ALLETE, Inc. (NYSE: ALE) today reported 2023 earnings of $4.30

per share on net income of $247.1 million and operating revenue of

$1.9 billion. Reported results from 2022 were $3.38 per share on

net income of $189.3 million and operating revenue of $1.6

billion.

“We are very pleased with our solid financial results in 2023

and our team’s execution of strategic initiatives that will drive

strong earnings growth and investment in clean energy for years to

come,” said ALLETE Chair, President, and Chief Executive Officer

Bethany Owen. “ALLETE’s Sustainability in Action strategy is

gaining momentum, with important regulatory decisions in 2024, that

will further support Minnesota Power’s EnergyForward clean energy

transformation.”

Owen continued, “Our updated five-year capital expenditure plan

of $4.3 billion reflects the tremendous growth opportunities at

Minnesota Power. We’ve added approximately $1 billion to our

previous plan, reflecting the significant investments in regulated

renewable and transmission projects necessary to advance a

clean-energy future and meet state carbon-free energy goals. By

building on our successful strategic initiatives of 2023 and 2024

and refining our capex plan, we project that ALLETE will achieve

our annual growth objective of 5 percent to 7 percent commencing in

2025, through our forecast period of 2028 and beyond. We are

confident in our strong growth outlook supported by our robust

pipeline of clean energy and transmission opportunities, a

constructive regulatory environment, and our highly skilled

employees.”

“Our consolidated 2023 earnings were in line with our revised

and higher earnings guidance for the year, including negative

weather impacts of approximately 5 cents per share in the fourth

quarter,” said ALLETE Senior Vice President and Chief Financial

Officer Steve Morris. “Our regulated businesses performed within

our guidance range; ALLETE Clean Energy’s strong financial results

were positively impacted by the arbitration award and improved our

liquidity position, however, did include negative effects from

historically low wind and weather conditions along with an outage

at a nearby substation impacting one of its facilities. We expect

this outage to negatively impact earnings into the first quarter of

2024. New Energy performed slightly above our expectations, and we

project strong growth momentum continuing in 2024.”

Earnings in 2023 reflect a net positive impact of a $40.5

million, or 71 cents per share, after-tax gain recognized from a

favorable arbitration award involving a subsidiary of ALLETE Clean

Energy. This positive result was partially offset by the negative

impacts of weather conditions throughout 2023. Earnings per share

dilution in 2023 was 11 cents due to additional shares of common

stock outstanding in 2023.

ALLETE’s Regulated Operations segment, which includes Minnesota

Power, Superior Water, Light and Power, and the Company’s

investment in the American Transmission Co., recorded net income of

$147.2 million, compared to $149.9 million in 2022. Net income at

Minnesota Power was slightly lower than 2022 primarily due to

higher operating and maintenance, depreciation and interest

expenses, and lower kilowatt hour sales to residential and

commercial customers due to less favorable weather conditions in

2023 compared to 2022. These decreases were partially offset by

increased sales to industrial customers in 2023 and lower property

tax expense in 2023. Our after-tax equity earnings in ATC were

higher than 2022 reflecting period over period changes in ATC’s

estimate of a refund liability related to the appeals court

decision on MISO return on equity complaints in 2022.

ALLETE Clean Energy recorded 2023 net income of $71.7 million,

compared to $16.3 million in 2022. Net income in 2023 reflects the

gain recognized for the favorable arbitration award. Net income in

2023 also included the gain on sale of the Red Barn project in 2023

of $4.3 million after-tax. These increases were partially offset by

historically low wind resources and availability at its wind energy

facilities in 2023, as well as negative earnings impact from a

forced network outage near its Caddo wind energy facility. Net

income in 2022 included reserves for an anticipated loss on the

sale of ALLETE Clean Energy’s Northern Wind project and earnings

from the legacy Northern Wind facilities, which were decommissioned

in April 2022 as part of the project.

