| | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 |

|

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Pursuant to §240.14a-12 |

| |

| ALLETE, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

The following email was sent to employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

From: Bethany Owen

Subject: ALLETE's Next Chapter

Dear fellow employees,

I’m excited to announce the next chapter of ALLETE’s journey as a leading sustainable, clean-energy company. Today, we agreed to partner with two investors -- Canada Pension Plan Investment Board (CPP Investments) and Global Infrastructure Partners (GIP) -- and start the process to become a private company.

We are confident CPP Investments and GIP are the right partners to advance our current ‘Sustainability in-Action’ strategy and enter our next chapter of growth. These partners are two premier, well-resourced infrastructure investors at a global scale with deep industry expertise and a long-term outlook. CPP Investments, which manages the investments of the Canada Pension Plan, is one of the largest and top performing national pension fund managers in the world and brings a long track record of investing in the energy space. GIP is a leading global infrastructure fund manager focused on large-scale investments in businesses and assets that provide essential services.

These partners take great pride in their responsible investment approach, which is centered on delivering value to their organizations and the communities where they operate. They are aligned with ALLETE’s focus on safety and our commitment to integrity, community engagement, local job retention and career growth and recognize that our teams and how we do business will continue to be key to ALLETE’s success. They also appreciate the important role our team and our ALLETE companies serve in our communities as well as our country’s energy future. While this partnership signals a change in ownership of ALLETE, it will not change our purpose or day-to-day work. Our new partners’ vision for the future aligns with our mission, and they are committed to leveraging their resources and expertise together with us every step of the way.

Importantly for you, CPP Investments and GIP are excited about our amazing teams and have made commitments with respect to workforce retention, as well as maintaining compensation levels and benefits programs and honoring union contracts. Under the terms of the agreement, ALLETE will remain locally managed with headquarters in Duluth, MN, and will maintain strong engagement with all of the communities our ALLETE companies and teams serve. I will continue to serve as CEO, and our close knit and deep team across the organization will remain in place.

We decided to embark on this path for a few reasons. As you know, ALLETE is already executing and delivering on our transformative strategy. We’re the #1 largest investor in renewable energy of all publicly traded utilities in the U.S. as a percentage of market capitalization, and we have many more planned investments in clean energy ahead across all our companies. And as an energy company, we need flexibility to ensure we are best positioned to meet our customers’ evolving needs. That’s where CPP Investments and GIP come in.

Just over the next 5 years, we have plans to double ALLETE in size – including through meaningful investments in projects that many of you are already working on. Longer-term, our strategy and planned projects extend well into the future – with billions of dollars of projects planned for the decades to come. Through this partnership, we will gain access to capital and supportive, experienced partners to advance our ‘Sustainability-in-Action’ strategy and enhance our commitment to provide affordable, reliable, and increasingly clean energy to our customers. As a private company, we will also have less exposure to volatile financial markets. Ultimately, we expect to be better positioned to provide value to our customers and invest in our communities.

We’ve posted a video here (Message from the CEO (allete.com) ) that highlights the benefits of this transaction, and I hope you’ll view it at your convenience. In addition, we’ll be hosting an all-employee town hall today at 9:00 am CST to discuss this news. In the meantime, I encourage you to review the attached FAQs and infographics for additional information.

While I recognize this announcement is a significant development, there are several steps and approvals required before we complete this process in mid-2025, including the approval of ALLETE’s shareholders, receipt of regulatory approvals and other customary closing conditions. As we work through these next steps, we will remain a public company.

I am grateful for your steadfast commitment to each other and our customers every single day. Together with these new partners, we are charting a course for a sustainable and equitable future for all. I hope you will share our excitement about this milestone and the opportunities this partnership will create for all of you, our customers, and our communities.

Take care,

-- Bethany

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

The following is the transcript of a video message from Bethany Owen made available to employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

Hi everyone. Thanks so much for taking a moment out of your day to listen to this message.

I’m excited to share with you that ALLETE has agreed to partner with two investors -- Canada Pension Plan Investment Board and Global Infrastructure Partners -- in a transaction that will result in ALLETE becoming a privately held company.

It’s such an exciting time for ALLETE – with this wonderful company in a position of great strength. And that is because of all of you -- your steadfast commitment to our shared purpose and values, to our customers, to our communities, and to each other.

I certainly understand you probably have a lot of questions – about this partnership, about the partners themselves, and perhaps most importantly, what all of this means for you.

So, before I go any further, I want to be very clear…While today’s announcement signals a change in the ownership of ALLETE, it will not change our purpose or our day-to-day work.

ALLETE will remain locally managed with our headquarters in Duluth, Minnesota, and we will continue our strong engagement with all the communities our ALLETE companies and talented teams serve.

CPP Investments and GIP are excited about our strategy and our amazing team of employees. They know you are key to our success moving forward, and they have made commitments to employee retention, and maintaining compensation levels and benefits programs.

The agreement with these partners also ensures union contracts will be honored and our strong leadership team will remain in place.

In short, this partnership is about gaining ready access to capital to fund the strategy that we are already executing together. It's about creating an even stronger company, while maintaining our outstanding team and culture – as we fulfill our shared purpose to lead the way to a sustainable clean energy future.

