Caterpillar Pares Guidance Amid Sluggish Demand

22 April 2016 - 10:40PM

Dow Jones News

Caterpillar Inc. pared its earnings and revenue forecasts for

the year as demand for its construction and mining equipment

remained sluggish through the first quarter, with little sign of

challenges easing this year.

Shares slipped 1.5% to $77.46 in premarket trading.

The company now expects revenue between $40 billion and $42

billion for 2016, compared with prior guidance of $40 billion to

$44 billion. That means the midpoint of the outlook range was cut

by $1 billion, to $41 billion, slightly above the consensus

estimate of $40.61 billion that analysts had projected, according

to Thomson Reuters.

Though the company said it had seen some market improvements, it

lowered its full-year outlook, citing factors such as lower

transportation sales—including rail, marine and the ending of

production of on-highway trucks—lower mining sales and weaker price

realization than expected.

Caterpillar also expects per-share profit of $3, or $3.70

excluding restructuring costs, compared with its previous outlook

of $3.50, or $4 excluding restructuring costs. The company said the

lower profit outlook reflected declining sales and higher

restructuring costs.

The guidance cut came Friday as Caterpillar reported

first-quarter results, which showed demand for the company's

equipment in the period continued to be dismal. Though there has

been moderate strength in the U.S. construction sector, that hasn't

been enough to offset plunging sales of machinery and engines used

for oil and natural-gas production and mining of commodities such

as coal.

Markets outside the U.S. that were once a growth engine for the

company lately have been a drag on performance. First-quarter sales

in Latin America fell 43%, largely on widespread economic weakness,

particularly in Brazil and Mexico.

Caterpillar had backed its full-year guidance in March, but

lowered first-quarter forecasts put pressure on executives to

deliver in the second half. Industry analysts were skeptical about

a significant improvement in market conditions, and some warned

that Caterpillar could have to pare its 2016 guidance.

Over all, Caterpillar posted a profit as $271 million, or 46

cents a share, compared with $1.25 billion, or $2.03 a share, in

the year-earlier period. Excluding restructuring costs, the company

earned 67 cents a share.

Caterpillar had guided for adjusted first-quarter earnings in a

range of 65 cents to 70 cents per share. Analysts were projecting

68 cents a share.

Revenue fell 26% to $9.46 billion, above company expectations

for $9.3 billion to $9.4 billion. Analysts had projected $9.39

billion.

Caterpillar expects to cut 10,000 jobs by the end of 2018, about

8% of its workforce.

Write to Joshua Jamerson at joshua.jamerson@wsj.com and Bob Tita

at robert.tita@wsj.com

(END) Dow Jones Newswires

April 22, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

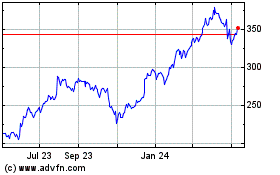

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

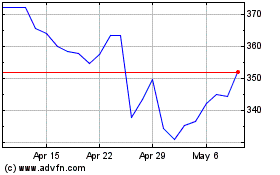

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024