Corporate and Other businesses, which include New Energy Equity,

BNI Energy, ALLETE Properties and investments in renewable energy

facilities, recorded net income of $28.2 million in 2023, compared

to net income of $23.1 million in 2022. Net income in 2023 reflects

higher earnings at New Energy Equity as a result of more renewable

development projects closed during 2023 and the impact of purchase

price accounting in 2022. Net income in 2023 also reflects earnings

from Minnesota solar projects placed into service in the fourth

quarter of 2022 and the second quarter of 2023, and a $3.8 million

after-tax income tax expense for the consolidated tax impact

related to the favorable arbitration award. Net income in 2022

included transaction costs of $2.7 million after-tax related to the

acquisition of New Energy in April 2022.

Details of the Company’s 2024 earnings guidance were filed as

part of today’s Form 8-K filing.

Live webcast on February 20, 2024; financial slides posted on

company website.

ALLETE’s earnings conference call will be at 10:00 a.m. (EST),

February 20, 2024, at which time management will discuss 2023

financial results and 2024 earnings guidance. Interested parties

may participate live by registering for the call at

www.allete.com/earningscall or may listen to the live audio-only

webcast, accompanied by supporting slides, which will be available

on ALLETE’s Investor Relations website

investor.allete.com/events-presentations. The webcast will be

accessible for one year at allete.com.

ALLETE is an energy company headquartered in Duluth, Minn. In

addition to its electric utilities, Minnesota Power and Superior

Water, Light and Power of Wisconsin, ALLETE owns ALLETE Clean

Energy, based in Duluth, BNI Energy in Bismarck, N.D., New Energy

Equity headquartered in Annapolis, MD, and has an eight percent

equity interest in the American Transmission Co. More information

about ALLETE is available at www.allete.com. ALE-CORP

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE's press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A "non-GAAP financial measure" is defined as a

numerical measure of a company's financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company's

financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE's management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company's

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company's ongoing

financial performance over the periods presented.

ALLETE, Inc.

Consolidated Statement of

Income

For the Periods Ended December

31, 2023 and 2022

Quarter Ended

Year to Date

2023

2022

2023

2022

Millions Except Per Share

Amounts

Operating Revenue

Contracts with Customers – Utility

$319.2

$299.0

$1,238.3

$1,259.3

Contracts with Customers – Non-utility

82.3

125.5

636.4

303.8

Other – Non-utility

1.2

1.3

5.1

7.6

Total Operating Revenue

402.7

425.8

1,879.8

1,570.7

Operating Expenses

Fuel, Purchased Power and Gas –

Utility

132.1

128.1

482.9

545.5

Transmission Services – Utility

21.9

19.2

88.2

76.7

Cost of Sales – Non-utility

36.8

85.9

473.5

182.8

Operating and Maintenance

91.1

80.8

345.3

318.9

Depreciation and Amortization

63.6

60.8

251.8

242.2

Taxes Other than Income Taxes

14.1

17.3

57.2

70.4

Total Operating Expenses

359.6

392.1

1,698.9

1,436.5

Operating Income

43.1

33.7

180.9

134.2

Other Income (Expense)

Interest Expense

(19.9)

(19.9)

(80.8)

(75.2)

Equity Earnings

5.6

5.6

21.7

18.7

Other

9.7

6.0

85.0

22.4

Total Other Income (Expense)

(4.6)

(8.3)

25.9

(34.1)

Income Before Non-Controlling Interest

and Income Taxes

38.5

25.4

206.8

100.1

Income Tax Expense (Benefit)

7.5

(11.8)

27.9

(31.2)

Net Income

31.0

37.2

178.9

131.3

Net Loss Attributable to Non-Controlling

Interest

(20.5)

(14.5)

(68.2)

(58.0)

