0001857853FALSE00018578532023-05-302023-05-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 30, 2023

TRAEGER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-40694 | | 82-2739741 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

1215 E Wilmington Ave., Suite 200 | | | | |

Salt Lake City, Utah | | | | 84106 |

(Address of principal executive offices) | | | | (Zip Code) |

(801) 701-7180

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | COOK | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

Traeger, Inc. (the “Company”) is amending its Current Report on Form 8-K filed on May 30, 2023 (the “Original 8-K”) to disclose certain compensation arrangements of James Hardy, as described below. Except as set forth in Item 5.02 below, the Original 8-K is not amended or supplemented.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 1, 2023, the Compensation Committee of the Board of Directors of the Company approved a letter agreement (the “Agreement”) between Traeger Pellet Grills, LLC (the “Traeger LLC”) and James Hardy, the President of Apption Labs Limited. The Agreement amends the offer letter between the Traeger LLC and Mr. Hardy, dated as of February 25, 2021, and sets forth certain compensation and benefits that Mr. Hardy will be entitled to receive in connection with his appointment to President of Apption Labs Limited and related relocation to the United Kingdom. The material changes under the Agreement are as follows:

•Mr. Hardy is entitled to reimbursement for certain relocation expenses in connection with, and contingent upon, the relocation of his primary residence to Leicester, United Kingdom on or prior to January 1, 2024.

•During the term of Mr. Hardy’s employment as President of Apption Labs Limited, Mr. Hardy will be entitled to reimbursement for business class air travel expenses in connection with up to two round trips taken by Mr. Hardy and his spouse between Leicester, United Kingdom and the United States.

•During the term of Mr. Hardy’s employment as President of Apption Labs Limited, Mr. Hardy will be entitled to receive certain tax equalization payments and tax return preparation assistance to the extent he receives income, gains or benefits in connection with his employment that become taxable outside of the United States.

•Following his relocation to the United Kingdom, Mr. Hardy will be eligible to participate in employee benefit plans maintained by Traeger LLC for the benefit of its regular full-time employees in the United Kingdom. In addition, Traeger LLC will provide United Kingdom and United States healthcare coverage for Mr. Hardy and his spouse.

The foregoing description of the Agreement is qualified in its entirety by reference to the full text of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Traeger, Inc. |

| | | |

Date: December 7, 2023 | By: | /s/ Dominic Blosil |

| | Dominic Blosil |

| | Chief Financial Officer |

December 4, 2023

Dear James:

Traeger Pellet Grills LLC. (the “Company”, “we”, or “us”) is thrilled that you have taken on the role of President of Apption Labs Limited (d/b/a MEATER), a wholly owned subsidiary of the Company. As discussed, we have agreed to provide you with the following changes and additions to your employment terms and compensation. This letter agreement (this “Letter Agreement”) amends the offer letter (the “Offer Letter”) entered into between you and the Company, dated as of February 25, 2021.

•Position: President of Apption Labs Limited (d/b/a MEATER).

•Principal Location: Leicester, United Kingdom.

•Relocation: It is currently anticipated that you will relocate your primary residence to Leicester, UK on or prior to January 1, 2024 (the “Relocation Deadline”). The Company will pay for your for reasonable and necessary relocation and moving expenses incurred in connection with your relocation (the “Relocation Expenses”). Relocation Expenses hereunder include: (i) the costs of shipping and storage (for up to six (6) months) of your household goods and personal effects; (ii) the costs of temporary housing for you and your family for up to thirty (30) days in the United Kingdom; (iii) the costs of a rental car for up to thirty (30) days and meals during your relocation; and (iii) airfare for any travel incident to such relocation. These Relocation Expenses should be coordinated through SIRVA, the Company’s relocation vendor for your assignment or paid out of the $12,000 relocation allowance which the Company will provide directly to you. In any cases where the services listed above cannot be booked through SIRVA, you may submit these expenses for reimbursement. Expenses must be reasonable, and it is advisable that you should confirm a pre-approved limit through Jane Carr or SIRVA before incurring expenses. Such reimbursement shall be dependent upon your submission, within sixty (60) days after such expenses are incurred, of documentation reasonably acceptable to the Company that evidences such expenses. Reimbursement of the Relocation Expenses, as applicable, shall be made promptly following the Company’s receipt of approved documentation, but no later than December 31 of the calendar year following the calendar year in which the expense is incurred. In the event you have not relocated by the Relocation Deadline, then you will not be eligible for the expense coverage or expense reimbursements provided hereunder.

