapEx(2) $14 $22 49% $47 $82 73% Net Debt(3) $318 $281 -12% $318 $281 -12%

Historical Financial Summary 7 $ in millions 1. Cost of Revenue consists of (i) taxes on net gaming revenue that is payable to the appropriate jurisdiction, (ii) licenses, permits and other fees required for the operation of gaming terminals and other equipment, (iii) location revenue share, which is governed by local governing bodies and location contracts, (iv) ATM and amusement commissions payable to locations, (v) ATM and amusement fees, and (vi) costs associated with the sale of gaming terminals. 2. Adjusted EBITDA and Adjusted Net Income are non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies. Accel does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to these non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 9 "Non-GAAP to GAAP Reconciliation.” 3. (Loss) gain on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation. Note: Numbers may not total due to rounding. Q4 YE YoY YoY 2019 2020 2021 2022 2022 2023 Growth 2022 2023 Growth No. of Locations 2,312 2,435 2,584 3,741 3,741 3,961 6% 3,741 3,961 6% No. of Terminals 10,499 12,247 13,639 23,541 23,541 25,083 7% 23,541 25,083 7% Net Gaming Revenue 411 301 706 925 263 283 8% 925 1,114 20% Other Revenue 18 16 29 45 16 15 (6%) 45 57 27% Gross Revenues 429 316 735 970 278 297 7% 970 1,170 21% % YoY Growth 28% (26%) 132% 32% 7% 21% Less: Cost of revenue (exclusive of amortization and depreciation expense shown below)(1) (282) (211) (494) (671) (195) (207) 6% (671) (817) 22% Gross Profit 147 105 241 299 83 90 9% 299 353 18% % Margin 34% 33% 33% 31% 30% 30% 31% 30% Less: G&A Expenses (69) (77) (111) (146) (42) (48) 13% (146) (180) 24% EBITDA 77 28 130 153 40 42 5% 153 173 13% Adjusted EBITDA(2) 80 34 140 162 43 45 3% 162 181 12% % Margin 19% 11% 19% 17% 16% 15% 17% 16% % YoY Growth 25% (57%) 312% 16% 3% 12% Less: Depreciation & amortization of property & equipment (26) (21) (25) (29) (9) (10) (29) (38) Less: Amortization of intangible assets and route and customer acquisition costs (18) (23) (22) (17) (5) (5) (17) (21) EBIT 33 (16) 83 106 27 27 106 114 Less: Other expenses, net (20) (9) (13) (9) (1) (1) (9) (6) Less: Interest expense, net (13) (14) (13) (22) (8) (9) (22) (33) Less: Income tax benefit (expense) (5) 17 (15) (21) (4) (3) (21) (20) Less: (Loss) gain on change in fair value of contingent earnout shares (3) (10) 8 (10) 20 0 3 20 (9) Less: (Loss) gain on change in fair value of warrants (21) 13 -- -- -- -- -- -- Less: Loss on debt extinguishment (1) -- (1) -- -- -- -- -- Reported Net Income (Loss) (37) (0) 32 74 13 16 74 46 Adjusted Net Income (2) 23 6 71 80 21 22 80 83 Twelve Months Ended Three Months Ended Twelve Months Ended December 31, December 31, December 31,

Accel Balance Sheet 8 Note: Numbers may not total due to rounding. $ in millions December 31, 2022 December 31, 2023 Assets Current Assets: Cash and cash equivalents $224 $262 Other current assets 75 51 Total current assets $299 $313 Property and equipment, net 212 261 Route and customer acquisition costs, net 18 19 Location contracts acquired, net 189 176 Goodwill 101 102 Other assets 43 42 Total assets $863 $913 Liabilities and Stockholders' Equity Current liab ilities: Short term debt and current maturities $23 $28 Accrued state and location gaming expense 24 28 Other current liabilities 42 53 Total current liabilities $90 $110 Long-term liab ilities: Long-term debt $519 $514 Contingent earnout share liability 23 32 Other liabilities 52 59 Total liabilities $684 $714 Total stockholders' equity $179 $198 Total liabilities and stockholders' equity $863 $913

