0000766421false00007664212024-10-212024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

October 21, 2024

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation) | | | | | | | | |

| 1-8957 | | 91-1292054 |

| (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 19300 International Boulevard | Seattle | Washington | | 98188 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Ticker Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | ALK | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This document is also available on our website at http://investor.alaskaair.com

ITEM 7.01. Regulation FD Disclosure

Pursuant to 17 CFR Part 243 (Regulation FD), the Company is submitting information relating to its financial and operational outlook in an Investor Update. The Investor Update is furnished herein as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information under this item shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

ITEM 9.01. Financial Statements and Other Exhibits

| | | | | | | | |

| | Alaska Air Group Investor Update |

| 104 | | Cover Page Interactive Data File - embedded within the Inline XBRL Document |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: October 21, 2024

/s/ EMILY HALVERSON

Emily Halverson

Vice President Finance and Controller

Exhibit 99.1

Investor Update - October 21, 2024

References in this update to “Air Group,” “Company,” “we,” “us,” and “our” refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified.

Certain financial information provided in this exhibit (“non-GAAP financial figures”) is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Non-GAAP financial figures may be useful to stakeholders, but should not be considered a substitute for GAAP figures. Air Group is not able to reconcile certain forward looking non-GAAP financial figures without unreasonable effort because the adjusting items will not be known until the end of the indicated future periods and could be significant. Please see the cautionary statement under “Forward-Looking Information.”

We are providing information about estimated fuel prices. Management believes it is useful to compare results between periods on an “economic basis.” Economic fuel expense is defined as the raw or “into-plane” fuel cost less any cash we receive from hedge counterparties for hedges that settle during the period, offset by the recognition of premiums originally paid for those hedges that settle during the period. Economic fuel expense more closely approximates the net cash outflow associated with purchasing fuel for our operation.

Forward-Looking Information

This update contains forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by our forward-looking statements, assumptions or beliefs. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2023. Some of these risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed in our most recent Form 10-K and in our subsequent SEC filings. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements made today to conform them to actual results. Over time, our actual results, performance or achievements may differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, assumptions or beliefs and such differences might be significant and materially adverse.

FINANCIAL UPDATE

Following Air Group’s acquisition of Hawaiian Holdings, Inc. ("Hawaiian") on September 18, 2024, our third quarter results will reflect consolidated financial and operational performance. We now expect our Q3 2024 combined results to be on the better end of our previously guided EPS range, inclusive of 13 days of Hawaiian's results. We expect to report the industry’s best adjusted pre-tax margin performance for the quarter, both on a legacy Air Group, and combined basis. EPS and margin performance was driven by strong Alaska results, with positive revenue and cost performance in the quarter. Revenue trends experienced throughout the third quarter are continuing into the fourth quarter, with strong advanced booking performance for both the Alaska and Hawaiian networks.

Air Group also recently completed the funding of its $2.0 billion loyalty financing. Approximately $1.5 billion will be used to refinance other high-yielding debt in October, including $985 million of HawaiianMiles 11.0% Senior Secured Notes and approximately $513 million of other secured debt with rates a few hundred basis points above the 5.7% weighted average cost of our loyalty financing. Altogether, these refinancings are expected to result in annualized interest cost savings of over $35 million for the combined company.

With the closing of our acquisition of Hawaiian Airlines late in the third quarter, Air Group now expects to publish its consolidated Q3 2024 earnings release and fourth quarter guidance on October 31, 2024. Our earnings release will include additional supplemental information beyond our normal release, including more MD&A of Q3 results, Q4 expectations, and written Q&A.

Given the proximity to our upcoming Investor Day scheduled for December 10th in New York, where further detail about the future plans and financial performance of the combined company will be shared, we do not plan to hold a third quarter earnings conference call. The investor relations team will also be available for additional communication following the release.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

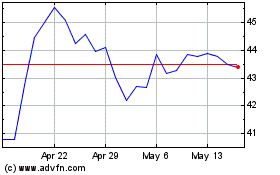

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Dec 2023 to Dec 2024