Net Income Attributable to

ALLETE

$51.5

$51.7

$247.1

$189.3

Average Shares of Common Stock

Basic

57.5

57.2

57.3

55.9

Diluted

57.6

57.2

57.4

56.0

Basic Earnings Per Share of Common

Stock

$0.89

$0.90

$4.31

$3.38

Diluted Earnings Per Share of Common

Stock

$0.89

$0.90

$4.30

$3.38

Dividends Per Share of Common

Stock

$0.68

$0.65

$2.71

$2.60

Consolidated Balance

Sheet

Millions

Dec. 31,

Dec. 31,

Dec. 31,

Dec. 31,

2023

2022

2023

2022

Assets

Liabilities and Equity

Cash and Cash Equivalents

$71.9

$36.4

Current Liabilities

$377.6

$716.2

Other Current Assets

396.2

681.6

Long-Term Debt

1,679.9

1,648.2

Property, Plant and Equipment – Net

5,013.4

5,004.0

Deferred Income Taxes

192.7

158.1

Regulatory Assets

425.4

441.0

Regulatory Liabilities

574.0

526.1

Equity Investments

331.2

322.7

Defined Benefit Pension & Other

Postretirement Benefit Plans

160.8

179.7

Goodwill and Intangibles – Net

155.4

155.6

Other Non-Current Liabilities

264.3

269.0

Other Non-Current Assets

262.9

204.3

Redeemable Non-Controlling Interest

0.5

—

Equity

3,406.6

3,348.3

Total Assets

$6,656.4

$6,845.6

Total Liabilities and Equity

$6,656.4

$6,845.6

Quarter Ended

Year to Date

ALLETE, Inc.

December 31,

December 31,

Income (Loss)

2023

2022

2023

2022

Millions

Regulated Operations

$34.8

$30.5

$147.2

$149.9

ALLETE Clean Energy

5.3

1.3

71.7

16.3

Corporate and Other

11.4

19.9

28.2

23.1

Net Income Attributable to ALLETE

$51.5

$51.7

$247.1

$189.3

Diluted Earnings Per Share

$0.89

$0.90

$4.30

$3.38

Statistical Data

Corporate

Common Stock

High

$62.16

$67.45

$66.69

$68.61

Low

$49.29

$47.77

$49.29

$47.77

Close

$61.16

$64.51

$61.16

$64.51

Book Value

$48.81

$47.03

$48.81

$47.03

Kilowatt-hours Sold

Millions

Regulated Utility

Retail and Municipal

Residential

277

297

1,089

1,148

Commercial

325

332

1,347

1,359

Industrial

1,866

1,698

7,044

6,745

Municipal

116

121

466

540

Total Retail and Municipal

2,584

2,448

9,946

9,792

Other Power Suppliers

811

605

2,819

3,149

Total Regulated Utility

3,395

3,053

12,765

12,941

Regulated Utility Revenue

Millions

Regulated Utility Revenue

Retail and Municipal Electric Revenue

Residential

$38.7

$33.4

$150.3

$156.7

Commercial

42.0

42.7

177.5

178.5

Industrial

153.3

142.2

590.2

585.7

Municipal

8.2

8.3

33.4

40.2

Total Retail and Municipal

242.2

226.6

951.4

961.1

Other Power Suppliers

42.9

41.2

146.1

165.8

Other (Includes Water and Gas Revenue)

34.1

31.2

140.8

132.4

Total Regulated Utility Revenue

$319.2

$299.0

$1,238.3

$1,259.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220094408/en/

Investor Contact: Vince Meyer 218-723-3952 vmeyer@allete.com

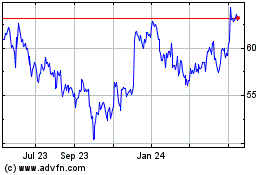

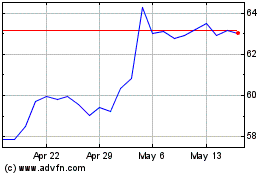

Allete (NYSE:ALE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Dec 2023 to Dec 2024