Non-GAAP to GAAP Reconciliation 9 1. Amortization of intangible assets and route and customer acquisition costs consist of upfront cash payments and future cash payments to third-party sales agents to acquire the location partners that are not connected with a business acquisition, as well as the amortization of other intangible assets. We amortize the upfront cash payment over the life of the contract, including expected renewals, beginning on the date the location goes live, and recognizes non-cash amortization charges with respect to such items. Future or deferred cash payments, which may occur based on terms of the underlying contract, are generally lower in the aggregate as compared to established practice of providing higher upfront payments, and are also capitalized and amortized over the remaining life of the contract. Future cash payments do not include cash costs associated with renewing customer contracts as we do not generally incur significant costs as a result of extension or renewal of an existing contract. Location contracts acquired in a business combination are recorded at fair value as part of the business combination accounting and then amortized as an intangible asset on a straight-line basis over the expected useful life of the contract of 15 years. “Amortization of intangible assets and route and customer acquisition costs” aggregates the non-cash amortization charges relating to upfront route and customer acquisition cost payments and location contracts acquired, as well as the amortization of other intangible assets. 2. Stock-based compensation consists of options, restricted stock units, performance-based stock units, and warrants. 3. (Loss) gain on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving certain exchange conditions, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation. 4. Other expenses, net consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses. 5. Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations. 6. Emerging markets consist of the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing. Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first. We currently view Iowa and Pennsylvania as emerging markets. Prior to April 2023, Nebraska was considered an emerging market. Prior to July 2022, Georgia was considered an emerging market. Note: Numbers may not total due to rounding. $ in millions 2019 2020 2021 2022 2022 2023 2022 2023 Reported Net Income (Loss) (37) (0) 32 74 13 16 74 46 (+) Amortization of intangible assets and route and customer acquisition costs (1) 18 23 22 17 5 5 17 21 (+) Stock-based compensation(2) 2 6 6 7 2 2 7 9 (+) (Loss) gain on change in fair value of contingent earnout shares (3) 10 (8) 10 (20) (0) (3) (20) 9 (+) (Loss) gain on change in fair value of w arrants 21 (13) – – – – – – (+) Other expenses, net(4) 20 9 13 9 1 1 9 6 (+) Tax effect of adjustments(5) (11) (10) (11) (8) (1) (1) (8) (9) Adjusted Net Income 23 6 71 80 21 22 80 83 (+) Depreciation and amortization of property & equipment 26 21 25 29 9 10 29 38 (+) Interest expense, net 13 14 13 22 8 9 22 33 (+) Emerging markets(6) – 1 3 3 1 (0) 3 (1) (+) Income tax (benefit) expense 17 (7) 26 29 5 4 29 29 (+) Loss on debt extinguishment 1 – 1 – – – – – Adjusted EBITDA 80 34 140 162 43 45 162 181 Twelve Months Ended Three Months Ended Twelve Months Ended December 31, December 31, December 31, March 31, June 30, Sep. 30, Dec. 31, March 31, June 30, Sep. 30, Dec. 31, 2022 2022 2022 2022 2023 2023 2023 2023 Reported Net Income 16 22 22 13 9 10 10 16 (+) Amortization of intangible assets and route and customer acquisition costs (1) 4 4 5 5 5 5 5 5 (+) Stock-based compensation(2) 2 2 1 2 2 3 3 2 (+) (Loss) gain on change in fair value of contingent earnout shares (3) (3) (6) (10) (0) 5 5 2 (3) (+) Other expenses, net(4) 3 2 3 1 3 0 2 1 (+) Depreciation & amortization of property & equipment 6 7 8 9 9 9 9 10 (+) Interest expense, net 4 4 6 8 8 8 8 9 (+) Emerging markets(6) 0 1 0 1 (1) 0 (0) (0) (+) Income tax expense 5 7 5 4 6 6 5 3 (+) Loss on debt extinguishment – – – – – – – – Adjusted EBITDA 35 43 41 43 46 47 44 45 Three Months Ended Three Months Ended December 31, 2022 2023 Debt, net of current maturities 519 514 (+) Current maturities of debt 23 28 (-) Cash and cash equivalents (224) (262) Net Debt 318 281

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

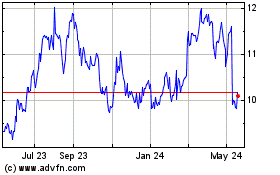

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

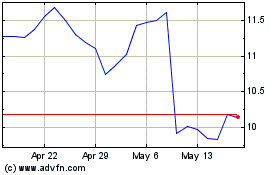

Accel Entertainment (NYSE:ACEL)

Historical Stock Chart

From Apr 2023 to Apr 2024