•Travel and Business Expense Reimbursement: During the term of your employment, the Company will either pay for directly or reimburse you for all reasonable travel and other business expenses incurred by you in the performance of your duties to the Company in accordance with the applicable Company policy.

•Home Leave: Annually, the Company will provide for two round-trip business class air transportations for you and your spouse between Leicester, UK and any location in the United States (excluding Hawaii and Alaska), subject to your submission to the Company of

substantiating documentation promptly after the relevant personal travel expense is incurred in accordance with applicable Company policy.

•Tax Equalization and Tax Preparation.

oDuring the term of your UK assignment, and to the extent you receive income, gains or benefits with respect to your employment as President of Apption Labs Limited that becomes taxable outside of the United States, the Company will provide you with tax equalization so that the income and employment tax burden incurred by you is not substantially greater or less than the tax that you would have paid had you performed all of your duties to the Company in Cantonment, Florida. As such, the Company will withhold a “hypothetical” tax from your employment compensation that will reflect more or less what you would have paid had you remained working in Florida. The Company will use such hypothetical withholdings to fund all actual taxes (US federal, US social security and Medicare and UK taxes) required by Treasury Regulation Section 1.409A-1(b)(8)(iii)) for so long as you are receiving any income, gains or benefits in connection with your employment in such position.

oIn addition, the Company will provide you with tax return preparation assistance by a mutually agreed firm with such costs to be reimbursed (net of taxes) to you with respect to the tax years ending December 31 of 2023, 2024, 2025 and 2026 or, if earlier, until the date on which you cease to be required to report such wage income, gains or benefits (including equalization or the tax preparation provided hereunder) on UK tax returns under applicable laws.

•Benefits. You will be eligible to participate in all of the employee benefits and benefit plans that the Company generally makes available to its regular full-time employees located in the United Kingdom. Additionally, Traeger will provide a Healthcare benefit package that provides coverage for you in both the United Kingdom and the United States. Payroll deductions in line with US employee contributions for premiums will be reflected in your monthly salary payments. You will continue to be subject to US social security throughout your UK assignment and continue to be eligible to participate in the US retirement plan.

Except as specifically set forth herein, the Offer Letter remains unchanged and in full force and effect. For the avoidance of doubt, nothing in this letter will create the relationship of employer and employee between you and Apption Labs Limited (d/b/a MEATER).

This Letter Agreement will be governed by and construed and enforced in accordance with Delaware law without regard to the conflict of laws provisions thereof.

Please indicate your acknowledgement of, and agreement to, the terms and conditions set forth in this letter by signing and dating the enclosed duplicate original of this letter in the space provided below and returning the signed letter to Jane Carr at jcarr@Traeger.com and Courtland Astill at castill@traeger.com. Please retain one fully-executed original for your files.

Traeger, Inc.

By: /s/ Courtland Astill

Courtland Astill

Interim General Counsel

Accepted, Acknowledged, and Agreed.

By: /s/ James Hardy

James Hardy Date

v3.23.3

Cover Page

|

May 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

May 30, 2023

|

| Entity Registrant Name |

TRAEGER, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40694

|

| Entity Tax Identification Number |

82-2739741

|

| Entity Address, Address Line One |

1215 E Wilmington Ave

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Salt Lake City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84106

|

| City Area Code |

801

|

| Local Phone Number |

701-7180

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

COOK

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001857853

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

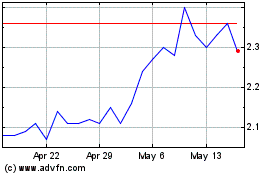

Traeger (NYSE:COOK)

Historical Stock Chart

From Apr 2024 to May 2024

Traeger (NYSE:COOK)

Historical Stock Chart

From May 2023 to May 2024