BorgWarner, Inc. (BWA) - Bull of the Day

14 September 2011 - 10:00AM

Zacks

BorgWarner, Inc. (BWA) continues to focus on new product

launches supported by new business opportunities and acquisitions.

Demand for its fuel-efficient engines and transmissions have grown

stronger due to more stringent government regulations. As a result,

the company's revenues soared 28% in the second quarter of 2011,

despite a drop in global vehicle production.

Furthermore, the company expects 25% to 28% growth in sales in

2011. Its profit significantly exceeded the Zacks Consensus

Estimate by $0.14 per share during the reported quarter.

Our long-term Outperform recommendation on the stock indicates

that it will perform better than the overall market. Our $82 target

price, 18.6X our 2011 EPS estimate, reflects this view.

BORG WARNER INC (BWA): Free Stock Analysis Report

Zacks Investment Research

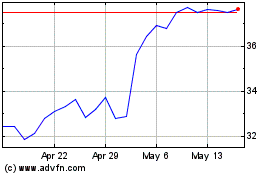

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jun 2024 to Jul 2024

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Jul 2023 to Jul 2024