---------

It’s important for you to know that ALLETE chose this path. Because our company is in a position of such strength, we were essentially able to choose our own destiny.

We are a relatively small company doing BIG and important things across the nation. Over just the next 5 years, we are planning to invest more than $4 billion dollars, which will approximately double the size of ALLETE. These

investments are in projects across our family of businesses – many of which you are already working on today.

And, our long-term strategy and planned projects extend well beyond those 5 years – with billions of dollars of projects planned for the decades to come.

Transitioning to a private company will provide ALLETE with the ready access to capital needed for our team to execute our transformative strategy across our family of businesses.

With these strong, well-respected partners in CPP Investments and GIP, ALLETE's future is even brighter as we grow – together.

That’s why we’re here today.

---------

Our team has worked closely with the CPP Investments and GIP teams, and it’s clear these partners believe WE have the right team and the right strategy. And our culture and values are well aligned.

They recognize and appreciate that how we do business has been and will continue to be the key to ALLETE’s success now and into the future.

As I outlined in my email earlier today, CPP Investments and GIP are premier, well-resourced infrastructure investors with deep industry expertise and a long-term outlook.

Together, they bring over four decades of experience investing in large-scale infrastructure businesses across sectors to support sustainable, long-term growth.

Both CPP Investments and GIP take great pride in their responsible investment approach -- delivering value to their organizations and the communities where they operate.

We’re pleased to have found partners that share our excitement for our strategy, appreciation for our talented team of employees, and commitment to supporting our communities and customers.

With ready access to capital from CPP Investments and GIP well into the future, I believe we will enhance our ability to build a sustainable and equitable future for all.

Most importantly, our priorities will not change with this transition. Across our family of businesses, our teams will continue to innovate and deliver for our customers just as we always have.

---------

I am excited to begin this new chapter for ALLETE with all of you.

And today is just the first step in the process.

We expect to close this transaction in mid-2025, subject to the approval of ALLETE’s current shareholders, the receipt of state and federal regulatory approvals, and other customary closing conditions.

As we work through these next steps, we will continue to operate as a publicly traded company.

For now, the most important thing is that we all remain focused on working safely, serving our customers with excellence, supporting each other, and executing our strategy -- with all of the projects and opportunities we have currently underway and those planned for the future.

---------

In closing, I just want to say what a tremendous honor it is to work with you all as, together, we lead this great company into the very bright future.

I am so proud to work with all of you as we continue to put sustainability into action for our customers, our communities, and the climate.

I'm looking forward to more conversations with you all as we move ahead.

Thank you again for your time this morning!

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE

Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

The following buyer infographic was made available to employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

The following transaction infographic was made available to employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

The following employee FAQ was made available to employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

The following newsletter was sent to former employees of ALLETE, Inc. and its subsidiaries on May 6, 2024:

The following was posted by ALLETE, Inc. on social media platform X on May 6, 2024:

The following was posted by ALLETE, Inc. on social media platform LinkedIn on May 6, 2024:

The following letter was sent to partners/vendors by ALLETE, Inc. and its subsidiaries on May 6, 2024:

ALE Partner – Vendor Letter

Subject: Announcing the Next Step in ALLETE’s Journey

[Dear Valued Partner // INSERT CUSTOMARY GREETING]:

We are excited to announce the next phase of ALLETE’s journey as a leading sustainable clean-energy company. ALLETE has agreed to be acquired by a partnership of investors jointly led by Canada Pension Plan Investment Board (CPP Investments) and Global Infrastructure Partners (GIP) and start the process to become a private company. A copy of the press release we issued can be found here [INSERT LINK].

We are confident CPP Investments and GIP are the right partners to help us advance our ‘Sustainability-in-Action’ strategy as we enter our next chapter of growth. CPP Investments and GIP are premier, well-resourced infrastructure investors at a global scale with deep industry expertise and long-term outlooks. Together, they bring over four decades of experience investing in large-scale infrastructure businesses across sectors to support sustainable, long-term growth. They are fully aligned with our vision for the future and committed to leveraging their expertise and resources to support us in our next phase of growth. Ultimately, we expect this transaction will allow us to move forward as an even stronger partner to you.

While we are excited to be taking this step forward, it is important to note that nothing is changing today. There are several steps required before we complete this process, which we expect to occur in mid-2025, subject to the approval of ALLETE’s shareholders, the receipt of regulatory approvals and other customary closing conditions. As we work through these next steps, we remain a public company and we are operating as usual. You should not expect any changes in the way we work with your organization. All of your current contracts will remain in place, and you will be able to work with the same ALLETE contacts.

Following the close of the transaction, we will continue to partner with you in the same way we always have. ALLETE will remain locally managed with headquarters in Duluth, MN, and maintain its strong engagement with all of the communities our ALLETE companies and employees serve. Together, we will continue to invest in the clean-energy transition and build on our 100 plus-year history of delivering safe, reliable, and competitively priced energy to our customers.

Thank you for your continued support and partnership. We look forward to working together for years to come as we enter this exciting next chapter for ALLETE.

