UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2025

Commission File Number 001-13422

AGNICO EAGLE

MINES LIMITED

(Translation of registrant’s name into English)

145 King Street

East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101 (b)(1): ¨

Note: Regulation S-T Rule 101 (b)( 1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101 (b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBITS

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

AGNICO EAGLE MINES LIMITED |

| |

|

(Registrant) |

| |

|

|

| Date: 01/15/2025 |

By: |

/s/ Chris Vollmershausen |

| |

|

Chris Vollmershausen |

| |

|

Executive Vice-President, Legal, General Counsel & Corporate Secretary |

Exhibit 99.1

JOINT NEWS RELEASE

Agnico Eagle and O3 Mining Issues a Reminder

to O3 Mining Shareholders to

Tender their Shares to Agnico Eagle’s All Cash Offer Expiring January 23, 2025

| · | Offer is expiring

on January 23, 2025 |

| · | $1.67 cash offer

represents a 58% premium to O3 Mining's closing price on December 11, 2024 |

| · | Offer unanimously

recommended by Board and Special Committee of O3 Mining |

| · | 39%

of outstanding shares of O3 Mining have signed Lock-up Agreements to tender to the Offer |

| · | Questions

or Need Assistance? Contact Laurel Hill Advisory Group at 1-877-452-7184 or email assistance@laurelhill.com |

Toronto

(January 15, 2025) – Agnico Eagle Mines Limited (NYSE: AEM, TSX: AEM) ("Agnico") and O3 Mining Inc. (TSXV: OIII,

OTCQX: OIIIF) ("O3"), today sent a letter to shareholders of O3 reminding them to promptly tender their common shares in

O3 to Agnico’s friendly all cash offer of $1.67 per common share. The January 23, 2025 expiry date is quickly approaching

and shareholders of O3 are encouraged to tender their shares well in advance of the expiry date to ensure intermediaries have time to

process the requests.

Reasons

to Tender

| ü | Agnico

is offering to acquire your shares for $1.67 in cash per Common Share |

| ü | The

Offer represents a 58% premium to the closing price of the Common Shares prior to announcement

of the Offer |

| ü | Agnico

and O3 entered into a definitive support agreement, pursuant to which Agnico agreed to offer

to acquire all of the outstanding Common Shares in cash by way of a friendly take-over bid |

| ü | The

Offer is valued at approximately $204 million on a fully diluted in-the-money basis |

Locked-Up

Shareholders and O3 Board Recommendations

Agnico

has entered into lock-up agreements with all directors and officers of O3 and several of O3’s largest shareholders, representing

approximately 39% of the issued and outstanding Common Shares. These shareholders have agreed to tender their shares to the Offer, and

you are encouraged to do the same well in advance of the January 23, 2025 expiry time in order to receive payment in a timely manner.

In addition,

the board of directors of O3 has unanimously recommended that shareholders tender their Common Shares to the offer (see How to Tender

Your Shares below for details).

To ensure

you do not miss out on the Offer, it is critical to tender your shares before 11:59 p.m. (EST) on January 23, 2025 (the “Expiry

Time”). Shareholders are encouraged to act well in advance of the Expiry Time to ensure tender instructions are received in a timely

manner.

If you

have already tendered your shares no further action is required.

How

to Tender Your Shares

| Shareholder Type |

How do I tender my Common Shares? |

| Beneficial Shareholders – Most shareholders are beneficial shareholders. This means your Common Shares are held through a broker, bank or other intermediary, and you do not have a share certificate or DRS advice |

Contact your bank or your broker immediately and instruct them to tender your Common Shares to the Offer |

| Registered Shareholders – You are a registered shareholder if you hold your Common Shares directly (through a share certificate, DRS advice or other method of direct ownership) |

Contact Laurel Hill Advisory Group:

Phone: 1-877-452-7184 (toll-free)

Email: assistance@laurelhill.com |

If you

have any questions or require any assistance with tendering your Common Shares to the Offer, please contact our Depositary and Information

Agent:

Laurel

Hill Advisory Group

North

American Toll-Free: 1-877-452-7184

Outside

North America: +1-416-304-0211

E-mail:

assistance@laurelhill.com

Visit

us at www.agnicoeagle.com/Offer-for-O3-Mining to receive the most up-to-date information about the Offer.

About

O3 Mining Inc.

O3 Mining

Inc. is a gold explorer and mine developer in Québec, Canada, adjacent to Agnico Eagle's Canadian Malartic mine. O3 Mining owns

a 100% interest in all its properties (128,680 hectares) in Québec. Its principal asset is the Marban Alliance project in Québec,

which O3 Mining has advanced over the last five years to the cusp of its next stage of development, with the expectation that the project

will deliver long-term benefits to stakeholders.

About

Agnico Eagle Mines Limited

Agnico

Eagle is a Canadian based and led senior gold mining company and the third largest gold producer in the world, producing precious metals

from operations in Canada, Australia, Finland and Mexico, with a pipeline of high-quality exploration and development projects. Agnico

Eagle is a partner of choice within the mining industry, recognized globally for its leading environmental, social and governance practices.

Agnico Eagle was founded in 1957 and has consistently created value for its shareholders, declaring a cash dividend every year since

1983.

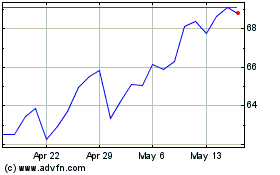

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

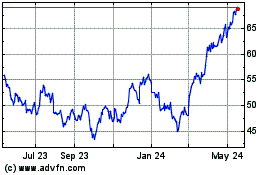

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Feb 2024 to Feb 2025