Sincerely,

[INSERT NAME]

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

The following letter was sent to non-utility customers by ALLETE, Inc. and its subsidiaries on May 6, 2024:

ALE Non – Utility Customer Letter

Subject: Announcing the Next Step in ALLETE’s Journey

[Dear NAME // INSERT CUSTOMARY GREETING]:

As you are an important partner to [INSERT SUBSIDIARY], I wanted to reach out directly to share an update related to our ownership structure.

[SUBSIDIARY] is a wholly-owned subsidiary of ALLETE, a public energy company with operations across the nation. We are excited to share with you that ALLETE has agreed to be acquired by a partnership of investors jointly led by Canada Pension Plan Investment Board (CPP Investments) and Global Infrastructure Partners (GIP). We believe this transaction will allow us to continue providing energy solutions and supporting our customers. It will also position the Company well to advance our ‘Sustainability-in-Action’ strategy as we enter our next chapter of growth.

We are confident CPP Investments and GIP are the right partners for us. They are each premier, well-resourced infrastructure investors at a global scale with deep industry expertise and long-term outlooks. Together, they bring over four decades of experience investing in large-scale infrastructure businesses across sectors to support sustainable, long-term growth. Importantly, while this partnership signals a change in ownership of ALLETE, it will not change our operations, strategy or shared purpose and values. We expect this will be a seamless process and remain committed to meeting your needs.

We expect the transaction will close in mid-2025, subject to the approval of ALLETE’s shareholders, the receipt of regulatory approvals and other customary closing conditions. As we work through these next steps, we continue to operate as usual. This means you should not expect any changes to your service, and all current customer agreements will remain in place. Following the close of the transaction, ALLETE will remain locally managed with headquarters in Duluth, MN, and maintain strong engagement with all the communities our ALLETE companies and employees serve.

Should you have any specific questions, please do not hesitate to reach out to [INSERT].

Thank you for your continued support.

Sincerely,

[INSERT NAME]

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC.

More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

The following text was posted by ALLETE, Inc. on the website banner of the investor portion of its website (investor.allete.com) on May 6, 2024:

ALLETE has entered an agreement to be acquired by a partnership led by Canada Pension Plan Investment Board and Global Infrastructure Partners and start the process to become a private company. Learn more at www.ALLETEforward.com.

The following information was posted on ALLETE, Inc.’s microsite (www.ALLETEforward.com) on May 6, 2024:

Important Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a proxy statement on Schedule 14A with the Securities and Exchange Commission (“SEC”). ALLETE also may file other documents with the SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will be able to obtain such documents (if and when available) free of charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of management, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information regarding ALLETE’s directors and executive officers is contained in (i) the “Directors, Executive Officers and Corporate Governance,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” sections of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 of ALLETE, which was filed with the SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of Directors,” “Compensation Discussion and Analysis,” and “Ownership of ALLETE Common Stock” sections in the definitive proxy statement for the 2024 annual meeting of shareholders of ALLETE, which was filed with the SEC on March 28, 2024. To the extent the holdings of ALLETE’s securities by ALLETE’s directors and executive officers have changed since the amounts set forth in the proxy statement for its 2024 annual meeting of shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities, holdings or otherwise, will be set forth in the proxy statement and other materials relating to the merger when they are filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking Information

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the proposed acquisition of ALLETE, shareholder and regulatory approvals, the expected timetable for completing the proposed transaction and any other statements regarding ALLETE’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to: failure to obtain the required vote of ALLETE’s shareholders; the timing to consummate the proposed transaction; the risk that the conditions to closing of the proposed transaction may not be satisfied; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; and the diversion of management’s time on transaction-related issues.

When used in this communication, or any other documents, words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “target,” “could,” “goal,” “intend,” “objective,” “plan,” “project,” “seek,” “strategy,” “target,” “may,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the beliefs and assumptions of management at the time that these statements were prepared and are inherently uncertain. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These risks and uncertainties, as well as other risks and uncertainties that could cause ALLETE’s actual results to differ materially from those expressed in the forward-looking statements, are described in greater detail under the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the year ended December 31, 2023 and in subsequently filed Forms 10-Q and 8-K, and in any other SEC filings made by ALLETE. These risks should not be considered a complete statement of all potential risks and uncertainty, and will be discussed more fully, along with other risks associated with the proposed transaction, in the proxy statement to be filed with the SEC in connection with the proposed transaction. Management cautions against putting undue reliance on forward-looking statements or projecting any future results based on such statements or present or prior earnings levels. Forward-looking statements speak only as of the date hereof, and ALLETE does not undertake any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by applicable law.

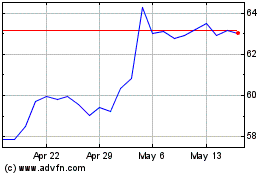

Allete (NYSE:ALE)

Historical Stock Chart

From Nov 2024 to Dec 2024

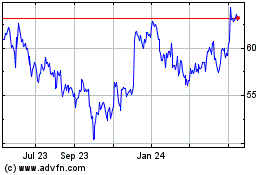

Allete (NYSE:ALE)

Historical Stock Chart

From Dec 2023 to Dec 2024